National Storage Mechanism | Additional information

RNS Number : 1538J

Buccaneer Energy PLC

27 November 2025

Buccaneer Energy Plc

("Buccaneer" or the "Company")

27 November 2025

Acquisition of Additional Fouke Area Acreage,

Enabling Sidetrack and New Production Potential

Buccaneer Energy (AIM: BUCE), an international oil & gas exploration and production company with development and production assets in Texas, USA, is pleased to announce the acquisition of a 32.5% interest in offsetting leasehold acreage in the Fouke area of the Pine Mills field.

Highlights:

|

|

| • |

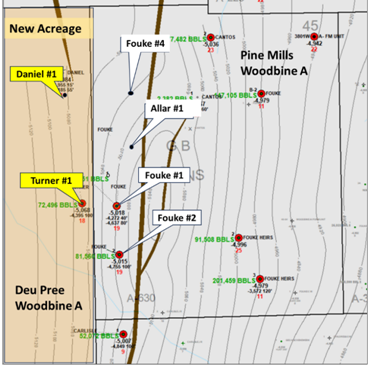

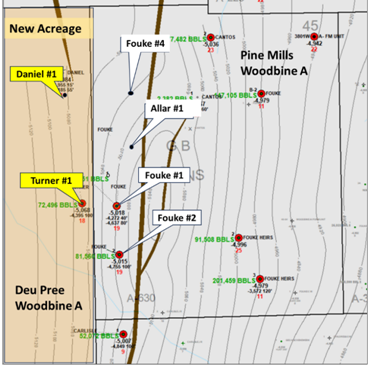

New Acreage: 32.5% working interest in acreage directly west of the Allar #1 location. |

| • |

Sidetrack Opportunity: Enables potential westward sidetrack of the Allar #1 away from bounding fault. |

| • |

Shut-in Wells: Includes Turner #1 and Daniel #1 wells (32.5% WI each). Turner #1 planned for near-term return to production; Daniel #1 retained as potential injector for future waterflood development. |

| • |

Enhanced Recovery Plan: Discussions underway with Texas Railroad Commission regarding formation of an enhanced recovery unit in the Fouke area. |

| • |

Next Well: Fouke #4 remains on track to spud in late December 2025. |

The following map illustrates the new acreage position, including the location of Allar #1, the Fouke wells, and the area now accessible for a potential sidetrack.

Paul Welch, Buccaneer Energy's Chief Executive Officer, commented:

"The addition of this acreage is an important step for Buccaneer as we look to further our development of the Fouke area by unlocking the opportunity to pursue an optimal sidetrack for the Allar #1 well. The Company will now progress preparatory work including reviewing the well plan, cost estimates, and timing in conjunction with its partner. The Turner #1 well provides near-term production potential, while Daniel #1 offers longer-term development optionality.

With this acreage now secured and Fouke #4 progressing toward spud, we are well positioned to continue building production and value across Pine Mills. I look forward to updating investors as we progress these various workstreams."

For further information, contact:

|

|

|

Buccaneer Energy plc

Paul Welch, CEO |

Email: |

[email protected] |

|

|

|

SP Angel Corporate Finance LLP

(NOMAD/Joint Broker)

Stuart Gledhill / Richard Hail / Adam Cowl |

Tel: |

+44 (0) 20 3470 0470 |

Oak Securities (Joint Broker)

Robert Bell / Nick Price |

Tel: |

+44 (0) 20 3973 3678 |

|

|

|

Celicourt Communications

(PR/IR)

Mark Antelme / Charles Denley-Myerson |

Tel:

Email: |

+44 (0) 20 7770 6424

[email protected] |

This information is provided by RNS, the news service of the London Stock Exchange. RNS is approved by the Financial Conduct Authority to act as a Primary Information Provider in the United Kingdom. Terms and conditions relating to the use and distribution of this information may apply. For further information, please contact [email protected] or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms and conditions, to analyse how you engage with the information contained in this communication, and to share such analysis on an anonymised basis with others as part of our commercial services. For further information about how RNS and the London Stock Exchange use the personal data you provide us, please see our Privacy Policy.

END

ACQBUBDBBUDDGUL