Understanding Net Margin in Business Finance

Net profit margin, or net margin, shows how much profit a company makes from its sales. It's a key number that shows if a company is doing well financially. This ratio helps us see if a company can turn its sales into profit.

The net profit margin is shown as a percentage. This makes it easy to compare how profitable different companies are. It's a way to see if a company is good at making money from its sales.

Understanding net margin is important for investors, analysts, and business leaders. It tells them if a company's management is making enough profit from its sales. Net margin includes things like total revenue, costs, and taxes. Companies can improve their net profit margin by selling more or spending less.

For example, Apple Inc. has a net profit margin of 26%. This shows they are very good at making money from their sales. It's a sign of their financial health and success.

Key Takeaways

- Net margin measures a company's net income as a percentage of its revenue.

- Net profit margin is a key indicator of a company's financial health and profitability.

- The net profit margin formula involves dividing net income by revenue and multiplying by 100.

- Companies can enhance their net profit margin by increasing sales or reducing expenses.

- Net margin is a more complete measure of profitability than gross margin or operating margin.

- High-profit margin sectors include software and gaming, while operations-intensive industries often have lower margins.

What is Net Margin?

Net margin, also known as net profit margin, shows how much of a company's sales turn into profit. It's found by subtracting all costs from sales, then dividing by sales and multiplying by 100. This metric helps check if a company is running well, setting good prices, and doing financially well.

The net margin formula is similar to the margin formula. It shows the difference between what a company earns and what it spends. By looking at net profit margin, businesses can spot where to get better and make smart money choices. For example, they can make more money by selling more or spending less, like by selling more to current customers or cutting costs.

Here are some key points to consider when analyzing net margin:

- Net profit margin is a better measure of profit than gross profit margin.

- Big differences between gross and net profit margins can mean low costs or high overheads.

- Companies can boost profit margins by cutting costs or making more sales.

For instance, Apple Inc.'s net profit margin was 15% as of September 28, 2024. This means they kept $0.15 for every dollar sold. Knowing the net margin formula helps businesses grow and make more money.

| Industry | Average Net Profit Margin |

|---|---|

| Construction | 5-10% |

| Grocery Stores | 2-5% |

| Entertainment | 10-20% |

| Retail | 5-15% |

Calculating Net Margin

To find a company's net margin, you need to divide its net income by revenue and then multiply by 100. This shows how profitable a company is. It helps financial experts make smart choices. The net profit margin formula is vital for financial analysis.

When figuring out profit margin, look at the company's financial statements. Find the net income and revenue. Then, use these numbers to calculate the net profit margin. This lets you compare it to industry standards to see how well the company is doing.

A good net profit margin is usually over 10%. But, this can change based on the industry and company size.

Some important things to think about when calculating net margin include:

- Revenue: The total income from sales and other activities.

- Net income: The earnings after subtracting expenses, taxes, and other deductions.

- Non-operating items: Things like interest expense and tax rates that can affect the net profit margin.

Understanding how to find and compute profit margin gives financial experts valuable insights. They can make better decisions about investments and business activities.

| Company | Net Profit Margin |

|---|---|

| Bob's Books | 29% |

| S&P 500 | 11.2% |

Types of Net Margin

When looking at a company's finances, it's key to know about different profit margins. There are four main types: gross profit margin, operating profit margin, pretax profit margin, and net profit margin. It's important to understand the difference between net profit margin vs gross profit margin for those in finance and investing.

The net profit margin ratio shows how well a company turns its sales into profits. It's found by dividing net income by revenue and then multiplying by 100. A high net margin ratio means a company is good at keeping costs low and making profits. For example, tech giants like Microsoft and Alphabet often have high margins, while retailers like Walmart and Target have lower ones.

Some industries are known for their high profit margins, like luxury goods and software development. On the other hand, industries like transportation and agriculture have lower margins. As of January 2024, the U.S. saw high profit margins in banks, oil and gas, and tobacco companies.

| Industry | Average Net Profit Margin |

|---|---|

| Luxury Goods | 20-30% |

| Software Development | 15-25% |

| Transportation | 5-10% |

By looking at net profit margin vs gross profit margin and other metrics, we can really understand a company's financial health. This helps investors and financial experts make better choices.

