Understanding Your Company's Financial Position Today

Evaluating financial position is key to business success. Not just numbers, these figures tell an important story. By looking closely at financial statements, business leaders learn about their company's health, stability, and growth opportunities.

Knowing your financial position lets you see risks and chances. This insight helps you change strategies when needed. It's crucial for doing well in a competitive market.

Companies aim to make global financial data easy to get. Understanding complex financial info is vital. The balance sheet, income statement, and cash flow statement show the company's financial story clearly.

Key Takeaways

- Evaluating your company's financial position allows foresight into fiscal stability and growth potential.

- Financial statements are crucial for a holistic view of a company's financial health.

- Financial ratios and metrics are essential for comparative industry benchmarks and internal analysis.

- Effective inventory management is indicated by a balance of lower inventory values and higher sales levels.

- Market-to-book multiples serve as an indicator of a stock’s potential over or undervaluation.

- Shareholder equity reflects the actual stake of investors in the company, encompassing asset and liability assessments.

- Financial data automation and analysis is central to strategic decision-making and sustaining industry competitiveness.

What is Financial Position and Why It Matters?

Knowing a company's financial position is key for everyone from investors to company executives. It shows a company's assets, liabilities, and equity at a certain time. This snapshot is crucial for smart financial choices.

Definition of Financial Position

The financial position tells us what a company owns and what it owes. It's shown in the balance sheet. This helps us see if the company can make money, keep running, and grow.

