Unlock Profitable Stock Trading: Start Now

To succeed in stock trading, you need to know how it works. The stock market is where people buy and sell stocks on different exchanges. Knowing how stocks work helps you make smart investment choices. Trading stocks comes with risks, but with the right skills, you can succeed.

Learning the basics of stock trading is key. A diverse portfolio can lower the risk of big losses. By following a disciplined trading approach, you can boost your chances of success. This includes understanding how to evaluate a trade and set entry and exit points.

Key Takeaways

- Understanding the stock market and how to trade stocks is essential for success.

- A diversified portfolio can help reduce risk and increase possible returns.

- Evaluating stock trading setups and managing risk are critical for profitable trading.

- Knowing how does stocks work and how do stocks work helps in making informed investment decisions.

- A disciplined approach to stock trading, including setting entry and exit points, can increase chances of success.

- Stock trading requires a deep understanding of the markets, trading strategies, and risk management techniques.

- Successful stock trading involves a combination of knowledge, skills, and experience, as well as a thorough understanding of stock trading principles.

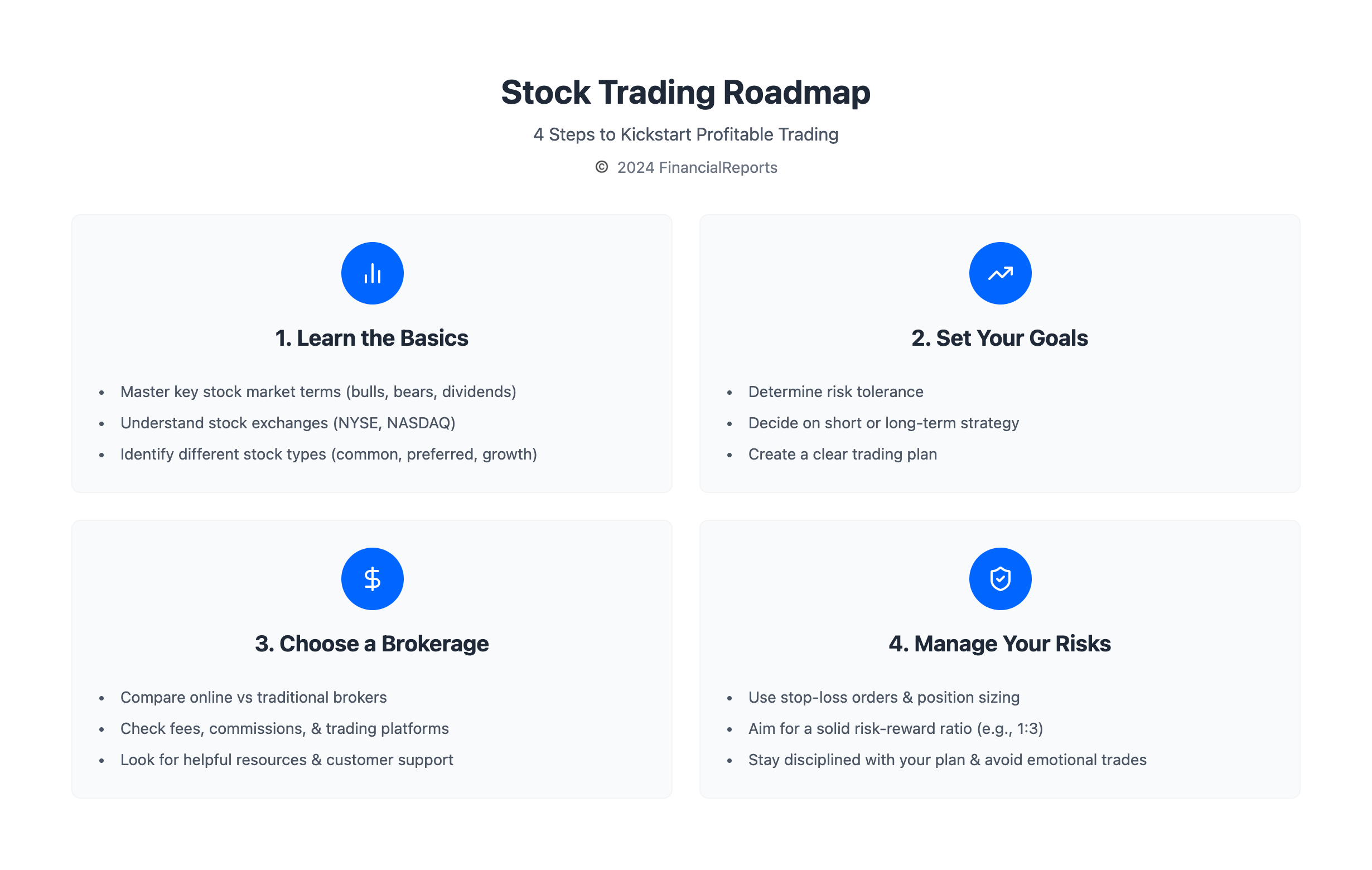

Understanding the Stock Market Basics

To start trading stocks, you need to know the basics of the stock market. It might seem tough at first, but with the right info, anyone can begin. First, learn important terms like bulls and bears, which describe market trends. Knowing these terms helps you make smart investment choices and improve at trading.

There are different kinds of stocks, like common, preferred, and growth stocks. Each has its own features and benefits. For instance, common stocks let you own part of a company and vote on important decisions. Preferred stocks offer a higher claim on earnings but don't give voting rights. Understanding these differences is key to growing your investment portfolio.

Stock exchanges, like the New York Stock Exchange (NYSE) and NASDAQ, are where you buy and sell stocks. They're open from 9:30 a.m. to 4 p.m. Eastern Time. Knowing how to use these exchanges helps beginners start their investment journey and get better at trading.

| Stock Exchange | Hours of Operation |

|---|---|

| NYSE | 9:30 a.m. - 4 p.m. ET |

| NASDAQ | 9:30 a.m. - 4 p.m. ET |

By grasping the basics of the stock market, beginners can start their investment journey. With practice and patience, anyone can become a skilled stock trader and investor.

Setting Your Trading Goals

