AI Terminal

JARVIS SECURITIES PLC

Annual Report • Dec 30, 2025

7727_10-k_2025-12-30_55bb40c5-26da-4c92-b878-0a1fda2f7782.html

Annual Report

Open in ViewerOpens in native device viewer

National Storage Mechanism | Additional information ![]()

RNS Number : 1182N

Jarvis Securities plc

30 December 2025

The information contained within this announcement is deemed by the Company to constitute inside information as stipulated under the Market Abuse Regulation (EU) No. 596/2014 as it forms part of United Kingdom domestic law by virtue of the European Union (Withdrawal) Act 2018, as amended by virtue of the Market Abuse (Amendment) (EU Exit) Regulations 2019.

Jarvis Securities plc

("Jarvis Securities" or "the Company" and with its subsidiaries the "Group")

Audited Results for the 18 months ended 30 June 2025

FCA Update

Notice of General Meeting

CHAIRMAN'S STATEMENT

The release of final audited accounts for the Company was delayed in July 2025, and the Company's accounting reference date was extended to 30 June 2025 to allow the completion by Jarvis Investment Management (JIML) of the sale of its retail execution-only brokerage clients. I am pleased to confirm that the transaction completed and JIML received the initial sale proceeds of £9m on 8 July 2025 ("Completion"). Two further deferred consideration payments are due of £1m each, payable twelve and twenty four months after Completion subject to certain criteria as set out in the Company's announcement of 15 April 2025.

The Board of Jarvis Securities is committed to delivering an effective and efficient wind-down of JIML and it has now appointed S&W Partners LLP (S&W) to monitor this objective on its behalf. The Directors believe a professional independent firm with extensive experience in the wind down of regulated entities will be better placed to challenge and advise and will be in the best interests of clients and shareholders. JIML is continuing to deliver the wind-down and clear the remediation tasks, therefore costs remain significant at this time.

Jarvis Securities continues to receive interest income, though much reduced due to the reduction in client money held by JIML. So long as this continues together with other small revenue streams the Board will continue to review on a quarterly basis its ability to pay dividends. The Directors currently believe JIML has headroom to cover its cost until the final close down of operations, which will be reviewed and monitored as part of the recent engagement with S&W. JIML is currently restricted from paying up any dividend to JSP under the conditions of the Voluntary Agreed restrictions (VReQ) with the FCA (see announcement dated 16th September 2022).

S&W have also been asked to review the remaining business assets of the Group and advise if there are any further sales which might generate value. As at 29th December 2025 the Group currently has cash of £10.4m.

As set out in the Company's announcement of 15 April 2025, whilst the Directors continue to keep their strategic options under review it is still the intention of the Directors to seek cancellation of the Company's admission to trading on AIM pursuant to AIM Rule 41 in due course (the "Proposed Cancellation"). The Proposed Cancellation would be subject to, inter alia, shareholder approval, with the expectation that any distributable reserves remaining in the Company at the time of the Proposed Cancellation would then be returned to shareholders.

As always, I would like to thank all off our staff for their hard work and support over what has been another challenging and stressful period.

FCA Update

The Board of Jarvis also confirms today that as part of the wind down process and the ongoing engagement with the FCA, the board of its subsidiary company, JIML, has due to historic breaches of FCA conduct of business rules determined it has incurred an obligation to provide redress to certain clients. The first breach is in respect of inducement rules, specifically the sharing of commission with an introducer. The second breach is with regards to unclear and potentially misleading language in legacy versions of the JIML client terms of business when describing the rate and circumstances in which interest would be paid on client money held.

The details of the redress scheme are yet to be finalised, and are subject to engagement with the FCA. In addition, the calculation of the likely cost of any redress is complex and the directors of JIML have been required to make assumptions about how any financial redress payable to clients should be calculated, which clients should be included in the scope of the redress scheme and the percentage of clients that are expected to opt in to the redress scheme. However, JIML, having taken legal advice, currently estimates that this will incur a liability over the next 12 months in the region of £2.8m. Although, if the assumptions given above transpire to be incorrect, this amount may be materially adjusted in the future. More details of this are set out in Note 25 (below)

General Meeting

The Company will today dispatch to shareholders its Annual Report and Accounts for the 18 months ended 30 June 2025, and a notice convening a General Meeting ("GM") of the Company, to approve the accounts to be held at Spa Hotel, Tunbridge Wells, TN4 8XJ on 29 January 2026 at 9am. The Annual Report and Accounts and Notice of GM will also be available from the Company's website, www.jarvissecurities.co.uk .

Andrew Grant

Chairman

Kieran Price, Finance Director of Jarvis Securities Plc, has approved this announcement and authorised its release.

Enquiries:

Jarvis Securities plc [email protected]

Andrew Grant

Zeus Capital 020 3829 5000

Katy Mitchell

STRATEGIC REPORT

Key developments and outlook

In September 2022 the firm's regulated subsidiary Jarvis Investment Management Limited ("JIML") agreed to a voluntary restriction with the FCA of certain regulated activities, and the appointment of a skilled person to review their systems and controls.

Throughout 2023, 2024 and 2025 to date JIML has continued to co-operate with the FCA and the skilled person by providing all information requested and to develop systems and controls as recommended by the skilled person. This has been a resource intensive process and taken a considerable amount of management's time as well as internal and external cost.

One outcome of this process has been the recruitment of a number of senior staff with the specialist skills required to take the business out of the voluntary restriction. This resulted in a significant, and permanent, increase to the cost base of the regulated entity. At the same time, the firm's number of model B clients continued to reduce, impacting trading volumes and therefore revenue prior to the decision to wind-down.

The external developments of the economy are widely known. Central bank policy of using interest rates in order to subdue price inflation continued though to August 2024, after which rates began to fall as inflationary pressures reduced. This has continued to be the case, reducing the revenue available from client money treasury deposits. Also, increased price competition from an increasing number of much larger firms who are able to take advantage of a number of economies of scale that are not available to Jarvis.

The above internal and external factors have been the key contributors to the firm's decision to sell the retail client book, give notice to all corporate clients, and wind-down the remaining business. This culminated in the announcement on 15th April 2025 of JIML entering into a conditional sale agreement disposing of its retail execution-only brokerage business to Interactive Investor Services Limited for a consideration of up to £11,000,000 payable in cash. The sale completed on 7th July 2025 and the first amount payable of £9,000,000 was received by JIML on 8th July 2025. Following the sale, JIML is currently in the process of winding down Subsequently, two items of redress have been identified within JIML, and financial provisions have been made as detailed within these financial statements.

Jarvis Securities Plc continues to review its strategic options, though once JIML's operations are wound down, the firm would then no longer own, control, or conduct any trading business. Accordingly, pursuant to AIM Rule 15 the firm would, at that time, become an AIM Rule 15 Cash Shell and would be required to make an acquisition or acquisitions that constitutes a reverse takeover under AIM Rule 14, within 6 months of becoming an AIM Rule 15 Cash Shell. It is currently anticipated Jarvis will become an AIM Rule 15 Cash Shell on the date that all, or substantially all, of JIML's client agreements or assets are transferred to a third party.

At this time, the Directors do not intend to make any acquisitions. Whilst they continue to keep their strategic options for the remaining assets of the Group under review, the Directors currently intend to seek a cancellation of the Company's admission to trading on AIM pursuant to AIM Rule 41 (the "Proposed Cancellation") in due course, with the expectation that, following the lifting of the VREQ, any distributable reserves remaining in the Company at the time of the Proposed Cancellation would then be returned to shareholders. The Proposed Cancellation would be subject, inter alia, to shareholder approval. Further announcements will be made in due course.

Performance

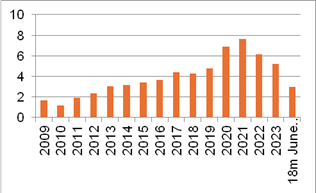

Results and quarterly dividends (pence per share)

The consolidated profit for the period after income tax amounted to £2,182,644 (Year to 31st December 2023: £3,981,233). The company paid quarterly interim dividends per share totalling 6.75p during the period (Year to 31st December 2023: 8.75p). The company will review dividends on a quarterly basis. A special dividend of 2.9p was declared on 31st July 2025. No final dividend is proposed by the board.

Annual Dividend (pence per share)

* In 2015 in addition to total quarterly dividends of 4.125p per share a 2.5p special dividend was also paid.