Key Components of Financial Position

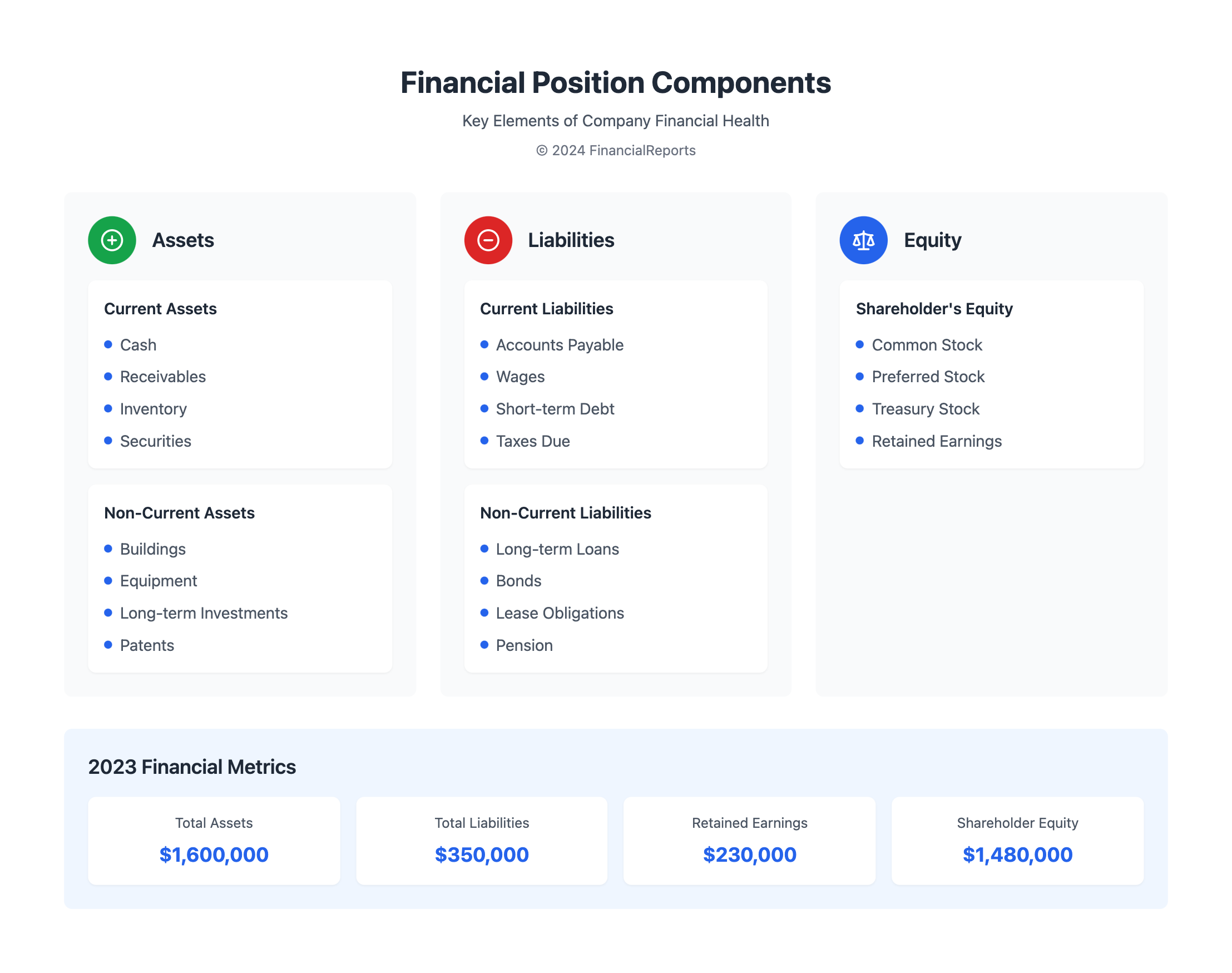

A company's financial position is shown through assets, liabilities, and equity. These are vital for thorough financial reviews and making big company decisions.

| Component | Description | Examples |

|---|---|---|

| Assets | Resources owned by the company that are expected to bring economic benefits. | Cash, inventory, property |

| Liabilities | Obligations the company must fulfill, which involve financial debts or other commitments. | Loans, accounts payable |

| Equity | The residual interest in the assets of the company after deducting liabilities, often seen as the net worth. | Common stock, retained earnings |

Companies produce a financial condition statement for legal reasons and to help stakeholders. It shows the company's financial status over time. This improves transparency and accountability.

By looking at financial ratios from the balance sheet, one can find out about a company’s efficiency, debt levels, and assets. Such insights are crucial for investors to make good decisions.

In conclusion, knowing a company's financial position is the base for strong planning and decisions. It offers a detailed picture of finances, helping to guide growth and profit.

Exploring Financial Statements

Looking into financial statements reveals a company's money story. It's key for financial position analysis and making smart choices. These reports, like balance sheets and income statements, show the company's financial health. They are critical for those involved to check profitability and financial stability.

Balance Sheet Overview

The balance sheet shows a company's financial state at a specific time. It uses the formula Assets = Liabilities + Shareholder Equity. This splits assets and liabilities into current and long-term, showing short and long-term financial situations.

Balance sheets give insight into how a company uses its capital. They help evaluate the return on investment. Below, we break down the key parts:

| Category | Examples | Description |

|---|---|---|

| Current Assets | Customer debts, inventory, securities | Resources likely converted to cash within a year |

| Non-Current Assets | Buildings, equipment | Long-term resources, subject to depreciation |

| Current Liabilities | Wages, accounts payable | Obligations due within a year |

| Non-Current Liabilities | Long-term loans, bonds payable | Obligations due after more than one year |

Income Statement Insights

An income statement tells us about a company's profits over time, showing financial movements. It lists revenues and costs, highlighting operational efficiency and profit-making ability. Metrics like gross profit, EBT, and net earnings are key for financial position analysis.

Cash Flow Statement Importance

The cash flow statement tracks actual cash movement, separate from profits. It's key for seeing how well a company manages its cash. This includes funding operations, investing in growth, paying debts, and giving back to shareholders. It's crucial for avoiding financial issues and planning for future success.

Financial statements are a full set of tools for reviewing a company's finances. They help in making informed decisions and complying with laws. Using up-to-date financial reporting software improves precision and insights. This helps businesses face challenges and seize chances.

