Top Picks for Best Starter Stocks for Beginners

Investing in the stock market can help you grow your wealth over time. The average return is about 10% each year. For new investors, picking the right starter stocks is key.

Companies like Apple and Microsoft are great choices. Apple has a huge market value of $3.4 trillion and a P/E ratio of 34. Microsoft has a market value of $3.2 trillion and a P/E ratio of 36. These stocks, along with Coca-Cola and Procter & Gamble, are stable and have growth opportunities.

When choosing starter stocks, look at market size, earnings growth, and dividend yield. For example, Procter & Gamble offers a 2.3% dividend yield and an EPS of $5.59. This makes it a good choice for those wanting regular income. By understanding these factors, beginners can make smart investment choices.

Introduction to Starter Stocks

Stocks like Apple and Microsoft are great for new investors. They provide a solid base for a diversified portfolio. As beginners gain experience, they can explore more options to grow their wealth.

Key Takeaways

- Investing in the stock market can provide an average return of 10% per year.

- Best starter stocks, such as Apple and Microsoft, are often recommended for beginners.

- Factors like market capitalization, earnings growth, and dividend yield are key when choosing beginner stocks.

- Procter & Gamble and Coca-Cola are good choices for beginners due to their stability and growth.

- Diversification is essential for a successful portfolio, and beginners should mix starter stocks with other options.

- Understanding the stock market and making informed decisions is vital for long-term success.

- Best beginner stocks can help build a strong portfolio and achieve financial goals.

Understanding the Basics of Stock Market Investing

Investing in the stock market can seem scary, but it's not. With the right knowledge, it can help you grow your wealth. When picking stocks for beginners, look at market size, earnings growth, and dividend yield.

Starting with a small amount, like $25 a week, is doable. It's important to know about different stocks. This includes blue-chip, dividend, and growth stocks. By setting short and long-term goals, beginners can build a diverse portfolio. This matches their risk level and financial dreams.

Some key things for beginners to think about include:

- Knowing your risk level and investment style to meet your goals

- Thinking about your goals, like saving for a home, vacation, retirement, or a child's education

- Understanding the need for diversification and how to do it with index funds or ETFs

Learning the basics of stock market investing is key. By choosing the right stocks for beginners, you can set yourself up for success. This builds a strong base for your investment portfolio.

