Understanding the Various Trader Types in Finance

Finance has many trader types, each with its own way of working. Day traders, swing traders, and position traders all play big roles in the market. Knowing about these types is key to understanding finance.

Traders like technical and fundamental traders use different methods. Technical traders look at past price data to predict the future. Fundamental traders study a company's financial health to make decisions. Knowing these differences helps investors make better choices.

Key Takeaways

- There are several types of traders in finance, each with distinct characteristics and strategies.

- Day traders aim to profit from short-term price movements and market volatility.

- Swing traders analyze stocks to capture gains from tradable swings in stock price action over days to weeks.

- Technical traders rely on historical data, charts, and patterns to predict market movements.

- Understanding the different types of traders is essential for navigating the complex world of finance.

- The types of traders, including novice, generalist, and specialist traders, face unique challenges and opportunities in the market.

- Recognizing the differences between types of traders can help investors make informed decisions and achieve their financial goals.

Introduction to Trader Types

It's key to know the different trader types in the market. Each trader has a unique role in setting market trends and prices. There are many types, like fundamental, noise, market timer, sentiment, and arbitrage traders. They use various styles, such as day, swing, position, algorithmic, and scalping trading.

Knowing what each trader type does is important. It helps investors and financial pros make smart choices. For example, fundamental traders look at company events like earnings reports. On the other hand, noise traders make quick trades without looking at the big picture.

The Importance of Understanding Trader Types

Knowing about trader types is very important. It helps in spotting market trends and making smart decisions. It also helps in creating good trading plans and managing risks. Here are some key points:

- Types of traders: fundamental, noise, market timer, sentiment, and arbitrage traders

- Trading styles: day, swing, position, algorithmic, and scalping

- Why it matters: spotting trends, making smart choices, creating good plans, and managing risks

Overview of Trading Styles

Trading styles vary a lot among traders. Day traders, for example, make many trades a day to make small profits. Swing traders hold positions for days or weeks, waiting for big price changes. Knowing these styles is key for navigating the trading world.

| Trader Type | Trading Style | Description |

|---|---|---|

| Fundamental Trader | Long-term | Focuses on company-specific events like earnings reports, stock splits, reorganizations, or acquisitions |

| Noise Trader | Short-term | Operates without specific fundamental data and makes short-term trades based on economic trends |

| Day Trader | Short-term | Makes dozens or even hundreds of trades per day to scalp a small profit from each trade |

