Top Risk Analysis Tools for Secure Assessment

Organizations face many cyber threats. On average, they see 1,636 cyberattacks every week. This number has gone up by 30% from Q2 2023 to Q2 2024. To fight these threats, risk analysis tools and risk management tools are key. They help make decisions safer and more efficient.

These tools offer better visibility of threats, easier risk management, and help follow rules. They also reduce the damage from breaches and save money on mitigation. The cost of these tools varies a lot, from $24/user/month to unknown for top-tier options. Choosing the right tool depends on understanding the risks, the cost, how easy it is to use, and if it meets compliance standards.

Key Takeaways

- Organizations face an average of 1,636 cyberattacks per week, with a 30% increase from Q2 2023 to Q2 2024.

- Risk analysis tools and risk management tools are essential for secure, streamlined decision-making processes.

- Automation and interactive interfaces can help businesses proactively address risks and strengthen defenses.

- Risk analysis tools provide enhanced threat visibility, streamlined risk management, and mitigation cost savings.

- The pricing for risk analysis tools varies widely, from $24/user/month to undisclosed for high-end solutions.

- Comprehensive understanding, cost variation, usability, compliance, and proactive threat detection are key considerations for selecting security risk assessment tools.

- Risk quantification involves forecasting loss frequency and severity to improve decision-making and defend against data breaches.

Understanding Risk Analysis Tools

Risk analysis is key in many fields, like finance and healthcare. It helps spot possible dangers. Tools for risk assessment are vital for this task. They use methods like qualitative and quantitative analysis to find weaknesses.

These tools are used everywhere, from managing wealth to keeping investments safe. They help businesses find risks, guess their effects, and plan how to deal with them. Techniques like decision tree analysis and fault tree analysis are common in this field.

Some main steps in risk analysis are:

- Identifying risks and uncertainties

- Estimating impacts and building analysis models

- Analyzing results and implementing solutions

Knowing how risk assessment tools work helps organizations make smart choices. They can handle complex risks better. This leads to success and better outcomes.

| Risk Analysis Technique | Description |

|---|---|

| Qualitative Risk Analysis | Scenario-based, focuses on identifying risks that need detailed analysis and necessary controls |

| Quantitative Risk Analysis | Utilizes mathematical models and simulations to assign numerical values to risks |

Key Features of Effective Risk Analysis Tools

Effective risk analysis tools are key for businesses to spot, check, and lower risks. They should be easy to use, so everyone can understand the process. Tools like risk assessment matrices and decision trees help sort and focus on risks.

These tools must also handle data well, pulling info from many places. This helps spot trends and patterns, making it simpler to handle risks. Clear reports are also vital, giving a full view of risks and helping make smart choices.

Some important features of good risk analysis tools include:

- User-friendly interface

- Data integration capabilities

- Comprehensive reporting features

These features help businesses quickly find, check, and reduce risks. This protects their assets and reputation. By using these tools, businesses can make wise choices and stay ahead of risks.

| Risk Analysis Tool | Features |

|---|---|

| Risk Assessment Matrix | Identifies and prioritizes risks |

| Decision Tree | Maps different pathways and outcomes |

Types of Risk Analysis Tools Available

Risk analysis tools are key for spotting and handling risks in many fields. Companies need to pick the right tools to manage risks well. There are many types of tools, each with its own benefits and drawbacks.

Companies can pick between qualitative and quantitative tools, based on their needs. Qualitative tools help identify and rank risks. Quantitative tools give a detailed look at risks and their effects. Special software, like SentinelOne for cybersecurity, can also target specific risks.

Qualitative vs. Quantitative Risk Analysis Tools

Qualitative tools are often paired with quantitative ones for a full risk check. These include templates, checklists, and project management software with risk features.

Dedicated Software vs. Integrated Solutions

Dedicated software, like financial risk tools, focuses on certain risks. Integrated solutions, though, work across many systems for a broader risk view. Some common tools are:

- Risk matrix

- Decision tree

- Failure modes and effects analysis (FMEA)

- Bowtie model

Knowing the different tools helps companies choose the right ones for their needs.

| Tool | Description |

|---|---|

| Risk Matrix | A tool used to identify and prioritize risks based on their likelihood and impact |

| Decision Tree | A tool used to evaluate different courses of action and their possible outcomes |

| FMEA | A tool used to spot and check possible failures in a system or process |

| Bowtie Model | A tool used to spot and check possible risks and their effects |

Top Risk Analysis Tools for Businesses

Businesses have many tools to manage risks. These tools help spot, analyze, and lessen risks. We'll look at some top tools for risk analysis.

