Grayscale Bitcoin Trust ETF

Provides investors exposure to Bitcoin in a traditional securities format.

GBTC | US

Overview

Corporate Details

- ISIN(s):

- N/A

- LEI:

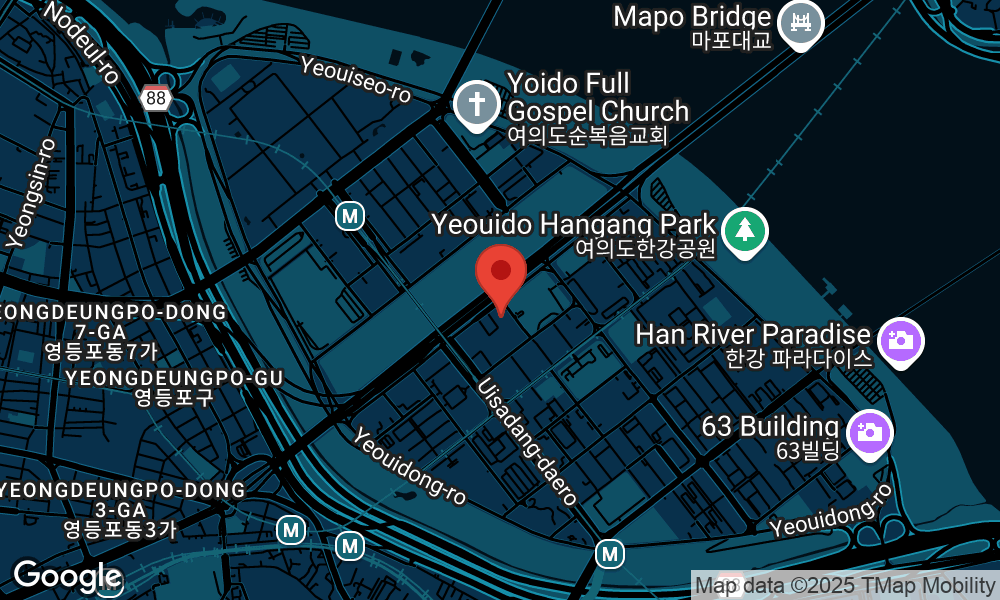

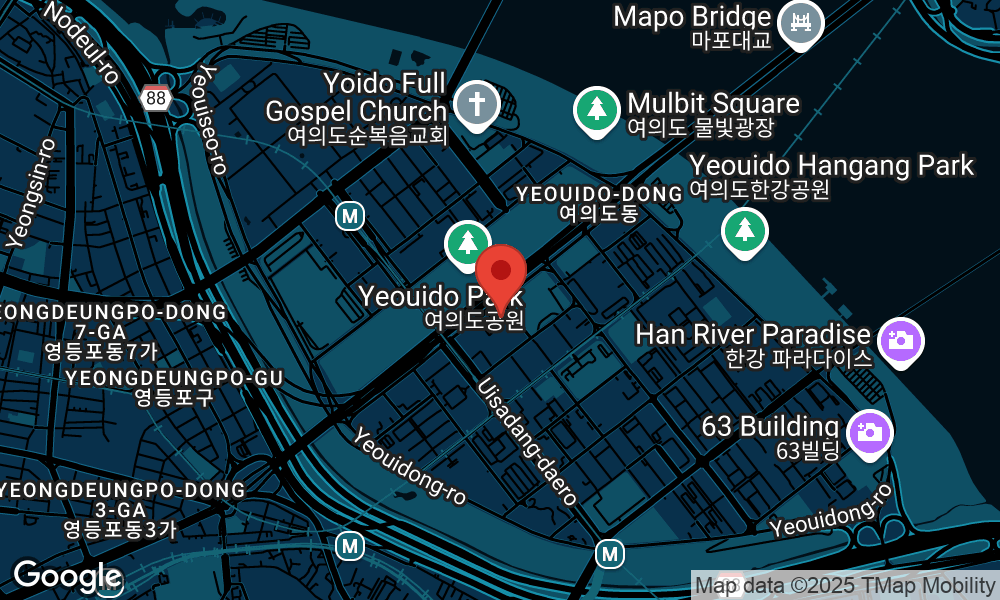

- Country:

- United States of America

- Address:

- 290 HARBOR DRIVE, 6902 STAMFORD

- Sector:

- Financial and insurance activities

- Industry:

- Activities of trusts, funds and similar financial entities

Description

Grayscale Bitcoin Trust ETF (GBTC) is a passively managed investment product designed to provide investors with exposure to Bitcoin in a traditional securities format. The Trust's investment objective is for the value of its shares to reflect the value of the Bitcoin it holds, less the Trust's expenses and other liabilities. It enables both individual and institutional investors to gain exposure to the cryptocurrency without the complexities of direct purchase, storage, and custody. Originally launched in 2013 and converted to a spot ETF in 2024, GBTC is one of the largest and longest-standing Bitcoin investment vehicles available.

Unlock This Filing & Millions More

You're one step away from the data you need. Create a free account to instantly view this filing and get access to powerful research tools.

Filings

| Date | Filing | Language | Size | Actions | |

|---|---|---|---|---|---|

| No filings match the current criteria. | |||||

Automate Your Workflow. Get a real-time feed of all Grayscale Bitcoin Trust ETF filings delivered via API.

Market Data

Market Data Not Available

Financials & KPIs

Unlock Full Financials for Grayscale Bitcoin Trust ETF

This data is available as part of our premium data solutions. Contact our team for access.

Need More History? Access decades of standardized financials for Grayscale Bitcoin Trust ETF via our API.

Insider Transactions

| Date | Insider Name | Position | Type | Shares | Value |

|---|---|---|---|---|---|

| No insider transactions recorded for this company. | |||||