AI Terminal

B Hodl PLC

Transaction in Own Shares • Sep 22, 2025

17758_rns_2025-09-22_06b815a2-c484-4cb7-a95f-a39ddd4c31f6.html

Transaction in Own Shares

Open in ViewerOpens in native device viewer

National Storage Mechanism | Additional information ![]()

RNS Number : 1686A

B HODL PLC

22 September 2025

22 September 2025

B HODL Plc

("B HODL" or "The Company")

Admission to the AQSE Growth Market

B HODL Plc, the first British company founded for Bitcoin accumulation and revenue generation from the Bitcoin in its treasury, is pleased to announce that trading in its Ordinary Shares will commence at 8:00 a.m. today on the AQSE Growth Market ("Admission"), under the ticker HODL and ISIN number IM00BV6P5N30 (SEDOL: BV6P5N3).

Company Information

The Company has raised £13,335,256.38 before expenses by way of a direct subscription by investors for 95,251,802 new ordinary shares in the Company ("Subscription Shares") at 14 pence per share ("Issue Price").

In addition, B HODL has raised a further £2,000,000 before expenses through an increased and oversubscribed WRAP Retail Offer conducted on its behalf by Winterflood Securities at the Issue Price. As a result, the Company has today issued 14,285,718 new ordinary shares pursuant to the WRAP Retail Offer ("WRAP Offer Shares").

As a result, B HODL has now raised a total of £ 15,335,256.90 before expenses through the issue of 109,537,520 new ordinary shares at the Issue Price. The Subscription Shares and WRAP Retail Offer Shares will be issued credited as fully paid and will rank pari passu in all respects with the existing Ordinary Shares, including for dividends and other distributions declared, paid or made following Admission.

The Directors have a long-term vision to become a global player in Bitcoin services, with a focus specifically on Lightning liquidity and infrastructure, which they believe will be required for the Bitcoin eco-system to mature and spread to mainstream adoption.

The core strategy of the Company is to generate revenues from a significant and expanding Bitcoin treasury. Initially B HODL will focus on generating revenue through the operation of lightning nodes. It will use its own Bitcoin Treasury to provide the liquidity required to permit the rapid scaling of operations leading to increasing routing fees being secured. The Company will seek to expand its revenue generating activities and adopt new opportunities as they arise. The Directors believe that revenue generating activities will grow and diversify markedly in the future.

B HODL intends to accumulate a significant amount of Bitcoin, as quickly as possible, funded by further issues of Ordinary Shares.

Commenting, Freddie New, CEO of B HODL, said:

"Today's Admission is a landmark moment for B HODL. We are proud to be the first listed British company dedicated from day one to Bitcoin accumulation and revenue generation. The strong support we have received from our new investors, with the WRAP offer upsized and closed early due to demand, underlines the scale of interest in Bitcoin's long-term potential - both as an asset and as a means of payment. With our Admission complete, we can now focus on building our Bitcoin treasury and deploying it productively through Lightning infrastructure. We believe this strategy positions us at the heart of Bitcoin's next phase of growth and we are excited to be commencing this journey with all our stakeholders."

Danny Scott, CBO of B HODL, said:

"We are delighted to welcome a broad base of new shareholders alongside our strategic investors and look forward to this journey together. Our team has been building in Bitcoin for over a decade, and we are determined to make B HODL the leading UK listed Bitcoin company.

"The hard work of building the future of finance begins now."

Total Voting Rights

Following the issue of the 95,251,802 Subscription Shares and the 14,285,718 WRAP Offer Shares, the Company has 139,887,520 Ordinary Shares of £0.01 each in issue, which also represents the total number of voting rights in the Company. This figure should be used by shareholders as the denominator for the calculations by which they will determine if they are required to notify their interest in, or a change to their interest in, the Company under the FCA's Disclosure and Transparency Rules.

