Understanding Your Outstanding Margin Amount

Knowing your outstanding margin amount is key in the world of leveraged trading. It's the amount you owe a brokerage after borrowing to buy securities. This lets you buy more, but it also raises your risk and chance for big gains.

In margin trading, how much you owe affects how much you can invest. You can borrow up to 50% of a stock's price. This means you can make more money, but you also face bigger risks. You need at least $2,000 to start, and you might pay interest on the loan, adding to your costs.

Introduction to Margin Trading

Margin trading lets you borrow money from a brokerage to buy stocks. It's good for short-term gains but comes with big risks. You need to keep a certain amount in your account to avoid losing more than you can afford.

Key Takeaways

- The outstanding margin amount refers to the balance an investor owes to a brokerage after borrowing funds to purchase securities.

- Margin debt can significantly impact an investor's overall risk exposure and gain opportunities.

- Investors can borrow up to 50% of the purchase price of a stock in a margin account with an initial margin deposit.

- Brokers may charge interest on margin loans, leading to additional costs for investors.

- Maintaining a minimum account balance is critical to avoid margin calls and manage risks.

- Understanding your outstanding margin amount and margin debt is vital for smart investing and risk management.

What is Outstanding Margin Amount?

The outstanding margin amount is the money an investor owes their brokerage. This happens in a margin trading account. When you open a margin account, you start with a "minimum margin". This amount changes based on the securities you trade.

Margins let investors use borrowed money to buy more shares. This can increase profits. But, it also means more risk of losing money.

Definition of Outstanding Margin

The outstanding margin is what's left after subtracting cash and assets from the securities' value. Keeping an eye on this amount is key to avoid losing your shares.

Importance in Trading and Investing

For those who trade on margin, knowing the outstanding margin amount is critical. It helps in making smart decisions and managing risks. The goal is to borrow wisely and keep enough funds to avoid losing your shares.

Some important facts about margin trading include:

