AI Terminal

STRATEGIC MINERALS PLC

Earnings Release • May 7, 2025

7933_bfr_2025-05-07_0112b0ab-6a51-4377-bfdc-4e5635a94efc.html

Earnings Release

Open in ViewerOpens in native device viewer

National Storage Mechanism | Additional information ![]()

RNS Number : 5806H

Strategic Minerals PLC

07 May 2025

The information contained within this announcement is deemed by the Company to constitute inside information as stipulated under the Market Abuse Regulations (EU) No. 596/2014 ('MAR') which has been incorporated into UK law by the European Union (Withdrawal) Act 2018.

07 May 2025

Strategic Minerals plc

("Strategic Minerals" or the "Company")

Upgrade of Historical Tungsten Results Through Re-analysis of Samples from Prior Drilling at Redmoor

Strategic Minerals plc (AIM: SML; USOTC: SMCDF), an international mineral exploration and production company, is pleased to announce that its wholly owned subsidiary, Cornwall Resources Limited ("CRL"), has received positive results from the re-analysis of 73 pulp samples from previous CRL exploration drilling programmes, following a review of prior analytical techniques and cutoff grades used to select tungsten samples for analysis using a higher detection limit method. The results identify an overall increase in grades which may have a positive impact on the future planned remodelling and resource estimation process.

Highlights:

· As part of the ongoing re-logging campaign at Redmoor, a review process was undertaken on recent assay results. As a result, it was identified as prudent to reduce the analytical cutoff grade utilised to select samples for x-ray fluorescence ("XRF"), rather than Inductively Coupled Plasma ("ICP"), analysis down from 0.5% tungsten trioxide ("WO ₃") to 0.3% WO ₃ for higher levels of analytical accuracy.

· A review of tungsten-bearing samples from CRL's 2017-2018 exploration drilling campaigns identified 73 samples which reported WO ₃ grades by ICP analyses between 0.3 - 0.5% along with several samples which reported >0.5%, which had not been submitted for the more appropriate XRF analysis. These samples were subsequently re-analysed using XRF analysis at ALS Laboratories, Loughrea.

· Results identified an overall increase in WO ₃ grades in most of the analysed samples , with 36 samples returning a greater than 5% increase in WO₃ grade, including 20 samples returning a greater than 10% increase in WO₃ grade .

· The average increase in grade from the 73 analysed samples is 9.2% . Alongside results from the ongoing relogging and sampling programme, the results from this re-analysis further validate the potential for upside at Redmoor (see Table 1 for individual sample results) .

· The majority of these samples lie within or adjacent to the high-grade zones that form the current MRE. Following the announcement of CRL's securing of UK Shared Prosperity Funding (see RNS dated 7 April 2025), the relogging and sampling programme, and further re-analysis of historic samples, will be continued alongside the fully funded exploration drilling activities, with all results combined with the aim of producing an updated Mineral Resource Estimate ("MRE") of the Redmoor tungsten-tin-copper deposit within 12-months.

Commenting, Dennis Rowland, CRL Project Manager, said:

" These laboratory results highlight the significant upside created by the decision to review, reassess, and build upon previous work undertaken at Redmoor. Through the re-analysis of certain tungsten sample pulps from 2017 and 2018 diamond drillcore, this low cost, high impact process has shown that some sample results previously incorporated into Redmoor's 2019 mineral resource estimate were underreported.

"These results further validate the potential upside within the Redmoor deposit and will inform future planned resource modelling updates. The geological team continues the relogging and sampling of Redmoor's 2017 drill core, whilst also preparing for newly announced activities, including 5,000 metres of new diamond core drilling planned for H2 2025."

Background: Re-analysis of Certain Tungsten-Bearing Samples from 2017 - 2018 Drillcore

CRL is pleased to confirm the conclusion of re-analysis and receipt of results of 73 sample pulps from previously reported tungsten-bearing samples from its 2017 and 2018 drill programmes.

