Unlock the Secrets of Share Market Investing

To succeed in the stock market, you need to understand how to invest in shares. The right knowledge and strategies can lead to financial freedom. Long-term success comes from disciplined strategy and a deep understanding of the market.

Learning about stock trading is key. This includes day trading, swing trading, and long-term investing. These skills help make informed decisions. By learning about the share market, you can navigate it better.

Introduction to Share Market Investing

Investing in stocks can seem hard, but with the right tools, you can succeed. Books, websites, online brokers, and courses can help. Knowing how to invest is vital for making smart choices and reaching your financial goals.

Key Takeaways

- Developing a long-term investment strategy is key for success in stock trading.

- Diversification is essential for managing risk when investing in stocks.

- Technical and fundamental analysis are powerful tools for identifying trends and making informed investment decisions.

- Knowing when to buy and sell stocks based on market trends is critical for success in stock trading.

- Resources such as books, websites, online brokers, and courses are available to help individuals learn how to learn share market and understand stock exchange education.

- A complete guide to navigating the stock market can help investors achieve financial freedom and unlock the secrets of share market investing.

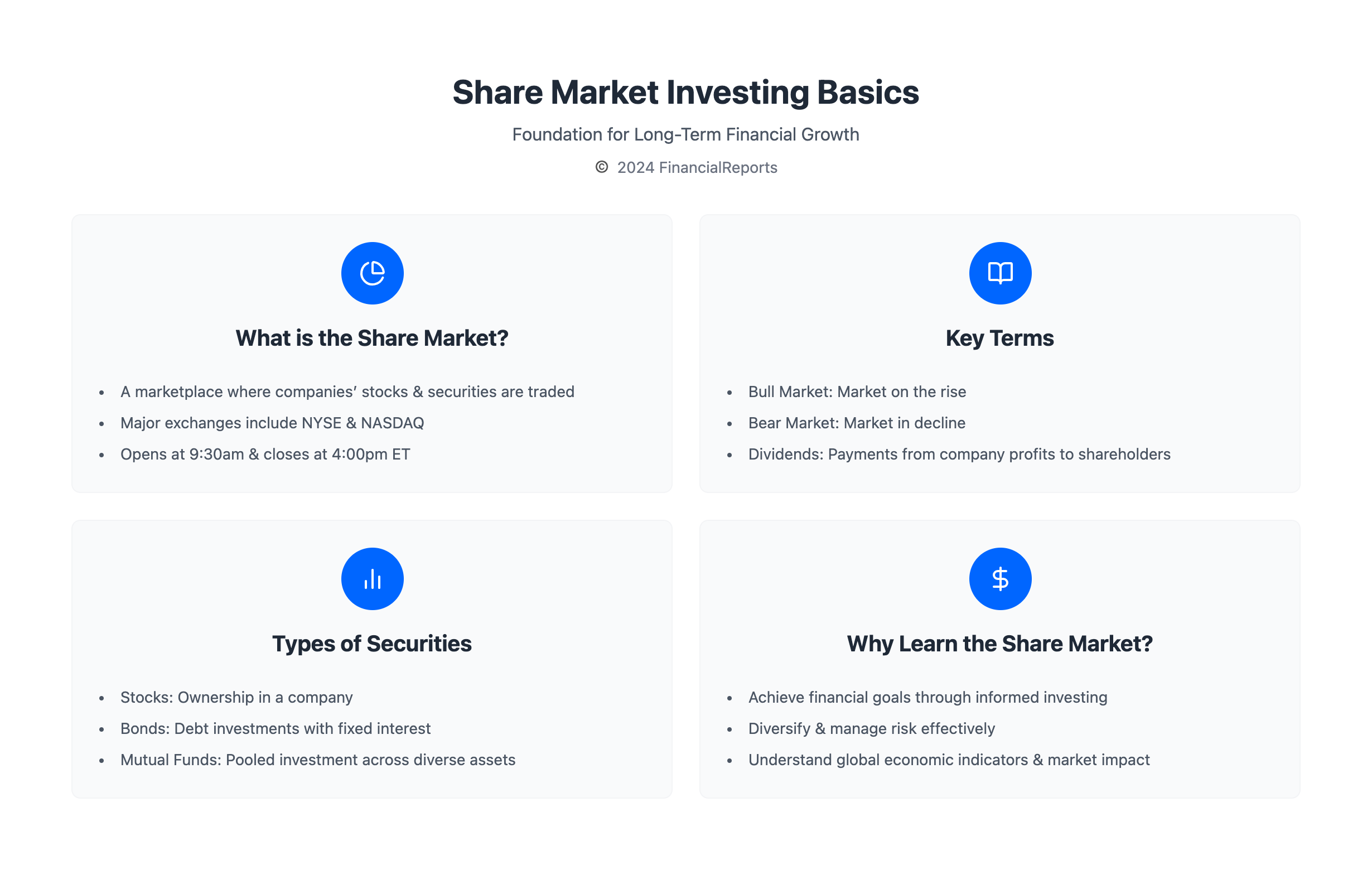

Understanding the Share Market Basics

To get into share market investing, you need to know the basics. This means learning about stock market trends and getting a good stock exchange education. The share market, or stock market, is where companies raise money by selling shares to the public.

What is the Share Market?

The share market is a place where people buy and sell shares of companies. The New York Stock Exchange (NYSE) and the Nasdaq are big names in this world. They open at 9:30 a.m. and close at 4 p.m. Eastern time.

Key Terms Every Investor Should Know

When you study the stock market, there are important terms to learn. Here are a few:

- Bull market: a time when the market keeps growing

- Bear market: a time when the market keeps falling

- Dividends: money companies pay to their shareholders

Types of Securities Traded

The share market has different types of securities. Stocks are like owning a piece of a company. Bonds are like loans to companies. Mutual funds mix money from many investors to buy different securities.

| Security Type | Description |

|---|---|

| Stocks | Represent ownership in companies |

| Bonds | Represent debt obligations |

| Mutual Funds | Pool money from many investors to buy securities |

Importance of Learning the Share Market

Learning the share market is key for those aiming to grow their wealth through investments. It helps make smart choices and reach financial targets. Stock exchange education lays a solid base for a career in finance and boosts financial knowledge.

