Understanding Revenue and Expenses: Business Basics

In business, how money comes in and goes out is very important. Revenue and expenses are at the heart of understanding business success. Revenue is what a company earns before taking anything out. It shows how well a company is doing. Expenses, on the other hand, are the costs of running a business, like paying workers or keeping things working.

Knowing about revenue and expenses isn't just about numbers. It's seeing how they affect a company's growth and profit. A good system to watch these helps put money where it's needed most. This helps in following rules and making smart money choices.

Key Takeaways

- Managing how money comes in and goes out is key to good financial performance and business success.

- It's important to know different types of business costs for taxes and making decisions.

- Keeping personal and business money separate keeps personal stuff safe and meets IRS rules.

- Detailed income statements and balance sheets help check if a company is making money and its financial health.

- Knowing where future money might come from helps plan for what's coming next.

- Technology, like software and automation, makes keeping track of money easier and more efficient.

- The rules around what costs you can deduct and how come from the Internal Revenue Code.

What is Revenue?

Understanding revenue is key to knowing how well a business is doing. It's often seen as the company's lifeblood. Revenue is the total money made from selling goods or services. It shows how big and successful a business's operations are. This helps in reviewing the company's finances and planning for the future.

Definition of Revenue

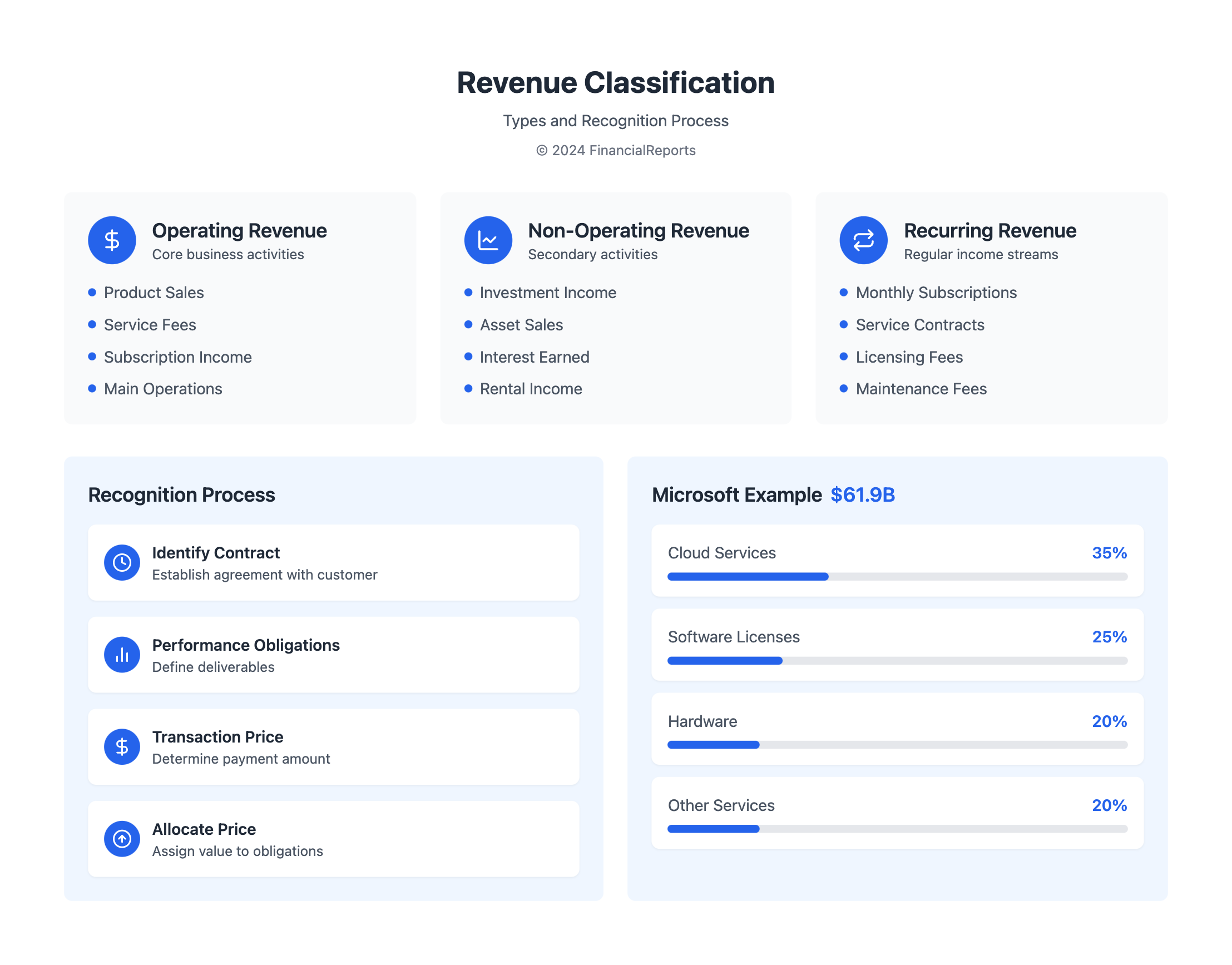

Revenue, also called sales or the top line, is the gross income from the main business activities. For example, Microsoft reported revenue of $61.9 billion for the quarter ending March 31, 2024. This shows strong sales and suggests a large market presence and profit-making abilities.

Types of Revenue

The types of revenue a company makes can vary greatly. Here are some examples:

- Operating Revenue: Comes from the main business activities, like selling products or services.

