AI Terminal

Kasei Digital Assets Plc

Interim / Quarterly Report • Dec 11, 2025

10311_rns_2025-12-11_243880c2-3576-441b-8e6d-7dfaa39affcc.html

Interim / Quarterly Report

Open in ViewerOpens in native device viewer

National Storage Mechanism | Additional information

Stackbitcointreasury plc

("the Company")

Preliminary results for the year ended 31 July 2025

Posting of Annual Report

Stackbitcointreasury plc (AQSE: STAK) is pleased to announce its Annual Report and financial statements for the year ended 31 July 2025 (the “Annual Report”). The Annual Report and Accounts are available on the Company’s website at https://www.stackbitcoin.co.uk/investor-centre

The Company’s AGM notice will follow shortly.

For further information please contact:

| Stackbitcointreasury plc Jai Patel Chief Executive Officer |

[email protected] |

| VSA Capital Limited (AQSE Corporate Adviser) Andrew Raca Sam Gurung |

+44 (0) 7469 152 119 |

About Stackbitcointreasury plc

The Company is a UK-based investment vehicle dedicated to providing investors with regulated and transparent exposure to Bitcoin, the world’s leading cryptocurrency. The Company’s strategy focuses on direct investment in Bitcoin and disciplined treasury management to deliver long-term capital growth. In addition, the Company may selectively acquire cash-generating businesses that complement its core objectives, supporting its Bitcoin accumulation strategy and enhancing shareholder value.

Group Strategic Report

For the Year Ended 31 July 2025

2025 has been a significant year for the crypto asset industry, driven by a shift in political winds accompanied by regulatory clarity. Whilst Bitcoin itself has traded in a broad range, developments in the stablecoin arena have led to increased interest in other aspects of the blockchain ecosystem—specifically smart contract functionality, with Ethereum being the primary beneficiary.

The Company previously announced that it would conduct a strategic review in light of its inability to scale, in addition to concerns from shareholders regarding share liquidity. It was decided that the Company would sell down its portfolio of assets into favourable market conditions through 2025, aligning with previous crypto market cycles, with a view to returning the proceeds to shareholders.

Throughout the period, The Company commenced a sell-down of its core digital asset portfolio, reflecting strong market conditions and the Board’s decision to return capital to shareholders.

By 31 July 2025, the Company had reduced its investment holdings to two remaining positions: Alkimi and Reality Protocol. The Alkimi investment was subsequently disposed of after the reporting date at a gain. The Reality Protocol holding remains in place; however, given ongoing uncertainty regarding the investee’s ability to execute its business plan, the Board has written the carrying value down to £50,000 at year-end.

Administrative expenses increased modestly during the period, rising from £273,319 to £288,344, primarily reflecting normal increases in operating activity associated with portfolio realisation. As a consequence of the portfolio disposals, the Company’s cash position strengthened significantly. The elevated cash balance generated interest income recognised during the year.

Since the period-end, the Company has embarked on the process to return capital to current shareholders whilst repositioning the business. Following approval by shareholders in General Meeting on 9 December 2025, the Company intends to refocus the business on Bitcoin specifically, with a reinvigorated team and a fresh injection of capital. The process of returning capital to shareholders is expected to complete by the end of January 2026 following court approval after which the goal of the business moving forward will be to build the UK’s flagship Bitcoin treasury company with its sole mission to accumulate and STACK Bitcoin. We look forward to Kwasi Kwarteng joining the board as Executive Chairman and Paul Withers as Non-Executive Director with effect from 21 January 2026.

The Company is excited to embark on this new journey in what continues to be a dynamic industry.

Turnover

Turnover increased by 21% in 2025, rising from £54,328 in 2024 to £65,864. This was due to an increase in yield generation.

Company change of name

After the year ended 31 July 2025 the company changed its name from Kasei Digital Assets Plc to Stackbitcointreasury plc.

Directors’ Report

For the Year Ended 31 July 2025

The directors present their report and the financial statements for the year ended 31 July 2025.

Directors

The directors who served during the year were:

Bryan Coyne

Steven Davis

Brendan Kearns

Jai Patel

Jane Thomason

Small companies note

In preparing this report, the directors have taken advantage of the small companies exemptions provided by section 415A of the Companies Act 2006.

