AI Terminal

Resolute Mining Limited

Regulatory Filings • Dec 15, 2025

10548_bfr_2025-12-15_f0aeead8-3c04-49af-b5c3-03dfcd70092c.html

Regulatory Filings

Open in ViewerOpens in native device viewer

National Storage Mechanism | Additional information ![]()

RNS Number : 5487L

Resolute Mining Limited

15 December 2025

15 December 2025

Updated Doropo DFS Confirms Strong Project Economics

Resolute Mining Limited ("Resolute" or "the Company") (ASX/LSE: RSG), the Africa-focused gold miner, is pleased to announce results of the updated Definitive Feasibility Study ("DFS") for the Doropo Gold Project ("Doropo" or the "Project") in Côte d'Ivoire.

The updated Doropo DFS compiled by Lycopodium, which builds on the 2024 DFS1 prepared by Centamin plc ("2024 DFS"), outlines a larger project (+55% ore) with an extended mine life (+3 years), higher average life of mine production and compelling financials.

The full technical report can be found on the Resolute website on the Reports page.

Highlights

• Life-of-mine ("LOM") average production of approximately 170koz pa over 13 years (for total production of 2.2Moz) from mill feed of 59Mt grading 1.31g/t containing 2.50Moz of gold (previously 167koz pa over 10 years)

• DFS delivers significant returns with a post-tax project NPV5% (100% basis) of US$1.46bn, IRR of 49% at a conservative gold price assumption of US$3,000/oz

• First five years average annual gold production of 204koz at an all-in sustaining cost ("AISC") of US$1,294/oz

• Updated and Competitive LoM AISC of ~US$1,406/oz (2024 DFS: US$1,047/oz)

• Significant upside at recent average spot gold prices of ~US$4,200/oz where post-tax NPV5% increases to US$2.76bn (100% basis) with an IRR of 77% and payback period of approximately 1 year

• Revised capital cost estimate of US$516M (2024 DFS: US$373M) reflecting the larger scale project (fresh ore processing capacity increased from 4.0 Mtpa to 4.9 Mtpa) and up-to-date pricing

• Total Ore Reserve estimate of 59.1Mt grading 1.31g/t for 2.50Moz of contained gold across eight keys areas, representing a ~33% increase in contained gold. Ore Reserves estimated at a conservative gold price of US$1,950/oz

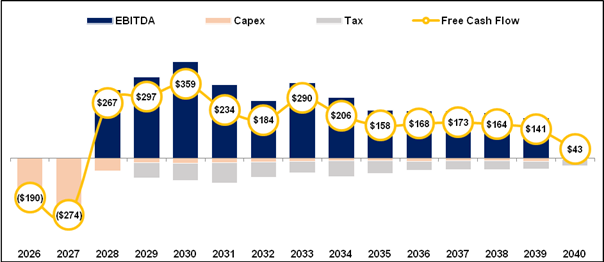

• In first five years average annual post-tax free cash flow and EBITDA (100% basis) of US$268M and US$364M respectively and payback period of 1.7 years

• Updated DFS strengthens Resolute's path to becoming a highly diversified gold producer across multiple assets and countries, targeting annual production of over 500kozpa from 2028

Chris Eger, Managing Director and CEO commented:

"This update confirms the outstanding economics of the Doropo Gold Project which is poised to become another high-quality gold mine in West Africa. Doropo is a high-margin, long-life gold mine that will significantly strengthen Resolute's operating portfolio, increasing group production to over 500koz per annum from 2028 and adding another jurisdiction to our production profile.

Doropo will produce approximately 170koz per annum for over 13 years at a competitive average AISC of US$1,406/oz, delivering a post-tax NPV5% of US$1.46bn and IRR of 49%. The average annual gold production of over 200koz in the first five years means the updated construction capital cost of US$516M will be paid back in under two years at a US$3,000/oz gold price. At a gold price assumption closer to today's prices (US$4,200/oz) the post-tax NPV5% and IRR increases to approximately US$2.8bn and 77% respectively on a 100% basis. Furthermore, we are confident of the potential for future mine life extensions at Doropo through growing the existing resources as well as exploration potential on the permits.

This has been achieved through optimisations at a higher, although still conservative, reserve price of US$1,950/oz (versus US$1,450/oz in the 2024 DFS). To further optimise the economics, we decided upon a processing plant that has a larger capacity for the fresh ore (4.9 Mtpa up from 4.0 Mtpa in the 2024 DFS). These revisions on the plant meaningfully enhance production, and account for over half (US$80M) of the US$143M increase in capital cost from the 2024 DFS.

In addition to the value Doropo will add to Resolute and its shareholders we anticipate the Project will provide major benefits to the local communities and Côte d'Ivoire. In our US$3,000/oz base case we expect to contribute more than US$420M in government royalties and social fund payments over the Project's current life. Beyond these direct financial benefits, the Project will also create significant employment opportunities, with a peak construction workforce of over 1500 personnel and over 400 employees during operations.

We have spent significant time in Cote D'Ivoire, since the acquisition, meeting stakeholders and the Minister of Mines has reaffirmed the government's commitment to deliver our Mining License by early 2026, if not before. Our November meeting in Abidjan was highly productive, and we remain confident in the collaborative relationship we have built with the Ivorian authorities. Receipt of the permit will let us to proceed with FID and financing, keeping us on track for construction to begin in H1 2026."

Doropo Project Overview

The Doropo Gold Project is situated in the Bounkani Region of Côte d'Ivoire, approximately 480 km northeast of Abidjan and 50 km north of Bouna, near the Burkina Faso border.

Resolute acquired the Doropo Project from AngloGold Ashanti in May 2025 and has been updating the 2024 DFS since then.

Table 1 includes operational and financial highlights at a flat long-term base-case gold assumption of US$3,000/oz.

| Units | Value | |

| Mine Life | Years | 13 |

| LOM ore processed | kt | 59,102 |

| LOM strip ratio | w:o | 4.9 |

| LOM feed grade processed | Au g/t | 1.31 |

| LOM gold recovery | % | 88% |

| LOM gold production | koz | 2,196 |

| Upfront capital cost | US$M | 516 |

| Life of Mine average: | ||

| Gold, average annual production | koz | 169 |

| Cash costs per ounce | US$/oz | 1,123 |

| AISC per ounce | US$/oz | 1,406 |

| EBITDA | US$M | 294 |

| Free Cash Flow (post-tax) | US$M | 214 |

| Project years 1 to 5: | ||

| Gold, average annual production | koz | 204 |

| Cash costs per ounce | US$/oz | 1,005 |

| AISC per ounce | US$/oz | 1,294 |

| EBITDA | US$M | 364 |

| Free Cash Flow (post-tax) | US$M | 268 |

| Pre-Tax Economics | ||

| Net present value - 5% | US$M | 1,959 |

| Internal Rate of Return | % | 57% |

| Post-Tax Economics | ||

| Net present value - 5% | US$M | 1,457 |

| Internal Rate of Return | % | 49% |

| Payback period (from first production) | Years | 1.7 |

Table 1: Economic Summary

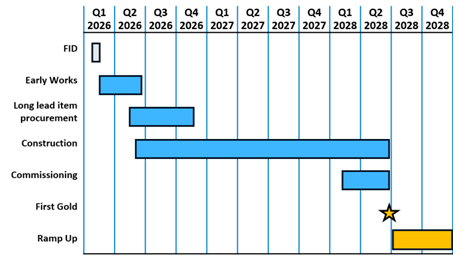

Conventional open pit mining is modelled to start at the end of 2027 with commissioning and ramp up in the first half of 2028.

The ore production schedule assumes the Souwa 'hub'' region (Souwa, Nokpa, Chegue Main, Chegue South) is operated as one mining area, Kilosegui as a separate mining area with other satellite deposits mined early in the mine life.

Figure 1: Production Profile and AISC (US$/oz)

In the first five years average annual gold production is 204koz at an AISC of US$1,294/oz. At the base case gold assumption of US$3,000/oz and on a 100% basis this generates average annual free cash flow of US$268M and a payback period of under two years.

