Unlock Higher Earnings Per Share: Growth Tips for Success

Earnings per share (EPS) growth shows how well a company is doing financially. It tells us if a company can make more money and increase value for its shareholders. To boost EPS, it's key to look for undervalued shares with strong growth. Use both fundamental and technical analysis to spot stocks on the rise.

EPS growth is found by dividing net income minus dividends on preferred stock by the average number of shares. For example, a company with $2 million net income, $200,000 in dividends, and 800,000 shares would have an EPS of $2.25. Good EPS means steady growth or being above average. Bad EPS shows a decline or being far below others, showing its importance in making investment choices.

Introduction to EPS Growth

Companies like Apple Inc. show high EPS, showing they are very profitable and financially sound. Cutting costs, growing revenue, and buying back shares can all help increase EPS. Knowing what affects EPS growth helps investors make better choices to boost their earnings and returns.

Key Takeaways

- EPS growth is a key way to check a company's financial health and its ability to give returns to shareholders.

- Look for undervalued shares with strong EPS growth for better success.

- Use both fundamental and technical analysis to find stocks that are going up and breaking through.

- Good EPS means steady growth or being above average, while bad EPS shows decline or being far below others.

- Cost cutting, revenue growth, and share buybacks can all help increase EPS, leading to more earnings per share growth.

- Looking at EPS trends over time gives insights into a company's long-term financial health. Seasonal changes can also affect EPS, like in retail during peak sales times.

- Understanding what affects EPS growth is key for making smart investment choices and increasing earnings per share growth.

Understanding Earnings Per Share Growth

Earnings per share (EPS) growth is key for investors and financial experts. It shows how well a company makes profit for each share. This growth is a sign of a company's financial health.

To find EPS growth, you subtract preferred dividends from net income. Then, divide that by the number of shares. This shows how much profit each share gets.

Earnings per share growth is very important. It directly affects how much value shareholders get. A company with growing EPS is seen as a better investment. This is because it shows the company is making more money for its owners.

EPS growth also affects a company's stock price. When EPS grows, the stock price often goes up. This makes the company more attractive to investors.

What is Earnings Per Share (EPS)?

Earnings per share (EPS) shows a company's net income per share. It's a key way to measure how profitable a company is. It helps compare different companies' performance.

The EPS growth rate is important for stock prices. But, it's best to look at other financial metrics too. This gives a full picture of a company's health.

Importance of EPS Growth

Earnings per share growth shows a company's profit-making ability. A company with growing EPS is more appealing to investors. This is because it shows the company is making more money for its owners.

EPS growth also boosts shareholder value. A higher EPS growth rate can make the stock price go up. This makes the company more attractive to investors.

Factors Influencing EPS Growth

Many things affect earnings per share growth. These include revenue growth, profit margins, and how well a company manages costs. A company's success in boosting revenue and keeping profit margins high is key. Also, managing costs well helps keep profits up and allows for growth.

Financial experts say revenue growth is a big factor in eps growth. Companies that grow their revenue and keep costs low tend to see their earnings per share grow. Plus, profit margins are important because higher margins mean more profit and higher earnings per share.

Here are some key factors that can affect eps growth:

- Revenue growth and profit margins

- Cost management strategies

- Market conditions, including industry trends and economic cycles

It's vital for investors and financial experts to understand these factors. They help figure out if a company's earnings per share will grow. By looking at these factors, investors can make better choices about where to put their money.

| Factor | Impact on EPS Growth |

|---|---|

| Revenue Growth | Positive impact, as increased revenue can lead to higher earnings per share |

| Profit Margins | Positive impact, as higher margins can lead to increased profitability and higher earnings per share |

| Cost Management | Positive impact, as effective cost management can enable companies to maintain profitability and invest in growth initiatives |

Strategies to Improve EPS

Companies can boost their earnings per share (EPS) by using smart strategies. Making operations more efficient is key. It helps businesses run smoother and use resources better, leading to more profit.

Another way is to create new ways to make money. This means spreading out income sources and growing in new markets. It helps companies earn more and grow their EPS.

Investing in new technology is also vital. It boosts productivity and profit, helping to grow EPS.

Some key strategies to improve EPS include:

- Streamlining processes to enhance operational efficiency

- Developing innovative revenue streams through diversification and market expansion

- Investing in technology to drive productivity and profitability

By using these strategies, companies can grow their EPS. This makes them more appealing to investors and stakeholders.

| Strategy | Benefits |

|---|---|

| Enhancing Operational Efficiency | Increased productivity and profitability |

| Developing Innovative Revenue Streams | Reduced dependence on a single revenue source and increased earnings |

| Investing in Technology | Driven productivity and profitability |

Analyzing EPS Trends

To understand the eps growth meaning and its impact, it's key to look at earnings per share growth trends. We examine historical data to spot patterns and changes in eps growth. This helps investors and financial experts see a company's profitability and growth chances.