Evaluating Assets and Liabilities

Managing a company's finances well means taking a step-by-step approach. It’s key to evaluate assets and financial liabilities. This helps figure out the company net worth. It's the foundation for smart financial planning and making big decisions. We'll look at different assets and liabilities so you can understand net worth better.

Types of Assets

Assets are vital for making money. They come in two types: current and non-current. Current assets include things like cash, money owed to you, and what you have in stock. Non-current assets are long-term things like investments and property. Knowing about these assets helps gauge how well a business can operate and its financial state.

- Cash and cash equivalents – vital, easy-to-use assets for daily needs.

- Receivables – money customers owe, showing potential income.

- Inventory – items to be sold or used, closely tied to profits.

- Property and equipment – big items needed for business over a long time.

Types of Liabilities

Liabilities are what a company owes, like debts or obligations from doing business. They're important for managing money flow and funding plans. Knowing about them helps keep the company's finances balanced.

- Accounts payable – what you need to pay suppliers soon.

- Accrued expenses – expenses that have happened but aren’t paid yet.

- Long-term debt – money owed that takes over a year to pay back.

Understanding Net Worth

The company net worth shows the value left after paying off all debts. It hints at how stable and growth-ready a company is. To find it, subtract what you owe from what you have. This gives you a solid number showing the company’s true value.

| Financial Metric | Current Period | Previous Period | Percentage Change |

|---|---|---|---|

| Total Assets | $500,000 | $450,000 | 11.11% |

| Total Liabilities | $300,000 | $320,000 | -6.25% |

| Net Worth | $200,000 | $130,000 | 53.85% |

Keeping an eye on these financial metrics helps. It lets stakeholders know if current strategies work. They can make smarter choices to boost profit and keep the company strong.

Importance of Equity in Financial Position

Knowing a company's financial position is very important for people involved. At the heart of this analysis is the idea of shareholder equity. This tells us about the company's health and how stable it is. It shows what the owners really have, the ability to grow, attract funds, and give value to shareholders.

Concept of Shareholder Equity

Shareholder equity, or net worth, shows the value to shareholders after settling all debts. It's key to see how well a company uses its capital to create more value. The calculation, as seen here, means equity is assets minus liabilities. This shows the company's real worth, beyond just market changes.

The parts of shareholder equity are:

- Retained earnings

- Common and preferred stock

- Treasury stock

Each part helps the company's financial strength, guiding strategy and drawing investors.

Role of Retained Earnings

Retained earnings are vital, showing profits reinvested or saved for future plans. This part tells us about a company’s profit, position in the market, and success chances. It's a key element of financial reporting.

Table showing how retained earnings affect shareholder equity:

| Year | Total Assets | Total Liabilities | Retained Earnings | Shareholder Equity |

|---|---|---|---|---|

| 2021 | $1,200,000 | $300,000 | $150,000 | $1,050,000 |

| 2022 | $1,400,000 | $320,000 | $180,000 | $1,260,000 |

| 2023 | $1,600,000 | $350,000 | $230,000 | $1,480,000 |

This table shows equity growing because of retained earnings. It points to a financially stronger company.

In short, understanding and managing shareholder equity and retained earnings are key. They help a company stay solid and ready for the future.