** In 2019 in addition to total quarterly dividends of 6.56p per share a 3.75p special dividend was also paid

*** In 2021 in addition to total quarterly dividends of 13.5p per share a 8.5p special dividend was also paid

The special dividends are excluded from the graph

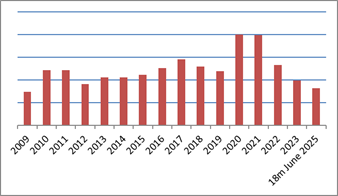

Profit before tax - £m

The reduction in profit before tax on an annualised basis has been caused by lower commission income as trading volumes have continued to decrease, combined with continued significant internal and external remediation costs relating to the voluntary requirement and skilled person. These are reported within Exceptional administrative expenses in the Consolidated Income Statement, which also includes legal fees in relation to the sale of the retail business and provisions for redress totalling £2,831,848. When adjusted, the PBT for the 18 months to 30th June 2025 of £7.0m (being PBT £3.0m plus Exceptional administrative costs £4.0m) is lower on an annualised basis than the Year to 31st December 2023 equivalent of £6.5m (being PBT £5.2m plus Exceptional administrative expenses £1.3m). These exceptional costs have been partially offset by increased average interest income over the period.

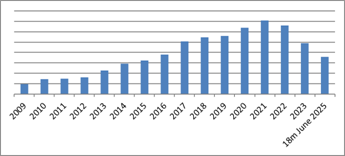

Trade Volumes - average daily volume (1)

Trade volumes have declined further during the 18 months to 30th June 2025, due to a combination of markets conditions and reduction in Model B clients.

Cash under administration - average balance (1)

Cash under administration is a function of client numbers and trade volumes. During the 18 months to 30th June 2025 cash under administration continued to decrease from prior periods, mainly due to the reduced volumes year-on-year.

(1) These graphs are to demonstrate the trend and values have been intentionally omitted

Group structure

The principal trading subsidiary of the group is Jarvis Investment Management Ltd. Jarvis Investment Management Ltd is the 100% owner of three dormant nominee companies. For regulatory reasons relating to administration and cost, Jarvis Securities plc is the AIM traded parent, holds most of the assets of the group and is responsible for activities that fall outside the scope of regulated investment business. Jarvis Investment Management Ltd is a Member of The London Stock Exchange (LSE) and Aquis Stock Exchange (AQSE) and is authorised and regulated by the Financial Conduct Authority (FCA). This status is essential for the trading activities of the group and therefore compliance with the rules of both the LSE and FCA is of paramount importance. The group provides retail execution-only stockbroking, ISA investment wrappers, and savings schemes. In addition, it provides financial administration, settlement and safe custody services in all these areas to other stockbrokers and investment firms as well as individuals.

Capitalisation and financing

Jarvis Securities plc had 64,000,000 authorised Ordinary 0.25p shares. Of these, 44,731,000 were in issue at the end of the period. These shares are admitted to trading on AIM. The business requires no debt or external financing. The Board balance the use of cash between maintaining sufficient reserves for regulatory requirements, the stated dividend policy, and delivery the wind-down plan.

EPS and P/E ratio

The principal measures used by investors to compare and rate publicly traded companies are the earnings per share (EPS) and the relative multiple to these earnings of the current share price (the price earnings or P/E ratio). The Board must have regard to these measures in order to maximise returns to investors. EPS is a result of dividing profit after tax by the average number of shares in issue throughout the period. The P/E ratio is the average share price during the year divided by EPS. The average share price during the period was 49p (Year to 31st December 2023: 123p). The P/E ratio is largely a product of the market price of the shares in the Company and hence is largely beyond the control of the Board. These measures are important to investors and hence need to be given high regard.

18 months to 30th June 2025 EPS (annualised): 3.25p

Year to 31st December 2023 EPS: 8.90p

Rate of change: -63.5%

18 months to 30th June 2025 P/E ratio: 10.08

Year to 31st December 2023 P/E ratio: 13.85

Principal risks and uncertainties

The following are the main risks to the Jarvis Securities plc group that are considered and monitored by the board:

Revenue risk

The Jarvis business model has several income streams. These are primarily commission income, interest income and fixed fee income. As described earlier in this report, each of these areas has been subject to various external pressures, resulting in the decision to sell the retail execution-only brokerage business.

Regulatory risk

Changes in the regulatory environment resulting in additional costs or significant system or product amendments.

The firm operates in the "execution only", transaction processing and reporting, and safe custody areas of the financial services environment. Retail clients are currently only able to sell or hold assets. As part of ongoing risk management, the firm avoids entry into areas where it lacks expertise or that have additional regulatory complexities. The firm is currently undergoing a skilled person review and is using outside expertise as required to ensure the correct risk framework is established and the firm is fully compliant with its Consumer Duty obligations during the wind-down period.

Competitor risk

The firm operates in a competitive industry and has many larger competitors in the execution only retail and institutional market.

Cybercrime

Loss of data, client assets or corporate assets through breaches of our IT infrastructure would result in financial loss to the firm and reputational damage.

The board acknowledge the growing threat of cybercrime and maintain up to date industry standards in IT security. The firm's IT infrastructure is externally audited, policies and procedures are in place to minimise the risk of critical data loss, employees must complete ongoing training in money laundering and fraud prevention and all computers are installed with malware protection.

Interest rate risk

The interest rate environment has a significant effect on the earnings of the company. This risk is reducing as Jarvis Investment Management Limited's wind down progresses and the amount of client money deposits falls.

Economic risk

Market sentiment directly impacts on bargain numbers transacted and hence commission income for the company, however this is no longer significant as Jarvis Investment Management Limited is in wind-down and has recently moved to a hold/sell only product for remaining retail clients.

Reputational risk

As the custodian of the wealth of our clients, the firm adopts procedures that minimise the risk of fraudulent activity occurring either within the firm or by a third party.

Operational risk

The main risk Jarvis is exposed to in its day to day activities is settlement risk, and all procedures within the firm are designed to mitigate this risk where possible. There may be instances where errors occur which leave the firm unintentionally exposed to market risk as a result of an error in its operating processes. Given the volume of transactions being processed these errors are extremely infrequent. When they do occur, they are reviewed to see if further process enhancements can be made to minimise future errors.

Key personnel risk

Loss of key personnel is a threat to any skills-based business.

The firm attempts to set remuneration at competitive market levels and empower key employees so that they enjoy working at Jarvis. All employment contracts for key staff members include sufficient notice periods for replacements to be recruited and trained. Jarvis Investment Management Limited has designed and implemented a staff retention schedule, together with a financial package, to ensure that staff with the appropriate skills remain with the firm until the appropriate point within the wind down of the company. The firm has also introduced initiatives such as hybrid working for specific roles, flexibles hours etc. in order to attract and retain high calibre staff, which it acknowledges as a challenge especially given the firms outside London location.

Third party reliance risk

Any take over at the London Stock Exchange could result in major unanticipated changes for Jarvis and its commercial clients.

The board monitor any proposed changes to the pricing structure of The London Stock Exchange and will calculate any impact on the wind down of Jarvis Investment Management Limited.

Regulatory capital

Jarvis Investment Management Limited, the Group's main operating subsidiary, is a class 2 non-small and not interconnected firm (non SNI firm), authorised and regulated by the FCA, and together with its' parent, Jarvis Securities Plc, forms a UK Investment Firm Group. At 30th June 2025 Jarvis Investment Management Limited had regulatory capital resources of £0.7m and an Own Funds Threshold Requirement of £7.1m, giving a capital solvency ratio of 11% as at that time, the company was awaiting the completion of the sale of the execution-only retail brokerage business, which returns the capital solvency ratio to 204% as at 31st July 2025.

Jarvis Investment Management Limited maintains an Internal Capital and Risk Assessment (ICARA), which includes reviewing the risks the firm is exposed to and performing a range of stress tests to determine the appropriate level of regulatory capital and liquidity required by Jarvis Investment Management Limited. Consolidated regulatory capital forecasts are performed quarterly prior to the payment of any dividend from Jarvis Securities Plc. Jarvis Investment Management Limited's MIFIDPRU 8 disclosures are published annually on the company's website and provide further details about the Company's regulatory capital resources and requirements.

Section 172(1) Statement

The directors act in good faith to make decisions, the outcome of which, they consider will be most likely to promote the success of the group for the benefit of its members as a whole both in current periods and in the long term.

In discharging their duties above, the directors carefully consider amongst other matters, the impact on and interests of other stakeholders in the group and factor these into their decision-making process.

