Understanding Annualized Return on Investment (ROI)

In finance, the annualized return on investment or ROI is key. It shows how well an investment is doing compared to its cost. This number, usually a percentage, tells us the growth rate of an investment over time. The strength of ROI is that it changes irregular ups and downs into a yearly standard number. This makes financial decisions more accurate for investors everywhere.

The annualized ROI is like a lighthouse for investors. It helps them navigate through ups and downs in the market. It shows the real growth rate of investments over time. This lets investors compare different strategies clearly. So, it supports wise financial choices, whether you're just starting or have lots of experience.

Key Takeaways

- Annualized ROI is crucial for evaluating an investment's profitability over its entire duration.

- Expressed as a percentage, it allows for an analytical comparison of different investments.

- Calculation of annualized ROI entails compounding effects, offering a more precise measure than simple ROI.

- Understanding annual ROI is a cornerstone of sound financial decision-making and portfolio management.

- Institutional clients and investors utilize annualized ROI to strategize and optimize investment choices.

- Annualized ROI forms the backbone of effective investment growth rate determination and benchmarking.

What is Annualized Return on Investment?

The annualized return on investment, or ROI, is a key finance tool. It measures profits over a year, adjusted for time. This helps compare different investment options, no matter how long the investment period. It offers a real look at how investments pay off over time.

Definition and Importance

Annualized ROI improves on basic ROI by adding the effects of compounding yearly. It shows the real yearly growth of investments. It's simple yet powerful for understanding how well an investment performs. This measure is crucial for checking how investments might grow.

Following rules like the Global Investment Performance Standards (GIPS) makes annualized ROI reliable. It needs at least a year's data to be meaningful. This ensures investments are compared fairly across the board.

How is it Calculated?

