Understanding Risk Analysis Meaning | Key Insights

Risk analysis is key for businesses to spot and handle possible dangers. It helps them make smart choices and stay efficient in a changing world. A Verizon report shows that 14% of business breaches started with exploiting weaknesses, nearly tripling from last year. This shows why good risk analysis is so important.

This process looks at possible risks, like cyber threats, and finds ways to lessen them. It shows how companies can get ahead of dangers before they happen.

The meaning of risk analysis goes beyond just finding risks. It's about figuring out which ones are most important. This is where numbers and stats come in, helping to understand the financial and likelihood of threats. By using risk analysis, companies can prepare for and tackle risks, helping them grow and stay strong in a tough market.

For example, a company might use numbers to figure out how much a cyber attack could cost them. Then, they make a plan to avoid that risk.

Key Takeaways

- Risk analysis is essential for assessing possible dangers to businesses

- Understanding risk analysis meaning helps companies make smart choices and follow rules

- Quantitative risk analysis uses numbers and stats to look at risks

- Risk analysis example: using numbers to understand risks and make plans to avoid them

- Good risk analysis is key for keeping operations smooth and business growing

- Risk analysis helps companies get ready for and deal with risks, like cyber threats, ahead of time

What is Risk Analysis?

Risk analysis is key for organizations to handle possible risks. It's about spotting, checking, and sorting risks to lessen their effects. The risk analysis meaning focuses on using data to look at threats and tell risks from unknowns.

Definition of Risk Analysis

Risk analysis is a detailed process to find, check, and sort risks. It uses numbers and opinions to see risks and how they might affect a company. There are a few main types of risk analysis:

- Quantitative risk analysis, which uses numbers and models to measure risk

- Qualitative risk analysis, which uses opinions to create a risk model

Importance in Decision-Making

Risk analysis is very important for making choices. It helps companies think about the good and bad of different choices. By doing a good risk analysis, companies can make smart choices that reduce risks and grab chances.

The good things about risk analysis include better planning, following rules, keeping things running, and making people trust the company more.

| Risk Analysis Type | Description |

|---|---|

| Quantitative Risk Analysis | Assigns numerical values to risk using mathematical models and simulations |

| Qualitative Risk Analysis | Relies on subjective judgment to build a theoretical model of risk |

Types of Risk Analysis

Risk analysis is key for organizations to spot, evaluate, and lessen risks. There are two main types: qualitative and quantitative. Qualitative analysis uses scores to judge risk based on how severe and likely its outcomes are. Quantitative analysis, on the other hand, uses data to calculate risk.

Knowing about risk analysis and using it in examples can really help manage risks. This is important for any business.

A simple example of qualitative risk analysis is the risk matrix. It's a table that shows the chance of a risk happening against its possible impact. This helps organizations focus on the most critical risks and plan how to tackle them.

Quantitative risk analysis, though, uses stats and data to measure risks. It gives a clearer picture of a risk's impact. This method is best for big projects or high-stakes situations.

| Type of Risk Analysis | Description |

|---|---|

| Qualitative Risk Analysis | Assesses risk based on perception of severity and likelihood |

| Quantitative Risk Analysis | Calculates risk based on available data |

In summary, knowing about the different risk analysis types and using them in examples is vital. It helps organizations make smart choices and reduce risks. By mixing qualitative and quantitative analysis, businesses can create a solid risk management plan that fits their goals.

