Top Industries with Highest Profit Margins Revealed

The average gross profit margin across all industries is 36.56%, with net profit margins at 8.54%. Banking and investment lead with the highest profit margins. Banking, in particular, boasts the highest margins at 100% gross and 30.89% net. This makes it a standout in high profit margin businesses.

On the other end, the auto and truck industry has the lowest gross profit at 12.45%. Real estate development has the lowest net profit margin at -16.35%.

Investors and financial experts are keen on high margin businesses like the apparel industry. It has an average gross profit margin of 51.93%. Knowing which industries have the highest profit margins is key for evaluating performance and making smart investments. Our data-driven insights shed light on market trends and opportunities, showing the significance of high profit margin businesses across sectors.

Key Takeaways

- The average gross profit margin across all industries is 36.56%, and the average net profit margin is 8.54%.

- Banks have the highest average profit margins at 100% gross and 30.89% net, making them a high profit margin business.

- Industries with highest profit margins, such as banking and investment, dominate the list with high profit margins.

- The apparel industry has an average gross profit margin of 51.93%, making it a high margin business.

- Understanding high profit margin business is key for assessing industry performance and making informed investment decisions.

- Real estate investment trusts (REITs) in the retail sector have an average gross profit margin of 77.63% and an average net profit margin of 23.32%.

- Energy, Financials, and Technology sectors collectively contributed 63% of the global $2.9 trillion profit in 2023, with high margin businesses driving growth.

Understanding Profit Margins in Business

Profit margins show how well a business is doing financially. They are a percentage of how much money a company keeps from each dollar it makes. High margin businesses, like tech companies, can make a lot of money because they charge high prices and keep costs low. But, companies in retail often face tough competition and struggle to make a profit because their margins are thin.

Definition of Profit Margin

To find a company's profit margin, you divide its net income by its revenue. For example, if a company makes $100,000 in net income and $1,000,000 in revenue, its profit margin is 10%. Companies in the software industry, known for their high profit margins, can reach 20% or more. This is because they have high gross margins and low operating costs.

Importance of Profit Margins

Profit margins are key to understanding a company's financial health and competitiveness. Businesses with highest profit margins usually have strong brands, a competitive edge, and efficient operations. They can use their profits to grow, innovate, and increase their market share.

How Profit Margins are Calculated

To calculate profit margins, you need to figure out revenue, cost of goods sold, and operating expenses. The profit margin is then shown as a percentage. This gives a clear picture of a company's profitability. For example, tech giants like Microsoft and Alphabet have consistently shown high double-digit profit margins. This shows they are successful in maintaining high high margin businesses in the tech sector.