When analyzing eps trends, we look at what affects earnings per share growth. This includes changes in revenue, managing expenses, and changes in the number of shares. For example, a rise in revenue can lead to higher eps, while falling sales can lower eps.

Historical Data Analysis

Historical eps data is found in annual reports, financial websites, and paid databases. We use this data to calculate important metrics like the payout ratio and dividend coverage ratio. By looking at these metrics, we can see how eps trends relate to dividend payments.

Forecasting Future Growth

To predict future eps growth, we use models and predictive analytics. We analyze industry trends, competitor performance, and market conditions. This helps investors make smart choices and anticipate eps growth changes.

Benchmarking Against Competitors

It's important to compare eps growth with competitors and industry standards. This lets us see how a company stacks up. By comparing, we can spot areas for improvement and guess a company's growth chances.

| Company | EPS Growth Rate | Industry Average |

|---|---|---|

| Company A | 10% | 8% |

| Company B | 12% | 10% |

| Company C | 8% | 9% |

By studying eps trends and comparing with competitors, we get a better grasp of a company's earnings growth. This helps investors make informed choices.

The Role of Share Buybacks

Share buybacks can greatly affect a company's eps growth. They reduce the number of shares and boost earnings per share. For example, cutting shares from 100 million to 90 million can raise eps from $0.50 to $0.56. This could lead to a 12% increase in stock price.

Companies that regularly buy back shares often see their stock prices go up. This is because of increased shareholder value and eps growth. The Invesco Buyback Achievers Portfolio (PKW) ETF focuses on U.S. companies that have bought back at least 5% of their shares in the last year. This shows how important share repurchases are in the market.

But, research shows that share buybacks don't always add value. There's no clear link between the amount of buybacks and how much shareholders gain. Here's a table that shows how share buybacks affect eps growth and total return to shareholders:

| Company | Share Repurchase Intensity | EPS Growth | TRS |

|---|---|---|---|

| Company A | High | 8% | -40% |

| Company B | Low | 2% | 10% |

The table shows that there's no clear link between how much a company buys back shares and how much shareholders gain. This means that buying back shares might not be the best way to increase value for shareholders.

Researching Industry Benchmarks

To grasp earnings per share growth, it's key to look at industry benchmarks. This means finding high-growth sectors and seeing what makes some industries stand out. By studying the best companies in each field, investors can find useful tips and strategies for their own choices.

Investors can check out investment research websites for more on stock research and spotting growth sectors. Important things to think about when looking at earnings per share growth include:

- Revenue growth and profit margins

- Cost management strategies

- Industry trends and competitor analysis

By looking at these points and getting the eps growth meaning in various settings, investors can make better choices. This could lead to higher returns on their investments.

Trade the very best shares. Those shares should be undervalued by the market and growing earnings per share (EPS) strongly.

In the end, researching industry benchmarks and understanding earnings per share growth is vital for investors aiming for smart decisions and long-term success in the stock market.

The Impact of Dividends on EPS

Dividends are key in a company's earnings per share (EPS) growth. They reduce the earnings that can be reinvested. The dividend payout ratio shows how well a company balances dividends with growth.

A company's EPS growth is tied to its dividend policy. High dividend payouts mean less money for growth. Low payouts mean more money for growth, boosting EPS.

Important metrics to look at include:

- Dividend payout ratio: the percentage of net income paid out in dividends

- Retention ratio: the percentage of net income retained by the company

- EPS growth rate: the rate at which a company's eps is growing over time

EPS growth is vital for a company's stock price. Dividends play a big role in this. Knowing how dividends affect EPS helps investors make better choices.

| Company | Dividend Payout Ratio | EPS Growth Rate |

|---|---|---|

| Company A | 50% | 10% |

| Company B | 20% | 20% |

In summary, dividends' effect on EPS growth is complex. It depends on a company's dividend policy and its growth investments. By looking at payout and retention ratios, investors can understand a company's EPS growth better.

Managing Debt for EPS Growth

Managing debt well is key to growing earnings per share. A company needs the right mix of debt and equity to boost eps growth. Using debt wisely for growth helps keep finances stable and raises earnings per share.