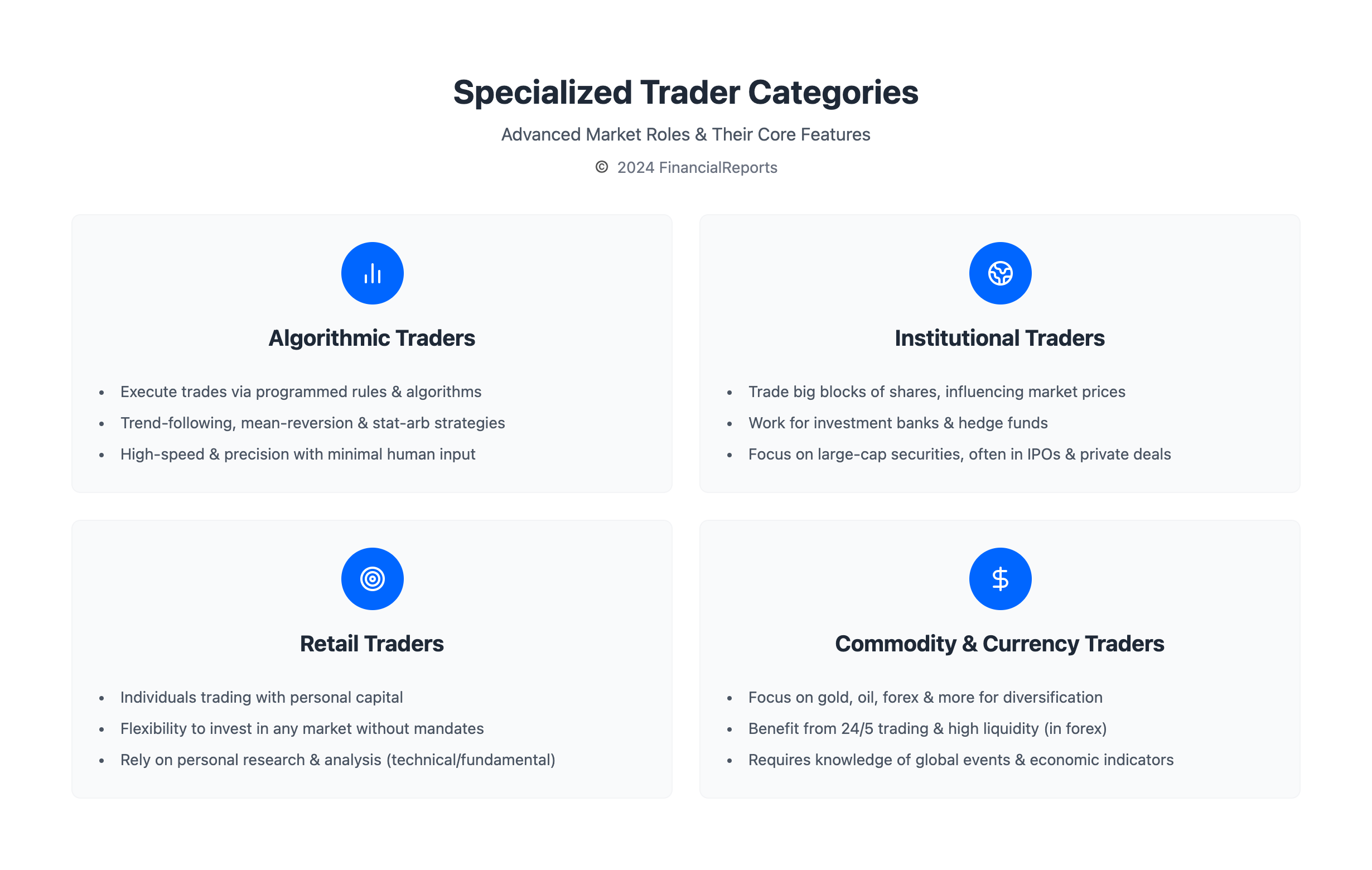

Day Traders

Day traders open and close positions in the same day. They aim to make money from small price changes. This style is popular for those who like fast action and quick results.

They use technical analysis and chart patterns to find good trades. This helps them make quick decisions.

Day traders limit their losses by setting a max loss per trade. This is usually 1% to 2% of their capital. They also use tools like real-time data and high-speed internet to find the best times to buy and sell.

Strategies Employed by Day Traders

Day traders often use leverage to increase profits. But, they must know the market well and follow strict rules to avoid big losses. Some common strategies include:

- Scalping: traders aim for quick profits, often in seconds to minutes.

- Momentum trading: they look for bigger price changes in a day.

- Range trading: they use support and resistance levels to make decisions.

Risks Associated with Day Trading

Day traders pay more in commissions because they trade often. They also face high risks, like quick losses and margin calls. But, they can make money on both sides of the market, which is key to their success.

Swing Traders

Swing traders hold positions for days or weeks to catch part of a price move. They use technical analysis and chart patterns to find good trades. This approach is more flexible than day trading, as it doesn't require constant screen watching.

Swing traders rely on technical analysis to spot trends and patterns. They manage risks over longer periods. Their goal is to make profits in financial securities over short to medium terms. Volatility is key, as it offers chances for profit, making volatile stocks ideal.

Swing traders use tools like moving averages and momentum indicators. They evaluate trades based on risk and reward. They combine technical and fundamental analysis for better insights. The benefits include less time needed, short-term profit chances, and using technical analysis. But, there are downsides like overnight risks, sudden losses, and missing long-term trends.

Successful swing traders focus on multiday patterns and indicators. They might trade with smaller sizes due to overnight risks. Knowing swing trading strategies helps in making better investment choices.

Position Traders

Position traders hold onto their investments for a long time. They aim to make money from big price changes over time. They use deep analysis of the market and trends to find good times to trade.

