Understanding Revenue vs Profit: Key Differences

Revenue and profit are key terms in finance, but many confuse them. Revenue is the total money a business makes before paying for anything. Profit is what's left after all costs are subtracted. Knowing the difference is vital for planning and making smart choices.

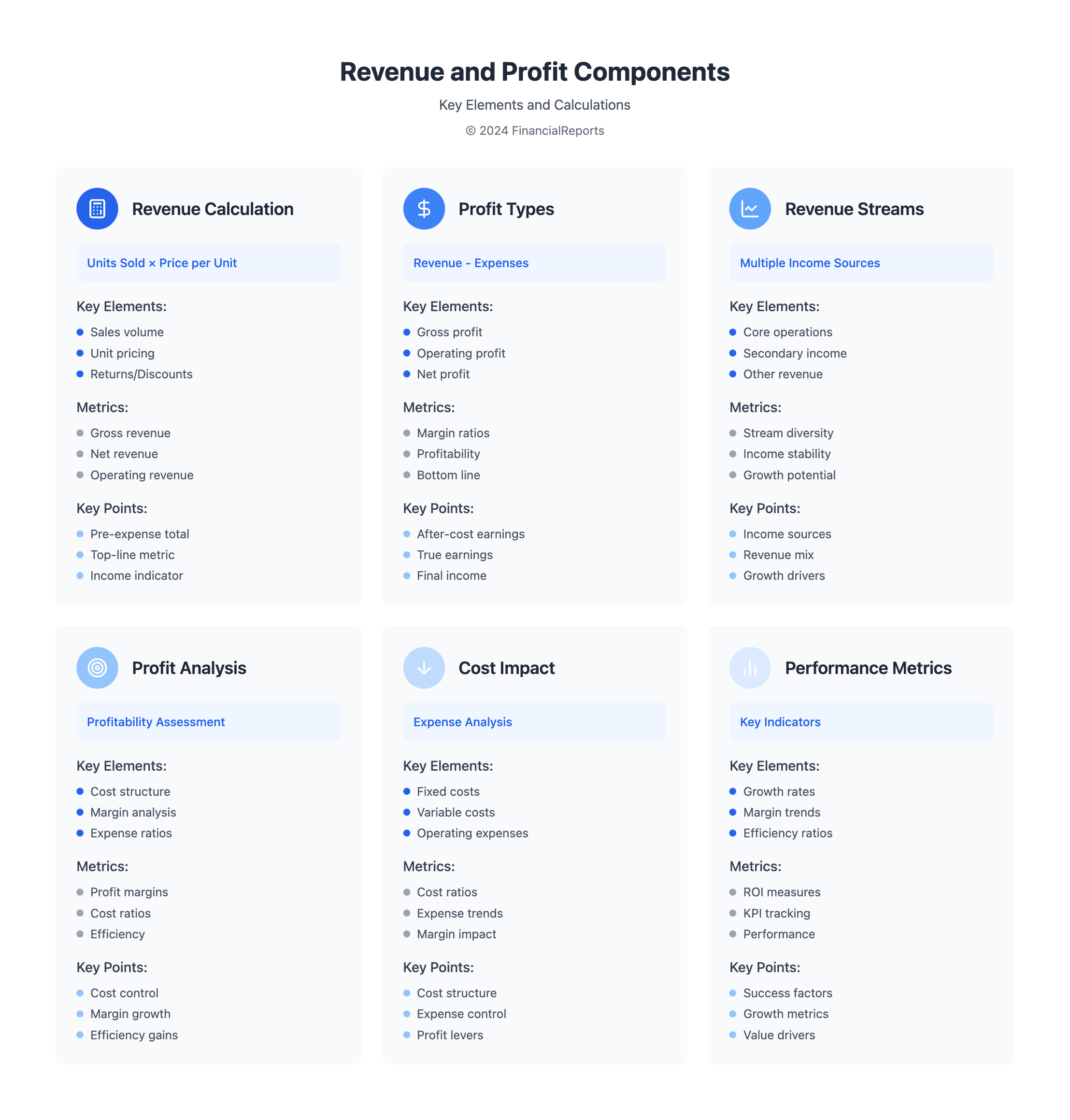

Many wonder if revenue comes before or after expenses. Revenue is found by multiplying how much is sold by the price of each item. After discounts and returns, we get net revenue. Profit comes from subtracting costs from net revenue. For example, Amazon shows how high revenue doesn't always mean profit.