- Non-Operating Revenue: Comes from side activities, like interest on investments or selling an asset.

- Recurring Revenue: Consistent money made from subscriptions or contracts.

- One-Time Revenue: Money made from single transactions, not repeated business.

Different revenue streams need different strategies. They also impact a business's long-term success and risk levels differently.

Importance of Revenue in Business

Revenue is critical in running a business. It affects many major decisions and plans. Here are some key reasons why:

- Financial Health Indicator: Revenue shows if a company is doing well financially and can grow. Analysts and investors look at revenue to understand a company's market position and success.

- Basis for Revenue Recognition: Accurate financial reporting and following rules are crucial. Companies use different accounting methods to properly report revenue, matching it with real business activities.

- Strategic Planning: Revenue trends help forecast the future and shape strategic plans. They affect how budgets are set, resources allocated, and actions taken to grow the business.

This makes revenue's role in business vital, from making it to recognizing it. Understanding revenue shapes management strategies and competition performance.

Table: Financial metrics influenced by revenue

| Financial Metric | Description | Relevance to Revenue |

|---|---|---|

| EBITDA | Earnings Before Interest, Taxes, Depreciation, and Amortization | Assesses profitability without considering non-operational costs |

| Net Income | Revenues minus all costs, showing profit | Based on gross revenue, showing total profit |

| Cash Flow | The net cash moving in and out | Though different, cash flow is affected by when revenue is recognized |

What are Expenses?

In the business world, managing expenses well is key to staying healthy and making more profit. It's important to understand the basics of expenses to see how they affect company finances and strategies.

Definition of Expenses

Expenses are the costs a business faces when working to make money. This includes salaries for workers and costs for making products. They have a big effect on what the income statement shows. The IRS says only costs that are "ordinary and necessary" can reduce your taxable income.

