Unlock Profitability Formula Insights for Success

Learning the profitability formula is key for financial experts, investors, and big clients. It helps them make smart choices and plan ahead. The formula shows how well a company is doing financially and how good its managers are. It's all about how much money a company makes compared to what it spends and owns.

By using the profitability formula, businesses can see how much profit they make. They can look at different profit margins like gross, operating, and net. This helps them make choices based on solid data.

When analyzing profits, companies look at money made from different sources. They use both numbers and words to understand this. This helps them find out what makes money, improve their products, and cut costs. By focusing on profitability, companies can check their financial health with important numbers.

To figure out how profitable they are, companies use special formulas. These formulas help them see how well they're doing financially. This way, they can make smart decisions.

Key Takeaways

- Mastering the profitability formula is essential for financial professionals, investors, and institutional clients.

- Understanding how to calculate profitability is key for checking a company's health and skill.

- The profitability formula includes ratios like gross, operating, and net profit margin.

- Putting a focus on profitability helps understand what makes money and where to cut costs.

- Companies use formulas to check their financial health and make smart choices.

- Important ratios like return on assets and equity show how well a company makes money.

- Using the profitability formula and ratios helps businesses make informed decisions for success.

Understanding the Profitability Formula

Profitability is key for any business. Knowing the profitability formula helps make smart choices. It's a vital part of financial analysis, showing how well a company earns money. The formula helps calculate important ratios like gross margin and net profit margin.

What is Profitability?

Profitability means a company can make money from its work. It shows how well a company uses its resources. The financial metrics give a full view of a company's success, including its income, expenses, and profits.

Importance of Profitability

Profitability matters to many, like owners, managers, and investors. It shows a company's financial health and its ability to return investments. The formula helps figure out key metrics like return on equity and return on assets, which are vital for judging a company's success.

Key Components of the Formula

The formula has important parts like revenue, costs, and profits. The types of revenue and costs are key because they affect earnings. Metrics like gross margin and net profit margin show how well a company prices its products and manages costs.

- Gross Margin Ratio Formula: Gross Margin Ratio (%) = Gross Profit ÷ Net Revenue

- Net Profit Margin Ratio Formula: Net Profit Margin Ratio (%) = Net Income ÷ Revenue

Understanding the profitability formula helps businesses make better choices. It lets them improve their financial health. The formula and its metrics offer a detailed way to check a company's financial state and find ways to get better.

Financial Metrics That Impact Profitability

Business owners and managers use profit margin analysis for important decisions. They look at financial metrics like profitability ratios to check a company's health. This helps them make smart choices about operations, investments, and financing.

Profitability can be measured through revenue, costs, and profit margins. These metrics show how well a company earns money and grows. By studying them, businesses can spot areas to improve and make better financial choices.

Revenue Streams

Revenue streams are key to a company's success. They include sales, services, and investments. Knowing how each stream contributes to profits is vital for good business decisions.

Cost Structures

Costs, both fixed and variable, affect profit margins. Analyzing these costs helps businesses find ways to cut expenses. This is where profitability ratios like gross margin and operating margin are useful.

Profit Margins

Profit margins, like gross, operating, and net margins, are important for checking profitability. They show how well a company earns and grows. Understanding these ratios helps businesses make better financial choices.

| Profitability Ratio | Definition | Formula |

|---|---|---|

| Gross Profit Margin | Compares gross profit to sales revenue | Gross Profit / Sales Revenue |

| Operating Profit Margin | Evaluates earnings as a percentage of sales pre-interest and taxes | Operating Profit / Sales Revenue |

| Net Profit Margin | Shows net income relative to total revenue | Net Income / Sales Revenue |

