AI Terminal

ARIANA RESOURCES PLC

Regulatory Filings • Nov 27, 2025

7497_rns_2025-11-27_a301f946-c930-4ae9-82da-2a6f81871f66.html

Regulatory Filings

Open in ViewerOpens in native device viewer

National Storage Mechanism | Additional information ![]()

RNS Number : 1640J

Ariana Resources PLC

27 November 2025

|

|

27 November 2025

AIM: AAU

ASX: AA2

Kizilcukur Drilling Identifies Potential Extensions to Satellite Production for Kiziltepe Mine, Türkiye

Ariana Resources plc (AIM: AAU, ASX: AA2, "Ariana" or the "Company"), the mineral exploration, development and production company with gold project interests in Africa and Europe, has recently completed a drilling programme at Kizilcukur through its 23.5% ownership in Zenit Madencilik San. ve Tic. A.S. ("Zenit") in the Kiziltepe region, western Türkiye. Kizilcukur is being advanced towards providing satellite ore feed to the producing Kiziltepe Gold-Silver Mine.

Highlights:

· Diamond drilling programme tested all three main zones of mineralisation at the Kizilcukur Deposit (Zeki, Ziya, and Zafer) located 22km NE of the Kiziltepe Gold-silver Mine, and identified potential extension zones.

· 2,769 metres across 31 holes completed, with best intercepts including:

o 4.90m @ 4.53g/t Au + 118.3g/t Ag (KCR-D07-25) - from 24.40m

o 3.60m @ 2.89g/t Au + 77.5g/t Ag (KCR-D19-25) - from 59.30m

o 1.90m @ 5.39g/t Au + 70.6g/t Ag (KCR-D21-25) - from 66.10m

· Zenit is continuing to work towards the mining of Kizilcukur as a satellite source of ore for the Kiziltepe Gold-Silver Mine, which is in production, and environmental permitting is underway.

· Zenit is currently targeting a late 2026 commencement of operations from Kizilcukur, as an extension to the Kiziltepe mining operations.

Dr. Kerim Sener, Managing Director, commented:

"The results of this drilling programme at Kizilcukur continue to demonstrate that the extensions of the known vein systems remain prospective and have the potential to add to the resource opportunity at this deposit. In particular, a few intercepts of a newly drilled vein system located on the eastern flank of the deposit suggest further upside in that direction.

"Zenit is continuing to work towards the mining of Kizilcukur as a satellite source of ore for the nearby Kiziltepe Gold-Silver Mine, currently in production. Associated environmental permitting is underway as part of this process and the team are working towards integrating Kizilcukur into the mining schedule for the Kiziltepe Sector. A local public consultation meeting was recently completed successfully as part of the permitting process, with a view to commencing operations late in 2026."

The information contained within this announcement is deemed by the Company to constitute inside information as stipulated under the Market Abuse Regulations (EU) No. 596/2014 as it forms part of UK Domestic Law by virtue of the European Union (Withdrawal) Act 2018 ("UK MAR").

Introduction

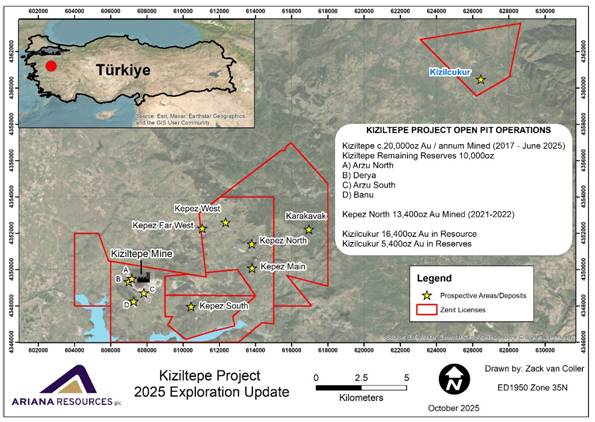

The Kizilcukur Project ("Kizilcukur" or "the Project") consists of one operational licence located in Balikesir Province in Western Türkiye. The Project is located 22km to the northeast (straight line) and 70km by road from the Kiziltepe Mine. Kizilcukur is being explored and developed as part of Zenit Madencilik's ("Zenit") operations, 23.5% of which are by Ariana. Zenit has been exploring in the vicinity of the Kiziltepe Mine (Figure 1) in search of additional ore sources to augment production from the Kiziltepe processing plant.

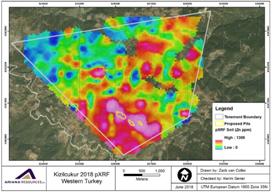

Figure 1: Summary map of the Kiziltepe Project area, with the Kizilcukur Deposit highlighted in blue

Kizilcukur Drilling

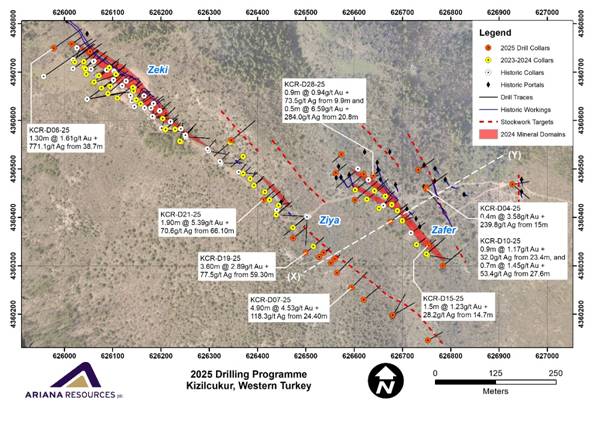

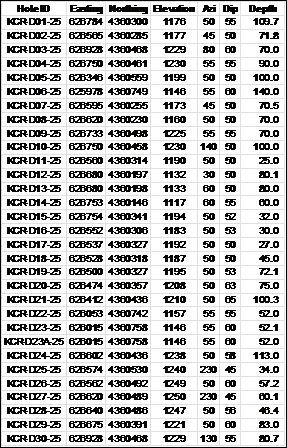

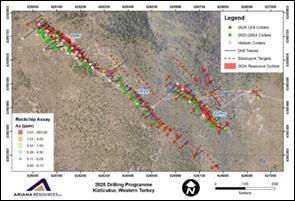

In July 2025, the Zenit exploration team initiated a new phase of exploration and resource HQ diamond drilling at Kizilcukur for 2,769 metres across 31 drill holes (Figure 2). The average depth for all drilling was approximately 69 metres, with a minimum depth of 25 metres and a maximum depth of 140 metres. The dip angles ranged from 45° to 65° to test the extent of the mineralisation at depth. All drill core has been sampled and processed at the Kiziltepe Mine Laboratory ("KML").

The programme, which is now complete, was primarily designed to provide resource step-out drilling along the northwestern and southeastern extents of the Zeki, Ziya, and Zafer vein resource areas. In addition to the resource step-out drilling, four drill holes were drilled on the far eastern area of the Kizilcukur vein system, to test a series of shallow depressions surrounded by mineralised quartz float mapped in 2014. These depressions are thought to represent a series of "bell-pit" workings.

Resource drilling for the southeastern extension of the Ziya vein tested mostly outcropping and mapped extensions of the vein system, which in the past were not accessible due to a lack of drilling-road infrastructure and steep terrain (Figure 2).

Figure 2: Plan view of the Kizilcukur Project, showing historic and completed drillholes in relation to the currently defined resources. Between 2023 and 2024, the Zenit team has drilled over 3,500 metres at Kizilcukur.

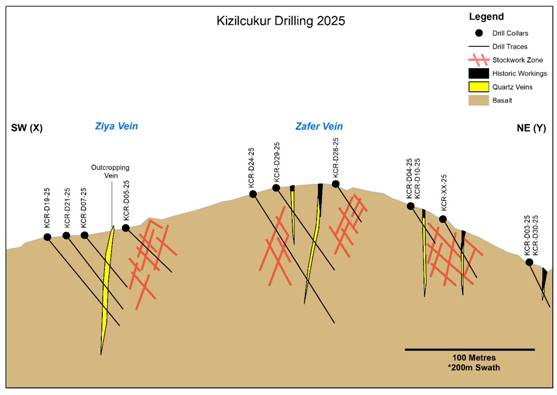

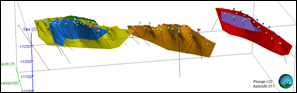

As in previous programmes (AIM: 22 February 2024), the 2025 drilling programme intercepted the complex multi-phase mineralisation characteristic of the Kizilcukur deposit. Three different mineralisation phases have been identified and are being evaluated in further detail. These represent epithermal quartz veins, manganese-rich zones, and a deeper massive sulphide lead and zinc zone, which are suggestive of a low to intermediate sulphidation type system (Figure 3).

Significant intercepts from the 2025 drilling programme at Kizilcukur include:

· 4.90m @ 4.53g/t Au + 118.3g/t Ag from 24.40m in KCR-D07-25

o including 1.00m @ 10.45g/t Au + 158.7g/t Ag from 25.8m

· 3.60m @ 2.89g/t Au + 77.5g/t Ag from 59.30m in KCR-D19-25

· 1.90m @ 5.39g/t Au + 70.6g/t Ag from 66.10m in KCR-D21-25

o including 0.90m @ 10.61g/t Au + 100.2g/t Ag from 66.1m

Figure 3: A northeast-southwest cross-section through the Kizilcukur vein deposit, showing the Ziya and Zafer veins, as well as peripheral exploration gold-bearing quartz veins and all representative drill holes from the 2025 drilling.