Employees

Directors receive information on various staff metrics. The directors are committed to promoting a healthy workforce comprising both physical and mental wellbeing. The directors keep staff informed of key issues through structured communication channels, promote inclusion in the workplace and also provide training and development opportunities which are considered of benefit to the group and employees. Using the Group's recruitment and development strategies, the directors seek to attract and retain talented staff. A staff retention policy has been implemented to ensure staff are incentivised to remain with the firm for the required length of time in order to support the wind-down.

Customers

The directors commit considerable time, effort and resources into understanding and responding to the needs of our customers at all times. We act to service our customer's needs to the highest standards and have procedures in place for the escalation of disputes on the infrequent occasions they occur.

Suppliers

The Group seeks to pay all suppliers any undisputed amounts due and that conform with the Group's billing requirements within agreed terms.

Community and the environment

The Group takes its role within the community seriously and promotes and encourages community and charitable contribution. The Group also recognises the importance of environmental responsibilities and whilst not in an industry that has a significant impact on the environment, it participates in schemes such as cycle to work to promote environmental awareness.

Standards and conduct

The group has a series of defined codes of practice regarding ethical standards and the conduct of business. These are clearly communicated to every staff member and adherence to which is expected and enforced.

Consolidated income statement for the 18 MONTHS ended 30 JUNE 2025

| 18 Months to | Year to | ||||

| 30/06/25 | 31/12/23 | ||||

| Notes | |||||

| £ | £ | ||||

| Discontinued operations: | |||||

| Revenue | 3 | 17,850,462 | 13,088,907 | ||

| Administrative expenses Exceptional administrative expenses Lease finance costs |

5 13 |

(10,808,061) (4,050,186) (18,852) |

(6,523,706) (1,337,522) (17,090) |

||

| Profit before income tax | 5 | 2,973,363 | 5,210,589 | ||

| Income tax charge | 7 | (790,719) | (1,229,356) | ||

| Profit for the period | 2,182,644 | 3,981,233 | |||

| Attributable to equity holders of the parent | 2,182,644 | 3,981,233 | |||

| Earnings per share | 8 | P | P | ||

| Basic and diluted | 4.88 | 8.90 | |||

Consolidated statement of comprehensive income for the PERIOD

| Notes | 18 Months to | Year to | |||

| 30/06/25 | 31/12/23 | ||||

| £ | £ | ||||

| Profit for the period | 2,182,644 | 3,981,233 | |||

| Total comprehensive income for the period | 2,182,644 | 3,981,233 | |||

| Attributable to equity holders of the parent | 2,182,644 | 3,981,233 |

The notes form part of these financial statements

Consolidated STATEMENT OF FINANCIAL POSITION at 30 JUNE 2025

| 30/06/25 | 31/12/23 | ||||||||||

| Notes | |||||||||||

| £ | £ | ||||||||||

| Assets | |||||||||||

| Non-current assets | |||||||||||

| Property, plant and equipment | 9 | - | 505,184 | ||||||||

| Intangible assets | 10 | - | 45,331 | ||||||||

| Goodwill | 10 | - | 342,872 | ||||||||

| - | 893,387 | ||||||||||

| Current assets held for sale/to be disposed of on wind down | |||||||||||

| Property, plant and equipment | 9 | 375,256 | - | ||||||||

| Intangible assets | 10 | 13,391 | - | ||||||||

| Goodwill | 10 | 342,872 | - | ||||||||

| Trade and other receivables | 12 | 1,598,653 | 2,011,608 | ||||||||

| Investments held for trading | 14 | 11,991 | 11,966 | ||||||||

| Cash and cash equivalents | 15 | 6,423,956 | 5,514,075 | ||||||||

| 8,766,119 | 7,537,649 | ||||||||||

| Total assets | 8,766,119 | 8,431,036 | |||||||||

| Equity and liabilities | |||||||||||

| Capital and reserves | |||||||||||

| Share capital | 16 | 111,828 | 111,828 | ||||||||

| Merger reserve | 9,900 | 9,900 | |||||||||

| Capital redemption reserve | 9,845 | 9,845 | |||||||||

| Retained earnings | 4,075,963 | 4,912,384 | |||||||||

| Total equity attributable to the equity holders of the parent | 4,207,536 | 5,043,957 | |||||||||

| Non-current liabilities | |||||||||||

| Deferred tax | 7 | - | 54,266 | ||||||||

| Lease liabilities | 13 | - | 223,515 | ||||||||

| - | 277,781 | ||||||||||

| Current liabilities | |||||||||||

| Deferred tax | 7 | 48,180 | - | ||||||||

| Trade and other payables | 17 | 1,493,441 | 2,541,690 | ||||||||

| Lease liabilities | 13 | 185,114 | 73,997 | ||||||||

| Provisions | 25 | 2,831,848 | - | ||||||||

| Income tax | 7 | - | 493,611 | ||||||||

| 4,558,583 | 3,109,298 | ||||||||||

| Total liabilities | 4,558,583 | 3,387,079 | |||||||||

| Total equity and liabilities | 8,766,119 | 8,431,036 | |||||||||

CoMPANY STATEMENT OF FINANCIAL POSITION at 30 JUNE 2025

| 30/06/25 | 31/12/23 | ||||

| Notes | |||||

| £ | £ | ||||

| Assets | |||||

| Non-current assets | |||||

| Property, plant and equipment | 9 | - | 505,184 | ||

| Intangible assets | 10 | - | 45,331 | ||

| Goodwill | 10 | - | 342,872 | ||

| Investment in subsidiaries | 11 | - | 884,239 | ||

| - | 1,777,626 | ||||

| Non-current assets held for sale | |||||

| Property, plant and equipment | 9 | 202,012 | - | ||

| Intangible assets | 10 | 13,391 | - | ||

| Goodwill | 10 | 342,872 | - | ||

| Investment in subsidiaries | 11 | 1,767,788 | - | ||

| Trade and other receivables | 12 | 409,450 | 166,298 | ||

| Cash and cash equivalents | 15 | 3,366,005 | 1,406,811 | ||

| 6,101,518 | 1,573,109 | ||||

| Total assets | 6,101,518 | 3,350,735 | |||

| Equity and liabilities | |||||

| Capital and reserves | |||||

| Share capital | 16 | 111,828 | 111,828 | ||

| Capital redemption reserve | 9,845 | 9,845 | |||

| Retained earnings | 5,139,103 | 1,840,421 | |||

| Total equity attributable to the equity holders | 5,260,776 | 1,962,094 | |||

| Non-current Liabilities | |||||

| Deferred Tax | 7 | - | 55,523 | ||

| Lease Liabilities | 13 | - | 223,514 | ||

| - | 279,037 | ||||

| Current liabilities | |||||

| Deferred Tax | 7 | 50,008 | - | ||

| Trade and other payables | 17 | 790,734 | 541,996 | ||

| Lease liabilities | 13 | - | 73,997 | ||

| Income tax | 7 | - | 493,611 | ||

| 840,742 | 1,109,604 | ||||

| Total liabilities | 840,742 | 1,388,641 | |||

| Total equity and liabilities | 6,101,518 | 3,350,735 |

The parent company's profit for the 18 months to 30 June 2025 was £6,317,748 (Year to 31 December 2023: £5,128,416).

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

| Share capital | Merger reserve | Capital redemption reserve | Retained earnings | Total equity | |

| £ | £ | £ | £ | £ | |

| At 1 January 2023 | 111,828 | 9,900 | 9,845 | 4,845,114 | 4,976,687 |

| Profit for the financial year | - | - | - | 3,981,233 | 3,981,233 |

| Dividends | - | - | - | (3,913,962) | (3,913,962) |

| At 31 December 2023 | 111,828 | 9,900 | 9,845 | 4,912,385 | 5,043,958 |

| Profit for the period | - | - | - | 2,182,644 | 2,182,644 |

| Dividends | - | - | - | (3,019,066) | (3,019,066) |

| At 30 June 2025 | 111,828 | 9,900 | 9,845 | 4,075,963 | 4,207,536 |

COMPANY STATEMENT OF CHANGES IN EQUITY

| Share capital | Capital redemption reserve | Retained earnings | Total equity | |