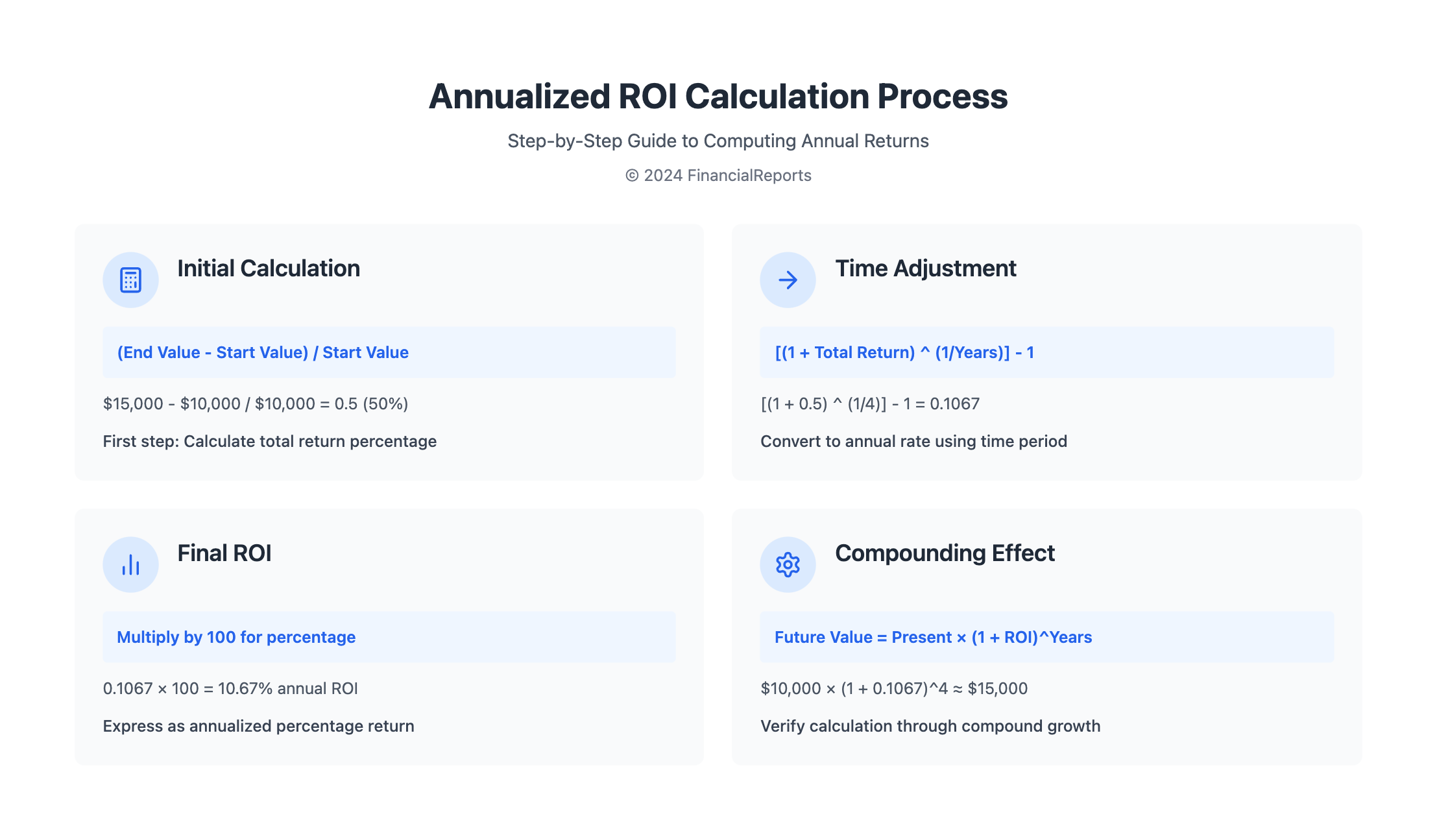

Calculating annualized ROI starts with a simple formula. It adjusts returns to an annual perspective. For example:

- Initial Investment: $10,000

- End of Period Value: $15,000

- Duration: 4 years

To find the annualized ROI, you first find the initial ROI, which is 50%. Then adjust it to an annual rate. In our example, it turns out to be around 10.67% each year.

Take Mutual Fund A and B, both with a 5.5% annualized return over five years. This shows how annualized ROI lets us compare different investments fairly. This key uniformity helps analysts and investors make better choices.

In short, understanding annualized ROI is vital for comparing investment profits. It's especially useful for looking at investments that span several years.

The Formula Behind Annualized ROI

Understanding the formula for calculating annualized return on investment (ROI) is crucial. We need to know the key parts that make it accurate. This section looks closely at these parts. It also explains how to do this important financial calculation. We'll see how compounding reflects the true performance of an investment over time.

Identifying Key Variables

To work out annualized ROI, you need a few important details: how much you first put in, the investment's end value, and how long you've had the investment. These details help investors figure out how well their investment did over the time it was at risk.

Step-by-Step Calculation

To start calculating annualized ROI, first find the total return. This is the difference between the final and initial values of the investment. Next, divide this result by the initial investment to find the basic return rate. To make this rate annual, apply the compounding over the period you've held the investment. Here's the formula:

Annualized ROI = [(Ending Value / Beginning Value) ^ (1 / Number of Years)] - 1

This method turns the growth rate into an annual figure, no matter how long the investment lasted. It gives a consistent way to measure performance. For example, if a $500,000 investment grows to $700,000 in three years, the annualized ROI works out to:

[(700,000 / 500,000) ^ (1 / 3)] - 1 = 0.119 or 11.9%

How we represent financial figures, like using compounding, changes how we view investment success and effectiveness. Annualizing returns lets us compare different investments and times. It's key for smart investment management.

Using the annualized ROI properly, with compounding in mind, gives a clearer picture of an investment's return. This is essential for honest and correct financial planning and analysis.

Benefits of Using Annualized ROI

Annualized Return on Investment (ROI) helps financial experts and investors understand how well investments do over time. It makes comparing investments easier by putting them on the same time scale. This is key in areas like performance evaluation, financial benchmarking, and investment comparison.

Clear Performance Measurement

Annualized ROI measures how well an investment does by showing its yearly growth. This helps us see how different investments like stocks, real estate, or business tech upgrades perform. For example, Novula Tech's equipment investment had an Annualized ROI of 10.69%.

This way, the yearly growth rate helps us judge success clearly. It lets us compare an investment's performance with others easily.

Comparative Analysis

Annualized ROI is not just for tracking how well investments do. It's key for financial benchmarking. It lets investors see how their investments or portfolios compare to others. For example, comparing traditional investments to new market chances shows which is better.

By using Annualized ROI, financial experts can compare different kinds of investments. This includes bonds, stocks, and real estate. Each has its own risks and returns. This helps in making better investment choices.

Adding Annualized ROI into financial planning helps deeply analyze investment portfolios. It ensures choices are based on data and real-world issues. Its use in shaping investment strategies is very important. It makes financial decisions clearer and more precise in a changing market.

Annualized ROI vs. Other Return Measures

To figure out which investment strategies work best, it’s key to know the difference between annualized Return on Investment (ROI) and other measures like Simple ROI and Compound Annual Growth Rate (CAGR). This discusses how they vary and why it matters when comparing returns over different time periods.