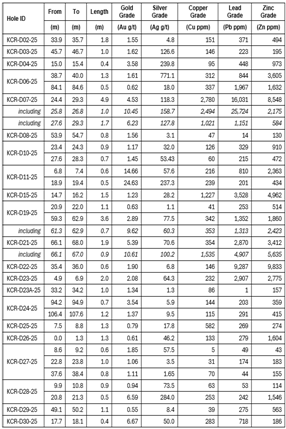

| Hole ID | From | To | Length | Gold Grade |

Silver Grade | Copper Grade | Lead Grade | Zinc Grade |

|---|---|---|---|---|---|---|---|---|

| (m) | (m) | (m) | (Au g/t) | (Ag g/t) | (Cu ppm) | (Pb ppm) | (Zn ppm) | |

| --- | --- | --- | --- | --- | --- | --- | --- | --- |

| KCR-D02-25 | 33.9 | 35.7 | 1.8 | 1.55 | 4.8 | 151 | 371 | 494 |

| KCR-D03-25 | 45.7 | 46.7 | 1.0 | 1.62 | 126.6 | 146 | 223 | 195 |

| KCR-D04-25 | 15.0 | 15.4 | 0.4 | 3.58 | 239.8 | 95 | 448 | 973 |

| KCR-D06-25 | 38.7 | 40.0 | 1.3 | 1.61 | 771.1 | 312 | 844 | 3,605 |

| 84.1 | 84.6 | 0.5 | 0.62 | 18.0 | 337 | 1,967 | 1,632 | |

| KCR-D07-25 | 24.4 | 29.3 | 4.9 | 4.53 | 118.3 | 2,780 | 16,031 | 8,548 |

| including | 25.8 | 26.8 | 1.0 | 10.45 | 158.7 | 2,494 | 25,724 | 2,175 |

| including | 27.6 | 29.3 | 1.7 | 6.23 | 127.8 | 1,021 | 1,151 | 584 |

| KCR-D08-25 | 53.9 | 54.7 | 0.8 | 1.56 | 3.1 | 47 | 14 | 130 |

| KCR-D10-25 | 23.4 | 24.3 | 0.9 | 1.17 | 32.0 | 126 | 329 | 910 |

| 27.6 | 28.3 | 0.7 | 1.45 | 53.4 | 60 | 215 | 472 | |

| KCR-D11-25 | 6.8 | 7.4 | 0.6 | 14.66 | 57.6 | 216 | 810 | 2,363 |

| 18.9 | 19.4 | 0.5 | 24.63 | 237.3 | 239 | 201 | 434 | |

| KCR-D15-25 | 14.7 | 16.2 | 1.5 | 1.23 | 28.2 | 1,227 | 3,528 | 4,962 |

| KCR-D19-25 | 20.9 | 22.0 | 1.1 | 0.63 | 1.1 | 41 | 253 | 514 |

| 59.3 | 62.9 | 3.6 | 2.89 | 77.5 | 342 | 1,352 | 1,860 | |

| including | 61.3 | 62.9 | 0.7 | 9.62 | 60.3 | 353 | 1,313 | 2,423 |

| KCR-D21-25 | 66.1 | 68.0 | 1.9 | 5.39 | 70.6 | 354 | 2,870 | 3,412 |

| including | 66.1 | 67.0 | 0.9 | 10.61 | 100.2 | 1,535 | 4,907 | 5,635 |

| KCR-D22-25 | 35.4 | 36.0 | 0.6 | 1.90 | 6.8 | 146 | 9,287 | 9,833 |

| KCR-D23-25 | 4.9 | 6.9 | 2.0 | 2.08 | 64.3 | 232 | 2,907 | 2,775 |

| KCR-D23A-25 | 33.2 | 34.2 | 1.0 | 1.34 | 1.3 | 86 | 1 | 157 |

| KCR-D24-25 | 94.2 | 94.9 | 0.7 | 3.54 | 5.9 | 144 | 203 | 359 |

| 106.4 | 107.6 | 1.2 | 1.37 | 9.5 | 115 | 291 | 415 | |

| KCR-D25-25 | 7.5 | 8.8 | 1.3 | 0.79 | 17.8 | 582 | 269 | 274 |

| KCR-D26-25 | 0.0 | 1.3 | 1.3 | 0.61 | 46.2 | 133 | 279 | 1,604 |

| KCR-D27-25 | 8.6 | 9.2 | 0.6 | 1.85 | 57.5 | 5 | 49 | 43 |

| 22.8 | 23.8 | 1.0 | 1.06 | 3.5 | 31 | 174 | 183 | |

| 37.6 | 38.4 | 0.8 | 1.11 | 1.7 | 70 | 44 | 155 | |

| KCR-D28-25 | 9.9 | 10.8 | 0.9 | 0.94 | 73.5 | 63 | 53 | 114 |

| 20.8 | 21.3 | 0.5 | 6.59 | 284.0 | 253 | 242 | 1,546 | |

| KCR-D29-25 | 49.1 | 50.2 | 1.1 | 0.55 | 8.4 | 39 | 275 | 563 |

| KCR-D30-25 | 17.7 | 18.1 | 0.4 | 6.67 | 50.0 | 283 | 718 | 186 |

Table 1: Significant gold intercepts calculated for 2025 Kizilcukur drilling using a 0.5g/t Au minimum cut-off and allowing for up to 1m internal dilution. Intercepts calculated using KML data. Silver, copper, lead and zinc shown to emphasise the different zones of mineralisation.

Summary of Kizilcukur Geology

The Project covers an area containing a series of sub-parallel quartz veins hosted by ophiolitic (dominantly basaltic) units that trend northwest and extend for about two kilometres. The veins exhibit classic low-sulfidation epithermal textures and attain a maximum true width of 8m. The Zeki Vein extends over a strike length of 820m.

Ore Reserves have been estimated for Kizilcukur as 84.9kt at 1.97g/t Au and 84.23g/t Ag for 5,400oz gold (Au) and 0.23Moz silver (Ag) contained metal. The Mineral Resource Estimate for Kizilcukur is 256.9kt at 1.98g/t Au and 74.54g/t Ag for 16,400oz Au and 0.62Moz Ag contained metal (2024). Resources are inclusive of reserves.

Trial mining was completed within the central part of the Zeki Pit in 2017. This pit is the largest and highest grade of the three pits defined following Whittle optimisation of the Kizilcukur resource in 2016. The General Directorate of Mining Affairs approved blasting operations on the licence as part of the Mining Permit (AIM: 18 November 2015).

Sampling and Assaying Procedures

All diamond drill core from Kizilcukur has been logged and sampled at the Kiziltepe Project and analysed at KML (Kiziltepe Mine Laboratory), where the results are systematically assessed.

HQ-size drill-core samples from the drilling programme at Kizilcukur were cut in half by a diamond saw and sent for analysis in batches in line with the Company's quality control procedures. Core recovery for all drilling conducted at Kizilcukur during this 2025 campaign was 91%.

From this programme, a total of 1,579 sample results for 1,236.7 metres of sampled drill core have been returned from the KML (including 339 QA/QC samples). Samples are also being analysed by ALS Global ("ALS") in Izmir as an external laboratory check as part of the QA/QC procedures used for the Project, with a minimum 10% check rate to be achieved by the end of the drilling programme.

QA/QC sample insertion rates vary depending on the batch size accepted by the laboratory. During the 2021-2025 drilling, Zenit QA/QC protocol required 1 blank, 1 CRM, 1 field duplicate, 1 pulp duplicate and over 10% samples analysed at an external laboratory. Since October 2022, KML has been accredited by the Turkish Accreditation Agency (TÜRKAK) with 'TS EN ISO/IEC 17025:2017 General Requirements for the Competence of Experimental and Calibration Laboratory'.

All samples were assayed for gold using a 30g fire assay. Multi-element ICP (Inductively Coupled Plasma) was used to analyse other elements. Reviews of the assay results have determined that all quality control and quality assurance samples (blanks, standards, field duplicates and pulp duplicates) passed the required quality control checks established by the Company, with duplicate samples showing excellent correlation. Laboratory sample preparation, assaying procedures and chain of custody are appropriately controlled. Zenit maintains an archive of half-core samples and a photographic record of all cores for future reference.

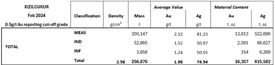

Kizilcukur Mineral Resource Estimate

| CLASSIFICATION | TONNAGE (t) |

GRADE | CONTAINED METAL | ||

|---|---|---|---|---|---|

| Au (g/t) |

Ag (g/t) |

Au (oz) |

Ag (oz) |

||

| --- | --- | --- | --- | --- | --- |

| Measured | 200,100 | 2.12 | 81.23 | 13,600 | 522,700 |

| Indicated | 52,900 | 1.52 | 50.97 | 2,600 | 86,600 |

| Inferred | 3,900 | 1.24 | 50.55 | 200 | 6,300 |

| TOTAL | 256,900 | 1.98 | 74.54 | 16,400 | 615,600 |

Notes:

1. The Kizilcukur Mineral Resource Estimate is reported in accordance with the JORC Code. Reported using a cut-off grade of 0.5g/t Au, inclusive of Reserves, depleted for mining to 26 March 2024.

