AI Terminal

Lexington Gold Limited

Regulatory Filings • Jan 13, 2026

10515_bfr_2026-01-13_8bfce6b9-3665-4ab3-afa9-4b5869cd6e39.html

Regulatory Filings

Open in ViewerOpens in native device viewer

National Storage Mechanism | Additional information ![]()

RNS Number : 5979O

Lexington Gold Limited

13 January 2026

13 January 2026

Lexington Gold Ltd

("Lexington Gold" or the "Company")

Updated Independent JORC Mineral Resource Estimates for the Jones Keystone

and Loflin Deposits in the USA - Total JORC Resource estimate for the

JKL Project up 53% to 323,500 Au oz

Lexington Gold (AIM: LEX; OTCQB: LEXLF), the gold exploration and development company with a growing portfolio of high quality projects in South Africa and the United States, is pleased to announce the receipt of updated independent JORC (2012) Mineral Resource Estimates for the Jones Keystone and Loflin deposits on the Jones Keystone-Loflin ("JKL") Project, prepared by Pivot Mining Consultants (Pty) Ltd ("Pivot").

The updated Mineral Resource Estimates reflect, inter alia, a decrease in the cut-off grades applied for reporting Mineral Resources at both deposits, following Pivot's updated consideration of RPEEE JORC requirements being the criteria for "reasonable prospects for eventual economic extraction" ("RPEEE") as per its independent reports dated 9 January 2026.

Highlights:

· 53% increase in contained gold for the combined JKL Project comprising:

o Total Inferred Resource of 12.90 Mt at 0.78 g/t Au for 323,500 oz of contained gold

· Updated independent JORC (2012) Mineral Resource Estimate for the Jones Keystone deposit comprising:

o Total Inferred Resource of 9.36 Mt at 0.76 g/t Au for 228,000 oz of contained gold

o Reported at a cut-off grade of 0.45 g/t Au (previously 0.5 g/t Au)

· Updated independent JORC (2012) Mineral Resource Estimate for the Loflin deposit comprising:

o Total Inferred Resource of 3.54 Mt at 0.84 g/t Au for 95,500 oz of contained gold

o Reported at a cut-off grade of 0.35 g/t Au (previously 0.5 g/t Au)

· Mineralisation at both Jones Keystone and Loflin remains open down dip and along strike with additional targets identified from previous ground and aerial geophysics surveys, field mapping and untested historical workings

· Potential for further increase in the resources at Jones Keystone as well as Loflin and Loflin South through additional future drilling

Bernard Olivier, CEO of Lexington Gold, commented:

"Pivot's updated independent JORC (2012) Mineral Resource Estimates for the JKL Project (effective as of 9 January 2026) have increased the combined Inferred Mineral Resource by over 50% to approximately 323,500 ounces of contained gold (approximately 12.9 Mt at 0.8 g/t Au), compared to the previously reported combined total for the JKL Project of approximately 211,000 ounces in November 2022, following Pivot's review of the applicable economic parameters and adjustments in the cut-off grades applied for both projects. This material increase provides a stronger, independently prepared technical basis for assessing the scale and overall characteristics of the JKL Project."

Mark Greenwood, Director, added:

"This updated independent JORC resource estimate materially strengthens the strategic positioning of our JKL Project. A combined Inferred Resource of approximately 323,500 ounces of Au, representing an increase of over 50%, provides a clearer view of the scale and comparability of the project for parties evaluating possible strategic initiatives, including potential partnering or disposal outcomes. We believe this updated resource statement improves the quality of information available to the market which will assist prospective counterparties and stakeholders in their technical and commercial assessment of the project."

Additional Information

1. Pivot Mining Consultants (Pty) Ltd

Pivot was requested by Lexington Gold to update the previous Mineral Resource estimates in respect of the Jones Keystone and Loflin deposits on the JKL Project located in North Carolina, USA (including the incorporation of results from drilling and trenching completed up to 2022 and subsequent modelling updates). These latest Mineral Resource estimates (effective as of 9 January 2026) have been reported in accordance with the guidelines of the "Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves (2012 Edition)" (JORC Code).

Pivot is an independent technical consulting group, with no direct or indirect interests in Lexington Gold. Neither Pivot, nor the key personnel responsible for its work, have any material interest in Lexington Gold, the companies associated with this project, their subsidiaries or their mineral properties. The Mineral Resource estimates were undertaken by Ken Lomberg, who is a Competent Person with the requisite professional experience, as set out in the JORC Code. Mr Lomberg is the Director of Geology and Resources at Pivot.

2. Mineral Resources

The updated Mineral Resource estimates for the Jones Keystone and Loflin deposits that form part of the larger JKL Project, as at 9 January 2026, are presented in Table 1. The Mineral Resource estimate for the Jones Keystone project can be found in Table 2, while Mineral Resource estimates for Loflin can be found in Table 3. The estimates are in respect of in situ material.

