Your Guide to the Dow Jones PE Ratio

The Dow Jones PE ratio is key for investors. It shows the market's value and growth chances. It's a vital part of investment analysis, giving insights into the market's health.

Knowing the Dow Jones p e ratio is vital for smart investing. It helps see if the market is too high or too low.

The Dow Jones PE ratio is found by dividing the Dow Jones Index's current price by its earnings per share. This ratio gives a quick view of the market's value. It lets investors compare it to past values and make better choices.

This ratio is useful for both value and growth investors. It helps spot market chances and dangers.

Introduction to the Dow Jones PE Ratio

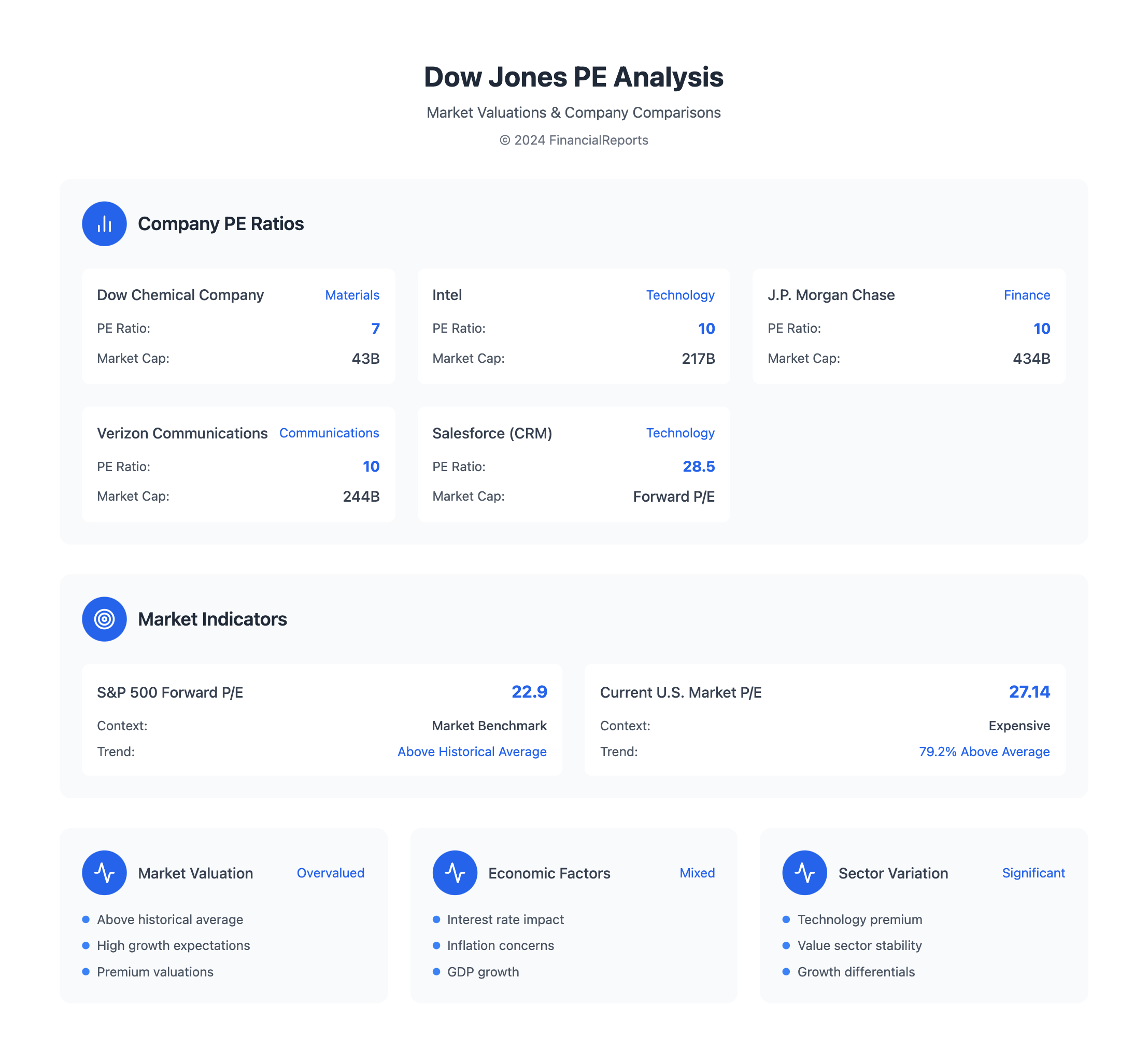

Current market trends show the market is overvalued. For example, the S&P500 10-year P/E Ratio is 79.2% above its average. This shows why looking at the Dow Jones PE ratio is so important.

