Which Financial Statement Is Prepared First in Business

Effective financial reporting is built on timely and accurate financial statements. These documents capture a company's financial actions. They show how financially healthy a company is. The first document made is the Income Statement. It is crucial for other financial reports that follow.

The Income Statement is also known as the profit and loss statement. It shows a company's revenues and costs. By doing this, it finds out if the company made a profit or a loss. It's not just about numbers. This statement helps understand how profitable a company is. It also helps make future financial plans.

The order in which financial statements are made matters. Making the Income Statement first is important. It provides key information for more financial planning and reporting.

To improve access to global financial data, we put the Income Statement first in accounting. It calculates net income by subtracting expenses from revenues. This gives a clear picture of how well a company did financially in a certain time.

Key Takeaways

- The Income Statement is the antecedent in the sequence of financial statement preparation.

- It provides a summary of revenues and expenses, leading to a calculation of net income.

- Having an accurate Income Statement is pivotal for the formulation of other financial reports.

- It aids in evaluating profitability trends and plays a decisive role in financial strategy.

- The net income figure from the Income Statement is instrumental for articulating subsequent financial statements, such as the Statement of Retained Earnings and the Balance Sheet.

- Businesses must maintain precise records to ensure the accuracy and integrity of the financial statements.

- By analyzing cash flows, assets, and liabilities, companies can facilitate informed, data-driven decision-making.

Understanding Financial Statements

Financial statements are key tools in financial management. They are vital for checking an organization's financial health and work efficiency. These records offer a comprehensive financial overview. They show a business's financial moves. By making statement analysis possible, they help with many financial and strategic choices.

What Are Financial Statements?

Financial statements are reports that show a company's financial activities and state. They act as formal records. Stakeholders use them to grasp the company's financial health and make smart choices. They include details on profits, assets, debts, and cash flow. This ensures all key financial areas are covered.

Importance of Financial Statements

Analyzing financial reports helps understand how current strategies perform in making money and using resources. They're crucial for meeting legal requirements, attracting investors, planning for the future, and being clear with stakeholders. Also, this analysis predicts and spots risks related to growth and investments.

Types of Financial Statements

Out of many financial reports, three are especially important to financial management:

| Statement | Purpose | Key Components |

|---|---|---|

| Income Statement | Analyze profitability over a specific period. | Revenue, Expenses, Net Income, EPS, EBITDA |

| Balance Sheet | Snapshot of financial standing at a specified point. | Assets, Liabilities, Shareholders' Equity |

| Cash Flow Statement | Monitor cash influx and outflow within a period. | Operations Cash Flow, Investing Cash Flow, Financing Cash Flow |

Studying these statements gives a full view of a company's financial path. It improves statement analysis and financial management methods. This leads to better forecasts about financial health and future profits. Thus, financial statements are crucial for a comprehensive financial overview.

The Order of Financial Statement Preparation

The right way to prepare financial statements is key to good financial health. It shows us how well a company is doing. The accounting cycle is a neat way to gather and look at data. This is crucial for reports that are right on target.

Overview of Preparation Order

Everything starts with the trial balance. It collects all accounts after the first journal entries. Next, we fix any mistakes by adjusting for things like wages owed, equipment wear and tear, and upfront payments. Then, the income statement comes to life. It carefully shows the direct results of how the business did.