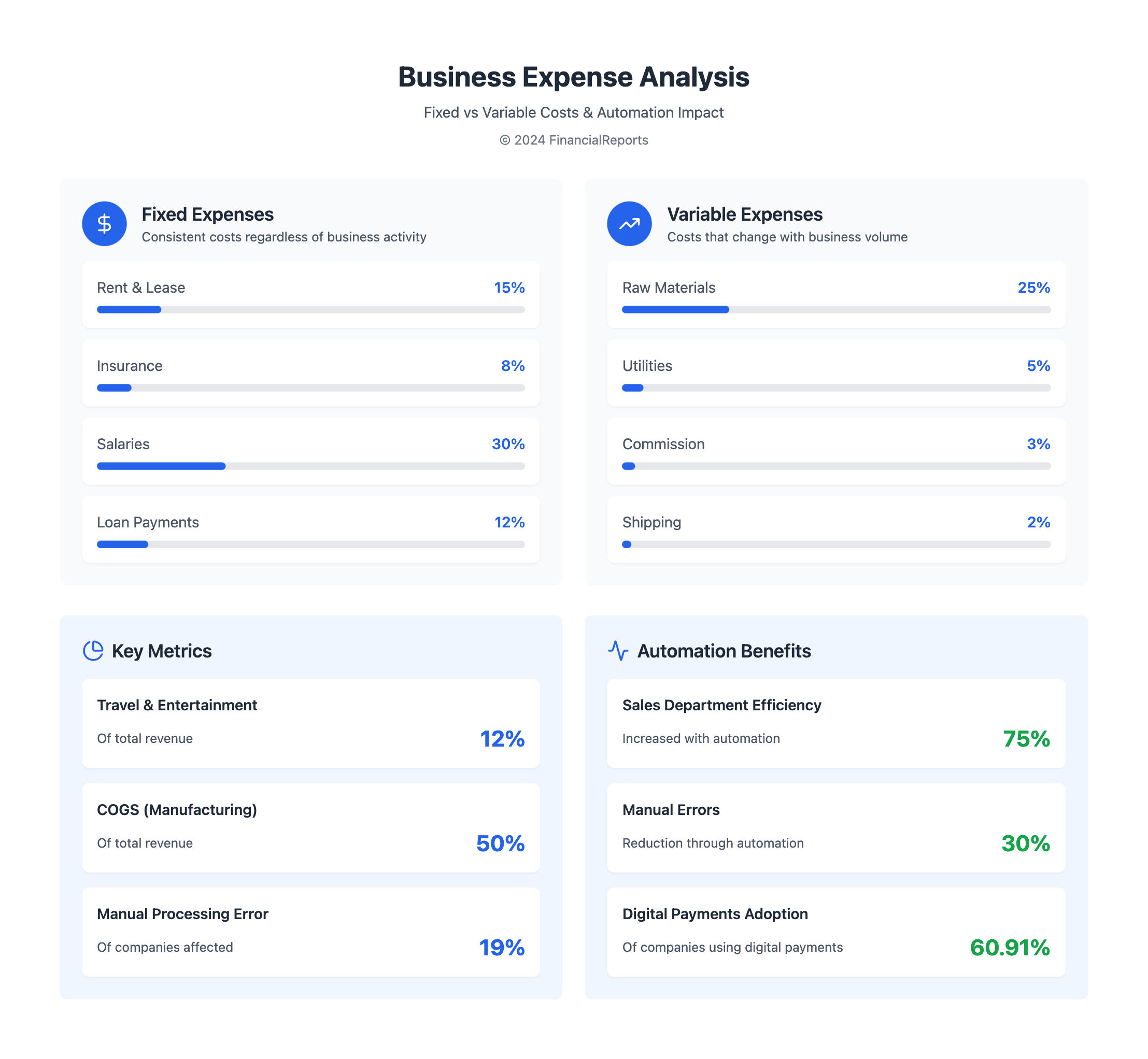

Fixed vs. Variable Expenses

Expenses are split into fixed and variable types, each with different effects on finances:

- Fixed Expenses: These costs don't change, even when business activities do. Rent, insurance, and long-term leases are examples.

- Variable Expenses: These costs go up or down based on how much a business does. Utility bills, materials, and supplies change with the amount produced.

Direct vs. Indirect Expenses

Knowing the difference between direct and indirect expenses helps with accurate financial reports:

- Direct Expenses: These are directly linked to making goods or services. They include raw materials and labor. They're key for figuring out the cost of goods sold and gross profits.

- Indirect Expenses: They're related to general business operations, not one specific area. This includes admin costs and marketing. Watching these costs is crucial for good profit margins.

Good expense management helps in lowering taxes and improving the cost of goods sold. Thus, it is crucial for businesses wanting a strong financial presence in competitive markets.

The Relationship Between Revenue and Expenses

Understanding the relationship between revenue and expenses is key for businesses. It helps not just in figuring out net income but in finding effective strategies. Good management of this relationship means accurate tax reporting and higher gross profit.

