Where Is Depreciation on the Income Statement Guide

Depreciation is key in financial reporting. It tells us how long a company's assets will last and helps in analyzing profits. It shows up as an important non-cash charge on the income statement. This charge shows how the value of physical assets drops over time. This shows business activities in real numbers. For many sectors, recording depreciation properly is crucial. It's not just about following rules. It's about being transparent and building trust with investors.

Seeing how depreciation affects accounting helps financial professionals. They can better understand its effects on net income and taxes. Understanding depreciation on the income statement is vital. It includes figuring out the depreciation expense and accumulated depreciation. This is a contra asset on the balance sheet. Our goal is to make financial data easy to access worldwide. We want to give investors and clients clear insights into financial statements.

Key Takeaways

- Depreciation expense is a non-cash charge on the income statement that informs investors about an asset's value decline.

- Accumulated depreciation is a contra-asset on the balance sheet, signifying total past depreciation.

- Understanding depreciation is integral for ensuring precise financial statements and investment evaluations.

- Depreciation influences both a company's net income and taxable income, affecting overall profitability.

- The proper accounting of depreciation expense is essential for accurate financial reporting.

- Financial experts advocate for the inclusion of depreciation analysis in a thorough profitability analysis.

- Automated accounting solutions provide consistency and accuracy in tracking depreciation expenses.

Understanding Depreciation: An Overview

The concept of depreciation is key in asset valuation and expense recognition. It helps businesses spread the cost of tangible assets over their expected lives. It's not just about a drop in asset value. It ensures that costs are matched with the revenue they generate, following accrual accounting rules.

Definition of Depreciation

Depreciation spreads the cost of a tangible asset across its useful life. It shows how asset value decreases because of use and time. This method is important for showing asset value drops on financial statements. For example, if a company has equipment worth $100,000 and it depreciates over 10 years, the company would note a $10,000 depreciation expense yearly.

Importance of Depreciation in Financial Statements

Adding depreciation to financial statements has big benefits. It gives a clearer asset value, helps in recognizing expenses properly, and affects taxes. Depreciation plays a big role in two financial statement parts:

- Income Statement: Depreciation expense is listed under operating expenses or in the cost of goods sold (COGS). It lowers taxable income each year, affecting net income.

- Balance Sheet: Accumulated depreciation changes an asset's book value. It's shown as a contra-asset account, lowering total asset value. Tracking depreciation is crucial for understanding a company's true value.

In our example, a 15% yearly depreciation means $15,000 off each year. This is key for those assessing a company's assets and profit margins over time.

The concept of depreciation is a basic yet strategic part of accounting. It helps in managing assets and in accurate financial reporting. Proper depreciation accounting ensures better capital expense planning, cash flow management, and tax compliance.

The Role of the Income Statement

The income statement is key in financial reporting. It shows a company’s financial activities over time. It highlights revenue, expenses, and net income. This document is crucial for understanding a company's profit.

Components of the Income Statement

An income statement has several important parts. These parts show a company’s financial results and operations. The main components are:

