The Best Stocks to Maximize Short-Term Returns

Investors looking to make quick profits can explore short-term investment options. With high interest rates, these options are more appealing. Short-term stocks offer a safe way to grow your money, perfect for urgent needs like a house down payment or wedding.

Short-term investments last less than three years and are safer but earn less than long-term ones. Knowing the best stocks for quick gains is key. Options like high-yield savings and money market accounts can earn 4% to 5% annually, beating the 0.42% average savings account rate.

Introduction to Short-Term Investing

Investors can look into short-term stocks and other options to boost their returns. High-yield online savings and money market accounts offer 4% to 5% returns, making them appealing for quick gains.

Key Takeaways

- Short-term investments can provide a safe and stable way to grow your wealth.

- Short-term stocks can be ideal for those who need to have their money at a certain time.

- High-yield savings accounts and money market accounts can provide annual percentage yields between 4% and 5%.

- The national average interest rate on savings accounts stands at 0.42%, much lower than the 4% to 5% returns from high-yield accounts.

- Short-term investment options, such as bank certificates of deposit (CDs) and U.S. government bond funds, can provide returns of 3% to 4% or more.

- Cash management accounts can provide interest rates between 3% and 5%, making them a viable option for short-term investors.

Understanding Short-Term Investing

Short-term investing means buying and selling stocks in a year to make quick profits. It offers high liquidity, letting investors quickly reach their financial goals. To find good short term stocks, research and analysis are key. Zacks Investment Research helps by pointing out top stocks like Leidos Holdings and First American Financial.

Quick money can be made through short-term investments with high returns. Options include certificates of deposit (CDs), high-yield savings accounts, and government bonds. These choices are relatively safe but come with some risks. It's important to weigh the risks and rewards and diversify your portfolio.

Success in short-term investing requires strategies like fundamental and technical analysis. Swing and day trading are also effective. These methods help investors make smart choices and increase their earnings. By focusing on liquid securities and using tools like stock screeners, investors can succeed in the short-term market.

To start with short-term investing, understanding the concept and its risks is essential. With the right knowledge and strategies, investors can make the most of short-term opportunities. Exploring different options and keeping up with market trends helps investors make informed decisions and achieve success in short-term investing.

Key Indicators for Stock Selection

Choosing the right stocks for short term high yield investments is key. Quick return investments need a deep look at earnings reports, market trends, and volume and volatility. For fast growth in short term savings, picking stocks with quick growth is vital.

To make smart choices, investors should look at these factors:

- Analyzing earnings reports to find companies with steady revenue growth

- Understanding market trends to spot new chances

- Checking volume and volatility to see if a stock can offer quick gains

By focusing on these indicators, investors can make better choices. This way, they can increase their returns on short term high yield investments. With the right plan, quick return investments can help grow your short term savings.

Sectors with High Short-Term Potentials

Investors looking for quick investments often focus on sectors that outperform the market. For instance, the technology sector might see a 10% rise, while the overall market, like the S&P 500, might only see a 3% increase. To find the best stocks short term, it's vital to understand current trends and the short-term gains possible in different sectors.

