Unlock Morning Stock Trading Success with Top Strategies

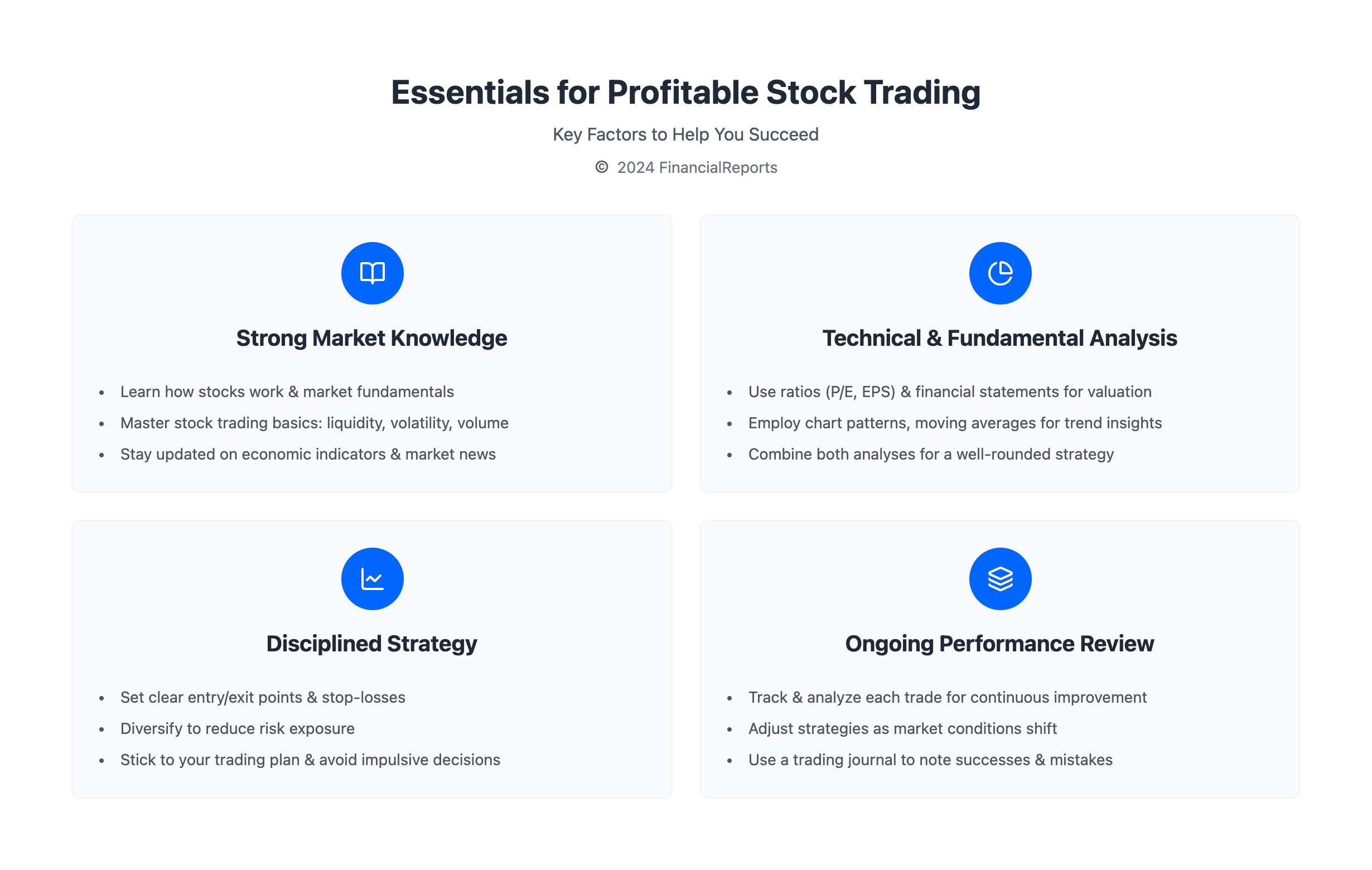

To succeed in morning stock trading, you need a strong base in options trading and a good strategy. The key is to mix technical and fundamental analysis. Also, knowing a company's financials and industry trends is vital. The ThinkOrSwim platform by TD Ameritrade is great for testing strategies with fake money.

Finding the right time to buy stocks is key. The first hour of the day is usually the most active. The best day to trade also depends on economic news and reports. By understanding these, traders can boost their morning success.