Figure 2: Free Cash Flow Profile (US$M)

The post-tax NPV sensitivity comparing varying discount rate percentages and gold price is presented in Table 2. The base case result for the Project is highlighted in bold.

| 3,000 | 3,500 | 4,000 | 4,500 | |

| 5% | 1,457 | 2,000 | 2,543 | 3,086 |

| 7% | 1,245 | 1,723 | 2,202 | 2,680 |

| 10% | 988 | 1,388 | 1,789 | 2,189 |

Table 2: Sensitivity of post-tax NPV5% (US$M) to Discount Rate and Gold Price (US$/oz)

Key Updates

The principal update has been optimising the pit shells at a higher, but still conservative, reserve gold price assumption of US$1,950/oz (2024 DFS: US$1,450/oz). This has increased the ore reserve by approximately 55% to 59.1Mt with contained gold increasing to 2.5Moz (2024 DFS: 1.9Moz).

Key areas of the DFS that have been updated include the following:

• As a result of the increased ore reserves, and to add operational flexibility, it was decided to increase the processing plant capacity for fresh ore from 4.0Mpta in the 2024 DFS to 4.9Mtpa

• Further work by the energy consultant indicated grid power without back-up generators is suitable. Resolute is planning to evaluate adding a solar and battery lease option which is expected to improve power costs and enhance sustainability credentials

• Increased capital costs (c. $142M) due to increase in plant capacity ($80M), general cost inflation ($14M), capital costs that were underestimated or omitted in the 2024 DFS ($35M) and additional contingency ($13M)

• Increase in the size of the water storage dam (WSD) to approximately 6 Mm3 capacity to ensure that the processing facility has ample water reserve

• Land acquisition and compensation in line with a larger project development area (PDA) and larger pits

• Tailing Storage Facility (TSF) sized for larger volume based on 60Mt vs 40Mt in 2024 DFS

• Site security bolstered significantly

• Operating costs updated with current market pricing

The key changes from the 2024 DFS and the 2025 DFS update are shown in Table 3:

| 2024 DFS | 2025 DFS Update | Variance | ||

| Mining | ||||

| Life of Mine | Years | 10 | 13 | 30% |

| Pit shells design | US$/oz | 1450 | 1950 | 34% |

| Total Tonnes Mined | Mt | 225.8 | 348.8 | 54% |

| Total Ore Mined | Mt | 38.2 | 59.1 | 55% |

| Total Waste Mined | Mt | 187.6 | 289.7 | 54% |

| Ore Grade | g/t | 1.53 | 1.31 | -14% |

| Contained Gold | koz | 1,876 | 2,497 | 33% |

| Processing | ||||

| Oxide & Transition | Mtpa | 5.4 | 5.4 | 0% |

| Fresh | Mtpa | 4.0 | 4.9 | 23% |

| Infrastructure | ||||

| TSF Capacity | Mt | 40 | 60 | 50% |

| Water Storage Dam Capacity | m3 | 2,000,000 | 6,150,000 | 208% |

| Power | ||||

| Power Supply | Grid | Grid | ||

| Power Installed | MW | 27 | 33 | 18% |

| Construction Capital Cost | US$M | 373 | 515 | 38% |

| Operating Costs | ||||

| Mining | US$/t mined | 3.8 | 4.1 | 4% |

| Processing | US$/t milled | 12.1 | 14.5 | 20% |

| G&A | US$/t milled | 3.8 | 3.5 | -8% |

| Key Outputs | ||||

| Gold Production (LoM) | Moz | 1.7 | 2.2 | 31% |

| Avg. Annual Gold Production | Koz pa | 167 | 169 | 1% |

| AISC (LoM Avg.) | US$/oz | 1,047 | 1,406 | 33% |

| Gold Price | US$/oz | 1,900 | 3,000 | 58% |

| Discount Rate | % | 8% | 5% | -38% |

| NPV (post-tax, 100% basis) | US$M | 426 | 1457 | 242% |

| IRR (post-tax) | % | 34% | 49% | 42% |

Table 3: Key updates in the 2025 DFS

Capital Cost Update

A full capital cost review was performed reflecting the current cost environment and changes to the Project scale.

The upfront capital cost estimate is US$516M which is approximately $142M higher than that 2024 DFS ($373M) due to increasing the plant capacity, general cost inflation, inclusion of capital costs that were underestimated or omitted in the 2024 DFS and additional contingency. The breakdown of areas where capital costs estimates have increased from the 2024 DFS is shown in Table 4.

| Increase from 2024 DFS (US$M) | |

| Capital costs associated with increased plant capacity: • Plant upgrades - US$28.4M • TSF and WSD - US$19.2M • Site Infrastructure - US$11.1M • Additional comminution equipment - US$8.6M • Contractor's Overheads - US$5.7M • Water Harvesting Dam - US$4.4M • Pre-Operations Mining - US$2.2M |

79.6 |

| Omitted or underestimated capital costs in 2024 DFS: • Grid Power and Emergency Supply - US$11.5M • Additional land take and ownership costs - $11.0M • Construction Costs (Camp, Labour & Expenses) - US$7.0M • Insurance and Duties - US$1.8M • Other - US$4.1 |

35.4 |

| Cost inflation (3% inflation rate) | 14.1 |

| Increased contingency on higher capital cost | 13.3 |

| Total | 142.4 |

Table 4: Areas of capital cost increase from 2024 DFS

Several opportunities have been identified that may reduce capital or operating costs, improve schedule flexibility, or enhance long-term project performance. These will be further assessed and incorporated into ongoing technical work.

Regarding power supply, Resolute intends to conduct a study on a solar and battery solution, with the aim of integrating it during the early years of production. This initiative is expected to lower operational power costs and reduce greenhouse gas emissions. The study will be carried out alongside process plant construction and implemented as soon as practicable.

Operating Cost Updates

The operating costs have increased from the 2024 DFS as a full review was performed reflecting the current cost environment. This has been principally driven by the higher diesel and power price assumptions and the larger throughput of the processing plant.

Mining costs in the updated DFS are based on contractor submissions received in October 2025. Processing and G&A operating costs have been developed for a plant with a throughput equivalent to 5.4 Mtpa of oxide / transitional material and 4.9 Mtpa of fresh material.

| 2024 DFS (LoM avg) |

2025 DFS (LoM avg) |

Explanation | ||

| Mining (US$/t mined) |

3.8 ($85M/yr) |

4.1 ($109M/yr) |

· Up to date mining tenders, diesel price of $1.145/l (vs $1.00/l in 2024 DFS) | |

| Processing (US$/t milled) |

12.1 ($71M/yr) |

14.5 ($89M/yr) |

· The plant is larger and has installed power of 33MW (vs 27MW in 2024 DFS) · Unit power rate of US$0.135kWh (vs US$0.125/kWh in 2024 DFS) · Higher maintenance and consumables costs due to larger equipment and throughput of plant · Lower labour cost due to reduced number of expats and laboratory labour costs included in the contractor Laboratory costs (vs owner Lab in 2024 DFS) |

|

| AISC (US$/oz) |

1,047 | 1,406 | · $90/oz attributed to increase in royalties due to higher gold price assumption (US$1,900/oz in 2024 DFS) | |

Table 5: Operating cost comparisons

Ore Reserves

The Doropo ore reserve has increased from 38.2Mt at 1.53 g/t with contained gold content of 1,876 koz to 59.1 Mt grading 1.31 g/t for 2,495 koz of contained gold. The main driver of this increase is the higher reserve price assumed (US$1,950/oz). The ore reserve is on a 100% project basis and is reported in accordance with the JORC 2012 standard.

The ore reserve is across eight areas - see Table 6 - with 63% contained in two of the areas (Souwa and Kilosegui). Additional detailed information relating to generation of the Ore Reserves is set out in the JORC Table below.

| Proven | Probable | Total | |||||||

| Area | Mt | Grade (g/t Au) | Contained Gold (koz) | Mt | Grade (g/t Au) | Contained Gold (koz) | Mt | Grade (g/t Au) | Contained Gold (koz) |

| Souwa | 0.3 | 1.80 | 15.9 | 15.9 | 1.37 | 700.4 | 16.2 | 1.38 | 716.3 |

| Kilosegui | 0.2 | 1.16 | 6.4 | 21.6 | 1.22 | 849.1 | 21.8 | 1.22 | 855.5 |

| Nokpa | 0.4 | 2.34 | 26.9 | 3.7 | 1.69 | 201.7 | 4.1 | 1.75 | 228.6 |

| Chegue Main | 0.2 | 1.00 | 6.5 | 5.4 | 0.98 | 170.0 | 5.6 | 0.98 | 176.5 |

| Chegue South | 0.2 | 1.07 | 7 | 1.6 | 1.13 | 56.4 | 1.8 | 1.10 | 63.4 |

| Kekeda | 0.1 | 0.95 | 3.6 | 3.2 | 1.05 | 109.7 | 3.3 | 1.05 | 113.3 |

| Han | 0.1 | 1.88 | 6.8 | 3.8 | 1.93 | 232.3 | 3.9 | 1.93 | 239.1 |

| Enioda | 0.0 | 0.00 | 0 | 2.5 | 1.29 | 104.4 | 2.5 | 1.29 | 104.4 |

| Total | 1.4 | 1.58 | 73.1 | 57.7 | 1.31 | 2424.0 | 59.1 | 1.31 | 2497.1 |

Table 6: Ore Reserve Estimate

Financing Update

Resolute intends to use its existing balance sheet to progress Doropo into construction which is expected in H1 2026. The Company continues to generate robust cash flows from its operations and at the end of Q3 had a net cash position of US$136.6 million.

