What Is A 3 Income Statement Used For | Financial Guide

The 3 income statement combines an income statement, balance sheet, and cash flow statement. This combination creates a powerful framework for financial analysis. It helps stakeholders understand a company's financial health deeply. These financial tools are crucial in today's changing markets and economic uncertainty.

They have been key in financial reporting since the 1929 market reforms. This allows people to evaluate a company's future and investment worth easily. Also, the 3 income statement is required for public companies. It ensures they share their financial status openly with investors.

The connection between these statements is vital. The net income from the income statement shows profits. It also links to the balance sheet and cash flow statement. This shows how depreciation affects net income to get a true cash flow picture. It gives a clear view of how the company operates financially.

The way these statements interact affects various financial aspects. Things like buying equipment or financing decisions impact all three statements. This shows how essential the 3 income statement is for checking a company's health. It helps leaders make informed strategic plans.

Key Takeaways

- The 3 income statement consists of an income statement, balance sheet, and cash flow statement, pivotal for comprehensive financial review.

- Understanding financial statements empowers stakeholders to evaluate company performances with clarity and precision.

- Net income ties the three statements together, reflecting profitability and cash flow positioning.

- Depreciation adjustments and capital expenditure impacts underscore the interconnected nature of financial reports.

- Changes in net working capital and financing events reveal the implications of operational and strategic business decisions.

- Financial modeling and certification such as FMVA enhance an analyst’s capability to construct and interpret complex financial forecasts.

- Adequate preparation, integration, and formatting are critical when creating a robust 3-statement financial model.

Understanding the 3 Income Statement Concept

The 3 statement financial model is key for businesses to showcase and analyze financial well-being. It combines three crucial financial statements: the income statement, balance sheet, and cash flow statement. Each one focuses on different financial areas, offering a full view important for decision-making and analysis.

Definition of a 3 Income Statement

A 3 income statement is a comprehensive financial model. It pulls together vital data from three accounting statements — the income statement, balance sheet, and cash flow statement. This model isn't just about profit. It also highlights a business's stability and cash flow. An income statement shows how well a company is doing by listing revenues and expenses. The balance sheet looks at the company's financial position at a given time. The cash flow statement shows cash movements compared to net income.

Components of the 3 Income Statement

The parts of the 3 statement financial model give deep insights into a company's performance and survival capabilities. Here are the key components explained:

- Income Statement: This starts the analysis, showing revenues, expenses, gains, and losses. It ends with net income, showing profitability within a certain time.

- Balance Sheet: It presents a date-specific snapshot of assets, liabilities, and shareholder equity. It proves that assets must equal liabilities plus shareholders' equity.

- Cash Flow Statement: This breaks down cash movements from operations, investments, and financing. It's essential for checking liquidity and financial health.

Together, these elements form the three major financial statements. They're crucial for investors, regulatory bodies like the U.S. Securities and Exchange Commission (SEC), and others. These stakeholders assess a company's financial strength and operations.

Key Financial Statements Explained

Corporate finance has three main documents to look at. These are the balance sheet, the cash flow statement, and the income statement. Each plays a key part in showing a company's financial status. They help everyone understand a company's financial health.