2. Refer to sections 5.5.4 and 5.5.5 of the IGR for further information regarding the Kizilcukur Mineral Resource Estimate including information required by ASX Listing Rule 5.8.

Kizilcukur Ore Reserve Estimate

| CATEGORY | TONNAGE (t) |

GRADE | CONTAINED METAL | ||

|---|---|---|---|---|---|

| Au (g/t) |

Ag (g/t) |

Au (oz) |

Ag (oz) |

||

| --- | --- | --- | --- | --- | --- |

| Proven | 46,900 | 2.02 | 85.33 | 3,050 | 128,700 |

| Probable | 38,000 | 1.92 | 82.57 | 2,350 | 101,200 |

| TOTAL | 84,900 | 1.97 | 84.23 | 5,400 | 229,900 |

Notes:

1. The Kizilcukur Ore Reserves are reported in accordance with the JORC Code. Reported using a cut-off grade of 0.5g/t Au. Depleted for mining to 30 August 2024.

2. Refer to sections 5.5.6 to 5.5.8 of the IGR for further information regarding the Kizilcukur Ore Reserves including the information required by ASX Listing Rule 5.9.

The Board of Ariana has approved this announcement and authorised its release.

Contacts:

| Ariana Resources plc Michael de Villiers, Chairman Dr. Kerim Sener, Managing Director |

Tel: +44 (0) 20 3476 2080 | |

| Beaumont Cornish Limited (Nominated Adviser) Roland Cornish / Felicity Geidt |

Tel: +44 (0) 20 7628 3396 | |

| Zeus Capital (Joint Broker) Harry Ansell / Katy Mitchell Fortified Securities (Joint Broker) Guy Wheatley Yellow Jersey PR Limited (UK Financial PR) Dom Barretto / Shivantha Thambirajah / Bessie Elliot M&C Partners (Aus Financial PR) Christina Granger / Ben Henri Shaw and Partners Limited (Lead Manager - ASX) Damien Gullone |

Tel: +44 (0) 203 829 5000 Tel: +44 (0) 203 411 7773 Tel: +44 (0) 7983 521 488 [email protected] Tel: +61 438 227 286 [email protected] Tel: +61 (0)2 9238 1268 |

Beaumont Cornish Limited ("Beaumont Cornish") is the Company's Nominated Adviser and is authorised and regulated by the FCA. Beaumont Cornish's responsibilities as the Company's Nominated Adviser, including a responsibility to advise and guide the Company on its responsibilities under the AIM Rules for Companies and AIM Rules for Nominated Advisers, are owed solely to the London Stock Exchange. Beaumont Cornish is not acting for and will not be responsible to any other persons for providing protections afforded to customers of Beaumont Cornish nor for advising them in relation to the proposed arrangements described in this announcement or any matter referred to in it.

About Ariana Resources plc:

Ariana is a mineral exploration, development and production company dual listed on AIM (AIM: AAU) and ASX (ASX: AA2), with an exceptional track record of creating value for its shareholders through its interests in active mining projects and investments in exploration companies. Its current interests include a major gold development project in Zimbabwe, gold-silver production in Türkiye and copper-gold-silver exploration and development projects in Kosovo and Cyprus.

For further information on the vested interests Ariana has, please visit the Company's website at www.arianaresources.com.

Zeus Capital Limited, Fortified Securities and Shaw and Partners Limited are the brokers to the Company and Beaumont Cornish Limited is the Company's Nominated Adviser.

Competent Persons Statement

The information in this announcement relating to Exploration Results at the Kizilcukur Project is based on, and fairly represents, information and supporting documentation prepared by Mr Zack van Coller BSc (Hons). Mr van Coller is a full-time employee of Ariana Resources plc. Mr van Coller is a Member of the Australian Institute of Mining and Metallurgy, a Fellow of the Geological Society London (a Registered Overseas Professional Organisation as defined in the ASX Listing Rules), and has sufficient experience which is relevant to the style of mineralisation and type of deposit under consideration and to the activity which has been undertaken to qualify as a Competent Person as defined in the 2012 Edition of the 'Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves" (the JORC Code 2012). Mr van Coller consents to the inclusion in this report of the matters based on the information compiled by him, in the form and context in which it appears.

The information that relates to Mineral Resources and Reserves is based upon information compiled by Miss Ruth Woodcock, Exploration Group Leader, Ariana Resources plc. Miss Woodcock is a member of Recognised Professional Organisations as defined by JORC 2012: a Chartered Geologist (CGeol, Geological Society of London) and European Geologist (EurGeol, European Federation of Geologists) and has sufficient experience which is relevant to the style of mineralisation and type of deposit under consideration and to the activity upon which she is reporting as a Competent Person as defined in the 2012 Edition of "The Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves." Ms. Woodcock consents to the inclusion in this report of the matters based on the information compiled by her, in the form and context in which it appears.

Forward looking statements and disclaimer

This announcement contains certain "forward-looking statements". Forward-looking statements can generally be identified by the use of forward-looking words such as "forecast",

"likely", "believe", "future", "project", "opinion", "guidance", "should", "could", "target", "propose", "to be", "foresee", "aim", "may", "will", "expect", "intend", "plan", "estimate", "anticipate", "continue", "indicative" and "guidance", and other similar words and expressions, which may include, without limitation, statements regarding plans, strategies and objectives of management, anticipated production dates, expected costs or production outputs for the Company, based on (among other things) its estimates of future production of the Projects. To the extent that this document contains forward-looking information (including forward-looking statements, opinions or estimates), the forward-looking information is subject to a number of risk factors, including those generally associated with the gold exploration, mining and production businesses. Any such forward-looking statement also inherently involves known and unknown risks, uncertainties, and other factors that may cause actual results, performance, and achievements to be materially greater or less than estimated. These factors may include, but are not limited to, changes in commodity prices, foreign exchange fluctuations, general economic and share market conditions, increased costs and demand for production inputs, the speculative nature of exploration and project development (including the risks of obtaining necessary licenses and permits and diminishing quantities or grades of reserves), changes to the regulatory framework within which the Company operates or may in the future operate, environmental conditions including extreme weather conditions, geological and geotechnical events, and environmental issues, and the recruitment and retention of key personnel.

The Board of Ariana Resources plc has approved this announcement and authorised its release.

Drill Collars Table for Kizilcukur 2025

(ED50 / UTM Zone 35)

| Hole ID | Easting | Northing | Elevation (m) | Azi (°) | Dip (°) | Depth (m) |

|---|---|---|---|---|---|---|

| KCR-D01-25 | 626784 | 4360300 | 1176 | 50 | 55 | 109.7 |

| KCR-D02-25 | 626565 | 4360285 | 1177 | 45 | 50 | 71.8 |

| KCR-D03-25 | 626928 | 4360468 | 1229 | 80 | 60 | 70.0 |

| KCR-D04-25 | 626750 | 4360461 | 1230 | 55 | 55 | 90.0 |

| KCR-D05-25 | 626346 | 4360559 | 1199 | 50 | 50 | 100.0 |

| KCR-D06-25 | 625978 | 4360749 | 1146 | 55 | 60 | 140.0 |

| KCR-D07-25 | 626595 | 4360255 | 1173 | 45 | 50 | 70.5 |

| KCR-D08-25 | 626620 | 4360230 | 1160 | 50 | 50 | 70.0 |

| KCR-D09-25 | 626733 | 4360498 | 1225 | 55 | 55 | 70.0 |

| KCR-D10-25 | 626750 | 4360458 | 1230 | 140 | 50 | 100.0 |

| KCR-D11-25 | 626560 | 4360314 | 1190 | 50 | 50 | 25.0 |

| KCR-D12-25 | 626680 | 4360197 | 1132 | 30 | 50 | 80.1 |

| KCR-D13-25 | 626680 | 4360198 | 1133 | 60 | 50 | 80.0 |

| KCR-D14-25 | 626753 | 4360146 | 1117 | 60 | 55 | 60.0 |

| KCR-D15-25 | 626754 | 4360341 | 1194 | 50 | 52 | 32.0 |

| KCR-D16-25 | 626552 | 4360306 | 1183 | 50 | 53 | 30.0 |

| KCR-D17-25 | 626537 | 4360327 | 1192 | 50 | 50 | 27.0 |

| KCR-D18-25 | 626528 | 4360318 | 1187 | 50 | 50 | 45.0 |

| KCR-D19-25 | 626500 | 4360327 | 1195 | 50 | 53 | 72.1 |

| KCR-D20-25 | 626474 | 4360357 | 1208 | 50 | 63 | 75.0 |

| KCR-D21-25 | 626412 | 4360436 | 1210 | 50 | 65 | 100.3 |

| KCR-D22-25 | 626053 | 4360742 | 1157 | 55 | 55 | 52.0 |

| KCR-D23-25 | 626015 | 4360758 | 1146 | 55 | 60 | 52.1 |

| KCR-D23A-25 | 626015 | 4360758 | 1146 | 55 | 60 | 52.0 |

| KCR-D24-25 | 626602 | 4360436 | 1238 | 50 | 58 | 113.0 |

| KCR-D25-25 | 626574 | 4360530 | 1240 | 230 | 45 | 34.0 |

| KCR-D26-25 | 626562 | 4360492 | 1249 | 50 | 60 | 57.2 |

| KCR-D27-25 | 626620 | 4360489 | 1250 | 230 | 45 | 60.1 |

| KCR-D28-25 | 626640 | 4360486 | 1247 | 50 | 56 | 46.4 |

| KCR-D29-25 | 626675 | 4360391 | 1221 | 50 | 60 | 83.0 |

| KCR-D30-25 | 626928 | 4360468 | 1229 | 130 | 55 | 80.7 |

JORC Table 1 - Kizilcukur

Section 1 Sampling Techniques and Data

(Criteria in this section apply to all succeeding sections.)