In addition to using its internal cash flows, the Company is actively considering a range of funding options to support the construction of the Doropo project. A comprehensive financing strategy will be communicated alongside the Final Investment Decision (FID).

Resolute has received significant interest from several financing groups which have expressed their intent to support Doropo's development. This level of interest reflects a high degree of confidence in the project, and the Company plans to expedite these discussions to advance the Project throughout its construction phase.

Next Steps

Resolute will continue engaging with the Ivorian government and progressing Doropo towards construction to achieve first gold in H1 2028. Key next steps include:

· Commencement of front-end engineering works;

· Tender and award of the EPCM and engineering contracts;

· Building owners project team in preparation for FID;

· Upon receipt of the Exploitation Permit, start to progress the resettlement action plan and livelihood restoration plan

Figure 3: Approximate Project Timeline

Contact

| Resolute Matthias O'Toole-Howes [email protected] +44 203 3017 620 |

Public Relations Jos Simson, Tavistock [email protected] +44 207 920 3150 Corporate Brokers Jennifer Lee, Berenberg +44 20 3753 3040 Tom Rider, BMO Capital Markets +44 20 7236 1010 |

Authorised by Mr Chris Eger, Managing Director and Chief Executive Officer

Competent Person Statement

The 2025 Doropo Ore Reserve Estimate was completed by Mr. Ross Cheyne FAusIMM. Mr. Cheyne is employed by Orelogy Consulting. Mr. Cheyne has sufficient experience which is relevant to the style of mineralisation and type of deposit under consideration and to the mining activity being undertaken to qualify as a Competent Person as defined in the 2012 Edition of the JORC Code.

The information in this announcement that relates to the Mineral Resource estimate has been based on information and supporting documents prepared by Mr Bruce Mowat, a Competent Person who is a member of The Australian Institute of Geoscientists. Mr Mowat is a full-time employee Resolute Mining Limited Group and has sufficient experience relevant to the style of mineralisation and type of deposit under consideration and to the activity which has been undertaken to qualify as a Competent Person. Mr Mowat confirms that the Mineral Resource estimate is based on information in the supporting documents and consents to the inclusion in the report of the Mineral Resource estimate and related content based on the information in the form and context in which it appears.

Cautionary Statement about Forward-Looking Statements

This announcement contains certain "forward-looking statements" including statements regarding our intent, belief or current expectations with respect to Resolute's business and operations, market conditions, results of operations and financial condition, and risk management practices. The words "likely", "expect", "aim", "should", "could", "may", "anticipate", "predict", "believe", "plan", "forecast" and other similar expressions are intended to identify forward-looking statements. Indications of, and guidance on, future earnings, anticipated production, life of mine and financial position and performance are also forward-looking statements. These forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause Resolute's actual results, performance and achievements or industry results to differ materially from any future results, performance or achievements, or industry results, expressed or implied by these forward-looking statements. Relevant factors may include (but are not limited to) changes in commodity prices, foreign exchange fluctuations and general economic conditions, increased costs and demand for production inputs, the speculative nature of exploration and project development, including the risks of obtaining necessary licences and permits and diminishing quantities or grades of reserves, political and social risks, changes to the regulatory framework within which Resolute operates or may in the future operate, environmental conditions including extreme weather conditions, recruitment and retention of personnel, industrial relations issues and litigation. The production target in the updated DFS contains no Inferred Mineral Resources. To the extent a production target is based on those Inferred Mineral Resources, there is a low level of geological confidence associated with Inferred Mineral Resources and there is no certainty that future exploration work will result in the determination of inferred mineral resources or that the production target itself will be realised

Forward-looking statements are based on Resolute's good faith assumptions as to the financial, market, regulatory and other relevant environments that will exist and affect Resolute's business and operations in the future. Resolute does not give any assurance that the assumptions will prove to be correct. There may be other factors that could cause actual results or events not to be as anticipated, and many events are beyond the reasonable control of Resolute. Readers are cautioned not to place undue reliance on forward-looking statements, particularly in the current economic climate with the significant volatility, uncertainty and disruption caused by the COVID-19 pandemic. Forward-looking statements in this document speak only at the date of issue. Except as required by applicable laws or regulations, Resolute does not undertake any obligation to publicly update or revise any of the forward-looking statements or to advise of any change in assumptions on which any such statement is based. Except for statutory liability which cannot be excluded, each of Resolute, its officers, employees and advisors expressly disclaim any responsibility for the accuracy or completeness of the material contained in these forward-looking statements and excludes all liability whatsoever (including in negligence) for any loss or damage which may be suffered by any person as a consequence of any information in forward-looking statements or any error or omission.

ASX LISTING RULE 5.16 AND 5.17 REQUIREMENTS

The material assumptions on which the production target for the Project and the forecast financial information derived therefrom are based are detailed in the DFS Summary Report, which is available on the Company's website.

The production target is based on Probable and Proven Ore Reserves that have been prepared by Competent Persons in accordance with the requirements of the JORC Code (2012).

ASX LISTING RULE 5.9.1 REQUIREMENTS

Key DFS assumptions and outputs are summarised in Table 7 and 8 below. Further details are available in the DFS Summary Report, which is available on the Company's website.

| Mining | Unit | Number |

| Ore Mined | Mt | 59,102 |

| Stripping Ratio | x | 4.9 |

| Ore Grade | g/t | 1.31 |

| Contained Gold | Koz | 2,497 |

| Processing | ||

| Mine life | Years | 13 |

| Processing rate | Mtpa | 4.9 |

| Total ore processed | kt | 59,102 |

| Recovery | % | 88% |

| Total gold production | koz | 2,196 |

| Average gold production | koz pa | 169 |

| Capital Costs | ||

| Direct construction costs | US$M | 372.8 |

| Pre-production mining costs | US$M | 23.6 |

| Owners' costs | US$M | 76.8 |

| Contingency | US$M | 42.3 |

| Total pre-production capital cost | US$M | 515.5 |

| Sustaining capital costs | US$M | 171.8 |

| Closure costs (net of salvage) | US$M | 33.2 |

| Operating Costs | ||

| Cash Costs | US$/oz | 1,123 |

| All-in Sustaining Costs | US$/oz | 1,406 |

Table 7: DFS Inputs and Assumptions

| Key Financial Metrics | Unit | Number | |

| US$3,000/oz Gold Price (base case) | Pre-tax NPV5% | US$M | 1,959 |

| Pre-tax IRR | % | 57% | |

| Pre-tax payback period | Years | 1.5 | |

| Post-tax NPV5% | US$M | 1,457 | |

| Post-tax IRR | % | 49% | |

| Post-tax payback period | Years | 1.7 | |

| US$4,200/oz Gold Price (spot case) | Pre-tax NPV5% | US$M | 3,669 |

| Pre-tax IRR | % | 86% | |

| Pre-tax payback period | Years | 1.0 | |

| Post-tax NPV5% | US$M | 2,760 | |

| Post-tax IRR | % | 77% | |

| Post-tax payback period | Years | 1.0 |

Table 8: DFS Outputs

A summary of the JORC Table is provided below for compliance regarding the Mineral Resources and Ore Reserves reported within and in-line with requirements of ASX Listing Rule 5.9.1.