The Balance Sheet

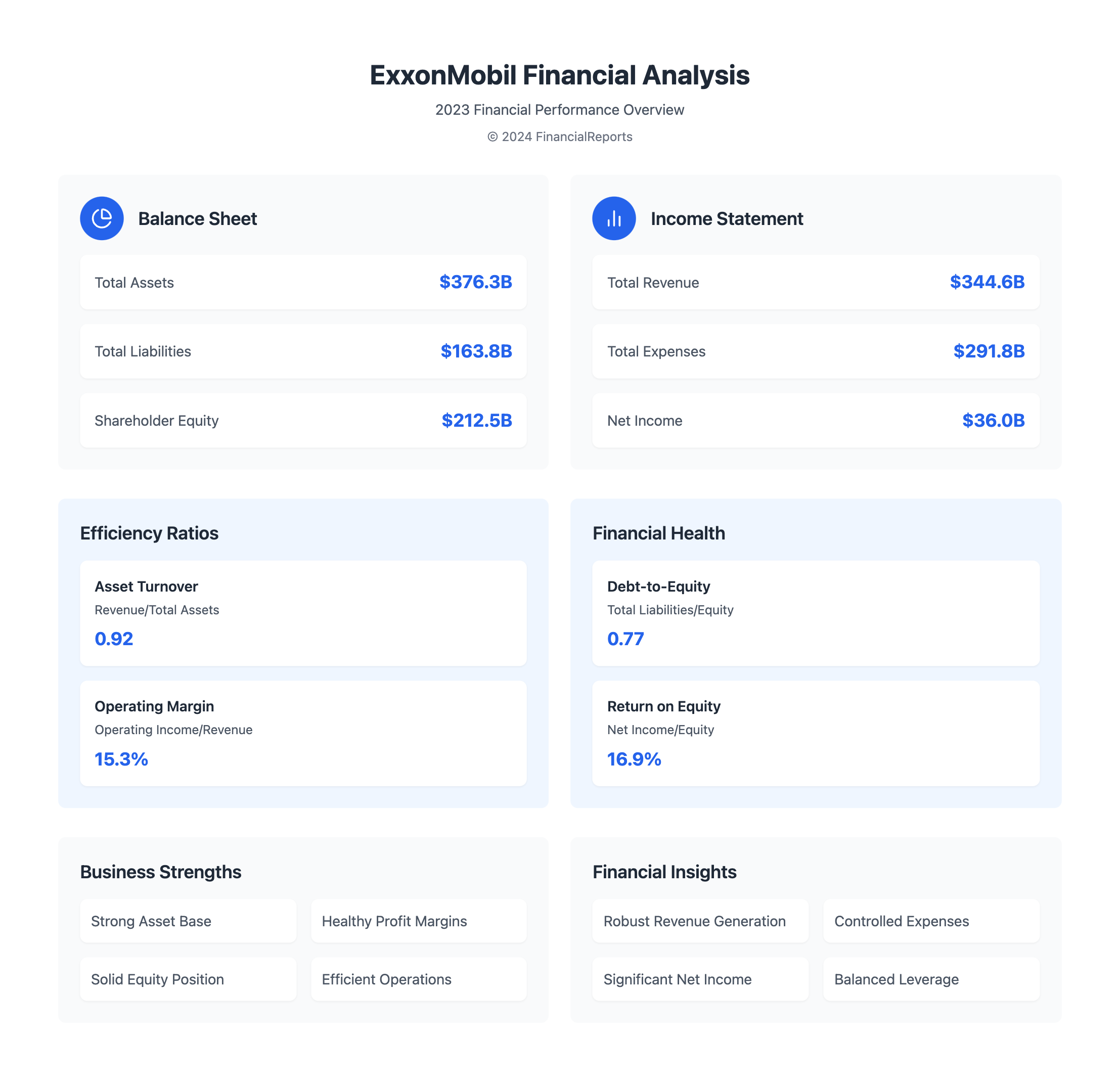

A balance sheet gives a snapshot of a company's finances at a certain moment. It shows what the company owns and what it owes. It also shows how much money shareholders have put in. For instance, at the end of 2023, ExxonMobil Corporation reported having assets worth $376.3 billion and liabilities of $163.8 billion. The shareholders' equity was $212.5 billion. This shows ExxonMobil's strong financial condition, which is important for gaining investors' trust and making business decisions.

The Cash Flow Statement

This document shows how well a company manages its cash. It details cash coming in and going out from different types of activities. It shows if a company can keep growing and stay efficient. In 2023, ExxonMobil's cash flow showed how the company wisely handles its operations and investments. This is essential for planning and making investment choices.