Some key benefits of learning the share market include:

- Diversifying investment portfolios to spread risks and earn profits

- Keeping an eye on economic indicators to make well-informed investment decisions

- Developing a deeper understanding of financial concepts, investment options, and market dynamics

Those who learn the share market gain valuable insights into business and finance. They can set clear goals and manage their finances well. With the right education, they can confidently navigate the stock market and make smart choices for their financial future.

| Investment Option | Risk Level | Potential Return |

|---|---|---|

| Stocks | High | High |

| Bonds | Low | Low |

| Mutual Funds | Moderate | Moderate |

Getting Started with Share Market Education

To start learning about the share market, it's key to know the basics of stock exchange education. You'll learn about stocks, bonds, and mutual funds. Begin with online courses or webinars that introduce the share market.

Some great resources for beginners include:

- Online courses on platforms like Coursera or Udemy

- Books on investing, such as "A Random Walk Down Wall Street" or "The Intelligent Investor"

- Joining investment clubs or online forums to connect with other investors

Using these resources, you can understand the share market better. Learning how to study share market trends helps make smart investment choices. With the right education, anyone can start investing and work towards their financial goals.

| Resource | Description |

|---|---|

| Online Courses | Introduction to share market basics and investing strategies |

| Books | In-depth guides to investing and share market analysis |

| Investment Clubs | Opportunities to connect with other investors and learn from their experiences |

Developing a Basic Investment Strategy

To start with a basic investment strategy, you need to know your goals, how much risk you can handle, and spread out your investments. When you're learning about the share market, think about what you want to achieve and how much risk you're okay with. Getting educated on the stock exchange is key to making smart choices.

First, you must set clear investment goals. This means figuring out what you want to get from your investments, like saving for retirement or a house. Next, understanding your risk tolerance is important. It shows how much risk you're ready to take on.

Defining Your Investment Goals

Setting your investment goals can be done by looking at your financial situation, how long you can invest, and what you prefer.

Having a diverse portfolio is key to reducing risk and increasing returns. This means investing in different things like stocks, bonds, and mutual funds. Learning about the stock exchange helps you see why diversification is good. It lowers risk and can lead to better growth over time. By learning about the share market and setting up a basic strategy, you can make smart choices and reach your financial goals.