These traders usually make fewer than 10 trades a year. This is different from day traders who focus on quick changes. Position traders invest for the long haul, waiting for trends to peak.

Some key traits of position traders include:

- They use technical and fundamental analysis, along with macroeconomic factors and price history, to make smart choices.

- They take a patient approach, aiming for long-term gains from trends that can last weeks or months.

- They focus on big market moves and need a strategic mindset and good risk management skills.

Position trading can lead to bigger profits but needs a lot of patience and good risk handling. A big plus is that it's time-efficient. Once a trade is made, traders can wait for the outcome without constant monitoring.

| Trader Type | Trading Frequency | Investment Horizon |

|---|---|---|

| Position Traders | Low | Long-term |

| Day Traders | High | Short-term |

| Swing Traders | Medium | Short-to-medium-term |

Scalpers

Scalpers are traders who make quick trades, often in seconds or minutes. They need fast thinking and quick actions. Their goal is to earn small profits from many trades in a day.

Scalpers handle a lot of trades and do well under pressure. They trade when markets are busiest, like early morning and late evening. Scalping techniques mean making many short trades, holding positions briefly. Success in scalping depends on skill, experience, and strategy.

Scalpers use special tools like Level II quotes and charts. They must accept risks and handle the stress of fast trading. Scalping can offer high returns and flexibility in markets like stocks and forex. But, it can also be costly, with commissions affecting profits.

To succeed, scalpers need to know scalping techniques well. They must manage risks and make fast decisions. With the right skills and strategy, scalpers can make good profits.

