What is a Financial Account: Types and Examples

A financial account is a key part of accounting for both individuals and companies. It shows the importance of keeping detailed records of money moves. This is crucial for making accurate financial statements. Understanding what is a financial account means knowing how money in and out affects balances. For assets, more money in means higher balances. For liabilities, it's the opposite.

There are five main types of financial accounts: assets, liabilities, equity, expenses, and income. Every business deal affects these accounts. This is due to the double-entry system, which boosts accuracy and accountability. To get deeper into financial acc knowledge, explore more about financial accounts.

In financial accounting, experts use a Chart of Accounts (COA). It lists all accounts in the ledger, including sub-accounts like Bank Accounts, Accounts Payable, and expense accounts for things like Insurance and Car Costs. This system makes financial reports clearer, helping in making big decisions.

Standards like GAAP and IFRS ensure companies worldwide maintain clarity for investors. Financial accounts are vital for looking into a company's financial health. This includes checking balance sheets or cash flow.

Key Takeaways

- Financial accounts are key for recording transactions and influencing balances in assets, liabilities, equity, expenses, and income.

- Debits and credits control the increase or decrease in account values, depending on the account type.

- Sub-accounts allow for a detailed tracking of transactions in each category.

- GAAP and IFRS are the set standards for financial reporting, promoting transparency and consistency.

- Financial statements like balance sheets and cash flow statements come from thorough financial accounting.

- Understanding financial accounts is crucial for evaluating a company's financial state, aiding smart business and investment choices.

Understanding Financial Accounts

Financial accounts are key for clear and responsible financial handling. They matter a lot for both people and groups. They are not just useful but also a main part of financial planning. Let's look at what financial accounts are and their importance in managing money.

Definition of a Financial Account

To define financial accounting, know it's about recording, summarizing, and reporting money transactions systematically. A financial account definition talks about organizing these transactions. They are put into categories like assets, liabilities, and equity on a balance sheet. For instance, current assets could be Cash at $20,000, Accounts Receivable at $3,000, adding up to show the business's available resources.

Financial accounts are created with care. They match each transaction with what the business does. This is shown in financial reports like balance sheets, income statements, and cash flow statements. These documents are vital. They show a company's financial health and are needed for planning and reporting.

Importance in Personal Finance

Knowing and handling financial accounts is vital for personal finance. It helps reach financial goals and keeps finances healthy. Here's how these accounts help in personal finance:

- Budgeting and Expense Tracking: It's easier to watch spending and investments with good financial accounts.

- Tax Planning and Filing: You need correct financial records for proper tax work and filing on time.

- Financial Planning and Analysis: Looking at financial reports helps make choices that fit long-term financial plans.

The setup of these accounts makes it simple to see what you own and owe. This makes managing your money easier. Every part, from watching cash flow to checking if an investment is good, depends on these accounts' clarity.

In the end, the role of financial accounts in personal finance is huge. It's not just about keeping records. It's about planning and looking ahead. This helps understand financial health well and manage money better.

Types of Financial Accounts

Understanding financial accounting meaning needs a look at different financial accounts. These accounts meet various financial goals. They show how managing money can be complex but important.

It's all about principles like revenue recognition and objectivity. These principles guide financial decisions.

Savings Accounts

If you want to grow your savings safely, savings accounts are key. They let your money grow over time by earning interest. It's a simple way to manage your savings with safety in mind.

Checking Accounts

Checking accounts are essential for everyday money use. They make paying for things easy and quick. This accessibility is vital for managing both personal and small business finances smoothly.

Investment Accounts

To build wealth, consider investment accounts. These accounts use stocks, bonds, and mutual funds to increase your money. They tie closely to revenue recognition and matching, key accounting concepts.

This shows how investment gains are tracked over time.

Retirement Accounts

Planning for retirement? IRAs and 401(k)s are crucial. They help save money for your retirement years and offer tax benefits. This aligns with financial accounting principles for personal financial planning.

Learning about these accounts helps understand financial accounting meaning better. Each type has its own rules, serving various financial needs. They ensure individuals and businesses can manage and grow their finances.