Ratios to Analyze Financial Position

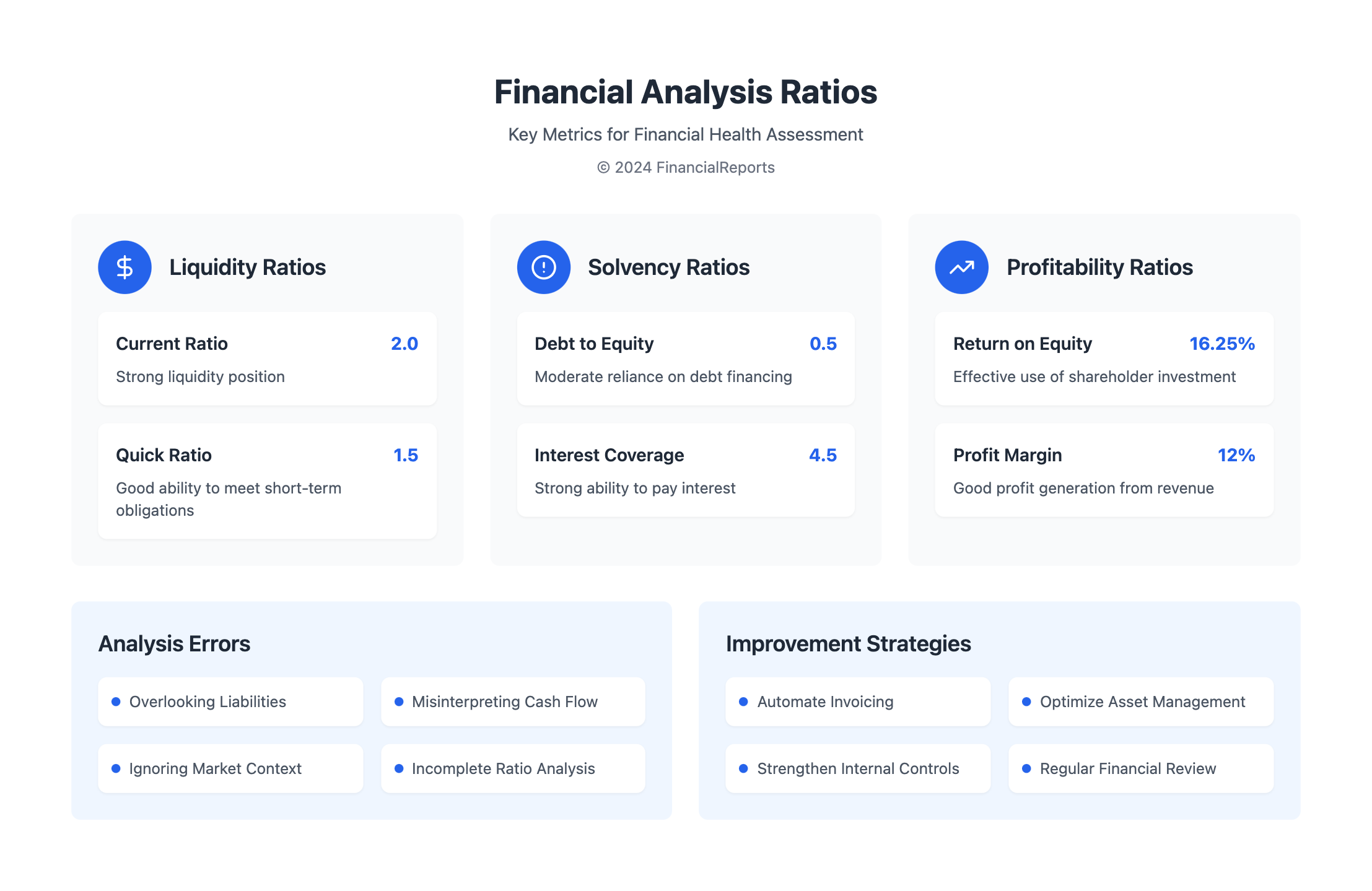

Financial ratio analysis is key in checking a company's health. These ratios light the way through financial statement details. They help stakeholders understand the company's financial well-being. Looking at liquidity, solvency, and profitability helps make important strategic choices.

Key Financial Ratios to Monitor

Different financial ratios show unique aspects of a company's performance:

- Liquidity Ratios: They check if a company can pay short-term debts without new funds. This includes the Current Ratio and Quick Ratio.

- Solvency Ratios: Ratios like Debt to Equity Ratio and Interest Coverage Ratio test long-term survival and debt handling.

- Profitability Ratios: These, for example, Return on Equity (ROE) and Profit Margin Ratio, show income efficiency against resources.

