Understanding Gross Margin Meaning in Finance

Gross margin shows how well a company is doing financially. It's the percentage of money left after paying for labor and materials. To figure it out, you divide gross profit by revenue and then multiply by 100%. This helps see how efficient and profitable a company is.

The gross margin is the difference between what a company sells and what it costs to make. It's shown as a percentage of sales. This is key for understanding a company's financial health.

Knowing about gross margin is important for those in finance, investors, and business leaders. It helps them make better financial plans and decisions. Gross margin shows how well a company controls its costs. It's vital for making smart business choices.

Key Takeaways

- Gross margin is a critical indicator of a company's financial health.

- The gross margin definition is closely tied to a company's ability to generate higher profits.

- Understanding what does gross margin mean is important for financial professionals and business leaders.

- Gross margin is calculated as gross profit divided by revenue, multiplied by 100%.

- The gross margin meaning in finance is a measure of a company's efficiency in controlling its production costs.

- Define gross margin to make informed business decisions and optimize financial strategies.

- Gross margin provides insight into a company's ability to generate higher profits by efficiently managing production costs.

What is Gross Margin?

Gross margin is a key financial metric that shows how well a company does. It's found by subtracting the cost of goods sold from revenue, then dividing by revenue. This gives a percentage. Knowing this helps understand a company's pricing, production, and financial health.

Definition and Importance

The gross profit margin is vital for a company's market position. A high margin shows a company can set good prices, control costs, and make more money. Here are some important points about gross margin:

- Measures company efficiency

- Analyzes income statement changes

- Helps set prices

- Used by investors for market analysis

How Gross Margin is Different from Other Margins

Gross margin stands out because it only looks at the cost of goods sold and revenue. It's different from net margin and operating margin. Here's a table showing the differences:

| Margin Type | Formula | Description |

|---|---|---|

| Gross Margin | (Revenue - Cost of Goods Sold) / Revenue | Measures company efficiency and pricing strategies |

| Net Margin | (Gross Profit - (General and Administrative Expenses + Interest on Loans + Taxes)) / Sales | Measures company profitability after all expenses |

Components of Gross Margin

Gross margin is key in finance. Knowing its parts helps businesses make smart choices. The main parts are revenue and cost of goods sold (COGS). Revenue is the total sales money for a time. COGS includes direct costs like labor and materials used in making goods.

The cost of sales margin shows the difference between revenue and COGS. It's vital for spotting cost-cutting and sales boost areas. A high gross margin means more profit and efficiency. A low one might mean cutting costs or raising prices.

To figure out the cost margin definition, businesses must link revenue, COGS, and gross margin. The gross margin is found by subtracting COGS from revenue. Then, divide by revenue to get the ratio. This ratio is a key sign of a business's health.

Things like labor, material, and production costs can change the gross margin. To boost it, businesses can cut costs, raise prices, or work more efficiently. By knowing the gross margin parts and tracking the ratio, businesses can grow and stay profitable.

Calculating Gross Margin

To find gross margin, you need to know the formula. It's Gross Margin = (Net Sales - Cost of Goods Sold) / Net Sales * 100. This formula is key for checking a company's profit.

Let's look at an example. Say a company made $200,000 in sales and spent $100,000 on goods. Using the formula, the gross margin is ($200,000 - $100,000) / $200,000 * 100 = 50%. This means they keep 50% of what they sell after costs.

Here's how to calculate gross margin:

- Determine net sales

- Calculate cost of goods sold

- Apply the gross margin dollars formula

By following these steps and using the formula, you can understand your company's financial health. This metric is vital for pricing, cost control, and investment choices.

| Company | Net Sales | Cost of Goods Sold | Gross Margin |

|---|---|---|---|

| Dani's Apparel | $200,000 | $100,000 | 50% |

Importance of Gross Margin in Financial Analysis

Gross margin is key in financial analysis. It shows how well a company runs and its pricing. A deep look into gross margin can reveal a company's true value and how long it can last. For example, Apple and Amazon showed high gross profit margins in 2021, at 37.6% and 41.9% respectively.