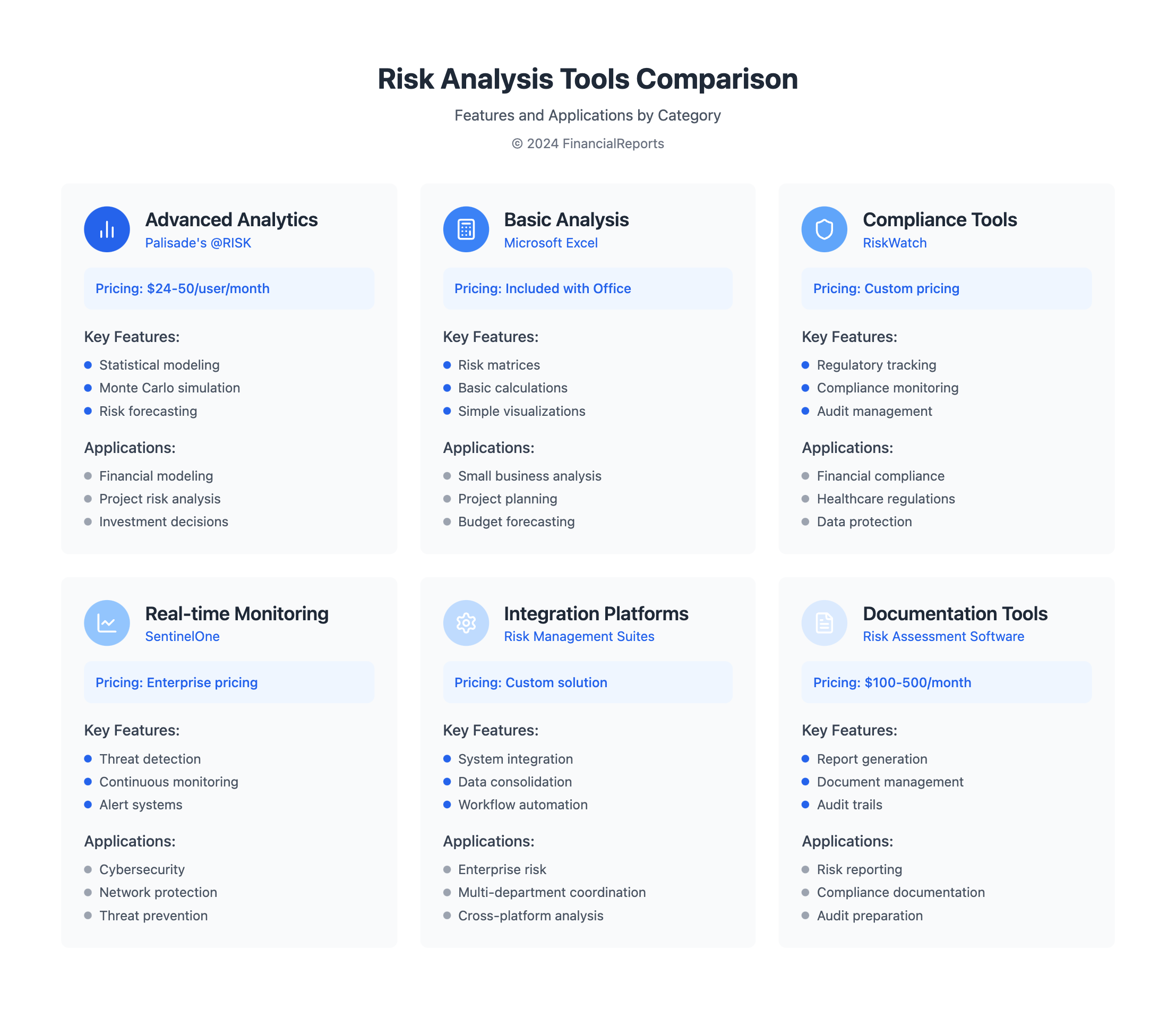

Tools like Microsoft Excel, Palisade's @RISK, and RiskWatch are key. They help reduce risks and make operations clear. This is vital for effective risk management.

