Uncover EBITDA Multiples Across Industries

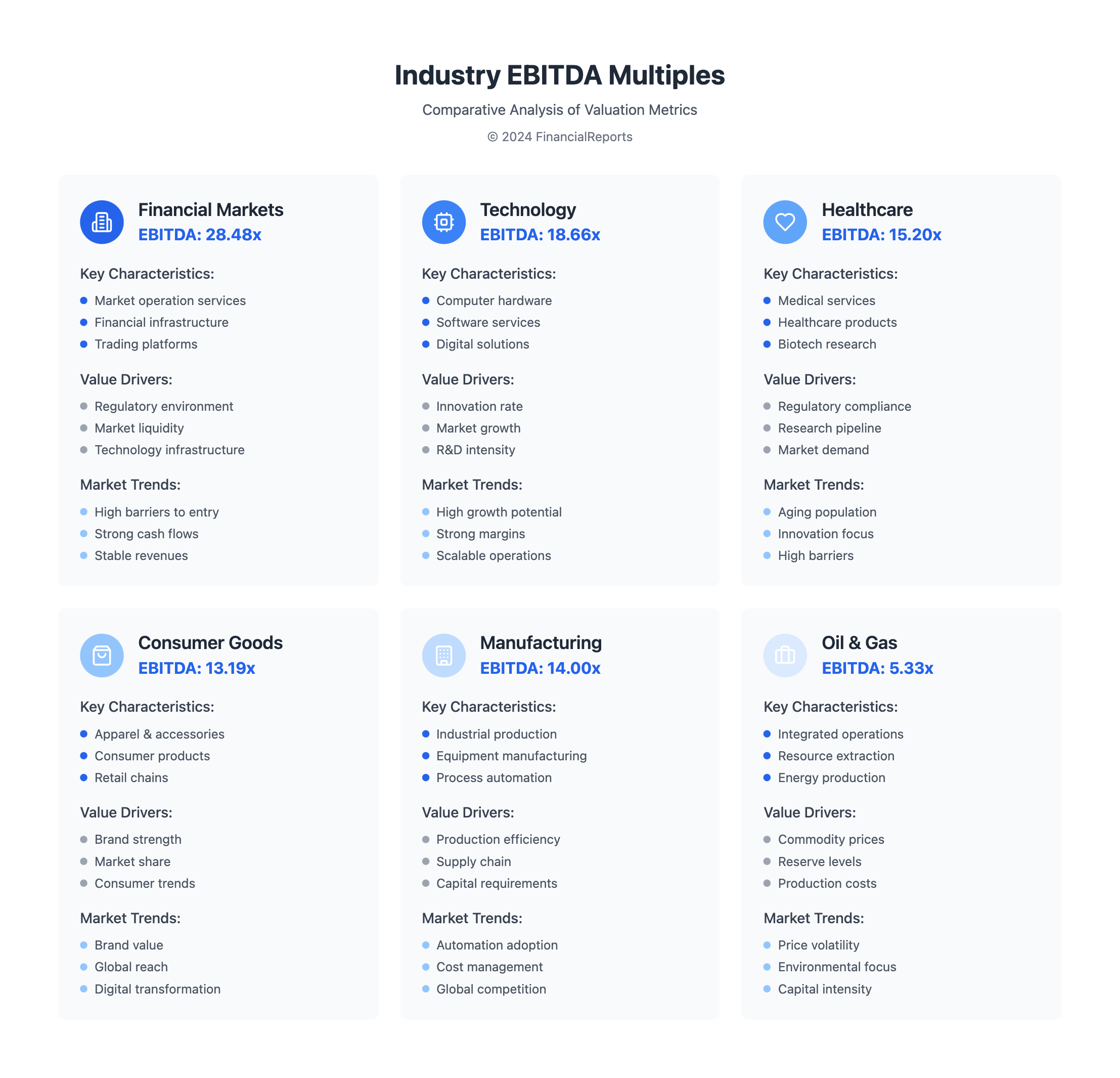

EBITDA multiples by industry are key for investors and analysts. They show a company's value. The highest EBITDA multiple is 28.48 for Financial & Commodity Market Operators & Service Providers. The lowest is 5.33 for Integrated Oil & Gas.