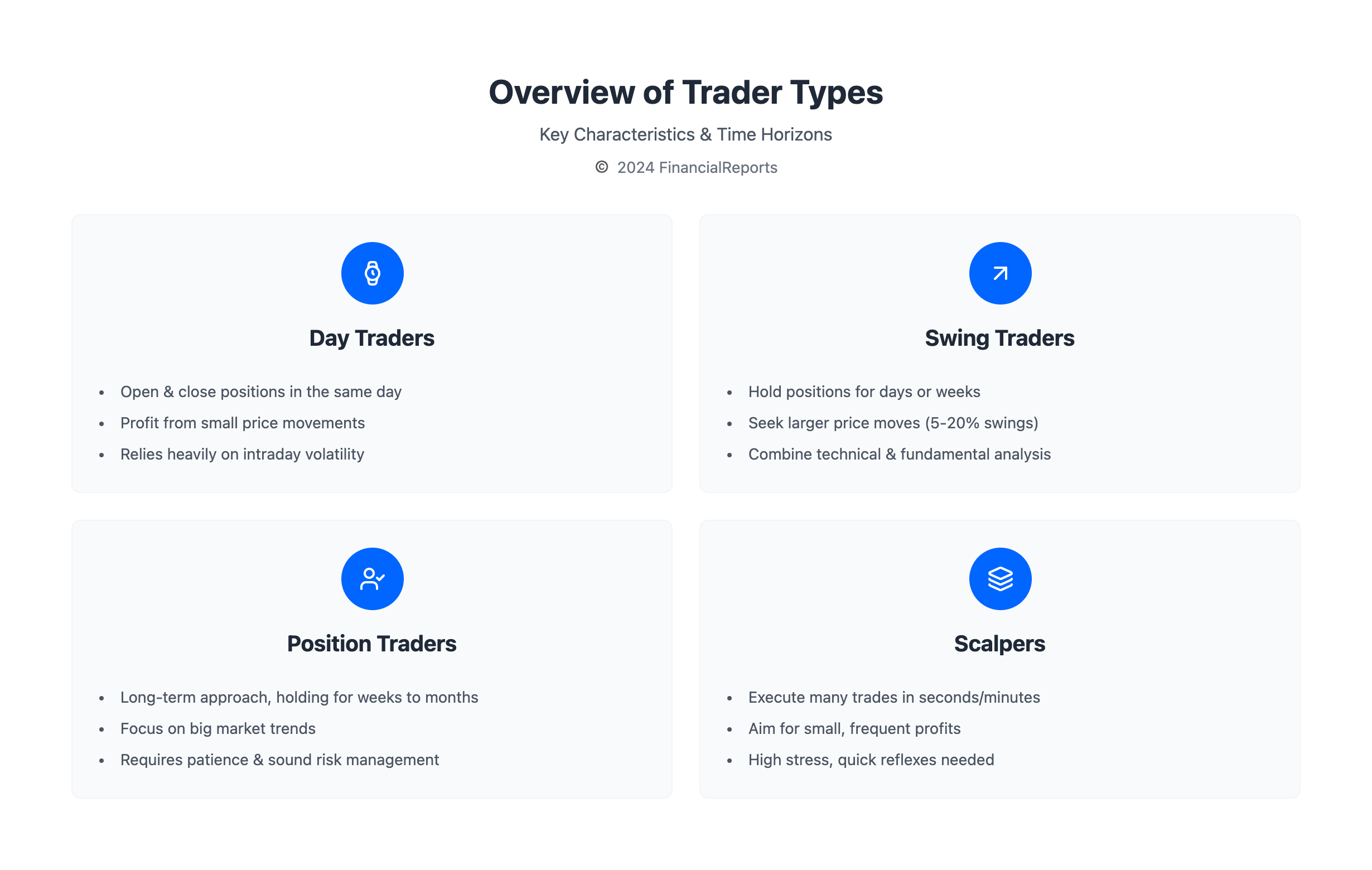

Algorithmic Traders

Algorithmic traders use computer programs to make trades based on set rules. These rules might include technical indicators and market trends. This method, known as algorithmic trading strategies, makes trading faster and more accurate. It also reduces the need for human input.

Some common strategies include following trends, mean reversion, and statistical arbitrage. Trend-following algorithms adjust to market changes. This helps traders make money from long-term trends and avoid big losses during market ups and downs.

Mean reversion strategies use tools like moving averages and Bollinger Bands. They look for when prices stray from their usual levels. Statistical arbitrage uses complex models to spot price differences between financial products for profit.

Algorithmic traders employ various algorithms for different tasks. These include:

- Volume-weighted average price (VWAP) algorithms

- Time-weighted average price (TWAP) algorithms

- Arrival price algorithms

- Single-stock algorithms

- Implementation shortfall algorithms

- Percentage of volume algorithms

These algorithms help with order execution, arbitrage, and following trends. They are mainly used by big investors and trading firms.

Institutional Traders

Institutional traders work for big institutions like investment banks and hedge funds. They use both fundamental and technical analysis to find good trades. They make decisions based on a deep understanding of the assets they trade.

These traders handle big blocks of shares, at least 10,000. They get basis point fees for each deal. Institutional trading strategies can really move a security's price because of their large trades. Some key traits of these traders include:

- They can invest in securities not open to regular traders, like swaps and forwards.

- They get better deals in initial public offerings (IPOs) than individual traders do.

- They focus more on big-cap securities than individual traders do.

Institutional traders are key players in the financial markets. Their institutional trading strategies can really shape the market. Knowing how they work is important for anyone looking to succeed in the markets.

Retail Traders

Retail traders are individuals who buy and sell securities through a brokerage. They use technical analysis and chart patterns to find trading opportunities. They make decisions based on their own research and analysis.

Characteristics of Retail Traders

Retail traders can make trades without affecting the market. They can buy and sell almost any financial product without limits. They also have less liquidity constraints, allowing them to open or close positions without significant impacts on liquidity.

Retail Trading Strategies

Retail traders use various strategies to profit from short-term price movements and market volatility. They use technical analysis and leverage to capitalize on market volatility and capture gains. Some common strategies include:

- Day trading: opening and closing trades intraday to profit from small price movements

- Swing trading: holding positions for 1 to 6 days to profit from speculated swings of 5-20%

- Technical trading: analyzing statistical trends from historical price data to identify tradable opportunities

Retail traders can benefit from using these strategies. They have the flexibility to trade in any market without investment mandates. This gives them more freedom compared to institutional traders.

| Trading Strategy | Description |

|---|---|

| Day Trading | Opening and closing trades intraday to profit from small price movements |

| Swing Trading | Holding positions for 1 to 6 days to profit from speculated swings of 5-20% |

| Technical Trading | Analyzing statistical trends from historical price data to identify tradable opportunities |

Currency Traders

Currency traders, also known as forex traders, focus on trading currencies on the foreign exchange market. They use forex trading strategies to find good trading opportunities. They make decisions based on a deep understanding of the currencies involved. The forex market is known for its high liquidity and 24/5 trading hours, attracting many currency traders.