This report was approved by the board on 9 December 2025 and signed on its behalf by

Brendan Kearns

Director

Chartered Accountants’ Report to the Board of Directors on the Preparation of the Unaudited Statutory Financial Statements of Stackbitcointreasury plc

For the Year Ended 31 July 2025

In order to assist you to fulfil your duties under the Companies Act 2006, we have prepared for your approval the financial statements of Stackbitcointreasury plc for the year ended 31 July 2025 which comprise the Consolidated Statement of Comprehensive Income, the Consolidated Balance Sheet, the Company Balance Sheet, the Consolidated Statement of Changes in Equity, the Company Statement of Changes in Equity and the related notes from the Group's accounting records and from information and explanations you have given us.

As a practising member firm of the Institute of Chartered Accountants in England and Wales (ICAEW), we are subject to its ethical and other professional requirements which are detailed at https://www.icaew.com/regulation.

This report is made solely to the Board of Directors of Stackbitcointreasury plc, as a body, in accordance with the terms of our engagement letter. Our work has been undertaken solely to prepare for your approval the financial statements of Stackbitcointreasury plc and state those matters that we have agreed to state to the Board of Directors of Stackbitcointreasury plc, as a body, in this report in accordance with ICAEW Technical Release TECH07/16AAF. To the fullest extent permitted by law, we do not accept or assume responsibility to anyone other than Stackbitcointreasury plc and its Board of Directors, as a body, for our work or for this report.

It is your duty to ensure that Stackbitcointreasury plc has kept adequate accounting records and to prepare statutory financial statements that give a true and fair view of the assets, liabilities, financial position and profit of Stackbitcointreasury plc. You consider that Stackbitcointreasury plc is exempt from the statutory audit requirement for the year.

We have not been instructed to carry out an audit or review of the financial statements of Stackbitcointreasury plc. For this reason, we have not verified the accuracy or completeness of the accounting records or information and explanations you have given to us and we do not, therefore, express any opinion on the statutory financial statements.

Brindley Goldstein Ltd

Waltham Cross

London

EN8 7AN

Date: 3 December 2025

Consolidated Statement of Comprehensive Income for the Year Ended 31 July 2025

| Note | 2025 £ |

2024 £ |

|

| Turnover | 65,864 | 54,327 | |

| Gross profit |  65,864 |

54,327 |

|

| Profit / (loss) on investment asset | - | 134,881 | |

| Profit / (loss) on disposal of digital asset | 2,283,404 | 84,744 | |

| Administrative expenses | (288,344) | (273,319) | |

| Operating profit |  2,060,924 |

633 |

|

| Tax on profit | (599,071) | - | |

| Profit for the financial year |   1,461,853 1,461,853 |

633 |

|

| Other comprehensive income: | |||

| Items that will not be reclassified to profit or loss: | |||

| Fair value movements | (1,535,141) | 1,106,409 | |

| Other comprehensive income for the period |  (1,535,141) |

1,106,409 |

|

| Total comprehensive income for the year |   (73,288) |

1,107,042 1,107,042 |

|

| Profit for the year attributable to: |

Consolidated Balance Sheet

As at 31 July 2025

| Note | 2025 £ |

2024 £ |

|||

| Fixed assets | |||||

| Intangible assets | 9 | 600,723 | 2,737,186 | ||

600,723 |

2,737,186 |

||||

| Current assets | |||||

| Debtors: amounts falling due within one year | 11 | 19,359 | 817,642 | ||

| Cash at bank and in hand | 12 | 2,921,259 | 244,863 | ||

2,940,618 |

1,062,505 |

||||

| Creditors: amounts falling due within one year | (39,031) | (224,093) | |||

| Net current assets |  |

2,901,587 |  |

838,412 | |

| Total assets less current liabilities |  3,502,310 |

3,575,598 |

|||

| Net assets |   3,502,310 3,502,310 |

3,575,598 3,575,598 |

|||

| Capital and reserves | |||||

| Called up share capital | 332,284 | 332,284 | |||

| Share premium account | 3,946,878 | 3,946,878 | |||

| Capital redemption reserve | (27,992) | (27,992) | |||

| Other reserves | (414,579) | 1,120,562 | |||

| Profit and loss account | (334,281) | (1,796,134) | |||

3,502,310 |

3,575,598 |

The directors consider that the Company is entitled to exemption from audit under section 477 of the Companies Act 2006 and members have not required the Company to obtain an audit for the year in question in accordance with section 476 of the Companies Act 2006.

The directors acknowledge their responsibilities for complying with the requirements of the Companies Act 2006 with respect to accounting records and the preparation of financial statements.

The Company's financial statements have been prepared in accordance with the provisions applicable to companies subject to the small companies regime.