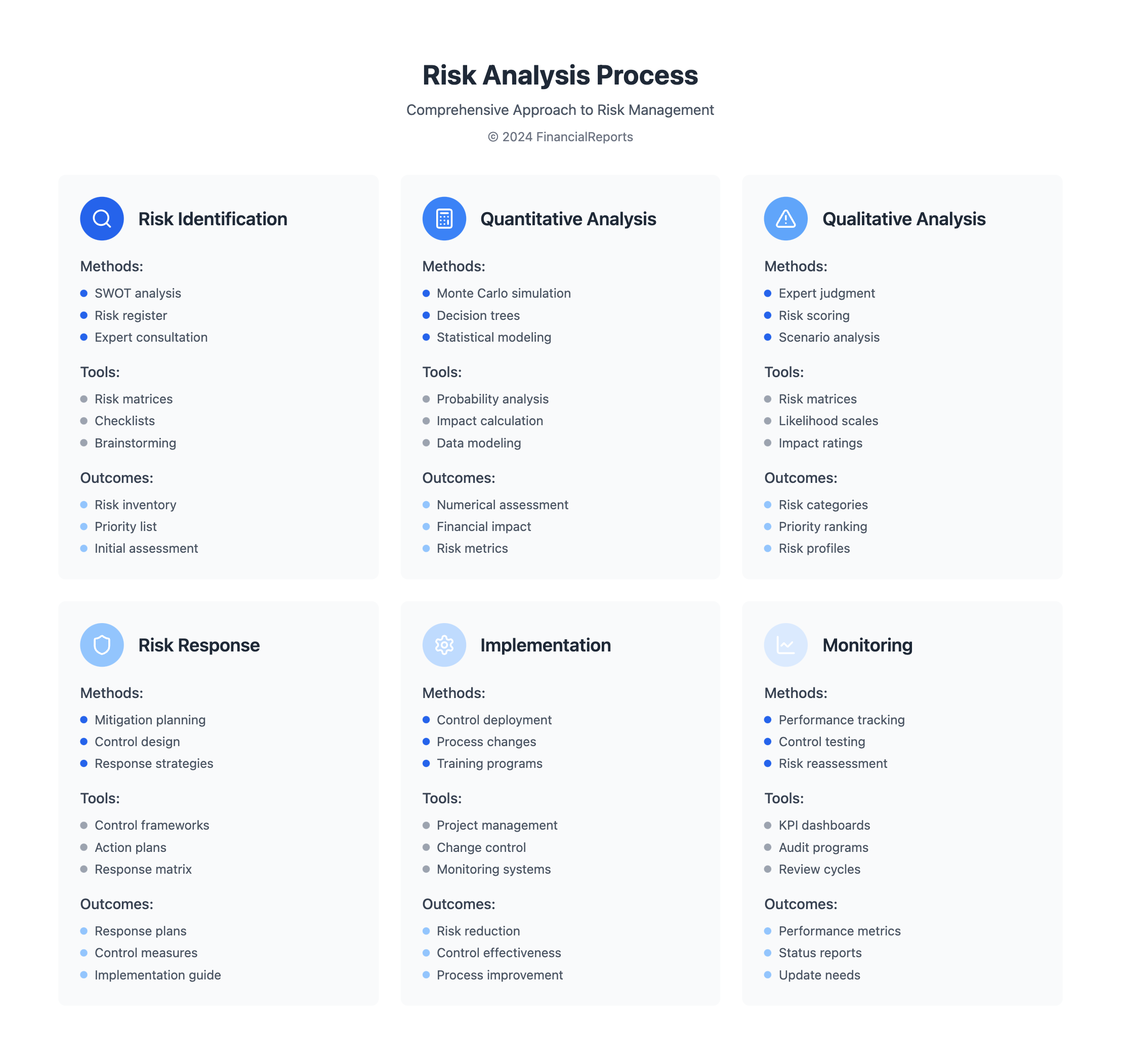

The Risk Analysis Process

Risk analysis is key to spotting and handling risks that could harm a business. A risk analysis example shows how to find, check, and tackle risks. The facilitated risk analysis process (FRAP) looks at one thing at a time, like a system or part of a business.

The steps in risk analysis are:

- Identifying risks: This means finding possible risks that could affect the business.

- Assessing risks: This is about figuring out how likely and big of an impact each risk could have.

- Developing responses: This is about coming up with plans to lessen or handle each risk.

A risk analysis example shows why this process is vital. It helps cut down on losses and grab chances. Businesses use tools like risk matrices and deep risk checks to make good plans.

| Risk Category | Likelihood | Impact |

|---|---|---|

| Financial | High | High |

| Operational | Medium | Medium |

| Strategic | Low | Low |

By sticking to a clear risk analysis process, businesses can get ready for risks. They can also make strong plans to deal with them.

Key Tools for Risk Analysis

Risk analysis is about finding and checking risks that could affect an organization's goals. To do this well, several important tools are used. These tools help find, check, and sort risks. This way, organizations can handle or lessen them.

Some top tools for risk analysis are:

- SWOT analysis, which finds an organization's strengths, weaknesses, opportunities, and threats

- Probability and Impact Matrix, which looks at how likely and big a risk is

- Risk Register, which keeps a detailed list of risks, their chances, impact, and how to fix them

Using these tools, organizations can better understand their risks. They can then make plans to manage them. This helps them make smart choices, avoid big losses, and grab chances. Good risk analysis is key for reaching business goals and staying strong in the long run.

Risk analysis is not a one-time thing. It needs to keep going with regular checks. As risks change, so must the plans to deal with them. With the right tools and methods, organizations can stay on top of risks and reach their targets.