To succeed in the stock market, it's key to learn how to trade stocks and set clear goals. You need to know your risk level and create a trading plan that matches your goals. Learning to trade stocks shows you how important it is to have realistic goals for a profitable strategy.

Understanding your risk tolerance is a big step in setting your goals. This means looking at your financial situation, investment experience, and how comfortable you are with risk. Knowing your risk tolerance helps you learn how to study stock trade and find a strategy that fits you. For instance, if you're not comfortable with risk, you might choose long-term investing. But if you're okay with risk, you could try short-term trading.

When setting your trading goals, consider these things:

- Define what you want from your investments, like keeping your money safe or growing it.

- Know your risk tolerance and adjust your strategy to fit it.

- Make a trading plan that shows how you'll enter and exit trades, how big your positions will be, and how you'll manage risk.

By taking these steps and learning about stock market trading, you can create a successful strategy. This strategy will match your goals and risk tolerance.

| Trading Goal | Risk Tolerance | Strategy |

|---|---|---|

| Capital Preservation | Low | Long-term investing |

| Growth | Medium | Short-term trading |

| Aggressive Growth | High | Day trading or swing trading |

Creating a Trading Plan

To start trading stocks, you need a trading plan. A good plan sets clear goals, like increasing your portfolio by 15% in a year. It's important to know the market and how much risk you can take.

Your plan should cover risk management, how big your trades are, and how you'll manage them. Aim for a 1:3 risk-reward ratio and risk no more than 2% of your capital per trade. This way, you can tailor your plan to fit your trading style.

When making a trading plan, consider these points:

- Set clear goals and objectives

- Understand your risk tolerance and capital

- Choose a trading style that fits you

- Determine when to enter and exit trades

By following these steps and learning from your experiences, you can create a solid trading plan. This will help you succeed in the stock market.

| Trading Style | Description |

|---|---|

| Position Trading | Long-term trading, holding positions for weeks or months |

| Swing Trading | Medium-term trading, holding positions for days or weeks |

| Day Trading | Short-term trading, holding positions for minutes or hours |

| Scalping | Very short-term trading, holding positions for seconds or minutes |

Choosing the Right Brokerage

When you start share trading, picking the right brokerage is key. This choice can greatly affect your trading journey and success. Knowing who the traders are in the stock exchange helps you understand the different broker types and their services.

