Stocks: Owning a Piece of a Company's Success

Buying a stock means you own a small part of a company. It's a great way to invest. Stocks are not like bonds, which are loans to companies. Over time, stocks have often done better than other investments, making them a favorite among investors.

It's important to know what stocks are and how they work. If a company has 1,000 shares and you own 100, you have 10% of the company. This shows how owning stock can give you a say in the company's future and a chance to earn money.

Introduction to Stock Ownership

The Dutch East India Company was the first to issue common stock in 1602. Today, 55% of Americans own stock, according to a 2020 Gallup Poll. Whether you're new to investing or just curious, understanding the stock market is key.

Key Takeaways

- Stocks represent fractional ownership of equity in a company, providing a source of income and control.

- Historically, stocks have outperformed most other investments over the long run, making them a popular choice for investors.

- Understanding what is a stock and how it works is essential for making informed investment decisions.

- Stock ownership can give you control and influence over a company's direction, more so if you own a majority of shares.

- 55% of Americans own stock, showing its importance in the investment world.

- Stocks can be bought and sold on stock exchanges, allowing investors to join the market.

Understanding What Stock in a Company Means

A stock is a way to own part of a company. It's key for investors to know what this means. Stocks let shareholders claim a part of the company's assets and profits.

There are many types of stocks, like common and preferred. Each has its own rights and benefits. Common stocks let shareholders vote and might get dividends. Preferred stocks have a stronger claim on earnings but no voting rights.

Choosing the right stock depends on the type. Each offers different risks and rewards. Investors need to understand these to make smart choices.

Some important things about stocks include:

- Common stocks: voting rights and possible dividend payments

- Preferred stocks: higher claim on earnings, no voting rights

- Market capitalization: shows a company's size, from small to large

Investors should know about stocks, their types, and forms. This knowledge helps make informed decisions. It can lead to long-term wealth.