By studying the Dow Jones price to earnings ratio, investors can understand the market better. This knowledge helps them make smarter investment choices.

Key Takeaways

- The Dow Jones PE ratio is a key metric for investors, indicating the market's valuation and growth.

- Understanding the Dow Jones p e ratio is essential for making informed investment decisions.

- The Dow Jones PE ratio is calculated by dividing the current price of the Dow Jones Index by its earnings per share.

- The current market trends indicate a strongly overvalued market, highlighting the importance of analyzing the Dow Jones PE ratio.

- Investors can use the Dow Jones PE ratio to identify opportunities and risks in the market.

- Analyzing the Dow Jones price to earnings ratio in the context of broader market trends is key for informed investment decisions.

What is the Dow Jones PE Ratio?

The dow jones average pe ratio compares a company's stock price to its earnings per share, or EPS. It can use past data (trailing PE) or future estimates (forward PE). This ratio helps investors quickly see the market's value. It shows if the market is too high or too low, helping investors decide.

The dow jones pe ratio adds up the PE ratios of the 30 Dow Jones Industrial Average stocks. This gives a full view of the market's value. For instance, some Dow Jones stocks have PE ratios under 10, which is rare today. The current estimated P/E Ratio for the U.S. Stock Market is 27.14, seen as "Expensive" compared to past averages.

| Company | Price-Earnings Ratio | Market Capitalization |

|---|---|---|

| Dow Chemical Company | 7 | $43 billion |

| Intel | 10 | $217 billion |

| J.P. Morgan Chase | 10 | $434 billion |

| Verizon Communications | 10 | $244 billion |

Investors can spot good investment chances using the dow jones pe ratio. Companies with low PE ratios might be cheap, while high ones might be pricey. By looking at the dow jones pe ratio and other signs, investors can pick the best options and reach their money goals.

Historical Context of the Dow Jones PE Ratio

The dow jones average pe ratio has changed a lot over time. This change is due to many economic and market factors. Looking at its history helps us understand today's PE ratio better. A pe ratio graph shows us the trends and patterns over time.

Major economic events have shaped the PE ratio. For example, the PE ratio soared during the dot-com bubble in the late 1990s. A p e ratio graph helps spot these trends. It guides investors in making better choices.

Important events like the 2008 financial crisis have also influenced the PE ratio. The crisis caused a big drop, but the ratio later recovered to pre-crisis levels. By studying the dow jones average pe ratio's history, investors can better understand the market. This knowledge helps them make smarter investment decisions.

How to Calculate the PE Ratio for the Dow Jones

To find the dow jones industrial average price earnings ratio, you need to do some math. First, add up all the stock prices in the index. Then, divide this total by the companies' total earnings per share (EPS). You can use either the last year's earnings or the next year's earnings estimates.

Let's say the total stock prices add up to $100 billion. And the total earnings per share are $5 billion. In this case, the djia pe ratio would be 20.

Here's how to calculate the pe ratio:

- Add up all the stock prices in the index.

- Find the total earnings per share (EPS) of the companies in the index.

- Divide the total stock prices by the total EPS.

By using the dow jones industrial average price earnings ratio, investors can understand the market's earnings expectations. This helps them make better investment choices. The djia price to earnings ratio is key for evaluating the dow jones index and its companies' values.

The Dow Jones PE Ratio Compared to Other Indexes

The Dow Jones PE ratio is often compared to other major market indexes. This includes the S&P 500 and NASDAQ. The russell 2000 pe ratio is also key, showing the value of small-cap stocks. The pe of russell 2000 index is usually higher than the Dow Jones. This shows small-cap stocks have more growth chance.