In the stock and share market, you'll find various brokers. Online brokers like Interactive Brokers, Charles Schwab, and Fidelity offer free trades on stocks and ETFs. This makes it simpler for traders to begin. Traditional brokers, though, might provide more personal service but charge more.

When picking a broker, think about fees, commissions, and trading platforms. You can open different types of accounts, like standard taxable accounts or IRAs. Top brokers in 2024, like Public, Robinhood, and E*TRADE, have different fees and account needs. It's important to compare them before deciding.

Some important things to look at when choosing a brokerage include:

- Commission-free trades on stocks and ETFs

- No minimum account requirements

- Low fees for options and futures trades

- User-friendly trading platforms

- Quality of customer support and education resources

By carefully looking at these points and thinking about what you need, you can make a smart choice. This will help you succeed in the stock and share market.

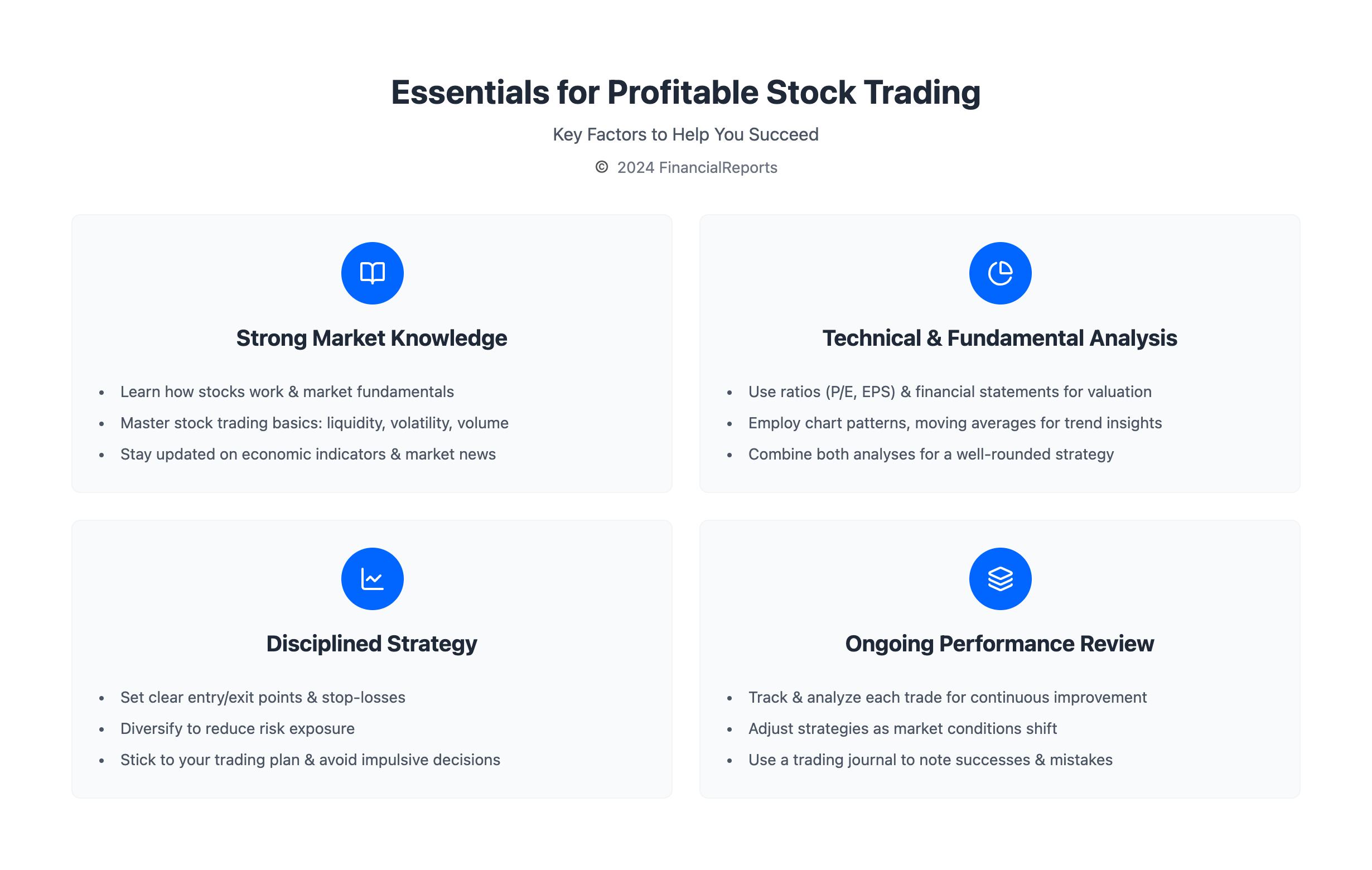

Fundamental Analysis in Stock Trading

Fundamental analysis is key in trading stock trading. It helps investors see beyond short-term price changes. By looking at financial statements, they can understand a company's health and value. This method uncovers the core factors that affect a company's success.

Financial ratios like the P/E ratio and EPS are vital. They show a company's financial health. These ratios help investors make smart choices in the trade stock market. By mixing fundamental and technical analysis, traders can craft a strong strategy.

Some benefits of fundamental analysis are:

- Identifying undervalued companies with growth

- Spotting red flags and overvalued investments

- Evaluating various securities beyond just stocks

- Uncovering investment opportunities before the market sees them

Using fundamental analysis, traders can make better choices. It boosts their success in the trade stock market. Whether you're new or experienced, it's a must for navigating trading stock trading and finding profitable investments.

Technical Analysis and Charting

Technical analysis is key for traders, giving insights into market trends. To learn how to trade equities well, traders need to grasp technical analysis basics. This includes understanding chart patterns and indicators.

When trading stocks, it's important to know how does stocks work and how to pay for them. Traders should learn about different charts, like candlestick and line charts. They also need to know how to read these charts. Technical indicators, such as moving averages and RSI, help spot trends and guide decisions.