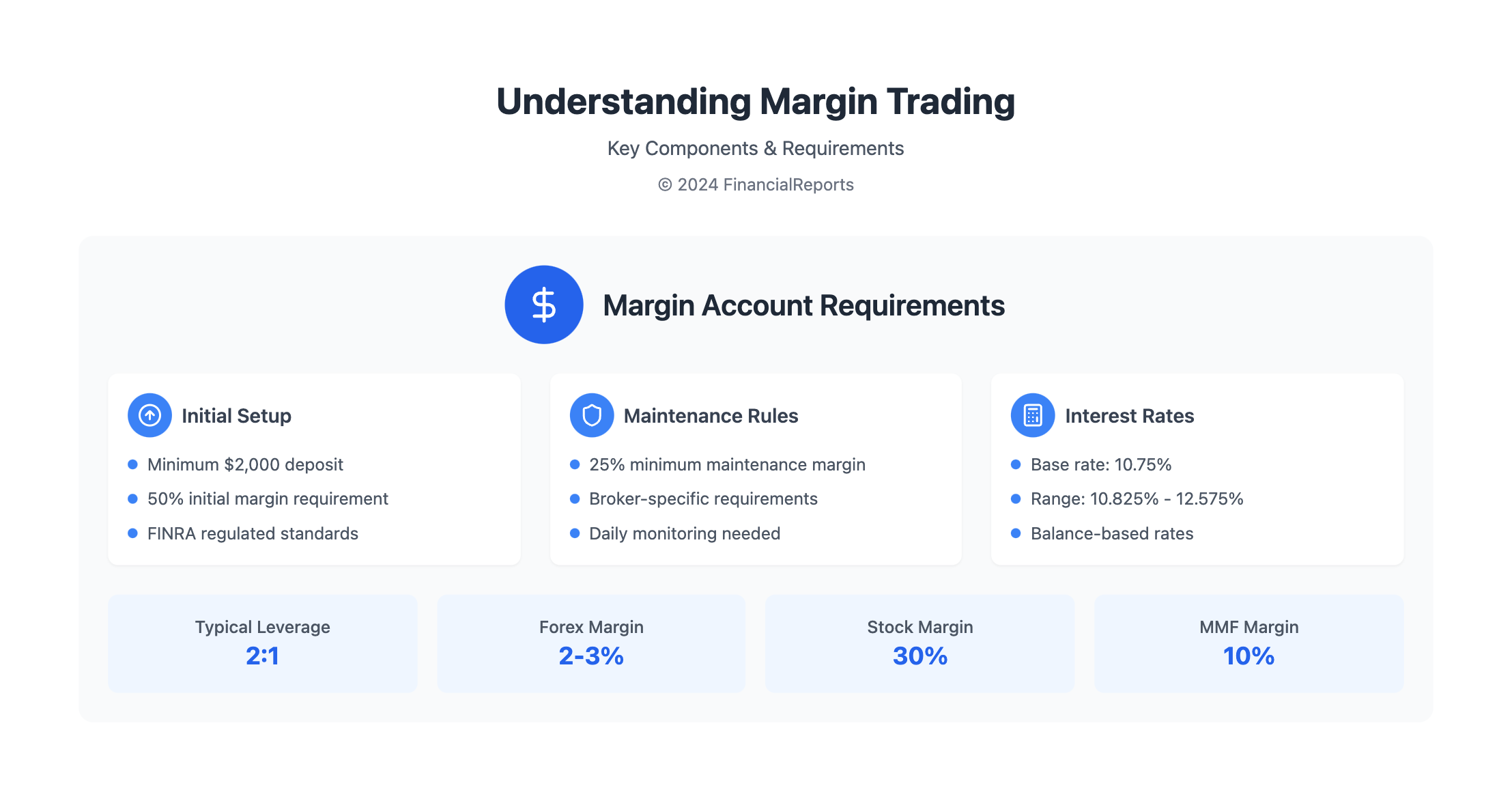

- The Financial Industry Regulatory Authority (FINRA) requires a minimum margin of at least $2,000.

- Federal Reserve Board Regulation T allows investors to borrow up to 50% of the purchase price of securities when trading on margin.

- Maintenance margin guidelines under FINRA rules require at least 25% equity based on the value of the margin account.

| Margin Requirement | Regulation |

|---|---|

| Minimum Margin | FINRA: $2,000 |

| Maintenance Margin | FINRA: 25% equity |

How Margin Accounts Work

Margin accounts let investors borrow money to buy securities. This is called margin borrowing. It can boost buying power but also raises margin debt risks. If not managed well, it can lead to big losses.

To open a margin account, you need to put in a minimum amount of cash or securities. This is called the initial margin. The Federal Reserve Board's Regulation T lets you borrow up to 50% of the purchase price. For instance, to buy $10,000 worth of stock, you need at least $5,000 in cash or securities.

Types of Margin Accounts

There are various margin accounts, each with its own rules. Some common ones include:

- Cash accounts: These don't allow borrowing and follow regular brokerage account rules.

- Margin accounts: These let investors borrow money to buy securities.

- Portfolio margin accounts: These use a risk-based approach to set margin requirements, considering the portfolio's overall risk.

Initial and Maintenance Margins

Margin accounts also have maintenance margin requirements. This is the minimum equity needed to avoid a margin call. If the account's equity drops below this, you'll get a margin call. You'll need to add more cash or securities to meet the requirement.

Calculating Your Outstanding Margin Amount

To figure out your outstanding margin amount, it's key to know how margin loans work. A margin loan lets investors borrow money to buy securities. They use those securities as collateral. The amount you borrow is your outstanding margin amount, and getting it right is important to avoid trouble.

Calculating it means finding the total value of your securities and subtracting any cash you have. This gives you your outstanding margin amount. Keep an eye on market changes and interest rates, as they can affect your margin amount.

When calculating your outstanding margin amount, consider these factors:

- Market value of securities

- Cash available in your account

- Interest rates on your margin loan

- Margin requirements set by your brokerage firm

Understanding how to calculate your outstanding margin amount helps you make smart investment choices. It also helps you avoid risks that come with margin trading.

Risks Associated with Margin Trading

Margin trading lets you buy securities with borrowed money. This can lead to big gains but also big losses. A major risk is margin calls, when the securities' value drops below a certain level.