Compared to the S&P 500, the Dow Jones PE ratio has stayed pretty steady. But, it has seen some ups and downs. The russell 2000 price earnings ratio has been more unpredictable. This is because small-cap stocks carry more risk but also have more growth chances.

When looking at these indexes, it's important to remember a few things. These include:

- Differences in index composition and sector weightings

- Historical trends in PE ratios and their implications for valuation

- The impact of interest rates and inflation on PE ratios

By looking at these points and comparing the Dow Jones PE ratio to other indexes, investors can better understand the market. This helps them make smarter investment choices.

Factors Influencing the Dow Jones PE Ratio

The dow jones price earnings ratio is shaped by many things. Earnings reports, macroeconomic indicators, and interest rates are key. Earnings reports can greatly affect the ratio, with surprises leading to changes.

Macroeconomic indicators like GDP growth and employment data also matter. They help shape the dow jones price earnings ratio.

Interest rates and inflation also play a role. When interest rates go up, the ratio might go down. This is because higher rates can make stock prices fall. But, if inflation drops, the ratio could rise. This is because lower inflation can boost investment and spending.

Other things like sector trends and global events can also impact the ratio. For example, a big demand for a sector can raise the ratio for companies in that area. Here's a table that shows the main factors affecting the dow jones price earnings ratio:

| Factor | Impact on Dow Jones PE Ratio |

|---|---|

| Earnings Reports | Positive or negative surprises can cause fluctuations |

| Macroeconomic Indicators | GDP growth and employment data can shape the ratio |

| Interest Rates and Inflation | Higher interest rates can lead to lower stock prices, while lower inflation can stimulate investment and consumption |

Knowing these factors is important for investors. It helps them make smart choices about the dow jones price earnings ratio and the dow price to earnings ratio.