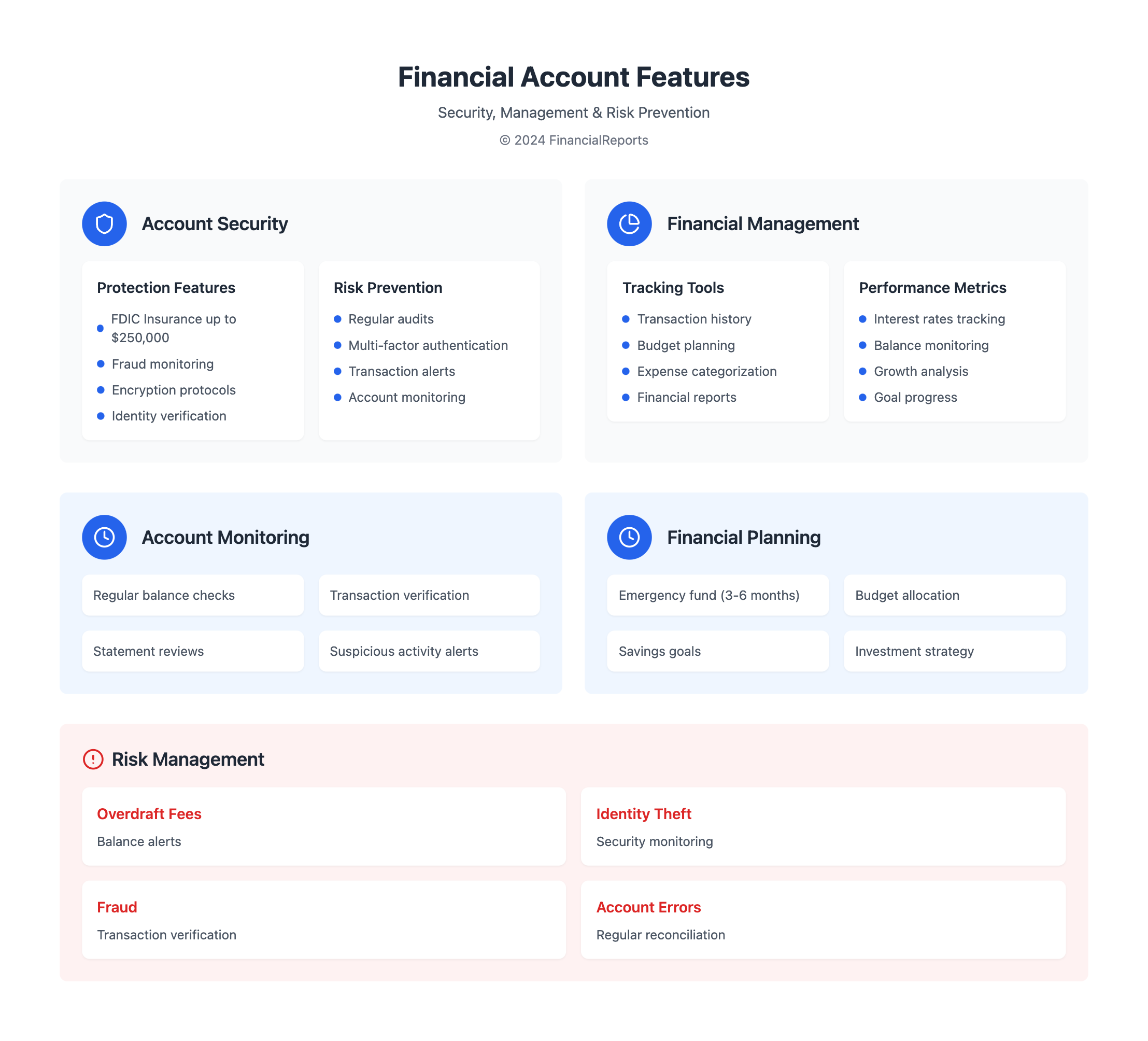

Key Features of Financial Accounts

Financial accounts have key features that shape how we handle our money. Knowing these details helps us meet our financial goals. We'll look at important areas like interest rates and the fees that come with financial accounts.