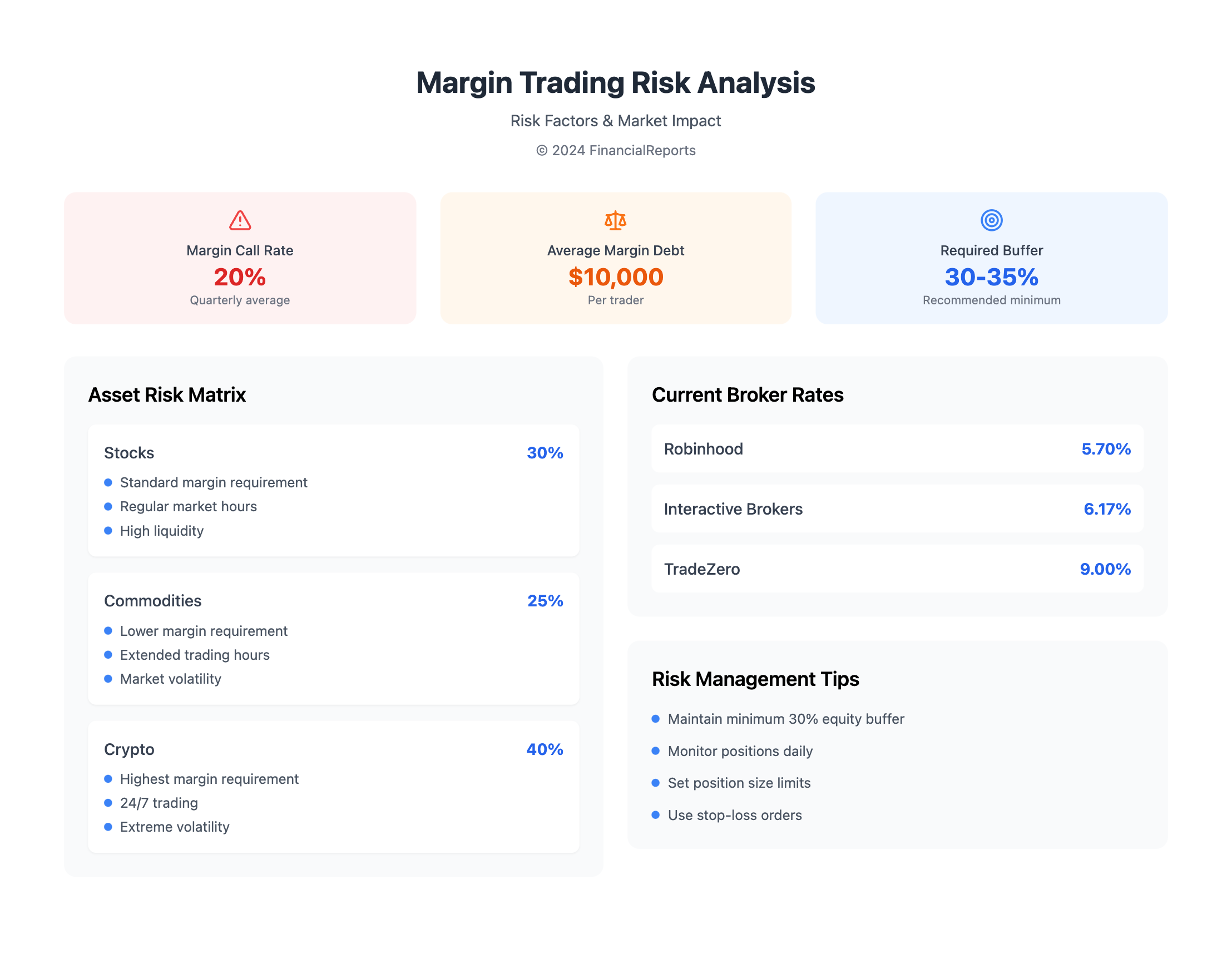

Studies show up to 20% of traders face margin calls each quarter. Some traders borrow up to 50% of a new security's cost. This shows the high risk involved.

To lower these risks, keep enough equity in your margin account. Stocks usually need 30% to 35% equity to avoid margin calls. But, market risks grow when security prices drop a lot.

Here are some key stats on margin trading risks:

- Ratio of margin traders experiencing margin calls in the last quarter: 20%

- Average outstanding margin amount per margin trader: $10,000

- Comparison of margin trading risks between different asset classes: stocks (30%), commodities (25%), cryptocurrencies (40%)

Margin traders need to know the risks of borrowing money. Keeping enough equity in your account helps avoid margin calls. This way, you can reduce losses and increase gains.

| Asset Class | Margin Trading Risk |

|---|---|

| Stocks | 30% |

| Commodities | 25% |

| Cryptocurrencies | 40% |

Managing Your Margin Effectively

To manage your margin well, it's key to know how a margin loan works. Keep an eye on your outstanding margin amount. Having extra funds in your margin account can prevent margin calls. Or, you could have funds set aside elsewhere to transfer to your margin account if needed.

Checking your margin balances often is important. This ensures they stay above the minimum, avoiding margin calls. Knowing how interest on borrowed money is calculated and added monthly is also critical. It affects your investment returns. Diversifying your investments can also help spread out risk and keep equity levels stable, reducing the chance of a margin call.