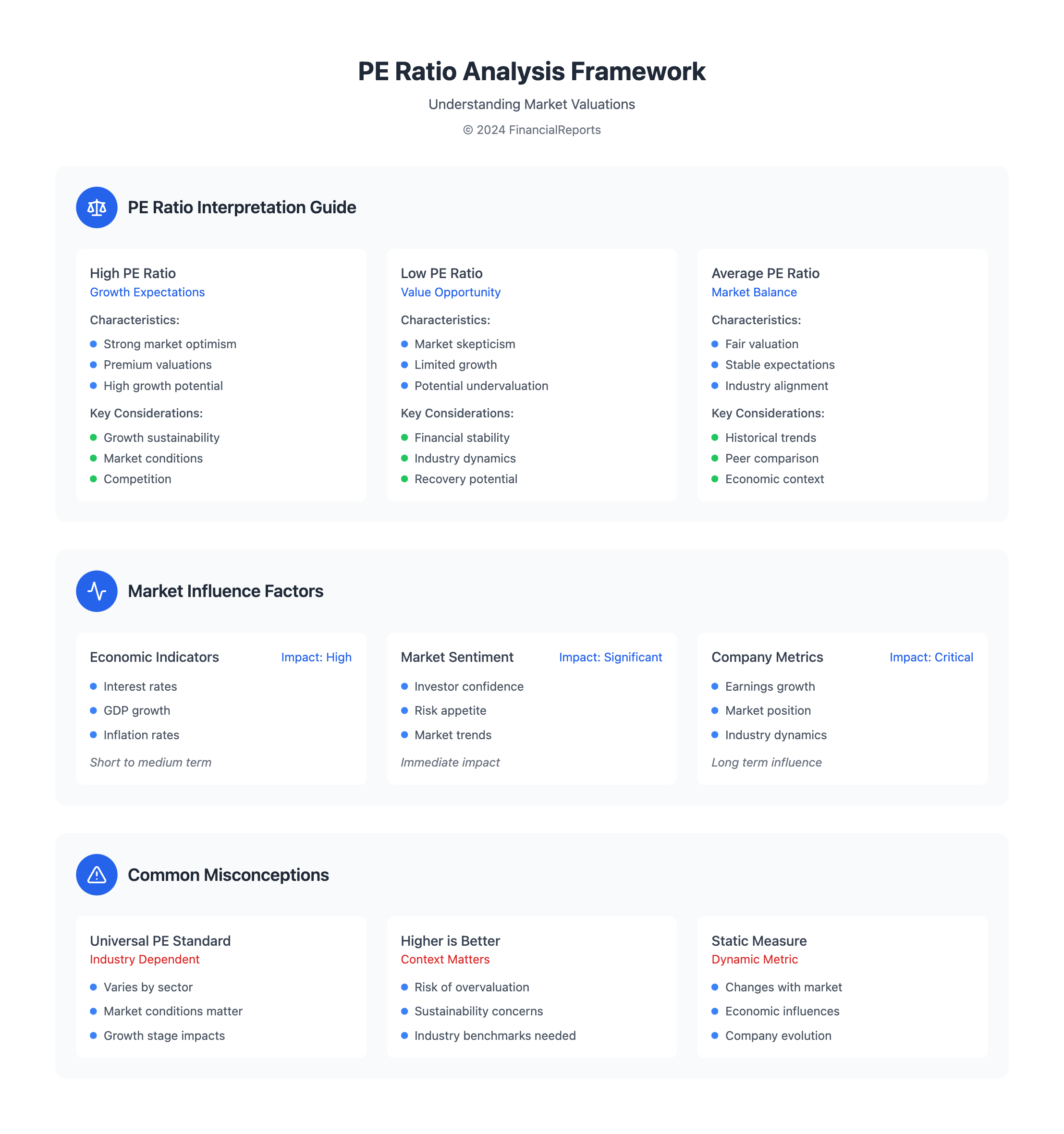

The Significance of a High or Low PE Ratio

The PE ratio of the Dow Jones Industrial Average is key for investors. It shows what the market thinks about a company's future. A high PE ratio means the market expects strong earnings and growth. On the other hand, a low PE ratio might mean the stock price is falling, even if earnings are steady.

The Russell 2000 Index PE ratio shows how small-cap companies are doing. It can be different from the Dow Jones.

Investors should look at these factors when checking the Dow Jones PE ratio:

- Historical trends: The PE ratio changes over time, showing how market views of a company's value shift.

- Industry comparisons: It helps compare companies in the same field, showing who's more valuable.

- Growth expectations: A high PE ratio often means the market expects a company to grow a lot. A low PE ratio might mean the company is undervalued.

In summary, knowing the importance of a high or low PE ratio is vital for investors. It helps them make better choices and understand the market. By looking at both the Dow Jones and Russell 2000 PE ratios, investors can get a clearer picture of the market.

| Index | PE Ratio | Implications |

|---|---|---|

| Dow Jones Industrial Average | High | Strong growth expectations |

| Russell 2000 Index | Low | Undervaluation or economic concerns |

How Investors Use the Dow Jones PE Ratio

Investors use the djia pe ratio to guide their investment plans. They look for undervalued markets. By checking the dow average pe, they see if a stock's price matches its earnings.

A low pe ratio might mean a stock is cheap. A high pe ratio could mean it's too expensive. This helps investors decide if a stock is good to buy or sell.

For example, investors compare a company's pe ratio to its industry average. This helps them see if it's cheap or expensive compared to others. They can use the price-to-earnings ratio to make these comparisons.

Investors also use the pe ratio to pick the right time to buy or sell. But, they should be careful and use other metrics too.

Some important things to remember when using the pe ratio include:

- Look at the pe ratio with other financial numbers, like earnings growth and profit margins

- Compare the pe ratio to the industry and market averages

- Remember, the pe ratio can be affected by things like interest rates and inflation

By carefully using the djia pe ratio, investors can understand a company's stock value better. The dow average pe is helpful, but it should be part of a bigger analysis. This way, investors can make smarter choices.

Common Misconceptions about the Dow Jones PE Ratio

When looking at the dow jones index pe ratio, it's key to know its limits and avoid common mistakes. Many think there's one perfect PE ratio for the market. But, the dow pe ratio changes due to different sectors and past trends.

Calculating the PE ratio for stocks is different from the Dow Jones index. Sector variability greatly affects the PE ratio. For example, tech stocks usually have high PE ratios because of their growth. On the other hand, utility stocks have lower ratios because they grow slower but are more stable.