As part of the relogging and sampling programme at Redmoor, a verification study was undertaken on the analytical process used on samples containing anomalous tungsten values. The standard assay suite employed by CRL is a multi-element inductively coupled plasma mass spectrometry ("ME-ICPMS") analysis which provides data for 48 elements used to provide the broadest possible understanding of the Redmoor deposit. This analysis method provides excellent low detection of elements, but has an upper limit for certain base metals, which are better analysed via alternate analysis above a certain elemental abundance. For tungsten, the additional multi element ME-XRF 15b analytical procedure is an industry best practice approach and has been shown to be the most accurate method in representing tungsten grades at Redmoor when compared to the ICP-MS method, confirmed by CRL's independent quality assurance / quality control ("QA/QC") programme on all submitted batches.

Following review of recent assay results from the ongoing re-logging campaign at Redmoor (see RNS' dated 3 August 2024, 2 December 2024 and 11 February 2025), it was identified that it was prudent to analyse samples which report grades, from analysis using the ME-ICP81 methodology, above 0.3% WO 3 with the ME-XRF 15b analysis method.

Subsequent review of tungsten-bearing samples from CRL's 2017-2018 exploration drilling campaigns identified 73 samples which reported tungsten trioxide (WO 3 ) grades between 0.3-0.5% and several which had reported over 0.5%, which had not previously undergone the appropriate XRF analysis. These samples were subsequently re-analysed using XRF analysis at ALS Laboratories, Loughrea.

These samples represent previous tungsten sample results from within or close to the modelled high-grade zones within the Redmoor sheeted vein system, which form part of the current JORC (2012) inferred MRE. As such, it is envisaged that increases in reported tungsten grades may have a positive impact on the future planned remodelling and resource estimation process.

With the lowering of the threshold used to select samples for XRF analysis, all samples that previously reported, and may in the future report, grades below 0.3% WO 3 will remain unaffected by this modification to the analysis methodology.

Results:

Results show that of the 73 samples, 36 samples returned a greater that 5% increase in WO 3 grade including 20 samples returned a greater than 10% increase in WO 3 grade.

As Figure 1 illustrates, the re-assays showed an excellent reproducibility across the entire grade range and overall illustrate that the samples re-analysed by the XRF method average 9.2% higher than when originally analysed by the ICP-MS method. Further, it is noted that there is a positive bias in that the higher the WO3 grade, the higher the percentage increase in re-analysis.

Figure 1. WO3% Comparison By Method for Re-Assayed pulps (all data)

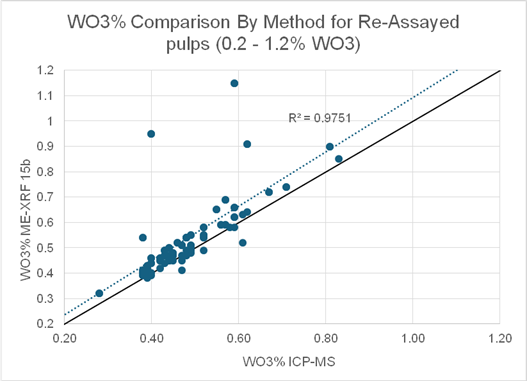

Figure 2 shows the majority of the data at more typical grade ranges for the deposit (0.2-1.2%) and illustrates that while not all samples reported higher values, the vast majority (84% of the dataset), returned a higher value by XRF analysis.

Figure 2. WO3% Comparison by Method for Re-Assayed pulps (0.2-1.2% WO3)

Overall, this process represents a positive improvement in tungsten grades of samples analysed and these results will be utilised to define the analysis strategy in all future sampling campaigns.

All results are exhibited in Table 1, appended to the RNS, showing the original WO 3 result, the re-analysed XRF WO 3 result, the difference in grades, and the percentage change. Some of these results may form part of highlight intersections, composite high-grade zones, or individual sample lengths previously reported through RNS releases from 2017 and 2018, and therefore any change in WO 3 result may have an effect on these previously reported intersections.

Relogging and Sampling Programme Status

The entirety of the 2018 drill core, comprising 12 holes for 7,375m has now been relogged. A total of 340 samples, representing 485.57m of new sample length, were collected from the 2018 core, adding additional data and identifying further mineralised intersections (see RNS dated 11 February 2025).