| Criteria | JORC Code explanation | Commentary |

|---|---|---|

| Sampling techniques | · Nature and quality of sampling (eg cut channels, random chips, or specific specialised industry standard measurement tools appropriate to the minerals under investigation, such as down hole gamma sondes, or handheld XRF instruments, etc). These examples should not be taken as limiting the broad meaning of sampling. · Include reference to measures taken to ensure sample representivity and the appropriate calibration of any measurement tools or systems used. · Aspects of the determination of mineralisation that are Material to the Public Report. · In cases where 'industry standard' work has been done this would be relatively simple (eg 'reverse circulation drilling was used to obtain 1 m samples from which 3 kg was pulverised to produce a 30 g charge for fire assay'). In other cases more explanation may be required, such as where there is coarse gold that has inherent sampling problems. Unusual commodities or mineralisation types (eg submarine nodules) may warrant disclosure of detailed information. |

· Reverse circulation (RC) sampling: Samples were collected at 1 m intervals and split using a two-stage riffle splitter, running each sample through twice. Wet samples were speared four times ensuring that even and representative samples were taken to the bottom and corners of each sample sack. Saturated wet samples were extracted using a "grab" sample manual technique. · Diamond Drilling: Full core was cut using a rock saw and half-core samples were taken at variable intervals ranging from 0.3 m to 2 m, with an average length of 1 m. Core recovery was recorded into the database. · Previously, samples were sent to an ISO accredited ALS laboratory in Izmir, Türkiye for Au and Ag analysis by fire assay, which is still used as an external laboratory for QA/QC purposes. · Samples are now prepared and analysed at Zenit's own internal Kiziltepe Mine Laboratory, for Au (fire assay), Ag (AAS), and 4-acid digest for all other elements. · Under normal Company operational procedures, sampling undertaken as early-stage exploration or reconnaissance is submitted to the laboratory for 30 g fire assay analysis. However, sampling undertaken on more advanced or resource stage projects are submitted for 50 g fire assay analysis, where it is expected that the larger sample mass will provide marginally more representative results. · As of January 2022, the Kiziltepe Mine Laboratory houses two ICP-OES (PerkinElmer Avio 550 and PerkinElmer Optima 8000) instruments, two Atomic Absorption Spectrometers (PerkinElmer's PinAAcle 900F), three drying ovens, three crushers, three pulverisers and seven furnaces. In addition, since October 2022 the Kiziltepe Mine Laboratory has been accredited by the Turkish Accreditation Agency (TÜRKAK) with "TS EN ISO/IEC 17025:2017 General Requirements for the Competence of Experimental and Calibration Laboratories". · Portable X-ray Fluorescence (pXRF) analysis is typically used on 1 m intervals on all drill core. This is primarily for geological modelling purposes. · Pulp rejects from all assayed samples are also analysed using pXRF analysis. This data is not used for mineral resource estimation purposes, but rather for internal evaluations conducted by the exploration team. pXRF certified reference standards are used on a regular basis in line with company procedures. |

| Drilling techniques | · Drill type (eg core, reverse circulation, open-hole hammer, rotary air blast, auger, Bangka, sonic, etc) and details (eg core diameter, triple or standard tube, depth of diamond tails, face-sampling bit or other type, whether core is oriented and if so, by what method, etc). | · Pre-2015 drilling was undertaken by HQ diameter diamond drilling (1,792 m). · 2015 drilling was undertaken by RC drilling (1,598 m). · 2018-19 drilling was undertaken by NQ diameter diamond drilling (746 m). · 2023 drilling was undertaken by HQ diameter diamond drilling (3,564 m). · 2025 drilling was undertaken by HQ diameter diamond drilling (2,769 m). |

| Drill sample recovery | · Method of recording and assessing core and chip sample recoveries and results assessed. · Measures taken to maximise sample recovery and ensure representative nature of the samples. · Whether a relationship exists between sample recovery and grade and whether sample bias may have occurred due to preferential loss/gain of fine/coarse material. |

· Recoveries were monitored and recorded into the sampling database. · Overall core recovery for diamond drilling in 2018-2019 was >75%. The figure is low due to recoveries falling below 10% where historic workings and cavities were intercepted. Holes without old workings had recoveries of up to 95%. Overall core recovery for the 2023 programme is 90%. Overall core recovery for the 2025 programme is 91 %. · Overall recovery for RC drilling is >90% and >85% for mineralised zones. Recoveries fall below 10% where historic workings and cavities were intercepted. Recovery was estimated by visual inspection of each bag. Weights were not recorded. · There is no bias between sample recovery and grade. |

| Logging | · Whether core and chip samples have been geologically and geotechnically logged to a level of detail to support appropriate Mineral Resource estimation, mining studies and metallurgical studies. · Whether logging is qualitative or quantitative in nature. Core (or costean, channel, etc) photography. · The total length and percentage of the relevant intersections logged. |

· All diamond core holes were logged lithologically (regardless of the presence of mineralisation) using a coded logging system for rock type, mineralisation, grain size, colour, alteration and any other relevant observations. · Mineralised zones were identified from observation of mineralogy and lithological characteristics. Portable XRF analysis was conducted post drilling, to provide supporting geochemical data for non-sampled regions in all drilling prior to 2023. Areas identified as geochemically anomalous by pXRF were further sampled. The pXRF was calibrated with the calibration discs on a regular basis. · Logging is qualitative in the comments section and quantitative (scales 1 to 3 or percentages) in the attributes such as alteration or mineralisation. · Logging of RC samples was carried out on washed samples with geological characteristics recorded to a database. · All diamond drill core trays are photographed (dry and wet) before sampling. Representative samples of RC chips are taken for each chip tray. |

| Sub-sampling techniques and sample preparation | · If core, whether cut or sawn and whether quarter, half or all core taken. · If non-core, whether riffled, tube sampled, rotary split, etc and whether sampled wet or dry. · For all sample types, the nature, quality and appropriateness of the sample preparation technique. · Quality control procedures adopted for all sub-sampling stages to maximise representivity of samples. · Measures taken to ensure that the sampling is representative of the in situ material collected, including for instance results for field duplicate/second-half sampling. · Whether sample sizes are appropriate to the grain size of the material being sampled. |

· Samples from diamond drill core were collected from sawn halves of identified zones of interest. · RC sampling: Samples were collected at 1 m intervals and split using a two-stage riffle splitter, running each sample through the splitter twice. Wet intervals were sub-sampled with scoop or spear. Samples were oven-dried at the laboratory if necessary. Although every metre was sampled from top to bottom of each hole, metres which were clearly unmineralised were not assayed. · Sample preparation technique is appropriate to the mineralisation style. · Splitting and sample preparation conducted on samples at the Kiziltepe Mine Laboratory: o Drying at 105OC o Crushing whole sample to ≤ 2 mm o Splitting of crushed sample to analyse o Pulverising sub-sample to 80% passing ≤75μm |

| Quality of assay data and laboratory tests | · The nature, quality and appropriateness of the assaying and laboratory procedures used and whether the technique is considered partial or total. · For geophysical tools, spectrometers, handheld XRF instruments, etc, the parameters used in determining the analysis including instrument make and model, reading times, calibrations factors applied and their derivation, etc. · Nature of quality control procedures adopted (eg standards, blanks, duplicates, external laboratory checks) and whether acceptable levels of accuracy (ie lack of bias) and precision have been established. |

· QC procedures for 2015 drilling included the insertion of certified reference standards, blank samples, duplicates and umpire laboratory check samples to monitor the accuracy and precision of laboratory data. The protocol followed included the insertion of one standard, one blank and two duplicates; each batch corresponding to 22 drilling samples. The overall quality of QA/QC meets or exceeds the currently accepted industry standards, to ensure the validity of the data used for resource estimation purposes. · In drill programmes since 2019, samples have been submitted in batches of 35 to ALS Global, Izmir, to include 1 blank, 1 CRM, 1 field duplicate and 1 pulp duplicate. Insertion rate of 11%. · Samples submitted to Kiziltepe Mine Laboratory are in batches of 20 to include 1 blank, 1 CRM, 1 field duplicate, 1 pulp duplicate and 1 internal Kiziltepe Mine Lab sample. Insertion rate of 20%. The Kiziltepe Mine Laboratory adds an additional duplicate sample which is a split of the 19th sample of each batch. Further to this, the laboratory adds 4 internal standards for their own instrumental QA/QC checks. · 10% of all drill samples are duplicated to submit to ALS Global, Izmir, as check samples at an external laboratory to confirm internal Kiziltepe Mine Laboratory results. · The overall quality of QA/QC procedures is considered adequate to ensure the validity of the data used for resource estimation purposes. · The handheld XRF is an Olympus Vanta. A series of 10 blank and certified reference material samples are used to check the quality of the pXRF data. These are scanned at a rate of 1 blank and 1 CRM for every 100 samples. The device does not require further calibration. |

| Verification of sampling and assaying | · The verification of significant intersections by either independent or alternative company personnel. · The use of twinned holes. · Documentation of primary data, data entry procedures, data verification, data storage (physical and electronic) protocols. · Discuss any adjustment to assay data. |