Investors should be careful when comparing the dow jones index pe ratio to stock PE ratios. A stock with a high PE ratio might not be overvalued if it's growing fast. And a stock with a low PE ratio might not be undervalued if it's growing slow. By understanding these points and avoiding common mistakes, investors can make better choices when using the dow pe ratio.

Future Outlook for the Dow Jones PE Ratio

The dow jones p e ratio is key for investors. Its future depends on the Dow Jones Industrial Average's performance. Some industries grow faster than others, so be careful when comparing stocks.

Salesforce (CRM) has seen a 98% increase in two years. It's a top performer in the Dow Jones Industrial Average (DJIA). Its forward price-to-earnings (P/E) multiple of 28.5 is a healthy premium compared to the S&P 500's forward P/E of 22.9.

The dow jones price to earnings ratio is affected by many things. These include technological innovation, changes in industries, and global economic shifts. Monetary policy changes, like interest rate adjustments and quantitative easing, also play a big role.

To deal with these complexities, investors can follow these strategies:

- Keep a close eye on the dow jones p e ratio to spot trends and shifts in the market.

- Spread out their investments to reduce risk and increase returns.

- Stay current with economic basics, interest rates, and market concentration to make smart investment choices.

By knowing what affects the dow jones price to earnings ratio and keeping up with market trends, investors can make smart choices. They can navigate the Dow Jones Industrial Average's complexities.

| Stock | Forward P/E Multiple |

|---|---|

| Salesforce (CRM) | 28.5 |

| S&P 500 | 22.9 |

Conclusion: The Role of the PE Ratio in Financial Decisions

The Dow Jones PE ratio is key for investors looking at the Dow Jones Industrial Average's value. It shows how the market sees the earnings of the 30 big companies in the index.

While the Dow Jones PE ratio is useful, it's not the only thing to look at. Other factors like industry trends, interest rates, and the economy also matter. They can change a company's PE ratio and what it means for investors.

Summary of Key Points

In this article, we've talked about what the PE ratio is, its history, and how to calculate it. We've also looked at how it compares to other indexes. We've covered what can affect the Dow Jones PE ratio, like earnings and investor feelings.

Final Thoughts for Investors

When you're looking at the stock market, remember the Dow Jones PE ratio is just one tool. By using this metric with a deep understanding of a company's basics, its industry, and the economy, you can make better investment choices. These choices should match your financial goals.

FAQ

What is the Dow Jones PE Ratio?

The Dow Jones PE Ratio is a key metric for valuing the Dow Jones Industrial Average. It shows the market's value by comparing stock prices to earnings. Investors use it to see if the market is too high or too low.

How is the Dow Jones PE Ratio calculated?

To find the Dow Jones PE Ratio, you divide the total market value by the earnings of its companies. This ratio helps investors quickly check if the market is fairly valued based on company earnings.

How does the Dow Jones PE Ratio compare to other market indexes?

The Dow Jones PE Ratio is compared to indexes like the S&P 500 and NASDAQ. These indexes have different ratios because of their company mix and size. Comparing these ratios helps understand market trends and value differences.

What factors influence the Dow Jones PE Ratio?

Many things affect the Dow Jones PE Ratio, like earnings reports and economic indicators. Interest rates and inflation also play a role. These factors cause the ratio to change, showing how the market views the Dow Jones Industrial Average.

What do high and low Dow Jones PE Ratios signify?

A high PE Ratio might mean the market is too optimistic or overvalued. A low ratio could signal undervaluation or economic worries. Investors use this ratio to gauge the market's value and make decisions.

How can investors use the Dow Jones PE Ratio in their strategies?

Investors can use the Dow Jones PE Ratio in different ways. They might look for undervalued markets or time their investments. But, it's best to use it with other indicators for a full analysis.

What are some common misconceptions about the Dow Jones PE Ratio?

Some think the Dow Jones PE Ratio is the same as individual stock ratios. But, it's a mix of company ratios. Another mistake is thinking there's one perfect PE ratio for all times. The right ratio changes with market conditions and history.