JORC Table

Section 1 Sampling Techniques and Data

(Criteria in this section apply to all succeeding sections.)

| Criteria | JORC Code explanation | Commentary |

|---|---|---|

| Sampling techniques | · Nature and quality of sampling (e.g. cut channels, random chips, or specific specialised industry standard measurement tools appropriate to the minerals under investigation, such as down hole gamma sondes, or handheld XRF instruments, etc.). These examples should not be taken as limiting the broad meaning of sampling. · Include reference to measures taken to ensure sample representivity and the appropriate calibration of any measurement tools or systems used. · Aspects of the determination of mineralisation that are Material to the Public Report. · In cases where 'industry standard' work has been done this would be relatively simple (e.g. 'reverse circulation drilling was used to obtain 1 m samples from which 3 kg was pulverised to produce a 30 g charge for fire assay'). In other cases more explanation may be required, such as where there is coarse gold that has inherent sampling problems. Unusual commodities or mineralisation types (e.g. submarine nodules) may warrant disclosure of detailed information. |

· The sampling was conducted using multiple techniques tailored to the project's geological and surface conditions. Soil sampling programs were extensive, collecting approximately 92,307 samples be-tween 2014 and 2022. Soils were sampled from the mottled zone or the top of the saprolite horizon to obtain coherent gold anomalies, utilising standardised grid patterns (typically 400 m x 400 m, with infill at 200m and 100 m where re-quired). Auger drilling was employed in areas with thick lateritic cover (>3 m), reaching saprolitic material with depths averaging 6.22 m and up to 30 m in some cases. Auger drilling recovered material systematically for gold analysis and geochemical interpretation. · Trenching programs (32 trenches to date) were used to expose in situ mineralised structures, allowing for systematic channel sampling. · Reverse Circulation (RC) and Diamond Core (DD) drilling were the principal methods used for delineating Mineral Resources. RC drilling was conducted using 5¼ to 5¾ inch diameter face-sampling hammers to recover one-metre interval samples, typically dry un-less groundwater was encountered. Diamond drilling employed HQ and NQ diameter core, with triple tube techniques for improving recovery in broken ground. RC samples were riffle split on site, and core samples were sawn to produce half-core for analysis. Sampling procedures incorporated QAQC measures, including the insertion of blanks, standards, and duplicates to ensure sample representivity. Assay protocols utilised 50 g fire assay (AAS finish) for gold, and multi element analysis was performed where applicable. |

| Drilling techniques | · Drill type (e.g. core, reverse circulation, open-hole hammer, rotary air blast, auger, Bangka, sonic, etc.) and details (e.g. core diameter, triple or standard tube, depth of diamond tails, face-sampling bit or other type, whether core is oriented and if so, by what method, etc.). | · Drilling methods involved a combination of Reverse Circulation (RC), Diamond Core (DD), and auger drilling methods. RC drilling was primarily used for delineating near-surface mineralisation and preliminary resource definition. RC drilling employed face sampling hammers with bit sizes ranging from 5¼ to 5¾ inches. Dry drilling was the standard procedure, with drilling halted at the water table to prevent contamination from wet samples; below groundwater, diamond drilling methods were applied. · Diamond core drilling used HQ and NQ diameter core. Triple-tube systems were implemented in highly bro-ken ground to maximise core recovery, while standard double-tube setups were used elsewhere. Orientation of diamond core was conducted selectively using Reflex ACT II core orientation devices to facilitate structural logging. Au-ger drilling was utilised for shallow exploration across areas with thick laterite cover. All drill methods were executed to a high standard with contractors experienced in gold exploration in West Africa |

| Drill sample recovery | · Method of recording and assessing core and chip sample recoveries and results assessed. · Measures taken to maximise sample recovery and ensure representative nature of the samples. · Whether a relationship exists between sample recovery and grade and whether sample bias may have occurred due to preferential loss/gain of fine/ coarse material. |

· Drill sample recovery was systematically monitored during both RC and diamond drilling programs. RC samples were weighed regularly, particularly from 2018 onwards, to monitor sample size consistency and ensure the representativeness of samples. Analysis of over 447,401 RC sample weights showed a consistent recovery trend stabilizing between 30-40 kg per metre after clearing the uppermost weathered horizons. Minor variations in sample weight were observed at shallow depths and in softer materials; however, statistical checks confirmed no significant bias in gold grade associated with sample mass. · Diamond core recovery was measured, with an overall average recovery of approximately 96% across the project. Recovery rates improved with depth, with >90% core recovery recorded for 89.5% of core samples, and exceeding 97.5% recovery below 50 m depth. Core recovery measurements were recorded in the database for each run. The use of triple-tube drilling in broken ground contributed to maintaining high recovery standards. The overall conclusion, supported by quality control reviews, was that there is no significant sampling bias attributable to differential recovery. |

| Logging | · Whether core and chip samples have been geologically and geotechnically logged to a level of detail to support appropriate Mineral Resource estimation, mining studies and metallurgical studies. · Whether logging is qualitative or quantitative in nature. Core (or costean, channel, etc.) photography. · The total length and percentage of the relevant intersections logged. |

· Comprehensive geological and geotechnical logging was undertaken for all drill-holes including RC and DD. Drillholes were logged systematically for a range of key geological attributes: lithology, alteration, mineralisation, texture, structure, weathering, and rock quality designation (RQD). RC samples were logged visually on site, with geological observations recorded both digitally and on physical log sheets where applicable. Diamond core was logged in greater detail, particularly for structural geology, alteration styles, mineral assemblages, and vein relationships, providing critical inputs for 3D geological modelling. · Photographic records were maintained for all diamond drill core - photographed both wet and dry - before sampling. Logging captured sufficient detail to support resource estimation, mining studies, and metallurgical investigations. Logging procedures included the use of a standardised lithological and alteration coding scheme to ensure consistency across the drilling campaigns. Digital capture of logging data into a centralised database with validation rules also enhanced data reliability. |

| Sub-sampling techniques and sample preparation | · If core, whether cut or sawn and whether quarter, half or all core taken. · If non-core, whether riffled, tube sampled, rotary split, etc. and whether sampled wet or dry. · For all sample types, the nature, quality and appropriateness of the sample preparation technique. · Quality control procedures adopted for all sub-sampling stages to maximise representivity of samples. · Measures taken to ensure that the sampling is representative of the in situ material collected, including for instance results for field duplicate/second-half sampling. · Whether sample sizes are appropriate to the grain size of the material being sampled. |

· Systematic sub-sampling and sample preparation protocols were employed to ensure that samples remained representative of in situ mineralisation. For RC drilling, 1 m samples were split on site using a three-tier riffle splitter to achieve a target sample size of ap-proximately 2 to 3 kg for laboratory submission. Wet samples encountered in shallow zones were left to dry naturally prior to splitting where possible. For diamond drilling, core was cut lengthwise using diamond-bladed core saws; half core samples were collected for routine assay, while the other half was preserved for reference and potential future re-assay. · Sample preparation at the laboratory followed industry best practices. Samples were oven dried, crushed to 70 to 85% passing 2 mm, then riffle split to produce a subsample for pulverisation. The pulverised material was milled to achieve at least 85% passing 75 microns, producing a pulp of approximately 150 to 250 g for fire assay analysis. Quality assurance measures were built into preparation workflows, including the regular inclusion of duplicate splits and check samples. Laboratory facilities used (primarily Bureau Veritas Abidjan, SGS Ouagadougou) operated to ISO 17025 standards, and internal laboratory QAQC reviews were conducted regularly. |

| Quality of assay data and laboratory tests | · The nature, quality and appropriateness of the assaying and laboratory procedures used and whether the technique is considered partial or total. · For geophysical tools, spectrometers, handheld XRF instruments, etc., the parameters used in determining the analysis including instrument make and model, reading times, calibrations factors applied and their derivation, etc. · Nature of quality control procedures adopted (e.g. standards, blanks, duplicates, external laboratory checks) and whether acceptable levels of accuracy (i.e. lack of bias) and precision have been established. |

· Assay methodologies were based on internationally recognised standards and utilised reputable laboratories. All drill samples were primarily analysed for gold using 50 g fire assay with atomic absorption spectroscopy (AAS) or inductively coupled plasma atomic emission spectroscopy (ICP-AES) finish. In cases where assays exceeded 10 g/t Au, samples were re-analysed using a gravimetric finish to im-prove accuracy. For some RC and trench samples, particularly those with coarse gold, photon assay techniques were trialled to validate fire assay results. · Quality control procedures were rigorous. Certified reference materials (standards), field blanks, and field duplicates were inserted into the sample stream at regular intervals - approximately one QAQC sample every 20 to 30 samples. Laboratory duplicates, in-ternal standards, and blanks were also monitored. QAQC data were routinely reviewed to ensure analytical accuracy and precision. Failures (e.g., a standard outside 3 standard deviations) triggered immediate re-assay of sample batches. No significant long-term bias or drift was observed across the assay dataset. Laboratories involved (Bureau Veritas, Abidjan and SGS, Ouagadougou) are ISO/IEC 17025 accredited, ensuring laboratory practices are consistent with industry best practice. |

| Verification of sampling and assaying | · The verification of significant intersections by either independent or alternative company personnel. · The use of twinned holes. · Documentation of primary data, data entry procedures, data verification, data storage (physical and electronic) protocols. · Discuss any adjustment to assay data. |