Significance of Preparation Sequence

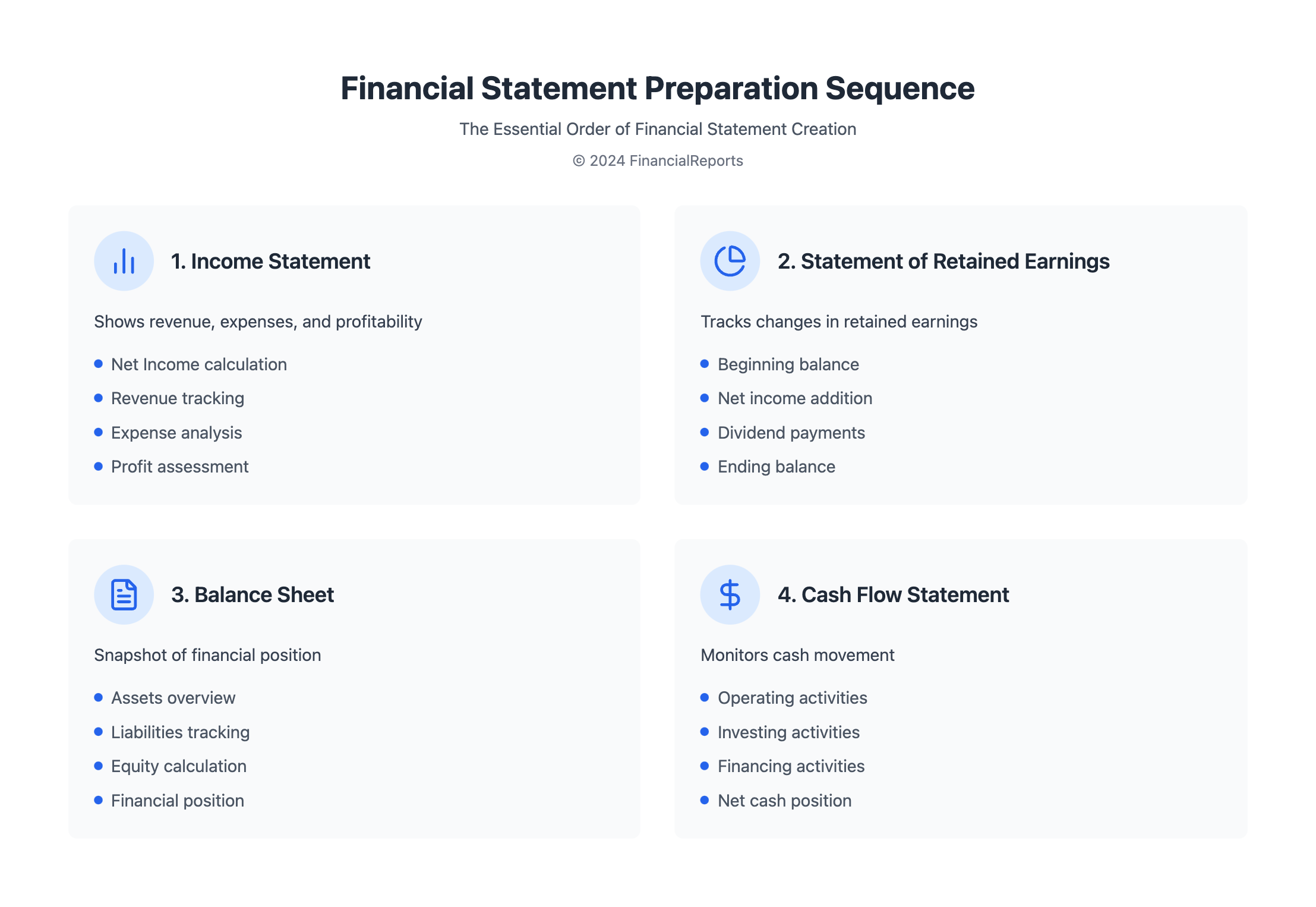

The steps to get ready financial statements are important. They start with the income statement, then go to the earnings report, the balance sheet, and the cash flow statement. This order gives a full picture of a company’s financial health. It helps give clear details for making big decisions.

By following these steps, we can see where money might be needed or saved. This information helps companies plan, manage debts, and improve how they handle their money. It's part of an overall process that looks at now and the future. This process is crucial for staying ahead in the market.

In the end, following the right steps for preparing financial statements is crucial. It helps companies get their finances right. This lets them make smart choices for growth and profit.

The Income Statement

The Income Statement, also known as the Profit and Loss statement, is key for viewing a company's finances over time. It's analyzed every quarter or year. It's vital for those looking to dive deep into profit and loss analysis. This helps them see if the company is being run well and how decisions affect money coming in and going out.

Definition and Purpose

An Income Statement breaks down revenues and expenses ending with net income. This number shows investors and managers if the company is making money. Its main goal is to reveal how healthy the company's finances are. This shapes decisions on investing, using resources, and planning operations.

Key Components of the Income Statement

The Income Statement contains several important parts:

- Sales Revenue: This is the total money from sales before taking anything out.

- Cost of Goods Sold: These are the direct costs of making the products.

- Gross Profit: This is what you get when you subtract the cost of goods sold from revenue.

- Operating Expenses: These are costs from everyday business activities.

- Net Operating Income: This is the money made from normal business stuff, before interest and taxes.

- Other Income/Expenses: Money made or spent outside of regular operations.

- Net Income: This is what's left after considering all revenues and expenses.

This setup is crucial for figuring out net income, a major measure of how well the business is doing.

When Is It Prepared?