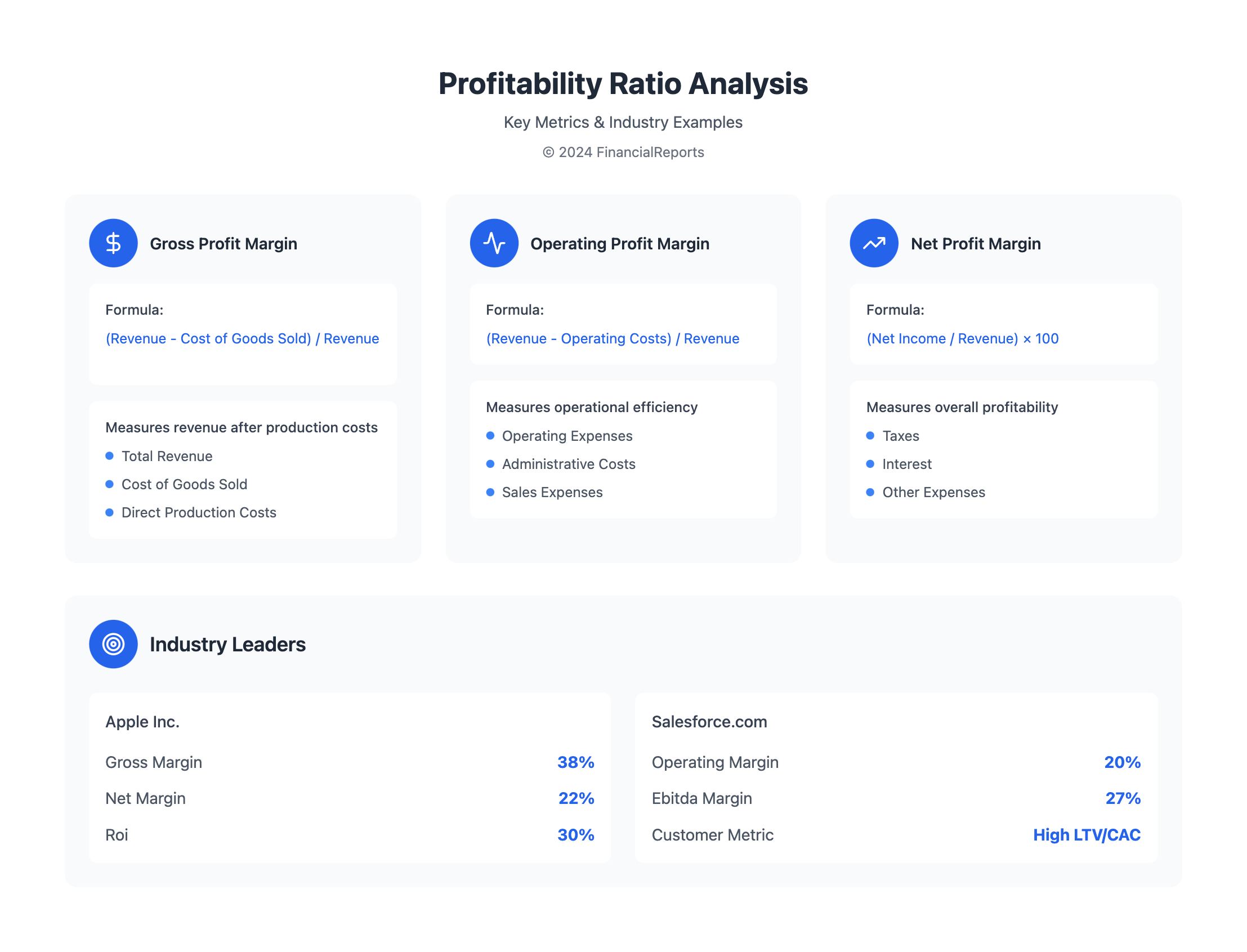

Different Types of Profitability Ratios

To understand a company's financial health, it's key to look at various profitability ratios. These ratios show how well a company makes money from its work. The profitability formula is a big part of figuring out these ratios. One important ratio is the gross profit margin.

This ratio is found by subtracting the cost of goods sold from total revenue. Then, divide by total revenue and multiply by 100. Other important ratios include the operating profit margin and net profit margin. Knowing how to use these ratios helps businesses make smart choices.

Gross Profit Margin

The gross profit margin is a key ratio that checks how well a company controls its production costs. It's found by subtracting the cost of goods sold from revenue, then dividing by revenue. For example, if a company makes $100 and spends $26 on goods, its gross profit margin is 74%.

Operating Profit Margin

The operating profit margin, or EBIT margin, shows how profitable a company's operations are. It's found by subtracting direct and operating costs from revenue, then dividing by revenue. This ratio helps businesses see how efficient they are.