Microsoft Excel for Basic Analysis

Microsoft Excel is great for simple risk analysis. It's easy to use and popular among businesses.

Palisade's @RISK for Advanced Statistical Analysis

Palisade's @RISK is for complex risk modeling. It's perfect for businesses needing detailed analysis.

RiskWatch for Compliance Monitoring

RiskWatch helps with compliance. It's key for businesses that need to watch and manage risks closely.

Using these tools, businesses can match their risk plans with their goals. This helps lower risk events and losses.

| Tool | Description |

|---|---|

| Microsoft Excel | Basic risk analysis |

| Palisade's @RISK | Advanced statistical analysis |

| RiskWatch | Compliance monitoring |

How to Choose the Right Risk Analysis Tool

Choosing the right risk analysis tool is key. You need to know what your organization needs. Look at the scope, compatibility, and how it fits into your operations. The goal is to pick tools that support your long-term plans.

Think about the type of risk assessment you need. There are different methods like quantitative, qualitative, and semi-quantitative. Quantitative uses numbers to measure risks. Qualitative uses opinions to rank risks.

Assessing Organizational Needs

To find the best tool, consider these points:

- Asset-based risk assessment to protect key resources

- Vulnerability-based risk assessment to spot major risks

- Threat-based risk assessment to look at risks from threat actors

Evaluating Tool Compatibility with Existing Systems

Make sure the tool works with your current systems. Look at how it fits with your compliance software, if it can be customized, and how it reports to stakeholders. The right tool can save money, improve operations, and show you're serious about IT governance.

The Hyperproof's 2023 IT Compliance Benchmark Report shows 63% of people plan to spend more on IT risk management in 2023. This shows the need for good risk management tools. By picking the right tool, you can better handle risks and reach your goals.

Benefits of Utilizing Risk Analysis Tools

Risk assessment tools are key in spotting and handling risks in many fields. They help companies make better choices and strengthen their risk management plans. These tools offer strong decision-making, clear metrics, and long-term cost savings. They ensure resources are used wisely without waste.

Some main advantages of using risk assessment tools include:

- Improved risk identification using advanced techniques and algorithms

- Increased efficiency by automating repetitive tasks like data entry and risk scoring

- Better decision-making with real-time insights and data visualization tools

- Enhanced compliance through features like automated tracking and reporting

By using risk assessment tools, companies can tackle the hurdles of managing risks. They can identify and assess risks in complex settings. These tools help in creating detailed risk management plans, setting up metrics to check success, and regularly reviewing and updating key risks and vulnerabilities.

With the right tools, companies can make smart business choices. This aligns with their overall strategy and boosts confidence and reputation among stakeholders.

Integrating Risk Analysis Tools into Business Processes

It's key for companies to use risk analysis tools well. This helps them handle risks before they become big problems. By using these tools, companies can avoid big losses and find new chances.

Here are some good ways to use risk analysis tools:

- Do deep risk checks to find out what could go wrong and where

- Make detailed plans to deal with risks

- Teach teams how to use these tools and plans

When companies use risk tools in their work, they make better choices. They also get better at fixing risks. This helps them reach their goals. Risk tools are important for helping companies manage risks well.

Common Challenges in Risk Analysis

Organizations often face challenges when using risk assessment tools. These include too much data and managing it. Using reliable software can help make better decisions.

Some common challenges in risk analysis include:

- Data overload and management: Organizations struggle to manage and analyze large amounts of data, which can lead to errors in modeling and communication struggles.

- Resistance to change: Organizations may resist adopting new risk assessment instruments and tools, which can lead to inadequate risk management practices.

The Committee of Sponsoring Organizations (COSO) offers a detailed ERM framework. It helps companies manage risks better. The International Organization for Standardization (ISO) framework also helps by focusing on identifying risks and opportunities.