Key Takeaways

- Develop a solid foundation in options trading to succeed in morning stock trading

- Use the ThinkOrSwim platform to test strategies with PaperMoney before committing real money

- Identify the best time of day to buy stocks, considering the first hour as the most volatile

- Understand the importance of technical and fundamental analysis in the best strategy to buy stocks in the morning

- Recognize the best day to trade stocks depends on various market factors, including economic news and reports

- Utilize the best strategy to buy stocks in the morning to increase chances of success in the morning stock trading session

- Consider the best time of day to buy stocks and the best day to trade stocks when developing a trading plan

Understanding Morning Market Dynamics

Understanding the morning stock market is key to success. The first hour of the day is the best time to buy stocks. This is because the market is most active and volatile during this time.

The best time to sell stocks is also important. Selling at the right time can help you make more money. Stocks often drop at the end of the day due to news and trends. Knowing what affects morning stock prices can help traders make better choices.

Some important statistics for morning trading include:

- The opening and closing hours are the busiest, with the most activity.

- Early in the month, trading days tend to have stronger returns.

- Trading days before long weekends also show higher returns.

By understanding these dynamics and using them in a trading strategy, traders can do better in the morning. It's also important to consider the impact of institutional investors and day traders. Using tools like market profile and order flow can help make informed decisions.

| Time of Day | Market Activity |

|---|---|

| 9:30 a.m. - 10:30 a.m. ET | Significant price moves, high volatility and volume |

| 11:30 a.m. - 3:00 p.m. ET | Decreased volatility and volume |

| 3:00 p.m. - 4:00 p.m. ET | Surge in activity, institutional investors and day traders close positions |

Preparing for the Trading Day

To do well in morning stock trading, you need to get ready for the day. Look at what happened in the market overnight and check out the latest news. Knowing the best day to sell stock often means understanding how the market reacts to news and trends.

Traders use different tactics to make the most of market changes. For example, the Gap and Go Trading strategy is about buying stocks with a gap in price from the day before. The best time to sell stocks during the day is usually the last hour, when prices can swing wildly. With the right plan and current news, traders can boost their morning success.

When getting ready for trading, think about a few important things:

- Liquidity and volatility of the stocks

- Volume of trades

- Economic news and reports

By looking at these points and using the best strategy to buy stocks in the morning, traders can make smart choices. It's also key to have enough time for trading and to pick a good broker with low fees and reliable platforms.

| Strategy | Description |

|---|---|

| Gap and Go Trading | Buying stocks when there is a gap between the previous day's closing price and the current day's opening price |

| Technical Analysis | Analyzing charts and trends to predict future price movements |

