Understanding STD Margin in Financial Reporting

Profit margins show how much of a company's sales turn into profit. There are four main types: gross, operating, pretax, and net profit margins. The std margin, or standard margin, gives a detailed look at profit after standard costs are subtracted. It's key in financial reports, showing how efficient and competitive a company is.

The std margin is found by taking the gross margin and subtracting fixed costs. These costs include things like utility bills, rent, and insurance. Knowing about std margin helps investors, lenders, and businesses see how well a company is doing. In this article, we'll look at what std margin is, how it's calculated, and why it matters in financial reports and making decisions.

Key Takeaways

- Std margin is a critical metric in financial reporting, providing insights into a company's profitability and efficiency.

- The standard margin is calculated by subtracting fixed costs from the gross margin.

- Understanding std margin is essential for investors, lenders, and businesses to assess financial health and growth.

- Std margin offers a nuanced perspective on profitability, accounting for standard costs and expenses.

- This metric is vital for decision-making, allowing companies to evaluate their pricing power and production processes.

- Std margin is a key component of financial analysis, providing a complete view of a company's financial performance.

- Industry-specific insights into std margin can help companies identify areas for improvement and optimize their financial strategies.

What is STD Margin?

STD margin, or standard margin, is a way to measure a company's profit. It subtracts usual costs from what the company makes. This gives a clearer picture of a company's real profit compared to just looking at gross profit.

The std margin is found by taking what's left after removing costs like salaries, rent, and bills from the revenue.

Definition of STD Margin

The std margin is very important in finance. It shows how well a company can handle costs and make money. By using std margin, experts can find ways to better manage costs and plan for growth.

Importance in Financial Analysis

In finance, std margin is key to knowing a company's health. It lets us compare how profitable different companies are, no matter their size or costs. For example, a company with a high std margin might be more competitive.

Here are some important things about std margin:

- Helps measure profitability by deducting standard operational costs from revenue.

- Provides a more realistic view of a company's bottom-line profitability.

- Is a key indicator of a company's ability to manage costs and generate profits.

| Industry | Net Profit Margin | Gross Profit Margin |

|---|---|---|

| Construction | 5% | 19% |

| Retail | 5% | 22% |

| Restaurants | 15% | 67% |

Understanding std margin and its role in finance helps businesses make better choices. This can lead to higher profits and better competition.

Components of STD Margin

To grasp the standard margin, we need to look at its parts. It includes revenue and costs like the cost of goods sold (COGS) and operating expenses. COGS covers direct costs for making products or delivering services, like labor and materials. Operating expenses are indirect costs, like rent, utilities, and admin costs.

It's key to know the difference between fixed and variable costs. For example, a factory might have fixed costs like rent and variable costs like labor and materials. Knowing these helps businesses work better and make more money.

Revenue and Cost of Goods Sold (COGS)

Revenue is all income from sales, including any discounts or returns. COGS includes direct costs for making products. The standard margin is found by subtracting COGS from revenue, then dividing by revenue and multiplying by 100. This shows how profitable a company is.

Operating Expenses

Operating expenses are costs for running the business, not including COGS. These can be fixed or variable, like salaries, rent, and marketing. By looking at these expenses compared to revenue, businesses can cut costs and work more efficiently.

Knowing the parts of the standard margin helps businesses make smart choices and grow. By checking these parts often, companies can get better at making money.

How to Calculate STD Margin

To find the std margin, you need to know the formula and steps. It's about subtracting fixed costs from revenue. This is shown as: STD Margin = Revenue - Fixed (Standard) Costs.

Calculating std margin involves a few steps. First, you need to find the revenue and fixed costs. Revenue is the money made from sales. Fixed costs are expenses that don't change with sales. Examples include rent, salaries, and insurance.

Formula Breakdown

The std margin formula has two parts: revenue and fixed costs. Revenue is the money from sales. Fixed costs are expenses that stay the same, no matter the sales.

Step-by-Step Calculation

To find the std margin, follow these steps:

- Find the revenue: This is the money made from sales.

- Find the fixed costs: These are expenses that don't change with sales.

- Subtract the fixed costs from the revenue: This gives you the std margin.

For example, let's say a shop makes $100,000 in revenue and has $30,000 in fixed costs. The std margin would be $70,000. This means the shop has $70,000 to cover variable costs and make profit.

Factors Influencing STD Margin

Many things can change a company's STD margin. Economic conditions and industry trends are big ones. For example, high inflation can raise costs, hurting STD margin.