In accounting for gross margin, watching how a company's margin changes is vital. This change can show shifts in the market, better production, or stronger pricing. Also, comparing margins with competitors can highlight strengths or weaknesses. Here's a table showing the gross profit margins of different companies:

| Company | Gross Profit Margin |

|---|---|

| Apple | 37.6% |

| Amazon | 41.9% |

| Walmart | 24.9% |

| Nike | 44.5% |

| Costco | 14.7% |

By carefully analyzing gross margin, companies can spot where to get better. They can then tweak their prices to grow their margins. This can boost their earnings and make them more appealing to investors and others who care about the company's success.

Gross Margin vs. Net Margin

When looking at a company's health, we focus on two important metrics: gross margin and net margin. Gross margin shows how much profit a company makes from selling its products or services. It's the percentage of revenue left after subtracting the cost of goods sold. Net margin, on the other hand, shows how much of each dollar of revenue turns into profit after all expenses are subtracted.

Gross margin looks at just the cost of goods sold and revenue. Net margin, though, considers all expenses, including taxes and other costs. For example, Apple's gross profit margin in Q3 2024 was 46.3%. This shows they manage their production costs well. But their net profit margin was 24.9%, showing the effect of other expenses on their profits.

Key Differences

- Gross margin is found by subtracting the cost of goods sold from net sales, then dividing by net sales and multiplying by 100.

- Net profit margin subtracts all expenses, including COGS, interest, and taxes, from net sales. Then it divides by net sales and multiplies by 100.

When to Use Each Metric

It's important to compare companies in the same industry and look at trends over time. Both gross and net profit margins help understand a company's financial health. A negative net profit margin might mean a company is losing money. This could be due to higher costs, economic issues, or new technologies.

By knowing the difference between gross and net margin, financial experts can see a company's profitability at different levels. This helps them make better decisions.

| Company | Gross Profit Margin | Net Profit Margin |

|---|---|---|

| Apple Inc. | 46% | 24.9% |

Factors Affecting Gross Margin

When you do a gross margin analysis, it's key to look at what affects a company's gross margin. The cost of sales margin is a big deal here. If it's high, your gross margin goes down. But if it's low, your gross margin goes up.

To boost your gross margin, you can try a few things. For instance, setting the right prices can help. Also, cutting down on production costs is a smart move. You can get better deals from suppliers or make your operations more efficient.

Here are some important things that can change your gross margin:

- Pricing strategy: Changing how you price things can help you make more money.

- Production costs: Lowering what it costs to make your products can also help.

- Supply chain efficiency: Making your supply chain better can cut down on costs and boost your gross margin.

By knowing these factors and doing regular gross margin analysis, companies can make better choices. This helps them stay profitable and competitive in their field.

Gross Margin Trends Over Time

Looking at gross margin trends is key for businesses. It helps spot patterns and oddities in their money data. By checking past gross margin data, companies learn about their cost efficiency and how much money they make. Gross margin analysis shows if their prices are right and if they can save money.

It's important to compare current margins with industry standards and past numbers. This lets businesses see how they're doing financially. It helps them decide where to put their resources and plan for the future. Margin growth is a big deal for investors looking at how well a company is doing.

| Year | Gross Margin | Revenue Growth |

|---|---|---|

| 2020 | 30% | 10% |

| 2021 | 32% | 12% |

| 2022 | 35% | 15% |

By watching gross margin trends, businesses can see changes in costs and sales. This lets them tweak their plans to improve their finances. Keeping up with gross margin analysis and margin growth is vital for staying ahead and succeeding in the long run.