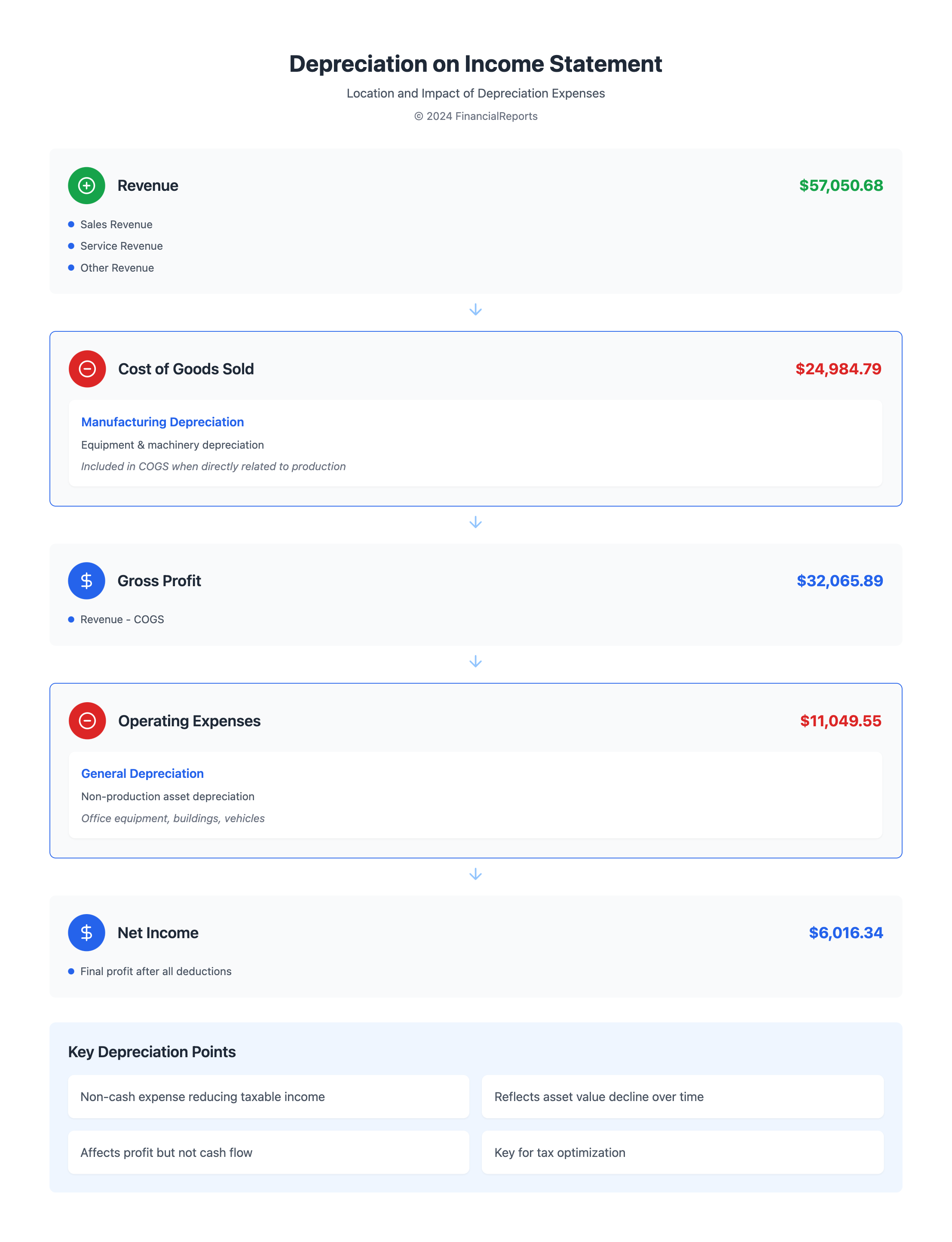

- Sales/Revenue: This is the total money made from business activities. It includes cash received and receivables. For example, Coffee Roaster Enterprises Inc. made $57,050.68 by the end of Dec. 31, 2023.

- Cost of Goods Sold (COGS): These are direct costs related to making goods sold by a company. COGS for Coffee Roaster Enterprises Inc. was $24,984.79.

- Gross Profit: This is what you get when you subtract COGS from Sales/Revenue. It shows basic profitability. The Gross Profit for Coffee Roaster Enterprises Inc. was $32,101.89.

- Operating Expenses: These are costs for daily business activities. They include depreciation, rent, salaries, and utilities. Total expenses were $11,049.55.

- Net Income: This is the final profit after deducting all expenses from revenues. It includes operational, interest, and tax expenses. For Coffee Roaster Enterprises Inc., net income was $6,052.34.

How Income Statement Reflects Business Performance

The income statement shows earnings and operating expenses. It helps in analyzing earnings. By showing costs and revenues, it lets stakeholders check how well a firm is doing in making profit.

| Indicator | Coffee Roaster Enterprises Inc. | Dead Simple Coffee Inc. |

|---|---|---|

| Total Revenue and Gains | $57,050.68 | $62,311.06 |

| Total Expenses and Losses | $51,411.37 | $51,411.37 |

| Net Income | $6,052.34 | $10,899.69 |

| Gross Profit Percentage | 56.27% | 56.21% |

| Operating Earnings | $21,052.34 | Data not available |

| Net Profit Percentage | 10.60% | 17.49% |

This table shows a financial comparison between two companies. It highlights key metrics like net income and operating earnings. This underlines how vital the income statement is in evaluating a business's financial health and making decisions.