· Samples taken in 2023-2025 have been submitted to Zenit's Kiziltepe Mine Laboratory, with 10% also selected for check assays at ALS Global in Izmir throughout the sampling program. Samples for check assays are chosen from areas suspected to be mineralised. · All samples prior to 2023 were submitted to the internationally accredited laboratory of ALS Global in Izmir, Türkiye (ISO 9001:2008 accredited). · At the resource definition stage three staged duplicates; one field, one crush and one pulp, are inserted into each 22 sample batch. · Primary data, data entry procedures, data verification and data storage protocols are in line with industry best-practice. · Assay data has not been adjusted. · No twin holes have been drilled. Although intercepts have been tested and verified by re-drilling into them from alternative angles, particularly when testing some of the older holes or holes drilled by previous companies. · All samples (30 g or 50 g) are analysed using fire assay with AAS (Au-AA23) and aqua regia with ICP-AES (ME-ICP41). · Since early 2021 the Kiziltepe Mine Laboratory has undergone expansion to deal with increased sample capacity. Initial verification of assay results from newly installed laboratory instruments is still undergoing internal review. Check results from the external laboratory (ALS Izmir) have been received and reviewed, demonstrating that received assay data and associated QA/QC samples fall within expected levels. Evaluations of incoming check data for the Kiziltepe Mine Laboratory and ALS Laboratory will continue to be assessed. |

| Location of data points | · Accuracy and quality of surveys used to locate drill holes (collar and down-hole surveys), trenches, mine workings and other locations used in Mineral Resource estimation. · Specification of the grid system used. · Quality and adequacy of topographic control. |

· All collar positions were located initially by hand-held GPS and later surveyed by a professional surveyor using DGPS equipment. · Downhole deviation surveys were routinely carried out in all holes, using a down-hole Gyro on 4 m intervals. The Gyro data was then later calibrated with Flex-it survey tool data and corrected to ED50 UTM 35N. · Topographic data is collected by DGPS. |

| Data spacing and distribution | · Data spacing for reporting of Exploration Results. · Whether the data spacing and distribution is sufficient to establish the degree of geological and grade continuity appropriate for the Mineral Resource and Ore Reserve estimation procedure(s) and classifications applied. · Whether sample compositing has been applied. |

· Due to the steep terrain, drill spacing is largely dependent on accessible sites. In many instances more than one hole was drilled from a single site with drill hole separation achieved by using diverging downhole trajectories. · Sample compositing has not been applied at the sampling stage. · Sample spacing and distribution is sufficient to establish the geological and grade continuity required for modelling and resource estimation. |

| Orientation of data in relation to geological structure | · Whether the orientation of sampling achieves unbiased sampling of possible structures and the extent to which this is known, considering the deposit type. · If the relationship between the drilling orientation and the orientation of key mineralised structures is considered to have introduced a sampling bias, this should be assessed and reported if material. |

· The dip of the vein mineralisation for most of the deposit is steeply dipping to subvertical, striking 310o NW. Local grade continuity follows the dip of the mineralisation for the entire deposit. Drill hole trajectories were angled in order to intersect the mineralisation obliquely. · No biases are expected from the drilling direction. |

| Sample security | · The measures taken to ensure sample security. | · Samples are stored at a secure company facility at the Kiziltepe Mine Site in a clean area free of any contamination. · During drilling programmes pre-2019 samples were delivered to ALS Global, Izmir once a week by Aras Cargo, Sindirgi. · The measures taken to ensure sample security for samples used for analysis and QA/QC include the following: 1. Chain of Custody is demonstrated by both Company and ALS Global in the delivery and receipt of sample materials. 2. Upon receipt of samples, ALS Global delivers by email to the Company's designated Quality Control Manager, confirmation that each batch of samples has arrived, with its tamper-proof seal intact, at the allocated sample preparation facility. 3. Any damage to or loss of samples within each batch (e.g., total loss, spillage or obvious contamination), must also be reported to the Company in the form of a list of samples affected and detailing the nature of the problem(s). · In the 2023 and 2025 drilling programmes, the majority of samples have been analysed by the Zenit's Kiziltepe Mine Laboratory. Samples are delivered securely from the drill site to the laboratory by the exploration team and are securely held at the laboratory in the fenced off and guarded mine site, with no unauthorised access. |

| Audits or reviews | · The results of any audits or reviews of sampling techniques and data. | · Reviews on sampling and assaying results were conducted for all data internally. · Zenit has implemented QA/QC programmes covering all aspects of sample location and collection that meets or exceeds the currently accepted industry standards. · Ariana implemented a QA/QC programme based on international best practice during the initial exploration work and subsequent drilling programmes. The company has continued to review and refine the QA/QC programme as these exploration campaigns have progressed. |

Section 2 Reporting of Exploration Results

(Criteria listed in the preceding section also apply to this section.)

| Criteria | JORC Code explanation | Commentary |

|---|---|---|

| Mineral tenement and land tenure status | · Type, reference name/number, location and ownership including agreements or material issues with third parties such as joint ventures, partnerships, overriding royalties, native title interests, historical sites, wilderness or national park and environmental settings. · The security of the tenure held at the time of reporting along with any known impediments to obtaining a licence to operate in the area. |

· The Kizilcukur Project consists of one operational license (No. 200700970) and is owned by Zenit Madencilik San. ve Tic. A.S. ("Zenit") Joint Venture ("JV") with Proccea Construction Co. and Ozaltin Holding A.S. (23.5% owned by Ariana). · It is located in the Balikesir Province in Western Türkiye (coordinates: 626150 mE; 4360440 mN). · A royalty of 2% Net Smelter Return on commercial production from the Project is payable to Dogu Akdeniz Mineralleri San. Ve Tic. Ltd. · There are no known impediments to the current operations. |

| Exploration done by other parties | · Acknowledgment and appraisal of exploration by other parties. | · Pre-2007, Eurogold Madencilik A.S. identified the occurrence of gold and silver at Kizilcukur through various stream sediment sampling programmes. · Kefi Minerals Plc acquired the project in 2007. · In 2007, systematic rock and channel sampling was undertaken by Kefi for 485 samples. · In 2008, Kefi completed 1,185.2 m of diamond drilling for 8 holes. During this time Kefi also contracted external polished block and other petrological analyses. · In 2009, Kefi completed an initial soil sampling programme for 452 samples. · In 2011, Kizilcukur was acquired by Ariana Resources. · Since 2020, Kizilcukur has been operated by Zenit. |

| Geology | · Deposit type, geological setting and style of mineralisation. | · The Project covers an area containing a series of sub-parallel quartz veins hosted by ophiolitic units that trend northwest and extend for about two kilometres. The veins exhibit classic low-sulphidation epithermal features and attain a maximum true width of 8 m. The vein system extends over a strike length of over 900 m. |

| Drill hole Information | · A summary of all information material to the understanding of the exploration results including a tabulation of the following information for all Material drill holes: o easting and northing of the drill hole collar o elevation or RL (Reduced Level - elevation above sea level in metres) of the drill hole collar o dip and azimuth of the hole o down hole length and interception depth o hole length. · If the exclusion of this information is justified on the basis that the information is not Material and this exclusion does not detract from the understanding of the report, the Competent Person should clearly explain why this is the case. |

· Diamond drilling for a total of 2,769 m (for 31 holes) was completed during Q3 2025 at the Kizilcukur Project. The programme was primarily designed to provide resource step-out drilling along the north-western and south-eastern extents of the Zeki, Ziya, and Zafer vein resource areas. Collars of the 2025 programme are detailed below from KCR-D01-25 to KCR-D30-25. · Diamond drilling for a total of 3,563.8 m (for 56 holes) was completed in 2023 at the Kizilcukur Project. The primary objective of the programme was to increase the confidence in the resource, and upgrade the classification, in addition to further testing along known mineralised structures, both at depth and along strike. In particular, the vein systems at Ziya and Zafer were targeted, which had previously received only limited drill testing. In addition, in-fill drilling at depth and along strike was completed at the Zeki main vein system. · All results from the 2023 drill programme were announced on AIM. Details of collars, surveys and mineralisation intercepts are noted in these press releases: o 22/02/2024 (FINAL DRILLING RESULTS RECEIVED FOR KIZILCUKUR) o 28/11/2023 (DRILLING COMPLETED AT KIZILCUKUR). · Drilling prior to 2023 has also been previously reported on AIM. |

| Data aggregation methods | · In reporting Exploration Results, weighting averaging techniques, maximum and/or minimum grade truncations (eg cutting of high grades) and cut-off grades are usually Material and should be stated. · Where aggregate intercepts incorporate short lengths of high grade results and longer lengths of low grade results, the procedure used for such aggregation should be stated and some typical examples of such aggregations should be shown in detail. · The assumptions used for any reporting of metal equivalent values should be clearly stated. |