The Income Statement

The income statement, or profit and loss statement, tracks earnings and expenses over time. It shows how profitable a company is. For 2023, ExxonMobil reported revenues of $344.6 billion and expenses of $291.8 billion. This led to a net income of $36 billion. This information is crucial for stakeholders to understand the company's profit-making ability and cost management.

| Financial Statement | 2023 Totals (in billions) |

|---|---|

| Assets | $376.3 |

| Liabilities | $163.8 |

| Shareholder Equity | $212.5 |

| Revenue | $344.6 |

| Expenses | $291.8 |

| Net Income | $36.0 |

These three key financial statements offer a full view of a company's finances. They are vital for keeping operations transparent, staying compliant, and making good strategic choices. They form the basis of a solid financial model. This model is used for accurate financial forecasting and analysis.

Purpose of the 3 Income Statement

The 3 Income Statement is key for managing businesses wisely. It helps in checking financial health, analyzing business performance, and making investment choices. This tool looks at different parts of a company's finances. It gives important information to people involved.

Financial Analysis

Using the 3 Income Statement for financial analysis is very helpful. It lets businesses dive into their financial information. They can understand how profitable they are and how efficiently they operate. Starting with revenue and ending with net income helps measure financial well-being accurately. This deep analysis is good for spotting trends and planning smart moves.

Performance Tracking

Tracking business performance with the 3 Income Statement is a big advantage. It shows the financial status now and how it’s changing. Looking at net profit, operating costs, and gross profit helps see if business plans are working. This is key for improving how a business does over time.

Investment Evaluation

For investors, the 3 Income Statement is very important. It breaks down the money made from doing business, financial events, and decisions by management. They look at things like earnings per share and dividends to guess future gains. So, it's essential for deciding on investments and planning market strategies.

| Financial Statement | Role in Financial Analysis | Importance in Investment Decision-making |

|---|---|---|

| Income Statement (I/S) | Tracks revenue to net income progression | Assesses profitability to forecast dividends and earnings |

| Cash Flow Statement (CFS) | Reconciles net income with cash inflows and outflows | Understands liquidity and cash management effectiveness |

| Balance Sheet (B/S) | Snapshot of assets, liabilities, and equity | Evaluates capital structure and financial stability |

The 3 Income Statement, with other financial statements, is central to detailed financial examination and smart financial management in companies. By using the information from these papers, firms can navigate the current market. They can also create strategies for better performance and profit in the future.

Detailed Breakdown of the Income Statement

An in-depth look at an income statement can tell us a lot about a company's financial health. It helps in making smart choices for the business. We start by looking at revenue, go through expenses, and end with net income analysis.

Revenue Recognition

Understanding how a company makes money starts with revenue recognition. It's the very beginning of the financial story. This part makes sure that the revenue reported is correct and follows the rules. Knowing about revenue helps us see if a business can grow and be strong financially.

Expense Classification

Managing expenses well depends on knowing exactly what the expenses are for. Income statements show expenses by type, like cost of goods sold and operational expenses. Looking closely at each type helps keep costs in check. This makes the budget work better and improves financial results.

Net Income Calculation

Net income shows how profitable a company is. It's found by subtracting total expenses from total revenue. Looking at net income tells us if a company is doing well financially. It's important for people outside the company and those running it who want to know about profits and dividends.

| Company | Total Revenue | Total Expenses | Net Income |

|---|---|---|---|

| Coffee Roaster Enterprises Inc. | $57,050.68 | $11,049.55 | $20,000.13* |

| Dead Simple Coffee Inc. | $57,833.72 | $8,299.22 | $10,899.69 |

*Note: The net income for Coffee Roaster Enterprises Inc. includes some extra math. This could be due to possible business changes or updates in reporting.

Breaking down an income statement into parts like revenue, expenses, and net income helps businesses improve. It allows for better strategies, more profit, and attracts investors. These details help financial experts guide companies to keep growing and stay financially strong.

Importance in Business Decision-Making

A 3 income statement deeply impacts strategic business choices. It lays a solid groundwork for budgeting and planning finances. It's key in strategic planning, helping set corporate aims and spot growth chances. It also drives better operations by closely looking at expenses and earnings.