Net Profit Margin

The net profit margin is a detailed ratio that looks at a company's overall profit. It's found by subtracting all expenses from revenue, then dividing by revenue. This ratio shows how well a company makes money, including all costs like taxes.

| Profitability Ratio | Formula | Example |

|---|---|---|

| Gross Profit Margin | (Revenue - Cost of Goods Sold) / Revenue | 74% |

| Operating Profit Margin | (Revenue - Direct costs - Operating costs) / Revenue | 35% |

| Net Profit Margin | (Revenue - Expenses) / Revenue | 30.2% |

By looking at these ratios, businesses can learn a lot about their finances. They can make better choices to grow and succeed. It's important to know the profitability formula and how to calculate these ratios.

The Role of Revenue and Costs in Profitability

When looking at a company's financial health, it's key to see how revenue and costs work together. The profitability ratio formula and equation help figure out if a company makes money. By checking out where the money comes from and how costs are managed, businesses can boost their profits.

Understanding Lifetime Value (LTV) and Customer Acquisition Cost (CAC) is important. LTV is the total value a customer brings over time. CAC is the cost to get a new customer. By balancing these, companies can set prices that help grow revenue.

Evaluating Revenue Sources

Revenue can come from many places, like selling products or services. To see how these help profits, companies can:

- Look at each revenue source

- Check how pricing affects revenue

- Watch costs for getting and keeping customers

Cost Management Strategies

Keeping costs down is vital for staying profitable. By working on both fixed and variable costs, businesses can do better. Some ways to manage costs include:

- Talking to suppliers to get better deals

- Improving how things are made

- Lowering energy use and waste

| Revenue | Cost | Profit |

|---|---|---|

| $100,000 | $60,000 | $40,000 |

| $150,000 | $80,000 | $70,000 |

By knowing how revenue and costs affect profits, businesses can plan better. Using the profitability ratio formula and equation helps make smart choices. This way, companies can grow and improve their profits.

Profitability Analysis Techniques

Profitability analysis is key for businesses to check if they make a profit. It looks at revenue and costs to find out what makes profit. Profitability analysis uses methods like break-even and contribution margin to check ratios. This helps in making smart choices.

Understanding profitability ratios is important. These include gross profit margin, operating profit margin, and net profit margin. They show how well a company is doing financially and where it can get better.

Some common ratios are:

- Gross profit margin: shows what's left after deducting the cost of goods sold from revenue

- Operating profit margin: shows what's left after deducting operating expenses from revenue

- Net profit margin: shows what's left after deducting all expenses from revenue

These ratios help businesses see how profitable they are. They guide in making choices to grow and boost profitability.

| Ratio | Formula | Description |

|---|---|---|

| Gross profit margin | (Net sales - COGS) / Net sales | Measures the percentage of revenue left after deducting the cost of goods sold |

| Operating profit margin | Operating profit / Total revenue | Measures the percentage of revenue left after deducting operating expenses |

| Net profit margin | (Net profit / Revenue) x 100 | Calculates the percentage of revenue left after deducting all expenses |

By applying these techniques and knowing about profitability ratios, businesses can understand their finances better. This knowledge helps in making choices to grow and improve financial health.

Factors Influencing Profitability

Calculating profitability involves many external factors. It's key for businesses to understand these to make smart choices and stay competitive. The formula looks at revenue, costs, and profit margins. But, market conditions, economic trends, and competition also play a big role.

To figure out profitability, businesses need to check their market position and find ways to get better. They should look at profitability ratios like gross and net profit margins. This helps them see how financially healthy they are. By watching these ratios and tweaking their plans, businesses can boost their profits and outdo rivals.

Some important factors that affect profitability include:

- Market size and growth rates

- Consumer trends and preferences

- Economic trends, such as inflation and interest rates

- Competition landscape and pricing power

By knowing these factors and using them in their formula, businesses can make smart choices. They can adjust prices or improve operations. The secret to success is being informed and flexible in a changing market.

| Factor | Description |

|---|---|

| Market Conditions | Influence profitability through market size, growth rates, and consumer trends |

| Economic Trends | Affect profitability through inflation, interest rates, and GDP growth |

| Competition Landscape | Impact profitability through pricing power and market share |