Knowing ebitda multiples by industry helps compare companies in the same field. This is important for businesses with different structures or assets.

EBITDA multiples are the Enterprise Value divided by EBITDA. They measure a company's profit ability. The ebitda multiple varies a lot, from Apparel & Accessories at 13.19 to Computer Hardware at 18.66.

As companies grow, ebitda multiples by industry become more critical. Investors use them to see a company's growth and value.

Key Takeaways

- EBITDA multiples by industry range from 4.07 to 28.48, with significant variations across sectors.

- The ebitda multiple is a critical metric for evaluating a company's valuation and profit.

- Understanding ebitda multiples by industry is essential for comparing companies within the same industry.

- Common ebitda multiples include Apparel & Accessories at 13.19 and Computer Hardware at 18.66.

- EBITDA multiples are calculated as the ratio of the Enterprise Value of a company to its EBITDA.

- Industry comparisons are critical for assessing a company's growth and value.

- EBITDA multiples by industry are influenced by various factors, including global conflicts, supply chain disruptions, and pandemic-induced behavior changes.

Understanding EBITDA and Its Importance

EBITDA, or Earnings Before Interest, Tax, Depreciation, and Amortization, shows a company's profit. It's found by adding net profit, interest, tax, depreciation, and amortization. This metric is key in valuing businesses, giving a clear look at how they operate without the extra costs of interest and taxes.

The franchise multiple ebitda is vital in setting a company's value, mainly in mergers and acquisitions. Knowing the value of small specialty food manufacture in terms of ebitda is important. The EBITDA multiple, which is the enterprise value divided by EBITDA, is a common tool in the industry.

Here are some key points to consider when evaluating EBITDA:

- EBITDA excludes depreciation and amortization, providing a clearer view of a company's operational performance.

- EBITDA is often used as an alternative metric to evaluate profitability, in comparison to metrics like earnings, revenue, and income.

- The EBITDA multiple is used by investors and analysts to assess if a company is overvalued or undervalued, aiding in investment decisions and M&A processes.

| Company | EBITDA Multiple | Enterprise Value | EBITDA |

|---|---|---|---|

| ABC Wholesale Corp | 14.0x | $100 million | $7.14 million |

Understanding EBITDA and its role in business valuation helps investors and analysts. They can make better choices when looking at companies, focusing on franchise multiple ebitda and the value of small specialty food manufacture in terms of ebitda.

Overview of EBITDA Multiples

EBITDA multiples are key in business valuation. They show a company's financial health and growth chances. The EBITDA multiple is found by dividing Enterprise Value by EBITDA. This lets us compare company values.

This metric is used in many ways. It helps investors and analysts find good takeover targets. It also shows if a company is worth more or less than it seems.

When using EBITDA multiples, comparing industries is very important. Different industries have different multiples. For example, tech companies often have higher multiples than old-school industries. Knowing these differences helps in making better business and investment choices.

In mergers and acquisitions, EBITDA multiples are also key. A low multiple might mean a company is a good buy. But a high multiple could mean it's overpriced. By looking at EBITDA multiples in different industries, we can make smarter choices and help businesses grow.

| Industry | EBITDA Multiple |

|---|---|

| Technology | 12-15x |

| Healthcare | 10-12x |

| Consumer Goods | 8-10x |

EBITDA Multiples in the Technology Sector

The tech sector is famous for its fast growth and new products. This leads to high EBITDA multiples. For example, software companies have an EBITDA multiple of 28.48. This shows a strong demand for them.

When looking at small business valuation multiples by industry, it's key to know the subsector. EBITDA multiples can change a lot between subsectors.

What affects EBITDA multiples in tech includes growth rates, market size, and innovation. The history of tech EBITDA multiples has seen big changes. Some subsectors have higher multiples than others. For instance, revenue multiples by industry can be from 2.1x to 3.3x. This depends on the revenue and subsector.