Work continues to progress in re-logging and sampling the 2017 drill core with a further two drillholes representing 709m so far relogged, and additional new samples selected from both drillholes for future analysis. A further 6,313m of drillcore is remaining from 18 holes for re-logging and sampling.

Competent Person Statement:

Information in this announcement pertaining to Reporting of Sampling Techniques and Data and Exploration Results has been reviewed and approved by Mr James McFarlane, BSc (Hons), MSc, MCSM, CGeol FGS, FNEIMME, CEng QMR FIMMM, RPGeo MAIG, FIQ. Mr McFarlane holds a BSc with Honours from The University of Wales, Aberystwyth in Environmental Earth Science and an MSc in Mining Geology from Camborne School of Mines, University of Exeter, he is also a Master of the Camborne School of Mines (MCSM). Mr McFarlane is a Fellow and Chartered Geologist with the Geological Society of London (CGeol FGS), a Chartered Engineer (CEng) and Fellow of the Institute of Materials, Minerals and Mining (FIMMM) through which he is also Qualified for Minerals Reporting (QMR). Mr McFarlane is a Member of the Australian Institute of Geoscientists (MAIG), and through which is Registered Professional Geoscientist in the joint fields of Mining and Mineral Exploration (RPGeo). Mr McFarlane is also a Fellow of the Institute of Quarrying (FIQ). Mr McFarlane is acting as an independent consultant and has been retained by the Cornwall Resources Limited to provide independent technical support. Mr McFarlane has sufficient experience relevant to the style of mineralisation and type of deposit under consideration, and to the activity which he is undertaking to qualify as a Competent Person as defined by the 2012 Edition of the Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves (the JORC Code) and under the AIM Rules.

Mr McFarlane consents to the inclusion in this announcement of the matters based on this information in the form and context in which it appears. Mr McFarlane confirms that the Company is not aware of any new information or data that materially affects the information included in the relevant market announcements, and that the form and context in which the information has been presented has not been materially modified.

| For further information, please contact: | ||

| Strategic Minerals plc | +44 (0) 207 389 7067 | |

| Mark Burnett | ||

| Executive Director | ||

| Website: | www.strategicminerals.net | |

| Email: | [email protected] | |

| Follow Strategic Minerals on: | ||

| X: | @SML_Minerals | |

| LinkedIn: | https://www.linkedin.com/company/strategic-minerals-plc | |

| SP Angel Corporate Finance LLP | +44 (0) 203 470 0470 | |

| Nominated Adviser and Broker | ||

| Matthew Johnson/ Charlie Bouverat/Grant Barker | ||

| Zeus Capital Limited | +44 (0) 203 829 5000 | |

| Joint Broker | ||

| Harry Ansell/Katy Mitchell | ||

| Vigo Consulting | +44 (0) 207 390 0234 | |

| Investor Relations | ||

| Ben Simons/Peter Jacob/Anna Sutton | ||

| Email: | [email protected] |

Notes to Editors

About Strategic Minerals Pls and Cornwall Resources Limited

Strategic Minerals plc (AIM: SML; USOTC: SMCDY) is an AIM-quoted, producing minerals company, actively developing strategic projects in the UK, United States and Australia.

In 2019, the Company completed the 100% acquisition of Cornwall Resources Limited and the Redmoor Tungsten-Tin-Copper Project.

The Redmoor Project is situated within the historically significant Tamar Valley Mining District in Cornwall, United Kingdom, with a JORC Compliant (2012) Inferred Mineral Resource Estimate published 14 February 2019:

| Cut-off (SnEq%) | Tonnage (Mt) | WO3 % |

Sn % |

Cu % |

Sn Eq1 % |

WO3 Eq % |

| >0.45 <0.65 | 1.50 | 0.18 | 0.21 | 0.30 | 0.58 | 0.41 |

| >0.65 | 10.20 | 0.62 | 0.16 | 0.53 | 1.26 | 0.88 |

| Total Inferred Resource | 11.70 | 0.56 | 0.16 | 0.50 | 1.17 | 0.82 |

1 Equivalent metal calculation notes; Sn(Eq)% = Sn% x 1 + WO3% x 1.43 + Cu% x 0.40. WO 3 (EQ)% = Sn% x 0.7 + WO 3 + Cu% x 0.28. Commodity price assumptions: WO3 US$ 33,000/t, Sn US$ 22,000/t, Cu US$ 7,000/t. Recovery assumptions: total WO3 recovery 72%, total Sn recovery 68% & total Cu recovery 85% and payability assumptions of 81%, 90% and 90% respectively