Industry Benchmarks for Gross Margin

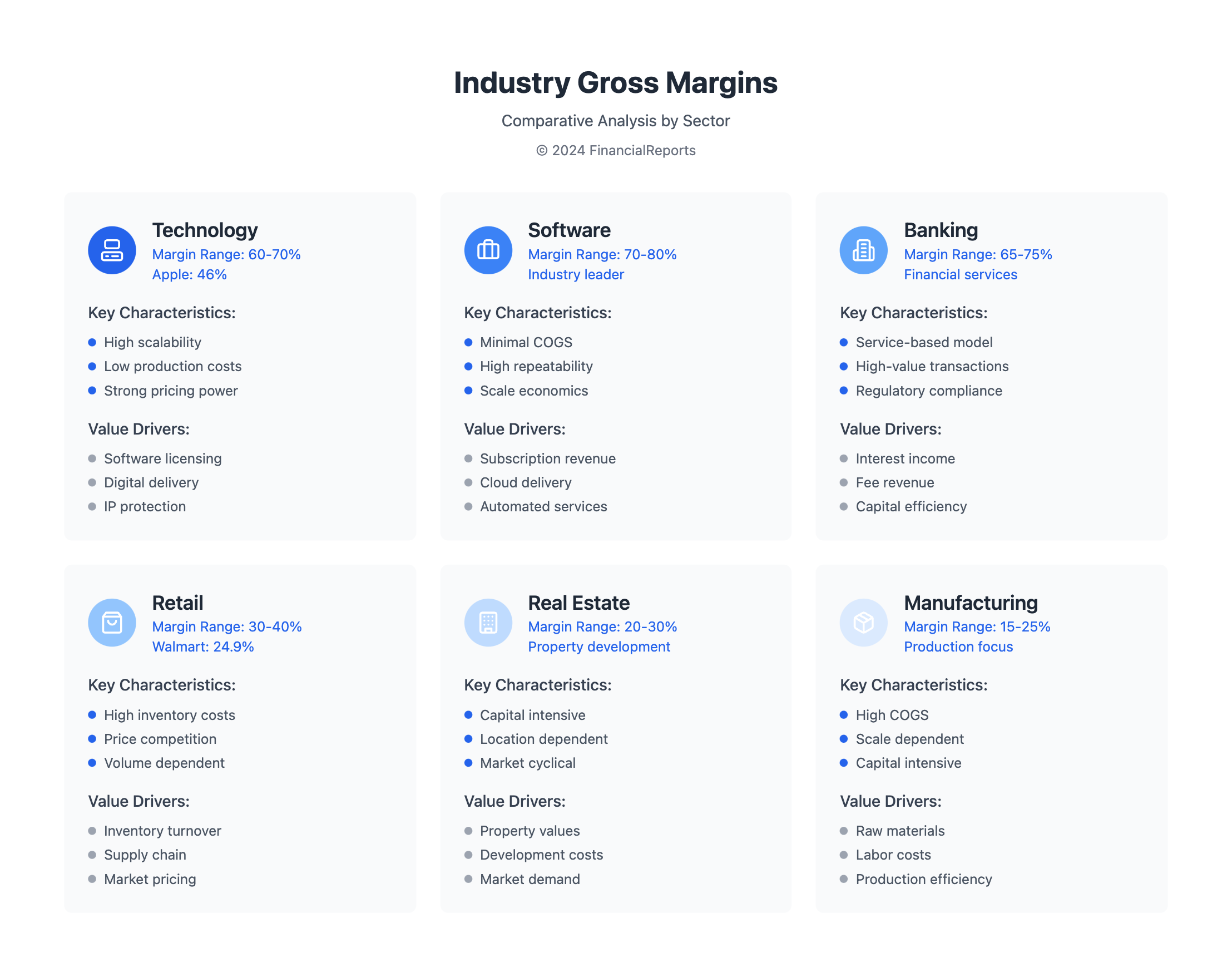

Understanding gross margin is key for companies to check their efficiency and for investors to see if a company is worth investing in. The tech industry shows how important gross margin is. Companies with a gross margin of 60% or more had a profit margin of 26%. On the other hand, those with a gross margin of 40% or less had a profit margin of just 4%.

Service-based industries often have higher gross margins because they have lower costs of goods sold (COGS). For example, the software industry has higher gross margins than retail. Here's a table showing gross margin benchmarks for different industries:

| Industry | Average Gross Margin |

|---|---|

| Technology | 60-70% |

| Software | 70-80% |

| Retail | 30-40% |

Companies can use gross margin analysis to set goals and boost their financial health. Knowing the industry's gross margin benchmarks helps businesses spot areas to improve. This way, they can make smart choices to increase their profits.

Improving Gross Margin

To boost gross margin, companies can cut costs or increase revenue. They might optimize their supply chain, improve production, or use value-based pricing. A detailed gross margin analysis is key to spot areas for betterment and monitor margin growth.

Effective ways to enhance gross margin include:

- Streamlining product offerings to reduce direct costs

- Renegotiating with suppliers for better deals

- Upselling to existing clients to increase revenue

- Increasing efficiency and productivity to reduce waste and optimize resources

By using these strategies, businesses can up their gross profit margins. This makes them more competitive and strong in changing market conditions. Keeping an eye on gross margin metrics helps spot trends. This way, companies can make smart choices to grow margins and boost their financial health.