Strategies for Minimizing Risk

- Maintain a financial buffer within the portfolio to promptly meet margin requirements in case of a margin call, preventing forced sales of investments.

- Understand the drivers of margin change to ensure effective margin management.

- Choose the right CCP to impact margin requirements.

By using these strategies and keeping an eye on your margin amount, you can lower the risks of margin trading. This helps you make smart choices to keep your margin balance healthy.

| Strategy | Benefits |

|---|---|

| Maintaining a financial buffer | Prevents forced sales of investments |

| Understanding margin change drivers | Ensures effective margin management |

| Choosing the right CCP | Impacts margin requirements |

Regulatory Guidelines on Margin Trading

Margin trading follows strict rules set by regulatory bodies. The Financial Industry Regulatory Authority (FINRA) and the Securities and Exchange Commission (SEC) oversee it. These rules help prevent investors from borrowing too much and ensure they have enough money in their accounts.

The Federal Reserve Board’s Regulation T requires a 50% initial margin for securities. This means investors must put down at least half the cost of a security in cash or other securities. The maintenance margin is set at 25% by Reg T. Margin borrowing and margin debt are watched closely to avoid too much risk and market problems.

Regulatory agencies have issued many notices and guidelines. For example, Regulatory Notice 24-13 asked for feedback on day trading rules. Regulatory Notice 21-24 updated FINRA’s margin rule on minimum equity. These rules help investors know their duties and stay within legal limits, reducing risks from margin borrowing and margin debt.

| Regulatory Notice | Date | Description |

|---|---|---|

| Regulatory Notice 24-13 | 10/29/2024 | Requested comment on the effectiveness and efficiency of requirements related to day trading |

| Regulatory Notice 21-24 | 07/06/2021 | Announced updates to interpretations of FINRA’s margin rule regarding minimum equity |

| Regulatory Notice 19-21 | 07/01/2019 | Concerning margin requirements for exchange-traded notes |

Impact of Market Volatility on Margin Amount

Market volatility can greatly change the outstanding margin amount. This happens because the value of securities in a portfolio goes up and down. This change affects how much money can be borrowed, as loans use these securities as collateral. It's important for investors to understand this, as it helps them manage risks.

Investors need to know how margin loans work and their risks. For example, how does a margin loan work with the outstanding margin amount? A margin loan lets investors borrow money with their securities as collateral. But, the loan amount can change based on the securities' value.

Here are some key points to keep in mind when dealing with market volatility and margin amounts:

- Keep an eye on market trends and adjust margin loans as needed

- Understand how margin loans and outstanding margin amounts are connected

- Know the risks of market volatility and margin trading

By grasping the effect of market volatility on margin amounts and how does a margin loan work, investors can make smart choices. This knowledge helps them manage their margin amount well. It also helps them avoid risks and make the most of their investments in a changing market.

| Market Volatility | Margin Amount | Risk Level |

|---|---|---|

| High | Fluctuating | High |

| Low | Stable | Low |

Differences Between Margin and Cash Accounts

Investing wisely means knowing the difference between margin and cash accounts. Margin accounts let you borrow money to invest, which can increase your gains but also raises the risk of debt. Cash accounts, on the other hand, require full payment by the settlement date, avoiding debt risks.

Margin accounts stand out because they allow you to borrow up to 50% of a security's price. This boosts your buying power. Yet, it also means you could face big losses if the market goes down.

When deciding between margin and cash accounts, consider a few things:

- Risk tolerance: Margin accounts are riskier because they involve borrowing money.

- Investment goals: Margin accounts might suit experienced investors looking to increase returns. Cash accounts are better for beginners or those who prefer less risk.

- Fees and requirements: Margin accounts usually have higher fees and minimums than cash accounts. They also might need you to meet certain rules.

The right choice between margin and cash accounts depends on your personal situation and goals. Knowing the differences helps you manage risk and make smart investment choices. This way, you can avoid too much debt and maximize your investment gains through careful borrowing.

Common Misconceptions About Margin Trading

Margin trading is a powerful tool for investors, but it's often misunderstood. Many think it's only for experienced investors. But, with the right education, anyone can use margin wisely. Knowing your outstanding margin amount is key to smart investing.

Some believe margin loans are complex and hard to manage. But, how does a margin loan work is simple. Investors borrow money from a brokerage to buy securities. The loan is backed by the securities in their account.

Here are important things to remember about margin trading:

- Margin needs change based on the security and brokerage.

- Investors can lose more than their initial investment if the market goes against them.