Tools for Measuring Profitability

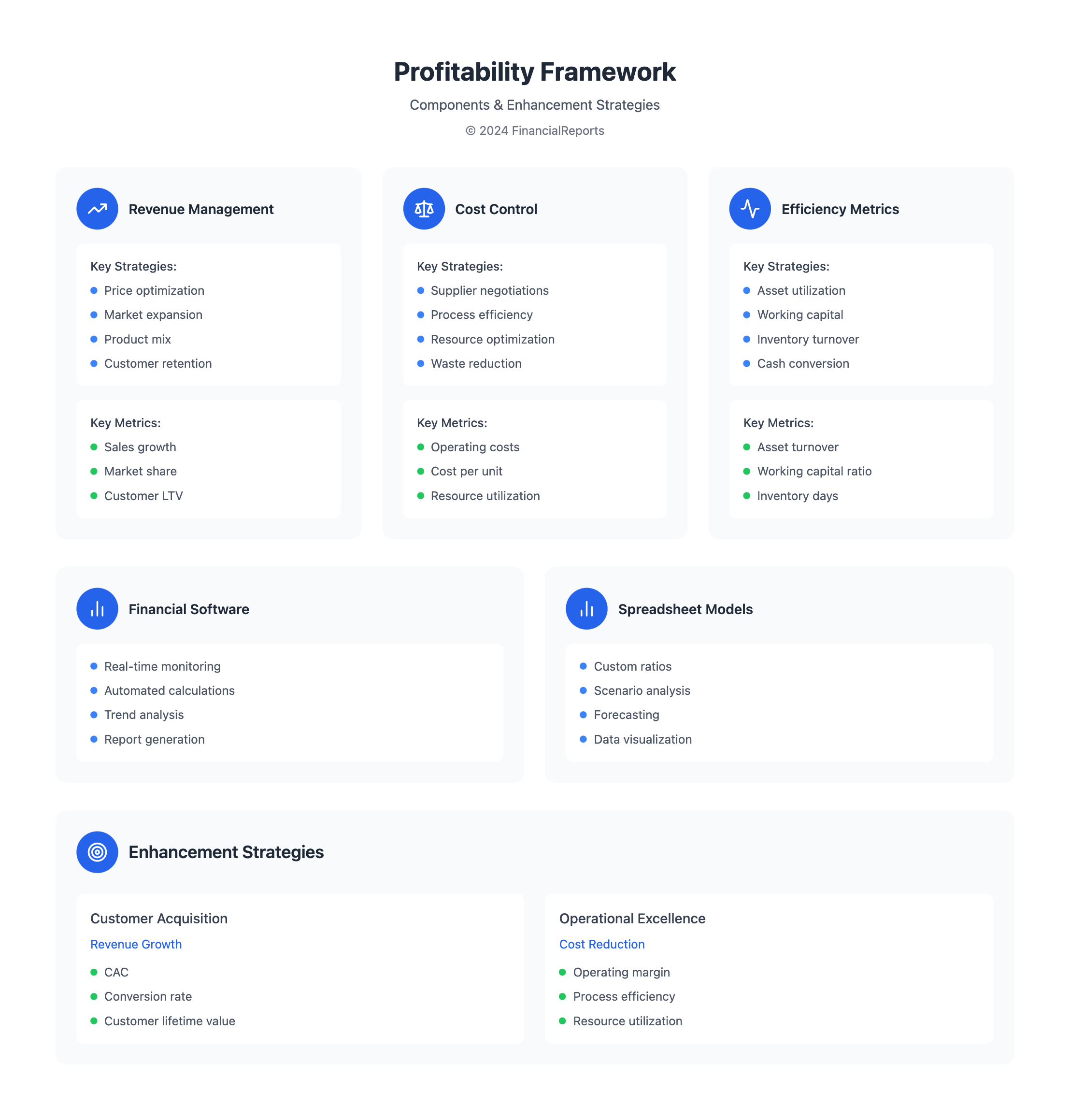

Businesses can use many tools to measure profitability. The profitability ratio formula shows how much profit a company keeps. Financial software helps calculate this ratio quickly, giving insights into financial health.

Important metrics include the gross, operating, and net profit margins. These are found using specific formulas. By tracking these, companies can spot where to improve and boost profits.

Financial Software Solutions

Financial software, like profit margin calculators, makes tracking easier. It gives instant insights into profit margins. These tools also connect with other business systems, like CRM and ERP.