· Verification of sampling and assaying was under-taken through a combination of internal reviews, du-plicate analyses, and independent data validation exercises. Field duplicates were collected regularly from RC drilling to monitor sampling precision, with results demonstrating satisfactory repeatability of gold grades. CRMs and blanks were inserted at regular intervals to monitor assay accuracy and contamination. QAQC charts were re-viewed continuously by project geologists and ex-ternal consultants during key drilling campaigns. · The primary assay laboratories (Bureau Veritas and SGS) conducted their own internal QC programs, which were also monitored. Limited twin drilling was conducted, with twin RC holes and DD holes used to verify mineralisation continuity, grade reproducibility, and geological interpretation; results confirmed good spatial reproducibility. While external umpire (secondary lab) assay pro-grams were not routinely undertaken, the performance of primary laboratories and internal QAQC programs were considered satisfactory for the reporting of Mineral Resources. Assay data and logging data were entered digitally into validated databases, and independent audits of the database have been performed during resource estimation reviews. |

| Location of data points | · Accuracy and quality of surveys used to locate drill holes (collar and down-hole surveys), trenches, mine workings and other locations used in Mineral Resource estimation. · Specification of the grid system used. · Quality and adequacy of topographic control. |

· Drillhole collar locations were surveyed using a combination of differential GPS (DGPS) systems and total station surveying where higher precision was required. The DGPS surveys were conducted by trained field surveyors to ensure location accuracy suitable for Mineral Re-source estimation, with horizontal and vertical accuracy generally within ±0.2m. In areas of rugged topography or logistical difficulty, survey-grade handheld GPS units were temporarily used during initial exploration stages (soil sampling, auger drilling, trenching), but were later replaced with DGPS surveys for all critical drill collars. · Elevation data were tied into the Nivellement Général de Côte d'Ivoire · (NGCI) vertical datum. A topographic digital terrain model (DTM) was produced using high-resolution satellite imagery and ground-truthing, which was used for both resource modelling and mine planning. Grid systems used were WGS84, Zone 30N for initial exploration and UTM Zone 30N (WGS84 projection) for final re-source definition. |

| Data spacing and distribution | · Data spacing for reporting of Exploration Results. · Whether the data spacing and distribution is sufficient to establish the degree of geological and grade continuity appropriate for the Mineral Resource and Ore Reserve estimation procedure(s) and classifications applied. · Whether sample compositing has been applied. |

· Drilling was conducted on nominal grid spacings ap-propriate for the level of confidence required for re-source estimation. In the main mineralised zones (Souwa, Chegue, and Kra-kara), RC and diamond drilling was performed on approximately 25 m x 25 m to 50 m x 50 m grids. Some areas of denser drilling (for example, grade control drilling) achieved spacing as tight as 10 m x 10 m. · Outside the main resource areas, reconnaissance and exploration drilling was more broadly spaced at 80 m x 80 m or larger intervals, appropriate for early-stage resource targeting. Soil sampling grids were generally established on 400 m x 400 m grids, with localised infill to 100 m or 200 m grids as needed. Data spacing was assessed during Mineral Re-source estimation and was found sufficient to establish geological and grade continuity for the appropriate classifications (Measured, Indicated, and Inferred). No sample compositing was applied prior to resource estimation; raw assay intervals were used directly in estimation procedures. |

| Orientation of data in relation to geological structure | · Whether the orientation of sampling achieves unbiased sampling of possible structures and the extent to which this is known, considering the deposit type. · If the relationship between the drilling orientation and the orientation of key mineralised structures is considered to have introduced a sampling bias, this should be assessed and reported if material. |

· Drilling programs were de-signed to target mineralised structures as close to perpendicular as possible to the interpreted dip of mineralisation at each de-posit. Most drillholes were oriented towards the south-east or southwest with an inclination of -50° to -60°, depending on the local structural orientation of gold-bearing zones. The mineralisation is generally hosted in north-northeast trending structures dipping moderately to steeply to the east or west, making these drill orientations ap-propriate to intersect mineralised zones at reasonable angles and to minimise bias in the intercept lengths. · Geological interpretations and cross sections confirm that drilling achieved reasonably representative intersections of mineralisation. No significant sampling bias related to drilling orientation was observed during resource modelling and estimation. In areas of uncertainty or more com-plex structure (fold closures, sheared zones), multiple drill directions were employed to cross-validate mineralisation geometry. |

| Sample security | · The measures taken to ensure sample security. | · Sample security protocols were implemented to ensure the integrity of all collected samples from the point of collection through to laboratory delivery. After collection, samples were placed into pre-numbered, durable plastic bags and securely sealed. Multiple samples were then packed into larger polyweave sacks for easier handling and protection during transport. Samples were stored in a secure, supervised facility at the exploration camp before transportation. · Transport to the assay laboratories (Bureau Veritas in Abidjan and SGS in Ouagadougou) was carried out either by company personnel or trusted, contracted couriers. Chain-of-custody forms were maintained throughout the transfer process, and receipt of samples was acknowledged in writing by laboratory staff. While rigorous internal controls were observed, there is no specific mention of external audits or independent over-sight of sample security protocols. However, no incidents of sample loss, tampering, or contamination have been reported, and laboratory reconciliation of received samples consistently matched dis-patch records. |

| Audits or reviews | · The results of any audits or reviews of sampling techniques and data. | · Audits and reviews of sampling techniques, assay data, and database integrity have been carried out periodically. Internal technical reviews were per-formed by Centamin's in-house geology and resource teams throughout the exploration and re-source evaluation phases. These reviews covered sampling practices, QAQC data performance, logging standards, and database quality, ensuring consistent application of protocols and identifying areas for procedural improvement where necessary. · Independent reviews of the Resource models and sup-porting exploration data were conducted as part of the NI 43-101 technical re-port preparation. Qualified Persons (QPs) signed off on the Mineral Resource estimates after assessing the drilling, sampling, and QAQC procedures. |

Section 2 Reporting of Exploration Results

(Criteria listed in the preceding section also apply to this section.)

| Criteria | JORC Code explanation | Commentary |

|---|---|---|

| Mineral tenement and land tenure status | · Type, reference name/number, location and ownership including agreements or material issues with third parties such as joint ventures, partnerships, overriding royalties, native title interests, historical sites, wilderness or national park and environmental settings. · The security of the tenure held at the time of reporting along with any known impediments to obtaining a licence to operate in the area. |

· The Doropo Project is located in the northeast of Côte d'Ivoire, in the Bounkani region approximately 480 km north of Abidjan, near the border with Burkina Faso. The project comprises a contiguous package of seven exploration permits ("Doropo Permit Package") covering a combined area of approximately 1,847 km². · All tenements are held in good standing with the Côte d'Ivoire Ministry of Mines and have been maintained in accordance with local legal requirements. There are no known outstanding disputes affecting the licenses. Surface rights, compensation arrangements with local communities, and environmental baseline studies have been addressed as part of the permitting and development process. Royalties include a government royalty (gold-price dependent) on gold production as prescribed under Ivorian mining law. No third-party ownership interests, material encumbrances, or joint venture arrangements affecting the Doropo Project have been disclosed. |

| Exploration done by other parties | · Acknowledgment and appraisal of exploration by other parties. | · Historical exploration activities prior to Centamin's involvement were limited. There are no records of systematic exploration or drilling by major international companies. Previous work primarily consisted of regional-scale geochemical surveys and government-sponsored mapping pro-grams conducted by the Côte d'Ivoire geological survey and local government initiatives. These activities provided basic geo-logical context but did not lead to significant discovery or development efforts. · Centamin's exploration efforts since acquiring the permits have been responsible for the identification, systematic testing, and advancement of the Doropo Mineral Resource. No Mineral Resources or significant exploration targets from previous explorers were inherited by Centamin. All resources re-ported to date result from Centamin's soil sampling, auger drilling, trenching, and drilling campaigns. As such, historical data has not materially contributed to the current Mineral Re-source Estimate. |