Pivot had previously completed a maiden Mineral Resource estimate for Loflin in September 2021 which was updated in August 2022, with its maiden Jones Keystone Mineral Resource estimate announced in November 2022. The updated Mineral Resource estimates set out herein apply revised cut-off grades for both deposits following updated RPEEE considerations. The combined total Mineral Resource estimation for the JKL Project is shown in Table 1 below.

| Deposit | Tonnage (Mt) | Grade - Au (g/t) | Content (oz) |

|---|---|---|---|

| Loflin (total) | 3.54 | 0.84 | 95,500 |

| Jones Keystone | 9.36 | 0.76 | 228,000 |

| JKL Total | 12.90 | 0.78 | 323,500 |

Table 1: Total Inferred Mineral Resource Estimation for the JKL Project in accordance with the terms of the JORC Code (2012) as of January 2026. Note that Loflin is reported at a cut-off grade of 0.35 g/t Au and Jones Keystone is reported at a cut-off grade of 0.45 g/t Au. Discrepancies may occur due to rounding.

| Deposit | Tonnage (Mt) | Grade - Au (g/t) | Contained (oz) |

|---|---|---|---|

| Jones Keystone | 9.36 | 0.76 | 228,000 |

Table 2: January 2026 Updated JORC Inferred Mineral Resource Estimate for Jones Keystone in accordance with the terms of the JORC Code (2012) with a cut-off Grade 0.45 g/t.

| Deposit | Tonnage (Mt) | Grade - Au (g/t) | Contained (oz) |

|---|---|---|---|

| Loflin Isocline | 3.25 | 0.82 | 85,800 |

| Loflin South Satellite 1 | 0.11 | 1.14 | 4,100 |

| Loflin South Satellite 2 | 0.18 | 0.99 | 5,600 |

| Total | 3.54 | 0.84 | 95,500 |

Table 3: January 2026 Updated JORC Inferred Mineral Resource Estimate for Loflin declared in terms of the JORC Code (2012) with a cut-off Grade 0.35 g/t. Discrepancies may occur due to rounding.

3. Estimation Methodology

Mineral Resource estimates for the Jones Keystone and Loflin deposits were completed using ordinary kriging of validated drill hole data within geological model constraints, and with appropriate cut-off grades applied. Drill hole data were reviewed and validated prior to resource estimation. Mineral Resources were classified in accordance with the JORC Code (2012). Geological and Mineral Resource models were constructed using the three-dimensional (3D) modelling software Datamine™ Studio RM and Micromine™, and are based on interpreted geology and structural controls. The estimates were subject to visual and statistical validation prior to acceptance.

The Competent Person responsible for the Mineral Resource estimation and classification is Mr Ken Lomberg, Pr.Sci.Nat. Consideration of Reasonable Prospects for Eventual Economic Extraction (RPEEE) was undertaken using a preliminary financial assessment assuming open-pit mining and a suitable processing facility.

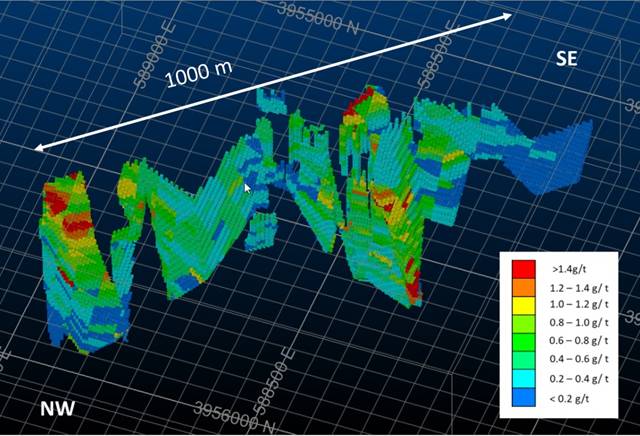

Figure 1: Isometric view of the Jones Keystone block model used for resource estimation. Image extracted from Pivot's Jones Keystone Mineral Estimation report dated 9 January 2026.

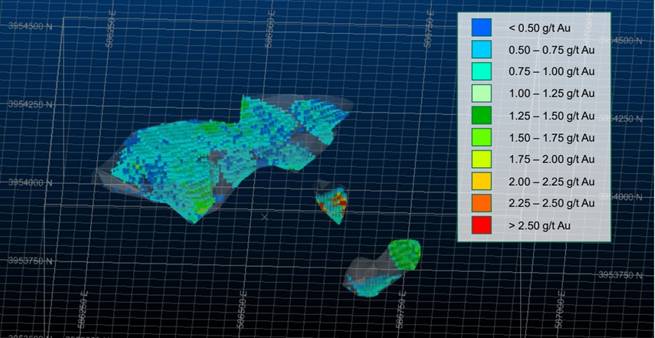

Figure 2: Isometric view of the Loflin block model used for resource estimation. Image extracted from Pivot's Loflin Mineral Estimation report dated 9 January 2026.

4. Geology and Geological Interpretation

The Jones Keystone and Loflin deposits are located within the Carolina Super Terrane, a well-established gold-bearing province in the southeastern United States that hosts major deposits including Haile, Ridgeway, Brewer and Barite Hill.

The primary geologic units at the JKL Project are interbedded mafic flows, volcanoclastics, and metasediments as well as large felsic intrusions and late dolerite dykes. Oxidation and saprolite development ranges from 5 to 30 metres.