| £ | £ | £ | £ | |

| At 1 January 2023 | 111,828 | 9,845 | 625,967 | 747,640 |

| Profit for the financial year | - | - | 5,128,416 | 5,128,416 |

| Dividends | - | - | (3,913,962) | (3,913,962) |

| At 31 December 2023 | 111,828 | 9,845 | 1,840,421 | 1,962,094 |

| Profit for the period | - | - | 6,317,748 | 6,317,748 |

| Dividends | - | - | (3,019,066) | (3,019,066) |

| At 30 June 2025 | 111,828 | 9,845 | 5,139,103 | 5,260,776 |

statement OF cashflows

for the 18 months to 30 june 2025

| CONSOLIDATED | COMPANY | ||||

| 18 months to | Year to | 18 months to | Year to | ||

| 30/06/25 | 31/12/23 | 30/06/25 | 31/12/23 | ||

| Notes | |||||

| £ | £ | £ | £ | ||

| Cash flow from operating activities | |||||

| Profit before income tax | 2,973,363 | 5,210,589 | 9,064,434 | 6,710,558 | |

| Depreciation and amortisation | 5 | 161,869 | 118,421 | 78,455 | 118,421 |

| Impairment of Investment | 11 | - | - | 1,716,451 | - |

| Lease finance cost | 18,852 | 17,090 | 6,188 | 17,090 | |

| 3,154,084 | 5,346,100 | 10,865,528 | 6,846,069 | ||

| (Increase) /Decrease in trade and other receivables | 894,855 | 1,377,319 | 128,907 | (78,374) | |

| (Decrease) /Increase in trade payables | (1,048,248) | (197,640) | (3,896,818) | (1,399,106) | |

| Increase in provisions | 2,831,848 | - | - | - | |

| Cash generated from operations | 5,832,539 | 6,525,779 | 7,097,617 | 5,368,589 | |

| Income tax (paid)/received | (1,772,316) | (1,285,032) | (1,772,316) | (1,285,032) | |

| Net cash from operating activities | 4,060,223 | 5,240,747 | 5,325,301 | 4,083,557 | |

| Cash flows from investing activities | |||||

| Purchase of property, plant and equipment | - | - | - | - | |

| Proceeds from sale of property, plant and equipment | - | - | - | - | |

| Purchase of investments held for trading | (186,207) | (57,933) | - | - | |

| Proceeds from sale of investments held for trading | 186,181 | 54,736 | - | - | |

| Investments in subsidiaries | - | - | (300,000) | (600,000) | |

| Purchase of intangible assets | - | (750) | - | (750) | |

| Net cash from investing activities | (26) | (3,946) | (300,000) | (600,750) | |

| Dividends paid | (3,019,066) | (3,913,962) | (3,019,066) | (3,913,962) | |

| Lease finance costs | (18,852) | (17,090) | (6,188) | (17,090) | |

| Repayment of lease liability | (112,398) | (70,410) | (40,854) | (70,410) | |

| Net cash used in financing activities | (3,150,316) | (4,001,462) | (3,066,107) | (4,001,462) | |

| Net (decrease)/ increase in cash & cash equivalents | 909,881 | (1,235,338) | 1,959,194 | (518,655) | |

| Cash and cash equivalents at the start of the period | 5,514,075 | 4,278,737 | 1,406,811 | 1,925,466 | |

| Cash and cash equivalents at the end of the period | 6,423,956 | 5,514,075 | 3,366,005 | 1,406,811 | |

| Cash and cash equivalents: | |||||

| Balance at bank and in hand | 5,161,461 | 5,169,380 | 3,366,005 | 1,406,811 | |

| Cash held for settlement of market transactions | 1,262,495 | 344,695 | - | - | |

| 6,423,956 | 5,514,075 | 3,366,005 | 1,406,811 |

1. Basis of preparation

The Company has adopted the requirements of international accounting standards as adopted by the United Kingdom and those parts of the Companies Act 2006 applicable to companies reporting under IFRS. The financial statements have been prepared under the historical cost convention as modified by the revaluation of financial assets at fair value through profit or loss.

These financial statements have been prepared in accordance with the accounting policies set out below, which have been consistently applied to all the periods presented. Due to the timing of the completion of the sale by JIML of its retail execution-only business, the Board decided to extend the accounting period from December 2024 to June 2025 in order to ensure the sale had completed prior to the preparation of the accounts, which it did on 7th July 2025. Because of this change, the amounts presented in the financial statements are not entirely comparable.

Due to the group no longer being a going concern (see below), all assets and liabilities have been reclassified as current. Assets are stated at the lower of carrying amount and fair value less costs to sell on a fair value basis, with no material write-ups or write downs.

New standards, not yet effective

There are no standards that are issued but not yet effective that would be expected to have a material impact on the entity in the current or future reporting periods and on foreseeable future transactions.

Significant judgements and estimates

The group makes estimates and assumptions concerning the future. These estimates and judgements are based on historical experience and other factors, including expectations of future events that are believed to be reasonable under the circumstances. The resulting accounting estimates will, by definition, seldom equal the related actual results. These judgements and estimates include impairment of investments, per note 11, and provisions and contingent liabilities, per note 25.

Going concern

The group's business activities, together with the factors likely to affect its future development, performance and position are set out in the Strategic Report (above). The financial position of the group, its cash flows, liquidity position and borrowing facilities are described within these financial statements. In addition, note 24 of the financial statements includes the group's objectives, policies and processes for managing its capital; its financial risk management objectives; details of its financial instruments and hedging activities; and its exposure to credit risk and liquidity risk.

The group has considerable financial resources, however, as described in the Strategic Report (above) , the firm is currently in wind-down and therefore the Board do not consider the going concern basis appropriate for these financial statements. This differs to the previous financial period reported, which were prepared on a going concern basis as, at that time, the firm intended to continue trading with the aim of increasing profitability.

2. Accounting policies

(a) IFRS 15 'Revenue from Contracts with Customers'

Commission - the group charges commission on a transaction basis. Commission rates are fixed according to account type. When a client instructs us to act as an agent on their behalf (for the purchase or sale of securities) our commission is recognised as income on a point in time basis when the instruction is executed in the market. Our commission is deducted from the cash given to us by the client in order to settle the transaction on the client's behalf or from the proceeds of the sale in instance where a client sells securities.

Management fees - these are charged quarterly or bi-annually depending on account type. Fees are either fixed or are a percentage of the assets under administration. Management fees income is recognised over time as they are charged using a day count and most recent asset level basis as appropriate.

Interest income - this is accrued on a day count basis up until deposits mature and the interest income is received. The deposits pay a fixed rate of interest. In accordance with FCA requirements, deposits are only placed with banks that have been approved by our Treasury Committee. Interest income is recognised over time as the deposits accrue interest on a daily basis.

(b) Basis of consolidation

Subsidiaries are all entities over which the Group has the power to govern the financial and operating policies generally accompanying a shareholding of more than half of the voting rights. The existence and effect of potential voting rights that are currently exercisable or convertible are considered when assessing whether the Group controls another entity. Subsidiaries are fully consolidated from the date on which control is transferred to the Group. They are deconsolidated from the date on which control ceases. The group financial statements consolidate the financial statements of Jarvis Securities plc, Jarvis Investment Management Limited, JIM Nominees Limited, Galleon Nominees Limited and Dudley Road Nominees Limited made up to 30 June 2025.

The Group uses the purchase method of accounting for the acquisition of subsidiaries. The cost of an acquisition is measured as the fair value of the assets given, equity instruments issued and liabilities incurred or assumed at the date of exchange. Identifiable assets acquired and liabilities and contingent liabilities assumed in a business combination are measured initially at their fair values at the acquisition date,

irrespective of the extent of any non-controlling interest. The cost of acquisition over the fair value of the Group's share of identifiable net assets acquired is recorded as goodwill. If the cost of acquisition is less than the fair value of the Group's share of the net assets of the subsidiary acquired, the difference is recognised in the income statement.

Intra-group sales and profits are eliminated on consolidation and all sales and profit figures relate to external transactions only. No profit and loss account is presented for Jarvis Securities plc as provided by S408 of the Companies Act 2006.

(c) Property, plant and equipment

All property, plant and equipment is shown at cost less subsequent depreciation and impairment. Cost includes expenditure that is directly attributable to the acquisition of the items. Depreciation is provided on cost in equal annual instalments over the lives of the assets at the following rates:

Leasehold improvements - 33% on cost, or over the lease period if less than 3 years

Office equipment - 20% on cost

Land & Buildings - Buildings are depreciated at 2% on cost. Land is not depreciated.

Right of use asset - Straight line basis over the lease period

The assets' residual values and useful lives are reviewed, and adjusted if appropriate, at each year end date. Gains and losses on disposals are determined by comparing proceeds with carrying amount. These are included in the income statement. Impairment reviews of property, plant and equipment are undertaken if there are indications that the carrying values may not be recoverable or that the recoverable amounts may be less than the asset's carrying value.