- Efficiency Ratios: Ratios such as Asset Turnover and Inventory Turnover review asset use to boost sales and inventory management.

- Market Prospect Ratios: Ratios like Earnings per Share (EPS) and Price-to-Earnings (P/E) Ratio forecast future performance and expectations.

Interpreting Ratio Analysis

Financial ratio analysis compares a company's performance to industry standards and spots trends. It helps stakeholders see risks and opportunities. The sample matrix below shows how to read financial health using key ratios:

| Ratio Type | Ratios | Example Values | Implication |

|---|---|---|---|

| Liquidity | Current Ratio | 2 | Strong liquidity, capable of covering short-term liabilities. |

| Solvency | Debt to Equity Ratio | 0.5 | Lower risk, indicates moderate reliance on debt financing. |

| Profitability | Return on Equity (ROE) | 16.25% | Effective at generating profits from shareholders' investments. |

| Efficiency | Inventory Turnover Ratio | 5 times | Good management of inventory levels relative to sales. |

| Market Prospects | Price-to-Earnings (P/E) Ratio | 9.49 | Favorable market valuation compared to earnings. |

This analysis helps watch the current financial state and plan for future growth. By frequently analyzing financial ratios, businesses can avoid financial trouble. They can also adjust their goals to aim for lasting success and stability.

Financial Position and Business Strategy

Getting finances right is key for smart strategic business decisions. It's central to making choices about money and tying those to big business plans. This way, the company's goals and money needs match, helping it grow and beat the competition.

Impact on Decision Making

Knowing a company's financial health helps a lot in making strategic choices. Looking closely at financial reports tells us the company's money status. This information is crucial for planning investments, managing funds, and deciding on dividends, like when to invest profits back into the business.

Aligning Financial Goals with Strategy

It's vital to match financial aims with business goals to improve efficiency and market stand. Keeping an eye on spending and managing cash flow helps set financial targets that support business plans. Implementing these steps ensures the company stays financially sound, ready to grow and explore new markets.

Schools like INSEAD show how well this can work with their online programs. They focus on real-life business scenarios and engaging studies. This helps professionals make smart business moves, showing how crucial finance-management is.

So, smart money management linked to business strategy is crucial for both today's operations and future growth. Keeping finances and goals in sync is key for long-lasting success.

Tools for Financial Position Assessment

New technology has changed how we look at financial health. Tools like financial analysis tools and financial dashboards help professionals make better, quicker decisions. These tools make it easier to handle complex data and improve decision accuracy.

Software for Financial Analysis

Today's financial analysis software is key for detailed financial reviews. It uses various methods to closely examine a business's finances. By pulling data from major financial reports, it gives a full view of financial well-being.

Utilizing Financial Dashboards

Financial dashboards simplify complex financial data. They show important metrics in real-time, like asset turnover, quick ratio, and return on equity. This helps users quickly understand financial details, making better financial decisions possible.

| Financial Metric | Description | Importance |

|---|---|---|

| Asset Turnover | Measures how efficiently a company uses its assets to generate sales. | Indicates operational efficiency |

| Quick Ratio | Indicates the ability of a company to meet its short-term obligations with its most liquid assets. | Measures liquidity without relying on inventory |

| Gross Profit Margin | Shows the financial health by revealing the amount of money left over from revenues after accounting for the cost of goods sold. | Helps in assessing operational efficiency and pricing strategy |

| Return on Assets (ROA) | Indicates how effectively a company uses its assets to generate profit. | Reflects the company’s efficiency in using its assets |

| Return on Equity (ROE) | Measures the profitability of a business in relation to shareholder’s equity. | Important for evaluating the profitability and efficiency of equity investment |

By using financial analysis tools and financial dashboards, companies understand their financial stance better. This leads to smarter, more strategic business choices. As these technologies get smarter, they will provide even better insights into finances.