More information on Cornwall Resources can be found at: https://www.cornwallresources.com

In September 2011, Strategic Minerals acquired the distribution rights to the Cobre magnetite project in New Mexico, USA, through its wholly owned subsidiary Southern Minerals Group. Cobre has been in production since 2012 and continues to provide a sustainable revenue stream for the Company.

In March 2018, the Company completed the acquisition of the Leigh Creek Copper Mine situated in the copper rich belt of South Australia. In April 2025, the Company signed a non-binding Heads of Agreement to grant an option to Axis Mining & Minerals Pty Ltd to acquire the Leigh Creek Copper Mine.

About the CIOS Good Growth Fund and UK Shared Prosperity Fund

This project is part-funded by the UK Government through the UK Shared Prosperity Fund. Cornwall Council is responsible for managing projects funded by the UK Shared Prosperity Fund through the Cornwall and the Isles of Scilly Good Growth Programme .

Cornwall and Isles of Scilly has been allocated £184 million for local investment through the Shared Prosperity Fund . This new approach to investment is designed to empower local leaders and communities, so they can make a real difference on the ground where it's needed the most.

UK Shared Prosperity Fund

The UK Shared Prosperity Fund proactively supports delivery of the UK-government's five national missions: pushing power out to communities everywhere, with a specific focus to help kickstart economic growth and promoting opportunities in all parts of the UK.

For more information, visit

https://www.gov.uk/government/publications/uk-shared-prosperity-fund-prospectus

For more information, visit https://ciosgoodgrowth.com

Appendix: Table of Results

Table 1: Original ICP-MS results compared with new XRF assay results for WO3 and associated changes in WO3 grade.

| Drill Hole | Sample ID | From (m) | To (m) | Interval (m) | Original Result | New Results | |