Budgeting and Forecasting

A 3 income statement plays a huge role in budgeting. It lets financial managers foresee a firm's financial health. This foresight is crucial for planning budgets and deciding on resources for future periods. Comparing planned budgets against real results helps businesses adjust swiftly to market changes.

Strategic Planning

Good business decisions come from deep dives into a 3 income statement. It aids leaders in predicting financial outcomes, shaping long-term strategies. These strategies may include entering new markets or changing pricing. They could also involve considering mergers or acquisitions.

Operational Efficiency

The 3 income statement analysis leads to better operations too. It allows management to spot spending inefficiencies across various departments. Finding where to cut costs can boost profits. This careful look at operations helps align costs with company strategies and market demands.

| Financial Aspect | Role in Decision-Making | Impact on Business Strategy |

|---|---|---|

| Revenue Tracking | Identifies growth areas and underperforming segments | Guides market expansion and product enhancement strategies |

| Expense Management | Highlights cost-saving opportunities | Informs operational adjustments and efficiency improvements |

| Profitability Analysis | Benchmarks against industry standards | Supports pricing strategy and competitive positioning |

How to Interpret a 3 Income Statement

Understanding a three-part income statement is vital. It involves looking at financial performance, profit margins, and trends over time. These parts give us a clear view of a company's business results and plans for the future.

Analyzing Profit Margins

Checking a company's financial health requires looking at profit margins. For example, Coffee Roaster Enterprises Inc.'s data shows important performance numbers. Their Gross Profit Margin for the year ending Dec. 31, 2018, was 56%. This tells us how well they make and price their products.

The Operating Profit Margin compares operating income, $21,016.34, to total revenue, $57,050.68. It shows the company's operational efficiency and how well it controls costs.

Understanding Trends and Patterns

Seeing financial trends helps with planning and forecasting. Looking at profit margins over time can show changes. These changes may point to upcoming challenges or chances in the market.

For instance, a constant drop in operating profit margin could mean increasing costs or decreasing sales. This would require a strategic rethink.

| Year | Total Revenue | Gross Profit | Operating Income | Net Income |

|---|---|---|---|---|

| 2018 | $57,050.68 | $32,065.89 | $21,016.34 | $6,016.34 |

| 2019 | $4,358,100 | $1,619,386 | $765,227 | $483,232 |

The table shows how comparing finances over years can reveal key insights. From 2018 to 2019, Coffee Roaster Enterprises Inc. saw big revenue and net income increases. This suggests they adapted well to market needs and improved their operations.

Analyzing a three-part income statement this way helps give recommendations. These can help a company grow and increase value for shareholders.

Common Uses in Various Industries

The 3 income statement is very useful in many areas. It's used everywhere from big companies to important charities. They use it to make sure they follow the financial rules of their industry financial practices, for both internal and outside needs.

Small Business Applications

Small companies really need a 3 income statement to build good small business financial strategies. It helps them keep track of money, control cash flows, and make smart choices. These decisions help them grow and stay strong. This statement also makes it easier to understand key financial numbers, like profit margins. This is crucial for knowing if the business is doing well.

Corporate Financial Reporting

In the business world, corporate reporting standards demand clear and precise financial records. The 3 income statement meets these needs by showing all aspects of a company's finances. This includes income, costs, and other expenses. This detailed report helps businesses attract money, reduce risks, and plan for the future. It makes sure companies are clear and responsible about their finances.

Nonprofit Organizations

Charities use the 3 income statement to manage their funds better. It shows they're being open about their finances to those who donate and support them. This openness builds trust and helps make sure they keep getting support. It clearly shows money spent and made, making it easier to focus on their main goals. It also makes sure they meet the standards donors and laws set.

In all these fields, customizing the income statements shows a deep knowledge of the specific industry financial practices. This proves how important and flexible the 3 income statement is in managing finances.