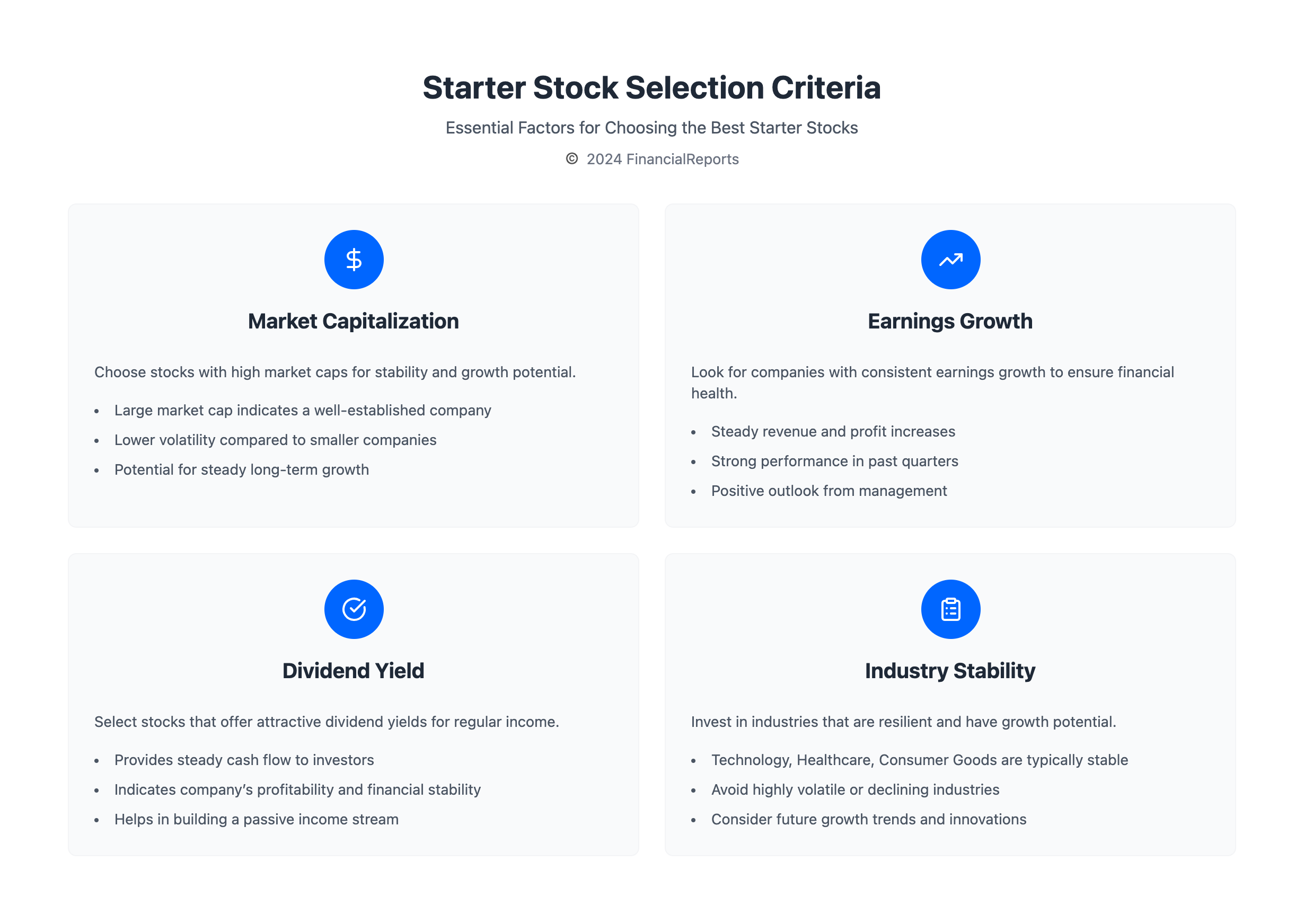

Criteria for Choosing Starter Stocks

When picking the best stocks for 2024, beginners should look at a few key things. A good stock should have a big market capitalization, showing it's big and stable. Earnings growth is also important, as it shows the company's health and growth chances.

Beginners should aim for stocks with steady earnings growth and a good dividend yield. Stocks with a history of paying dividends can offer a steady income and help smooth out market ups and downs. Important metrics to check include:

- Market capitalization: A measure of a company's size and stability

- Earnings growth: A key indicator of a company's financial health and growth

- Dividend yield: A measure of a stock's annual dividend payment relative to its stock price

By looking at these factors and doing research, beginners can make smart choices. Remember, investing in stocks comes with risks. It's key to have a diverse portfolio to lessen losses.

| Stock Metric | Description |

|---|---|

| Market Capitalization | A measure of a company's size and stability |

| Earnings Growth | A key indicator of a company's financial health and growth |

| Dividend Yield | A measure of a stock's annual dividend payment relative to its stock price |