Interest Rates

Interest rates determine how much money your assets can earn over time. They differ across various account types, such as savings, checking, or investment accounts. For instance, high-yield savings accounts provide better rates than regular ones. This affects how much wealth you can build.

This rate is key for anyone looking to grow their savings or invest. It influences how much you'll earn back and the value of money over time.

Fees and Charges

Fees and charges are part of having a financial account. They can lower your profits if you're not careful. You might face monthly fees, ATM withdrawal fees, overdraft fees, and transaction fees for high activity accounts.

- Monthly maintenance fees, often waived by maintaining a minimum balance or meeting specific deposit conditions

- ATM withdrawal fees, which vary between institutions and can accumulate over frequent withdrawals

- Overdraft fees, charged for transactions that exceed account balances

- Transaction fees, specifically relevant to accounts with high transaction volumes like checking accounts

Understanding these fees and finding ways to reduce them is crucial. When choosing a financial account, look for clear fee structures and possible discounts.

Both interest rates and fees are critical in banking. Savers and investors should consider these factors to align with their goals. This decision-making process is essential for effective financial planning and achieving strategic objectives.

How to Choose the Right Financial Account

Choosing the right financial account is very important for your money health. It helps you make smart decisions to meet your money goals. You should think about what you want to achieve with your money. Then, look closely at what different accounts offer you.

Assessing Your Financial Goals

Before picking an account, you must know your money goals. These could be saving for later in life, setting aside money for emergencies, or handling everyday money matters. Depending on your goal, you might need different accounts. For quick access to your money, a checking account works best. But for growing your savings over time, consider a high-interest savings or investment account.

Comparing Features

When comparing account features, consider the following key aspects:

- Interest Rates: The interest rates for savings accounts can vary a lot. While the average rate is around 0.60 percent, some top banks offer rates over 5 percent APY.

- Fees: It's important to know about fees. For checking accounts, monthly fees differ, and some banks ask you to keep a minimum balance to avoid fees. The average overdraft fee is $26.61, important if you might spend more than your balance.

- Account Services: Think about how easy it is to use the account. Look for things like plenty of ATMs, online banking, mobile check deposits, cash back rewards, or identity theft protection.

- Insurance and Security: Make sure your account is insured by the FDIC or NCUA up to $250,000. Also, check for security features like encryption and fraud monitoring.

- Customer Service: Good customer service can make banking easier. Choose banks known for being helpful and check if they have many physical branches, if that's important to you. About 38 percent of people still think bank branches are necessary.

To sum up, knowing what financial accounts are and picking the right features for your goals is key to managing and increasing your money well. Always pick an account that matches your current and future money needs.

Opening a Financial Account

To really understand what financial accounting means, you should know how to open a financial account. Different banks or credit unions might have their own steps. But they all aim to keep things safe and legal for everyone involved.

Required Documentation

Starting off, you'll need to gather some important papers to open an account. Here's what you usually need:

- Proof of identification (such as a government-issued ID)

- Proof of residential address (like a recent utility bill)

- Evidence of income or employment

- Initial deposit amount, if applicable

This paperwork lets banks figure out their risk and stick to rules. They have to keep track of how much money or assets they, as part of bigger financial systems.

Application Process

After you've got your documents ready, you can start applying to open your account. Here's what typically happens:

- Filling out an application form, either online or in-person

- Undergoing a credit check, especially for accounts with credit facilities

- Compliance checks, aimed at preventing issues like money laundering

- Account setup and confirmation of services and features

Once your application is approved, banks often give you an account number right away. Then, things like debit cards get sent to your home.

| Account Type | Typical Documentation Required | Common Features |

|---|---|---|

| Checking Account | ID, address proof, initial deposit | Direct deposits, unlimited withdrawals |

| Savings Account | ID, address proof | Interest accrual, withdrawal limits |

| Credit Account | ID, proof of income, credit check | Borrowing limit, variable interest rates |

| Investment Account | ID, address proof, financial assessment | Stocks, bonds, funds investments |

So, opening a financial account really shows you what financial accounting is about. It involves preparing the right documents and understanding the steps. With this knowledge, you can better manage your money. This helps you stay on top of finance laws, too.