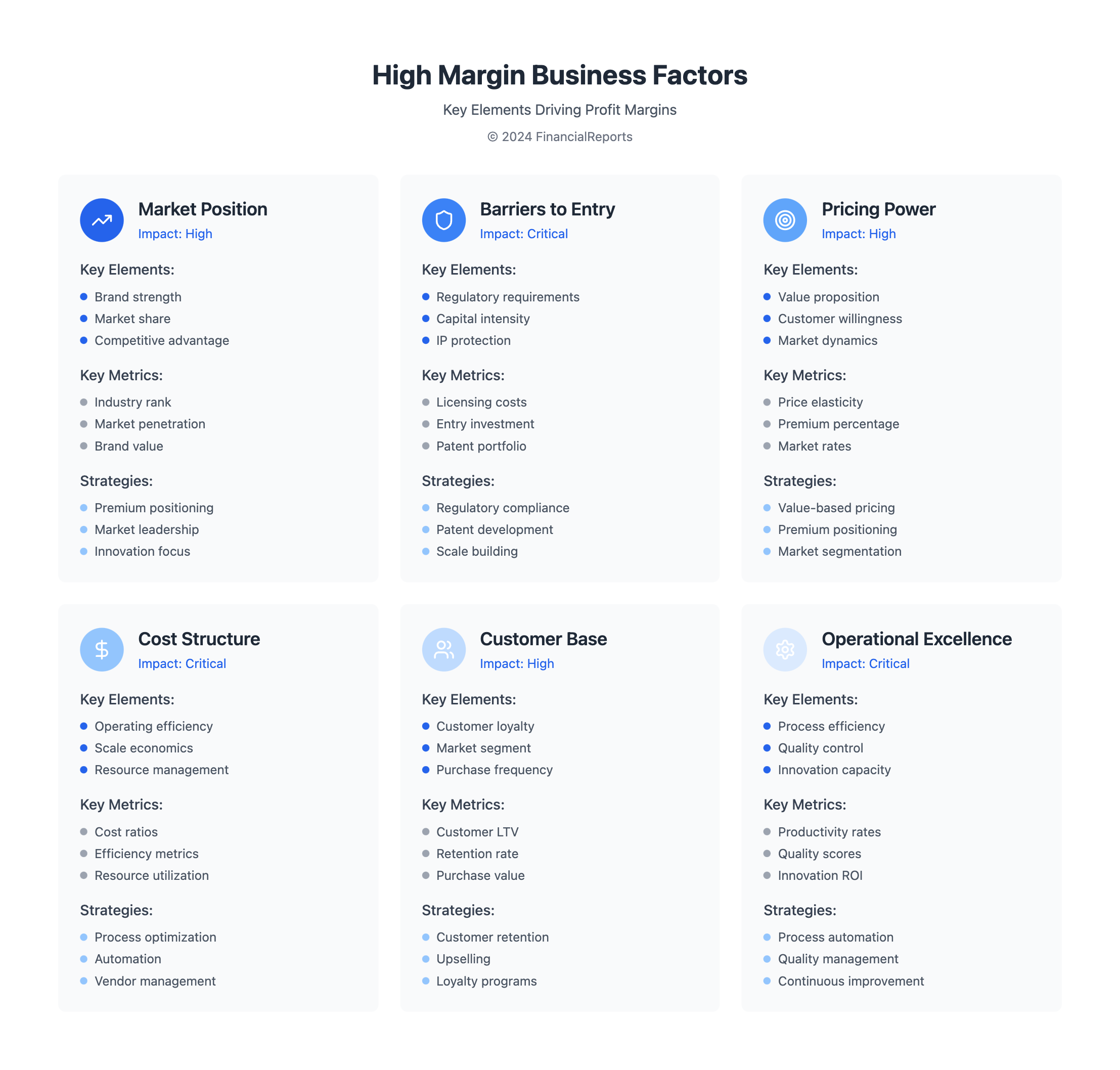

Key Factors Influencing Profit Margins

Understanding what affects profit margins is key to a company's financial health. A good ebitda margin by industry is vital for maintaining high margins. The best profit margin businesses balance market demand, pricing, and costs well. They also have a strong competitive edge, which helps keep prices high and costs low.

The average gross profit margin across all industries is 36.56%, with net profit margins at 8.54%. To boost profit margins, companies need to work on their costs and management. This includes cutting costs, increasing order values, and bettering vendor relationships. Important factors that affect profit margins include:

- Market demand and pricing power

- Cost structure and management

- Competitive landscape

For instance, the software industry has high profit margins, with an average net profit margin of 20%. On the other hand, the retail industry has lower margins, at 4%. By understanding these factors and using effective strategies, companies can improve their profit margins and stay competitive.

| Industry | Net Profit Margin |

|---|---|

| Software | 20% |

| Retail | 4% |

| Manufacturing | 8% |

Technology Sector: A Leader in Profitability

The technology sector is known for its high profit margins. Big names like Apple, Microsoft, and Alphabet show huge daily profits. With a market size over $5 trillion, it's a huge part of the global economy. The small business profit margin by industry is very high here, leading to growth and profit for many.

In the list of industries with best profit margins, tech stands out. Apple and Microsoft lead with their high margins. They excel in AI, cloud services, and semiconductors. Their ability to innovate makes the tech sector very attractive for investors.