(d) Intangible assets

Intangible assets are carried at cost less accumulated amortisation. If acquired as part of a business combination the initial cost of the intangible asset is the fair value at the acquisition date. Amortisation is charged to administrative expenses within the income statement and provided on cost in equal annual instalments over the lives of the assets at the following rates:

Databases - 4% on cost

Customer relationships - 7% on cost

Software developments - 20% on cost

Website - 33% on cost

Impairment reviews of intangible assets are undertaken if there are indications that the carrying values may not be recoverable or that the recoverable amounts may be less than the asset's carrying value.

(e) Goodwill

Goodwill represents the excess of the fair value of the consideration given over the aggregate fair values of the net identifiable assets of the acquired trade and assets at the date of acquisition. Goodwill is tested annually for impairment and carried at cost less accumulated impairment losses. Any negative goodwill arising is credited to the income statement in full immediately.

(f) Deferred income tax

Deferred income tax is provided in full, using the liability method, on differences arising between the tax bases of assets and liabilities and their carrying amounts in the consolidated financial statements. The deferred income tax is not accounted for if it arises from initial recognition of an asset or liability in a transaction, other than a business combination, that at the time of the transaction affects neither accounting or taxable profit or loss. Deferred income tax is determined using tax rates that have been enacted or substantially enacted by the balance sheet date and are expected to apply when the related deferred income tax asset is realised or the deferred income tax liability is settled.

Deferred income tax assets are recognised to the extent that it is probable that future taxable profit will be available against which the temporary differences can be utilised.

Deferred income tax is provided on temporary differences arising on investments in subsidiaries except where the timing of the reversal of the temporary difference is controlled by the Group and it is probable that the temporary differences will not reverse in the foreseeable future.

(g) Segmental reporting

A business segment is a group of assets and operations engaged in providing products or services that are subject to risks and returns that are different from those of other business segments. The directors regard the operations of the Group as a single segment.

(h) Pensions

The group operates a defined contribution pension scheme. Contributions payable for the year are charged to the income statement.

(i) Investments

Investments held for trading

Under IFRS investments held for trading are recognised as financial assets measured at fair value through profit and loss.

Investments in subsidiaries

Investments in subsidiaries are stated at cost less provision for any impairment in value.

(j) Share capital

Incremental costs directly attributable to the issue of new shares or options are shown in equity as a deduction from proceeds, net of income tax. Where the company purchases its equity share capital (treasury shares), the consideration paid, including any directly attributable incremental costs (net of income tax), is deducted from equity attributable to the company's equity holders until the shares are cancelled, reissued or disposed of. Where such shares are subsequently sold or reissued, any consideration received, net of any directly incremental transaction costs and the related income tax effects, is included in equity attributable to the company's equity holders.

(k) Cash and cash equivalents

Cash and cash equivalents comprise:

Balance at bank and in hand - cash in hand and demand deposits, together with other short-term, highly liquid investments that are readily convertible into known amounts of cash and which are subject to an insignificant risk of changes in value.

Cash held for settlement of market transactions - this balance is cash generated through settlement activity, and can either be a surplus or a deficit. A surplus arises when settlement liabilities exceed settlement receivables. This surplus is temporary and is accounted for separately from the balance at bank and in hand as it is short term and will be required to meet settlement liabilities as they fall due. A deficit arises when settlement receivables exceed settlement liabilities. In this instance Jarvis will place its own funds in the client account to ensure CASS obligations are met. This deficit is also temporary and will reverse once settlement receivables are settled.

(l) Current income tax

Current income tax assets and/or liabilities comprise those obligations to, or claims from, fiscal authorities relating to the current or prior reporting periods, that are unpaid at the Period end date. They are calculated according to the tax rates and tax laws applicable to the fiscal periods to which they relate based on the taxable profit for the period.

(m) Dividend distribution

Dividend distribution to the company's shareholders is recognised as a liability in the group's financial statements in the period in which interim dividends are notified to shareholders and final dividends are approved by the company's shareholders.

(n) IFRS 9 'Financial Instruments'

Financial assets

Financial assets are recognised in the Company's statement of financial position when the Company becomes party to the contractual provisions of the instrument.

Financial assets are classified into specified categorises. The classification depends on the nature and purpose of the financial assets and id determined at the time of recognition.

Financial assets are initially measured at fair value plus transaction costs, other than those classified as fair value through the income statement, which are measured at fair value.

Trade and other receivables

Trade receivables are recognised and carried at the lower of their original invoiced value and recoverable amount. Balances are written off when the probability of recovery is considered to be remote.

Derecognition of financial assets

Financial assets are derecognised only when the contractual rights to the cash flows from the asset expire, or when it transfers the financial asset and substantially all the risks and rewards of ownership to another entity.

Financial Liabilities

Financial liabilities are classified as either financial liabilities at fair value through the income statement or other financial liabilities.

Financial liabilities are classified according to the substance of the contractual arrangements entered into.

Derecognition of financial liabilities

Financial liabilities are derecognised when, and only when, the Company's obligations are discharged, cancelled, or they expire.

(o) IFRS 16 'Leases'

The lease liability is measured at the present value of the lease payments that are not paid at the commencement date, discounted using the interest rate implied in the lease or, if that rate cannot be readily determined, the Group's incremental borrowing rate.

The Group has applied judgement to determine the lease term for contracts with options to renew or exit early.

The carrying amount of right-of-use assets recognised was £384,985 at the lease start date of 27 September 2022. A finance charge of 5% APR is used to calculate the finance cost of the lease. The Group has elected not to recognise right of use assets and lease liabilities for leases of low value assets and short-term leases. Lease payments relating to these leases are expensed to profit or loss on a straight-line basis over the lease term.

(p) IFRS 15 'Non-current Assets Held for Sale and Discontinued Operations'.

The firm has implemented IFRS 5 for the accounting period ended 30th June 2025 as the Board do not consider the going concern basis of preparation to be appropriate due to the Board's decision to wind-down the business. Therefore, all revenue is considered to be derived from discontinued Operations, Fixed Assets have been reclassified as Non-current Assets Held for Sale, and all non-current liabilities have been reclassified as current.

(q) Provisions

The group has recognised provisions for liabilities of uncertain timing or amount including those for onerous leases, warranty claims, leasehold dilapidations and legal disputes. The provision is measured at the best estimate of the expenditure required to settle the obligation at the reporting date, discounted at a pre-tax rate reflecting current market assessments of the time value of money and risks specific to the liability.

3. Group revenue

The revenue of the group during the year was wholly in the United Kingdom and the revenue of the group for the year derives from the same class of business as noted in the Strategic Report.

| 18 months to 30th June 2025 | Year to 31st Dec 2023 | ||

| £ | £ | ||

| Gross interest earned from treasury deposits, cash at bank and overdrawn client accounts | 12,063,459 | 7,614,815 | |

| Commissions | 3,177,939 | 2,660,896 | |

| Fees | 2,609,064 | 2,813,196 | |

| 17,850,462 | 13,088,907 |

4. Segmental information

All of the reported revenue and operational results for the period derive from the group's external customers and continuing financial services operations. All non-current assets are held within the United Kingdom. The group is not reliant on any one customer and no customer accounts for more than 10% of the group's external revenues.

As noted in 2 (g) the directors regard the operations of the group as a single reporting segment on the basis there is only a single organisational unit that is reported to key management personnel for the purpose of performance assessment and future resource allocation.