| Stock Type | Characteristics |

|---|---|

| Common Stock | Voting rights, possible dividend payments |

| Preferred Stock | Stronger claim on earnings, no voting rights |

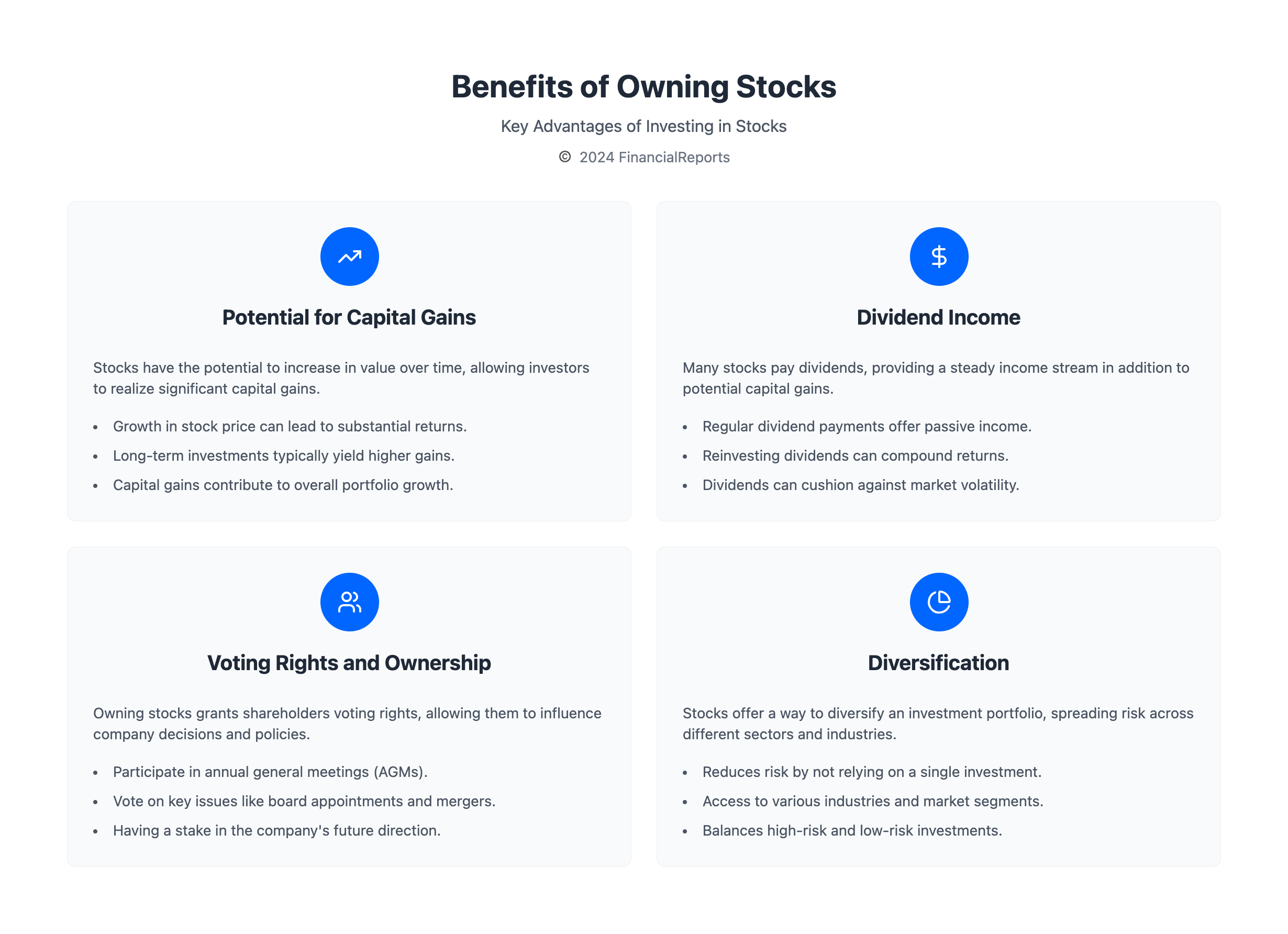

The Benefits of Owning Stock

Owning stock can bring many benefits. These include the chance for capital gains, dividend income, and voting rights. Stocks represent a share of a company's assets and profits. There are different kinds of stocks, like common and preferred shares, each with its own perks.

Stocks have often done well over time. The S&P 500 has only lost money in 13 years from 1974 to 2023. This shows why it's key to know what are stock meaning and how they can help diversify your investments. Key benefits of owning stock include:

- Potential for capital gains: Stocks can grow in value, giving investors a chance for capital gains.

- Dividend income: Many stocks pay dividends, providing a steady income for investors.

- Voting rights: Shareholders get to vote on big company decisions, influencing the company's direction.

By grasping the benefits of stock ownership and the various kinds of stocks, investors can make better choices. This can help them reach their long-term financial goals.

By grasping the benefits of stock ownership and the various kinds of stocks, investors can make better choices. This can help them reach their long-term financial goals.

| Investment | 10-year Return |

|---|---|

| S&P 500 | 9.80% |

| Russell 2000 | 8.39% |

| Russell 1000 | 13.15% |

How Stock Prices are Determined

Stock prices are set by the actions of buyers and sellers. The law of supply and demand is key. If more people want to buy than sell, prices go up. If more want to sell, prices drop.

When looking at sharing stock, it's important to know the types of stocks. This includes shares and stocks from different companies.

The performance of a company affects its stock price. Good earnings reports can make prices go up. Bad reports can make them fall. It's also important to look at the different types of stocks like growth, value, and dividend stocks.

Market Demand and Supply

The demand and supply of a stock greatly affect its price. More buyers mean higher prices, more sellers mean lower prices. It's vital for investors to keep up with market trends.

By understanding these factors, investors can make smart choices about sharing stock. This helps them reach their investment goals.

| Company | Market Cap | Stock Price |

|---|---|---|

| Apple | $3.37 trillion | $150 |

| Microsoft | $3.13 trillion | $200 |

| NVIDIA | $2.80 trillion | $500 |

By considering these factors and staying informed, investors can make smart choices. This helps them achieve their investment goals.

The Role of Stock Exchanges

Stock exchanges are key in the stock market. They offer a place for buying and selling stocks. The meaning of stock in economics is about owning a company's assets and profits. Stock exchanges help in this process.

The economic definition of stock links to supply and demand. Stock prices change based on what buyers and sellers do on these exchanges.

The New York Stock Exchange (NYSE) and NASDAQ are huge. Together, they have over $54 trillion in market value. These places help companies get money and investors trade stocks. They are vital for moving money around in the economy.

| Stock Exchange | Market Capitalization |

|---|---|

| NYSE | $28.32 trillion |

| NASDAQ | $26.62 trillion |

| Tokyo Stock Exchange | $6.93 trillion |

In summary, stock exchanges are vital for the stock market. They help in trading stocks and moving money around. Knowing about the meaning of stock in economics and the economic definition of stock helps investors make smart choices.