Spreadsheet Models

Spreadsheet models are another way to measure profitability. They offer a flexible way to analyze finances. By setting up models, companies can track key metrics, like net profit margin.

| Profitability Metric | Formula | Description |

|---|---|---|

| Gross Profit Margin Ratio | Gross Profits / Sales = Profit Margin | Calculates the percentage of revenue retained as gross profit |

| Operating Profit Margin Ratio | Operating Income / Sales = Profit Percentage | Calculates the percentage of revenue retained as operating profit |

| Net Profit Margin Ratio | Net Income / Sales = Profit Percentage | Calculates the percentage of revenue retained as net profit |

Using these tools, businesses can understand their profitability better. This knowledge helps make decisions that lead to growth and success.

Strategies to Enhance Profitability

Boosting profitability is key for businesses to thrive in the long run. Understanding profitability ratios measure is vital. These ratios show a company's financial health. By looking at these ratios, businesses can spot where to improve and make smart choices to boost profits.

Knowing the profitability ratio definition is essential. It gives a clear way to check how well a company is doing financially.

To boost profits, businesses can try a few things. They can set better prices, cut costs, and invest in new tech. Profitability financial ratios help see if these plans work and where to get better.

For example, a company might use these ratios to check if its pricing is right. If not, it can change things to make more money.

Some top ways to boost profits include:

- Using smart marketing and sales to get customers cheaper

- Buying new tech to make things run smoother and cheaper

- Setting prices just right to make more money

By using these methods and checking profitability ratios measure often, businesses can grow their profits. It's important to know what profitability ratio definition means. And using profitability financial ratios helps make better choices and grow the business.

| Strategy | Description | Benefits |

|---|---|---|

| Optimizing Pricing | Adjusting prices to maximize revenue and profitability | Increased revenue, improved profitability |

| Reducing Costs | Implementing cost-saving measures to reduce expenses | Improved profitability, increased competitiveness |

| Investing in Technology | Using technology to automate operations and improve efficiency | Increased efficiency, reduced costs, improved profitability |

Real-World Examples of Profitability Success

As we wrap up our look at the profitability formula, let's see how top brands use it to succeed. We'll look at how successful retail companies use smart pricing, cost control, and keeping customers to boost their profits.

Case Study: Successful Retail Brands

Apple Inc. is a tech giant known for its high prices and careful cost management. Apple's gross profit margin is around 38%, and its net profit margin is a whopping 22%. Their focus on new products and keeping customers happy has given them a strong return on investment (ROI) of over 30%.

Lessons from Service-Based Industries

Service companies like Salesforce.com have also improved their profits. Salesforce's operating profit margin is 20%, and its EBITDA margin is 27%. They use data to make smart choices, which helps them keep a good LTV to CAC ratio.

The main lesson is that successful companies always keep an eye on their profit strategies. By using the right metrics, they can improve their operations, pricing, and customer service. This helps them grow and stay profitable over time.

FAQ

What is the profitability formula?

The profitability formula shows how well a company makes money. It looks at revenue, costs, and other financial details. These help figure out if a business is profitable.

Why is profitability important for businesses?

Profitability shows a company's health and ability to make money. It helps in making smart decisions and planning for the future.

What are the key components of the profitability formula?

The formula includes revenue, costs, and profit margins. These are gross, operating, and net profit margins.

What are the different types of profitability ratios?

There are three main ratios: gross, operating, and net profit margins. They give insights into a company's financial health.

How can revenue and cost management strategies impact profitability?

Good revenue and cost management can boost profits. This means setting the right prices, finding new revenue sources, and saving costs without hurting quality or customer happiness.

What are some advanced techniques for analyzing profitability?

Advanced methods include break-even analysis and contribution margin analysis. They help see how profitable products or services are.

How do external factors influence a company's profitability?

External factors like market trends and competition affect profits. Keeping an eye on these and adjusting strategies is key to staying profitable.

What tools are available for measuring and analyzing profitability?

Tools like financial software and spreadsheets help analyze profits. They make it easier to make decisions to improve profitability.

What are some strategies for enhanced profitability?

Ways to boost profits include smart pricing, investing in technology, and efficient marketing. These help keep costs down and attract customers.

What can we learn from real-world examples of profitability success?

Learning from successful companies can offer insights. They show how to manage costs, price products, and keep customers through effective strategies.