| 5. Profit before income tax | 18 months to 30th June 2025 | Year to 31st December 2023 | |

| Profit before income tax is stated after charging/(crediting): | £ | £ | |

| Directors' emoluments | 1,229,864 | 729,827 | |

| Depreciation - right of use asset | 115,496 | 76,997 | |

| Depreciation - owned assets | 14,433 | 15,863 | |

| Amortisation (included within administrative expenses in the consolidated income statement) | 31,940 | 25,561 | |

| Low value leases | 13,794 | 8,852 | |

| Impairment of receivable charge / (credit) | (83,431) | (8,598) | |

| Bank transaction fees | 102,310 | 51,362 |

Details of directors' annual remuneration are set out below:

| 18 months to 30th June 2025 | Year to 31st December 2023 | |||||||

| £ | £ | |||||||

| Short-term employee benefits | 1,059,089 | 641,243 | ||||||

| Post-employment benefits | 158,959 | 74,393 | ||||||

| Benefits in kind | 11,816 | 14,191 | ||||||

| 1,229,864 | 729,827 | |||||||

| Details of the highest paid director are as follows: | ||||||||

| Aggregate emoluments | 386,500 | 357,500 | ||||||

| Post-employment benefits | 101,709 | - | ||||||

| Benefits in kind | 9,919 | 11,133 | ||||||

| 498,128 | 368,633 | |||||||

| Emoluments & Benefits in kind | Pension | Total | ||||||

| Directors | £ | £ | £ | |||||

| Andrew J Grant | 396,419 | 101,709 | 498,128 | |||||

| Kieran M Price | 205,353 | 19,750 | 225,103 | |||||

| S M Middleton | 55,000 | - | 55,000 | |||||

| Jarvis Investment Management Directors | 339,133 | 30,000 | 369,133 | |||||

| TOTAL | 995,905 | 151,459 | 1,147,364 | |||||

| During the period benefits accrued for four directors (Year to 31st December 2023: four directors) under a money purchase pension scheme. | ||||||||

| 5. Profit before Income tax (continued). Staff Costs The average number of persons employed by the group, including directors, during the year was as follows: |

||||||||

| 18 months to 30th June 2025 | Year to 31st December 2023 | |||||||

| Management and administration | 56 | 54 | ||||||

| The aggregate payroll costs of these persons were as follows: | £ | £ | ||||||

| Wages & salaries | 4,260,200 | 2,306,091 | ||||||

| Social security | 495,759 | 243,955 | ||||||

| Pension contributions including salary sacrifice | 266,612 | 107,971 | ||||||

| 5,022,571 | 2,658,017 |

Key personnel

The directors disclosed above are considered to be the key management personnel of the group. The total amount of employers NIC paid on behalf of key personal in the period was £112,365 (Year to 31st December 2023: £80,549).

Exceptional administrative costs

Exceptional administrative costs represent external third party professional advice and consultancy relating to the ongoing remediation and skilled persons work within the firm's subsidiary Jarvis Investment Management Limited, as well as Legal and professional costs in relation to the sale of the majority of retail clients by Jarvis Investment Management Limited.

| 18 months to 30th June 2025 | Year to 31st December 2023 | ||

| £ | £ | ||

| Costs in relation to skilled person review/remediation | 945,869 | 1,337,522 | |

| Costs in relation to the sale of the retail execution-only business | 272,469 | - | |

| Provision in respect of redress | 2,831,848 | - | |

| 4,050,186 | 1,337,522 |

| 6. Auditors' remuneration | |||

| During the year the company obtained the following services from the company's auditors as detailed below: | |||

| 18 months to 30th June 2025 | Year to 31st December 2023 | ||

| £ | £ | ||

| Fees payable to the company's auditors for the audit of the company's annual financial | |||

| Statements | 80,181 | 33,000 | |

| Fees payable to the company's auditors and its associates for other services: | |||

| The audit of the company's subsidiaries, pursuant to legislation | 17,000 | 17,000 | |

| Total audit fees | 97,181 | 50,000 | |

| Taxation Compliance | 6,175 | 5,650 | |

| 103,356 | 55,650 |

The audit costs of the subsidiaries were invoiced to and met by Jarvis Securities plc.

| 7. Income and deferred tax charges - group | 18 months to 30th June 2025 | Year to 31st December 2023 | ||||||

| £ | £ | |||||||

| Based on the adjusted results for the year: | ||||||||

| UK corporation tax | 795,625 | 1,231,304 | ||||||

| Adjustments in respect of prior years | 1,182 | 3,830 | ||||||

| Total current income tax | 796,807 | 1,235,134 | ||||||

| Deferred income tax: | ||||||||

| Origination and reversal of temporary differences | (4,752) | (5,779) | ||||||

| Adjustment in respect of prior years | (1,336) | 2 | ||||||

| Adjustment in respect of change in deferred tax rates | - | - | ||||||

| Total deferred tax charge | (6,088) | (5,777) | ||||||

| 790,719 | 1,129,357 | |||||||

The income tax assessed for the period is more than the standard rate of corporation tax in the UK for 2025 of 25% (Year to 31st December 2023 - 23.5%). The differences are explained below:

Profit before income tax

2,973.363

5,210,589

Profit before income tax multiplied by the standard rate of corporation tax in the UK of

25% (2023 - 23.5%)

743,341

1,225,559

Effects of:

Expenses not deductible for tax purposes

46,669

-

Adjustments to tax charge in respect of previous years

(154)

3,832

Ineligible depreciation

-

397

Deferred tax on timing differences

863

-

Adjustment in respect of change in deferred tax rate

-

(431)

Current income tax charge for the years

790,719

1,229,356

| Movement in (assets) / provision - group: | |||

| Provision at start of period | 54,266 | 60,044 | |

| Deferred income tax charged in the period | (4,750) | (5,778) | |

| Adjustment in respect of previous year | (1,336) | - | |

| Provision at end of period | (48,180) | 54,266 |

| Movement in (assets) / provision - company: | |||

| Provision at start of period | 55,523 | 61,006 | |

| Deferred income tax charged in the period | (5,515) | (5,483) | |

| Provision at end of period | 50,008 | 55,523 |

| 8. Earnings per share | 18 months to 30th June 2025 | Year to 31st December 2023 | ||||

| £ | £ | |||||

| Earnings: Earnings for the purposes of basic and diluted earnings per share |

||||||

| (profit for the period attributable to the equity holders of the parent) | 2,182,644 | 3,981,233 | ||||

| Number of shares: | ||||||

| Weighted average number of ordinary shares for the purposes of basic earnings per share | 44,731,000 | 44,731,000 | ||||

| 44,731,000 | 44,731,000 | |||||

| 9. Property, plant & equipment - group | Right of use assets - Leasehold | Leasehold & Property | Office Equipment |

Total | ||||

| Cost: | £ | £ | £ | £ | ||||

| At 1 January 2023 | 384,985 | 222,450 | 73,112 | 680,547 | ||||

| Additions | - | - | - | - | ||||

| Disposals | - | - | - | - | ||||

| At 31 December 2023 | 384,985 | 222,450 | 73,112 | 680,547 | ||||

| Additions | - | - | - | - | ||||

| Disposals | - | - | - | - | ||||

| At 30 June 2025 | 384,985 | 222,450 | 73,112 | 680,547 | ||||

| Depreciation: | ||||||||

| At 1 January 2023 | 19,250 | 20,952 | 42,301 | 82,503 | ||||

| Charge for the year | 76,997 | 1,949 | 13,914 | 92,860 | ||||

| On Disposal | - | - | - | - | ||||

| At 31 December 2023 | 96,247 | 22,901 | 56,215 | 175,363 | ||||

| Charge for the period | 115,496 | 2,923 | 11,510 | 129,929 | ||||

| On Disposal | - | - | - | - | ||||

| At 30 June 2025 | 211,743 | 25,824 | 67,725 | 305,292 | ||||

| Net Book Value: | ||||||||

| At 30 June 2025 | 173,242 | 196,626 | 5,387 | 375,255 | ||||

| At 31 December 2023 | 288,738 | 199,549 | 16,897 | 505,184 |

The net book value of non-depreciable land is £125,000 (31st December 2023: £125,000).

All property, plant & equipment assets are available for sale/disposal.

| 9. Property, plant & equipment - company | Right of use assets - Leasehold | Leasehold & Property | Office Equipment |

Total | ||||

| Cost: | £ | £ | £ | £ | ||||

| At 1 January 2023 | 384,985 | 222,450 | 73,112 | 680,547 | ||||

| Additions | - | - | - | - | ||||

| Disposals | - | - | - | - | ||||

| At 31 December 2023 | 384,985 | 222,450 | 73,112 | 680,547 | ||||

| Additions | - | - | - | - | ||||

| Disposals | (384,985) | - | - | (384,985) | ||||

| At 30 June 2025 | - | 222,450 | 73,112 | 295,562 | ||||

| Depreciation: | ||||||||

| At 1 January 2023 | 19,250 | 20,952 | 42,301 | 82,503 | ||||

| Charge for the year | 76,997 | 1,949 | 13,914 | 92,860 | ||||

| On Disposal | - | - | - | - | ||||

| At 31 December 2023 | 96,247 | 22,901 | 56,215 | 175,363 | ||||

| Charge for the period | 32,082 | 2,923 | 11,510 | 46,515 | ||||

| On Disposal | (128,329) | - | - | (128,329) | ||||

| At 30 June 2025 | - | 25,824 | 67,725 | 93,549 | ||||

| Net Book Value: | ||||||||

| At 30 June 2025 | - | 196,626 | 5,387 | 202,013 | ||||

| At 31 December 2023 | 288,738 | 199,549 | 16,897 | 505,184 |

The net book value of non-depreciable land is £125,000 (31st December 2023: £125,000).