Risk Analysis in Project Management

Risk analysis is key in project management. It helps sort out project dangers and spot the ones to watch closely. Knowing the risk analysis meaning lets managers get ready for possible problems. This way, they can use resources wisely to protect against big threats.

A risk analysis example in project management is using decision trees and Monte Carlo simulations. These tools help managers sort risks and plan how to deal with them. A good risk analysis can cut down on delays, save money, and make sure the project succeeds.

Some main benefits of risk analysis in project management are:

- Spotting threats and chances early on

- Using resources better

- Making stakeholders more confident

- Lowering the risk of going over budget

Adding risk analysis to project management plans helps projects run smoothly and succeed. It's vital for any project, big or small, to reach its goals and avoid risks.

Common Challenges in Risk Analysis

Risk analysis is key in making decisions, but it faces many hurdles. One big worry is underestimating risks, which can cause big losses. For example, the auto industry didn't see the pandemic coming, showing the need for better risk planning.

Another issue is not having enough data. This makes it hard to really understand risks, which is tough for complex systems or new events. To tackle this, using technology and working together across teams is vital. This way, we can get a full picture of risks.

Some common hurdles in risk analysis include:

- Underestimating risks

- Lack of data and information

- Difficulty in considering all risks

- Inadequate communication of risk information

By facing and solving these problems, companies can make better risk analysis plans. This leads to smarter decisions and less risk of loss. A good risk analysis example can protect a company's future and success.

The Role of Technology in Risk Analysis

Technology is key in making risk analysis better. It helps companies make smart choices. Tools like data analytics and machine learning help spot, check, and lower risks.

Technology's role in risk analysis is growing. It lets companies watch risks in real-time and predict them. For example, Monte Carlo simulations help guess what might happen. And cybersecurity software keeps data safe from hackers.

Using technology in risk analysis has many benefits. It makes finding and checking risks better. It also helps guess and stop risks before they happen. Plus, it lets companies watch risks as they change.

- Improved accuracy and efficiency in identifying and assessing risks

- Enhanced ability to predict and mitigate possible risks

- Real-time monitoring and analysis of risk factors

- Increased transparency and accountability in risk management

By using technology, companies can understand risks better. This helps them make choices that lead to success.