Some notable EBITDA multiples in the technology sector include:

- Adtech: 10.7x

- Cybersecurity: 12.6x

- B2B SaaS: 12.5x

- Software Development: 11.9x

These numbers show how different subsectors in tech are valued differently.

EBITDA Multiples in the Healthcare Industry

The healthcare industry is complex and heavily regulated. It has many factors that affect sector valuation multiples. Knowing about ebitda multiple valuation is key for investors, analysts, and business owners. It helps them understand the value of healthcare companies.

Different parts of the healthcare industry have unique ebitda multiple valuation traits. For example, hospitals have an average EBITDA multiple of 7.9x. Plastic surgery has a multiple of 8.8x. Here's a table showing the average EBITDA multiples for various healthcare segments:

| Segment | EBITDA Multiple |

|---|---|

| Hospitals | 7.9x |

| Plastic Surgery | 8.8x |

| Medical Devices | 10.5x |

| Medical Practices | 8.9x |

These differences in sector valuation multiples come from several factors. These include the regulatory environment, competitive landscape, and growth opportunities. By grasping these factors and their effect on ebitda multiple valuation, investors and analysts can make better choices when looking at healthcare companies.

EBITDA Multiples for Consumer Goods

The consumer goods sector is a big part of the global economy. It includes a wide range of products and services. The EBITDA multiple for consumer lending is 17.98, showing it's highly valued.

In the consumer goods sector, ebitda multiples by industry vary a lot. For example, luxury goods companies can have multiples over 20x because of their strong brands. Consumer products companies, on the other hand, might have multiples between 6.8x and 9x.

Here is a summary of the EBITDA multiples for different industries:

| Industry | EBITDA Multiple Range |

|---|---|

| Consumer Goods | 12-18x |

| Technology | 18-30x |

| Healthcare | 15-25x |

Knowing these valuation multiples by industry is key for investors and financial experts. By looking at ebitda multiples by industry, they can spot chances and risks in the consumer goods sector.

Real Estate and EBITDA Multiples

The real estate industry is big, and EBITDA multiples are key in valuing it. Knowing what affects these multiples is vital for investors and businesses. Location and market conditions are major factors, with different areas and property types showing unique traits.

Commercial REITs have an EBITDA multiple of 21.66, showing a high valuation. This is because commercial properties offer stable income and are less risky. On the other hand, small business valuation multiples by industry can change a lot. This depends on the property type, location, and market conditions.

The Role of Location and Market Conditions

Location and market conditions greatly affect EBITDA multiples in real estate. For example, urban areas with high demand and limited supply have higher EBITDA multiples. Also, acquisition multiples by industry can differ based on market conditions and the property type being bought.

| Industry | EBITDA Multiple |

|---|---|

| Commercial REITs | 21.66 |

| Residential REITs | 18.23 |

| Industrial REITs | 20.15 |

Understanding what affects EBITDA multiples in real estate is key for smart investments. By looking at location, market conditions, acquisition multiples by industry, and small business valuation multiples by industry, investors can better understand the market. This helps them make more informed choices.

EBITDA Multiples in the Manufacturing Sector

The manufacturing sector is very diverse, with different EBITDA multiples. DealStats shows the average EV/EBITDA multiple for manufacturing companies is about 14.0x. The median is 13.8x, with an average price-to-sales multiple of 2.1x and a median of 1.7x.

When looking at revenue multiples and sector valuations, the manufacturing sector shows interesting differences. For instance, chemical manufacturers often have higher valuations than food and beverage ones. Specialty ethnic foods in food manufacturing can reach mid-teens valuations. Larger companies usually get higher multiples because they're seen as less risky.

Some key statistics in the manufacturing sector include:

- Manufacturing sector EBITDA multiples: 5.4x

- Food & Beverage Processing sector EBITDA multiples: 5.2x

- Construction sector EBITDA multiples: 3.7x

These numbers show how EBITDA multiples vary across different parts of the manufacturing industry. Knowing these sector valuations is key for investors and financial experts to make smart choices.

| Sector | EBITDA Multiples |

|---|---|

| Manufacturing | 5.4x |

| Food & Beverage Processing | 5.2x |

| Construction | 3.7x |

In conclusion, EBITDA multiples in the manufacturing sector are shaped by many factors. This includes revenue multiples by industry and sector valuations. By grasping these factors and the differences in EBITDA multiples, investors and financial experts can make better decisions.