Investing Strategies for Stock Ownership

Investing in stocks needs a solid plan. It's important to know the different kinds of stocks and how they affect a business. Knowing what stocks mean in business helps make better investment choices. Stocks like growth, income, value, and blue-chip have unique traits and return potentials.

Choosing the right investment time frame is key. Long-term investments might offer more returns but also carry more risks. To lessen these risks, diversifying and using dollar-cost averaging are good strategies. Diversifying means spreading investments across various types. Dollar-cost averaging means investing a set amount regularly, no matter the market.

Some well-liked strategies include:

- Growth investing, which targets companies with high growth in sales and earnings

- Value investing, which looks for undervalued stocks based on their financials and competitive edge

- Dividend investing, which focuses on stocks that pay out regular dividends

By choosing a good investment strategy and understanding different stocks, investors can boost their chances of success. Knowing the stock meaning in business and keeping up with market trends helps make smart choices. This can help investors reach their financial goals.

Risks Involved in Stock Investment

Investing in stocks can be rewarding but also risky. It's important to know what shares mean and if stocks are securities. Stocks represent a company's ownership and their value changes with market and economic factors.

Market volatility, company risks, and economic downturns are major concerns. Market ups and downs can make it hard to guess stock prices. Poor company management or industry changes can also affect stock prices. Economic recessions can hurt the stock market by reducing spending and earnings.

To lessen these risks, diversifying your investments is key. This means spreading your money across different assets. Staying updated on market trends and economic conditions can also help. By understanding and managing these risks, investors can build a strong investment plan.

Some key statistics to consider include:

- Stocks have historically provided the most robust average annual returns over the long term, at just over 10 percent per year.

- Corporate bonds have provided around 6 percent annually in average returns.

- Treasury bonds have yielded approximately 5.5 percent per year in average returns.

Knowing the risks and possible returns of stocks helps investors make better choices. It's vital to grasp what shares mean and if stocks are securities. This ensures a full understanding of the investment world.

Choosing the Right Stock to Invest In

To invest wisely, it's key to research a company's basics, look at industry trends, and use stock ratings. When picking a stock, check the company's revenue growth, profit margins, and the team leading it. This helps understand if the company can do well.

Stocks rated A or B by Schwab Equity Ratings are seen as good buys. This cuts down the number of stocks to choose from. Looking at revenue growth, earnings, and EPS growth can help narrow it down even more. For value stocks, look for high dividend yields, low P/E ratios, and a price under the book value.

Some important things to think about when picking a stock include:

- Revenue growth over the last three years

- Current year earnings growth

- Current year EPS growth

- Above-average dividend yield

- Low P/E ratio

- Price less than the company’s book value

By carefully looking at these points and using stock ratings, investors can make smart choices. This helps create a winning stock investment plan. It ensures the stock fits with the investor's goals and how much risk they can take.

| Stock Rating | Number of Candidates |

|---|---|

| A or B by Schwab Equity Ratings | 814 |

| Additional criteria | 5 |

| Value stocks | 25 |

Understanding Stock Market Trends

Investors looking to buy stocks must first grasp what a stock is. They also need to know how market trends affect their investments. Trends can be shaped by economic signs, company results, and worldwide events. To make smart choices, it's key to keep up with the latest news and advice from market experts.

Understanding trend analysis is vital. Bull and bear markets usually last from one to three years. Secular trends, on the other hand, can span a decade or more. Bull markets show strong rallies, while bear markets have strong reactions with brief rallies.

Each bull and bear market has at least three intermediate cycles. These cycles can last from two weeks to six to eight weeks. Different time frames are used to spot trend directions, from 26 weeks to 52 weeks for longer views. For shorter views, time frames range from 10 days to six months.

The rate of change (ROC) indicator shows stock price changes over time. It usually looks at a 10-day period. Rising ROC signals a short-term bullish trend, while falling ROC points to a bearish trend. By grasping these trends and using the right tools, investors can make better choices about stocks to buy and craft a winning investment plan.

| Trend Type | Duration | Characteristics |

|---|---|---|

| Bull Market | 1-3 years | Strong rallies, weak reactions |

| Bear Market | 1-3 years | Strong reactions, short rallies |

| Secular Trend | 1-3 decades | Incorporates many primary trends |

The Tax Implications of Stock Ownership

Understanding the tax side of owning kinds of stocks is key. The tax rules for stock ownership can be tricky. It's vital to think about these rules when you invest.