· Metal equivalents have not been used. · Significant down-hole intercepts calculated for the 2025 Kizilcukur drilling program, using a 0.5 g/t Au minimum cut-off and allowing for up to 1 m internal dilution.  |

| Relationship between mineralisation widths and intercept lengths | · These relationships are particularly important in the reporting of Exploration Results. · If the geometry of the mineralisation with respect to the drill hole angle is known, its nature should be reported. · If it is not known and only the down hole lengths are reported, there should be a clear statement to this effect (eg 'down hole length, true width not known'). |

· Down hole length, true width not stated. · See Table above. · All drilling has previously been reported and modelled in three-dimensions accordingly. |

| Diagrams | · Appropriate maps and sections (with scales) and tabulations of intercepts should be included for any significant discovery being reported These should include, but not be limited to a plan view of drill hole collar locations and appropriate sectional views. |   2024 Resource Domains at Kizilcukur.  Mineralisation Phases at Kizilcukur. |

| Balanced reporting | · Where comprehensive reporting of all Exploration Results is not practicable, representative reporting of both low and high grades and/or widths should be practiced to avoid misleading reporting of Exploration Results. | · Intercept depths stated in the drill hole information but not stated in the data aggregation methods section are lower grade intersections. Down hole widths of intercepts are stated. |

| Other substantive exploration data | · Other exploration data, if meaningful and material, should be reported including (but not limited to): geological observations; geophysical survey results; geochemical survey results; bulk samples - size and method of treatment; metallurgical test results; bulk density, groundwater, geotechnical and rock characteristics; potential deleterious or contaminating substances. | · In 2011, Ariana completed an Induced Polarisation (IP) study to aid geological modelling and identify the resistive and chargeable properties of the Kizilcukur vein system. · In 2012, detailed 1:500 scale mapping of outcropping epithermal veins was conducted. · In 2013, larger scale geological mapping (1:5,000) was conducted over the main project area, with the assistance of pXRF analysis for rock typing. · In 2018, a detailed soil pXRF survey was completed for 562 samples.  · In 2023 an airborne magnetics survey was completed to better define the controlling structures of the Kizilcukur vein system, and also identifying new potential zones of gold mineralisation along strike of the known veins. · An automated multi-sensor core scanner (BoxScan) is being used to obtain data on geochemistry, mineralogy, magnetic susceptibility, core topography and high-resolution RGB colour imagery of core from the key holes from the 2023 Kizilcukur drilling program. Previously, 30 holes from the 2007, 2018 and 2019 drill programmes, totalling over 2,530 m (712 core trays) were scanned. Single-element and multi-element data analysis methods will be applied to the new data to aid machine learning by training the system on the known lithologies. Core scanning data from the latest drilling will help to decipher the phases of mineralisation in more detail and potentially improve on exploration targeting in future drilling programmes. · Initial metallurgical test work has been carried out at the Kiziltepe Mine Laboratory, with gold recoveries of 82 to 91%. |

| Further work | · The nature and scale of planned further work (eg tests for lateral extensions or depth extensions or large-scale step-out drilling). · Diagrams clearly highlighting the areas of possible extensions, including the main geological interpretations and future drilling areas, provided this information is not commercially sensitive. |

· To date, historic and recent exploration activities have identified approximately 2.3 km of anomalous outcropping epithermal veins within the Kizilcukur license. Presently, only 40% (0.9 km) of the exposed vein system have been drill-tested due to outcrop accessibility and infrastructure. Drill testing the remaining 60% of the known vein system may be undertaken in the future. · Ariana also have longer term plans to explore (using airborne geophysics), for potential shallow seated intrusive porphyries, which are likely sources for the Kizilcukur mineralisation and other associated mineralisation within the nearby district. |

NOTE: Sections 3 and 4 aren't provided here as no mineral resources or ore reserves are being reported. Section 5 is not relevant to this work as there is no estimation or reporting of diamonds or other gemstones in this project.

Section 3 Estimation and Reporting of Mineral Resources

(Criteria listed in section 1, and where relevant in section 2, also apply to this section.)

Criteria

JORC Code explanation

Commentary

Database integrity

· Measures taken to ensure that data has not been corrupted by, for example, transcription or keying errors, between its initial collection and its use for Mineral Resource estimation purposes.

· Data validation procedures used.

· The Kizilcukur resource data was stored in Datashed. Data has now been transferred to MX Deposit , the database management system used by the company since Q3 2021. It is exported as spreadsheets to be used in 3D modelling software (Leapfrog Geo and Edge).

· Previously, data was logged onto field sheets which were then entered into the data system directly by geologists working on the Project. In recent drill programmes, the logging has been completed directly into MX Deposit from field tablets.

· Data was validated on entry into the database, or on upload from the earlier MS Access databases, by a variety of means including the enforcement of coding standards.

· Laboratory data has been received in digital format and uploaded directly to the database.

· Original data sheets and files have been retained and are used to validate the contents of the database against the original logging.

· Independent consultants Coffey Geotechnics Ltd, a Tetra Tech company performed a visual validation by reviewing drill holes on section in Datamine Studio RM mining software.

· Ariana Resources performed validation checks in Leapfrog GEO and EDGE v. 2023.2.0.

Site visits

·

· Ariana staff have visited the site on numerous occasions, and supervised all 2015, 2018-2019 and 2023 drilling sampling and other operations at all times in order to introduce appropriate logging, sampling and drilling protocols.

· Ruth Woodcock (BSc, CGeol, EurGeol) of Ariana Resources is acting as the Competent Person for this study, and has been on site during active drilling programmes and other exploration activities. The site will be re-visited at a later date if further work is required.

· Zack van Coller (BSc) of Ariana Resources has been involved in all work on the project since 2010 and has completed the peer review of this MRE.

· Ariana Resources (Galata Madencilik) and Zenit Madencilik field staff are permanently on site.

Geological interpretation

· Confidence in (or conversely, the uncertainty of ) the geological interpretation of the mineral deposit.

· Nature of the data used and of any assumptions made.

· The effect, if any, of alternative interpretations on Mineral Resource estimation.

· The use of geology in guiding and controlling Mineral Resource estimation.

· The factors affecting continuity both of grade and geology.

· Sub-vertically-dipping vein-hosted mineralisation.

· Interpretations by Ariana of geological surfaces derived from 3D modelling of drill hole lithological data in Leapfrog Geo and Edge (v.2023.2.0).

· The Project covers an area containing a series of sub-parallel quartz veins hosted by ophiolitic units that trend northwest and extend for about two kilometres. The veins exhibit classic low-sulphidation epithermal features and attains a maximum true width of 8 m. The vein system extends over a strike length of 900 m.

Dimensions

· The extent and variability of the Mineral Resource expressed as length (along strike or otherwise), plan width, and depth below surface to the upper and lower limits of the Mineral Resource.

· In plan orientation, the deposit comprises three main lodes ranging in strike length from 290 m to 375 m over an overall strike length of 900 m.

· Lodes typically vary from 1 to 6.5 m in thickness with main lode averaging 2.5 m thickness.

· Mineralisation has vertical extents of approximately 100 m.

Estimation and modelling techniques

· The nature and appropriateness of the estimation technique(s) applied and key assumptions, including treatment of extreme grade values, domaining, interpolation parameters and maximum distance of extrapolation from data points. If a computer assisted estimation method was chosen include a description of computer software and parameters used.

· The availability of check estimates, previous estimates and/or mine production records and whether the Mineral Resource estimate takes appropriate account of such data.

· The assumptions made regarding recovery of by-products.

· Estimation of deleterious elements or other non-grade variables of economic significance (eg sulphur for acid mine drainage characterisation).

· In the case of block model interpolation, the block size in relation to the average sample spacing and the search employed.

· Any assumptions behind modelling of selective mining units.

· Any assumptions about correlation between variables.

· Description of how the geological interpretation was used to control the resource estimates.

· Discussion of basis for using or not using grade cutting or capping.

· The process of validation, the checking process used, the comparison of model data to drill hole data, and use of reconciliation data if available.

· Drill hole sample data was constrained within semi-manually constructed orebody wireframes defined by a nominal 0.3 g/t Au cut off. The model was based on gold results only, but silver was also estimated into that volume.

· Compositing was completed in Leapfrog EDGE using a 1 m best fit routine. Hard domain boundaries were applied to the main veins and soft boundaries with 1m range were applied to the smaller veins either side of the main veins, which forced all samples to be included in one of the composites by adjusting the composite length, while keeping it as close as possible to the selected intervals of 1m.

· Sample data was composited to a 1 m downhole length using a 0.3 g/t Au cut-off and maximum 1 m internal waste.

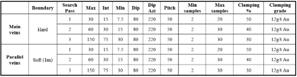

· An analysis of the grade distribution characteristics of the domain composites for each deposit was undertaken. Following analysis of the data it was decided that a top cut was not required. However, grade clamping was applied for gold results >12g/t. This has the effect of preserving the high grade, but not allowing it to smear over a large area.