Comparing EBITDA Multiples: A Cross-Industry Analysis

When we look at companies using ebitda multiple valuation, it's key to think about the industry. Each sector has its own traits that affect ebitda multiples. These include growth chances, rules, and market conditions.

The financial sector usually has high ebitda multiples, from 7-12x. The food processing industry sees ebitda multiples between 5-10x. The waste and industrial sector has ebitda multiples ranging from 5-10x, influenced by assets and rules.

Looking at ebitda multiples across industries gives us useful insights. By checking ebitda multiples of various sectors, we can spot which ones are more or less valued. This helps us understand why these trends happen. It also helps us make smarter investment choices and grasp the market's expectations for future growth.

Some important things that shape ebitda multiples across industries include:

- Growth chances and market conditions

- Rules and industry-specific factors

- Company-specific traits, like business model and competitive standing

By looking at these factors and analyzing ebitda multiples by industry, we can get a better grasp of the market. The ebitda multiple valuation method is a helpful tool for evaluating companies and spotting good investment chances.

Using EBITDA Multiples for Investment Decisions

When looking at businesses to invest in, EBITDA multiples are very helpful. For small businesses or startups, these multiples are often lower, around 4x. This is true for areas like franchise multiple ebitda and value of small specialty food manufacture in terms of ebitda. Here, smaller companies usually get lower multiples than bigger ones.

When valuing a business with EBITDA multiples, it's key to think about the industry and the company's size. For example, healthcare has big differences in EBITDA multiples. This is because of things like market conditions, patient demand, and payor rates. Healthcare platform acquisitions with EBITDA over $5 million get higher multiples than smaller acquisitions.

While EBITDA multiples are a good starting point, you should also look at other financial and qualitative factors. Just using EBITDA multiples can give you a partial view, which might not be accurate for complex businesses or industries.

FAQ

What is EBITDA and why is it important in business valuation?

EBITDA stands for Earnings Before Interest, Taxes, Depreciation, and Amortization. It shows how well a company is doing without the extra costs of interest, taxes, and depreciation. It's useful for comparing companies with different financial setups.

How are EBITDA multiples calculated and why are they important for industry comparisons?

To find EBITDA multiples, you divide a company's total value by its EBITDA. These multiples help compare companies in the same field. They ignore differences in how companies are financed or what they own.

What factors influence EBITDA multiples in the technology sector, and how do they differ from other industries?

In tech, EBITDA multiples are often higher. This is because tech companies grow fast, have big market chances, and innovate a lot. They usually get higher valuations than other sectors.

How do regulations and industry dynamics impact EBITDA multiples in the healthcare industry?

Healthcare's strict rules and different areas like drugs, devices, and services affect EBITDA multiples. Each area has its own valuation rules, making it key to understand these differences.

What trends in consumer behavior and market conditions influence EBITDA multiples in the consumer goods sector?

Changes in what people want, online shopping growth, and brand strength shape EBITDA multiples in consumer goods. Also, there are differences in valuations between developed and growing markets.

How do location, market conditions, and the unique characteristics of REITs affect EBITDA multiples in the real estate industry?

Real estate EBITDA multiples depend a lot on where the property is and the market. REITs, with their special structure and focus, have different valuations than other real estate businesses.

What factors drive EBITDA multiples in the manufacturing sector, and how do they compare to revenue multiples?

Manufacturing EBITDA multiples are influenced by how much money is needed to start up, new tech, and global supply chains. Each part of manufacturing has its own valuation rules, based on its special features and market spot.

How can EBITDA multiples be used effectively for investment decision-making, and what are the limitations of relying solely on this metric?

Use EBITDA multiples with other financial and non-financial data for smart investment choices. While useful, don't just rely on EBITDA multiples. They have limits, like for small businesses or franchises.