To find this balance, companies can try these strategies:

- Reducing debt to cut interest payments and boost earnings per share growth

- Adjusting capital structure for the best debt and equity mix

- Using earnings per share growth to check if debt management works

Managing debt well is vital for a company's long-term success. By focusing on debt management and the right capital mix, companies can add value for shareholders. This leads to steady earnings per share growth.

| Debt Management Strategy | EPS Growth Impact |

|---|---|

| Debt Reduction | Positive |

| Optimal Capital Structure | Positive |

| Ineffective Debt Management | Negative |

Understanding Stock Dilution

Stock dilution happens when a company issues new shares. This reduces the ownership of current shareholders. It can occur through secondary offerings, employee stock options, or convertible securities. Knowing about stock dilution is key for investors, as it affects a company's eps growth meaning and earnings per share growth.

Dilution can greatly impact earnings per share growth. When new shares are issued, the total number of shares goes up. This means the same net income is spread over more shares, lowering eps growth meaning. But, diluted EPS gives a fuller picture of a company's performance. It considers the effects of convertible securities and employee stock options.

Some common reasons for stock dilution are:

- Secondary offerings to raise more capital

- Employee stock options and equity-based pay

- Convertible securities, like convertible debt and preferred shares

Investors need to know the risks of stock dilution. It affects eps growth meaning and earnings per share growth. By understanding dilution, investors can make smarter choices in the stock market.

