Understanding the Truth About Financial Ratios

Financial ratios are key for looking at a company's financial health. They help us see how well a company is doing in terms of money, efficiency, and profit. By using these ratios, investors and analysts can understand a company's financial state and make smart choices.

Knowing about financial ratios is important. It helps us understand different types of ratios. These include ratios that show how liquid a company is, its profit, and how well it uses its assets. This info is key for seeing how well a company is doing and if it can grow.

Financial ratio analysis is a big part of looking at stocks. It lets investors compare companies in the same field and see how they've done over time. By looking at these ratios, investors can see if a company is good at making money, handling debt, and using its assets well. This info is important for making smart investment choices and getting better results.

Key Takeaways

- Financial ratios provide valuable insights into a company's liquidity, operational efficiency, and profitability.

- Financial ratio analysis is essential for fundamental equity analysis and investment decisions.

- Understanding financial ratios definition is critical for effective ratio analysis.

- Financial ratios help compare companies in the same industry and track their performance over time.

- Knowing and using financial ratios well can lead to better investment results.

- Using a mix of financial ratios is key for making confident investment choices.

- Financial ratios are used by many, including analysts, investors, and management teams, to evaluate a company's financial health and make informed decisions.

What Are Financial Ratios?

Financial ratios compare different parts of a company's financial statements. They give a quick look at a company's financial health and performance. These ratios help investors and analysts make decisions by providing numbers to work with.

Calculating financial ratios involves using formulas from a company's financial statements. For example, the current ratio shows if a company can pay its short-term debts. It's calculated by dividing current assets by current liabilities. This ratio, along with others, helps see if a company can meet its short-term needs.

Definition of Financial Ratios

Financial ratios help evaluate a company's performance and health. They are divided into types like liquidity, profitability, and efficiency ratios. Each type gives a different view of a company's financial state, helping investors and analysts make smart choices.

Importance in Financial Analysis

Financial ratios are key because they offer a way to compare companies of all sizes and in different industries. They let investors and analysts see how a company stacks up against others. This helps spot where a company is doing well and where it needs work, guiding better decision-making.