All property, plant & equipment assets are available for sale/disposal.

| 10. Intangible assets & goodwill - group & company | |||||||

| Goodwill | Databases | Software Development |

Website | Total | |||

| £ | £ | £ | £ | £ | |||

| Cost: | |||||||

| At 1 January 2023 | 342,872 | 25,000 | 146,788 | 3,877 | 175,665 | ||

| Additions | - | - | 750 | - | 750 | ||

| Disposals | - | - | - | - | - | ||

| At 31 December 2023 | 342,872 | 25,000 | 147,538 | 3,877 | 176,415 | ||

| Additions | - | - | - | - | - | ||

| Disposals | - | - | - | - | - | ||

| At 30 June 2025 | 342,872 | 25,000 | 147,538 | 3,877 | 176,415 | ||

| Amortisation: | |||||||

| At 1 January 2023 | - | 19,636 | 83,734 | 2,153 | 105,523 | ||

| Charge for the year | - | 1,000 | 23,269 | 1,292 | 25,561 | ||

| On Disposal | - | - | - | - | - | ||

| At 31 December 2023 | - | 20,636 | 107,003 | 3,445 | 131,084 | ||

| Charge for the period | - | 1,500 | 30,008 | 432 | 31,940 | ||

| On Disposal | - | - | - | - | - | ||

| At 30 June 2025 | - | 22,136 | 137,011 | 3,877 | 163,024 | ||

| Net Book Value: | |||||||

| At 30 June 2025 | 342,872 | 2,864 | 10,527 | - | 13,391 | ||

| At 31 December 2023 | 342,872 | 4,364 | 40,536 | 432 | 45,331 |

The goodwill balance represents an acquired customer base, and systems, processes and a registration that dramatically reduced the group's dealing costs. These systems and the registration contributed significantly to turning the group into a low cost effective provider of execution only stockbroking solutions. The key assumptions used by the directors in their annual impairment review are that the company can benefit indefinitely from the reduced dealing costs and the company's current operational capacity remains unchanged. The recoverable amount of the goodwill has been assessed at fair value less costs to sell. There are no reasonable changes in assumptions that would cause the cash generating unit value to fall below its carrying amount.

Following the sale of the retail execution-only business, the firm is reviewing the recoverable amount of the goodwill, and other intangible assets.

| 11. Investments in subsidiaries | Company | ||||||

| 18 months to 30th June 2025 | Year to 31st December 2023 | ||||||

| Unlisted Investments: | £ | £ | |||||

| Cost: | |||||||

| At start of period | 884,239 | 284,239 | |||||

| Investments during the period | 2,600,000 | 600,000 | |||||

| Impairment | (1,716,451) | - | |||||

| At end of period | 1,767,788 | 884,239 |

The Directors have reviewed the recoverability of the investment in Jarvis Investment Management Limited and made an impairment adjustment in the period of £1,716,451, based on the expected ultimate return of cash from the subsidiary upon completion of its' wind-down. There are uncertainties in relation to the provisions payable by the subsidiary (which are disclosed in note 25) which will ultimately impact the recoverable amount of this investment.

| Shareholding | Holding | Business | ||

| Jarvis Investment Management Limited | 100% | 85,000,000 | 1p Ordinary shares | Financial administration |

| Dudley Road Nominees Limited* | 100% | 2 | £1 Ordinary shares | Dormant nominee company |

| JIM Nominees Limited* | 100% | 1 | £1 Ordinary shares | Dormant nominee company |

| Galleon Nominees Limited* | 100% | 2 | £1 Ordinary shares | Dormant nominee company |

All subsidiaries are located in the United Kingdom and their registered office is 78 Mount Ephraim, Tunbridge Wells, Kent, TN4 8BS.

* indirectly held

| 12. Trade and other receivables | Group | Company | |||||

| Amounts falling due within one year: | 30th June 2025 | 31st December 2023 | 30th June 2025 | 31st December 2023 | |||

| £ | £ | £ | £ | ||||

| Trade receivables | 18,897 | 781,000 | - | 106,899 | |||

| Settlement receivables | 511,677 | 821,072 | - | - | |||

| Other receivables | 131,469 | 21,875 | - | 21,875 | |||

| Amount due from group undertaking | - | - | - | - | |||

| Prepayments and accrued income | 418,288 | 350,037 | 969 | 21,875 | |||

| Corporation tax | 481,898 | - | 372,057 | - | |||

| Other taxes and social security | 36,424 | 37,624 | 36,424 | 15,648 | |||

| 1,598,653 | 2,011,608 | 409.450 | 166,298 |

Settlement receivables are short term receivable amounts arising as a result of the settlement of trades in an agency capacity. The balances due are covered by stock collateral and bonds. An analysis of trade and settlement receivables past due is given in note 24. There are no amounts past due included within other receivables or prepayments and accrued income.

13. Leases

Lease liabilities are secured by the related underlying assets.

Due to Jarvis Investment Management limited being in wind-down, non-current lease liabilities have been reclassified as current liabilities.

The undiscounted maturity analysis of lease liabilities as at 30 June 2025 is as follows:

| < 1 year (£) | ||||||||

| Lease payment | 196,875 | |||||||

| Finance charge | (11,518) | |||||||

| Net present value | 185,114 |

| 30th June 2025 | |

| Lease liabilities included in the current statement of financial position | £ |

| Current | 185,114 |

| Non-current | - |

| 185,114 | |

| 30th June 2025 | |

| £ | |

| Amounts recognised in income statement | 18,852 |

| 18,852 |

The company had a lease with Sion Properties Limited, a company controlled by A J Grant, for the rental of 78 Mount Ephraim, a self-contained office building, which was assigned to the company's subsidiary Jarvis Investment Management Limited on 23rd May 2024. The lease has an annual rental of £87,500, being the market rate on an arm's length basis, and expires on 26 September 2027. The total cash outflow for leases in the 18 months to 30th June 2025 was £131,250 (Year to 31st December 2023 - £87,500).

Jarvis Investment Management Limited is currently assessing its options in relation to the lease of 78 Mount Ephraim as it is expected that the wind-down will be complete before the lease expires in September 2027.

| 14. Investments held for trading | Group | Company | ||||||||||||

| 18 months to 30th June 2025 | Year to 31st December 2023 | 18 months to 30th June 2025 | Year to 31st December 2023 | |||||||||||

| Listed Investments: | £ | £ | £ | £ | ||||||||||

| Valuation: | ||||||||||||||

| At start of period | 11,966 | 8,769 | - | - | ||||||||||

| Additions | 186,207 | 57,933 | - | - | ||||||||||

| Disposals | (186,181) | (54,736) | - | - | ||||||||||

| As at end of period | 11,992 | 11,966 | - | - | ||||||||||

| Listed investments held for trading are stated at their market value at 30 June 2025 and are considered to be level one assets in accordance with IFRS 13. The group does not undertake any principal trading activity. |

||||||||||||||

| 15. Cash and cash equivalents | Group | Company | ||||||||||||

| 30th June 2025 | 31st December 2023 | 30th June 2025 | 31st December 2023 | |||||||||||

| £ | £ | £ | £ | |||||||||||

| Balance at bank and in hand - group/company | 5,161,461 | 5,169,380 | 3,366,005 | 1,406,811 | ||||||||||

| Cash held for settlement of market transactions | 1,262,495 | 344,695 | - | - | ||||||||||

| 6,423,956 | 5,514,075 | 3,366,005 | 1,406,811 | |||||||||||

In addition to the balances shown above the group has segregated deposit and current accounts held in accordance with the client money rules of the Financial Conduct Authority. The group also has segregated deposits and current accounts on behalf of model B customers of £949,348 (31st December 2023 : £376,394) not governed by client money rules therefore they are also not included in the statement of financial position of the group. This treatment is appropriate as, although the business is not a going concern, no administrator is due to be appointed. However, were an administrator be appointed, these balances would be considered assets of the business.

| 16. Share capital | 30th June 2025 | 31st December 2023 | |

| Authorised: 64,000,000 Ordinary shares of 0.25p each |

160,000 160,000 |

160,000 160,000 |

|

| 30th June 2025 | 31st December 2023 | ||

| £ | £ | ||

| Opening balance | 111,828 | 111,828 | |

| Allotted, issued and fully paid: | |||

| 44,731,000 (2023: 44,731,000) Ordinary shares of 0.25p each | 111,828 | 111,828 |

The company has one class of ordinary shares which carry no right to fixed income.

| 17. Trade and other payables | Group | Company | |||||

| Amounts falling due within one year: | 30th June 2025 | 31st December 2023 | 30th June 2025 | 31st December 2023 | |||

| £ | £ | £ | £ | ||||

| Trade payables | 513,147 | 461,328 | 12,252 | 8,829 | |||

| Settlement payables | 271,116 | 1,126,083 | - | - | |||

| Amount owed to group undertaking | - | - | 739,232 | 482,067 | |||

| Other taxes and social security | - | - | - | - | |||

| Other payables | 498,142 | 627,239 | 1,750 | - | |||

| Accruals | 211,036 | 327,040 | 37,500 | 51,100 | |||

| Trade and other payables | 1,493,441 | 2,541,690 | 790,734 | 541,996 |

Settlement payables are short term payable amounts arising as a result of settlement of trades in an agency capacity. Trade payables and other taxes and social security are all paid at the beginning of the month after the invoice was received or the liability created.

| 18. Dividends | 18 months to 30th June 2025 | Year to 31st December 2023 | |

| £ | £ | ||

| Interim dividends paid on Ordinary 1p shares | 3,019,066 | 3,913,962 | |

| Dividend per Ordinary 1p share | 6.75 | 8.75 |

Please refer to the directors' report for dividends declared post year end.