Factors Influencing Net Margin

Net income margin shows how profitable a company is. To find it, you divide net income by sales. Knowing how to calculate profit margin helps businesses make smart choices. Many things affect net margin, like revenue, cost control, and industry specifics.

A high net profit margin means a company controls costs well and prices things right. A low margin shows poor cost management and pricing. To boost net margin, companies can sell more, price better, and cut costs.

Revenue Impact on Net Margin

Revenue is key to net margin. Companies can raise their margin by selling more or charging more. Good sales tactics, like value-based pricing, help increase revenue.

Cost Management and Its Effects

Controlling costs is vital for net margin. Companies can cut costs by better supplier deals, streamlining buying, and managing inventory. Lowering expenses boosts net margin and profit.

| Industry | Net Profit Margin |

|---|---|

| Advertising | 3.30% |

| Manufacturing | 8.00% |

| Retail | 4.00% |

| Software | 20% |

Understanding what affects net margin and using smart strategies can make businesses more profitable. This leads to long-term success.

Net Margin vs. Other Financial Ratios

To truly understand a company's financial health, we need to look at many financial ratios. The net profit margin is key, but knowing how to compare it with other ratios is also vital. For example, the gross profit margin shows how well a business runs by comparing gross profit to sales.

Other important metrics include EBITDA and operating margin. EBITDA, or Earnings Before Interest, Taxes, Depreciation, and Amortization, shows profits before non-operating costs like interest and taxes. The EBITDA margin is used in many valuations, even though it doesn't show actual cash flow. To find the net profit margin, we must look at all costs, including operating expenses, taxes, and interest.

When we check a company's financial health, it's good to look at these ratios:

- Gross profit margin: compares gross profit to sales revenue

- Operating margin: measures the percentage of sales left after accounting for normal operating expenses

- Net profit margin: shows a company's ability to generate earnings after all expenses and taxes

By learning how to calculate net profit margin and looking at these ratios, investors and financial experts can get a full view of a company's health. The net profit margin is just one part of the story. It's important to compare it with other ratios for a complete analysis.

Importance of Net Margin Analysis

Net margin analysis is key to checking a company's financial health and profit. It helps businesses see how well they manage costs and expenses. To find net profit, use the formula: (Net Income / Revenue) × 100.

Looking at net margin over time gives insights into a company's profit trends. This info helps in making big business decisions, like pricing and investments. For instance, a high net profit margin might mean investing in new products. On the other hand, a low margin might suggest cutting costs.

Some key benefits of net margin analysis include:

- Identifying the most profitable products, services, or markets

- Comparing current profit margins with past data to identify trends and make improvements

- Using industry averages and competitors' financial statements to provide context for evaluating profit margins

Using data tools and software helps companies analyze and track margins. This makes it easier to make smart decisions. A high net profit margin shows a company is financially stable and competitive.

Industry Benchmarks for Net Margin

Knowing industry benchmarks for net margin is key for businesses to check their financial health. To figure out profit margin, companies use a net profit calculation formula. This formula shows the percentage of revenue left after all costs, taxes, and interests are subtracted.