Common Mistakes in Assessing Financial Position

In the world of corporate finance, it's critical to accurately assess a company's financial health. However, the complexity of financial statements makes this task challenging. Errors in interpreting these documents can seriously distort the understanding of a company's true financial condition.

Overlooking Liabilities

One major mistake is not examining liabilities closely enough. It's important for companies to thoroughly evaluate both short-term and long-term debts. This should include loans, credit lines, and other debts like trade credits and equipment financing. Failing to do so can underestimate a company's financial obligations and negatively impact liquidity assessments.

Misinterpreting Cash Flow

Correctly understanding cash flow is crucial for a company's survival and growth. Mixing up cash flow with profits is a common error. It can mistakenly suggest that a company is financially healthier than it actually is.

Profit shows how much money a company can make, but it's not the same as cash in hand. This is because of factors like money owed by customers, bills to pay, and how much stock is held. Also, incorrectly categorizing cash flow activities can give a misleading view of how effective a company is operating and investing.

| Error Type | Common Manifestations | Implications |

|---|---|---|

| Liability Oversight | Ignoring long-term debts, not accounting for trade credits | Underestimation of financial obligations, skewed liquidity ratios |

| Cash Flow Misinterpretation | Confusing cash flow with profits, faulty cash flow statement classifications | Impaired financial health assessment, misleading operational efficiency metrics |

| Debt Management Neglect | Poor monitoring of debt maturity and coverage ratios | Risk of insolvency, inaccurate assessment of financial stability |

| Economic Moats Oversight | Underestimating factors providing competitive advantage | Potential oversight of a company's market position and long-term viability |

Avoiding these mistakes in financial analysis can greatly improve a company's understanding of its financial standing. Paying attention to cash flow and debt management enhances financial reporting accuracy. It also supports better strategic planning by using precise financial data.

The Role of Audits in Financial Position

Audits are key to confirming a company's financial standing. They ensure the financial reports are accurate and trusted. Auditors follow specific standards, known as the Generally Accepted Auditing Standards (GAAS). This way, they bring transparency and trust among investors, regulators, and the public.

Importance of External Audits

External audits boost the trust in financial statements. They are done by independent Certified Public Accounting (CPA) firms. These firms check a company's financial records against GAAS. They make sure everything is right and follows rules like the Sarbanes-Oxley Act (SOX) of 2002. A good audit report can help a company get loans since lenders often want to see it.

An external audit showing no problems means a company is financially solid and honest.

Internal Controls and Their Significance

Having strong internal financial controls helps manage risks in financial reporting. Internal audits look at these controls to see if they're working right. They make sure the company's processes match its policies and goals. The SOX act also makes companies check their internal controls to stop fraud and ensure financial truth.

By catching and fixing issues, internal controls help keep a company's finances and operations in top shape.

Together, external audits and internal controls give a clear picture of a company's finances. They ensure the company follows laws and works better, upping investor trust. This mix of audits supports reliable financial reports and strengthens a firm's financial plans.

How to Improve Your Company’s Financial Position

To make a company stronger financially, it's key to improve cash flow and manage assets better. These steps help operations run smoother and strengthen the company's money matters.

Strategies for Cash Flow Improvement

Good cash flow management is crucial for a business to keep going and grow. By adjusting how and when payments are made and received, companies can see a real benefit. Here are some smart moves:

- Use automation for faster invoicing and payments, which helps money come in quicker.

- Charge for late payments while rewarding those who pay early to ensure steady money flow.

- Work out better deals with suppliers to pay later without hurting your relationship with them.

- Spread out when you pay bills to keep your cash level steady.

By keeping a close eye on cash flow and managing it wisely, businesses can avoid money troubles. This also allows them to use extra cash for expanding the business.

Enhancing Asset Management

Better asset management can really help a company's finances. This involves making the most of what you have and investing smartly in new assets. Let's look at what's important:

- Check regularly to make sure every asset is adding value to your return on investment.

- Improve how often you maintain key equipment to make it last longer and work better.

- Get rid of assets that aren't doing well to focus on those that will earn more.