Gold mineralisation at both Loflin and Jones Keystone is typically hosted in sheared volcanoclastics but can occur in the mafic flows and to a lesser extent in the metasediments. Mineralised zones are associated with wide spread phyllic alteration. Ore minerals include pyrite (py) / pyrrhotite (po) ± arsenopyrite (asp) and native gold. Sulphides can be as disseminations, in stringer veinlets, and as sooty matrix material in sheer zones. Native gold is found within and along the margins of sulphides and is also found as free gold. Oxide gold is present in the saprolite profile above supergene mineralisation.

The Jones Keystone and Loflin deposits were classified as mesozonal orogenic gold by the North Carolina Geologic survey in 2018. These deposits formed along deformation zones that have been subjected to pervasive sulphidation.

Figure 3: 2021 drill core from Loflin displaying a phyllic altered and deformed volcanoclastic. Note that the core block measurement is in feet.

Figure 4: 1989 drill core segment from Loflin displaying sheared sulphides hosed in a foliated tuff.

5. Competent Person's Statement

The information contained in this announcement relates to Mineral Resource Estimate reports prepared by Mr Ken Lomberg (BSc (Hons) (Geology), BCom, MEng (Mining Engineering)) at Pivot. Mr Lomberg is a qualified geologist, registered with the South African Council for Natural Resources and is a Competent Person as defined by the JORC Code. Mr Lomberg has sufficient experience relevant to the style of mineralisation and type of deposit under consideration, and to the activity being undertaken, to qualify as a Competent Person as defined in the December 2012 edition of the "Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves" (JORC Code). Mr Lomberg has reviewed and approved the information in this announcement.

For further information, please contact:

| Lexington Gold Ltd Bernard Olivier (Chief Executive Officer) Edward Nealon (Chairman) Mark Greenwood (Director) Mike Allardice (Group Company Secretary) |

www.lexingtongold.co.uk [email protected] |

| Strand Hanson Limited (Nominated Adviser) Matthew Chandler / James Bellman / Abigail Wennington |

www.strandhanson.co.uk T: +44 207 409 3494 |

| Optiva Securities Limited (Joint Broker) | www.optivasecurities.com |

| Bartu Ciftci / Christian Dennis | T: +44 203 981 4178 |

| Marex Financial (Joint Broker) Angelo Sofocleous / Keith Swann / Matt Bailey (Broking) |

email: [email protected] T: +44 207 655 6000 |

Glossary of technical terms:

| "asp" | arsenopyrite; |

| "Au" | gold; |

| "g" | grammes; |

| "g/t" | grammes per tonne; |

| "Inferred Resource" | that part of a Mineral Resource for which quantity and grade (or quality) are estimated on the basis of limited geological evidence and sampling. Geological evidence is sufficient to imply but not verify geological and grade (or quality) continuity. It is based on exploration, sampling and testing information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes; |

| "JORC" | the Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves, as published by the Joint Ore Reserves Committee of The Australasian Institute of Mining and Metallurgy, Australian Institute of Geoscientists and Minerals Council of Australia; |

| "JORC (2012)" | the 2012 edition of the JORC code; |

| "m" | metre; |

| "Mineral Resource" | a concentration or occurrence of material of economic interest in or on the earth's crust in such form and quantity that there are reasonable and realistic prospects for eventual economic extraction. The location, quantity, grade, continuity, and other geological characteristics of a Mineral Resource are known, estimated from specific geological evidence and knowledge, or interpreted from a well-constrained and portrayed geological model; |

| "po" | pyrrhotite; |

| "py" | pyrite; |

| "t" | tonnes; and |

| "oz" | troy ounce. |

The information contained within this announcement is deemed by the Company to constitute inside information as stipulated under the Market Abuse Regulation (EU) No. 596/2014 as it forms part of United Kingdom domestic law by virtue of the European Union (Withdrawal) Act 2018 as amended by virtue of the Market Abuse (Amendment) (EU Exit) Regulations 2019.

Note to Editors:

Lexington Gold (AIM: LEX; OTCQB: LEXLF) is a gold exploration and development company currently holding interests in four diverse gold projects, covering a combined area of approximately 1,675 acres in North and South Carolina, USA and in six gold projects covering approximately 114,638 hectares in South Africa.

Further information is available on the Company's website: www.lexingtongold.co.uk or follow us through our social media channel: X: @LexGoldLtd.

Neither the contents of the Company's website nor the contents of any website accessible from hyperlinks on the Company's website (or any other website) is incorporated into, or forms part of, this announcement.

This information is provided by RNS, the news service of the London Stock Exchange. RNS is approved by the Financial Conduct Authority to act as a Primary Information Provider in the United Kingdom. Terms and conditions relating to the use and distribution of this information may apply. For further information, please contact [email protected] or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms and conditions, to analyse how you engage with the information contained in this communication, and to share such analysis on an anonymised basis with others as part of our commercial services. For further information about how RNS and the London Stock Exchange use the personal data you provide us, please see our Privacy Policy.

END

UPDSFDESEEMSEDF