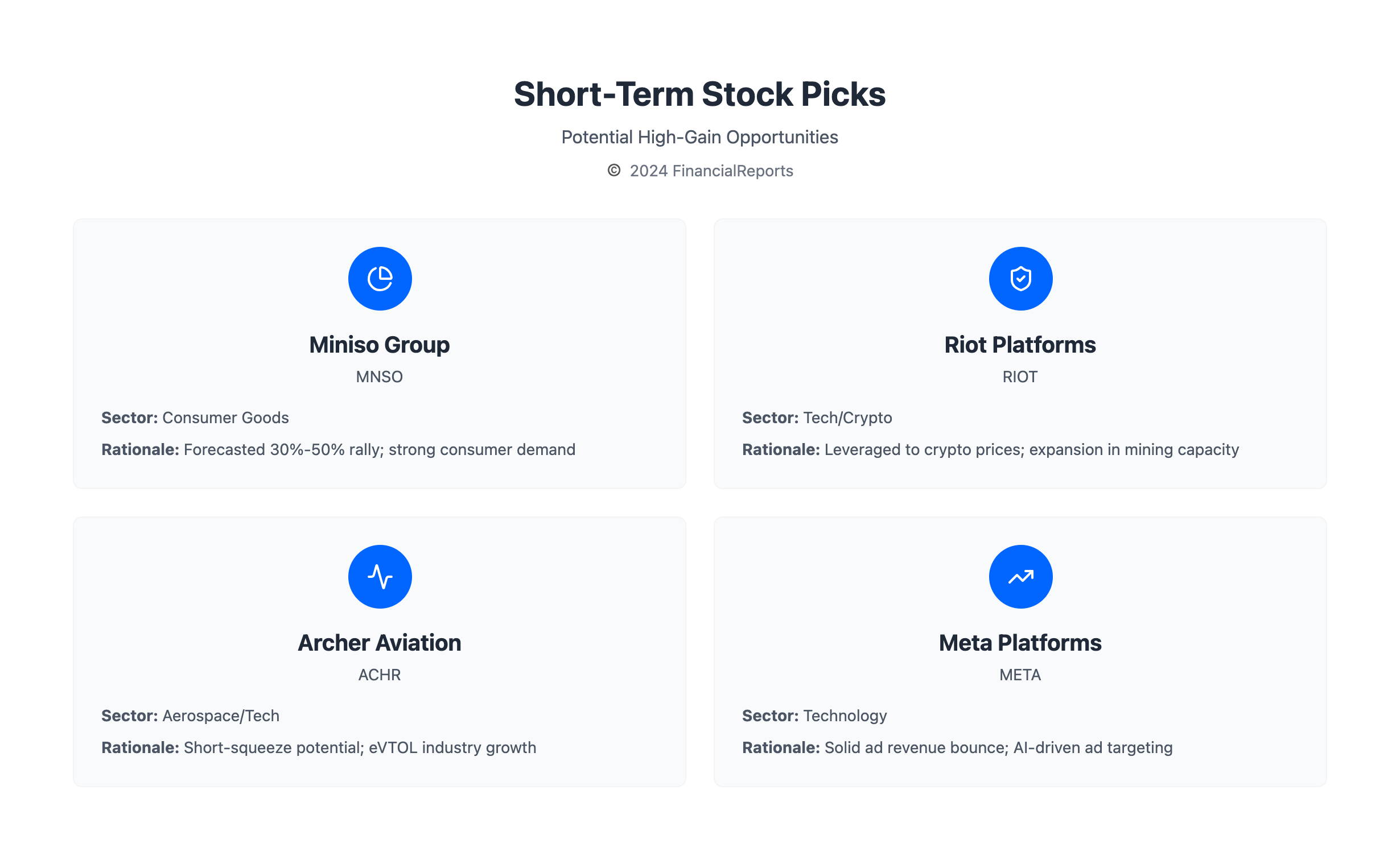

Key sectors for investors include technology, financial services, real estate, industrials, utilities, consumer discretionary, and consumer staples. When searching for what is the best stock to invest in short term, diversifying your portfolio is key. Look for sector-specific ETFs that can offer good results. Companies like Miniso Group (MNSO) and Meta Platforms (META) have shown promising growth for short-term investments.

Here are some key points to consider when evaluating sectors for short-term growth:

- Technology: Innovation and speed drive growth in this sector.

- Healthcare: Opportunities in biotech and pharmaceuticals offer short-term gains.

- Consumer Goods: Stability and growth in this sector can provide a safe haven for investors.

| Sector | Example Company | Potential Growth |

|---|---|---|

| Technology | Meta Platforms (META) | 60% in 2024 |

| Consumer Goods | Miniso Group (MNSO) | 50% in the coming months |

Top Stocks for Short-Term Gains

Looking for good stocks to invest in short term? Focus on companies with high growth and a strong market spot. Recent data shows some stocks are great for short term investment options. Miniso Group, Riot Platforms, and Archer Aviation are top picks with their fast revenue growth and big plans.