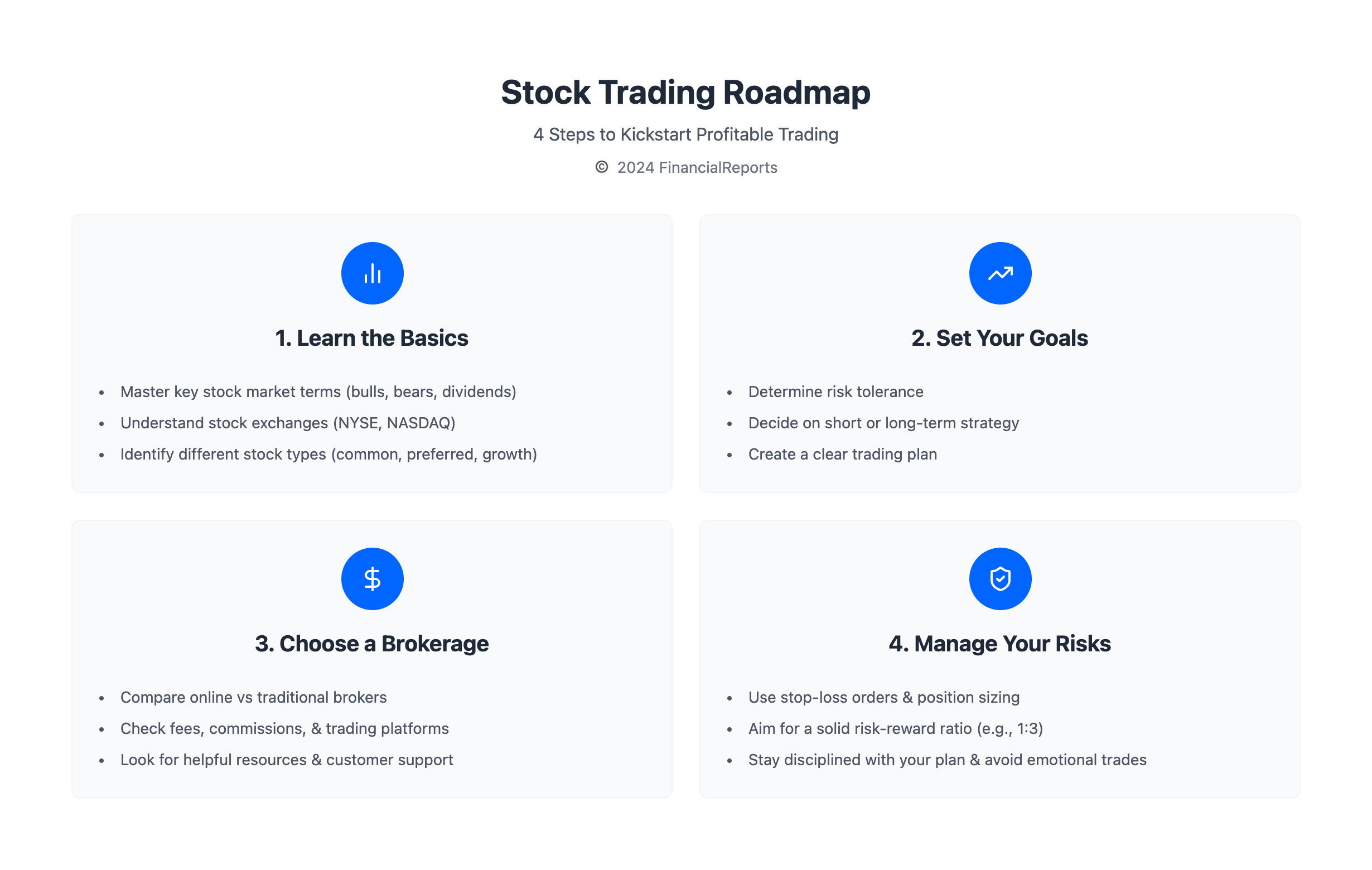

Setting Up Your Trading Plan

To succeed in morning stock trading, you need a solid trading plan. This plan should outline the best strategy to buy stocks in the morning. It should also consider the best time of day to buy stocks and the best day to trade stocks. Knowing how to trade options is key for morning trading success.

Your trading plan should have clear goals and a detailed strategy. It's wise to risk less than 2% of your total capital on each trade. Risking over 5% is considered high risk. Make sure to have enough time to watch your trades, whether all day or at set times.

Important parts of a trading plan include:

- Motivation and time commitment

- Risk attitude and goals

- Available capital and market knowledge

- Record-keeping and regular reflection on trading decisions

Using the right strategy and staying current with market news can boost your chances of success. Always test your strategies with PaperMoney before risking real money. Use a platform like ThinkOrSwim for trading.

| Trading Style | Description |

|---|---|

| Position Trading | Long-term trading, holding positions for weeks or months |

| Swing Trading | Medium-term trading, holding positions for days or weeks |

| Day Trading | Short-term trading, holding positions for a few hours or less |

| Scalping | Very short-term trading, holding positions for a few minutes or less |

Timing Your Trades Effectively

Timing is key in stock trading. The right moment to buy stocks can greatly boost your profits. Many think the first hour of trading is best for buying, as prices reflect market news then. Selling stocks is often better towards the day's end, when the market is most active.

Stocks often drop at the end of the day. This is because traders close their positions, leading to more selling. News and trends also play a role, causing prices to fall. To make smart choices, traders must keep up with market data and trends.

Some key points for effective trading timing include:

- Identifying a trade setup and trigger

- Setting a stop loss and price target

- Analyzing market trends and news

- Using technical indicators to inform trading decisions

Understanding when to buy and sell stocks is vital. Staying informed about market trends and news helps traders succeed. Whether you're experienced or new, timing your trades well is essential for reaching your investment goals.

| Trading Strategy | Best Time to Trade |

|---|---|

| Day Trading | First hour of the trading day |

| Swing Trading | End of the trading day |

| Position Trading | Any time, depending on market trends |

Assessing Market Sentiment

Traders need to check market sentiment to find the best day to sell stock. Knowing how investors feel helps understand market trends. The last hour of the day is often the best time to sell, as markets are most active then.