· A block model was constructed using a 2 m E by 2m N by 1 m RL parent block size. The block model is a non-rotated conventional block model with no sub-blocking used.

· Estimation was carried out using inverse distance squared (ID2) at the parent block scale. Three estimation passes were undertaken using specific composite data for each separate domain. Ordinary Kriging was not used as satisfactory variograms were not obtainable.

· Material from historical underground mining has not been subtracted as the extent of these is not clear. Surface trial mining material has been depleted from the resource as updated topography was used.

· Search parameters were as in the table below.

|

· Gold and silver have been estimated as mining products. No by-products or deleterious elements have been modelled.

· In general, gold and silver show a positive correlation with each other.

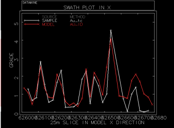

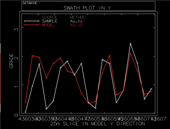

· A visual validation between drillhole data, composite data and block model data is carried out.

· Swath plots for each vein set showed good consistency between raw data, composites and estimated block grades.

Moisture

· Whether the tonnages are estimated on a dry basis or with natural moisture, and the method of determination of the moisture content.

· Tonnes have been estimated on a dry basis.

Cut-off parameters

· The basis of the adopted cut-off grade(s) or quality parameters applied.

· Measured, Indicated and Inferred Resources have been reported above a 1.0 g/t Au cut-off grade, i.e., economical cut-off. This is the same cut-off applied in previous estimates.

Mining factors or assumptions

· Assumptions made regarding possible mining methods, minimum mining dimensions and internal (or, if applicable, external) mining dilution. It is always necessary as part of the process of determining reasonable prospects for eventual economic extraction to consider potential mining methods, but the assumptions made regarding mining methods and parameters when estimating Mineral Resources may not always be rigorous. Where this is the case, this should be reported with an explanation of the basis of the mining assumptions made.

· No mining factors (i.e. dilution, ore loss, recoverable resources at selective mining block size) have been applied.

· It is assumed that the deposit will be an open pit operation with ore material trucked to the nearby Kiziltepe Mine carbon-in-leach plant for gold and silver extraction.

Metallurgical factors or assumptions

· The basis for assumptions or predictions regarding metallurgical amenability. It is always necessary as part of the process of determining reasonable prospects for eventual economic extraction to consider potential metallurgical methods, but the  assumptions regarding metallurgical treatment processes and parameters made when reporting Mineral Resources may not always be rigorous. Where this is the case, this should be reported with an explanation of the basis of the metallurgical assumptions made.

assumptions regarding metallurgical treatment processes and parameters made when reporting Mineral Resources may not always be rigorous. Where this is the case, this should be reported with an explanation of the basis of the metallurgical assumptions made.

· No metallurgical assumptions have been built into the resources because there is no intent at this point in time to convert the Mineral Resource into a Mineral Reserve.

· Initial metallurgical test work has been carried out at the Laboratory at the Kiziltepe Mine, with gold recoveries of 82 to 91%.

Environmental factors or assumptions

· Assumptions made regarding possible waste and process residue disposal options. It is always necessary as part of the process of determining reasonable prospects for eventual economic extraction to consider the potential environmental impacts of the mining and processing operation. While at this stage the determination of potential environmental impacts, particularly for a greenfields project, may not always be well advanced, the status of early consideration of these potential environmental impacts should be reported. Where these aspects have not been considered this should be reported with an explanation of the environmental assumptions made.

· The Competent Person is not aware of any known environmental or permitting issues on the projects, however, the estimate of Mineral Resources may be materially affected should such related issues arise.

Bulk density

· Whether assumed or determined. If assumed, the basis for the assumptions. If determined, the method used, whether wet or dry, the frequency of the measurements, the nature, size and representativeness of the samples.

· The bulk density for bulk material must have been measured by methods that adequately account for void spaces (vugs, porosity, etc), moisture and differences between rock and alteration zones within the deposit.

· Discuss assumptions for bulk density estimates used in the evaluation process of the different materials.

· Bulk density has been estimated into the model, based on calculations on drill core density measurements across 868 measurements. Based on these estimations, density in the total resource is 2.58g/cm3. The density measurements range from 1.99 to 3.65 g/cm3 depending on the lithology, with quartz vein material ranging from 2.21 to 3.65 g/cm3.

Classification

· The basis for the classification of the Mineral Resources into varying confidence categories.

· Whether appropriate account has been taken of all relevant factors (i.e. relative confidence in tonnage/grade estimations, reliability of input data, confidence in continuity of geology and metal values, quality, quantity and distribution of the data).

· Whether the result appropriately reflects the Competent Person's view of the deposit.

· Mineral Resources have been classified on the basis of confidence in geological and grade continuity using the drilling density, geological model and modelled grade continuity, in accordance with JORC 2012.

· Measured Mineral Resources have been defined by a 30 x 15 x 7.5 m search ellipse.

· Indicated Mineral Resources have been defined by a 60 x 30 x 15 m search ellipse.

· Inferred Mineral Resources have been defined in areas beyond the indicated search ellipse to the limits of the resource wireframes.

Audits or reviews

· The results of any audits or reviews of Mineral Resource estimates.

· The ID2 model was validated against the input drill hole composites for each domain by visual comparisons carried out against the composited drill hole samples for each domain against the modelled block grade.

· The Zenit Mining team conducted their own internal MRE estimation of Kiziltepe, using both their own and Ariana's input parameters and domain models, but using different software (Datamine Studio RM). Results between the Ariana and Zenit estimations were peer-reviewed and discussed. There was good correlation between the estimations.

· The previous mineral resource estimate on the Kizilcukur project was completed in 2020 by Tetra Tech (UK).

Discussion of relative accuracy/ confidence

· Where appropriate a statement of the relative accuracy and confidence level in the Mineral Resource estimate using an approach or procedure deemed appropriate by the Competent Person. For example, the application of statistical or geostatistical procedures to quantify the relative accuracy of the resource within stated confidence limits, or, if such an approach is not deemed appropriate, a qualitative discussion of the factors that could affect the relative accuracy and confidence of the estimate.

· The statement should specify whether it relates to global or local estimates, and, if local, state the relevant tonnages, which should be relevant to technical and economic evaluation. Documentation should include assumptions made and the procedures used.

· These statements of relative accuracy and confidence of the estimate should be compared with production data, where available.

· The Mineral Resource estimate at the global level for the Measured and Indicated Resources based on the estimation technique and data quality and distribution is considered to be adequate for the classification. Inferred Resources have a lower level of confidence outside of this range. The Exploration Target is categorised separately from Mineral Resources.

Section 4 Estimation and Reporting of Ore Reserves

(Criteria listed in section 1, and where relevant in sections 2 and 3, also apply to this section.)

| Criteria | JORC Code explanation | Commentary |

|---|---|---|

| Mineral Resource estimate for conversion to Ore Reserves | · Description of the Mineral Resource estimate used as a basis for the conversion to an Ore Reserve. · Clear statement as to whether the Mineral Resources are reported additional to, or inclusive of, the Ore Reserves. |

· The Measured and Indicated resources estimated by Zenit Madencilik for the Kizilcukur area, based on data to December 2023, were used as the basis for Ore Reserves. · The Ore Reserves, including adjustment for ore loss and dilution factors are included within declared Mineral Resources. |

| Site visits | · Comment on any site visits undertaken by the Competent Person and the outcome of those visits. · If no site visits have been undertaken indicate why this is the case. |

· See above for site visits of Competent Person for resource estimation. · Kadir Turan (BSc) of Zenit Madencilik is the Chief Mine Planning Engineer responsible for the reserves, optimisation study and mine design. · Kerim Sener BSc (Hons), MSc, PhD, Managing Director of Ariana Resources plc, and a Competent Person as defined by the JORC Code is acting as the Competent Person for the reserves part of this study. |

| Study status | · The type and level of study undertaken to enable Mineral Resources to be converted to Ore Reserves. · The Code requires that a study to at least Pre-Feasibility Study level has been undertaken to convert Mineral Resources to Ore Reserves. Such studies will have been carried out and will have determined a mine plan that is technically achievable and economically viable, and that material Modifying Factors have been considered. |

· The optimization and mine scheduling study was completed by the head Mine Planning Engineer of Ariana Resources' JV partner, Zenit Madencilik using Datamine Studio OP v2.12.58.0 and Auto scheduler plugin, as well as Studio NPVS v.1.4.26.0 for optimisation. · Kizilcukur is a satellite project to the Kiziltepe Mine, with mining planned for 2024. · A mine plan that is technically achievable and economically viable has been identified, with an open pit mine life of approximately 1-2 years. · All material modifying factors are considered by the Competent Person to have been accounted for in this Ore Reserve estimate. |

| Cut-off parameters | · The basis of the cut-off grade(s) or quality parameters applied. | · To determine the optimum open pit design, a cut-off grade estimate was performed. The cost per ton for mining, processing and overhead costs, mining dilution and loss factors, processing plant recoveries and net payable gold prices were derived from actual mine estimations, as provided by Zenit Madencilik. · A cut-off grade of 1g/t Au at a minimum mining width of 1.5 m was used to identify mineable shapes which formed the basis of design. · These cut-off grades are currently being used for the mining operations and are considered by the Competent Person to be appropriate for the operation, considering the nature of the deposit and the associated project economics. · The mine currently produces gold/silver doré bars for sale to the Istanbul Gold Refinery. |

| Mining factors or assumptions | · The method and assumptions used as reported in the Pre-Feasibility or Feasibility Study to convert the Mineral Resource to an Ore Reserve (i.e. either by application of appropriate factors by optimisation or by preliminary or detailed design). · The choice, nature and appropriateness of the selected mining method(s) and other mining parameters including associated design issues such as pre-strip, access, etc. · The assumptions made regarding geotechnical parameters (eg pit slopes, stope sizes, etc), grade control and pre-production drilling. · The major assumptions made and Mineral Resource model used for pit and stope optimisation (if appropriate). · The mining dilution factors used. · The mining recovery factors used. · Any minimum mining widths used. · The manner in which Inferred Mineral Resources are utilised in mining studies and the sensitivity of the outcome to their inclusion. ·  The infrastructure requirements of the selected mining methods. The infrastructure requirements of the selected mining methods. |