Some important things to think about when creating a basic investment strategy include:

- Setting clear investment goals

- Assessing risk tolerance

- Diversifying a portfolio

- Understanding the importance of stock exchange education

- Learning how to learn share market

Analyzing the Market

To do well in the stock market, you need to know how to study trends and get a good education in stock exchange. You must use different methods, like fundamental and technical analysis. Fundamental analysis looks at a company's financials, management, and industry trends to find its true value. Technical analysis, on the other hand, studies charts and patterns to guess future prices.

Fundamental Analysis Techniques

Fundamental analysis checks a company's financial health, management, and industry trends. It looks at financial statements to see a company's income, expenses, and profits. With a solid education in stock exchange, investors can make smart choices and feel confident in the market.

Technical Analysis Explained

Technical analysis studies charts and patterns to forecast future prices. It uses tools like moving averages and Bollinger Bands to spot trends. By mixing technical and fundamental analysis, investors can get a full view of the market. This helps them learn more and increase their chances of winning in the stock market.

Understanding Different Investment Options

Investors in the share market have many options to choose from. Each option has its own benefits and characteristics. It's key to understand stock exchange education to navigate these choices well.

Options like stocks, bonds, and mutual funds are common. They offer growth, income, and diversification. For instance, stocks let you share in a company's growth and get dividends. Bonds give regular interest and are generally safer.

Stocks, Bonds, and Mutual Funds

These are the basics of a portfolio. Stocks can grow over time, while bonds offer steady income. Mutual funds mix money to invest in various stocks, bonds, or securities.

Exchange-Traded Funds (ETFs)

ETFs are also popular. They offer a mix of stocks, bonds, or other securities. You can buy and sell them like stocks, any time during the day.

Real Estate Investment Trusts (REITs)

REITs let you invest in real estate without owning properties. They help diversify your portfolio and can earn rental income or dividends.

Knowing about these options helps you build a diverse portfolio. With the right education, you can confidently invest in the share market. This way, you make choices that fit your financial goals and risk level.

Choosing a Brokerage Firm

Investing in the share market means picking the right brokerage firm. It's key to learn how to study share market and understand stock exchange education. You need a reputable and reliable firm to guide you.

Many top brokers, like Interactive Brokers, Charles Schwab, and Fidelity, offer free stock and ETF trades. This makes starting easier. They also have various account types, such as individual and retirement accounts, for different needs.

When choosing a brokerage firm, think about these things:

- Types of accounts offered

- Fees and commissions

- Trading platforms and tools

- Customer support and education resources

Research and compare different firms to make a smart choice. Find one that fits your investment goals and needs. This will help you succeed in the share market with good stock exchange education.

Implementing Your Investment Plan

To start your investment plan, learning about the share market and stock exchange is key. This knowledge helps you make smart choices and reach your financial goals. First, set up a virtual trading account. It lets you practice with fake money and test your strategies.

When you make your first trade, think about your risk level, goals, and market trends. Use tools like moving averages and trading volume to guide your decisions. Also, knowing the P/E ratio and EPS helps you understand stock value and company profits.

Some important steps for your investment plan include: * Setting up a virtual trading account to practice trading * Making trades based on your strategy and risk level * Keeping an eye on your investments to adjust your portfolio * Staying informed about market trends and economic indicators

By following these steps and learning more about the share market, you can put your investment plan into action. Always remember to manage risks and keep up with market trends for long-term success.

| Investment Strategy | Risk Tolerance | Investment Goals |

|---|---|---|

| Conservative | Low | Long-term growth |

| Moderate | Medium | Balance of growth and income |

| Aggressive | High | Short-term gains |

Learning from Real-Life Success Stories

Learning about the stock market can seem tough. But, real-life success stories offer valuable insights and motivation. For instance, Tim Grittani made nearly $8.7 million through trading.

Understanding discipline and patience is key to a good trading strategy. Many successful traders, like Mark Croock, who made $1.3 million, stress the importance of quick loss cuts and goal focus.

Here are some key lessons from successful traders:

- Developing a mathematical approach to trading

- Using various indicators and strategies to inform trading decisions

- Setting stop loss orders to minimize losses

- Staying disciplined and patient in the face of market volatility

By studying successful traders, you can learn a lot about the stock market. Whether through online courses, books, or mentorship, real-life success stories are a great starting point for trading success.

| Trader | Profits | Winning Percentage | Average Profit per Trade |

|---|---|---|---|

| Tim Grittani | $8.7 million | 55% | $1,000 |

| Mark Croock | $1.3 million | 60% | $500 |

| Kyle Williams | $114,000 | 58% | $457 |

Staying Informed About Market Trends

To make smart choices in the share market, knowing the latest trends is key. Follow financial news from trusted sources like CNN, BBC, and The New York Times. Also, use tools like Google News and AP News for insights. It's important to understand economic indicators like inflation, unemployment, and GDP growth.