The Income Statement is usually made first in the financial reporting process. Getting it done early is important because it helps with the rest of the financial statements. Seeing profits early helps people dig deeper into how profitable the business is. This isn't just about looking at what’s happened. It's also about planning and shaping future business moves.

In the end, the Income Statement is more than just a report. It's a critical tool for financial analysis and making big decisions in a company. Getting it ready early provides quick insights into how well different strategies are working. This influences the next steps for the business and its policies.

The Balance Sheet

The Balance Sheet is key in financial reporting, showing a company's financial status at a certain time. It gives a clear financial position snapshot and helps in managing asset and assessing equity.

Definition and Purpose

A balance sheet shows a company's assets, liabilities, and equity clearly. It helps show the net worth, assist in planning, and in calculating financial ratios. It's crucial in showing financial stability and liquidity to those interested in the company.

Key Components of the Balance Sheet

- Assets: Items the company owns that will bring future benefits. Including cash and inventory, assets are split into current and noncurrent categories.

- Liabilities: What the company must pay back, settled by transferring assets or services. Like assets, liabilities are either current or long-term.

- Equity: The value left for owners after liabilities are cleared. It's the total assets minus total liabilities, including earnings and stockholder equity.

Timeline for Preparation

The balance sheet comes after the income statement and retained earnings statement. This order ensures all financial activities are correctly reported. For example, ABC's balance sheet confirms assets match liabilities plus equity, showing a balanced $75,000 at year-end.

In summary, the balance sheet is vital for planning and analyzing a company's financial health. Its role in asset management and providing a financial position snapshot is crucial for stakeholders and management.

The Cash Flow Statement

The Cash Flow Statement shows how cash moves in and out of a business. It's essential for understanding a company's finances. It helps track cash, analyze liquidity and solvency, and keeps the company financially flexible.

Definition and Purpose

This statement tracks cash and cash equivalents coming in and going out. It shows how well a company can generate cash. This is key for evaluating its operational performance, investment activities, and financial stability. It helps stakeholders make informed decisions for the future.

Key Components of the Cash Flow Statement

There are three main parts to the Cash Flow Statement:

- Cash Flow from Operating Activities (CFO): Includes money from sales, payments for supplies, salaries, and other business operations.

- Cash Flow from Investing Activities (CFI): Covers buying and selling long-term assets like equipment or investments.

- Cash Flow from Financing Activities (CFF): Shows cash changes from loans, stock deals, and paying dividends.

Preparation Timing in Context

The Cash Flow Statement is prepared after the income statement and balance sheet. It combines their data to assess how well a company manages cash flow changes. This bolsters financial flexibility. Below is a sample Cash Flow Statement:

| Activity Type | Net Cash Flow |

|---|---|

| Cash Flow from Operating Activities | $2,000,000 |

| Cash Flow from Investing Activities | -$1,500,000 |

| Cash Flow from Financing Activities | $500,000 |

| Total Net Cash Flow | $1,000,000 |

Knowing when and why this statement is prepared helps stakeholders use it. It supports business strategies and ensures solid finances.

The Role of the Trial Balance

The trial balance is crucial in preparing financial statements. It's more than just an internal document. It ensures the final accounts are accurate. It gives a clear view of all ledger balances at a specific time. This makes the trial balance vital for the accounting accuracy of financial reports.

Importance of the Trial Balance

A trial balance is key to checking if financial entries are correct. It's important for bookkeeping practices and showing a company's real financial status. The trial balance significance lies in finding errors early. This helps prevent financial mistakes.

How It Fits Into Financial Statements Preparation

The trial balance is crucial in financial reporting. After recording in journal books and moving to ledgers, it acts as a checkpoint. Before drafting major financial statements, the trial balance reviews everything.

| Type of Trial Balance | Purpose in Accounting Cycle | Key Features |

|---|---|---|

| Unadjusted Trial Balance | Compiles initial balances before adjustments | Includes all ledger accounts as raw data |

| Adjusted Trial Balance | Prepares balances post adjustment entries | Reflects figures after accounting adjustments |

| Post-Closing Trial Balance | Final review of accounts post closures | Lists all balance sheet accounts post temporary account closures |

This approach allows for thorough checks at different stages. It fits bookkeeping practices that need accuracy and precision. The trial balance's role in keeping accounting accuracy is crucial. It greatly affects the trustworthiness of financial reports. Its role in the accounting process is indispensable.