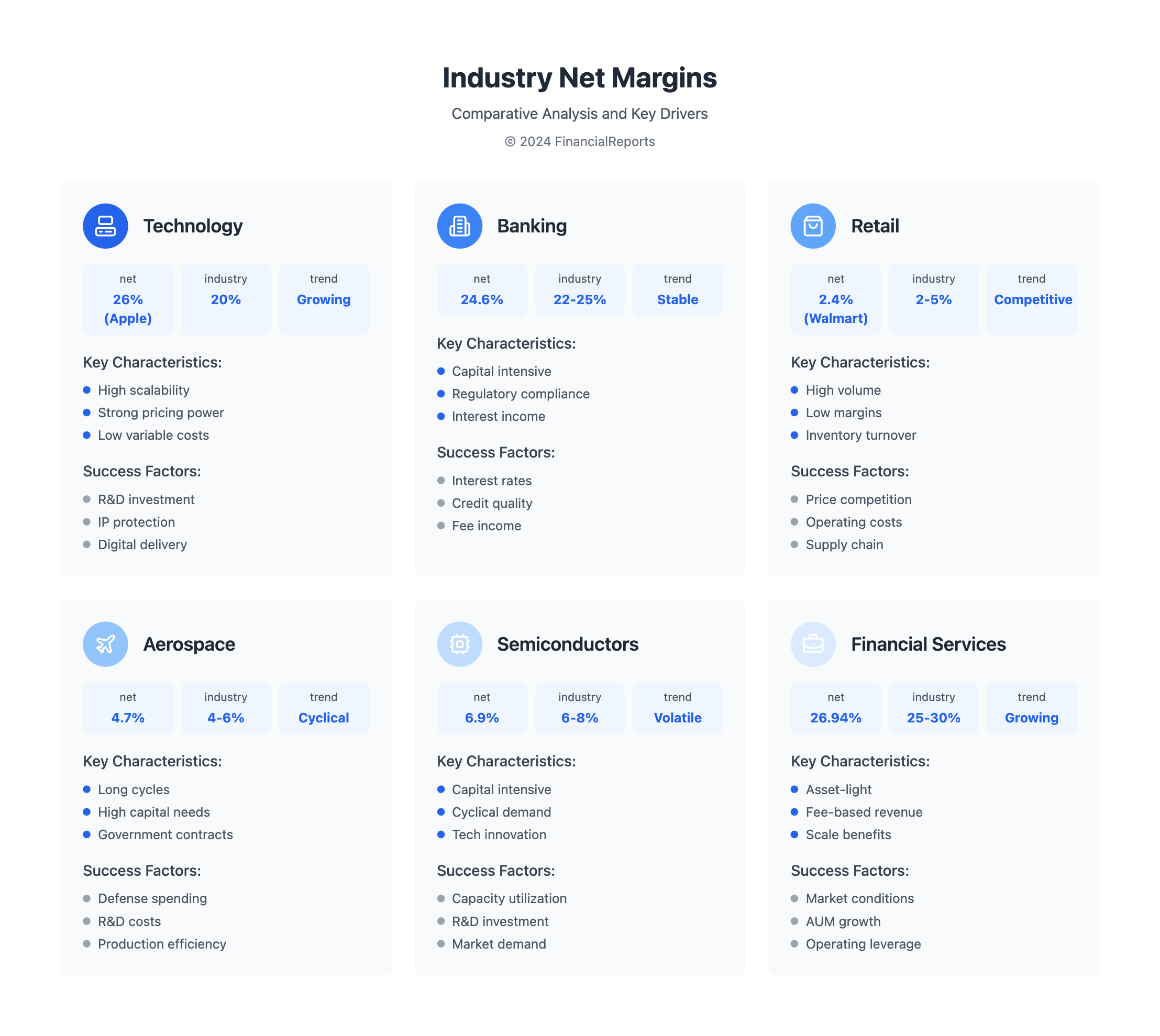

Industry benchmarks vary a lot across different sectors. For example, the Aerospace & Defense industry has a 4.7% average net profit margin. On the other hand, the Advertising Agencies industry has an average net profit margin of -3.2%. The Banking sector has an impressive 24.6% average net profit margin, and the Semiconductor Equipment & Materials industry has a 6.9% average net profit margin.

Some key industry benchmarks include:

- Aerospace & Defense: 4.7% average net profit margin

- Advertising Agencies: -3.2% average net profit margin

- Banks - Diversified: 24.6% average net profit margin

- Semiconductor Equipment & Materials: 6.9% average net profit margin

These benchmarks show why it's vital to look at industry-specific traits when judging a company's financial health. By knowing how to find profit margin percentage and using the net profit calculation formula, businesses can assess their net profit better. This helps them make smart choices to boost their financial health.

Improving Net Margin

To boost net margin, businesses can look at two main areas: increasing revenue or cutting expenses. The net profit percentage ratio shows how much of the revenue stays after all costs are subtracted. To figure out profit margin on a product, use the formula: net income divided by sales. This helps see how profitable each product or service is.