The financial statements were approved and authorised for issue by the board and were signed on its behalf by

Brendan Kearns

Company Balance Sheet

As at 31 July 2025

| Note | 2025 £ |

2024 £ |

|||

| Fixed assets | |||||

| Intangible fixed assets | 600,723 | 2,737,186 | |||

| Investments | 10 | 50,000 | 50,000 | ||

650,723 |

2,787,186 |

||||

| Current assets | |||||

| Debtors: amounts falling due within one year | 11 | 19,359 | 610,441 | ||

| Cash and cash equivalents | 12 | 2,921,259 | 244,863 | ||

2,940,618 |

855,304 |

||||

| Creditors: amounts falling due within one year | (246,232) | (224,093) | |||

| Net current assets |  |

2,694,386 |  |

631,211 | |

| Total assets less current liabilities |  3,345,109 |

3,418,397 |

|||

| Net assets excluding pension asset |  3,345,109 |

3,418,397 |

|||

| Net assets |   3,345,109 3,345,109 |

3,418,397 3,418,397 |

|||

| Capital and reserves | |||||

| Called up share capital | 15 | 332,284 | 332,284 | ||

| Share premium account | 3,789,677 | 3,789,677 | |||

| Capital redemption reserve | (27,992) | (27,992) | |||

| Other reserves | (414,579) | 1,120,562 | |||

| Profit and loss account brought forward | (1,796,134) | (1,796,767) | |||

| Profit for the year | 1,461,853 | 633 | |||

| Profit and loss account carried forward | (334,281) | (1,796,134) | |||

3,345,109 |

3,418,397 |

The directors consider that the Company is entitled to exemption from the requirement to have an audit under the provisions of section 477 of the Companies Act 2006 and members have not required the Company to obtain an audit for the year in question in accordance with section 476 of the Companies Act 2006.

The directors acknowledge their responsibilities for complying with the requirements of the Companies Act 2006 with respect to accounting records and the preparation of financial statements.

The Company's financial statements have been prepared in accordance with the provisions applicable to companies subject to the small companies regime.

The financial statements were approved and authorised for issue by the board and were signed on its behalf by

Brendan Kearns

Director

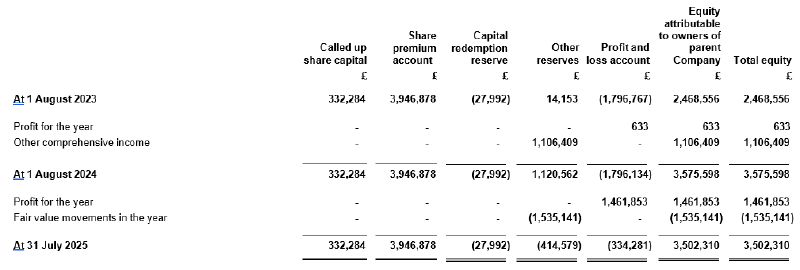

Consolidated Statement of Change in Equity

For the Year Ended 31 July 2025

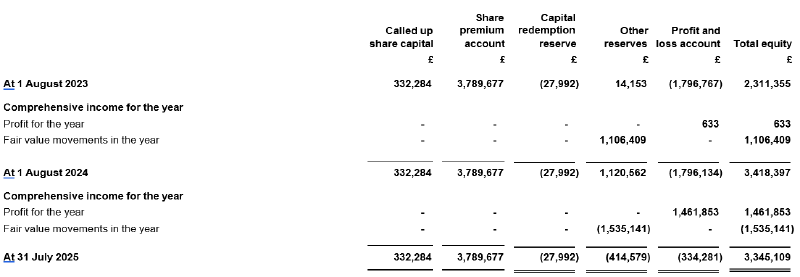

Company Statement of Changes in Equity

Notes to the Financial Statements

For the Year Ended 31 July 2025

- General information

Stackbitcointreasury plc is a public limited company limited by shares and incorporated in England. Its registered office is 72 Charlotte Street Ground Floor, London, England, W1T 4QQ, United Kingdom.

The Company's shares are traded on the Aquis Stock Exchange Growth Market under ticker KASH and ISIN number GB00BN950D98.

The Company's aim is to provide investors with exposure to the digital assets ecosystem and an attractive rate of return by levaraging the Board's expertise, experience and networks in the cryptocurrency sector. The Company also intends to invest in venture capital and private equity investments in the blockchain ecosystem.

- Accounting policies

2.1 Basis of preparation of financial statements

The financial statements have been prepared under the historical cost convention unless otherwise specified within these accounting policies and in accordance with Financial Reporting Standard 102, the Financial Reporting Standard applicable in the UK and the Republic of Ireland and the Companies Act 2006.

The preparation of financial statements in compliance with FRS 102 requires the use of certain critical accounting estimates. It also requires Group management to exercise judgment in applying the Group's accounting policies.