Where Depreciation Appears on the Income Statement

Understanding where depreciation fits on the income statement is key. It is a major expense that impacts a company's net income. It also affects how we view the financial health of a business.

Operating Expenses Section

Depreciation is usually found under operating expenses. This is because it's part of the costs from using fixed assets like machines and buildings. Recording it as an operating expense offers a clear look at business costs. This helps figure out the real profit from business operations.

Cost of Goods Sold (COGS) Considerations

In firms where assets are key to making products, depreciation shows up in the Cost of Goods Sold (COGS). For instance, the wear and tear on production gear is included in COGS. This makes the cost of producing goods more accurate. So, it influences the gross profit number.

Where to place depreciation, in operating expenses or COGS, influences financial analysis. It shapes how investors and analysts see a company's performance. It also impacts tax payments. Thus, knowing the effect of depreciation is crucial for financial strategy and analysis.

Types of Depreciation Methods

Financial accounting has different ways to account for asset depreciation. Each way fits the asset's type and use best. The choice of method affects how depreciation is calculated and has a big impact on financial reports and taxes. Here are the main methods, with each serving a unique role in finance.

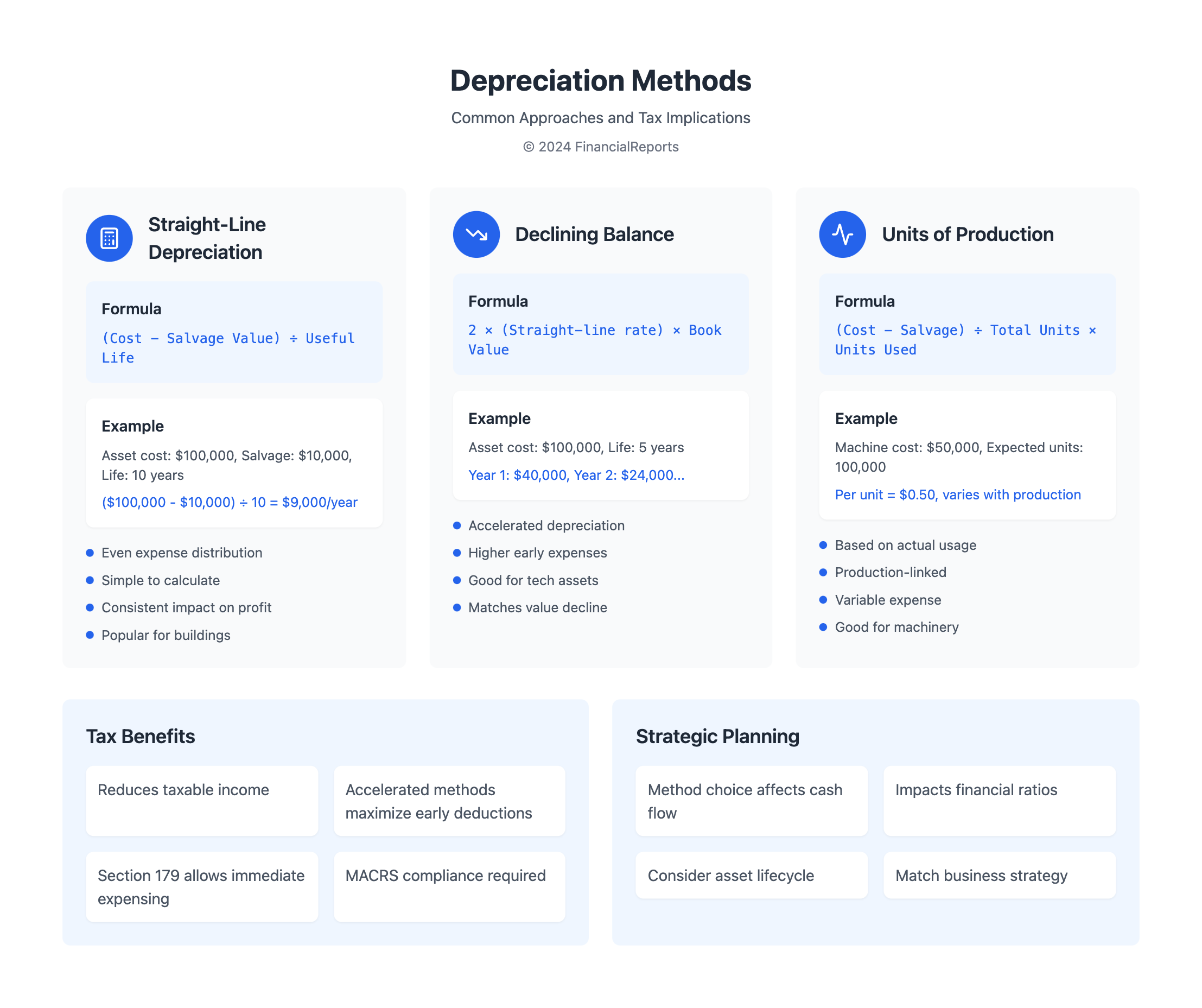

Straight-Line Depreciation

This method is popular because it's simple and spreads the cost evenly over the asset's life. Depreciation is found by taking the asset's cost, subtracting the salvage value, and dividing by the asset's lifespan. This results in the same expense amount every year, which helps with steady financial planning and analysis. Learn more.

Declining Balance Method

This is a faster depreciation method. It has higher expenses in the asset's early years that reduce over time. It suits assets that quickly lose value. The depreciation rate stays the same but is applied to the asset's decreasing value each year, considering the salvage value. This matches the decline in use or productivity, showing the asset's economic reality more accurately.

Units of Production Method

The units of production method links depreciation to how much the asset is used. It's perfect for equipment used in making goods. Depreciation is based on actual output; hence, the expense matches the asset's use each period. Although depreciation per unit is constant, total depreciation changes with production levels. This method gives a clear view of how well assets are used, helping in managing them.

Selecting the right depreciation method takes a careful look at the asset's characteristics and its role in business operations. Each method follows standard accounting rules and differently affects the financial statements. This influences how a company's financial health and tax strategies are seen.

Depreciation vs. Amortization