Impact of Business Transactions

Business transactions deeply impact financial statements due to their dynamic nature. Transactions like expenses or revenue change a company's financial standing. They tweak the balance sheet and both the income and cash flow statements. This adjustment outlines a business's overall financial health, just like in big company records.

Influence on Financial Statements

Recording transactions in order matters a lot. When something like a sale happens, it leads to entries across various financial documents. Sales increase income on the Income Statement and touch either the cash or receivables on the Balance Sheet. Keeping everything in sync is crucial for accurate financial records, showing how business accounts intertwine.

Timing and Sequence Considerations

Recording transactions quickly and accurately is key for reliable financial reports. It makes sure each statement is up-to-date, capturing the essence of transaction periods. Any delay or mistake in this process can cause big errors. This puts the trustworthiness and accuracy of financial data at risk.

| Financial Category | ExxonMobil Corporation (2023) | Metro Courier Inc. (January 20XX) |

|---|---|---|

| Total Revenue | $344.6 billion | $60,000 |

| Total Costs | $291.8 billion | Data Not Available |

| Total Assets | $376.3 billion | $88,100 |

| Total Liabilities | $163.8 billion | $200 |

| Total Equity | $212.5 billion | $87,900 |

| Net Income | $36 billion | $57,900 |

The table shows major differences in financial activities between a large and a small company. Yet, both follow the same principles of transaction recording and reporting. It highlights the importance of accounting standards, no matter the business size.

Standard Practices in Financial Reporting

In today's business world, following established financial practices is crucial. It ensures compliance and trust in financial reports. The Generally Accepted Accounting Principles (GAAP) and the International Financial Reporting Standards (IFRS) are key. They are the foundation for accounting standardization.

Generally Accepted Accounting Principles (GAAP)

GAAP is used mainly in the United States. It sets the standards for clear and consistent financial statements. Following GAAP helps companies meet regulations and offer a clear view of their finances. This framework is vital for those wishing to maintain financial practice norms.

International Financial Reporting Standards (IFRS)

IFRS sets global standards for financial reporting. It helps businesses speak a common financial language, no matter where they are. This is crucial for international companies, ensuring reliable financial information worldwide. Complying with IFRS also increases trust among investors by making financial reporting more consistent globally.

GAAP and IFRS are key in financial communication. They ensure that company finances are clearly shown. This builds confidence among stakeholders, who depend on these reports for making informed choices.

Following these standards is about more than rules. It ensures regulatory compliance, maintains reporting integrity, and supports a transparent financial world. These principles are at the heart of trust and efficiency in global financial markets.

The Significance of the Income Statement

The income statement is vital among financial statements. It is key for people inside and outside of the company. By showing income and spending, it sets the stage for strong strategic financial planning and profitability tracking. This tool shows a company's performance over time, affecting big business choices.

Performance Measurement

The income statement is crucial for measuring performance. It shows revenue, expenses, and net income clearly. This reveals how well a company manages operations and costs.

For example, YYZ Corp. saw a fall in net income from $75 million in 2021 to $50 million in 2022. This suggests they might need to change their financial plans or find ways to save money. Such details are vital for fiscal analysis and setting benchmarks.

Decision-Making Tools

The income statement is more than a financial report; it's key for making big decisions. It helps people understand a company's financial health and make smart choices. A fall in important numbers, like earnings per share for YYZ Corp. from $3 in 2021 to $2 in 2022, affects investor actions and company management.

This info helps with firm profitability tracking. It offers clear proof of financial results. This guides future investments, changes in operations, or big strategy shifts.

| Financial Metric | 2021 | 2022 |

|---|---|---|

| Net Income | $75 million | $50 million |

| Earnings Per Share | $3 | $2 |

| Dividends Per Share | $0.050 | $0.045 |

This table shows a drop in YYZ Corp.'s financial performance. It highlights the income statement's key role in tracking financial changes. By thoroughly reviewing such reports, companies can match their financial planning with real operations. This ensures they grow and remain profitable.

Challenges in Financial Statement Preparation

Creating financial statements is vital for true financial reporting, but it's often filled with hard challenges. Managing these obstacles well is crucial for the trustworthiness of financial reports.

Common Pitfalls

Common problems include errors in financial data and wrong use of accounting rules. For example, not following the Generally Accepted Accounting Principles (GAAP) can cause big mistakes in reports. Also, the complicated deals in big companies make reporting tough. Besides, weak internal controls may increase the chance of mistakes or fraud in the statements.

How to Overcome Challenges

To solve these key issues in making financial statements, use these strategies:

- Mitigating Errors: Set up strict checks for data. Regular audits, either internal or external, help cut down errors.