Difference from Simple ROI

Simple ROI is a straightforward way to see return that does not think about time's impact on money. It's a percentage showing the gain or loss compared to the first investment, not minding how long it took to get that return. For instance, a simple ROI of 20% doesn’t spell out if that was in a month or a year.

Annualized ROI, though, considers the year factor and compounding, which can change the return percentage a lot. It makes sure the length of the investment is factored into the calculation.

Comparing with CAGR

CAGR also smooths out return rates over time but looks at it differently. It’s used when the investment value changes at various rates over time. CAGR shows an average growth rate as if the investment grew at a steady pace. This helps a lot when comparing investments that last for different lengths of time.

| Return Type | Description | Use-Case | Example |

|---|---|---|---|

| Simple ROI | Percentage increase or decrease over the entire investment period without considering time compounding. | Quick assessment of profitability | 20% over 18 months |

| Annualized ROI | Reflects an annualized growth rate considering compounding. | Comparisons of returns accruing over different periods | 6.3% per annum over 18 months |

| Compound Annual Growth Rate (CAGR) | Shows a smoothed annual rate of growth using geometric progression. | Long-term investment growth portrayal | 7.2% per annum over 5 years |

In short, while annualized ROI and CAGR both give a look into growth rates across times, they serve different needs. Annualized ROI works well for many cash flow situations. CAGR fits when showing growth as consistent over several periods. Choosing and using these measures correctly leads to sharper financial analysis and choices.

Factors Affecting Annualized ROI

Several factors play a key role in determining the Annualized Return on Investment (ROI). These include how long you invest and the current market conditions. It's vital for investors to understand this. Doing so helps them adjust their strategies based on their willingness to take risks. This way, they can make better decisions in the financial world.

Investment Time Horizon

The length of time you invest has a big impact on your ROI. A short investment period might not let you fully benefit from market trends and compounding. This could lead to underestimating an asset's true value. On the other hand, investing for a longer period allows for a better evaluation of an investment's stability over different economic cycles. Grasping how time and ROI connect is key to reaching your long-term financial goals.

Market Volatility

Market volatility shows how much investment returns can change over time. High volatility means more risk, which can significantly affect your annualized ROI. This could lead to either higher gains or bigger losses. Investors should assess their risk tolerance and the market's state. This will help them shape their investment strategies for the best results.

| Investment Type | Average Annualized ROI | Contextual Market Condition |

|---|---|---|

| S&P 500 | 10% | Stable, historical average |

| Technology Stocks (2020) | Above 10% | High growth due to technological demand increase |

| Energy and Utilities | Varies; potential losses | Lower performance in volatile markets |

| Residential Real Estate | 10.6% | Steady growth, stable market |

| Commercial Real Estate | 9.5% | Stable, slightly lower than residential |

| Real Estate Investment Trusts (REITs) | 11.3% | Higher yield due to managed properties |

This table shows how changing your investment time and strategy based on market conditions affect returns. Considering these changes can help maintain investment stability. It's crucial for success in the long run.

Real-World Applications of Annualized ROI

In today's fast-changing financial markets, understanding your portfolio and financial analysis is key. Annualized Return on Investment (ROI) is a critical tool in this area. It offers a clear view on how investments perform, guiding strategic decisions.

Portfolio Performance Evaluation

The annualized ROI is vital for investors and financial advisors. It's used to assess how profitable portfolios are over time. This assessment helps align investments with strategic goals, using hard numbers. It's key in rebalancing portfolios to match an investor's financial goals and risk level. For example, discovering an 8.56% annual return over 650 days might lead to portfolio changes.

Investment Decision Making

Annualized ROI also influences investment decisions. It provides a uniform way to assess profits across various assets and time frames. This helps investors spot good long-term investment opportunities. Financial experts use it to see how investments stack up against benchmarks. This support clients in making smart, strategic choices. Say, when looking at two investments, one with a 15.75% return and another with an annualized 13.5% return, investors can pick what's best for their strategy and risk level.

Annualized ROI is vital in portfolio management and investment choices. It plays a crucial role in financial analysis and portfolio evaluation today. By making gains easier to compare over time, it boosts strategic financial planning and actions.

Case Studies Demonstrating Annualized ROI

The importance of annualized ROI can be seen through deep dives into investment cases. These studies show us the power of smart financial moves and the lessons we can learn, good and bad.

Successful Investment Strategies

Looking closely at the annualized ROI of top early childhood programs shows great financial benefits. The Perry Preschool project, for example, returned $7 to $12 for every $1 put in. This case proves the worth of investing in early education and its wide-reaching impacts.