Traders can use the Gap and Go Trading strategy to profit from price changes. This strategy buys stocks with a gap between the previous day's close and the current day's open. It works well with morning strategies, like waiting for a stock to gap up and then consolidate near the high.

Important indicators for market sentiment include:

- The VIX Fear Index, which measures near-term calls and puts to determine market direction

- Stock price breadth indicators, which analyze the number of advancing and retreating stocks and their volumes

- CNN's Fear and Greed Index, which scores market sentiment on a scale of zero to one hundred

By using these indicators and keeping up with market news, traders can boost their success in the morning. They can also figure out the best day to sell stock.

| Indicator | Description |

|---|---|

| VIX Fear Index | Measures near-term calls and puts to determine market direction |

| Stock Price Breadth Indicators | Analyzes the number of advancing and retreating stocks and their volumes |

| CNN's Fear and Greed Index | Scores market sentiment on a scale of zero to one hundred |

Implementing Risk Management Techniques

Risk management is key when buying stocks in the morning. It means setting stop-loss orders to control losses and spreading investments to lower risk. The best time to buy stocks changes with market conditions. The best day to trade also depends on a company's finances and industry trends.

Effective risk management involves several techniques:

- Setting stop-loss orders at 1-2% below the entry price

- Diversifying investments across industry sectors, market capitalization, and geographic regions

- Hedging positions using options, such as downside put options, to protect against losses

Using the right risk management can boost success in morning stock trading. It's important to find the best time and day to trade, based on analysis. With a strong risk management plan, traders can confidently make decisions in the morning stock market.

Learning from Market Trends

To succeed in morning stock trading, it's key to learn from market trends. Looking at past morning trends can give us valuable insights. The best time to buy stocks is often the first hour of the day, when markets are most active. Knowing the best time of day to sell stock is also important, as it can help you make more money.

Many wonder why do stocks drop at the end of the day. The answer often involves the market's reaction to news and trends. By understanding what affects morning stock prices, traders can make better choices. Important factors include:

- Market volume and liquidity

- News and announcements

- Macro and microeconomic factors

- Technical swing trading indicators

By considering these factors and keeping up with market trends, traders can make better choices. Whether you're buying or selling stocks, staying informed and adapting to market changes is key.

| Time of Day | Market Activity |

|---|---|

| 9:30 AM - 10:30 AM | High volatility and trading volume |

| 11 AM - 2 PM | Lunch hour lull, decreased trading volume and lower volatility |

| 3 PM - 4 PM | Increased volatility and trading volume |

Staying Informed with Real-Time Data

To do well in morning stock trading, staying informed is key. Use financial news services, trading platforms, and tools to find good trades. The best day to sell stock often depends on news and trends. So, it's important to keep up with market news and trends.

Investors can use tools like Google News and AP News to stay informed. These services gather news and financial data from many sources. Also, knowing the best time to sell stocks during the day helps. By using the right strategy and staying informed, traders can do better in the morning.

Some important tools and services for staying informed include:

- Financial news services like Benzinga Pro and MetaStock R/T

- Trading platforms with real-time data feeds and technical analysis tools

- News aggregators and financial calendars for real-time updates

By using these tools and services, traders can find a best strategy to buy stocks in the morning. This helps them make smart trading choices.

Reviewing Your Trading Performance

Reviewing your trading performance is key to improving your strategies and achieving success in the stock market. Do a detailed post-market analysis to find out your strengths, weaknesses, and what you need to work on. Look closely at your trade data, like profit factors, Sharpe ratios, and equity curves. This will help you understand how well your approach is working.

It's okay to change your strategies as the market changes. Good traders know how to adjust their methods to take advantage of new chances and avoid risks. Keep up with industry trends, economic news, and market feelings. This will help make sure your strategies stay effective and profitable.

FAQ

What is the best strategy to buy stocks in the morning?

To buy stocks in the morning, mix technical and fundamental analysis. Know the company's finances and industry trends well. This approach boosts your chances of success in the morning trading.

What is the best time of day to buy stocks?

Buying stocks in the first hour of the day is often best. This is when markets are most active. Remember, selling at the right time is also key to making profits.

What is the best day to trade stocks?

The best day to sell stock depends on market news and trends. It's vital to keep up with these to make smart trades.

Why do stocks drop at the end of the day?

Stocks often drop at the end due to market reactions to news and trends. Knowing these factors helps traders make better decisions.

What is the best time to sell stocks during the day?

Selling stocks in the last hour of the day can be the best. This is when markets are most unpredictable.