For those aiming for best stocks for short term gain, here are some picks:

- Miniso Group (NYSE:MNSO) is expected to rally by 30% to 50% in the next three months.

- Riot Platforms (NASDAQ:RIOT) stock is predicted to rise by 50% in the next few months.

- Archer Aviation (NYSE:ACHR) stock rallied by 33% in the last month.

These stocks could bring quick gains. But, always check their performance and market trends before investing.

| Stock | Expected Gain | Recent Performance |

|---|---|---|

| Miniso Group (NYSE:MNSO) | 30% to 50% | 26% increase in revenue |

| Riot Platforms (NASDAQ:RIOT) | 50% | Hash rate capacity increased to 22EH/s |

| Archer Aviation (NYSE:ACHR) | Short-squeeze rally possible | 33% rally in the last month |

Investing in stocks comes with risks. But, with the right info and strategy, you can make smart choices. By picking these good stocks to invest in short term and keeping up with market trends, you can confidently explore short term investment options.

Utilizing Technical Analysis

Technical analysis is a key tool for making quick profits in the stock market. It looks at past data, like price and volume, to guess future price changes. This helps investors make smart choices. It's great for finding the best stocks to make money fast and reduce risks.

There are many short-term investment options, and technical analysis fits each one. Day traders use trendlines and volume to spot good times to buy or sell. Swing traders look at chart patterns. A common method is the moving average crossover strategy, where traders watch moving averages for signals.

Some important indicators for timing trades include:

- Moving averages

- Relative strength index (RSI)

- MACD indicator

These tools help spot trends and guide decisions on short-term stocks. By mixing technical and fundamental analysis, investors can craft a solid plan for quick gains.

| Indicator | Description |

|---|---|

| Moving Averages | Track historical price data to identify trends |

| Relative Strength Index (RSI) | Measure the magnitude of recent price changes to identify overbought or oversold conditions |

| MACD Indicator | Identify trends and predict price movements by analyzing the relationship between two moving averages |

The Role of Market Sentiment

Market sentiment is key for quick profits, mainly in short term high yield investments. Knowing how investors think and how news affects stocks is vital. The CBOE Volatility Index (VIX) shows market mood, with high VIX levels meaning worries and low levels showing calm.

Some important signs of market mood include:

- The Bullish Percent Index (BPI), which counts stocks with positive trends

- The high-low index, comparing stocks at new highs to those at new lows

- Moving averages, like the 50-day and 200-day, to gauge market feelings

These signs help find good trades and boost quick return investments. Also, watching social media and news can give clues on market mood. This helps investors make smart choices for their short term savings.

Diversification Strategies for Short-Term Investing

When looking at quick investments, diversifying is key. It helps lower risks and increase chances of making money. A good mix of the best short-term stocks and other investments is a smart move.

A diversified portfolio spreads out your money across different types of investments. This can include stocks, bonds, and commodities. For instance, investing in index funds like the S&P 500 can offer wide diversification and save on fees. Also, putting money into foreign stocks and bonds can shield against U.S. market risks.

Some important points for diversifying include:

- Knowing your investment goals, time frame, and how much risk you can take

- Spreading your investments across different types, like stocks, bonds, and commodities

- Keeping your portfolio balanced by regularly adjusting it

- Watching and tweaking your portfolio as needed to match your goals and risk level

With a smart diversification plan, you can protect your investments from market dangers. It can also help boost your returns over time. Whether you're after quick gains or planning for the long haul, diversification is a must.

Common Mistakes to Avoid

When looking into good stocks for short-term gains, it's important to know common pitfalls. One big mistake is chasing after hot stocks, hoping to make quick profits. But this often means buying at high prices and selling at low ones, leading to big losses.

To make the most of short-term investments, it's vital to avoid these mistakes. Some key errors to watch out for include:

- Ignoring stop-loss orders, which can help limit losses if the market moves against your position.

- Overreacting to market fluctuations, which can lead to impulsive decisions based on short-term volatility.