Managing Your Financial Accounts

Understanding what is a financial account is key in personal finance. It helps improve your financial skills and builds a strong base for your future. We will look at important steps for managing your financial accounts well. This includes tracking your transactions and making budgets.

Tracking Transactions

Keeping an eye on each transaction is crucial. This step helps catch any mistakes early. It keeps your records accurate. Using tools like Remote Deposit Capture and the My First Bank Business Deposit App makes this easier. They let you track and manage your money online. Adding technology to your financial management is important. Tools like Positive Pay, ACH Block, and ACH Filter add an extra layer of safety.

Setting Budgets

Budgeting is vital in managing your finances. It means setting limits on your spending based on your goals and habits. For example, creating an emergency fund is smart. It should cover 3-6 months of expenses. For businesses, setting specific financial goals is key to grow. Budgets help businesses reach these targets. Use financial planning apps to make it easier to manage your budget.

Good management of your financial accounts leads to better financial knowledge and freedom. Tools like HighRadius' Record to Report suite make managing a mix of financial accounts simpler. They offer AI to spot issues and automate closing accounts each month. This makes financial tasks quicker and easier.

Navigating the financial world requires the right tools and methods. This is true for both individuals and businesses. Handling your financial accounts well is crucial, no matter your goal.

Benefits of Having Multiple Financial Accounts

Today, it's crucial to know how many financial accounts you should have. Understanding the financial account definition helps us see the big benefits. These benefits come from having more than one place to manage your money.

Diversification of Assets

Spreading your money across different accounts is smart. It's not just for big investors but for anyone. This approach boosts your financial security and growth potential.

By using a mix of checking, savings, and others, you reduce risks. Different accounts have different benefits, like some offer higher interest rates. For example, money market accounts can earn you more over time than standard savings.

Improved Financial Management

Understanding financial account definition means knowing how they make managing money easier. Having several accounts helps organize your money by purpose. For daily costs, emergencies, or saving, separate accounts work best.

Experts suggest dividing income into needs, wants, and savings. This setup prevents money mix-ups, helping you stick to your budget. Plus, it can make dealing with taxes simpler and offer bank perks.

- Emergency fund safety: Keep an emergency fund that can cover 3-6 months of expenses. It's a key to feeling secure during surprise situations.

- Strategic benefits: Some banks give you perks for having multiple accounts, such as better interest rates or rewards. This can be very beneficial.

- FDIC Insurance: Spreading your money can protect it up to $250,000 per bank with FDIC insurance. This coverage is per depositor and bank, for each type of account ownership.

Holding several financial accounts, if done wisely, boosts your money smarts, spending discipline, and financial growth. Learning the financial account definition shows it’s not just about storing cash. It's part of a broad strategy for better financial health and security.

Risks Associated with Financial Accounts

Understanding financial accounting meaning is key. It helps recognize risks in financial accounts. These risks range from operational to legal issues. They affect everyone from individual savers to large institutions. Let's look at two major risks in financial accounts.

Overdraft Fees

An overdraft means you spend more than you have, leading to big fees. This can happen due to bad management or unexpected expenses. Not only does it hurt financially, but it can also lower credit scores. This affects your future money options. With default rates expected to rise, close financial watch is essential.

Identity Theft

Identity theft is a major concern for account security. Unauthorized people may access and misuse your financial details. This affects both your present and future money health. Strong cybersecurity and personal vigilance are very important. Even small mistakes can cause huge financial and personal damage. The growing cyber threats demand strong security and constant risk awareness.

These risks highlight what financial accounting meaning really includes. It's about managing money and avoiding pitfalls. Being aware and proactive helps. This ensures financial accounts help us, not harm.

Tips for Maintaining Healthy Financial Accounts

To keep your financial accounts healthy and efficient, adopt good financial habits and tools. In today's world, financial stability is key. Knowing what is a financial account and how to improve it is critical.

Regular Monitoring

Watching your financial accounts closely lets you spot any odd or unexpected activities quickly. This way, you can keep your money safe from fraud and theft. Regular checks are important. They help you compare spending with budgets and track how investments are doing. This prevents surprises in your finances.