Directors Interests

The interests of the Directors and their immediate families and, so far as they are aware having made due and careful enquiries, of persons connected with them (all of which are beneficial, unless otherwise stated) (so far as is known to the Directors, or could with reasonable diligence be ascertained by them) in the Issued Share Capital at Admission are as follows:

| Name | Number of Ordinary Shares | % of Issued Share Capital | Number of Options* |

| Daniel Scott | 2,357,143 | 1.69 | 300,000 |

| Zakk Lakin | 2,000,000 | 1.43 | 300,000 |

| Frederick New | 2,000,000 | 1.43 | 300,000 |

| Allen Farrington | 2,000,000 | 1.43 | 300,000 |

| David Boylan | 2,000,000 | 1.43 | 300,000 |

| David Jaques | - | - | 300,000 |

* Each of the options is exercisable at the Issue Price and vests on the first anniversary of Admission.

Major Shareholders

In so far as known to the Company, the following persons have an interest, directly or indirectly, in the Company's capital or voting rights which is equal or above 3% of its capital or total voting rights as at Admission:

| Name | Number of Ordinary Shares | % of Issued Share Capital |

| Adam Back | 35,714,285 | 25.53% |

| CoinCorner | 20,000,000 | 14.30% |

| Rise Investments Ltd | 10,714,285 | 7.66% |

| Alexander Holt | 8,571,428 | 6.13% |

Warrants in issue on Admission:

The Company has issued warrants to subscribe for Ordinary Shares at the Issue Price as follows:

| Holder | Number | Performance Condition | Exercise Period |

| First Sentinel Corporate Finance Limited | 142,857 | None | Three years from Admission |

| CoinCorner Limited | 1,398,875** | The Company's market capitalisation reaching or exceeding £1 billion | Five years from Admission |

** The number of warrants to be issued to Coincorner was incorrectly stated in the Admission Document.

The City Code

The Takeover Code (the "Code") applies to B HODL PLC (the "Company"). Under Rule 9 of the Code, any person who acquires an interest in shares which, taken together with shares in which that person or any person acting in concert with that person is interested, carry 30% or more of the voting rights of a company which is subject to the Code is normally required to make an offer to all the remaining shareholders to acquire their shares.

Similarly, when any person, together with persons acting in concert with that person, is interested in shares which in the aggregate carry not less than 30% of the voting rights of such a company but does not hold shares carrying more than 50% of the voting rights of the company, an offer will normally be required if such person or any person acting in concert with that person acquires a further interest in shares which increases the percentage of shares carrying voting rights in which that person is interested.

An offer under Rule 9 must be made in cash at the highest price paid by the person required to make the offer, or any person acting in concert with such person, for any interest in shares of the company during the 12 months prior to the announcement of the offer.

The Company has agreed with the Panel that the following persons are presumed to be acting in concert in relation to the Company: CoinCorner Limited, Daniel Scott, Charles Woolnough, David Boylan, Zakk Lakin and Michel Crosbie.

Following Admission, the members of the concert party will be interested in 27,421,427 shares, representing 19.61% of the voting rights of the Company. Assuming exercise in full by the members of the concert party of warrants or options (and assuming that no other person converts any convertible securities or exercises any options or any other right to subscribe for shares in the Company), the members of the concert party would be interested in 30,370,302 shares, representing approximately 21.26% of the enlarged voting rights of the Company. A table showing the respective individual interests in shares of the members of the concert party on Admission and following the exercise of the convertible securities, warrants or options is set out below.

| Concert Party Member | Number of shares owned | % shareholding pre-Admission | Number of shares at Admission | % shareholding at Admission | Number of options and warrants | Number of shares following exercise of options and warrants | % shareholding following exercise of options and warrants |

| CoinCorner Limited | 20,000,000 | 65.90 | 20,000,000 | 14.30 | 1,398,875 | 21,398,875 | 14.98 |

| Daniel Scott | 2,000,000 | 6.59 | 2,357,142 | 1.69 | 300,000 | 2,657,142 | 1.86 |

| Charles Woolnough | - | - | 714,285 | 0.51 | 0 | 714,285 | 0.50 |

| David Boylan | 2,000,000 | 6.59 | 2,000,000 | 1.43 | 300,000 | 2,300,000 | 1.61 |

| Zakk Lakin | 2,000,000 | 6.59 | 2,000,000 | 1.43 | 300,000 | 2,300,000 | 1.61 |

| Michael Crosbie | 350,000 | 1.15 | 350,000 | 0.25 | 650,000 | 1,000,000 | 0.70 |

| Total | 26,350,000 | 86.82 | 27,421,427 | 19.61 | 2,948,875 | 30,370,302 | 21.26 |