Top 5 Beginner-Friendly Stocks

Top 5 Beginner-Friendly Stocks

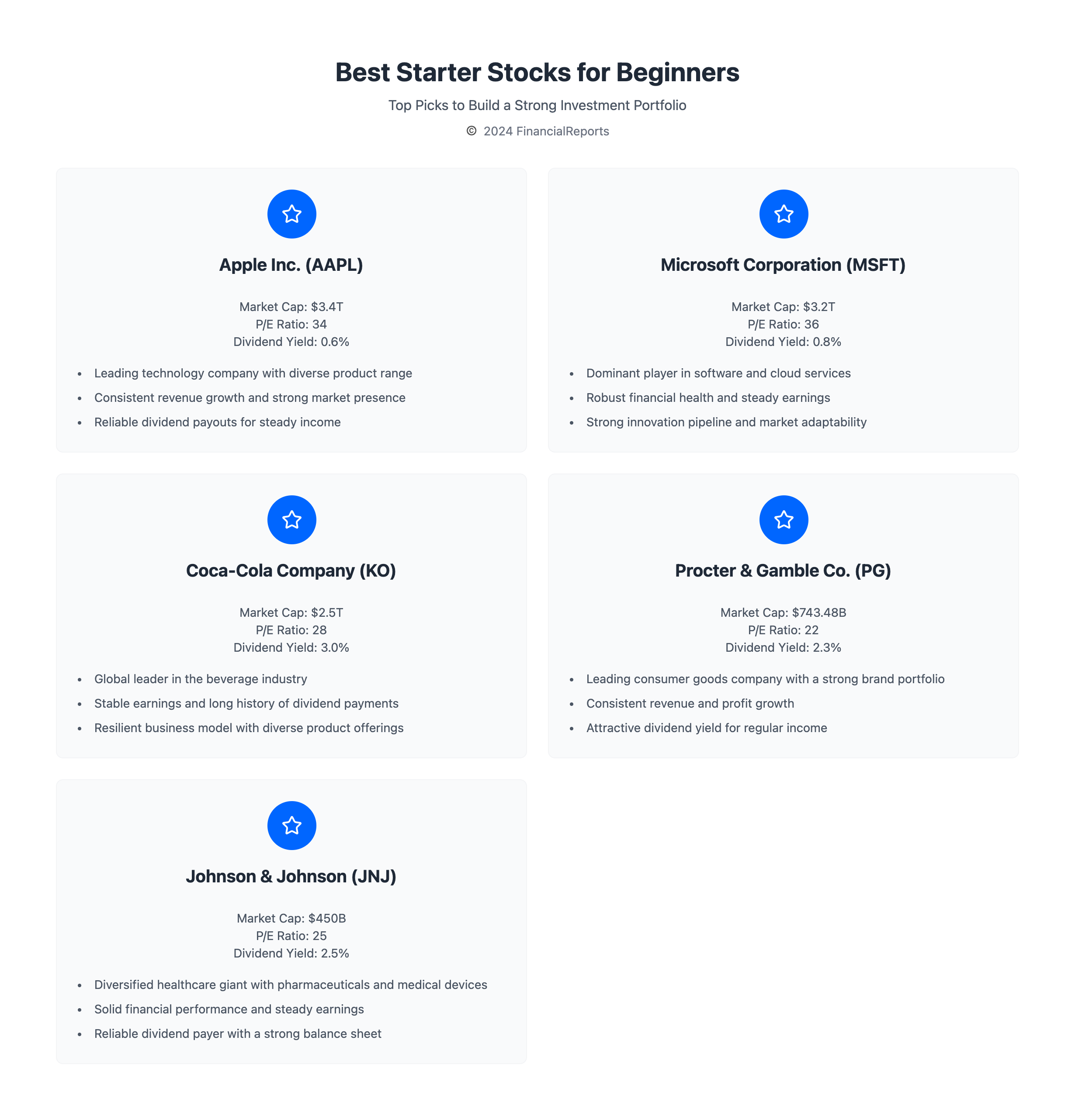

Investing in the stock market with little money requires careful choice. You need best stocks for beginners with little money 2024. These should be stable, have growth chances, and be affordable. Apple, Microsoft, Coca-Cola, Procter & Gamble, and Johnson & Johnson are top picks. They are well-known, have a strong track record, and are financially solid.

For new investors, these companies are a solid start. They offer a safe investment with growth chances. They have steady sales, strong finances, and pay good dividends.

Company Highlights

- Apple: A leader in the technology industry, with a diverse range of products and services.

- Microsoft: A dominant player in the software industry, with a wide range of products and services.

- Coca-Cola: A well-known consumer goods company, with a portfolio of iconic brands.

- Procter & Gamble: A leading consumer goods company, with a diverse range of brands and products.

- Johnson & Johnson: A healthcare company, with a wide range of pharmaceutical and medical products.

These companies are great for beginners with little money. They have strong finances, a stable market presence, and growth chances. As a beginner, it's key to research and understand these stocks before investing.

These companies are great for beginners with little money. They have strong finances, a stable market presence, and growth chances. As a beginner, it's key to research and understand these stocks before investing.

Exchange-Traded Funds (ETFs) and Their Benefits

For those new to investing, Exchange-Traded Funds (ETFs) are a solid choice. They offer a simple and affordable way to invest in a variety of stocks. This makes them perfect for beginners. ETFs trade like stocks, allowing you to buy and sell them all day.

ETFs cover a wide range of investments, from stocks and bonds to commodities. They bring several benefits, such as diversification, flexibility, and clear information. For instance, the Vanguard S&P 500 ETF has $588.2 billion in assets and a 0.03% expense ratio.

Overview of ETFs for Beginners

ETFs are a smart starting point for beginners in the stock market. They provide a low-cost, low-risk way to invest in a variety of stocks. Some key benefits include:

- Diversification: ETFs spread risk across different assets, reducing the impact of any single stock or sector.

- Flexibility: You can trade ETFs all day, allowing quick market responses.

- Transparency: ETFs list their holdings daily, so you always know what you own.

How to Invest in ETFs

To start investing in ETFs, beginners should research different types and their holdings. Consider factors like expense ratios, trading volumes, and bid-ask spreads. Some good ETFs for beginners include the Vanguard Total Stock Market ETF and the iShares Core S&P Small-Cap ETF.

The Importance of Diversification in a Starter Portfolio

Diversification is key in the stock market, more so for beginners. It means spreading investments across different assets like stocks, bonds, and commodities. This helps reduce risk and boosts the chance for growth over time. It's vital when picking the best stocks for a new portfolio.