Key Types of Financial Ratios

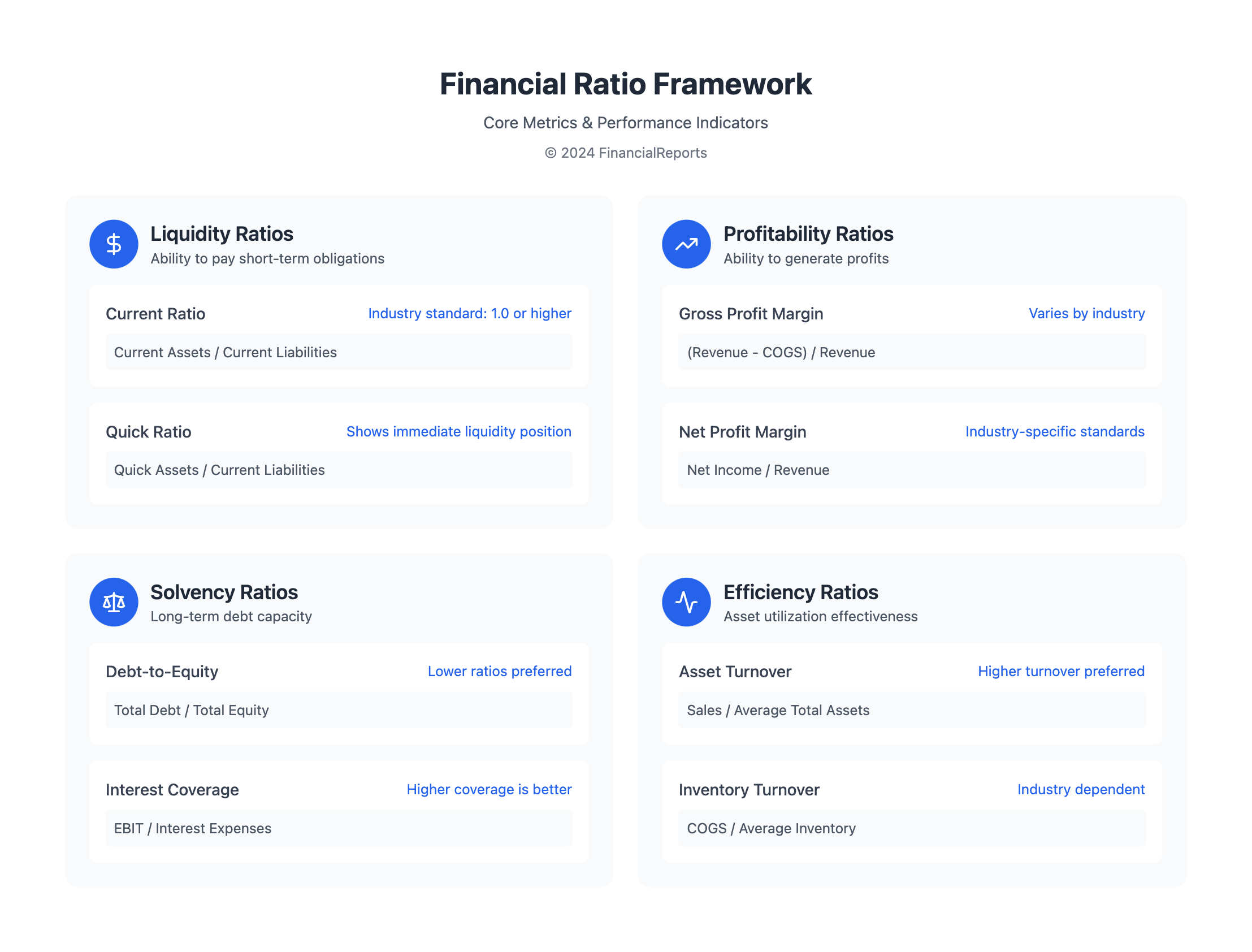

Financial ratios are key for checking a company's health and success. They include liquidity, profitability, solvency, and efficiency ratios. These tools help investors and creditors see if a company can make money, handle debt, and use assets well.

Examples of these ratios are the current ratio and the quick ratio. The current ratio shows if a company can pay short-term debts with what it has. A ratio of 1.0 or more is good, but it depends on the industry. Efficiency ratios, like the average collection period, show how well a company runs and where it can get better.

Here are the main types of financial ratios:

- Liquidity ratios: check if a company can pay short-term debts

- Profitability ratios: see how well a company makes money

- Solvency ratios: look at a company's long-term debt ability

- Efficiency ratios: check how well a company runs and uses assets

By looking at these ratios, companies and investors can really understand a company's finances. This info helps make smart choices about investing, lending, and business moves.

| Ratio Type | Description | Example |

|---|---|---|

| Liquidity Ratio | Measures ability to pay short-term debts | Current Ratio, Quick Ratio |

| Profitability Ratio | Evaluates ability to generate profits | Gross Profit Margin, Net Profit Margin |

| Solvency Ratio | Measures ability to meet long-term obligations | Debt-to-Equity Ratio, Debt Ratio |

| Efficiency Ratio | Evaluates operational performance and asset utilization | Average Collection Period, Average Days Inventory |

How to Calculate Financial Ratios

To do a deep financial accounting ratio analysis, you need to know how to calculate and understand financial ratios. These ratios are found in financial statements and give clues about a company's health and success.

Calculating financial ratios involves using data from financial statements like income statements and balance sheets. For instance, the price-to-earnings (P/E) ratio is found by dividing a company's stock price by its earnings per share. This ratio is important because it shows how much investors are willing to pay for a company's stock.

Some common financial ratios include:

- Liquidity ratios, such as the current ratio and quick ratio, which show if a company can pay off short-term debts.

- Profitability ratios, like the profit margin ratio and return on equity, which show how well a company makes profits.

- Solvency ratios, such as the debt-to-equity ratio, which check if a company can handle long-term financial duties.