Utilizing Financial Tools

Nowadays, financial tools make managing your money easier. They give you a clear view of your finances. Using budgeting apps, investment trackers, and savings calculators helps you make smart choices. These tools not only deepen your understanding of what is a financial account but also guide you through complex financial decisions.

| Strategy | Benefits | Recommended By |

|---|---|---|

| 50/30/20 Budget Rule | Simplifies budgeting by categorizing expenses | Elizabeth Warren |

| Emergency Fund | Covers 3-6 months of living expenses | Financial Advisors |

| Investment Tracking | Monitors growth and diversification | T. Rowe Price Studies |

| Regular Net Worth Review | Tracks financial progress and growth | Economic Analysts |

Good financial habits greatly help your financial health. Staying involved with your finances using advanced tools leads to structure and success. Know and use key principles about what is a financial account to succeed financially.

Conclusion: The Importance of Financial Accounts

Financial accounts play a key role in business and finance management. They make sure money is handled properly. Companies like ExxonMobil use them to make smart decisions. Their balance sheet and income statement show how they manage assets, liabilities, and profits.

For example, ExxonMobil's figures for the fiscal year 2023 are impressive. They had assets worth $376.3 billion and liabilities of $163.8 billion. Their equity was valued at $212.5 billion, with a net income of $36 billion. These numbers highlight the need for financial reports to understand a company's financial health.

Recap on Types and Uses

We've looked at different types of financial accounts. They meet various financial needs. From daily transactions to long-term investments, they are crucial for individuals and businesses. They help manage the financial well-being of companies like ExxonMobil.

Such accounts are central to strategic planning and regulatory compliance. They are also important for oversight by shareholders, investors, and financial institutions.

Final Thoughts on Financial Strategy

Financial experts, investors, and companies gain a lot from understanding financial accounts. ExxonMobil's detailed financial statements showcase the need for deep financial analysis. This knowledge helps in creating effective financial strategies.

Our goal is to make financial data more accessible and understandable. We aim to lead the financial industry towards transparency, efficiency, and accountability. Managing financial accounts well is essential for a company's long-term success and profitability.

FAQ

What is a Financial Account?

A financial account keeps track of business or personal money matters. It helps make accurate balance sheets and income statements. This is key for understanding financial health.

Why are Financial Accounts Important in Personal Finance?

In personal finance, financial accounts let you keep an eye on spending, investments, and savings. They're essential for taxes, planning, and reaching financial goals. They promote wise money management.

What Types of Financial Accounts are There?

Main financial accounts are savings, checking, and investment accounts, plus retirement ones like IRAs and 401(k)s. Each serves different needs like saving money or investing for growth.

What are Some Key Features of Financial Accounts?

Important features include interest rates, which affect fund growth, and fees like monthly maintenance. Understanding these can help you see how they impact your account's value.

How Do You Choose the Right Financial Account?

To find the best financial account, look at your goals and compare account features. Think about interest rates and fees. This helps pick an account that fits your financial plans.

What is Required to Open a Financial Account?

Opening an account usually needs ID, address proof, and sometimes a minimum deposit. Banks might ask for more documents based on the account type and laws.

How Should You Manage Your Financial Accounts?

Manage accounts by keeping track of all transactions. Use budget tools and software to help categorize transactions and oversee account performance.

What are the Benefits of Having Multiple Financial Accounts?

Multiple accounts can spread out your money, reducing risk, and help manage finances. This separation makes tax planning and sticking to a budget easier.

What Risks Are Associated with Financial Accounts?

Financial account risks include overdraft fees and identity theft. To stay safe, use strong online protection and keep an eye on your account movements.

What Are Some Tips for Maintaining Healthy Financial Accounts?

Keep your financial accounts healthy by watching transaction activities closely. Using financial tools can offer extra help with budgeting and keeping tabs on investments.

How do Financial Accounts Factor into Financial Strategy?

Financial accounts are crucial for a solid strategy. They help manage money wisely, ensuring growth, stability, and safety from financial surprises.