- Overcoming Accounting Hurdles: Keep accounting teams learning about new standards and practices. Using outsourced CFO services ensures expert financial management and following international standards.

- Accurate Financial Reporting: Use advanced software that meets accounting rules to streamline processes and avoid human mistakes. Strong data systems keep the financial information safe and correct.

Winning against these challenges needs staying current with financial practices and having experts who know the changing financial reporting field.

Conclusion: The First Step in Financial Reporting

The journey of financial reporting starts with making financial statements. This is key to sharing a business's financial story. The first statement made is usually the income statement. It shows a company's money made and spent, pointing out if they made a profit. Looking at Apple, we see how they note their sales and expenses. This detailed record leads to their net income of $525,000.

Summarizing the Preparation Process

The full health of a company is shown through several statements. These include the Cash Flow Statement, Balance Sheet, and Statement of Shareholder's Equity. Each has its role, like showing money movement or a firm's financial state at a specific time. They offer deep insights into a business.

Tools like the retained earnings formula and DuPont Analysis help. They let financial experts check a company's health under certain standards. This is crucial for understanding financial standing.

Key Takeaways for Businesses

It's vital for companies to see financial statement preparation as more than just a must-do. It's central to smart financial management and making informed decisions. The link between different financial statements is essential for deep financial analysis. This approach helps companies like Apple build a strong base for current and future wins.

Such reporting methods give a clear, full view. This is what stakeholders need. They want to keep tabs on the company's health and its ability to last.

FAQ

Which Financial Statement Is Prepared First in Business Accounting?

The income statement is always prepared first in business accounting. It shows the company's revenue and expenses. This highlights net income, a key indicator of financial health. It paves the way for other financial reports.

What Are Financial Statements?

Financial statements summarize a business's financial activities. They cover the income statement, balance sheet, and cash flow statement. Each one offers insights into the company's finances.

Why Are Financial Statements Important?

They offer a clear view of a company's financial performance and growth potential. They are vital for gauging revenue capabilities, guiding financial strategies, ensuring compliance, and helping with investments.

What Types of Financial Statements Are There?

Main types include the income statement, balance sheet, cash flow statement, and statement of retained earnings. Each provides unique insights into the company's financial health.

What Is the General Order of Financial Statement Preparation?

First comes the income statement. Then, the statement of retained earnings, balance sheet, and cash flow statement. This order ensures accurate and coherent financial reporting.

Why Is the Sequence of Financial Statement Preparation Significant?

This sequence is key for accurate, reliable financial data across reports. Each report builds on the last, ensuring a consistent financial story from profit, to financial position, to cash flow.

What Is the Purpose of an Income Statement?

Its purpose is to show a company's profitability over a time period. It looks at operations efficiency, costs, and net earnings. This informs about financial performance.

What Are the Key Components of the Income Statement?

It includes total revenue, cost of goods sold, gross profit, operating expenses, taxes, and net income. These reveal profit-making ability and expense management.

When Is the Income Statement Prepared?

It's prepared first after accounting period's closing entries. This could be monthly, quarterly, or annually, based on reporting needs.

What Is a Balance Sheet and When Is It Prepared?

A balance sheet shows a company's financial standing at a moment. It lists assets, liabilities, and shareholder equity. It's done after the income statement and statement of retained earnings.

How Does the Cash Flow Statement Fit into the Order of Preparation?

It's the last core statement prepared. It reflects cash movements from operations, investments, and financing. It draws from the income statement and balance sheet info.

Why Is the Trial Balance Important in Financial Statements Preparation?

The trial balance checks debits and credits in ledger accounts before making financial statements. It ensures data accuracy for reliable financial reporting.

How Do Business Transactions Impact Financial Statements?

Transactions change account balances, affecting financial statement summaries. Each must be accurately recorded to properly show the company's financial activity.

What Are GAAP and IFRS?

GAAP and IFRS are accounting standards for financial statement preparation and presentation. The US uses GAAP; IFRS is used worldwide for consistency.

How Does the Income Statement Serve as a Decision-Making Tool?

It offers key metrics like gross margin and net profit. These help assess efficiency, cost control, and profitability, guiding strategic choices.

What Are Common Financial Statement Preparation Pitfalls and How to Avoid Them?

Mistakes include wrong data entry, misinterpreting regulations, and old records. Avoid these by maintaining diligent bookkeeping, using good software, and regular account reconciliation.