| Geology | · Deposit type, geological setting and style of mineralisation. | · The Doropo Project is located within the Birimian-age greenstone belts of the West African Craton, a prolific geological setting known for hosting orogenic gold deposits. Specifically, the project lies in northern Côte d'Ivoire, comprising a sequence of volcano-sedimentary rocks, including mafic volcanics, interbedded metasediments, felsic intrusives, and minor ultra-mafic units. The local geology consists predominantly of intermediate to mafic volcaniclastic rocks, intruded by granitoid bodies and crosscut by regional shear zones. · Gold mineralisation is primarily structurally con-trolled, hosted within moderate- to steeply-dipping quartz-carbonate-sulphide vein arrays. These veins are developed along shear zones, fault splays, and lithological contacts. Mineralisation is associated with strong silica, sericite, carbonate, and minor chlorite alteration halos. Sulphide minerals such as pyrite, arsenopyrite, and lesser amounts of pyrrhotite are common, closely associated with gold occurrence. The mineralisation style is typical of orogenic lode gold systems, with gold generally occurring as free grains and fine inclusions within sulphides. Structural controls, including vein orientations and competency contrasts between rock units, are critical factors influencing the distribution and continuity of mineralisation. |

| Drill hole Information | · A summary of all information material to the understanding of the exploration results including a tabulation of the following information for all Material drill holes: o easting and northing of the drill hole collar o elevation or RL (Reduced Level - elevation above sea level in metres) of the drill hole collar o dip and azimuth of the hole o down hole length and interception depth o hole length. · If the exclusion of this information is justified on the basis that the information is not Material and this exclusion does not detract from the understanding of the report, the Competent Person should clearly explain why this is the case. |

· The NI 43-101 Technical Report of 2024 provides comprehensive drillhole information, covering collar lo-cations, drill hole depths, azimuths, dips, and key intersections. Drillhole collars were surveyed using differential GPS (DGPS) or total station equipment, and were tied into a local grid based on the UTM Zone 30N, WGS84 datum. Complete lists of drill collars, including northing, easting, elevation, azimuth, dip, and total depth, are included in appendices of the technical report for all holes used in Resource estimation. · Significant exploration results and Mineral Resource drill intersections are re-ported systematically, with true thickness considerations discussed where relevant. The database includes 5,794 drillholes for a total of 547,805 m of drilling. The report also provides detailed composite intercept tables for representative drilling results across all principal deposits (Souwa, Chegue, Krakara, etc.), including downhole depth intervals, gold grades, and sample lengths. |

| Data aggregation methods | · In reporting Exploration Results, weighting averaging techniques, maximum and/or minimum grade truncations (e.g. cutting of high grades) and cut-off grades are usually Material and should be stated. · Where aggregate intercepts incorporate short lengths of high-grade results and longer lengths of low-grade results, the procedure used for such aggregation should be stated and some typical examples of such aggregations should be shown in detail. · The assumptions used for any reporting of metal equivalent values should be clearly stated. |

· Exploration results and Mineral Resource drill intercepts are reported based on compositing of contiguous mineralised intervals. Assay results were compo-sited to ensure that sample length variability did not introduce bias. Only intervals above a certain cut-off grade (typically 0.5 g/t Au for mineralised zones) were included when reporting exploration results. · No top-cutting (grade capping) was applied when presenting raw exploration results; however, top-cutting was considered and applied during Mineral Re-source estimation to control the influence of extreme outlier grades. Composites used downhole lengths of 1 m, reflecting the RC and DD sampling intervals. Where lower grade mate-rial was present within higher-grade zones, internal dilution up to 2 m was accepted within the compo-sited interval to maintain geological continuity. |

| Relationship between mineralisation widths and intercept lengths | · These relationships are particularly important in the reporting of Exploration Results. · If the geometry of the mineralisation with respect to the drill hole angle is known, its nature should be reported. · If it is not known and only the down hole lengths are reported, there should be a clear statement to this effect (e.g. 'down hole length, true width not known'). |

· The majority of drilling was designed to intersect mineralisation as close as possible to true width by orienting drillholes approximately perpendicular to the dominant strike and dip of mineralised structures. Drill-holes were typically inclined at -50° to -60° angles depending on local geological conditions, and aimed at intersecting mineralised zones that dip moderately (30°to 70°) to-wards the east or west (ac-cording to the individual de-posit). As such, downhole intercept lengths reported in exploration results ap-proximate true widths in most cases, particularly in the main Souwa, Chegue, and Krakara deposits. · In cases where drilling was oblique to structures - particularly in folded or com-plex structural zones, true widths were estimated or commentary provided where necessary. No mate-rial bias in grade or continuity arising from drilling orientation was identified during Mineral Resource estimation. Geological modelling used structural measurements, cross sections, and 3D wireframes to constrain true thickness of the mineralised zones. |

| Diagrams | · Appropriate maps and sections (with scales) and tabulations of intercepts should be included for any significant discovery being reported These should include, but not be limited to a plan view of drill hole collar locations and appropriate sectional views. | · The NI 43-101 Technical Report of 2024 provides a variety of diagrams that illustrate the distribution of mineralisation, drill coverage, geological interpretation, and re-source outlines. These include: · Plan view maps showing drill hole collar locations and surface projections of the mineralised zones. · Cross sections and long sections through key deposits (e.g., Souwa, Chegue, Krakara) depicting lithological units, interpreted mineralisation wireframes, and drill intercepts. · 3D block models illustrating grade distribution and re-source classifications. · Regional geological maps. |

| Balanced reporting | · Where comprehensive reporting of all Exploration Results is not practicable, representative reporting of both low and high grades and/or widths should be practiced to avoid misleading reporting of Exploration Results. | · Exploration results are presented in a manner that is consistent with balanced reporting principles. Both positive results (significant gold intersections) and lower-grade or barren drilling outcomes are dis-cussed in the report narrative. Significant intercepts are reported based on a gold cut-off (typically 0.5 g/t Au), and intervals that do not meet this threshold are not excluded without comment - their absence is im-plied where relevant. Where drill programs encountered areas of weak mineralisation or barren geology, this is acknowledged qualitatively in the discussion of deposit extents and geological domains. · Resource estimation was based on all available drilling data, not just high-grade intervals. |

| Other substantive exploration data | · Other exploration data, if meaningful and material, should be reported including (but not limited to): geological observations; geophysical survey results; geochemical survey results; bulk samples - size and method of treatment; metallurgical test results; bulk density, groundwater, geotechnical and rock characteristics; potential deleterious or contaminating substances. | · In addition to drilling and trenching, that the previous owner has completed several substantive exploration programs across the Project area, including extensive soil geo-chemistry, auger drilling, geophysical surveys, and baseline environmental studies. · Soil geochemistry: Over 92,000 soil samples were collected between 2014 and 2022 on grids varying from 400 x 400 m down to 100 x 100 m, helping to identify coherent gold-in-soil anomalies that guided subsequent drilling. · Auger drilling: Approximately 28,000 auger holes were drilled to sample through laterite cover to saprolite, providing a 3D geochemical signature where soil sampling was in-effective. · Geophysics: Regional aeromagnetic and radio-metric surveys were con-ducted by government agencies, with Centamin reprocessing this data to aid in geological interpretation and target generation. Ground-based induced polarisation (IP) surveys were conducted selectively over key prospects to assist in structural interpretation. · Preliminary metallurgical test work was performed on representative mineralised material. Test work indicated that gold mineralisation was amenable to conventional gravity recovery and cyanide leaching, with excellent recoveries (>90%extraction) achievable. Additionally, environmental baseline studies have been completed across the Doropo permit area to sup-port permitting requirements. |

| Further work | · The nature and scale of planned further work (e.g. tests for lateral extensions or depth extensions or large-scale step-out drilling). · Diagrams clearly highlighting the areas of possible extensions, including the main geological interpretations and future drilling areas, provided this information is not commercially sensitive. |

· Future work will focus on advancing the deposit toward production readiness. Key programs planned include infill drilling to up-grade portions of the Mineral Resource from Indicated to Measured classification, particularly in the Souwa, Chegue, and Kra-kara deposits. Additional step-out and extensional drilling is also proposed to target near-mine exploration opportunities along the interpreted structural corridors, with the aim of in-creasing the overall re-source base. · Further geotechnical drilling and pit slope studies are planned to refine open-pit designs, along with additional hydrogeological investigations to support mine dewatering strategies. Metallurgical test work has been expanded, to include variability testing across different ore domains to optimise processing flowsheets. Environmental and social impact assessments (ESIA) will continue to ensure compliance with permitting obligations. |