Software Development Companies

Software development is a big part of tech, with many making good profits. They sell software to various industries. This has made tech one of the most profitable sectors, with many companies growing and making money.

IT Services and Consulting

IT services and consulting are also key in tech. They offer specialized services to businesses. Their high profit margins come from their expertise, making them vital to tech's success.

Financial Services: High Profits in Numbers

The financial services sector is known for its high profit margins. Banks, for example, make almost 100% in gross profits and about 30% in net income. This sector includes investment banking, brokerage services, and insurance. These areas make high profits thanks to their unique business models and risk management.

Several factors contribute to the high profit margins in financial services. These include:

- Strong demand for financial products and services

- Effective cost management and operational efficiency

- Ability to manage risk and maintain a stable balance sheet

The financial services sector is a big player in the high margin industries. Companies like JPMorgan Chase & Co. and Industrial and Commercial Bank of China Ltd. (ICBC) show big profits. Knowing the margins by industry helps investors and financial experts make smart choices and find growth opportunities.

Healthcare Sector: Robust Profit Margins

The healthcare sector is known for its high profit margins. This is due to several factors like intellectual property protection and ongoing innovation. Pharmaceutical companies, for example, invest heavily in research and development. This leads to patented drugs with high profit margins.

Some notable healthcare companies have reported significant operating margins. Tenet Healthcare has an operating margin of 12.2%, and HCA Healthcare has an operating margin of 11.8%. These high margins are due to strong demand for healthcare services and effective cost management. The healthcare sector is a prime example of a high profit margin business, with many companies reporting strong financial performance.

Here are some key statistics on the operating margins of major healthcare companies:

- Tenet Healthcare: 12.2%

- HCA Healthcare: 11.8%

- Universal Health Services: 8.4%

- Baylor Scott & White: 8.3%

- NYU Langone: 8.3%

These statistics show the robust profit margins in the healthcare sector. It makes the industry attractive for investors and a prime example of industries with highest profit margins.

Energy and Utilities: Profitability in Resources

The energy and utilities sector is filled with largest profit margin companies. The oil and gas industry has net profits close to 28.26% and gross margins of 58.75%. This sector is key for businesses with highest profit margins. It powers homes, industries, and transportation.

Several factors boost the high margin in this sector. These include global demand, price changes, and new technologies. For example, the utilities sector's market value was over $1.58 trillion in July 2022. Funds like the Utilities Select Sector SPDR Fund (XLU) offer a dividend yield of about 3%.

Renewable energy innovations are also key. Solar, wind, and energy storage solutions are becoming more important. As the world moves towards cleaner energy, companies like NextEra Energy will lead the way. They will drive growth and profitability in the sector.

| Industry | Net Profit Margin | Gross Margin |

|---|---|---|

| Oil and Gas | 28.26% | 58.75% |

| Utilities | 10-15% | 20-30% |

In conclusion, the energy and utilities sector offers big chances for high margin businesses. It's driven by growing demand and the shift to renewable energy. As the sector changes, companies that adapt and innovate will thrive. They will achieve high margin profitability.

Real Estate and Construction: A Profitable Market

The real estate and construction sectors are great for making money. What is a good ebitda margin by industry is very important. Companies like China State Construction (CSCEC) and China Railway Group have made a lot of money. CSCEC, for example, made over CNY 1.1 trillion in 2023 and had a 4.5% pre-tax profit margin.

In real estate, knowing the ideal profit margin is key. The best profit margin business in real estate depends on location, property type, and market trends. For example, retail REITs have a net profit margin of 23.32%, making them a good investment.