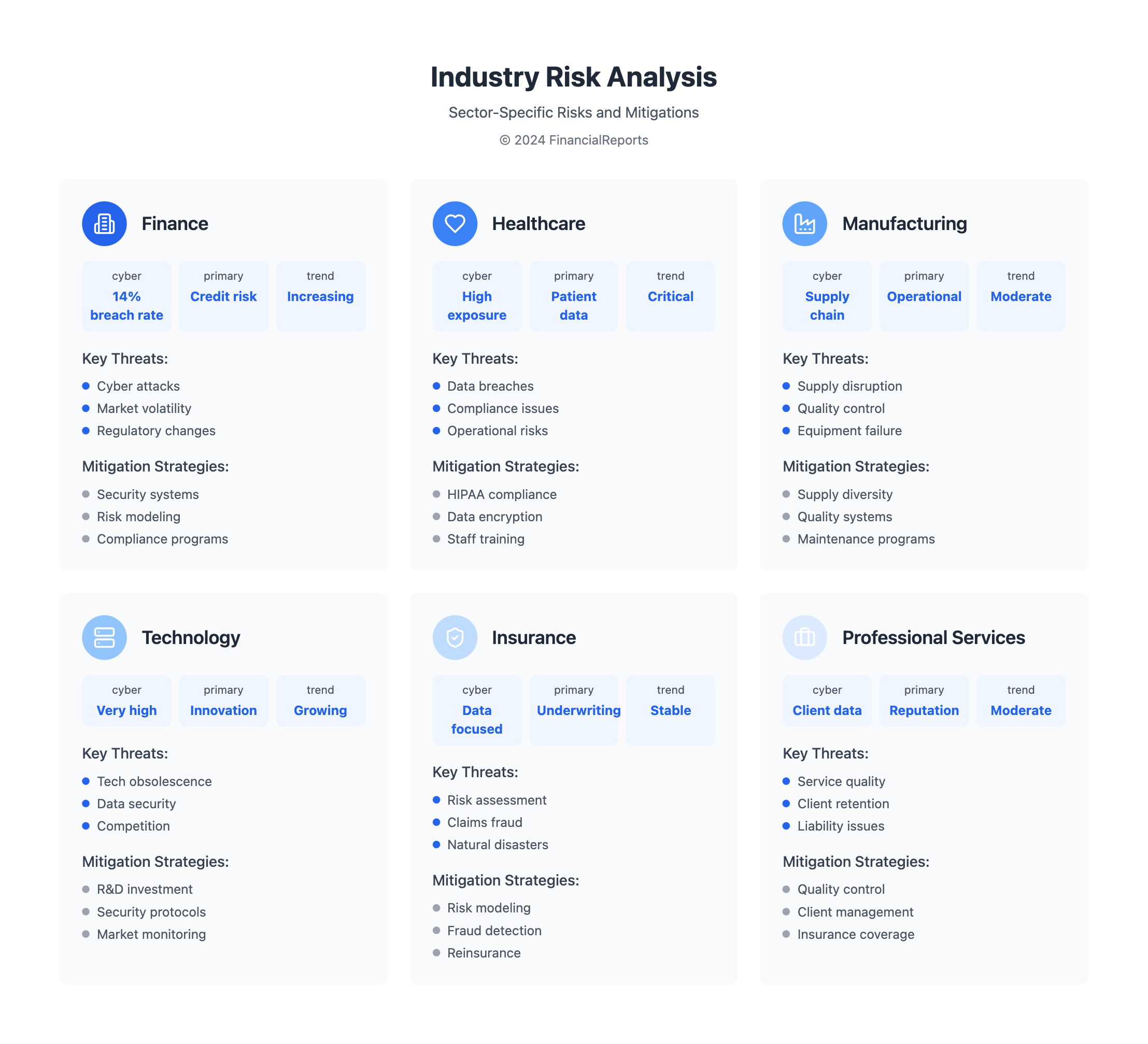

Key Industries Utilizing Risk Analysis

Risk analysis is key for many industries. It helps them spot, check, and lower risks. Knowing the risk analysis meaning is vital for smart choices and less loss. For example, finance uses it to check credit risks and improve portfolio management.

Finance, healthcare, and manufacturing need risk analysis to stay strong and grow. They use it in many ways, like:

- Finance and banking: to make smart investment choices and manage portfolios

- Healthcare: to weigh risks and benefits of new treatments and ensure quality

- Manufacturing: to model risks in supply chains and control quality

With risk analysis, companies can create plans to handle risks and grab chances. This helps them grow and succeed in business.

Best Practices for Effective Risk Analysis

Creating a strong risk analysis framework needs ongoing effort and teamwork. It starts withcontinuous monitoring and reevaluationof threats and how to handle them. Companies should check their risk lists often, update their risk levels, and change plans as needed.

Cross-departmental collaboration is key. Risk analysis should involve many teams, like finance, operations, and security. This way, everyone works together, sharing ideas and goals. This helps businesses understand risks better and make smarter choices.

Learning from pastrisk analysis examplescan also improve risk management. By studying past risks, their effects, and how they were handled, companies can get ready for future challenges. This helps them improve their risk analysis.

In the end, a proactive, data-driven, and team-based risk analysis approach is vital. It helps businesses deal with the complex and changing business world. By following these best practices, companies can spot, assess, and reduce risks. This sets them up for long-term growth and success.

FAQ

What is the definition of risk analysis?

Risk analysis is a method to look at possible dangers. It helps figure out the risks and how they might affect businesses, governments, and industries.

Why is risk analysis important for decision-making?

It gives leaders important insights. These insights help them make smart choices. They can plan better, manage resources well, and follow rules.

What are the two major categories of risk analysis?

There are two main types: qualitative and quantitative. Qualitative uses expert opinions and guesses. Quantitative uses math and stats.

How do businesses identify and prioritize risks in the risk analysis process?

Companies find and sort risks by how likely they are and how big the impact is. They work together to get better at this.

What are some key tools used in risk analysis?

Important tools include SWOT analysis, a matrix for risk, and risk registers. They help see threats, list risks, and spot big risks.

How does risk analysis enhance project management?

It helps avoid delays, save money, and make projects succeed. It uses tools like decision trees and simulations.

What are some common challenges in conducting effective risk analysis?

Challenges include not seeing risks, not having enough data, and not focusing on the right things. Technology and teamwork can help solve these.

How is technology transforming the field of risk analysis?

New tools for predicting and watching risks help organizations do better. They can understand risks better and be ready for anything.

What are some examples of industries leveraging risk analysis?

Finance, healthcare, and manufacturing use it to stay stable, find fraud, and make smart choices. It helps with supply chains too.

What are best practices for effective risk analysis implementation?

Good practices include always checking and updating, making sure everyone is on the same page, and using past data. This keeps risk management proactive.