Common Misconceptions About Gross Margin

Knowing what gross margin meaning is is key for businesses to make smart choices. But, there are common mistakes that can confuse what gross margin figures really mean. One big mistake is mixing up gross margin with markup, leading to wrong pricing plans. To clear things up, gross margin explained is the difference between what you earn and what it costs to make it, shown as a percentage of what you earn.

Another mistake is thinking that higher gross margins always mean better success. But, a high gross margin can sometimes mean you're charging too much or cutting corners on quality. It's important to look at how your industry does and your own situation when checking gross margin. For example, tech and software can have gross margins over 70%, while retail and food services usually have much lower ones.

To steer clear of these mistakes, businesses should get good at figuring out gross margin. Use the formula: Gross Margin = ((Revenue – Cost of Goods Sold) / Revenue) x 100. By really getting what gross margin numbers mean, companies can make better choices on pricing, managing costs, and where to invest. This can help them become more profitable and stay ahead in the market.

Tools for Tracking Gross Margin

Keeping an eye on gross margin is key for businesses to stay financially healthy. They can use various software to track and analyze their gross margin. For example, gross margin analysis tools offer insights into a company's efficiency and profits.

Good record-keeping is essential. This includes monitoring regularly, allocating costs correctly, and keeping detailed financial records. By following these steps, businesses can make sure their gross margin accounting is right. This helps them make smart decisions to grow and increase profits.

Some important steps for gross margin analysis are:

- Regularly check and update financial records for accuracy and completeness

- Use a strong cost allocation system to assign costs correctly to products or services

- Employ specialized software for easier gross margin analysis and fewer mistakes

By using these tools and following best practices, businesses can improve their gross margin accounting. This leads to better decision-making and financial results. Gross margin analysis is vital for financial management. By focusing on it, companies can stand out in their markets.

Conclusion: The Significance of Gross Margin in Business

Summary of Key Points

We've looked at how important gross margin is for a business's health and making smart choices. Gross margin is the difference between what a company earns and what it costs to make its products. It shows how profitable a business is.

Knowing what affects gross margin helps businesses see how well they're doing. They can check if they're making enough money and if their prices are right.

Future Outlook for Businesses

The business world is always changing, and focusing on gross margin will become even more important. Companies in many fields, like retail and tech, need to keep an eye on their gross margins. This helps them stay ahead and grow over time.

To succeed, businesses should look for ways to cut costs and make more money. They should also make sure their prices match what customers are willing to pay. Keeping a good gross margin is key for companies that want to do well in the future.

FAQ

What is the meaning of gross margin?

Gross margin shows how much profit a company makes from selling its products or services. It's the difference between what the company earns and what it costs to make or sell something. It helps show if a company is running efficiently and making money.

How is gross margin different from other financial margins?

Gross margin looks only at the costs of making a product or service. Other margins, like net margin and operating margin, also include costs like overhead, marketing, and administration. This makes them more detailed but also more complex.

What are the components of gross margin?

Gross margin has two main parts: revenue and cost of goods sold (COGS). COGS includes direct costs like labor, materials, and other expenses for making goods or services.

How do you calculate gross margin?

To find gross margin, subtract COGS from revenue. This gives you the gross profit. Then, divide the gross profit by revenue to get the gross margin percentage.

Why is gross margin important in financial analysis?

Gross margin is key for checking if a company is efficient and can set good prices. It shows how profitable a company is, its production costs, and how it stands against competitors.

How does gross margin differ from net margin?

Gross margin only looks at direct production costs. Net margin includes all costs, like overhead and marketing. Net margin gives a fuller picture of a company's profit.

What factors can impact a company's gross margin?

Several things can change a company's gross margin. These include pricing, production costs, supply chain efficiency, market conditions, and industry specifics. Companies need to manage these well to keep their gross margin high.

How can businesses improve their gross margin over time?

To boost gross margin, companies can cut costs by improving supply chains and automating processes. They can also increase revenue by using value-based pricing and optimizing product mixes.

What are common misconceptions about gross margin?

Some think a higher gross margin is always better. Others believe gross margin can be compared across different businesses or industries without context. These are not true.

What tools are available for tracking and analyzing gross margin?

Companies can use financial software, accounting systems, and data analytics to track and improve their gross margin. Keeping accurate records and allocating costs correctly is vital for reliable reports.