Introduction to Revenue and Profit

Revenue and profit are important in finance. They help businesses see how they're doing and make better choices. Understanding these terms is key to knowing a company's financial health.

Key Takeaways

- Revenue represents the total income generated by a business before accounting for expenses.

- Profit is the net amount remaining after subtracting all associated costs.

- Revenue vs net income is a critical distinction in financial analysis.

- Revenue is calculated by multiplying sales volume by sales price per unit.

- High revenue can coexist with negative profitability, as seen in the Amazon case study.

- Understanding the revenue vs profit dynamic is essential for financial planning and decision-making.

- Revenue vs profit is a key metric for evaluating a company's financial health.

What is Revenue?

Revenue is the total money a company makes from its main activities before any costs are subtracted. It's the first thing shown on an income statement. It shows how much money a company makes over a certain time. Knowing the difference between gross revenue vs gross profit and gross income vs revenue is key for finance experts. Revenue can grow because of more sales or higher prices. It's important to know the difference between revenue vs net revenue to understand a company's financial health.

There are various types of revenue. Operating revenue comes from a company's main activities. Non-operating revenue comes from other sources. Revenue versus profit is a big difference. Profit is what's left after costs and expenses are subtracted from revenue. Here are some important points about revenue:

- Operating revenue: earnings from core operations

- Non-operating revenue: income from non-core activities

- Gross revenue: total income before deductions

- Net revenue: revenue after deducting returns, discounts, and allowances

Understanding these concepts helps finance experts analyze financial statements. They can make better decisions about investments and how to use resources.

| Revenue Type | Description |

|---|---|

| Operating Revenue | Earnings from core operations |

| Non-Operating Revenue | Income from non-core activities |

| Gross Revenue | Total income before deductions |

| Net Revenue | Revenue after deducting returns, discounts, and allowances |

What is Profit?

Profit, also known as net income, is what's left after all business costs are subtracted from revenue. It shows if a business can make money and stay afloat. Knowing the difference between net income vs profit is key, as they're often mixed up but mean different things. Is profit the same as net income? They're connected, but net income includes all operating costs.

To figure out profit, you subtract total expenses from total revenue. This leads to different profits, like gross profit and net profit. Gross profit is sales minus just the cost of goods sold. Net profit is what's left after all costs and taxes are subtracted. It's also important to know profit vs gross profit and is net revenue the same as net income, as they're related but not the same.

Types of Profit

- Gross profit: revenue from sales minus cost of goods sold

- Operating profit: gross profit minus operating expenses

- Net profit: operating profit minus taxes and other expenses

Understanding the various profits helps businesses make better choices. This knowledge can improve their profit vs gross profit and boost their net income.

Key Differences Between Revenue and Profit

Knowing the difference between revenue and profit is key for businesses. Many confuse revenue vs gross profit and revenue vs profit definition. But, these concepts are vital for managing finances well. The main difference is how they are calculated and their role in business.

Financial Perspectives

Revenue is the total money a business makes. Profit is what's left after expenses are subtracted. Knowing the revenue vs profit definition helps see a company's financial health. For instance, a company might have high revenue but low profit because of high costs.

Calculation Methods

Calculating revenue and profit is different. Revenue is found by multiplying units sold by price. Profit is found by subtracting expenses from revenue. This difference is important because it shows how much a company can grow.

Some important metrics to look at include:

- Revenue growth rate

- Profit margin

- Return on investment (ROI)

Importance in Business

Understanding revenue and profit is essential for business strategy. By comparing revenue vs gross profit and revenue vs profit definition, companies can spot areas to improve. This knowledge is critical for a company's long-term success and sustainability.

The Role of Revenue in Business Growth

Revenue is key to business growth. It lets companies invest in new chances, grow, and grab more market share. Looking at the average yearly net vs revenue shows how much a company makes versus its profit. For example, Walmart made nearly $640 billion in 2023 but only $150 billion in net income. This shows how important revenue is in judging a company's success.

Managing revenue well means having different income sources. This helps avoid relying on just one income and boosts growth. Companies can use smart pricing and focus on their sales and marketing to grow revenue. For instance, they can track ARPU (average revenue per user) to fine-tune their pricing.

Revenue Streams

Good revenue management means finding and using many income sources. This includes:

- Diversified product or service offerings

- Subscription-based models

- Partnerships and collaborations

- Geographic expansion

Strategic Revenue Management

To really grow revenue, businesses need a smart plan. They should look at revenue churn rate, customer lifetime value, and return on equity. By checking these, companies can spot where to get better and make plans to boost their revenue.