Industry trends also matter a lot. Companies in high-demand, low-competition fields often see better STD margins. But, those in crowded markets with low demand might struggle.

Some key things that can affect STD margin include:

- Revenue and cost of goods sold (COGS)

- Operating expenses

- Economic conditions, such as inflation and interest rates

- Industry trends and competitive dynamics

It's vital for companies to understand these factors. By doing so, they can work on improving their STD margin. For instance, they might cut COGS or operating expenses to boost their margin.

| Factor | Description |

|---|---|

| Economic Conditions | Inflation, interest rates, and other economic factors that can impact STD margin |

| Industry Trends | Competitive dynamics, demand, and other industry-specific factors that can influence STD margin |

| Revenue and COGS | Factors that impact a company's revenue and cost of goods sold, such as pricing and production costs |

| Operating Expenses | Factors that impact a company's operating expenses, such as labor costs and overhead |

By looking at these factors and using smart strategies, companies can better their STD margin. This helps them reach their financial targets.

STD Margin vs. Other Profit Margins

When looking at a company's money, it's key to check different profit margins. This includes std margin and standard margin. These numbers show how profitable a company is. They help investors make smart choices.

A company's gross margin shows how much profit it makes from selling things. Companies with a gross margin of 60% or more usually do better than those with lower margins. Std margin, or standard margin, looks at more costs, like operating expenses. It gives a fuller picture of a company's profit.

Comparison with Gross Margin

Std margin and gross margin are different because of how they're calculated. Gross margin only looks at the cost of making and selling things. Std margin also includes other costs, like running the business. This makes a big difference in how profitable a company seems.

For example, a company might have a high gross margin but a low std margin. This is because its operating costs are high.

Comparison with Operating Margin

Operating margin shows how profitable a company is before it pays interest and taxes. Std margin gives a broader view of profit, but operating margin focuses on the core business. Looking at both std margin and operating margin helps investors understand a company's health better.

Here are the main differences between these margins:

- Gross margin: revenue minus cost of goods sold

- STD margin: revenue minus cost of goods sold and operating expenses

- Operating margin: revenue minus cost of goods sold and operating expenses, before interest and taxes

By looking at different profit margins, like std margin and standard margin, investors can understand a company's finances better. This helps them make better investment choices.

Importance of STD Margin for Businesses

Knowing the standard margin is key for businesses to see their profit and make smart choices. It shows how much profit is left after paying for the basics. This helps firms spot where they're losing money, change how they work, or invest better.

For example, a company with a low margin might need to raise prices or cut costs to get healthier financially.

As financial reporting guidelines say, the standard margin is a top indicator of a company's health. It's vital to watch it often to spot trends and boost profits. Ways to up the margin include cutting costs, getting rid of products that don't sell well, and tweaking prices.

Here are some ways the standard margin helps in making better business choices:

- Spotting where to cut costs

- Improving how much you charge

- Spending money wisely

By using the standard margin, businesses can make choices based on facts to grow and do better financially.

| Industry | Average Net Profit Margin |

|---|---|

| Advertising | 3.30% |

| Apparel | 5.87% |

| Financial services (non-bank and insurance) | 26.94% |

The table shows profit margins differ by industry. Understanding the standard margin helps businesses navigate their markets and make choices to grow and profit.

Applying STD Margin in Financial Forecasting

STD margin is key in financial forecasting. It helps predict future performance by analyzing past data and trends. Companies use it to set realistic goals and make smart decisions.

They include STD margin in their revenue projections. This helps adjust business strategies for better results.

Some important steps for using STD margin in forecasting are:

- Looking at competitors' margins to find ways to improve

- Changing prices to boost profit margins

- Scaling operations to match demand and revenue forecasts

Using STD margin in forecasting gives companies a competitive edge. It helps them make more accurate predictions. This leads to better decision-making and business growth.

| Financial Metric | Description |

|---|---|

| Std Margin | A measure of a company's profitability, calculated as the difference between revenue and the cost of goods sold |

| Gross Margin | A measure of a company's efficiency, calculated as the difference between revenue and the cost of goods sold, divided by revenue |

STD Margin in Different Industries

The standard margin, or std margin, is key to checking a company's financial health. It changes a lot between different industries. To get the std margin, we must look at what makes each sector unique.

In the manufacturing sector, companies like Apple Inc. (AAPL) show high operating profit margins. They had a 24% margin for the fiscal year ending Sept. 26, 2020. On the other hand, the retail clothing industry has lower margins because of tough competition.