How Revenue Affects Expenses

The way revenue and expenses interact impacts a company's financial health. An increase in revenue should not mean expenses go up just as much. Managing revenue well helps control costs and keep the gross profit margin healthy.

The Concept of Profit

Gross profit shows how efficient a business is before other costs. It's the difference between revenue and the cost of goods sold. The formula Gross Profit = Revenue – Cost of Goods sold shows sales impact on profit. Then, net income considers all costs, the formula Net Operating Profit Margin = Gross Profit – Operating Expense gives a full financial picture.

Impact on Business Strategy

Strategy changes can come from understanding revenue and expenses. This balance helps a business keep running and meet tax needs. For example, a T-shirt store with high gross profit but lower net profit focuses on cost and spending to raise net income.

| Financial Metric | Formula | Example Value |

|---|---|---|

| Gross Profit Margin | Gross Profit = Revenue - Cost of Goods Sold | 75% |

| Net Operating Profit Margin | Net Operating Profit Margin = Gross Profit - Operating Expense | 6% |

| Revenue Growth | Revenue = Average Sales Price x Units Sold | Data Not Available |

To learn more about improving your business's finances, visit this guide on revenues and expenses. It covers key points about revenue, expenses, and profit for a successful business.

Revenue Recognition Principles

Revenue recognition principles tell us how and when to record revenue in financial statements. This is key for keeping financial accounting standards consistent. It also makes net income and gross earnings clear.

Accrual Accounting vs. Cash Accounting

How we recognize revenue is deeply influenced by choosing between accrual and cash accounting. Accrual accounting is required for big U.S. companies. It records revenue when a service is provided, not when money is received. On the other hand, cash accounting records revenue only when cash is received. This method is widely used by small businesses, as per IRS rules, if they make under $25 million a year.

Timing of Revenue Recognition

Knowing when to recognize revenue is key to correct financial reports, like the cash flow statement. ASC 606 gives a five-step model for this. It helps meet the standards of the FASB and IASB. This model has made guidelines easier across different sectors.

Importance of Accurate Recognition

Getting revenue recognition right is vital for showing a company’s true financial health. Following rules like ASC 606 ensures revenue figures are true to economic activities. It also makes sure they can be compared easily across markets and time. This is crucial for proper reporting of earnings on financial statements.

| Aspect | Description | Effective Since |

|---|---|---|

| ASC 606 Adoption | Aligns global accounting practices for revenue recognition | May 28, 2014 |

| Five-Step Model | Framework to record revenue based on performance obligations and transaction price | Standardized post-2014 |

| Impact on Financial Statements | Enhances the transparency and comparability of net income and cash flows | Ongoing since implementation |

Following these financial accounting standards is not just legally required for many companies. It also lays the groundwork for strong financial reporting and business planning.

Expense Management Strategies

Managing your spending is key to keeping a business healthy. This starts with careful budgeting, keeping track of costs, and cutting expenses where you can. These steps make financial work smoother and financial reports more trusted.

Budgeting for Expenses

First off, you need a budget. It's a plan for your costs, helping you stay in line with your business goals. For example, spending on things like travel can eat up to 12% of your income. A good budget sets clear limits.

Tracking and Monitoring Expenses

Seeing where money goes is hard for 19% of companies. That's why good expense tracking tools are a must. They sort out which costs are tax-deductible and show where you're spending most. By keeping track, some firms save 4-5% on travel by finding better rates.

Cost-Cutting Techniques

Looking for ways to spend less is vital. You can renegotiate deals or reduce the cost of goods sold (COGS), which for manufacturers, is half their revenue. Also, moving away from old-style spreadsheets is key. Nearly 50% of businesses use them, but they can mess up your numbers.

| Expense Category | Percentage of Total Revenue | Impact on Operational Expenditures |

|---|---|---|

| Travel and Entertainment | 10%-12% | High |

| COGS (Manufacturing) | 50% | Critical |

| COGS (Professional Services) | 15% | Moderate |

| Advanced Expense Tracking Adoption | N/A | Improves financial statements accuracy |

Using smart financial habits with up-to-date analytics and data is crucial. It helps manage spending and save on taxes. Understanding and using these strategies keeps businesses ahead in tough markets.