The U.S. Securities and Exchange Commission says diversification is key for long-term financial success with less risk. The Financial Industry Regulatory Authority (FINRA) recommends 15 to 20 stocks across various industries for optimal diversification. Ways to diversify include:

- Investing in index funds, which offer a share in many assets

- Adding real estate or commodities to the mix

- Putting some money in bonds or other fixed-income investments

Diversifying a portfolio balances risk and reward, aiming for long-term success. It's critical for beginners, as it reduces risk and protects wealth. With a diversified portfolio, beginners can make more confident investment choices. This increases their chances of reaching their financial goals with the best starter stocks.

| Asset Class | Average Annual Return | Risk Level |

|---|---|---|

| Stocks | 12.3% | High |

| Bonds | 4-6% | Low |

| Real Estate | 11.5% | Medium |

The Role of Technology in Stock Trading

Technology has changed how we invest in the stock market. It makes buying and selling stocks easier and more convenient. For those with little money, online brokers and apps offer benefits like low fees and ease of use. When looking for the best stocks for beginners, technology's role is key.

Some key benefits of technology in stock trading include:

- Low fees: Online brokers and apps charge less than traditional brokers.

- Ease of use: Apps and online brokers have user-friendly interfaces. This makes it easy for beginners to navigate and trade.

- Access to a wide range of investment products: Technology lets investors access many products, including stocks, ETFs, and mutual funds.

When investing in the best stocks for beginners with little money, understanding fees is essential. This includes brokerage, trading, and management fees. By using technology wisely, beginners can make smart investment choices. This can help them achieve long-term success.

| Brokerage Firm | Fees | Investment Products |

|---|---|---|

| Robinhood | $0 | Stocks, ETFs, Options |

| Acorns | $1/month | Stocks, ETFs, Cryptocurrency |

| Fidelity | $4.95/trade | Stocks, ETFs, Mutual Funds |

Fundamental Analysis: How to Assess Stocks

When searching for the best stocks to invest in 2024, a deep dive into fundamental analysis is key. This method looks at a company's financial health and growth chances. It uses financial ratios like the price-to-earnings ratio, return on equity, and debt-to-equity ratio.

A good starting stock to buy must have a solid financial base. It should have a balanced balance sheet, steady revenue growth, and a strong position in its market. Important metrics to check include:

- Price-to-Earnings (P/E) ratio

- Return on Equity (ROE)

- Debt-to-Equity ratio

- Revenue growth

- Net income

By examining these metrics and the company's financial health, beginners can make smart investment choices. This approach boosts their chances of success in the stock market over the long term.

| Financial Ratio | Description |

|---|---|

| Price-to-Earnings (P/E) ratio | Compares a company's stock price to its earnings per share |

| Return on Equity (ROE) | Measures a company's profitability from shareholders' equity |

| Debt-to-Equity ratio | Evaluates a company's financial leverage |

Technical Analysis: Introduction for Beginners

Technical analysis helps predict stock prices by looking at past data. It finds trends and patterns in the market. This is great for beginners with little money to invest in the best stocks for beginners with little money.

Indicators like moving averages and Bollinger Bands are key. They show a stock's growth chances. Mixing technical and fundamental analysis boosts success. The best stocks to buy for beginners often show strong technical signs.

Basics of Chart Reading

Chart reading is a core part of technical analysis. It involves studying charts to spot trends. Beginners can learn to read different charts like line and candlestick charts.

Key Indicators to Understand

Beginners should know a few key indicators. These include:

- Moving averages

- Relative strength index (RSI)

- Bollinger Bands

These tools offer insights into a stock's growth. They help in making a trading plan.

Trading Strategies for Starters

Beginners need a trading plan that fits their goals and risk level. Combining technical and fundamental analysis is a good start. Knowing how to read charts and understand indicators helps make better investment choices.

Setting Investment Goals and Strategies

Investing in the stock market requires clear goals and strategies. Beginners need to know the difference between short-term and long-term investing. Short-term investing is for less than five years, while long-term is five years or more.

Setting realistic financial goals is key. It helps beginners plan their investment journey. This way, they can choose the best starter stocks wisely.

A diversified portfolio is important for less risk and more returns. Beginners should look for stocks with a good track record and strong finances. By researching and staying updated, they can make smart choices and reach their financial goals.

Some tips for beginners include:

- Start small and grow your investment over time.

- Spread your investments across different areas.

- Check and adjust your portfolio regularly to match your goals and risk level.

By following these strategies, beginners can boost their chances of long-term success. Whether you're new to investing or looking to grow your portfolio, a smart and disciplined approach is vital.