By using these frameworks and tools, organizations can make risk management easier. They can map internal controls to various standards. This helps in following regulatory rules.

| Challenge | Solution |

|---|---|

| Data overload and management | Adopt reliable risk assessment software |

| Resistance to change | Provide training and support for new risk assessment instruments and tools |

Futuristic Trends in Risk Analysis Tools

Technology keeps getting better, making risk management tools more advanced. Artificial intelligence and machine learning help analyze huge amounts of data fast. This means better risk assessments and smarter decisions.

New trends in risk analysis tools include using smart technologies to help humans make choices. Risk management is now part of a company's overall strategy. And, tools can assess risks in real-time. These changes will change how companies handle risks, making them more proactive and quick to respond.

These trends bring many benefits, such as:

- Clearer risk visibility and understanding

- Better risk prevention and management

- More efficient and effective risk analysis

By using these cutting-edge trends, companies can stay ahead. They can handle the complex risk world with confidence. Risk management tools and analysis help guide their decisions, leading to success.

Case Studies: Successful Implementations

Risk assessment tools have changed how industries handle risks. They help find threats and plan to avoid them. For example, a regional transportation company cut its accidents by 25% and insurance costs by 40% with a risk program.

In finance, these tools help manage investment risks better. A mid-sized insurance firm in North America boosted its claim payouts by 20% in 5 years. This shows how data helps in making better risk plans.

Financial Sector: Managing Investment Risks

In healthcare, these tools improve patient safety. A life sciences company faced project delays and cost increases. But, with risk tools, they managed risks better, avoiding delays and cost hikes.

Healthcare: Enhancing Patient Safety Through Risk Assessment

The table below shows how risk tools worked in different fields:

| Industry | Company | Results |

|---|---|---|

| Transportation | Regional Transportation Company | 25% reduction in accident rates, 40% reduction in insurance premiums |

| Insurance | Mid-sized Insurance Firm | 20% increase in claim payouts linked to natural disasters |

| Life Sciences | Life Sciences Organization | Reduced project risk, improved patient safety |

These examples show how risk tools help manage risks and improve strategies. By using these tools, companies can make smarter choices, lower threats, and boost their profits.

Conclusion: The Future of Risk Analysis Tools

The global risk analytics market is growing fast. It's expected to hit $54.95 billion by 2027, with a growth rate of 12.2%. This growth shows that risk analysis tools are becoming more important.

Companies in many fields are seeing the value of good risk management. They need to protect their money, improve how they work, and keep data safe. They also want to be ready for risks before they happen.

New technologies like artificial intelligence and machine learning will make risk tools better. These tools will be able to check for risks in real time. This means companies can spot and deal with threats faster and more accurately.

Also, better risk frameworks will help leaders make smart decisions. Tools like NIST Cybersecurity and COBIT 5 will guide them. This will help in setting up strong risk management plans.

Data breaches are getting more expensive, and could cost $5 trillion by 2024. So, using risk tools to handle ESG risks is key. These tools will help companies understand and manage these risks. This will protect their reputation and money in the future.

The future of risk tools will keep getting better thanks to technology. By using these new tools, companies can handle risks better. This will help them stay ahead and be successful for a long time.

FAQ

What are the key benefits of using risk analysis tools?

Risk analysis tools help make better decisions and reduce risks. They save money in the long run. They give detailed insights and real-time data to help plan ahead.

How do qualitative and quantitative risk analysis tools differ?

Qualitative tools use personal opinions to assess risks. Quantitative tools use numbers and stats to measure risks. Knowing the differences helps make better choices.

What are some of the top risk analysis tools available for businesses?

Top tools include Microsoft Excel for simple analysis and Palisade's @RISK for complex models. RiskWatch helps with compliance. These tools make it easier to manage risks and improve operations.

How can organizations choose the right risk analysis tool for their needs?

Choosing the right tool means looking at what you need, how it fits with your systems, and if it will grow with you. It's about finding a tool that matches your risk management goals.

What are the common challenges in implementing risk analysis tools?

Common issues include too much data, managing it well, and getting people to use the tools. Overcoming these with good planning and training is key to success.

How are risk analysis tools being transformed by emerging technologies?

New tech like AI and machine learning are changing risk tools. They offer better visibility, automation, and prediction. This helps protect against new threats and keeps businesses safe.