- Understanding the risks and rewards of margin trading is vital before starting.

| Margin Requirement | Security Type | Borrowing Limit |

|---|---|---|

| 50% | Stocks | Up to 50% of purchase price |

| 2-3% | Forex | Up to 20-50 times the account balance |

By knowing the truth about margin trading and avoiding common myths, investors can make better choices. This helps them reach their financial goals.

The Role of Interest Rates in Margin Accounts

When you think about margin borrowing, knowing how interest rates affect your debt is key. Interest rates on margin loans change based on the brokerage and the loan amount. For example, Schwab's base rate for margin accounts is 10.75% as of 12/20/2024. The effective rates range from 12.575% to 10.825% depending on your balance.

Interest rates on margin loans can greatly influence your investment gains. Margin maintenance requirements also differ, like 30% for stocks and 10% for Money Market Funds. To handle your margin debt well, it's important to look at interest rates and requirements when investing.

Here are some key points to consider when managing your margin debt:

- Interest rates on margin loans can change based on the brokerage and loan amount.

- Margin maintenance requirements vary by the type of securities you hold.

- Knowing the interest rates and requirements helps you make better investment choices.

| Brokerage Firm | Base Rate | Effective Margin Rates |

|---|---|---|

| Schwab | 10.75% | 12.575%-10.825% |

By keeping these points in mind and understanding interest rates' impact, you can make smarter investment choices. This helps you manage your margin borrowing better.

Tools and Resources for Margin Traders

Margin traders need good tools and resources to manage their margin amount well. They must understand how margin loans work. It's important to watch and adjust positions quickly with the right online platforms.

These platforms should have real-time margin tracking, customizable alerts, and tools for managing risk. Also, learning through webinars, tutorials, and market analysis is key. It helps traders make smart choices.

Choosing the right margin trading platform is critical. Look at margin rates, fees, and what you need to open an account. Here's a table comparing margin rates from different brokers:

| Broker | Margin Rate |

|---|---|

| Robinhood | 5.70% |

| Interactive Brokers | 6.17% |

| TradeZero | 9% |

With the right tools and resources, margin traders can improve their strategies. They can reduce risks and increase their returns on their margin amount.

The Future of Margin Trading

Trends in Margin Use

Margin requirements in futures trading can be as low as 3% to 12% of the contract value. This makes margin borrowing more accessible to many investors. Brokers often ask for extra funds to start and keep trading positions, showing the market's fast-changing nature.

Technological Innovations in Margin Trading

Artificial intelligence and machine learning are changing how traders handle risk. Automated systems now watch margin levels in real-time. They send alerts and help traders quickly respond to margin calls.

These tools help traders deal with market ups and downs better. They make decisions that protect their money. As futures and options markets grow, margin trading will be key for access and liquidity. By using new tech and keeping up with trends, traders can do well in margin trading.

FAQ

What is outstanding margin amount?

Outstanding margin amount is the total value of securities or assets bought on margin. This is from a broker or financial institution.

Why is outstanding margin amount important in trading and investing?

It affects an investor's buying power and risk level. It shows how much leverage is used, which can increase both gains and losses.

What are the different types of margin accounts?

There are standard and portfolio margin accounts. The main difference is in the margin requirements, affecting leverage.

How do I calculate my outstanding margin amount?

You need the total value of securities, the initial margin, and maintenance margin. Your broker or financial institution sets these.

What are the risks associated with margin trading?

Margin trading risks include margin calls and overleveraging. These can lead to significant losses if the market moves against you.

How can I effectively manage my margin account?

Manage your account by diversifying and regularly checking your balance. Stick to your broker's margin rules to avoid calls.

How do regulatory guidelines impact margin trading?

Agencies like the SEC and FINRA set rules for margin trading. Knowing these is key for safe and compliant trading.

How does market volatility affect my outstanding margin amount?

Market changes can greatly affect your margin positions. This can lead to margin calls if you don't meet the maintenance margin.

What are the key differences between margin and cash accounts?

Margin accounts use leverage, while cash accounts don't. Margin accounts have higher risks and rewards. Choose based on your risk tolerance and goals.

What are some common misconceptions about margin trading?

Some think margin trading always means higher returns. But it's risky and requires understanding of gains and losses.

How do interest rates impact my margin account?

Interest rates change borrowing costs in margin accounts. This affects trading profits. Keep an eye on interest rates.

What tools and resources are available for margin traders?

Online platforms offer tools for monitoring and managing margin. They also provide analytics and educational resources.

What are the emerging trends and innovations in margin trading?

New technologies like AI and machine learning are changing margin trading. They help in managing risk and offer advanced tools and strategies.