Admission Statistics

| Total Number of Subscription Shares to be issued | 95,251,802 |

| Total Number of WRAP Shares to be issued | 14,285,718 |

| Issued Share Capital on Admission | 139,887,520 |

| Percentage of Issued Share Capital represented by New Shares | 78.3% |

| Number of Warrants outstanding immediately following Admission | 1,541,732 |

| Number of Options outstanding immediately following Admission | 2,950,000 |

| Gross Proceeds of the Subscription and WRAP Retail Offer | £15,335,256.90 |

| Net Proceeds of the Subscription and WRAP Retail Offer | £15,024,842 |

| Market capitalisation on Admission | £19,584,252.80 |

Notes

The definitions used in this announcement have the same meaning as they have in the Admission Document.

The Directors of the Company accept responsibility for the contents of this announcement.

For further information, please contact:

| B HODL | |

| Freddie New, Chief Executive | [email protected] |

| Danny Scott, Chief Bitcoin Officer Communications Team |

[email protected] [email protected] |

| First Sentinel (AQSE Corporate Adviser) | |

| Paul Shackleton | [email protected] |

| Beatriz Iribarren | [email protected] |

| Celicourt Communications (Financial PR) | +44 (0)20 7776464 |

| Mark Antelme | [email protected] |

| Jimmy Lea |

Accountant's Report on the Unaudited Pro Forma Net Asset Statement

The Directors B HODL PLC

19-21 Circular Road,

Douglas

IM1 1AF

Isle of Man

22 September 2025

Dear Sirs,

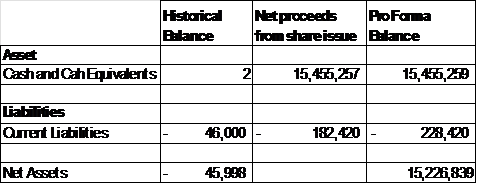

We report on the Unaudited Pro Forma Statement Of Net Assets in the Supplementary Admission Information, which is based on the description in the Statement. This information is for illustrative purposes to show the potential effects of a transaction, such as a share issue, on the company's financial information, using the accounting policies of B HODL PLC. It addresses a hypothetical situation and does not represent actual financial results.

The directors are responsible for preparing the Pro Forma Net Asset Statement Information in accordance with relevant regulations, including clearly stating the basis of preparation and ensuring adjustments are accurate and explained.

Our role as reporting accountants is to provide an opinion on the proper compilation of this information, as required by regulations. We do not assure the underlying historical data. Our work followed UK Standards for Investment Reporting (SIRs) and involved reviewing adjustments, comparing data to sources, and discussing the information with directors. We aimed to reasonably assure that the Pro Forma Net Asset Statement is properly compiled and consistent with B HODL's accounting policies.

In our opinion, the Unaudited Pro Forma Net Asset Statement Information is properly compiled on the stated basis, and this basis aligns with B HODL's accounting policies.

For the purpose of providing supplementary Admission information under the AQSE Growth Market Access Rule Book, we confirm the information in this report is

accurate and contains no material omissions.

Yours faithfully,

Edwards Veeder (UK) Limited

Reporting Accountants

This information is provided by RNS, the news service of the London Stock Exchange. RNS is approved by the Financial Conduct Authority to act as a Primary Information Provider in the United Kingdom. Terms and conditions relating to the use and distribution of this information may apply. For further information, please contact [email protected] or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms and conditions, to analyse how you engage with the information contained in this communication, and to share such analysis on an anonymised basis with others as part of our commercial services. For further information about how RNS and the London Stock Exchange use the personal data you provide us, please see our Privacy Policy.

END

NEXDFLFLEKLEBBL