Knowing how to calculate and understand these ratios helps investors and financial experts. They can then make smart choices based on a company's financial performance.

Interpreting Financial Ratios

Ratio analysis helps us understand a company's current state and future growth. It's key for investors and financial experts. By analyzing financial statements, we can spot trends, strengths, and weaknesses. This gives us a full picture of a company's financial health.

When looking at financial ratios, we must think about the bigger picture. This includes economic conditions, industry trends, and the company's unique situation. For instance, a company's profit margin can change due to market shifts. Here are some important things to keep in mind:

- Industry benchmarks: Compare the company's ratios to industry averages to determine its relative performance.

- Historical performance: Analyze the company's past ratios to identify trends and patterns.

- Competitor analysis: Compare the company's ratios to those of its competitors to determine its competitive position.

By considering these points and using financial statement analysis, we can better understand a company's financial health. This helps us make smart choices. Financial ratios and analysis are powerful tools for spotting opportunities and risks, aiding in informed investment decisions.

| Ratio | Formula | Example |

|---|---|---|

| Profit Margin Ratio | Net Profit / Revenue | 10% |

| Return on Investment (ROI) | Net Profit / Total Assets | 15% |

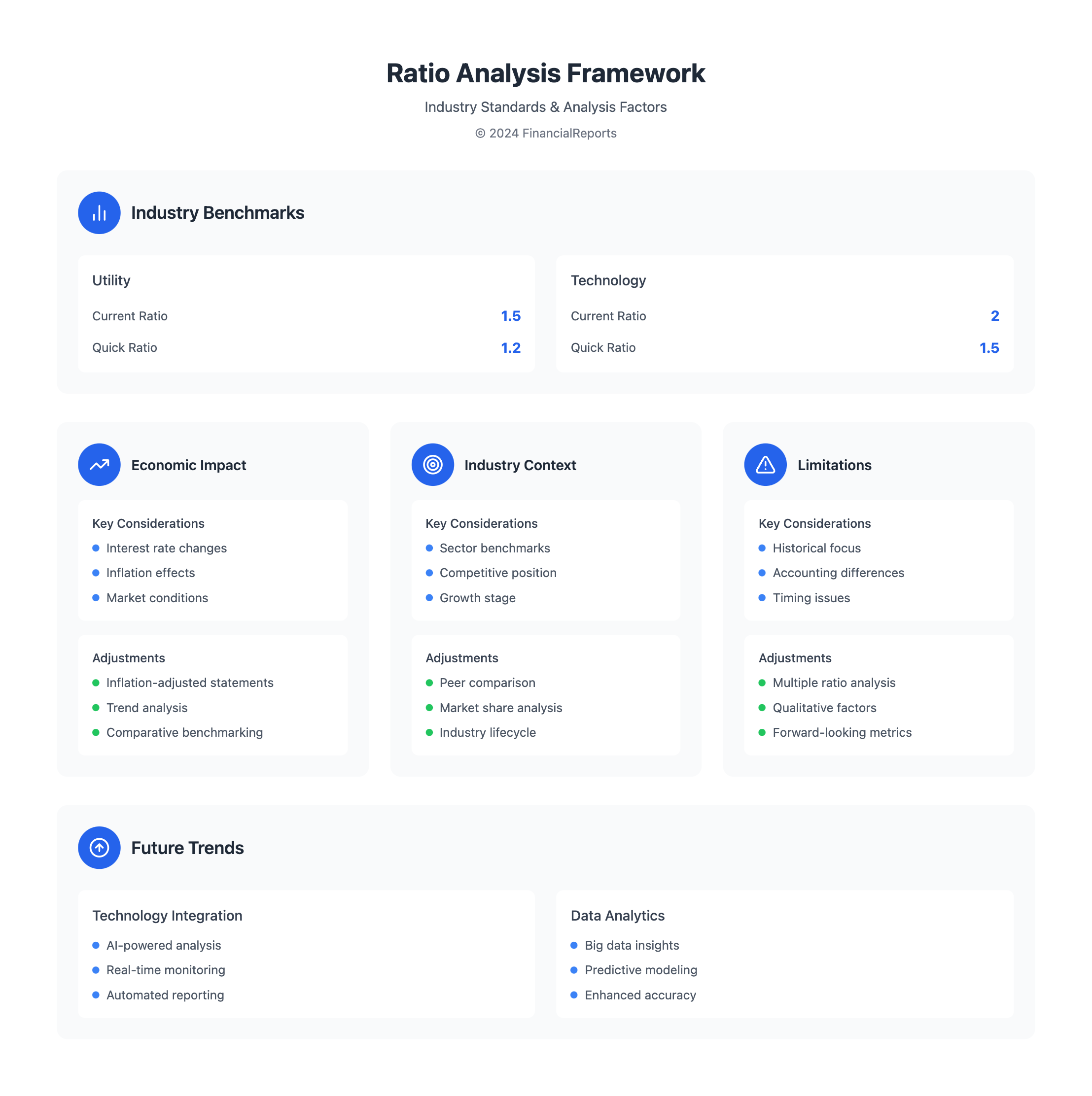

The Role of Industry Standards

Industry standards are key in financial ratio analysis. They help us understand a company's financial health by comparing it to others in the same field. For instance, what's normal for one industry might not be for another. A debt-equity ratio that's okay for a utility company could be too high for a tech firm.

When we look at a company's liquidity, we use ratios like the current and quick ratios. These show how well a company can pay its debts. By comparing these ratios to what's typical in the industry, companies can spot where they need to get better. This helps them stay competitive.

Some important standards include:

- D&B Business Browser, which provides industry, sector, and S&P 500 ratios for companies

- Factiva, which offers a Ratio Comparison Report for company, industry, sector, and S&P 500 ratios

- The Almanac of Business & Industrial Financial Ratios, which gives financial ratios for companies across different asset ranges by NAICS code

Using these standards helps companies understand their financial health better. This knowledge guides them in making smart choices to grow and improve.