| WO 3 % ICP-MS | WO 3 % ME-XRF 15b | Change in Grade (%) | |||||

| CRD031 | CRL004189 | 413.67 | 414.55 | 0.88 | 0.40 | 0.95 | 137.50 |

| CRD009 | CRL000530 | 257.52 | 258.87 | 1.35 | 0.59 | 1.15 | 94.92 |

| CRD012 | CRL001569 | 156.75 | 157.62 | 0.87 | 0.62 | 0.91 | 46.77 |

| CRD022 | CRL003082 | 492.24 | 494.24 | 2.00 | 0.38 | 0.54 | 42.11 |

| CRD031 | CRL004219 | 475.83 | 476.83 | 1.00 | 0.57 | 0.69 | 21.05 |

| CRD022 | CRL003027 | 405.00 | 406.00 | 1.00 | 0.55 | 0.65 | 18.18 |

| CRD013 | CRL001681 | 340.19 | 340.83 | 0.64 | 0.40 | 0.46 | 15.00 |

| CRD007 | CRL000357 | 245.67 | 246.15 | 0.48 | 0.28 | 0.32 | 14.29 |

| CRD026 | CRL003223 | 445.97 | 447.97 | 2.00 | 0.43 | 0.49 | 13.95 |

| CRD025 | CRL002882 | 361.97 | 362.97 | 1.00 | 0.44 | 0.50 | 13.64 |

| CRD018 | CRL000965 | 317.25 | 318.25 | 1.00 | 0.46 | 0.52 | 13.04 |

| CRD006 | CRL001355 | 307.34 | 307.97 | 0.63 | 0.48 | 0.54 | 12.50 |

| CRD028 | CRL003333 | 464.97 | 465.97 | 1.00 | 0.48 | 0.54 | 12.50 |

| CRD031 | CRL004245 | 538.95 | 539.95 | 1.00 | 0.49 | 0.55 | 12.24 |

| CRD015 | CRL001801 | 343.74 | 344.74 | 1.00 | 3.63 | 4.07 | 12.12 |

| CRD012 | CRL001546 | 122.07 | 124.07 | 2.00 | 0.59 | 0.66 | 11.86 |

| CRD017 | CRL001915 | 230.50 | 231.45 | 0.95 | 1.19 | 1.33 | 11.76 |

| CRD031 | CRL004249 | 542.85 | 543.85 | 1.00 | 0.52 | 0.58 | 11.54 |

| CRD018 | CRL002000 | 365.17 | 367.17 | 2.00 | 0.81 | 0.90 | 11.11 |

| CRD025 | CRL002824 | 281.15 | 282.15 | 1.00 | 0.39 | 0.43 | 10.26 |

| CRD019 | CRL002444 | 507.05 | 508.05 | 1.00 | 0.40 | 0.44 | 10.00 |

| CRD015 | CRD001794 | 333.04 | 335.04 | 2.00 | 0.42 | 0.46 | 9.52 |

| CRD019 | CRL002470 | 540.55 | 541.55 | 1.00 | 0.43 | 0.47 | 9.30 |

| CRD016 | CRL000889 | 317.98 | 318.98 | 1.00 | 0.47 | 0.51 | 8.51 |

| CRD028 | CRL003330 | 462.63 | 463.63 | 1.00 | 0.38 | 0.41 | 7.89 |

| CRD019 | CRL002435 | 494.10 | 495.10 | 1.00 | 0.39 | 0.42 | 7.69 |

| CRD030 | CRL003489 | 549.07 | 550.07 | 1.00 | 0.67 | 0.72 | 7.46 |

| CRD021 | CRL002570 | 605.23 | 606.23 | 1.00 | 0.42 | 0.45 | 7.14 |

| CRD009 | CRL000577 | 322.94 | 324.45 | 1.51 | 0.44 | 0.47 | 6.82 |

| CRD009 | CRL000581 | 328.53 | 329.9 | 1.37 | 0.45 | 0.48 | 6.67 |

| CRD022 | CRL003042 | 424.25 | 425.25 | 1.00 | 0.52 | 0.55 | 5.77 |

| CRD029 | CRL004100 | 547.74 | 548.74 | 1.00 | 0.56 | 0.59 | 5.36 |

| CRD023 | CRL002695 | 618.10 | 620.10 | 2.00 | 0.38 | 0.40 | 5.26 |

| CRD016 | CRL000893 | 321.40 | 322.90 | 1.50 | 0.39 | 0.41 | 5.13 |

| CRD025 | CRL002904 | 418.26 | 419.26 | 1.00 | 0.39 | 0.41 | 5.13 |

| CRD011 | CRL000629 | 230.26 | 231.44 | 1.18 | 0.59 | 0.62 | 5.08 |

| CRD015 | CRD001787 | 326.01 | 327.02 | 1.01 | 2.22 | 2.33 | 4.95 |

| CRD015 | CRD001777 | 311.99 | 312.99 | 1.00 | 2.03 | 2.13 | 4.93 |

| CRD022 | CRL003073 | 475.98 | 477.98 | 2.00 | 0.44 | 0.46 | 4.55 |

| CRD024 | CRL003191 | 632.00 | 633.10 | 1.10 | 0.44 | 0.46 | 4.55 |

| CRD009 | CRL000476 | 190.33 | 191.36 | 1.03 | 0.45 | 0.47 | 4.44 |