Some of the highest margin businesses in construction are:

- Residential Construction: 7-15% profit margin

- Commercial Construction: 5% profit margin

- Industrial Construction: 5% profit margin

By knowing what affects profit margins and finding the most profitable areas, investors and businesses can make smart choices. This helps them get the best returns.

| Company | Pre-tax Profit Margin | Revenue |

|---|---|---|

| China State Construction (CSCEC) | 4.5% | CNY 1.1 trillion |

| China Railway Group | 3.8% | CNY 1.3 trillion |

Consumer Goods: Insights into Profit Margins

The consumer goods sector is a big part of the global economy. Different industries show different profit margin trends. Some sectors, like luxury brands, have high profit margins because of their strong brand value and pricing.

In the food and beverage industry, companies face challenges like commoditization and changing consumer tastes. This can affect their profit margins. But, some industries, like apparel, have high profit margins, with a gross margin of 51.93%. It's important to look at each sector's unique characteristics to understand their profit margins.

Several factors influence profit margins in the consumer goods sector:

- Brand value and pricing strategies

- Commoditization and supply chain management

- Changing consumer preferences and trends

By studying these factors and profit margin trends, businesses can make better decisions. This can help them improve their profitability.

| Industry | Average Gross Profit Margin | Average Net Profit Margin |

|---|---|---|

| Clothing and Apparel Retail | 48.7% | 10.5% |

| Food and Beverage | 25.6% | 5.2% |

Understanding the Concept of High Margin Industries

High margin industries are sectors where businesses can earn significant profits due to high profit margins. These industries often have low production costs and high demand, allowing companies to charge premium prices for their products or services. This concept is essential for businesses looking to maximize their profitability and achieve financial success.

High margin industries typically have a competitive advantage due to their unique offerings and market positioning. By leveraging this advantage, businesses can generate substantial profits and drive growth. These industries often have a high demand for their products or services, creating a favorable market environment for businesses to thrive.

One key characteristic of high margin industries is their ability to maintain high profit margins. This is often achieved through efficient production processes, low overhead costs, and a strong market position. By optimizing these factors, businesses can maximize their profitability and achieve long-term financial success.

Investing in high margin industries can be a strategic move for businesses looking to increase their profitability. By identifying industries with high profit margins and understanding the factors that contribute to these margins, businesses can make informed investment decisions and position themselves for success.

Overall, high margin industries offer significant opportunities for businesses to earn substantial profits. By understanding the concept of high margin industries and identifying the factors that contribute to these margins, businesses can make strategic decisions to maximize their profitability and achieve long-term financial success.

FAQ

What are the key factors that influence profit margins across different industries?

Profit margins are shaped by several key factors. These include market demand and pricing power. Also, cost structure and management play a big role. The competitive landscape within an industry is another important factor.

Which industries consistently maintain the highest profit margins?

Industries with the highest profit margins include technology, financial services, and healthcare. In technology, software development and IT services lead the way. Financial services, like investment banking and insurance, also have high margins. Healthcare, with pharmaceuticals and medical devices, rounds out the top.

How do profit margins differ across the technology, financial services, and healthcare industries?

The technology sector is known for its high-margin businesses in software and IT services. Financial services, such as investment banking and brokerage, also boast impressive margins. Healthcare, driven by innovation and intellectual property, maintains robust margins in pharmaceuticals and medical devices.

What are some emerging industries with high profit potentials?

Emerging industries with high profit potentials include e-commerce, cloud computing, and green technology. These areas benefit from scalable models, low costs, and growing demand.

How can businesses and investors use profit margin data to make informed decisions?

Profit margin data helps businesses evaluate their financial health and spot areas for improvement. It also allows them to compare with peers. For investors, understanding profit margins helps identify growth opportunities and make informed decisions.

What are the different types of profit margins, and how are they calculated?

There are three main profit margin types: gross, operating, and net. Gross margin is gross profit over revenue. Operating margin is operating profit over revenue. Net margin is net income over revenue. These metrics offer insights into profitability at various business levels.

How do regulatory environments and market dynamics impact profit margins in specific industries?

Regulatory environments greatly affect profit margins, as seen in healthcare and energy. In healthcare, intellectual property and approval processes lead to high margins. In energy, regulations on emissions and renewable energy influence margins for traditional and alternative providers.