Section 3 Estimation and Reporting of Mineral Resources

(Criteria listed in section 1, and where relevant in section 2, also apply to this section.)

| Criteria | JORC Code explanation | Commentary |

|---|---|---|

| Database integrity | · Measures taken to ensure that data has not been corrupted by, for example, transcription or keying errors, between its initial collection and its use for Mineral Resource estimation purposes. · Data validation procedures used. |

· The drillhole database has been developed and man-aged using industry-standard practices. Geological, geotechnical, and assay data were initially collected in field log sheets or digital capture tools and subsequently entered into a centralised SQL-based data-base system. Data entry protocols included validation checks to reduce transcription errors, including dropdown lists for logging codes and automated field validations. Independent verification of key fields (collar locations, assay results, geology codes) against original laboratory certificates and field records was carried out periodically. · Database administration was performed by Centamin's in-house data management team, and peri-odic reviews and audits were conducted to check for consistency, missing fields, duplications, and logical errors. The data-base was exported and in-dependently validated prior to each Mineral Resource estimation. Assay results were matched against original laboratory certificates to ensure accuracy, and downhole survey data was checked for consistency with expected drillhole trajectories. No material errors or significant discrepancies were identified during validation. |

| Site visits | · Comment on any site visits undertaken by the Competent Person and the outcome of those visits. · If no site visits have been undertaken indicate why this is the case. |

· Site visits were conducted by Qualified Persons (QPs) responsible for the Mineral Resource estimate. The site visits included direct observation of drilling operations (RC and diamond drilling), core handling and sampling practices, geological logging procedures, and data management workflows. · During the site visits, the QP reviewed: drill collar lo-cations, sampling representivity (soil, auger, RC, DD), core logging facilities, QAQC sample insertion and management, sample security and transport procedures. · No material issues or in-consistencies were identified during the site visits. |

| Geological interpretation | · Confidence in (or conversely, the uncertainty of) the geological interpretation of the mineral deposit. · Nature of the data used and of any assumptions made. · The effect, if any, of alternative interpretations on Mineral Resource estimation. · The use of geology in guiding and controlling Mineral Resource estimation. · The factors affecting continuity both of grade and geology. |

· The Doropo Gold Project comprises sixteen prospects, Attire, Enioda, Chegue Main, Chegue South, Han, Hinda, Hinda South, Kekeda, Kilosegui, Nare, Nokpa, Sanboyoro, Solo, Souwa, Tchouahinin, and Vako. · The geological interpretation for each is based on a combination of surface mapping, soil geochemistry, trenching, drilling (RC and diamond core), and geophysical data. The mineralisation is structurally controlled, typically hosted within quartz-carbonate-sulphide vein arrays aligned along north-north-east trending shear zones. Detailed geological logging of drill core and RC chips provided information on lithology, alteration, mineralisation styles, and structure, which were incorporated into the 3D geological models. · Wireframes were constructed around logged mineralisation envelopes using a nominal cut-off of approximately 0.3 to 0.5 g/t Au, depending on deposit and geological domain. Interpretation of geological continuity, mineralised do-main boundaries, and grade distribution is sup-ported by close-spaced drilling (especially in Souwa, Chegue, and Kra-kara) and structural measurements taken from oriented core. Confidence in the interpretation is high where drilling density is greater, while areas of wider drill spacing retain a lower confidence, resulting in appropriate resource classification into Measured, Indicated, or Inferred. |

| Dimensions | · The extent and variability of the Mineral Resource expressed as length (along strike or otherwise), plan width, and depth below surface to the upper and lower limits of the Mineral Resource. | · The Doropo Mineral Re-source comprises multiple discrete deposits, the largest of which are Souwa, Chegue, and Krakara. These deposits are structurally controlled lode gold systems that occur along northeast-trending shear zones. The mineralised zones are typically hosted in altered mafic to intermediate volcanic rocks and are characterised by moderate to steep dips. · The combined strike length of individual mineralised lodes within the Doropo Project is over 12 km, with individual deposits ranging from 300 m to over 2.5 km in length. Mineralised zones are generally 3 to 15 m thick but can reach widths of up to 30 m in dilational zones or where stacked lodes coalesce. The mineralisation extends from near surface to vertical depths of 100 to 250 m, with some mineralised domains drilled to 300 to 400 m vertical depth, particularly in Souwa. |

| Estimation and modelling techniques | · The nature and appropriateness of the estimation technique(s) applied and key assumptions, including treatment of extreme grade values, domaining, interpolation parameters and maximum distance of extrapolation from data points. If a computer assisted estimation method was chosen include a description of computer software and parameters used. · The availability of check estimates, previous estimates and/or mine production records and whether the Mineral Resource estimate takes appropriate account of such data. · The assumptions made regarding recovery of by-products. · Estimation of deleterious elements or other non-grade variables of economic significance (e.g. sulphur for acid mine drainage characterisation). · In the case of block model interpolation, the block size in relation to the average sample spacing and the search employed. · Any assumptions behind modelling of selective mining units. · Any assumptions about correlation between variables. · Description of how the geological interpretation was used to control the resource estimates. · Discussion of basis for using or not using grade cutting or capping. · The process of validation, the checking process used, the comparison of model data to drill hole data, and use of reconciliation data if available. |

· Software used for the Mineral Resource estimate included Geoaccess Professional, Leapfrog Geo, Surpac and Isatis v2018.5. · The Mineral Resource estimate for the Doropo Project was estimated using Ordinary Kriging (OK) interpolation and Local Uniform Conditioning (LUC). Estimation was conducted within hard boundary mineralisation domains defined by 3D wireframes, con-structed based on geological logging, assay results, trenching, and geophysical interpretations. Drillhole data was composited to 1 m intervals prior to estimation. High-grade outlier values were assessed through statistical analysis of gold grade distributions by domain, and top cuts were applied on an individual domain basis to reduce the influence of extreme grades. In some areas a distance limiting constraint was applied. Variogram models were developed in Gaussian space to model the spatial continuity of gold grades and back transformed prior to estimation. Search ellipses were oriented along the dominant structural trends observed in the mineralisation. · The block models were constructed for each de-posit with a parent block size of 5 m x 5 m x 2.5 m -the assumed ultimate SMU block size and rotated according to the orientation of the deposit. The OK interpolation was undertaken into relatively large panel blocks - predominantly 20 m x 20 m x 5 m but variable depending on deposit. Sub-blocking was utilised to accurately honour geological and mineralisation boundaries. · No mining dilution or recovery factors were applied; the estimate reflects in-situ grades and tonnages. · Only gold was estimated; no deleterious elements were modelled. No by-products were considered, and no correlations be-tween variables were assumed as only gold was economically significant. · The model was validated through visual inspections, comparison of input composite grades to block grades, swath plot analysis, and global statistical checks. No reconciliation to mining production was possible as the Doropo Project remains pre-production at this time. |

| Moisture | · Whether the tonnages are estimated on a dry basis or with natural moisture, and the method of determination of the moisture content. | · Tonnages are estimated and reported on a dry basis. |

| Cut-off parameters | · The basis of the adopted cut-off grade(s) or quality parameters applied. | · The Mineral Resource estimates for the Doropo Project were reported using a 0.3 g/t Au cut-off grade. This cut-off was selected based on PFS assumptions that reflect open pit mining methods, anticipated pro-cessing costs, metallurgical recoveries, and a long-term gold price assumption. · The 0.3 g/t Au cut-off represents a reasonable expectation for economic ex-traction in a conventional open-pit scenario with moderate stripping ratios and CIL (carbon-in-leach) gold recovery. |

| Mining factors or assumptions | · Assumptions made regarding possible mining methods, minimum mining dimensions and internal (or, if applicable, external) mining dilution. It is always necessary as part of the process of determining reasonable prospects for eventual economic extraction to consider potential mining methods, but the assumptions made regarding mining methods and parameters when estimating Mineral Resources may not always be rigorous. Where this is the case, this should be reported with an explanation of the basis of the mining assumptions made. | · Mining factors and assumptions are based on the expectation of open pit mining methods using conventional truck and shovel operations. Optimised pit shells were generated using Whittle optimisation software to test the reason-able prospects for eventual economic extraction. These pit shells informed the re-porting constraints applied to the Mineral Resource estimate · The pit optimisations were generated by Orelogy in 2025 with key mining parameters summarised below; • All models were re-blocked to 10 mX x 10 mY x 5 mRL; • Gold price assumption of USD3,000 per troy ounce; Overall pit wall slope angles used are (in the range of): o 24° in oxide; o 28° in transitional; o 48° in fresh; • Mining Recovery of 92% (8% ore loss); • Mining Dilution of 14%; • Process Recovery: Oxide: 93.5% |