Knowing how depreciation and amortization differ is vital for true financial statements. Both spread out an asset's cost across its life. But they focus on different assets. Depreciation is for things you can touch, like machines. Amortization is for things you can't touch, like patents. It's key to show these correctly to meet financial rules and show how asset values drop over time.

Key Differences Explained

Depreciation and amortization both break down an asset's cost over time. Yet, they target different things. Depreciation applies to tangible assets, items you can physically touch. This includes cars and equipment, using methods like Straight-line or Declining balance. Amortization is for intangible assets, such as copyrights or software. It usually uses a straight-line method for about 15 years.

Vehicles, for example, might depreciate faster in the first few years. On the other hand, amortization spreads cost evenly across years. This is key for accurate financial reporting and tax duties. Amortization ensures financial compliance by rightly altering earnings and affecting company value through book value reductions.

Impacts on Financial Statements

| Concept | Application to Asset Type | Methodology | Impact on Financial Statements |

|---|---|---|---|

| Depreciation | Tangible Assets (e.g., equipment, buildings) | Accelerated (e.g., Declining Balance, Sum-of-the-years-digits) | Reduces asset value, affects earnings and taxable income |

| Amortization | Intangible Assets (e.g., software, patents, trademarks) | Straight-line | Even expense distribution, affects earnings, less impact on tax due to no salvage value |

Depreciation and amortization both aim to show how asset values go down over time with scheduled expenses. This helps give a true view of a company's earnings. Plus, it offers tax breaks since these costs are deductible. Hence, properly using these methods is crucial for effective asset management and financial truthfulness.

Accounting for Depreciation

Depreciation is a key concept in accounting. It greatly affects the trustworthiness of financial reports. Here, we explore how to record depreciation and keep track of accumulated depreciation. Both are essential for financial record accuracy.

Recording Depreciation Entries

Depreciation tracks the decrease in value of assets over time. This could be due to use or becoming outdated. Recording these changes properly is vital for accurate asset values. This keeps financial records precise.

Every period, the expense from depreciation is put as a debit. It appears on the income statement. This lowers the net profit, showing the cost of using the asset. A common method is straight-line depreciation. It subtracts the salvage value from the asset's initial cost and divides it by its useful life.

Accumulated Depreciation in Financial Records

Accumulated depreciation appears on the balance sheet as a contra asset account. This lowers the total value of fixed assets shown. It's all the depreciation expenses for an asset up to now. This gives a real view of how much the asset has lost in value over time.