Industry-Specific STD Margin Benchmarks

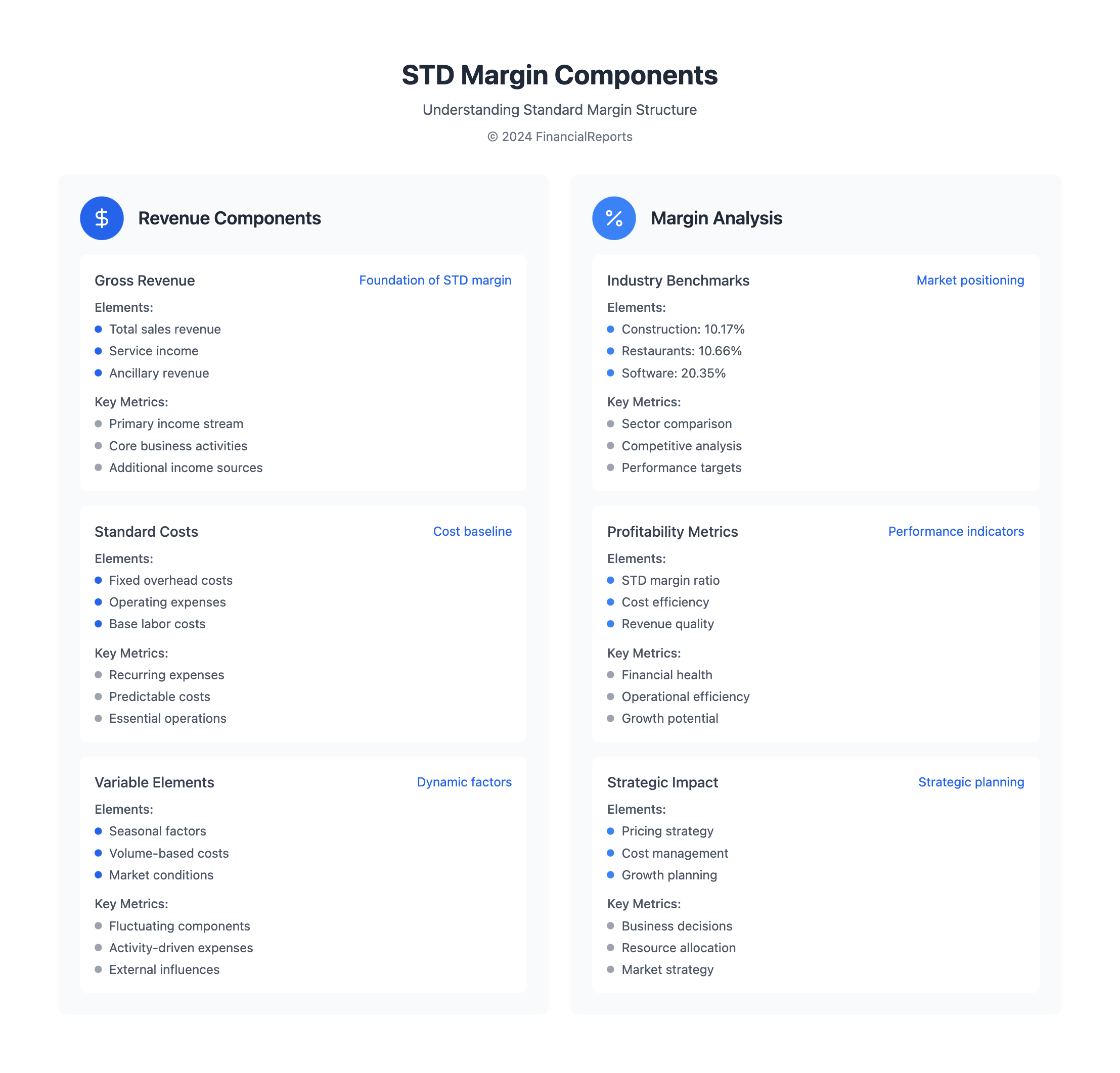

Some industries have their own std margin benchmarks, such as:

- Construction Supplies: 10.17%

- Restaurant/Dining: 10.66%

- Software (Entertainment): 20.35%

- Tobacco: 27.52%

Knowing these benchmarks is vital for businesses to check their profits and make smart choices. By adjusting prices, controlling costs, and managing stock, companies can boost their std margin. This helps them stay ahead in their markets.

The std margin is very important for a company's success. It's key to keep checking and improving the std margin. This ensures the company stays profitable and successful over time.

Common Mistakes in STD Margin Calculation

Calculating the standard margin is key for businesses to check their profits and make smart choices. But, there are common errors that can mess up these calculations. One big mistake is misunderstanding costs, which can lead to wrong standard margin figures.