Measuring Revenue Growth

It's vital for companies to know how their revenue growth is doing. This knowledge can help improve their financial performance and standing in the market. To do this, they use detailed methods and metrics to ensure their plans meet their goals.

Metrics for Revenue Growth

Some metrics are key for understanding revenue trends in business. The Compound Annual Growth Rate (CAGR) looks at the average growth rate over several years. It makes it easier to see long-term trends by averaging yearly fluctuations. Metrics like Monthly Recurring Revenue (MRR) and Average Revenue Per User (ARPU) help track the financial health and growth potential of a company.

Analyzing Sales Trends

Looking at sales trends is crucial for knowing past achievements and predicting future ones. Companies study sales changes over time and compare them to previous years. This review helps spot trends that affect revenue. They also use metrics like customer acquisition cost (CAC) and customer lifetime value (LTV) to see how well they're getting and keeping customers. This impacts revenue vs expenses.

Importance of Revenue Forecasting

Revenue forecasting is highly important. It uses past data and market analysis to guess future earnings. This prediction aids in planning budgets, resources, and identifying risks, giving companies an edge. Scenario analysis helps businesses prepare for different financial situations, promoting steady growth and survival.

| Year | Revenue Growth (%) | CAGR (%) | MRR |

|---|---|---|---|

| 2020 | 15 | 5 | $500K |

| 2021 | 20 | 6 | $625K |

| 2022 | 25 | 7 | $780K |

For more tips on boosting revenue growth, many practical strategies can be found on this website. From refining pricing strategies to improving customer retention, these tips can greatly help in reaching long-term financial goals.

Common Challenges with Revenue and Expenses

For any business, accurate financial reporting is key. It brings stability and clear sight to operations. But many factors make accuracy hard.

Misclassification of Revenue and Expenses

Misclassification can skew how a company looks financially. It has led to major scandals, like Enron. To avoid such issues, it's important to improve audits and controls. Watch out for red flags such as unearned revenue or inflated sales.

Variability in Expenses

Expenses can vary a lot. This depends on things like market conditions and how much you produce. Bad practices, like overvaluing inventory or not writing off what's old, can mess up financial statements. To keep track, it’s wise to closely monitor expenses and use strict rules for recognizing them.

Economic Factors Impacting Revenue

The economy greatly affects how much money a company makes. Changes in what people want to buy, inflation, or new laws can all disrupt revenue. Companies need flexible strategies to handle these ups and downs. This shows how crucial good financial forecasting and planning are.

| Issue | Example | Impact |

|---|---|---|

| Revenue Misclassification | Fraudulent sales reporting | Distorted financial statements |

| Expense Fluctuations | Inventory adjustments | Erratic financial outcomes |

| Economic Impact | Regulatory changes | Altered revenue forecasts |

Understanding the ins and outs of financial reporting is vital. Handling expenses and adapting to economic changes are big challenges. Financial pros must pay close attention and plan smartly.

The Role of Technology in Tracking Revenue and Expenses

Technology is changing how organizations manage finances. Tools like accounting software, financial process automation, and data analytics are key for tracking revenue and expenses accurately. These technologies make operations smoother, improve financial precision, and help in making better business decisions.

Accounting Software Solutions

Today's accounting software comes loaded with features that make tracking money easy and accurate. QuickBooks and Xero let companies watch their money in real-time, making sure financial reports are always fresh. XYZ Accounting found that firms using these softwares see a 15% profit boost in the first year. This shows how managing money well leads to more profit.

Automation of Financial Processes

Automating financial jobs is a big deal for today's businesses. It cuts down mistakes and lets people work on important tasks. Tools that automate payroll, bill paying, and budgets make things easier. In fact, 75% of sales departments say automation has made them much more efficient.