Tools for Analyzing a 3 Income Statement

Financial experts use robust tools to analyze a three-statement income model properly. This ensures the results are accurate and insightful. This approach makes financial analysis simpler and more effective.

Spreadsheet Software

Spreadsheet analysis in financial models heavily relies on programs like Microsoft Excel. Excel is key for organizing data across various financial statements. It handles complex calculations, making it ideal for financial professionals.

Financial Analysis Tools

Special financial modeling tools are made for tasks like forecasting and valuation. They have advanced features for analyzing financial performance and risks. Oracle’s Hyperion and IBM Cognos, for example, let experts create detailed models and simulations.

Accounting Software

Accounting systems lay the groundwork for accurate financial statements. QuickBooks and SAP ERP ensure transactions are recorded correctly. They help integrate financial data to show an organization's current financial state.

Advanced spreadsheet software, specialized financial modeling tools, and robust accounting systems are key for analyzing a three-statement income model. They offer deep insights and help financial professionals make precise decisions.

Limitations of a 3 Income Statement

The 3 Income Statement offers detailed insights but has its flaws. Main issues come from how it can be misunderstood and the different accounting methods used. These make it hard for people trying to figure out a company's finances just by looking at income statements.

Potential Misinterpretations

One big problem is how some numbers are just best guesses. These estimates greatly impact the financial reports. Because of this, it's very important for readers to look deeper. They need to understand that these guessworks can show a company's finances differently than they are.

Variability in Accounting Methods

Different places and industries use different accounting rules. This makes it hard to compare companies or different time periods. For example, how a company handles costs like depreciation, inventory values, or how it records sales can change its financial reports a lot.

| Accounting Method | Implication on Financial Reporting | Common Adjustment Requirement |

|---|---|---|

| Depreciation (Straight Line vs. Accelerated) | Variation in reported expenses and asset values | Adjusting for investment analysis comparisons |

| Inventory Valuation (FIFO vs. LIFO) | Differences in reported COGS and ending inventory | Normalization for consistent gross profit margins across periods |

| Revenue Recognition (Over Time vs. At Point of Sale) | Timing differences in revenue reporting | Reconciliation for performance measurement |

This shows why being very careful and using standard ways to compare data is crucial. It points out the financial statement limitations. It also shows why a smart approach to interpreting financial statements is necessary.

Real-World Examples of 3 Income Statements

Exploring real-world case studies in finance shows how income statements work. They reveal the statement's structure and its key role in financial planning and strategy. This is true across various sectors.

Case Study of a Tech Company

Tech companies use income statements to show big research and development spends. These documents highlight the journey of tech products from idea to sellable item. They cover costs like getting patents and making prototypes.

Tech firms often have big earnings from non-regular sources. This includes money from licensing patents or selling technology just once. These earnings are vital for those watching the company's financial health and innovation success.

Financial Insight from a Retail Business

Retail businesses analyze revenue through income statements. This gives a clear picture of how well they manage inventory. It shows how sales events or promotions affect profits.

They closely watch gross profit and operating income. These figures help investors and managers see how responsive customers are and how well costs are controlled.

| Financial Metric | Tech Company | Retail Business |

|---|---|---|

| Research & Development Expenses | $4.5 million | N/A |

| Patent Income | $1.2 million | N/A |

| Inventory Turnover | Not Applicable | 8 times per year |

| Gross Profit Margin | 56% | 30% |

| Sales Revenue | $50 million | $75 million |

| Seasonal Sales Impact | Low | High |

Using case studies in finance well helps companies and financial pros get great insights. They learn more from income statements. This guides decisions on capital spending and operational changes.

Best Practices for Creating a 3 Income Statement

For those in the financial field, making detailed and accurate financial models is key. Creating a 3 income statement is crucial. This combines the Income Statement, Balance Sheet, and Cash Flow Statement over five years. Best practices in making financial statements show a dedication to clear financial reporting. They also make these documents more useful in big decisions.