| Industry | Current Ratio | Quick Ratio |

|---|---|---|

| Utility | 1.5 | 1.2 |

| Technology | 2.0 | 1.5 |

Limitations of Financial Ratios

Financial ratios help us understand a company's financial health. But, they have their limits. They are great for spotting trends, but don't look at them alone. It's important to use them with other financial and non-financial data.

Some major downsides of financial ratios include:

- They only show past results, not what's to come.

- They can be skewed by inflation, making comparisons tricky.

- Changes in accounting rules can mess with the numbers, making them hard to compare.

While ratio analysis is useful, it's key to know its limits. This way, financial experts can make better decisions. They can use ratios more wisely and avoid mistakes.

| Ratio | Formula | Description |

|---|---|---|

| Working Capital | Current Assets - Current Liabilities | Measures a company's ability to meet its short-term obligations. |

| Current Ratio | Current Assets / Current Liabilities | Evaluates a company's liquidity and ability to pay its short-term debts. |

The Impact of Economic Conditions

Economic conditions greatly affect financial ratios. It's key to think about these when we look at ratio analysis. In tough economic times, companies might see lower profit ratios. This is because people spend less and costs go up.

But, when the economy is growing, financial ratio analysis numbers can go up. Companies make more money and are more profitable.

Looking at financial accounting ratio analysis, we must think about how the economy affects ratios. For example, inflation can make the cost of goods sold go up. This can lower profit margins. Also, inflation can make borrowing costs rise, which can make the debt-to-equity ratio go up. This might show that a company is in financial trouble.

To really understand financial ratios, we need to adjust for inflation. We can do this by using inflation-adjusted financial statements. Or, we can apply inflation indices to the data. This way, we can see how a company is really doing financially.

Some important financial ratios to look at when thinking about the economy include:

- Debt-to-equity ratio

- Interest coverage ratio

- Inventory turnover

- Quick ratio

These ratios give us clues about a company's financial health. They help us see if it can handle tough economic times.

Utilizing Financial Ratios in Decision Making

Financial ratios and financial statement analysis are key for investors and management. They offer insights into a company's performance and financial health. Ratio analysis helps understand these insights for better decision-making.