Some important technical analysis concepts are:

- Trend lines and support and resistance levels

- Candlestick patterns, such as doji and hammer

- Indicators, such as moving averages and RSI

Traders can craft a trading strategy using these tools. Whether they trade daily or invest long-term, combining technical and fundamental analysis helps. This approach gives traders a deeper market understanding, leading to better decisions.

| Technical Indicator | Description |

|---|---|

| Moving Averages | Average price of a security over a certain period |

| Relative Strength Index (RSI) | Measure of the magnitude of recent price changes |

Developing a Successful Trading Strategy

To succeed in the stock market, you need to know the stock market basics and have a good trading strategy. First, figure out what kind of trader you are. Then, decide how long you want to trade and what you'll trade. This helps you create a plan that fits your goals and needs.

Learning to trade stocks starts with understanding the basics. You should know about different trading strategies like day trading, swing trading, and position trading. Learning these strategies helps you build a trading plan that matches your goals and risk level.

Here are some important things to think about when making a trading strategy:

- Test your strategy with different indicators and time frames to see how it performs.

- Use past data to find strategies that have made money.

- Backtest your strategy to see how it did in the past and how it might do in the future.

- Look for strategies that make a profit over short or long periods.

By following these steps and keeping up with market trends, you can create a trading strategy that helps you reach your goals in the stock market.

| Strategy | Description |

|---|---|

| Day Trading | Buying and selling stocks within a single trading day |

| Swing Trading | Buying and selling stocks over a shorter period, typically 2-5 days |

| Position Trading | Buying and holding stocks for an extended period, typically weeks or months |

Managing Your Trades Effectively

Success in the stock market depends on good trade management. It's about knowing the basics of the equity market and understanding stock market trends. Knowing what a trade share is and how it affects your portfolio is key.

Risk management is a big part of trade management. It means setting stop-loss and take-profit orders to control losses and profits. You need to know the stock market well and make smart decisions based on trends. For more on day trading strategies, check out day trading resources.