Staying Informed: Resources for Stock Investors

As a beginner investor, it's key to keep up with the stock market. There's a lot of info out there, making it hard to know where to begin. Luckily, many resources are available to help beginners stay informed and make smart investment choices.

Top resources include news sites like CNBC, Bloomberg, and The Wall Street Journal. These sites offer the latest news and analysis on stocks. Online courses from Investopedia and Coursera also teach investing and personal finance basics.

For deeper insights, books like "A Random Walk Down Wall Street" and "The Intelligent Investor" are great. They offer valuable strategies for investing in the stock market. By using these resources, beginners can grow their knowledge and confidence. This helps them make better choices about the best starter stocks for their portfolio.

Some popular resources for stock investors include:

- News outlets: CNN, BBC, The New York Times, Reuters

- Financial websites: The Wall Street Journal, Bloomberg, CNBC

- Online courses: Investopedia, Coursera

- Books: "A Random Walk Down Wall Street", "The Intelligent Investor"

By tapping into these resources, beginners can stay updated. They can make informed decisions about the best stocks to invest in, including the best starter stocks for their portfolio.

Common Mistakes to Avoid as a Beginner

Investing in the stock market can be tricky, even with best stocks for beginners with little money. One big mistake is emotional investing. This means making choices based on feelings, not facts. It can lead to buying or selling stocks too quickly, based on short-term changes.

Another mistake is not doing enough research. Beginners should look for best stocks to invest in for beginners with solid financials and a strong track record. This way, they can aim for long-term success and meet their financial goals.

When picking stocks, keep these tips in mind:

- Diversify to reduce risk.

- Do deep research on a company's finances, management, and industry trends.

- Choose stocks with strong fundamentals, like a stable financial state, competitive edge, and growth.

To succeed in the stock market, beginners should avoid common pitfalls. They should stick to a solid investment plan. It's important to stay informed, disciplined, and avoid making decisions based on emotions or short-term trends.

| Investment Type | Risk Level | Potential Return |

|---|---|---|

| High-Yield Savings Account | Low | 2-5% |

| Index Funds | Moderate | 5-10% |

| Stocks | High | 10-20% |

Moving Forward: Your Investment Journey Begins

Starting your investment journey is exciting. Building a strong portfolio and getting professional advice are key steps. Begin by spreading your investments across different areas, like best starter stocks to buy, bonds, and ETFs. This approach reduces risk and can lead to steady growth over time.

Keep an eye on your investments and make changes as needed. This might mean rebalancing your portfolio or adjusting it based on market changes. The good stocks for beginners to buy should offer stability, growth, and income.

If you're new to investing, getting professional help is a good idea. Financial advisors and investment managers can offer valuable advice. They help you make smart choices and manage your investments well.

FAQ

What are the best starter stocks for beginners?

Top beginner stocks include Apple, Microsoft, and Coca-Cola. Also, Procter & Gamble and Johnson & Johnson are great choices. These companies have a strong track record and are financially stable.

How do I understand the basics of stock market investing?

First, learn what stocks are and how the stock market works. Understand the risks and rewards of investing. It's also important to know about different stock types and how to check a company's financial health.

What key factors should I consider when choosing starter stocks?

Look at the company's market size, earnings growth, and dividend yield. A big market size means stability. Earnings growth shows financial health. Dividends offer a steady income.

What are the benefits of investing in exchange-traded funds (ETFs)?

ETFs offer diversification, flexibility, and transparency. They let you invest in many stocks at once. This can reduce risk and be traded like individual stocks.

Why is diversification important in a starter portfolio?

Diversification helps reduce risk and increase returns. By investing in different assets, beginners can balance risk and reward in their portfolio.

How can technology help beginners in the stock market?

Technology makes investing easier for beginners. Online brokers and apps offer low fees and easy-to-use interfaces. But, it's important to know about trading fees.

What is the role of fundamental and technical analysis in stock investing?

Fundamental analysis looks at a company's financial health and growth. Technical analysis studies chart patterns to predict prices. Using both can help beginners make smart choices.

How should I set investment goals and strategies as a beginner?

Set clear financial goals and create a strategy that fits your risk level and timeline. Decide if you want to invest short-term or long-term. Having a plan helps you stay on track.

What are some common mistakes beginners should avoid in the stock market?

Avoid emotional investing and ignoring research. Don't chase market trends. These mistakes can lead to bad decisions and losses.

How can I build a strong portfolio and seek professional help as a beginner?

Start with a diversified portfolio and regularly check and adjust your investments. Getting advice from a financial advisor can also help. They can guide you to reach your financial goals.