19. Financial Instruments

The group's principal financial instruments comprise cash and various items such as trade receivables, trade payables etc. that arise directly from operations. The main purpose of these financial instruments is the funding of the group's trading activities. Cash and cash equivalents and trade and other receivables are categorised as held at amortised cost, and trade and other payables and provisions are classified as held at amortised cost. Other than investments held for trading all financial assets and liabilities are held at amortised cost and their carrying value approximates to their fair value.

The main financial asset of the group is cash and cash equivalents which is denominated in Sterling and which is detailed in note 15. The group operates a low risk investment policy and surplus funds are placed on deposit with at least A rated banks or equivalent at floating interest rates.

The group also holds investments in equities and property.

20. Immediate and ultimate parent undertaking

There is no immediate or ultimate controlling party.

21. Related party transactions

The company had a lease with Sion Properties Limited, a company controlled by a director of the company, for the rental of 78 Mount Ephraim, a self-contained office building, which was assigned to the company's subsidiary Jarvis Investment Management Limited on 23rd May 2024. The lease has an annual rental of £87,500. Full details of this lease are disclosed in Note 13.

During the period Jarvis Investment Management Limited paid Jarvis Securities Plc £27,000 (Year to 31st December 2023: £18,000) for rental of a disaster recovery site.

During the year Jarvis Securities Plc paid £1,995,967 (2023: £352,522) in respect of relief for tax losses incurred by Jarvis Investment Management Ltd

Jarvis Investment Management Limited was owed £739,232 by Jarvis Securities Plc as at 30th June 2025 (31st December 2023: £482,067).

During the period, directors, key staff and other related parties by virtue of control carried out share dealing transactions in the normal course of business. Commissions for such transactions are charged at various discounted rates. The impact of these transactions does not materially or significantly affect the financial position or performance of the company. At 30 June 2025, these same related parties had cash balances of £Nil (31st December 2023: £44,738). No interest was earned during the period (Year to 31st December 2023: £0). In addition to cash balances other equity assets of £574,769 (31st December 2023: £4,151,917) were held by JIM Nominees Ltd as custodian.

During the period Jarvis Securities Plc received £11,759,467 (Year to 31st December 20233: £7,365,165) in respect of interest earned on client balances held by Jarvis Investment Management Limited, in exchange for use of intellectual properties owned by Jarvis Securities Plc.

At the period end Directors directly held 18,266,486 shares in the company (31st December 2023: 11,125,620). A further 5,356,454 shares (31st December 2023: 12,546,620) shares were held by concert parties of the directors as defined by the City Code on Takeovers and Mergers.

22. Capital commitments

As of 30th June 2025, the company had no capital commitments (31st December 2023: nil).

23. Fair value estimation

The fair value of financial instruments traded in active markets is based on quoted market prices at the balance sheet date. The quoted market price used for financial assets held by the company is the current bid price. The carrying value less impairment provision of trade receivables and payables are assumed to approximate their fair values.

24. Financial risk management objectives and policies

The directors consider that their main risk management objective is to monitor and mitigate the key risks to the group, which are considered to be principally credit risk, compliance risk, liquidity risk and operational risk. Several high-level procedures are in place to enable all risks to be better controlled. These include detailed profit forecasts, cash flow forecasts, monthly management accounts and comparisons against forecast, regular meetings of the full board of directors, and more regular senior management meetings.

The group's main credit risk is exposure to the trading accounts of clients. This credit risk is controlled via the use of credit algorithms within the computer systems of the subsidiary. These credit limits prevent the processing of trades in excess of the available maximum permitted margin at 100% of the current portfolio value of a client.

A further credit risk exists in respect of trade receivables. The group's policy is to monitor trade and other receivables and avoid significant concentrations of credit risk. Aged receivables reports are reviewed regularly and significant items brought to the attention of senior management.

The compliance risk of the group is controlled through the use of robust policies, procedures, the segregation of tasks, internal reviews and systems controls. These processes are based upon the Rules and guidance notes of the Financial Conduct Authority and the London Stock Exchange and are overseen by the compliance officer together with the management team. In addition, regular compliance performance information is prepared, reviewed and distributed to management.

The group does not make use of bank loans or overdraft facilities. Financial risk is therefore mitigated by the maintenance of positive cash balances and by the regular review of the banks used by the group. Liquidity is monitored on an intra-day basis, and management received daily reports showing both fund availability and bank diversification for client money. The liquidity of corporate funds is managed by the Finance department, and both client and corporate liquidity form part of the remit of the Treasury committee, which sits monthly within JIML. Other risks, including operational, reputational and legal risks are under constant review at senior management level by the executive directors and senior managers at their regular meetings, and by the full board at their regular meetings.

The group derives a significant proportion of its revenue from interest earned on client cash deposits and does not have any borrowings. Hence, the directors do not consider the group to be materially exposed to interest rate risk in terms of the usual consideration of financing costs, but do note that there is a risk to earnings. This risk is considered no longer relevant as the group is no longer a going concern.

The capital structure of the group consists of issued share capital, reserves and retained earnings. Jarvis Investment Management Limited has an Internal Capital and Risk Assessment process ("ICARA"), as required by the Financial Conduct Authority ("FCA") for establishing the amount of regulatory capital to be held by that company. The ICARA gives consideration to both current and projected financial and capital positions. The ICARA is updated throughout the year to take account of any significant changes to business plans and any unexpected issues that may occur. The ICARA is discussed and approved at a board meeting of the subsidiary at least annually. Capital adequacy is monitored regularly by management. Jarvis Investment Management Limited uses the simplified approach to Credit Risk and the standardised approach for Operational Risk to calculate Pillar 1 requirements. Jarvis Investment Management Limited observed the FCA's regulatory requirements throughout the period. Information disclosure under MIFIDPRU 8 is available from the group's websites. Further information regarding regulatory capital is disclosed in the strategic report.

The group offers settlement of trades in sterling as well as various foreign currencies. The group does not hold any material assets or liabilities other than in sterling and converts client currency on matching terms to settlement of trades realising any currency gain or loss immediately in the income statement. Consequently, the group has no foreign exchange risk.

As of 30 June 2025, trade receivables of £110,771 (31st December 2023: £275,691) were past due and were impaired and partially provided for. The amount of the provision was £35,114 as at 30 June 2025 (31st December 2023: £35,506). The individually impaired receivables relate to clients who are in a loan position and who do not have adequate stock to cover these positions. The amount of the impairment is determined by clients' perceived willingness and ability to pay the debt, legal judgements obtained in respect of, charges secured on properties and payment plans in place and being adhered to. Where debts are determined to be irrecoverable, they are written off through the income and expenditure account. The group is in the process of collecting outstanding amounts as part of the wind-down process.

| Group | Company | ||||||

| Provision of impairment of receivables: | 18 months to 30th June 2025 | Year to 31st December 2023 | 18 months to 30th June 2025 | Year to 31st December 2023 | |||

| £ | £ | £ | £ | ||||

| At 1 January | 35,506 | 57,828 | - | - | |||

| Charge / (credit) for the period | 83,039 | (13,724) | - | - | |||

| Uncollectable amounts written off | (83,431) | (8,598) | - | - | |||

| At end of period | 35,114 | 35,506 | - | - |

25. Provisions and Contingent Liabilities