To succeed, currency traders need discipline and risk management skills. They must also keep up with market news and trends. Economic indicators play a big role in currency values. Some common forex trading strategies include:

- Technical analysis: studying charts and patterns to identify trends and predict future price movements

- Fundamental analysis: analyzing economic indicators and news events to understand their impact on currency values

- Combining time frames: using multiple time frames to secure profitable positions

By employing these forex trading strategies and staying informed, currency traders can thrive in the fast-paced forex market. They make informed decisions to reach their trading goals.

Commodity Traders

Commodity traders focus on trading items like gold, oil, or crops. They use long-term trends and deep knowledge of the items to make trades. This field offers diversification and protection against inflation but demands discipline and risk management.

Experts say there are different types of commodity traders. Commercial traders know about supply chains, while pure traders aim for profit. Quant traders come from math and science backgrounds.

What is Commodity Trading?

Commodity trading is about buying and selling items like gold or oil. The U.S. Commodity Exchange Act defines commodities. Major exchanges include ICE Futures U.S. and the Chicago Board of Trade.

Trading Strategies for Commodities

Traders use commodity trading strategies to make money. These include looking at supply and demand, price trends, and using math models. Each method helps find good trading opportunities.

Market Influences on Commodity Prices

Many things affect commodity prices, like supply and demand, weather, and world events. For example, a drought can change crop prices. Traders must keep up with news to make smart choices. With the right commodity trading strategies, traders can succeed.

Conclusion

Understanding the different types of traders and their styles is key to success in the financial markets. Each trader, from day traders to position traders, has a unique approach. Knowing these differences helps investors make better choices and create effective trading plans.

The Future of Different Trader Types

Technology and market changes will likely boost algorithmic and institutional traders. They will use advanced data and automated systems. Yet, human traders, like day and swing traders, are vital. They bring expertise, adaptability, and market insight that algorithms can't match.

Final Thoughts on Selecting the Right Trading Style

Finding the right trading style is essential for success in finance. It depends on understanding oneself, risk tolerance, and goals. By weighing the pros and cons of each style and improving one's approach, investors can achieve long-term success.

FAQ

What are the main types of traders in finance?

In finance, traders can be day traders, swing traders, or position traders. There are also scalpers, algorithmic traders, and institutional traders. Retail traders, currency traders, and commodity traders make up the rest.

What are the key characteristics of day traders?

Day traders close their positions by the end of the day. They aim to make money from small price changes. They use charts and patterns to make quick decisions.

How do swing traders differ from day traders?

Swing traders hold their positions for days or weeks. They aim to profit from bigger price moves. They use charts to find opportunities, giving them more time than day traders.

What is the focus of position traders?

Position traders keep their positions for a long time. They aim to make money from big price changes. They use long-term trends and fundamental analysis, needing patience and careful risk management.

What is the strategy of scalpers?

Scalpers make many trades in a day. They aim to make small gains that add up. They use charts and patterns for quick decisions, needing discipline and careful risk management.

How do algorithmic traders use technology?

Algorithmic traders use computer programs for trades. They follow set rules based on technical indicators. This method allows for fast execution and systematic risk management.

What is the role of institutional traders in the markets?

Institutional traders work for big firms like banks and hedge funds. They use both fundamental and technical analysis for trades. Their big trades can really move the market.

Who are retail traders, and what are their trading strategies?

Retail traders trade with their own money online. They use charts and patterns for decisions. They rely on their own research and analysis.

What are the key aspects of currency trading?

Currency traders focus on trading currencies. They use charts and patterns for decisions. They benefit from the market's high liquidity and 24/5 trading.

How do commodity traders approach the market?

Commodity traders trade things like gold and oil. They use long-term trends and fundamental analysis. This approach offers diversification and protection against inflation.