This figure can't go over the asset's original cost. So, the asset's value never shows as less than zero. This rule keeps financial record accuracy intact. Accumulated depreciation is also factored back into earnings. This is done before interest and taxes are considered, to calculate EBITDA.

Impact of Depreciation on Taxes

Depreciation deductions are key in tax reporting. They greatly affect a company's taxes. Financial pros and investors need to understand this to use taxes wisely and boost their plans.

Tax Deductibility of Depreciation

Depreciation lowers your tax bill each year. It does this by spreading out the cost of physical assets over time. This means you pay less tax because your earnings seem smaller.

The Modified Accelerated Cost Recovery System (MACRS) lets businesses speed up depreciation early on. This can make the early tax bills of an asset much smaller.

Depreciation Strategies for Tax Optimization

Choosing the right depreciation methods is vital. It must fit tax laws and help maximize deductions. Here are some common methods:

- Straight-Line Depreciation: Costs are divided evenly over the asset's life.

- Declining Balance: Early years see high depreciation rates that drop over time.

- Units of Production: Depreciation is directly tied to how much the asset is used.

- Sum-of-the-Years' Digits: An accelerated method that gives bigger deductions early on.

Choosing a depreciation method impacts tax deductions and fits into wider financial plans. The Section 179 Deduction is a key chance for tax savings. This lets businesses deduct the full price of qualified equipment up to $1,220,000 in 2024. But total purchases must not go over $3,050,000. Beyond this, the deduction decreases.

Smart tax planning with depreciation deductions helps businesses recover costs and lower tax bills. This boosts cash flow and financial health.

Analyzing Depreciation Expenses

Understanding depreciation expenses is key for financial analysts and investors. It greatly affects profit analysis and cash flow. Knowing about this non-cash charge helps judge a company’s performance and investment potential. In this discussion, we look at depreciation's effects on finance and operations.

Evaluating Depreciation Impact on Profitability

Depreciation affects profitability but not cash flow directly. It is the yearly expense of an asset’s cost on the income statement. Even though it lowers net income, this charge shows the true cost of using an asset. For instance, investing in PP&E results in large depreciation expenses.

These expenses impact profitability metrics like EBITDA. They align costs with the revenue from using assets. This gives a real view of economic performance.

Depreciation and Cash Flow

Depreciation's role in cash flow appears in the cash flow statement. Here, the non-cash charge is added back to net income under operating activities. This calculation shows funds available for investment without current cash spending. Thus, despite reducing net income, depreciation does not lower cash but increases it via tax savings. It shows the importance of understanding business liquidity and investment strategy.

Monitoring depreciation helps understand a company's value and spending efficiency. For more, check this guide on accumulated depreciation and depreciation. It is vital for those wanting to know more about financial principles.

Common Misconceptions About Depreciation

Depreciation plays a key role in managing finances and assets. But, some depreciation myths twist how we see its effect on the asset lifecycle. These financial misconceptions include wrong beliefs about what depreciation is and how it impacts businesses.

Clarifying Myths Surrounding Depreciation

Many think depreciation is just a bookkeeping trick with no real effect. This is not true. Proper depreciation shows the real decrease in an asset’s value over time. This affects taxes and how a business's value is viewed.

There's also a mix-up between depreciation and amortization. Depreciation is for tangible things like machines and buildings. Amortization is for intangible things like patents.

Importance of Accurate Depreciation Reporting

Tracking depreciation correctly is key for following laws and being transparent in financial reports. It's vital for investors and stakeholders to know a company's real financial health. It also helps to meet accounting rules and gives a better view of business operations and taxes.

| Concept | Impact on Business | Common Misunderstanding |

|---|---|---|

| Depreciation as non-cash expense | Improves EBITDA representation | Seen as an actual cash expenditure |

| Acceleration of depreciation | Higher initial deductions, lowers taxable income | Considered as altering asset value |

| Impact on tax liabilities | Reduces pre-tax income, optimizing tax benefits | Often overlooked in financial planning |

| Depreciation vs. Amortization | Different methods required for tangible vs. intangible assets | Commonly conflated, leading to reporting errors |

It is vital to understand and clear up these depreciation myths. This helps in strategic financial planning and accurate record-keeping. Managing depreciation correctly is crucial through the asset's entire life.