The Company has taken advantage of the exemption allowed under section 408 of the Companies Act 2006 and has not presented its own Statement of Comprehensive Income in these financial statements.

The following principal accounting policies have been applied:

2.2 Basis of consolidation

The consolidated financial statements present the results of the Company and its own subsidiaries ("the Group") as if they form a single entity. Intercompany transactions and balances between group companies are therefore eliminated in full.

The consolidated financial statements incorporate the results of business combinations using the purchase method. In the Balance Sheet, the acquiree's identifiable assets, liabilities and contingent liabilities are initially recognised at their fair values at the acquisition date. The results of acquired operations are included in the Consolidated Statement of Comprehensive Income from the date on which control is obtained. They are deconsolidated from the date control ceases.

In accordance with the transitional exemption available in FRS 102, the Group has chosen not to retrospectively apply the standard to business combinations that occurred before the date of transition to FRS 102.

2.3 Foreign currency translation

Functional and presentation currency

The Company’s functional and presentational currency is GBP.

Transactions and balances

Foreign currency transactions are translated into the functional currency using the spot exchange rates at the dates of the transactions.

At each period end foreign currency monetary items are translated using the closing rate. Non-monetary items measured at historical cost are translated using the exchange rate at the date of the transaction and non-monetary items measured at fair value are measured using the exchange rate when fair value was determined.

Foreign exchange gains and losses resulting from the settlement of transactions and from the translation at period-end exchange rates of monetary assets and liabilities denominated in foreign currencies are recognised in profit or loss except when deferred in other comprehensive income as qualifying cash flow hedges.

Foreign exchange gains and losses that relate to borrowings and cash and cash equivalents are presented in the Consolidated Statement of Comprehensive Income within 'finance income or costs'. All other foreign exchange gains and losses are presented in profit or loss within 'other operating income'.

On consolidation, the results of overseas operations are translated into Sterling at rates approximating to those ruling when the transactions took place. All assets and liabilities of overseas operations are translated at the rate ruling at the reporting date. Exchange differences arising on translating the opening net assets at opening rate and the results of overseas operations at actual rate are recognised in other comprehensive income.

2.4 Revenue

Revenue is recognised to the extent that it is probable that the economic benefits will flow to the Group and the revenue can be reliably measured. Revenue is measured as the fair value of the consideration received or receivable, excluding discounts, rebates, value added tax and other sales taxes. The following criteria must also be met before revenue is recognised:

2.5 Current and deferred taxation

The tax expense for the year comprises current and deferred tax. Tax is recognised in profit or loss except that a charge attributable to an item of income and expense recognised as other comprehensive income or to an item recognised directly in equity is also recognised in other comprehensive income or directly in equity respectively.

The current income tax charge is calculated on the basis of tax rates and laws that have been enacted or substantively enacted by the balance sheet date in the countries where the Company and the Group operate and generate income.

2.6 Intangible assets

Intangible assets are initially recognised at cost. After recognition, under the revaluation model, intangible assets shall be carried at a revalued amount, being its fair value at the date of revaluation less any subsequent accumulated amortisation and subsequent impairment losses - provided that the fair value can be determined by reference to an active market.

Revaluations are made with sufficient regularity to ensure that the carrying amount does not differ materially from that which would be determined using fair value at the end of the balance sheet date.

All intangible assets are considered to have a finite useful life. If a reliable estimate of the useful life cannot be made, the useful life shall not exceed ten years.

2.7 Valuation of investments

Investments in subsidiaries are measured at cost less accumulated impairment.

Investments in unlisted Group shares, whose market value can be reliably determined, are remeasured to market value at each balance sheet date. Gains and losses on remeasurement are recognised in the Consolidated Statement of Comprehensive Income for the period. Where market value cannot be reliably determined, such investments are stated at historic cost less impairment.

2.8 Debtors

Short-term debtors are measured at transaction price, less any impairment. Loans receivable are measured initially at fair value, net of transaction costs, and are measured subsequently at amortised cost using the effective interest method, less any impairment.

2.9 Cash and cash equivalents

Cash is represented by cash in hand and deposits with financial institutions repayable without penalty on notice of not more than 24 hours. Cash equivalents are highly liquid investments that mature in no more than three months from the date of acquisition and that are readily convertible to known amounts of cash with insignificant risk of change in value.

2.10 Creditors

Short-term creditors are measured at the transaction price. Other financial liabilities, including bank loans, are measured initially at fair value, net of transaction costs, and are measured subsequently at amortised cost using the effective interest method.