Managing emotions is also important in trade management. Here are some tips:

- Set clear goals and stick to them

- Have a trading plan and follow it

- Stay informed but avoid emotional decisions

- Use technical analysis to spot trends and patterns

By using these tips and staying focused, you can manage your trades well. This will help you succeed in the stock market, understanding trade shares and equity market basics.

| Trading Style | Holding Period | Time Commitment | Relative Risk and Volatility |

|---|---|---|---|

| Swing Trading | Days to a few weeks or months | Moderate | Moderate |

| Position Trading (Long-Term Trading) | Several months, years, or decades | Low | Low to moderate |

| Day Trading | Intraday (positions closed by the end of the trading day) | High | High |

Keeping Up with Market News

To succeed in the stock market, staying informed is key. Learning to trade in the share market means having access to reliable financial news. Follow trusted sources like Bloomberg, CNBC, and The Wall Street Journal for in-depth market coverage.

It's also important to understand economic indicators like GDP, inflation, and unemployment rates. These help in making smart investment choices. For example, the CNBC app offers real-time stock quotes and analysis, making it a great tool for traders.

News aggregators like Google News and AP News help gather financial data from various sources. Services like Google Alerts and Feedly send customized alerts on specific topics. This helps traders make better investment decisions.

By keeping up with market news, traders can make more informed choices. As Warren Buffett said, "Price is what you pay. Value is what you get." Staying informed helps understand the value of your investments.

Evaluating Your Trading Performance

As you learn to trade stocks, it's key to check your performance often. This helps you grow and succeed. By regularly reviewing your trades, you can spot what works and what doesn't. This way, you can make better choices to improve your trading.

Tracking and Analyzing Your Trades

Keep a detailed record of your trades. Note when you buy and sell, how much you make or lose, and why you made each choice. Looking at this data can show you patterns and help you see your strengths and weaknesses.

It can also guide you in making your trading better. Compare your results to big market indexes like the Dow Jones or S&P 500. This helps you see how you're doing compared to the market.

Learning from Your Experiences

Think about your good and bad trades. Figure out what made them happen. Look for strategies and decisions that lead to success and plan to use them more.

On the other hand, study your mistakes. Understand why they happened and how to avoid them in the future. This way, you can learn from your experiences and get better at trading.

FAQ

What is the importance of understanding trading capital, risk management, and different trading strategies?

Understanding these key areas is vital for profitable stock trading. It helps traders navigate the markets with confidence. This knowledge is essential for achieving financial goals.

What are the key elements of understanding stock market basics?

Knowing the basics of the stock market is critical. Traders must learn key terms, types of stocks, and how to use stock exchanges like the NYSE and NASDAQ.

How should traders set their trading goals?

Setting clear trading goals is essential. Traders need to understand short-term and long-term strategies. They also need to know their risk tolerance to set realistic goals.

What are the components of an effective trading plan?

A good trading plan is key. It includes risk management, position sizing, and trade management. Traders must also know how to set effective entry and exit points.

What factors should traders consider when choosing a brokerage?

Choosing the right brokerage is vital. Traders should compare online and traditional brokers. They should look at fees, commissions, and trading platforms.

How can traders use fundamental analysis to their advantage?

Fundamental analysis is important in stock trading. Traders need to learn how to analyze financial statements and understand market trends.

What are the key technical analysis tools and chart patterns traders should know?

Technical analysis and charting are essential. Traders should know basic chart patterns and the importance of indicators like moving averages and RSI.

How can traders develop a successful trading strategy?

Creating a successful trading strategy is critical. Traders should explore different strategies like day trading and swing trading. They should also test and refine their strategy.

What are the key elements of effective trade management?

Effective trade management is vital. Traders need to understand risk management, like position sizing and stop-loss orders. They also need to manage emotions like fear and greed.

Where can traders find reliable sources of financial news and economic indicators?

Staying updated with market news is important. Traders should use reliable sources like Bloomberg and The Wall Street Journal. They should also know how to interpret economic indicators.

How can traders evaluate their trading performance and learn from their trades?

Evaluating trading performance is essential. Traders should track and analyze their trades. They should learn from mistakes and adjust their strategy.