Here are some ways to up net margin:

- Optimizing pricing strategies to reflect customer value perception

- Streamlining processes and adopting technology to improve operational efficiency

- Reducing operating costs by negotiating with suppliers and optimizing expenses

- Investing in employee training to increase productivity and efficiency

By using these strategies, businesses can up their net profit margin and stay ahead. For instance, a company can check out investopedia for tips on boosting net margin. Regularly checking and tweaking their plans, companies can reach a higher net profit margin. This is key for lasting success and growth.

| Industry | Average Net Profit Margin |

|---|---|

| Apparel | 5.87% |

| Beverage (soft) | 18.50% |

| Financial services (non-bank and insurance) | 26.94% |

Challenges in Maintaining Net Margin

Businesses face many challenges in keeping their net margins stable. Economic factors like inflation, exchange rates, and interest rates play a big role. These factors can change a company's net profit formula a lot.

For example, inflation can make the cost of goods sold go up. This can lower the net income divided by net sales. Market competition and pricing pressure also affect net margins. Companies in competitive markets may find it hard to keep their prices up, leading to lower net income.

To tackle these issues, businesses can cut costs, work more efficiently, and invest in growth strategies. This can help them keep their net margins healthy.

Some effective strategies include:

- Reducing overhead costs and optimizing supply chains

- Investing in digital transformation to improve efficiency and customer experience

- Creating pricing strategies that balance revenue growth with profitability

By understanding and addressing these challenges, businesses can keep their net margins strong. This is important for long-term growth and profitability. The net profit formula shows a company's profitability clearly. It's a key metric for investors and financial analysts.

Case Studies and Real-World Examples

Let's look at how net margin analysis works in real life. We'll compare Apple Inc. and Walmart Inc. Apple's net profit margin is 26%. This shows how important it is to keep costs low and make the most of new products.

Walmart, on the other hand, has a net margin of just 2.4%. This highlights the tough competition in retail. It shows how hard it is to make a profit when prices are very low.

Apple's success comes from charging high prices for its products and controlling costs well. For every dollar in sales, Apple makes $0.26 as net profit. This high margin lets Apple invest in research and marketing, keeping it ahead in the market.

Walmart, with a 2.4% net margin, faces big challenges. Despite its size and buying power, it must deal with low prices, high costs, and a lot of stores. Walmart's story teaches us the value of cutting costs, using technology, and finding new ways to make money to keep margins healthy.

FAQ

What is net margin?

Net margin, also known as net profit margin, shows how profitable a company is. It's the percentage of revenue left as profit after all costs are subtracted. This includes the cost of goods sold, operating expenses, interest, and taxes.

Why is net margin important in business?

Net margin is key to understanding a company's health and profit-making ability. It reveals how well a company operates, its pricing, and overall financial health. This makes it essential for investors, analysts, and business leaders.

How do you calculate net margin?

To find net margin, use the formula: Net Margin = Net Income / Revenue. You divide a company's net income by its total revenue or net sales.

What is the difference between gross margin, operating margin, and net margin?

Gross margin is the difference between revenue and the cost of goods sold. Operating margin shows profitability after operating expenses. Net margin is the final profit after all expenses, including interest and taxes, are subtracted.

What factors influence a company's net margin?

Several factors affect net margin. These include changes in revenue, pricing, cost management, and competitive pressures. Also, regulatory environments and economic conditions play a role. Effective financial management is vital for maintaining and improving net margins.

How does net margin compare to other financial ratios?

Net margin is compared to profit margin, EBITDA margin, and other ratios. Each ratio offers unique insights into a company's financial health. This helps in understanding different aspects of the business.

Why is net margin analysis important for business decisions?

Analyzing net margin trends helps businesses spot patterns and make informed decisions. It guides pricing, cost-cutting, and investment strategies. This supports evidence-based decision-making.

What are typical industry benchmarks for net margin?

Net margin benchmarks vary by industry due to factors like capital intensity and competition. Analyzing industry benchmarks helps assess a company's financial performance against peers.

How can businesses improve their net margin?

To boost net margin, focus on revenue growth, pricing, and operational efficiency. Cost-cutting strategies like supply chain optimization and lean management are also effective. A balanced approach is key for sustainable margin growth.

What are the challenges in maintaining net margin?

Maintaining net margin can be tough due to economic factors and market competition. Adaptability and strategic financial management are essential to overcome these challenges and keep net margins healthy.