2.11 Provisions for liabilities

Provisions are recognised when an event has taken place that gives rise to a legal or constructive obligation, a transfer of economic benefits is probable and a reliable estimate can be made.

Provisions are measured as the best estimate of the amount required to settle the obligation, taking into account the related risks and uncertainties.

Increases in provisions are generally charged as an expense to profit or loss.

- Turnover

An analysis of turnover by class of business is as follows:

| 2025 £ |

2024 £ |

||

| Staking Income | 15,305 | 20,073 | |

| Option Premium | 14,045 | 21,022 | |

| Interest Income | 36,514 | 13,233 | |

| 65,864 | 54,328 | ||

| Analysis of turnover by country of destination: | |||

| 2025 £ |

2024 £ |

||

| United Kingdom | 65,864 | 54,327 | |

| 65,864 | 54,327 |

- Operating profit

| The operating profit is stated after charging: | ||

| 2025 £ |

2024 £ |

|

| Exchange differences |  1,153 1,153 |

241 241 |

- Auditors’ remuneration

During the year, the Group obtained the following services from the Company’s auditors:

| 2025 £ |

2024 £ |

7,200 7,200 |

7,200 7,200 |

Fees payable to the Company auditors for the audit of the consolidated and parent Company’s financial statements

- Employees

The average monthly number of employees, including the directors, during the year was as follows:

The average monthly number of employees, including the directors, during the year was as follows:

2025 2024

No. No.

Employees 2 2

- Directors’ remuneration

2025 2024

£ £

Directors' emoluments 54,000 47,728

54,000 47,728

- Parent company profit for the year

The Company has taken advantage of the exemption allowed under section 408 of the Companies Act 2006 and has not presented its own Statement of Comprehensive Income in these financial statements. The profit after tax of the parent Company for the year was £1,461,853 (2024 - £633).

- Intangible assets

Group

Development expenditure

£

Cost

At 1 August 2024 2,737,186

Additions 193,593

Disposals (1,123,934)

Revaluation surplus (1,206,121)

At 31 July 2025 600,724

Net book value

At 31 July 2025 600,724

At 31 July 2024 2,737,186

- Fixed asset investments

Company

Investments

in

subsidiary companies

£

Cost or valuation

At 1 August 2024 50,000

At 31 July 2025 50,000

- Debtors

Group Group Company Company

2025 2024 2025 2024

£ £ £ £

| Amounts owed by group undertakings | - | 207,201 | - | - | |||

| Other debtors | - | 90 | - | 90 | |||

| Prepayments and accrued income | 19,359 | 11,280 | 19,359 | 11,280 | |||

| Deferred taxation | - | 599,071 | - | 599,071 | |||

| 19,359 | 817,642 | 19,359 | 610,441 |

- Cash and cash equivalents

| 2025 £ |

2024 £ |

||||||

| Cash at bank and in hand | 2,921,259 | 244,863 | |||||

| 2,921,259 | 244,863 |

- Creditors: Amounts falling due within one year

| Group | Group | Company | Company | ||||

| 2025 £ |

2024 £ |

2025 £ |

2024 £ |

||||

| Trade creditors | 18,441 | 866 | 18,441 | 866 | |||

| Amounts owed to group undertakings | - | 207,201 | 207,201 | 207,201 | |||

| Other taxation and social security | 6,590 | 2,026 | 6,590 | 2,026 | |||

| Accruals and deferred income | 14,000 | 14,000 | 14,000 | 14,000 | |||

| 39,031 | 224,093 | 246,232 | 224,093 |

- Deferred taxation

| Group | |||||||

| 2025 £ |

|||||||

| At end of year | - |

Company

2025

£

-

Group Group Company Company

2025 2024 2025 2024

£ £ £ £

Tax losses carried forward - 599,071 - 599,071

- 599,071 - 599,071

- Share capital

2025 2024

£ £

Allotted, called up and fully paid

33,228,360 (2024 – 33,228,360) Shares of £0.01 each 332,284 332,284

Share Capital consists of 33,228,350 (2024: 33,228,350) subscribed Shares at £0.01 each. Of which 2,799.157 are unsubscribed Treasury Shares.

- Subsidiary undertaking

Subsidiary undertaking

The following was a subsidiary undertaking of the Company:

Name Registered office Class of shares Holding

Kasei Blockchain Holdings Ltd 72 Charlotte Street Ordinary 100%

Ground Floor, London,

United Kingdom

W1T 4QQ

The aggregate of the share capital and reserves as at 31 July 2025 and the profit or loss for the year ended on that date for the subsidiary undertaking was as follows:

Name Proft/(Loss)

Kasei Blockchain Holdings Ltd 207,201