Consistency in Reporting

Being consistent in reporting these 3 statements is very important. It helps in comparing data over time. Every forecast, like revenue growth or days receivables, should be based on past financial data. This increases their future accuracy. It's also vital to check how data from different statements relate. This ensures that our conclusions, like how lowering costs affects profit, are correct.

Regular Updates and Reviews

The world of finance always changes, so financial models must be updated regularly. Updating models helps quickly adjust to market shifts. Being good at Excel and making quick, sensible guesses are essential skills here. They allow for immediate updates to costs and projections. Setting up regular checks ensures a model stays useful and insightful.

FAQ

What is a 3 income statement used for?

A 3 income statement is used to analyze a company's financial health. It shows how well the business is doing. This helps in making investment choices and looking at profitability and operational efficiency.

Can you define a 3 income statement?

A 3 income statement includes three key financial statements. It provides a deep look at a company's financial situation. This way, you can see the company's activities, position, and cash flow over time.

What are the components of a 3 income statement?

The components are the income statement, balance sheet, and cash flow statement. The income statement covers revenue and expenses. The balance sheet shows assets, liabilities, and equity. The cash flow statement checks the cash coming in and out.

What does the balance sheet show?

The balance sheet shows a company's assets and what it owes. It also includes the equity of shareholders. This provides a snapshot of the company's financial worth at a certain time.

How does the cash flow statement serve a business?

The cash flow statement shows how well a business can generate cash. This cash pays debts, funds operations, and allows for investments. It's vital for understanding the actual cash used and created.

Why is the income statement important?

The income statement is key for showing a company's profit. It subtracts expenses from revenues. This gives insight into how well the company can make money from its operations.

How is the 3 income statement used for investment evaluation?

The 3 income statement helps investors understand a company's financial performance. It shows profitability, liquidity, and growth potential. This comprehensive model aids in making well-informed decisions.

What is the role of revenue recognition in the income statement?

Revenue recognition determines when to record revenues. It's crucial for accurately measuring performance. This ensures profit is calculated correctly.

How does expense classification benefit a business?

Classifying expenses lets businesses manage costs better. It helps in tracking spending. This can lead to cost cuts or better operations.

Why is net income calculation critical?

Net income calculation is essential for showing profit after all costs, including taxes. It's a major measure of a company's financial success.

What are the implications of a 3 income statement for budgeting and forecasting?

The 3 income statement supports budgeting and forecasting. It offers data to set financial goals and plan operations. This helps businesses make smart, strategic choices.

How can strategic planning benefit from a 3 income statement?

Strategic planning gains from the 3 income statement. It provides financial insights for growth planning and resource use. This shapes competitive strategies.

Why is operational efficiency tied to the 3 income statement?

The 3 income statement shows where efficiency can improve. It tracks revenue and expense trends. This helps businesses increase profitability.

How should one analyze profit margins using a 3 income statement?

Analyze profit margins by looking at revenue versus expenses. This shows how well costs are controlled. It helps understand the profit from products or services.

Why is it essential to understand trends and patterns in financial data?

Understanding financial trends helps spot issues or opportunities. This guides adjustments to improve financial health.

How are a 3 income statement and its applications different for small businesses compared to large corporations?

Small businesses use the 3 income statement for basic financial tracking. Large companies face more complex standards. They use it for deeper analysis and strategy.

In what ways do nonprofit organizations use the 3 income statement?

Nonprofits use the 3 income statement for resource management and accountability. It shows their financial stability to donors and stakeholders.

What tools are available for analyzing a 3 income statement?

Tools range from Excel to advanced forecasting software. There are also accounting systems for detailed financial reporting.

What are the limitations of a 3 income statement?

The 3 income statement can have issues due to accounting estimates and method differences. Complex financial data might be misunderstood.

Can you give examples of how a 3 income statement is used in different industries?

In tech, it may focus on R&D and patent profits. In retail, it looks at inventory and sales. Industries tailor it to their needs.

What are the best practices for creating a 3 income statement?

Keep consistent in accounting and reporting. Regularly update and review for accuracy. Include audits and benchmarking for better reliability and understanding.