By understanding and avoiding these common mistakes, investors can make better choices. This can help them find the best stocks for quick gains, improving their short-term investment options.

| Mistake | Impact |

|---|---|

| Chasing Hot Stocks | Buying High, Selling Low |

| Ignoring Stop-Loss Orders | Increased Losses |

| Overreacting to Market Fluctuations | Impulsive, Poorly Informed Decisions |

Resources for Stock Research

Investors looking to make the most from short term stocks can find great help in various resources. These include financial news, stock screening tools, and online trading platforms. For example, stock investment research tools with AI insights offer valuable info for smart choices.

Popular stock screeners like Morningstar, Finviz, and TradingView help find the best stock to make money short term. They come with features like filters and real-time data. Online trading platforms like Fidelity and IBKR also have tools for managing short term investment options.

Choosing a brokerage account means looking at the stock screeners they offer. Here are some top picks:

- Trade Ideas: costs between free to $254 per month

- FINVIZ: charges $39.50 per month or $299.50 per year

- ZACKS: offers a free version and a premium membership at $249 per year

Using these resources and tools can help investors make better choices. It's key to check the features and costs to find the right one for your goals and strategy.

Conclusion: Making Informed Decisions

Exploring short-term investing shows that getting good returns needs a smart plan. Knowing key indicators and market trends helps find good investments. This way, you can meet your financial goals and save for the short term.

short term high yield investments

and

quick return investments

that fit your needs.

Recap of Key Strategies

This article covered important strategies for short-term investing. We talked about diversifying your portfolio and using stop-loss orders to manage risk. These tips can help you feel more confident in the market and increase your chances of making good investments.

short term high yield investments

Importance of Continuous Learning

The financial markets are always changing. It's key for short-term investors to keep up with new trends and news. Learning more through publications, online resources, or experts will help you make better choices and adjust to market changes.

Final Thoughts on Short-Term Investing

Short-term investing has risks, but it can also offer quick returns and savings. If you're ready to learn and improve, you can do well in this fast-paced field. Use the strategies from this article and keep learning to succeed in short-term investing.

FAQ

What is the definition of short-term investing?

Short-term investing means buying and selling financial assets like stocks and bonds. The goal is to make money quickly, usually in days to months.

What are the risks associated with short-term stocks?

Short-term stocks can be very volatile. Their prices can change quickly due to market shifts and news. Investors should be ready for losses and understand the risks.

What are the key strategies for success in short-term investing?

Success in short-term investing requires analyzing earnings reports and understanding market trends. It also means evaluating volume and volatility, diversifying, and using technical analysis tools. Avoiding mistakes like chasing hot stocks is also key.

What are the sectors with high short-term potentials?

Sectors like technology, healthcare, and consumer goods have high short-term potentials. They often show innovative trends and growth, leading to quick gains for investors.

What are the top stocks for short-term gains?

Zacks Investment Research names Leidos Holdings, First American Financial, and McKesson as top stocks for quick gains. The Gap and SkyWest are also on the list. These stocks show strong performance and growth.

How can technical analysis help in short-term investing?

Technical analysis is useful for short-term investing. It uses chart patterns and indicators to spot trading opportunities. This helps investors make better short-term trades and increase their returns.

How can market sentiment impact short-term investing?

Market sentiment, including investor psychology and news, affects short-term stock prices. By tracking sentiment, investors can predict stock movements and make informed decisions.

Why is diversification important in short-term investing?

Diversification is key in short-term investing to reduce risk and increase returns. Spreading investments across different sectors and stocks helps protect against losses and boosts chances of gains.

What are the common mistakes to avoid in short-term investing?

Avoiding mistakes like chasing hot stocks and ignoring stop-loss orders is important. Overreacting to market changes can also lead to big losses. These mistakes can hurt your chances of success.

What resources are available for stock research in short-term investing?

Investors have many resources for stock research, including financial news, stock screening tools, and online platforms. These tools provide insights and data to help make informed decisions and maximize gains.