For investors, ratios like the price-to-earnings (P/E) ratio, debt to equity (D/E), and return on equity (ROE) are vital. They help evaluate a company's value, profitability, and leverage.

For Investors

Investors use ratios to check a company's value and growth. The P/E ratio shows a stock's growth chance. The D/E ratio shows a company's financial risk.

For Management

Management uses ratios to set goals, find ways to improve, and make big decisions. Ratios like the current ratio, quick ratio, and gross profit margin are important. They show a company's liquidity, efficiency, and profit.

By using financial ratios and analysis, investors and management can make smart choices. This drives business growth and profit. Ratio analysis is a powerful tool, and knowing its meaning is key for success.

Future Trends in Financial Ratio Analysis

Artificial intelligence and machine learning are changing financial analysis. They make ratio analysis faster and more accurate. This helps in making quick and smart financial choices.

Now, ratio analysis covers more data. Big data analytics add depth to financial insights. This includes looking at a company's health through various financial ratios.

Emerging Trends and Technologies

Some new trends and technologies in financial ratio analysis are:

- Artificial intelligence and machine learning for predictive analytics

- Big data analytics for more detailed financial insights

- Cloud-based platforms for quick data access and analysis

- Automated reporting and dashboard tools for easier decision-making

These changes are making financial ratio analysis better. They help professionals make better choices and grow businesses. Keeping up with these advancements is key.

| Financial Ratio | Formula | Description |

|---|---|---|

| Current Ratio | Current Assets / Current Liabilities | Checks if a company can pay short-term debts |

| Debt-to-Equity Ratio | Total Liabilities / Shareholder's Equity | Looks at a company's debt and risk |

| Return on Assets (ROA) | Net Income / Total Assets | Shows a company's profit and asset use |

By using these new trends and technologies, financial experts can find new insights. This leads to better financial analysis and business growth.

Conclusion: The Value of Financial Ratios

Financial ratios are key in financial analysis. They help investors, analysts, and managers understand a company's health and growth. Knowing how to use ratio analysis is vital for making smart choices.

Liquidity ratios show if a company can pay its short-term debts. Profitability ratios look at how well it makes money. These ratios give a full view of a company's finances. By comparing them to others, you can spot what's working and what's not.

While financial ratios are useful, they should be used with other data too. This gives a complete picture for better decision-making. Keeping up with new trends in ratio analysis helps you stay ahead in a changing market.

FAQ

What are financial ratios and why are they important?

Financial ratios are numbers that show how well a company is doing financially. They help us understand a company's health and growth chances. These ratios are key for analyzing finances because they let us compare different companies easily.

What are the main categories of financial ratios?

There are several types of financial ratios. These include liquidity, profitability, solvency, and efficiency ratios. Each type helps us look at a company's financial health and how well it operates.

How are financial ratios calculated?

To find financial ratios, we use data from a company's financial statements. It's important to use the right formulas and avoid mistakes to get accurate results.

How should financial ratios be interpreted?

When we look at financial ratios, we need to consider many things. This includes industry standards, past performance, and the company's unique situation. Understanding ratios well helps us see a company's true financial health.

What is the role of industry standards in financial ratio analysis?

Industry standards help us understand a company's ratios better. They let us compare a company to its peers. It's important to know the industry when looking at ratios.

What are the limitations of relying solely on financial ratios?

Financial ratios have their limits. They don't always tell the whole story of a company's health. It's best to use ratios with other financial and non-financial data for a full picture.

How can broader economic conditions impact the interpretation of financial ratios?

Economic factors like interest rates and inflation can change ratio values. It's important to adjust for these changes when comparing ratios over time or across industries.

How can financial ratios be applied in decision-making processes?

Financial ratios are useful for investors and company managers. Investors use them to pick stocks and understand risks. Managers use ratios to check performance, find areas to improve, and make strategic decisions.

What are the emerging trends and future developments in financial ratio analysis?

New technologies like AI and big data are changing how we use financial ratios. Also, new financial standards and the use of non-financial data will shape the future of ratio analysis.