Data Analytics for Financial Performance

Data analytics gives companies insights into their financial health. It helps them manage money better, forecast the future, and fine-tune strategies for more profit. With big data analytics, businesses find new ways to grow and control risks. This makes data a powerful tool for them.

| Technology | Revenue Increase | Expense Management Improvement | Efficiency Gain |

|---|---|---|---|

| Accounting Software (e.g., QuickBooks, Xero) | 15% net profit increase | 20% reduction in unnecessary expenses | 25% increase in financial document retrieval efficiency |

| Automation Tools | Encourages strategic focus | Streamlines financial tasks | 30% reduction in manual errors |

| Data Analytics | Optimized revenue strategies | Effective risk management | Identifies growth opportunities |

Legal and Tax Implications

Knowing the legal and tax sides of handling business money is key. It helps you follow the rules and make the most of your taxable income. The tricky parts of tax on different revenues and claiming deductions need careful financial watch and planning.

Tax Treatment of Revenue

Revenue is key for any business, and its tax treatment greatly impacts company income. It's important to know what counts as taxable or not. For example, payments for direct physical damages in lawsuits are usually non-taxable. But, other settlement types can affect your taxable income. This highlights the importance of keeping accurate financial records.

Deductions for Business Expenses

Smartly handling business deductions can greatly reduce taxable income. Expenses that are directly related to running a business can often be deducted. But, it's crucial to know tax rules, like the difference between capital spends and deductible expenses. Costs like rent, utilities, and payroll must be well-documented for tax and audit reasons.

Compliance with Financial Regulations

It's vital to comply with financial rules. This means following reporting standards, proving expenses, and correctly recording revenue. With frequent changes in laws, companies must be flexible. Not following the rules can lead to big fines and harm the business’s reputation.

It's up to the company to prove the correct tax treatment of deals, especially settlements. Keeping detailed records, including about settlements and costs, defends against tax disputes. This thorough management aids in using tax rules to your advantage.

Getting through tax rules, using business deductions rightly, and sticking to financial laws are crucial. They help avoid financial issues, fostering steady growth and success.

Reporting Revenue and Expenses

Accurate handling of money matters is key for clear financial reporting. By making detailed financial statements and understanding the income statement, businesses show true transparency. Recent data from a University Financial Reports shows good income reporting and smart management of financial statements improve accountability and fiscal understanding.

Creating Financial Statements

In schools and universities, making detailed financial statements helps watch over funds closely. For instance, universities use a Revenue and Expense Statement Detail report during reviews. This makes sure all money movement is correctly recorded and matches the original documents.

Understanding the Income Statement

The income statement is vital for seeing if a business is making money, as it shows revenue and expenses. It's crucial for knowing net income, which tells about financial health. Universities look closely at transactions for a certain period to find and fix any money issues quickly.

Importance of Transparency in Reporting

Being open in financial reporting builds trust with everyone involved. It shows that an institution is managing its finances well and with honesty. This comes from not only what the reports say but also how they are shared, like through electronic means to staff and managers and to those with system access.

| Financial Document | Purpose | Details |

|---|---|---|

| Profit and Loss Statement | Gauge Profitability | Breakdown of all revenues and expenses, showing net profit after all deductions. |

| Balance Sheet Report | Monitor Financial Health | Tracks assets and liabilities to depict what the entity owns versus what it owes. |

| Cash Flow Statement | Track Financial Movements | Details cash inflows and outflows, providing insights into the actual financial status. |

Detailed reporting and organized financial documents like the Income Statement create a strong financial management system. This process of reporting financial data helps keep a close watch on finances and makes business operations more transparent.

Improving Financial Health

Keeping your finances in shape is key, whether it's for personal use or business. It includes making more money and spending less. Plus, it's about keeping profits high. Finding a balance is vital for growth and being able to adapt.

Strategies for Increasing Revenue

Getting your financial health right involves making more money. This can be done by offering better services. It also means getting more customers in smarter ways. Businesses can become more profitable by reaching new markets or improving their products. This helps them stay ahead and respond well to market changes. Managing your assets well is also key for making more money and keeping profit margins high.

Reducing Expenses Smartly

It's important to cut costs wisely to stay financially healthy. Using less money in smart ways, like automating tasks, can keep quality up. Strategies like paying off debt with the avalanche or snowball methods help too. They reduce what you owe, making your money situation better.