- Think about leasing instead of buying to save upfront costs and stay flexible with cash.

Good asset management means working smarter, not harder. It cuts down on waste and boosts the performance of your assets.

| Strategy | Impact | Implementation Example |

|---|---|---|

| Automate invoicing | Reduces days sales outstanding | Use CRM platforms to automate billing processes |

| Stagger bill payments | Maintains uniform cash flow | Schedule weekly payments instead of a lump sum at month-end |

| Regular asset review | Maximizes asset ROI | Conduct quarterly reviews to assess asset performance |

| Lease high-cost equipment | Improves cash flow management | Opt for operational leases to mitigate repair and maintenance costs |

Future Trends in Financial Position Analysis

Looking ahead, the financial analysis field is constantly changing due to new innovations and rules. Businesses work hard to keep up with these changes in the financial world. Artificial Intelligence (AI) and advanced data analytics are now key tools. They help financial experts examine and use large amounts of data very effectively. Making smart decisions is crucial for success. This is because the value of a business links to its future cash flow. This is especially true in today's unpredictable markets, where most startups struggle with financial planning.

Impact of Technology on Financial Analysis

The rise of digital technology has made accurate financial forecasts more important than ever for creating value. AI, machine learning, and blockchain are more than just popular terms. They help provide detailed financial data. These technologies automate the making of complex financial reports. They also support quick, real-time reporting. This makes financial analysis more responsive and useful.

Evolving Financial Regulations and Standards

As technology advances, so do financial rules and regulations. Companies must be flexible with their financial reporting and compliance. Now, integrated reporting includes non-financial data like ESG metrics. Investors use these metrics to predict a company's future success. With systems from CFO Hub, financial leaders can meet new standards and bring in experienced financial professionals. These changes show that financial analysis isn't just about numbers anymore. It's about combining different types of data to help businesses succeed in uncertain times.

FAQ

What constitutes a company's financial position?

A company's financial position includes assets, liabilities, and shareholder equity. It shows what the company owns and owes. It also shows the invested capital and retained earnings.

Why is understanding financial position important for a company?

Knowing a company's financial position helps make smart decisions. It helps plan payments, invest wisely, and manage risks. This leads to financial stability and growth.

How can one evaluate a company's financial position through financial statements?

To evaluate a company's financial stance, look at the balance sheet, income statement, and cash flow statement. These documents reveal a company's assets, profitability, and liquidity.

What are the key financial ratios used in analyzing a company's financial health?

Essential financial ratios include the gross profit margin, net profit margin, and current ratio. There's also return on equity and debt-to-equity ratio. They measure a company's performance in key areas.

How do assets and liabilities affect a company's financial position?

Assets bring value and make money for the company. Liabilities are what the company owes. The balance between assets and liabilities shapes the company's net worth and stability.

What role do audits play in financial position assessment?

Audits offer an honest look at a company's financial statements. They verify the accuracy and trustworthiness of the data. This is vital for stakeholders and market trust.

What tools are available for assessing a company's financial position?

There are various tools, like financial analysis software, that help analyze financial statements. They provide up-to-the-minute financial insights.

How can a company improve its financial position?

Improving financial position can be done by better cash flow management. Also, by optimizing how receivables and payables are handled, and managing assets better.

How is shareholder equity significant in a company's financial position?

Shareholder equity shows what owners would claim after debts are cleared. It indicates a company's ability to add value for shareholders and its long-term health.

In what ways may financial position analysis evolve in the future?

Financial analysis will likely improve with AI and data analytics. Changes in financial laws will also play a part. This will make financial reporting and analysis better and faster.

What are common errors when assessing financial position?

Common mistakes include not seeing all liabilities, mixing up cash flow with profits, and misjudging liquidity. These errors can mislead about a company's health.

Why is the cash flow statement important?

The cash flow statement is key because it shows how cash is made and spent. It tells us about the available cash, crucial for daily operations and meeting debts.