The Impact of Profit on Business Sustainability

Understanding the financial health of a company is key. It's important to know the difference between revenue and profit. Revenue is the total income a company makes. Profit is what's left after expenses are subtracted.

Revenue growth can help increase profit, but they're not the same. Net revenue and profit differ because net revenue considers the cost of goods sold. Profit looks at all expenses.

A company's profit margin shows its financial health. By analyzing profit margins, businesses can spot areas for improvement. For instance, Amazon has focused on improving its profit margins.

This has allowed Amazon to invest in its business and grow over time. Companies like Amazon show that focusing on profit can lead to financial stability and success.

| Company | Profit Margin | Revenue Growth |

|---|---|---|

| Amazon | 4.3% | 21.3% |

| Industry Average | 3.5% | 10.2% |

Understanding profit's impact on business sustainability helps companies make better decisions. They can focus on cost reduction, operational optimization, or tax planning. Prioritizing profit is essential for long-term financial health.

Analyzing Revenue vs Profit in Financial Statements

When looking at financial statements, it's key to know the difference between revenue and profit. Revenue is the money a company makes from its main activities. It's shown as the first number on an income statement. Profit, or net income, is the last number. It shows how much money the company keeps after paying for everything.

Many wonder if net revenue is the same as net income. The answer is no. Net revenue is the total money made by a company. Net income is what's left after all costs are subtracted. Also, gross revenue vs revenue is different. Gross revenue includes all sales income. Revenue might not include some non-operating income.

| Financial Metric | Definition |

|---|---|

| Revenue | Total income from core operations |

| Net Income | Profit earned after deducting expenses |

| Gross Revenue | Total income from sales, including non-operating income |

Knowing how revenue and profit relate helps experts understand a company's financial state. They can then decide if the company is doing well or has room to grow.

How Revenue Influences Profit

Revenue growth is key to a company's financial health. But, it doesn't always mean profit growth. For example, Amazon made $514 billion in revenue in 2022 but lost $2.7 billion. This shows the need to manage costs well to make a profit.

It's important for businesses to understand how revenue and profit are linked. Revenue growth can come from selling more or adding new products. But, profit growth needs careful planning, considering costs, scalability, and competition.

Revenue Growth vs Profit Growth

Revenue growth means selling more and getting more customers. But, profit growth is harder to measure. It depends on costs, expenses, and taxes. Amazon's case shows that just growing revenue doesn't always mean profit growth.

Understanding Scalability

Scalability is key for growing both revenue and profit. A scalable business can grow revenue without raising costs too much. But, if costs grow too fast, profit growth can be hard. For instance, a company with high fixed costs might find it tough to grow profits, even with more sales.

Cost Structures and Their Impact

Cost structures greatly affect a company's profit. High costs for goods or operations can make it hard to grow profits, even with more sales. Knowing how costs impact profits helps businesses make better decisions on pricing, production, and resources.

The Importance of Cash Flow

Cash flow is key to a company's financial health. It helps pay debts, invest in growth, and handle financial ups and downs. Good cash flow management keeps a business liquid, ready to meet short-term needs.

Businesses with high costs or changing sales need to watch their cash flow closely. A company's cash flow can be positive or negative. This shows if it's bringing in more money than it spends.

Cash flow versus revenue and profit is a big difference. A company can have positive cash flow but not make a profit. Or, it can have high profits but struggle with cash flow.

To manage cash flow well, businesses should:

- Keep an eye on sales revenue, profit margins, and cash flow predictions

- Balance revenue, profit, and cash flow

- Plan for changes in cash coming in and going out

By focusing on cash flow, businesses can fund growth, pay debts, and stay strong in the long run. This boosts sales profit and revenue.

Common Misconceptions About Revenue and Profit

Understanding the difference between revenue and profit is key in financial analysis. Revenue is the total income from normal business activities, like selling goods and services. It's often seen as the top line. Profit, on the other hand, is the financial gain after subtracting expenses from revenue. It's called the bottom line.

Many people get confused about whether revenue comes before or after expenses. They often think revenue is the same as profit. But, net profit vs net income are different. Net profit is what's left after all expenses are subtracted from revenue. Net income includes all earnings, including revenue and other income.

Here are some key points to clear up the confusion:

- Revenue shows a company's sales and market demand.

- Profit reveals a company's financial health by showing how well it manages costs and operates.

Knowing the difference between revenue and profit helps businesses make better decisions. Just focusing on revenue growth can hurt profit. But, balancing revenue growth with profit management can lead to better stability and competitiveness.