| CRD018 | CRL000994 | 358.17 | 359.17 | 1.00 | 3.42 | 3.57 | 4.39 |

| CRD010 | CRL001477 | 122.45 | 124.45 | 2.00 | 0.71 | 0.74 | 4.23 |

| CRD027 | CRL002984 | 432.95 | 434.02 | 1.07 | 0.49 | 0.51 | 4.08 |

| CRD023 | CRL002648 | 372.67 | 373.67 | 1.00 | 0.52 | 0.54 | 3.85 |

| CRD015 | CRD001771 | 302.65 | 303.86 | 1.21 | 0.57 | 0.59 | 3.51 |

| CRD026 | CRL003263 | 527.41 | 528.91 | 1.50 | 0.61 | 0.63 | 3.28 |

| CRD009 | CRL000531 | 258.87 | 259.97 | 1.10 | 0.62 | 0.64 | 3.23 |

| CRD013 | CRL001695 | 364.56 | 366.38 | 1.82 | 0.38 | 0.39 | 2.63 |

| CRD022 | CRL003010 | 328.52 | 330.52 | 2.00 | 0.38 | 0.39 | 2.63 |

| CRD025 | CRL002806 | 258.19 | 259.19 | 1.00 | 0.39 | 0.40 | 2.56 |

| CRD017 | CRL001890 | 187.45 | 189.45 | 2.00 | 0.83 | 0.85 | 2.41 |

| CRD009 | CRL000430 | 115.36 | 115.82 | 0.46 | 0.43 | 0.44 | 2.33 |

| CRD002 | CRL000106 | 297.14 | 298.42 | 1.28 | 0.44 | 0.45 | 2.27 |

| CRD022 | CRL003080 | 490.04 | 491.24 | 1.20 | 0.44 | 0.45 | 2.27 |

| CRD014 | CRL000704 | 144.46 | 145.34 | 0.88 | 0.48 | 0.49 | 2.08 |

| CRD027 | CRL002995 | 449.02 | 450.02 | 1.00 | 0.49 | 0.50 | 2.04 |

| CRD009 | CRL000435 | 120.12 | 120.75 | 0.63 | 0.49 | 0.49 | 0.00 |

| CRD016 | CRL000792 | 105.32 | 106.32 | 1.00 | 0.45 | 0.45 | 0.00 |

| CRD016 | CRL000838 | 243.27 | 244.27 | 1.00 | 0.58 | 0.58 | 0.00 |

| CRD020 | CRL002126 | 355.76 | 356.76 | 1.00 | 0.40 | 0.40 | 0.00 |

| CRD025 | CRL002829 | 287.15 | 288.15 | 1.00 | 0.47 | 0.47 | 0.00 |

| CRD024 | CRL003193 | 642.03 | 643.03 | 1.00 | 0.39 | 0.39 | 0.00 |

| CRD028 | CRL003328 | 460.63 | 461.63 | 1.00 | 0.42 | 0.42 | 0.00 |

| CRD017 | CRL001886 | 182.61 | 184.61 | 2.00 | 0.59 | 0.58 | -1.69 |

| CRD027 | CRL002991 | 445.02 | 446.02 | 1.00 | 0.49 | 0.48 | -2.04 |

| CRD022 | CRL003017 | 340.98 | 342.98 | 2.00 | 0.48 | 0.47 | -2.08 |

| CRD020 | CRL002144 | 380.07 | 381.07 | 1.00 | 0.40 | 0.39 | -2.50 |

| CRD021 | CRL002602 | 686.70 | 688.70 | 2.00 | 0.39 | 0.38 | -2.56 |

| CRD025 | CRL002886 | 369.97 | 370.97 | 1.00 | 0.47 | 0.45 | -4.26 |

| CRD025 | CRL002819 | 277.15 | 278.15 | 1.00 | 0.52 | 0.49 | -5.77 |

| CRD020 | CRL002120 | 347.75 | 348.76 | 1.01 | 0.47 | 0.41 | -12.77 |

| CRD026 | CRL003255 | 518.60 | 520.00 | 1.40 | 0.61 | 0.52 | -14.75 |

This information is provided by RNS, the news service of the London Stock Exchange. RNS is approved by the Financial Conduct Authority to act as a Primary Information Provider in the United Kingdom. Terms and conditions relating to the use and distribution of this information may apply. For further information, please contact [email protected] or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms and conditions, to analyse how you engage with the information contained in this communication, and to share such analysis on an anonymised basis with others as part of our commercial services. For further information about how RNS and the London Stock Exchange use the personal data you provide us, please see our Privacy Policy.

END

UPDUPUMWAUPAPUQ