Lessons from Failures

It's important to learn from investments that didn't pan out. Examining early childhood programs that missed their marks reveals key insights. Some didn't bring a good return, pointing to a mismatch in cost versus benefits. These examples make us think again about our financial tactics and how to adjust them.

| Program | ROI | Cost-Benefit Ratio |

|---|---|---|

| Perry Preschool Project | $7-$12 per $1 invested | Highly Positive |

| Generic Early Childhood Program | Varied | Negative to Neutral |

These cases add a lot to building a sound financial strategy, with insights from both wins and losses. They help organizational leaders and strategists improve their investment approaches. Learning from these studies is key in making financial plans that can handle the challenges of the economy.

Common Misconceptions about Annualized ROI

Many investors still get mixed up about annualized return on investment (ROI), even though it's important in finance. These ROI misunderstandings can mess up their choices. We need to correct these wrong ideas to help people invest smarter and get better results. Let's clear up these financial myths and make annualized ROI easier to understand.

Myths vs. Facts

Some people think taking bigger risks always means making more money. But facts show this isn't true. Big companies and diverse funds often do better than smaller ones over time. And, believing real estate is always a sure win overlooks costs like upkeep and taxes. These can really eat into your profits.

Clarifying Misunderstandings

It's important to really understand annualized ROI. For example, the Sharpe Ratio lets investors measure how well their money is doing for the risk they take. And even though putting money in fixed deposits seems safe, inflation can make the real value of these earnings quite low or even negative. This shows why being cautious with 'safe' investments matters.

| Investment Type | One-Year Performance | Three-Year Performance | Five-Year Performance |

|---|---|---|---|

| Large-Cap Funds | Better than Small/Mid Cap | Better than Small/Mid Cap | Better than Small/Mid Cap |

| Fixed Deposits | 6.4% (after tax) | N/A | N/A |

| Real Estate | Varies significantly | Varies significantly | Varies significantly |

This table helps us see how wrong beliefs change the way we view ROI across various investments. It underlines the need to grasp concepts like inflation, risk, and how the economy changes. Breaking down these financial myths and sorting out ROI misunderstandings boosts our understanding of finances. This, in turn, helps investors and analysts make better choices.

Tools for Calculating Annualized ROI

Calculating Annualized Return on Investment (ROI) is key in professional investing. With modern technology, we have tools that make this easier. These tools help evaluate investment performance and guide strategic decisions.

Software and Online Calculators

Investment software and online financial calculators are made for complex calculations. They consider costs like taxes and insurance, which affect ROI. By automating these calculations, investors cut down on errors and save time. The tools use advanced algorithms that factor in compounding and market shifts, ensuring all financial details are accurate.

Spreadsheets and Manual Calculations

Many financial experts still use spreadsheets for manual ROI calculation. Spreadsheets are flexible and can be customized for specific projects. This method also helps investors understand financial metrics deeply. It ensures they aren't too dependent on automation for their financial decisions.

| Calculation Tools | Key Benefits | Common Usage |

|---|---|---|

| Investment Software | High precision, Time-efficient, Error minimization | Complex investment portfolios |

| Online Financial Calculators | Accessibility, User-friendly, Quick computations | Standard ROI and annualized ROI calculations |

| Spreadsheets | Customization, Detail-oriented audits, Educational tool | Ad-hoc financial analysis and scenario planning |

In conclusion, choosing between investment software, financial calculators, or manual ROI calculations in spreadsheets is crucial. Each tool significantly improves financial analysis accuracy and efficiency. The best choice depends on the investor's needs, ensuring a bespoke approach to calculating annualized ROI.

How to Improve Your Annualized ROI

To boost your annual ROI, focus on strategic investing and regular performance review. This means refining your investment strategies and looking closely at your portfolio. Though it can be tough, it's key for better financial results over time.

Strategies for Effective Investing

- Diversification: Spread your investments across different types, like stocks, bonds, and global markets. This lowers risks and makes the most of various economies.

- Value and Size Effects: Aim to invest in undervalued firms and smaller companies. These have often performed well, boosting returns in many markets.

- Asset Allocation: Keep evaluating and shifting your investment mix based on risk and goals. Doing this might add a return of 3% to 5% each year.

- Cost Management: Choose passively managed funds when they fit, since they usually have lower fees. For example, a portfolio managed passively could charge 0.40%, much less than an active fund's 1.20%.

Importance of Regular Review

Doing regular performance reviews is vital for investment optimization. Yearly check-ups ensure you meet your financial goals and adapt to market changes.

- Annual Performance Review: Have a check-up every year. This helps adjust your investments by comparing them to benchmarks like the S&P 500 Index.