Best Practices for Tracking Depreciation

In the world of finance, tracking depreciation is key. It helps companies follow accounting rules and keeps financial reports accurate. For the best results, using an updated accounting system is a must. This system should handle different ways of calculating depreciation.

Using Accounting Software

Modern accounting software helps a lot in managing fixed assets. It can deal with various depreciation methods like the straight-line, declining balance, and units of production. RedBeam is a great example of such a software. It makes managing asset inventory and calculating depreciation easier. This helps financial pros save time and reduce mistakes, letting them make better strategic choices.

Regular Review and Adjustment

Checking asset life cycles and depreciation schedules often is crucial. Every asset needs a regular look to make sure its value on the books matches its real-world worth. This includes adjusting for market changes, how much it’s used, and new tech. These checks help in keeping depreciation tracking accurate and up to date.

By doing this, companies can stay transparent and build trust with investors. Keeping up with these practices is good for following laws and making accounting more efficient. It's all about having a clean and trustworthy financial system in today’s fast-changing economy.

Conclusion: The Significance of Depreciation on the Income Statement

Understanding depreciation on the income statement offers deep insights to financial experts. It sets a high standard for financial responsibility. By looking closely at income statements, we see how depreciation affects key financial ratios. Ratios like return on assets and fixed asset turnover change with depreciation calculations. This approach stresses the importance of accuracy and following global standards like GAAP and IFRS.

Key Takeaways

Companies use different methods, such as straight-line or declining balance, to report depreciation. This shows how well they manage assets and make investments. Seeing depreciation as a non-cash expense helps us understand its impact on net income and taxes. It highlights why businesses must adjust for changes in an asset's useful life or salvage value. All this ensures reports meet strict accounting standards.

Final Thoughts on Financial Reporting

In summary, depreciation plays a key role in financial reports. It systematically lowers the value of assets and outlines net income. Using methods like straight-line or declining balance is crucial. They help spread out the cost of assets over their life. This shows annual revenue and costs clearly. Properly recording depreciation highlights a company’s financial health. It's vital for reducing risk and making smart choices for investors. Keeping financial data accurate and accessible worldwide is our goal. We aim to highlight the importance of accurate depreciation in corporate governance.

FAQ

Where is depreciation found on the income statement?

Depreciation is listed under operating expenses on the income statement. It lowers operating income. This is key for assessing a company's profit and efficiency.

What role does depreciation play in financial statements?

Depreciation recognizes that tangible assets wear out over time. It matches costs to the revenue they produce. This follows the accrual accounting rule and impacts both net income and asset value.

How does the income statement reflect a business's performance?

The income statement shows a company's financial results. This includes revenues, expenses, gains, and losses. It's vital for understanding financial health and success.

Can depreciation be included in Cost of Goods Sold (COGS)?

Yes, depreciation can be part of COGS. This is for depreciation linked to assets used in making goods.

What are the different methods of depreciation, and how do they affect financial reporting?

Methods like straight-line, declining balance, and units of production exist. They spread out asset costs over time in different ways. The choice of method can influence a company's profit and tax bills.

How do depreciation and amortization differ in their impacts on financial statements?

Depreciation deals with tangible assets' costs. Amortization is for intangible assets. Both affect the book value. They're non-cash expenses that are considered in cash flow but apply to various assets.

What is the process for recording depreciation in accounting?

Depreciation is logged as an expense. This action also boosts the accumulated depreciation on the balance sheet. It's crucial for accurately showing asset values.

How does depreciation affect a company's tax reporting?

Depreciation shrinks pre-tax income, which may reduce taxes. Companies use it for tax planning to get the most deductions allowed by law.

Why is understanding depreciation important for evaluating a company's profitability?

Realizing depreciation's effect is crucial for seeing true net income and profitability, like EBITDA. Even though it doesn't directly take cash out, it matters for cash flow and shows how well assets are used.

What are some common misconceptions about depreciation?

Many think depreciation means an actual cash loss, or it doesn't affect cash flow. But, it's really about spreading out an asset's cost and has tax impacts.

What are best practices for tracking and managing depreciation?

Good tracking involves advanced accounting tools for handling different depreciation methods. Keeping asset and depreciation records updated ensures financial reports are accurate.

What is the significance of accurate depreciation on the income statement?

Accurate depreciation matters for showing true asset management and company operations. It's key for trust in governance, insightful analysis, and keeping investor trust.