| Metallurgical factors or assumptions | · The basis for assumptions or predictions regarding metallurgical amenability. It is always necessary as part of the process of determining reasonable prospects for eventual economic extraction to consider potential metallurgical methods, but the assumptions regarding metallurgical treatment processes and parameters made when reporting Mineral Resources may not always be rigorous. Where this is the case, this should be reported with an explanation of the basis of the metallurgical assumptions made. | · Preliminary metallurgical test work has been conducted on representative mineralised material from the Doropo Project. Samples were collected across a range of deposits (Souwa, Chegue, Krakara) and across different oxidation states (oxide, transitional, and fresh rock). Test work was performed at certified laboratories and included gravity recovery tests, cyanidation leaching tests, and bottle roll tests. · The results indicate that gold mineralisation is amenable to conventional gravity recovery followed by CIL (carbon-in-leach) pro-cessing, achieving high gold recoveries generally exceeding 90%. Oxide material exhibited slightly higher recovery rates than fresh rock, but all major ore types demonstrated favour-able leach kinetics. No significant metallurgical challenges, such as refractory gold or deleterious elements affecting processing, were identified during initial test work. |

| Environmental factors or assumptions | · Assumptions made regarding possible waste and process residue disposal options. It is always necessary as part of the process of determining reasonable prospects for eventual economic extraction to consider the potential environmental impacts of the mining and processing operation. While at this stage the determination of potential environmental impacts, particularly for a greenfields project, may not always be well advanced, the status of early consideration of these potential environmental impacts should be reported. Where these aspects have not been considered this should be reported with an explanation of the environmental assumptions made. | · Environmental and social baseline studies have been conducted across the project area, including flora and fauna surveys, water quality sampling, heritage site assessments, and social impact studies. These baseline investigations were undertaken to inform the Environmental and Social Impact Assessment (ESIA) process, which is a legal requirement for obtaining a Mining Licence in Côte d'Ivoire. · An ESIA and Resettlement Action Plan (RAP) were prepared in accordance with Ivorian regulations and submitted to the relevant authorities. Environmental certificates and approvals have been granted as part of the Mining Licence issuance. Key environmental risks identified (such as water management, waste disposal, and biodiversity preservation) have been assessed at a preliminary level and mitigation measures proposed, although final designs (e.g., for tailings storage facilities and mine waste dumps) will be completed during Feasibility Studies. · There are no known environmental issues that would materially affect the reasonable prospects of eventual economic extraction of the Mineral Resources. Ongoing monitoring and additional environmental studies are planned as the project advances toward development. |

| Bulk density | · Whether assumed or determined. If assumed, the basis for the assumptions. If determined, the method used, whether wet or dry, the frequency of the measurements, the nature, size and representativeness of the samples. · The bulk density for bulk material must have been measured by methods that adequately account for void spaces (vugs, porosity, etc.), moisture and differences between rock and alteration zones within the deposit. · Discuss assumptions for bulk density estimates used in the evaluation process of the different materials. |

· Bulk density measurements were taken systematically using drill core samples from across the various deposits and oxidation zones (oxide, transitional, and fresh rock). The measurements were con-ducted using the Archimedes principle (water immersion displacement method) on core samples. Samples were oven-dried before testing to ensure that moisture content did not artificially influence the density readings. · A substantial dataset of 19,587 bulk density measurements were collected and statistically analysed. Density values were assigned to different oxidation domains as follows: · Oxide material: average bulk density ~1.8-2.0 t/m³ · Transitional material: ~2.3-2.5 tm³ · Fresh rock: ~2.7 t/m³. · These domain-specific densities were applied to the block model based on the oxidation state of each block. Density variability was reviewed, and no significant spatial inconsistencies were identified that would materially affect the Mineral Resource estimate. |

| Classification | · The basis for the classification of the Mineral Resources into varying confidence categories. · Whether appropriate account has been taken of all relevant factors (i.e. relative confidence in tonnage/grade estimations, reliability of input data, confidence in continuity of geology and metal values, quality, quantity and distribution of the data). · Whether the result appropriately reflects the Competent Person's view of the deposit. |

· The Mineral Resource has been classified and reported in accordance with the CIM Definition Standards. Resources were classified into Measured, Indicated, and Inferred categories based on a combination of drilling density, geo-logical confidence, continuity of mineralisation, and data quality. · Measured Resources were assigned in areas where drilling density was highest (nominally on 10 m x 10 m grids), geological and mineralisation continuity was well established, and data quality (assays, surveys, logging) was considered excellent. · Indicated Resources were defined in areas of moder-ate drilling density (typically 25 m to 30 m spacing) where mineralisation continuity and geological controls were reasonably well understood. · Inferred Resources were assigned to zones with broader drill spacing up to 50 m x 50 m, lower geological confidence, or where extrapolation beyond drilling data was required. · The classification approach appropriately reflects the level of confidence in the underlying geological models, sampling methods, and assay results. |

| Audits or reviews | · The results of any audits or reviews of Mineral Resource estimates. | · No independent audit has been completed on the Doropo Mineral Resource Estimate. · Cube Consulting undertook regular internal peer reviews during the course of the MRE work. |

| Discussion of relative accuracy/ confidence | · Where appropriate a statement of the relative accuracy and confidence level in the Mineral Resource estimate using an approach or procedure deemed appropriate by the Competent Person. For example, the application of statistical or geostatistical procedures to quantify the relative accuracy of the resource within stated confidence limits, or, if such an approach is not deemed appropriate, a qualitative discussion of the factors that could affect the relative accuracy and confidence of the estimate. · The statement should specify whether it relates to global or local estimates, and, if local, state the relevant tonnages, which should be relevant to technical and economic evaluation. Documentation should include assumptions made and the procedures used. · These statements of relative accuracy and confidence of the estimate should be compared with production data, where available. |

· The relative accuracy and confidence of the Doropo Mineral Resource estimates are considered ap-propriate for the classification levels assigned. · No production data is available for direct reconciliation, as the project is still in the exploration and development phase. · At the global scale, the Mineral Resource estimate is considered to have an accuracy commensurate with industry expectations for a project at the advanced exploration and prefeasibility stages. |

Section 4 Estimation and Reporting of Ore Reserves

(Criteria listed in section 1, and where relevant in section 2, also apply to this section.)

Criteria

JORC Code explanation

Commentary

Mineral Resource

estimate for conversion to Ore Reserves

· Description of the Mineral Resource estimate used as a basis for the conversion to an Ore Reserve

· Clear statement as to whether the Mineral Resources are reported additional to, or inclusive of, the Ore Reserves.

The Mineral Resource Estimate (MRE) for the Doropo project as at September 2025 has been used for the 2025 DFS Update for the Doropo Gold Project and the associated Ore Reserve estimation that underpins it.

The Mineral Resource has been reported in accordance with the Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves (JORC 2012).

The Mineral Resource Estimate is inclusive of the 2025 Doropo Ore Reserve Estimate.

Site visits

· Comment on any site visits undertaken by the Competent Person and the outcome of those visits.

· If no site visits have been undertaken indicate why this is the case.

The 2025 Doropo Ore Reserve Estimate was completed by Mr. Ross Cheyne FAusIMM. Mr. Cheyne is employed by Orelogy Consulting. Mr. Cheyne has sufficient experience which is relevant to the style of mineralisation and type of deposit under consideration and to the mining activity being undertaken to qualify as a Competent Person as defined in the 2012 Edition of the JORC Code.

Mr Cheyne was the Qualified Person for the previous Mineral Reserve Estimate developed by Centamin. This was released under Canadian National Instrument 43-101 which did not require a site visit to be undertaken, Mr Cheyne has not carried out a site visit as part of this Ore Reserve update, He has had numerous briefings with multiple independent consultants that have attended site since 2022 through both the PFS and DFS project assessment phases and therefore has a sound understanding of the site conditions

Study Status

· The type and level of study undertaken to enable Mineral Resources to be converted to Ore Reserves.

· The Code requires that a study to at least Pre- Feasibility Study level has been undertaken to convert Mineral Resources to Ore Reserves. Such studies will have been carried out and will have determined a mine plan that is technically achievable and economically viable, and that material Modifying Factors have been considered.

The Doropo Mineral Resource has been converted to an Ore Reserve through the completion of a Feasibility Level Mining Study (FS).