· Open pit designs were updated in 2023. · The Competent Person considers the proposed mining method to be appropriate for the size and scale of mineralisation. · Overall pit wall slopes of 43o were used, with the optimum pit slope selected based on iteration with a combination of different pit designs. Geotechnical parameters were based on design work undertaken for the Kiziltepe Feasibility Study by the Middle East Technical University (METU) Mining Engineering Department in Ankara, taking into account geological structure, rock type and design orientation constraints. It was established that the geotechnical parameters considered for the operation to date are suitable for further mining. · Mining dilution assumed for the reserve estimation is 10%. Ore mining recovery factor for reserve estimation is 90%. · A minimum mining width of 1.5 m and bench height of 10m (production slice height of 5 m, 2.5 m for ore to control and minimise dilution) is used based on the nature of the deposit and the equipment fleet currently in use at the Kiziltepe Mine and available for use at Kizilcukur. |

| Metallurgical factors or assumptions | · The metallurgical process proposed and the appropriateness of that process to the style of mineralisation. · Whether the metallurgical process is well-tested technology or novel in nature. · The nature, amount and representativeness of metallurgical test work undertaken, the nature of the metallurgical domaining applied and the corresponding metallurgical recovery factors applied. · Any assumptions or allowances made for deleterious elements. · The existence of any bulk sample or pilot scale test work and the degree to which such samples are considered representative of the orebody as a whole. · For minerals that are defined by a specification, has the ore reserve estimation been based on the appropriate mineralogy to meet the specifications? |

· The ore extracted from Kizilcukur will be treated at the Kiziltepe Processing Plant. This plant processes all ore sources from the Kiziltepe Sector. · Ore is ground using a standard crushing circuit followed by a ball mill for grinding. The ground ore is thickened and treated by a combination of Carbon in Column (CIC) and Carbon in Leach (CIL) processes. Gold and silver loaded carbon undergo standard elution, electrowinning and smelting processes to produce doré bars. · Ore is blended based on grade to maintain a constant input grade to the process plant. · As the mine has been operating since late 2016 (first gold pour in 2017), the metallurgical recoveries of different ore types are well understood. Metallurgical recovery for this processing plant to date is 92% for Au and 75% for Ag. The difference in the metallurgical characteristics of the Kizilcukur ore compared to Kiziltepe ore is accounted for by using predicted recoveries of 88% and 80% for gold and silver respectively. · There are no deleterious elements of significance. · See Section 3 for details on metallurgical test work. · The ore reserve estimation is based on the appropriate mineralogy and grades for the Kiziltepe Processing Plant. |

| Environmental | · The status of studies of potential environmental impacts of the mining and processing operation. Details of waste rock characterisation and the consideration of potential sites, status of design options considered and, where applicable, the status of approvals for process residue storage and waste dumps should be reported. | · The Kizilcukur Project is located within Operating Licence number 200700970. The ore will be trucked to the Kiziltepe Processing Plant for which an EIA was completed in 2013. The processing methods and tailings storage facility as assessed by the EIA (2013) is the same as has been assumed for this ore reserve estimate. · Tailings from the process plant are discharged to the tailings dam after cyanide destruction. · Baseline environmental monitoring is carried out on and around mine site, in line with regulations. · The waste rock has potential for acid rock drainage (ARD) due to the presence of arsenic and sulphide bearing mineralisation. Limestone is (calcium carbonate) trucked to the waste rock dump (WRD) from a local quarry at regular elevation intervals and spread to cover the whole WRD to minimize any potential ARD. There is a water channel around the WRD diverting any water from the area. Water draining out of the WRD is channelled into a concrete sump, where it is monitored and then diverted to the tailings dam. · A top-soil management plan is in place, with soil stored for remediation purposes at the end of mine life. · Stockpile areas for waste rock were identified with sterilization drilling. Waste material is also utilized for construction of infrastructure such as road and earthworks. · Kiziltepe Gold and Silver Mine is an operating mine and is compliant with all local environmental regulatory requirements and permits. |

| Infrastructure | · The existence of appropriate infrastructure: availability of land for plant development, power, water, transportation (particularly for bulk commodities), labour, accommodation; or the ease with which the infrastructure  can be provided, or accessed. can be provided, or accessed. |

· The existing infrastructure is adequate to support the existing operations. The processing facilities were expanded in 2021 to allow greater ore throughput, accommodating the lower grade and higher tonnage nature of other areas of the Kiziltepe Sector. · The deposits are located within the Company's licence area with extraction rights according to the General Directorate of Mining and Petroleum Affairs (Maden ve Petrol İşleri Genel Müdürlüğü: MAPEG). Ore is processed at the Company's current facilities, with ore delivered by truck to the Kiziltepe Process Plant. · Offices and mechanical workshop buildings are available. Power for the offices, workshop and weighbridge is provided via the existing grid system, with diesel generators as backup. · Labour is readily available as the operation is in production and planned extraction rates are consistent with current capacity. · G&A and processing labour are part of the existing company staff. Canteen facilities and associated services requirements continue to be serviced by the current infrastructure. |

| Costs | · The derivation of, or assumptions made, regarding projected capital costs in the study. · The methodology used to estimate operating costs. · Allowances made for the content of deleterious elements. · The source of exchange rates used in the study. · Derivation of transportation charges. · The basis for forecasting or source of treatment and refining charges, penalties for failure to meet specification, etc. · The allowances made for royalties payable, both Government and private. |

· Kiziltepe Gold and Silver Mine is an operating open pit mine with associated infrastructure and an operating processing facility on site. A capital expenditure for Kizilcukur is largely limited to that required to sustain the ongoing operation at the current level. · Operating cost estimates are derived from actual costs incurred by the existing mining and processing operations within the licence area. · Average mining operating costs (drill, blast, load, haul) of US$1.7 per ton was assumed, consistent with the current mining rates. · Assumed processing costs of US$47 per ton processed (including G&A) for this processing method are based on actual costs to date. · There are no deleterious elements of significance at this project. · All financial calculations for the Ore Reserves have been completed using US Dollars. Local Turkish Lira exchange rates are pegged to the US Dollar. · Transportation charges are based on current contracts. · Gold/silver doré is sold to Istanbul Gold Refinery. Selling costs of US$160/oz is assumed (including government share, royalties, smelting costs, transport). · Royalties and taxes are assumed as a percentage of ounce price plus smelter costs. |

| Revenue factors | · The derivation of, or assumptions made regarding revenue factors including head grade, metal or commodity price(s) exchange rates, transportation and treatment charges, penalties, net smelter returns, etc. · The derivation of assumptions made of metal or commodity price(s), for the principal metals, minerals and co-products. |

· A detailed LOM mine schedule has not yet been completed. · Revenue is based on a gold price of US$1900 per troy ounce and silver price of US$23 per troy ounce. These are considered to be reasonable long-term average prices for the purposes of Ore Reserve estimates. |

| Market assessment | · The demand, supply and stock situation for the particular commodity, consumption trends and factors likely to affect supply and demand into the future. · A customer and competitor analysis along with the identification of likely market windows for the product. · Price and volume forecasts and the basis for these forecasts. · For industrial minerals the customer specification, testing and acceptance requirements prior to a supply contract. |

· The market for gold and silver is well established. The metal price is fixed externally, however the Company has reviewed a number of metal forecast documents from reputable analysts and is comfortable with the market supply and demand situation. · A specific study relating to customer and competitor analysis has not been completed as part of this project. Gold and silver are openly traded via transparent open-market systems and marketing of these products is generally straightforward. · Price and volume forecasts have been studied in reports from reputable analysts, based on metal supply and demand, US$ and global economics. |

| Economic | · The inputs to the economic analysis to produce the net present value (NPV) in the study, the source and confidence of these economic inputs including estimated inflation, discount rate, etc. · NPV ranges and sensitivity to variations in the significant assumptions and inputs. |

· The mine development and open pit designs are developed or updated on an annual basis and reflect current and projected mine performances for the Ore Reserves. · The mine plan created to derive the Ore Reserves is optimised to maximise cash flow, thus providing positive cash margins in all years when modifying factors are applied. |

| Social | · The status of agreements with key stakeholders and matters leading to social licence to operate. | · To the best of the Competent Person's knowledge, agreements with key stakeholders pertaining to social licence to operate are valid and in place. |