Start by learning how to learn share market basics and why stock exchange education matters. By keeping up with trends, you can confidently navigate the market. Key points to remember include:

- Following financial news and analysis from reliable sources

- Utilizing investment tools and software

- Understanding economic indicators

By keeping these tips in mind, you can make better decisions and reach your investment goals. Whether you're new to how to learn share market or looking to deepen your stock exchange education, staying informed is vital for success.

| Source | Description |

|---|---|

| CNN | 24/7 news coverage |

| Google News | News aggregator |

| The New York Times | Reliable news source |

Managing Your Portfolio

Managing your portfolio well is key to reducing risk and boosting returns. It's important to check your investments often. Look at the price-to-earnings (P/E) ratio, dividend yield, earnings growth, and the company's financial health. Learning how to study stock market trends and keeping up with stock exchange education helps a lot.

A good portfolio mixes different types of investments. This includes big, medium, and small companies, cash, bonds, mutual funds, and ETFs. For instance:

- Large cap companies have total stock market values of approximately $10 billion or more.

- Mid cap companies have market capitalizations of $2 billion to $10 billion.

- Small cap companies have market values under $2 billion.

It's wise to rebalance your portfolio at least once a year. This keeps it in line with your long-term financial goals. By watching your portfolio and making smart choices, you can tweak your strategy. This helps you reach your investment targets.

| Investment Type | Market Value | Risk Level |

|---|---|---|

| Large Cap | $10 billion+ | Lower |

| Mid Cap | $2-10 billion | Medium |

| Small Cap | Higher |

Preparing for Market Volatility

As the financial markets face ups and downs, it's key for investors to be ready. Knowing about market cycles and having plans for down times can reduce risk. This helps in reaching your long-term investment goals.

Keeping calm during market storms is vital. Don't rush into decisions out of fear or panic. Stick to your long-term plan. Try using dollar-cost averaging, where you invest the same amount regularly, no matter the market.

Also, check and rebalance your portfolio often. This makes sure it fits your risk level and financial goals. Spread your investments across different types to lessen the effect of market ups and downs. Talk to a financial expert to create a plan that suits you.

FAQ

What is the share market?

The share market, also known as the stock market, is where companies' stocks and other securities are traded.

What are the key terms every investor should know?

Key terms include bulls (those who think the market will rise) and bears (those who think it will fall). Dividends are payments to shareholders. Market capitalization is the total value of a company's shares.

Why is it important to learn about the share market?

Learning about the share market can help you grow your wealth. It can lead to financial independence and security. It also helps you understand the economic impact of stock markets.

What resources are available for beginners to learn about the share market?

Beginners can use online courses and webinars. They can also read books and join investment clubs. These resources help deepen understanding of the share market.

How do I develop a basic investment strategy?

First, define your investment goals. Then, assess your risk tolerance. Lastly, understand the importance of diversification.

What are the different analysis techniques for the share market?

There are two main techniques. Fundamental analysis looks at a company's financial health and future prospects. Technical analysis studies market trends and patterns.

What are the different investment options available in the share market?

Options include stocks, bonds, mutual funds, ETFs, and REITs. Each offers different ways to invest.

How do I choose the right brokerage firm?

Look at the types of accounts they offer. Consider their fees and commissions. Compare different online brokerages to find the best fit.

How do I implement my investment plan?

Start by setting up a virtual trading account. Then, execute your first trade. Always keep an eye on your investments.

What can I learn from real-life success stories and failures?

Studying successful investors and market experts can teach you a lot. It helps you avoid common mistakes and learn from others' experiences.

How can I stay informed about market trends?

Follow financial news and analysis. Use investment tools and software. Understand key economic indicators to stay updated.

How do I manage my investment portfolio?

Regularly review your investments. Rebalance your portfolio as needed. Make informed decisions on when to sell.

How can I prepare for market volatility?

Understand market cycles and develop strategies for down markets. Stay emotionally resilient in your investing approach.