Balancing Revenue and Expenses

Finding the right balance between making and spending money means more profits. Regular check-ups on your finances and flexible business plans help keep this balance. This not only keeps your finances healthy but also helps them grow even when markets change.

| Strategy | Impact |

|---|---|

| Review financial policies | Ensures consistent alignment with current economic conditions and company goals |

| Implement cost efficiency measures | Reduces operational costs, enhancing cash flow and profit margins |

| Optimize asset utilization | Improves return on investment, crucial for long-term financial sustainability |

| Debt reduction | Decreases interest expenses, increasing net profit and overall financial health |

For lasting growth, businesses must both increase their income and carefully cut costs. This two-sided strategy boosts profits and financial health. It's what you need to win in today's tough market.

Future Trends in Revenue and Expense Management

Businesses today face a changing financial landscape with new trends. One important change is how AI is used in finance. It helps with better forecasts and improves how companies interact with customers. Also, it helps financial experts make better decisions using data. Now, 60.91% of companies use digital payments. And focusing on controlling employee expenses is a key trend. This shows the need for advanced, automated solutions is growing.

The Impact of AI and Machine Learning

AI and machine learning are changing how finances are managed. For example, Alan Tyson, CEO of DATABASICS, talks about 'touchless' expense reports. These reports are created automatically, saving employees time. Additionally, the market for software to manage expenses is growing. It is expected to reach $12.7B by 2031. Big companies like Oracle (NetSuite), Intuit, and SAP are investing to stay ahead. They focus on innovation to meet market demands.

Sustainability in Business Finances

More companies now focus on being sustainable. This affects both the environment and how they handle money. Being eco-friendly helps a company's image and its profits. Businesses combining efficiency with sustainability get ahead in the market. This is because people prefer companies that are responsible. For example, business travel, a big part of expenses, changed a lot due to the pandemic. It showed the need for financial plans that can adjust when needed.

Evolving Consumer Expectations and Revenue Models

As customers' needs change, companies must also change how they make money. New business models focus on what customers want. This shows a company can adjust quickly to new trends. For instance, managing travel and expenses is a big challenge. There's been a rise in the misuse of funds and the cost of handling expenses manually. Yet, companies that use automated systems see more productive workers and save money. With the demand for these systems growing, especially in North America, adapting to these changes is key for success.

FAQ

What exactly are revenue and expenses in a business context?

Revenue is the total income from a business's main operations before costs or expenses are taken out. Expenses are all costs a business faces while making revenue. This includes costs for materials, labor, and overhead.

How are revenues and expenses reported in financial statements?

Revenues and expenses appear in an income statement. This document shows a company's profitability. It does this by calculating net income from subtracting expenses from revenues.

Are gains on the sale accounted for in the income statement?

Yes, gains from selling assets are recorded in the income statement. They're often listed under non-operating revenue or other income. This affects the business's overall profit or loss for that period.

What is the distinction between revenue vs. expenses?

Revenue is the money a company makes from its regular activities. Expenses are the costs to make that revenue. The profit or loss is found by looking at the difference between them.

What are some common types of revenue for businesses?

Common revenue types are sales of goods and services, licensing and royalties income, investment income, and revenue from asset sales. Each type shows different aspects of business operations and activities not related to operations.

How do fixed and variable expenses differ?

Fixed expenses stay the same, no matter how much a company produces. Examples include rent and salaries. Variable expenses, like raw materials and utilities, vary with the production volume.

What determines if a business expense is deductible?

The IRS requires business expenses to be "ordinary" and "necessary" for them to be deducted. Ordinary expenses are common in a business, while necessary expenses must be helpful.

Can you explain accrual accounting vs. cash accounting in terms of revenue recognition?

With accrual accounting, revenue and expenses are recognized when they occur, not when cash is exchanged. In cash accounting, revenue and expenses are recognized only when cash changes hands.

Why is it important to accurately recognize revenue?

Accurate revenue recognition gives a clear picture of a company's financial performance and growth. It also helps meet regulations and manage taxes properly.

What strategies can businesses use to manage expenses effectively?

To manage expenses, businesses can make a detailed budget, analyze expenses regularly, and cut costs without harming product quality or growth.