Case Studies of Revenue and Profit Dynamics

It's key for businesses to grasp the link between revenue and profit. Companies like Facebook and Amazon have thrived by using different strategies. Facebook makes a lot of money from ads, while Amazon stays profitable by selling many different things.

Looking at revenue vs net revenue shows how costs affect profit. Gross income vs revenue is also important. It helps businesses see how their prices and costs work together. By understanding these, companies can grow in a healthy way.

Successful Business Models

Many companies have found ways to manage their money well. Here are a few examples:

- Facebook makes a lot from ads.

- Amazon grows by selling lots of different things.

- Apple keeps profits high by selling expensive products.

Lessons from Failures

But, some companies haven't done so well. They've learned some hard lessons:

- It's vital to know how revenue and profit work together.

- Businesses need to be flexible to keep up with the market.

- Keeping costs low is key to making a profit.

| Company | Revenue Model | Profit Margin |

|---|---|---|

| Advertising-based | 20-30% | |

| Amazon | Diversification | 10-20% |

| Apple | High-margin products | 30-40% |

Tools for Measuring Revenue and Profit

It's key for businesses to measure revenue and profit well. This helps them make smart choices. Many tools and software are out there to help track finances. They let companies see their income, profit margins, and where they can get better.

Popular software like QuickBooks, Xero, and FreshBooks offer invoicing and expense tracking. They also help with financial reports. Tools like RevPro and Aptitude Revenue Recognition Engine help follow revenue rules.

Key Performance Indicators

Businesses should watch key performance indicators (KPIs) like gross revenue and profit margins. These KPIs show how well a company is doing financially. They help spot trends in income and profit.

- Gross revenue: the total money made by a business in a time period

- Net revenue: the money made by a business after returns and allowances are taken out

- Profit margins: the percentage of money a business keeps after expenses are subtracted

Using these tools and software, businesses can understand their finances better. This helps them make choices based on data to grow and make more money.

| Financial Metric | Formula | Description |

|---|---|---|

| Gross Profit Margin | (Revenue - Cost of Sales) / Revenue * 100 | The percentage of revenue that a business retains after deducting the cost of goods sold |

| Net Profit Margin | Net Profit / Revenue * 100 | The percentage of revenue that a business retains after deducting all expenses |

Conclusion: Why Both Are Essential for Business Success

Understanding how revenue and profit work together is key for any business to thrive. Revenue shows how much money a company makes, but profit shows if it's making money after costs. By keeping a strategic financial balance and optimizing revenue-to-profit management, businesses can grow in a way that fits their goals.

Good financial planning means looking at both making money and saving costs to boost optimal profitability. Companies need to check their money-making plans, prices, and how they work to make more money. They also need to manage their cash flow well to have money for growth and to handle economic ups and downs.

By taking a balanced approach, businesses can stay strong, face challenges, and grab new chances. The secret is finding the right mix between making more money and keeping profits high. This is done with data and knowing the market and competitors well.

FAQ

What is the difference between revenue and profit?

Revenue is the income a company makes before any costs are subtracted. Profit is what's left after all costs and expenses are taken out.

Is revenue the same as net income?

No, they are not the same. Revenue is the total income. Net income is the profit after all expenses and taxes are subtracted.

How does revenue affect profit?

Revenue is the first step to profit. If revenue goes up but costs don't, profit can go down. But, if revenue and costs are managed well, profit can increase.

What is the difference between gross revenue and net revenue?

Gross revenue is income before any deductions. Net revenue is what's left after deducting things like discounts and taxes.

Is profit the same as net income?

Profit and net income are often used the same way. Profit is the money left after expenses. Net income is the final figure on the income statement, including all revenue, expenses, and taxes.

Why is it important to understand the difference between revenue and profit?

Knowing the difference helps with financial planning and decision-making. Revenue shows a company's size and reach. Profit shows how well it's doing financially.

How can a company have high revenue but low profit?

High revenue but low profit can happen if costs are too high. This can be due to thin profit margins or heavy investment in growth.

What are some examples of revenue streams?

Revenue streams include sales, subscription fees, rental income, and more. The type of streams depends on the company's business model.

How can a company increase its profit margins?

To boost profit margins, a company can cut costs, streamline operations, and negotiate better deals. It can also raise prices and improve how it uses resources.

How do revenue and profit appear on financial statements?

Revenue is the first number on the income statement. Profit is shown in different ways, like gross profit and net profit, further down. The balance sheet also shows revenue and profit figures.