Another error is ignoring other income, like interest or extra sales. This gives a partial view of a company's money situation. To steer clear of these blunders, it's important to know the standard margin well.

Misclassifying Fixed vs. Variable Costs

Getting fixed and variable costs wrong can really affect standard margin figures. Fixed costs, like rent and salaries, stay the same no matter how much you produce. Variable costs, like materials and labor, change with how much you make. It's critical to correctly sort these costs for accurate standard margin numbers.

Omitting Ancillary Revenue Streams

Leaving out extra income, like interest or by-product sales, can also mess up standard margin figures. These incomes can add a lot to a company's profits. They should be included in standard margin calculations for accuracy.

By avoiding these common mistakes and getting standard margin calculations right, businesses can make better choices and grow. Using a standard margin as a guide can help companies check their financial health and spot areas to get better.

Tools and Software for Managing STD Margin

Managing std margin well is key for businesses to stay profitable and competitive. Many tools and software help with this, making it easier to track and calculate std margin. Financial reporting software gives companies timely insights into their financial health.

Tools like QuickBooks offer advanced features for managing std margin. They include automated calculations and detailed reports. Spreadsheets, such as Excel, let businesses create custom templates for tracking std margin. This way, they can fit their tracking to their specific needs.

Using these tools brings several benefits:

- They make std margin calculations more accurate and efficient.

- They give a clear view of a company's financial performance and profitability.

- They make reporting and analysis easier.

By using these tools, businesses can better manage their std margin. This helps them make smart decisions to grow and increase profits. With the right technology and knowledge, companies can handle std margin management well. This ensures a healthy std margin that supports their long-term success.

| Tool/Software | Key Features | Benefits |

|---|---|---|

| QuickBooks | Automated calculations, detailed reporting | Improved accuracy, enhanced visibility |

| Excel | Customizable templates, advanced formulas | Streamlined reporting, tailored approach |

Best Practices for Monitoring STD Margin

Keeping a healthySTD marginis key for businesses to stay profitable and competitive. It's important to regularly check and analyze this financial metric. Also, be ready to change your business strategies when needed.

Regular Review and Analysis

Checking yourSTD margindata often is vital. It helps spot trends and issues early. AddSTD marginanalysis to your financial reports, looking at revenue, costs, and expenses.

This way, you'll understand what affects yourSTD margin. You can then make quick changes to keep your profits high.

Adjusting Business Strategies

Markets and industries change, so your business strategies must too. This might mean changing prices, finding new ways to make money, or cutting costs. Being flexible helps you manage yourSTD margin well.

It also sets your business up for success in the long run.

FAQ

What is STD Margin?

STD Margin, or Standard Margin, shows how much profit a company makes after paying fixed costs. These costs include salaries, rent, and utility bills. It gives a clear view of a company's real profit.

Why is STD Margin important in financial analysis?

STD Margin helps accurately measure a company's profit. It's better than other metrics like gross and operating margins. It shows the real financial health of a business, helping with cost management and planning.

What are the key components of STD Margin?

STD Margin focuses on revenue and fixed costs. Fixed costs include the Cost of Goods Sold (COGS) and operating expenses like rent and utilities.

How is STD Margin calculated?

To calculate STD Margin, subtract fixed costs from revenue. This separates fixed from variable costs. It shows the business's true profit.

What factors can influence STD Margin?

Many things can affect STD Margin. This includes inflation and industry changes. Knowing these helps businesses stay profitable.

How does STD Margin differ from other profit margin metrics?

STD Margin focuses on fixed costs, giving a detailed view of profit. It's useful for comparing different business areas or making strategic decisions.

What are the key applications of STD Margin for businesses?

STD Margin helps businesses check their profit, spot weak areas, and plan better. It's key for financial planning and comparing with competitors.

How does STD Margin vary across different industries?

Different industries have different costs that affect STD Margin. For example, manufacturing focuses on raw materials, while services focus on salaries. Knowing these differences is vital for financial analysis.

What are some common mistakes in calculating STD Margin?

Mistakes include mixing up fixed and variable costs, ignoring extra revenue, and missing standard expenses. Accurate cost tracking and detailed reports are essential.

What tools and software are available to manage STD Margin?

Tools like QuickBooks and Excel templates help with STD Margin. They make calculations easier, more accurate, and save time.

How can businesses effectively monitor and manage STD Margin over time?

Regular reviews and forecasting are key. Adapting to market changes helps keep profits up. STD Margin guides businesses to meet their financial goals.