- Rebalancing Portfolio: It's crucial to rebalance your portfolio often. This keeps your risk level in line with your strategy, even when markets shift.

- Utilization of Tools: Use advanced tools for better investment tracking and management. They provide in-depth analysis and help keep your portfolio in order.

By following these investment strategies and reviews, you can build a strong investment plan. This greatly helps in achieving a high annualized ROI.

Evaluating Annualized ROI Over Time

Understanding annualized ROI's growth is key to better financial results. It needs a focused method which involves performance tracking. One also must use adaptive investment strategies from return on investment analysis findings.

Tracking Investment Performance

Good investment management always tracks performance. It compares the gains to the initial cost and industry standards. For example, versus the S&P 500's usual 10% yearly return, tracking shows if an investment is doing better or worse.

This comparison helps adjust strategies as needed.

- Annualized ROI is great for comparing different investment times and checking consistency in various market conditions.

- Tracking ROI helps see trends, guessing future performance from past results.

- Regular ROI checks make sure investments stay on track with financial goals, even when markets change or unexpected events happen.

Adapting Strategies Based on Results

Changing strategies based on results boosts ROI. By looking at performance data, investors decide to increase, decrease, or keep their market positions. This is key in unpredictable markets where old plans might not work.

- Portfolio rebalancing can aim for high-return opportunities or lessen failing assets.

- Advanced ROI calculations consider all costs and contributions for a true profit view.

- Leveraging should be used with care due to higher risks, despite potential for greater returns.

Using these approaches is at the heart of smart investment management. It helps make plans that can withstand market shifts and meet financial goals.

Conclusion: Embracing Annualized ROI in Investing

Annualized Return on Investment (ROI) plays a crucial part in understanding a portfolio's true growth. It allows us to compare different investments fairly, keeping in mind how time affects returns. For investors looking to grow their wealth wisely, Annualized ROI is an essential tool.

Summary of Key Takeaways

Analyzing data from the S&P 500 and Nasdaq 100 shows that smart use of ROI metrics leads to strong investment growth. A positive ROI means an investment is doing well, but annualized ROI lets us compare over time. It considers things like tech improvements, better customer experiences, and automation, which are key for a company's future success.

The Future of Investment Analysis

The complexity of modern markets means future investment analysis will rely more on sophisticated annualized ROI calculations. This method's precision is crucial for sectors like healthcare and retail. So, finance professionals need to use the powerful, data-driven insights of annualized ROI to enhance their analysis and predictions.

FAQ

What exactly is annualized return on investment?

Annualized return on investment (ROI) tells us how successful an investment has been, but as a yearly rate. It helps to see how profitable an investment is by converting its total returns into a yearly figure.

Why is annualized ROI important?

Annualized ROI is key for comparing how investments do over different times and types, factoring in the money's value over time.

How do you calculate annualized ROI?

To calculate it, take the final value, subtract the initial investment, and then divide by the initial investment. Next, raise this to the power of 1 divided by the years held. Subtract 1, then multiply by 100 for a percentage.

What are the key variables in the annualized ROI formula?

The main parts of the formula are the investment's initial and final values, plus the total time in years it was held.

What benefits does using annualized ROI offer?

Annualized ROI is useful for its clarity in measuring performance. It helps compare different investments and benchmark against standards.

How does annualized ROI differ from simple ROI or CAGR?

Unlike simple ROI, annualized ROI shows returns each year, taking account of compounding. CAGR gives a smooth growth rate, but not the ups and downs like annualized ROI does.

What factors can affect the calculation of annualized ROI?

The length of time invested and market ups and downs greatly impact annualized ROI. Longer times give a better view of growth, while high volatility can change returns much.

How is annualized ROI utilized for portfolio performance evaluation?

Annualized ROI helps assess how well a portfolio is doing each year. It's used to fine-tune investment choices and strategies.

What common misconceptions exist about annualized ROI?

People often get wrong how the length of an investment affects annual returns. They also forget how much market swings can change annualized figures.

What tools are available to calculate annualized ROI?

There are many online tools and software to help calculate annualized ROI accurately. These include online calculators and spreadsheet functions.

How can one improve their annualized ROI?

To boost annualized ROI, it helps to plan ahead, keep up with market trends, spread out investments, and regularly check how they're doing to adjust strategies.

Why is it important to evaluate annualized ROI over time?

Tracking annualized ROI over years is essential for seeing how investments change and making sure strategies lead to the best long-term gains.

How will the use of annualized ROI in investment analysis evolve in the future?

The use of annualized ROI is expected to become even more important. The financial world needs better ways to understand and steer through complex markets. This means relying more on nuanced metrics like annualized ROI for smart investing.