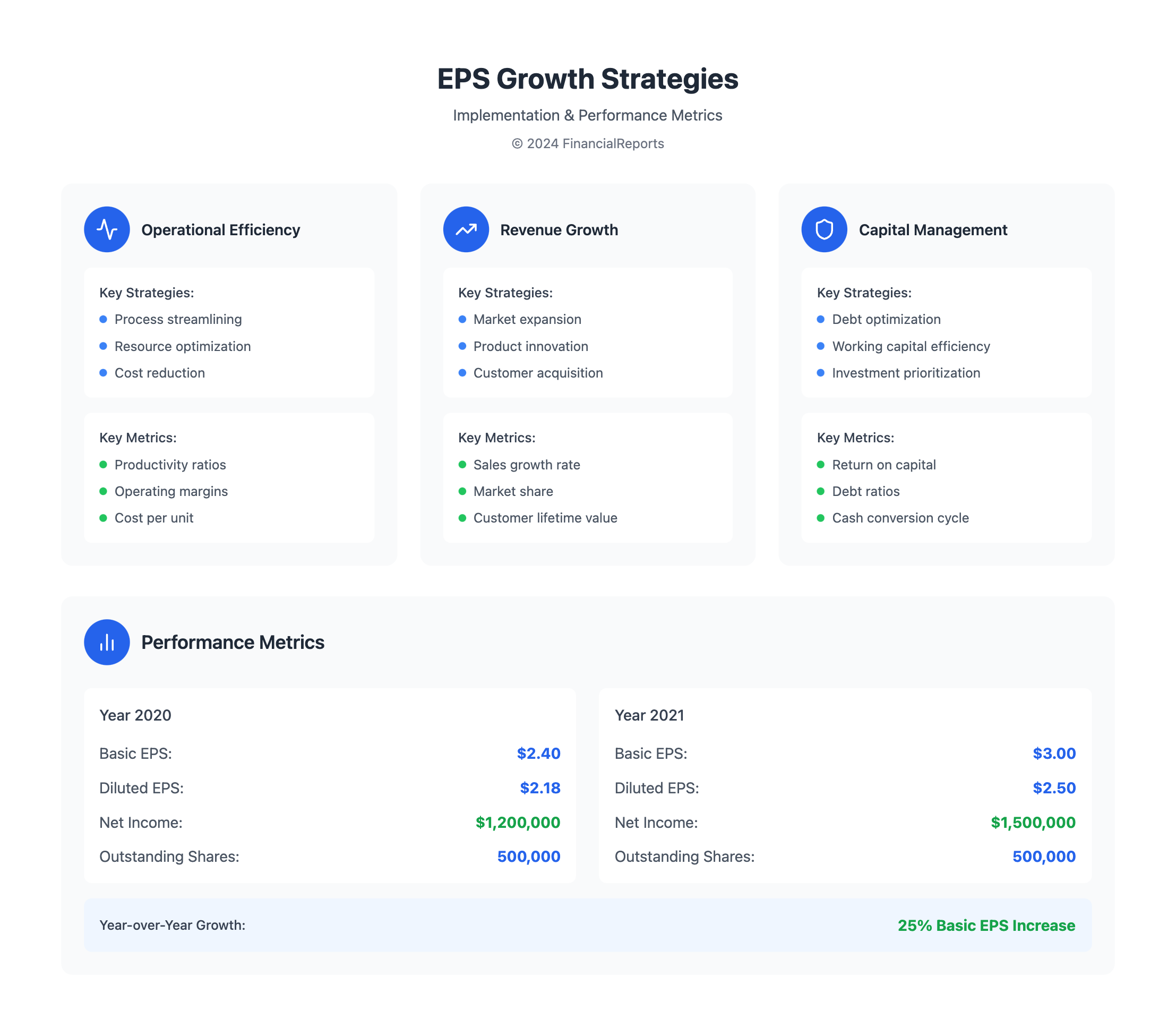

Measuring Success in EPS Growth

To measure the success of eps growth, it's key to track important indicators. These include return on equity, free cash flow growth, and economic value added. These metrics help investors understand a company's financial health and future prospects.

When looking at eps growth, consider these key metrics:

- Basic EPS and diluted EPS

- Net income and outstanding shares

- Options exercised and diluted common shares outstanding

For instance, a company with a basic EPS of $3.00 and a diluted EPS of $2.50 in 2021 shows growth. But, it's important to look at other factors too. This includes how equity options markets affect stock price and share value.

| Year | Basic EPS | Diluted EPS | Net Income | Outstanding Shares |

|---|---|---|---|---|

| 2020 | $2.40 | $2.18 | $1,200,000 | 500,000 |

| 2021 | $3.00 | $2.50 | $1,500,000 | 500,000 |

By examining these metrics and other factors, investors can make smart choices. They can see how well a company's eps growth strategies work.

Real-World Case Studies

As we wrap up our look at earnings per share (EPS) growth strategies, let's look at real examples. These stories show both the wins and the hurdles companies hit. By studying leaders like Apple Inc. and Amazon.com Inc., we can learn a lot for our own growth plans.

Powering Growth Through Innovation and Customer Focus

Apple's EPS growth is a big success story. It's all about innovation and making customers happy. Apple keeps making new, exciting products and services. This keeps prices high and customers loyal.

By always thinking about the user, Apple shows how innovation boosts earnings.

Cultivating a Customer-Centric Mindset for Sustainable EPS Growth

Amazon.com Inc. has also grown its EPS a lot. It focuses on customers, being efficient, and making smart buys. Amazon's dedication to great service and innovation helps it stand out in a tough market.

This example shows how caring for customers and being efficient can lead to steady earnings growth.

While big successes like Apple and Amazon are inspiring, we also learn from those who face challenges. Knowing what doesn't work helps us avoid mistakes. This way, we can make better choices for our businesses and aim for lasting success.

section>

FAQ

What is Earnings Per Share (EPS)?

Earnings per share (EPS) shows a company's net income divided by the number of shares. It helps investors see how profitable a company is.

Why is EPS growth important?

EPS growth is key because it affects how much a stock is worth. When EPS grows, the stock price often goes up. This is good for both businesses and investors.

How does EPS affect shareholder value?

EPS growth means a stock's price can go up. Companies with strong EPS growth attract more investors. They're willing to pay more for a company's future earnings.

What are the key factors that drive EPS growth?

Several things drive EPS growth. These include more revenue, higher profit margins, and better cost management. Also, being in a favorable market helps. Companies that manage these well can grow their EPS.

What strategies can companies use to improve their EPS?

To boost EPS, companies can work more efficiently, find new ways to make money, and use technology to improve. These steps can help increase EPS growth.

How can companies analyze and forecast EPS growth?

Companies look at past EPS data to spot trends and understand what has worked before. To predict future EPS, they use financial models and analytics. This helps them see how they might do in the future.

What is the impact of share buybacks on EPS growth?

Share buybacks can make EPS look better by reducing the number of shares. But, their long-term effect on value is complex. Companies need to weigh the pros and cons before using buybacks to boost EPS.

How can companies utilize industry benchmarks for EPS growth?

By studying top companies in their field, businesses can learn a lot. This helps them find areas to grow and adopt strategies that work well.

How do dividend policies affect EPS growth?

Dividend policies are a trade-off. Companies must decide between giving money back to shareholders or keeping it to invest in growth. Finding the right balance is key to long-term success.

What is the role of debt management in driving EPS growth?

Good debt management is important for EPS growth. Companies should keep their debt in check and find ways to reduce it. This helps maintain strong EPS and financial health.

How does stock dilution affect EPS growth?

Stock dilution, like from stock options or new shares, can hurt EPS growth. Companies must manage this to keep their EPS strong and value for shareholders high.

How can companies measure the success of their EPS growth initiatives?

To see if EPS growth efforts are working, companies look at things like return on equity and free cash flow. They also check how well management is doing. This ensures the company's financial health is strong and sustainable.