There are different stock options, like Restricted Stock Units (RSUs), Incentive Stock Options (ISOs), and Non-Qualified Stock Options (NSOs). Each has its own tax rules. For instance, RSUs are taxed on your W-2 form based on their value when they become yours.

Here are some important tax points for stock ownership:

- Capital gains tax hits you when you sell stocks. The tax rate depends on how long you held the stock.

- Dividends are taxed too. The tax rate varies based on the dividend type and your tax bracket.

- Using tax strategies like tax-loss harvesting and charitable donations can lower your taxes and boost your returns.

Talking to a tax expert is a must to grasp the tax rules for your stocks. They can help you find ways to pay less in taxes. By knowing the tax rules for kinds of stocks and sharing stock, you can make better investment choices and get more from your money.

| Type of Stock Option | Tax Implication |

|---|---|

| RSUs | Included in income on W-2 form based on fair value of shares when they vest |

| ISOs | No tax implications at grant or exercise, but subject to Alternative Minimum Tax (AMT) |

| NSOs | Subject to ordinary income tax at exercise, and capital gains tax at sale |

How to Buy and Sell Stocks

To start buying and selling stocks, you need to open a brokerage account. This can be done in about 15 minutes. Online brokerages like Charles Schwab and Fidelity offer low fees and easy-to-use platforms.

When picking a brokerage, think about account fees, investment options, customer support, and mobile app features. These factors are important for a good experience.

There are many types of stocks and form of stocks to choose from. You can buy individual stocks, ETFs, or mutual funds. Some brokerages even offer fractional shares, letting you buy a part of a stock.

When trading, you can use different orders. Market orders are good for those who hold stocks long-term. Limit orders let you control the price of your trade. Here are some key terms to know:

- Market order: buys or sells a stock at the best available price

- Limit order: buys or sells a stock at a specified price

- Stop-loss order: sells a stock when it falls to a specified price

Online trading platforms make it easy to buy and sell stocks. Many brokerages offer free trades for online stock trades. Popular choices include Robinhood, Charles Schwab, and Fidelity.

When choosing a brokerage, consider fees, investment choices, customer support, and mobile app features. These factors will help you find the best fit.

| Brokerage | Account Minimum | Commission |

|---|---|---|

| Robinhood | $0 | Commission-free |

| Charles Schwab | $0 | Commission-free |

| Fidelity | $0 | Commission-free |

The Future of Stock Ownership

Looking ahead, understanding what are stock meaning is key. Technology and changing investor tastes will shape this future. Online brokerages and mobile apps have made trading stocks easier. These tools play a big role in how we own stocks today, with ESG investing becoming more popular.

Some trends that will influence stock ownership include:

- More technology in trading and owning stocks

- More people wanting to invest in sustainable ways

- Investors focusing on long-term gains and diversifying their portfolios

As the stock market grows, staying informed is vital. Knowing about these trends helps investors make smart choices. This way, they can move through the market with confidence.

| Trend | Description |

|---|---|

| Technological advancements | Increased use of online brokerages and mobile apps to facilitate stock trading and ownership |

| ESG investing | Growing demand for sustainable investment options and consideration of environmental, social, and governance factors |

| Changing investor preferences | Greater focus on long-term investing, diversification, and sustainable investment options |

Conclusion: Embracing Stock Ownership

Stock ownership is a big step, needing a good grasp of the stock market and its changes. By doing your homework and planning carefully, you can reach your financial dreams.

Learning about stocks, market trends, and risks is key. Being well-informed helps you make smart choices. This way, you can move through the stock world with confidence and boost your success chances.

Whether you're new or experienced, this guide gives you a strong base for getting into stocks. By following these tips and learning more, you can tap into the stock market's power. This will help you build a strong investment portfolio that matches your financial goals.

FAQ

What is a stock?

A stock is a security that shows you own part of a company. You can buy and sell them on stock exchanges.

What are the different types of stocks?

There are mainly two types: common and preferred stocks. Common stocks let you vote and get dividends. Preferred stocks have a higher claim on earnings but no voting rights.

Why is stock ownership important?

Stock ownership can lead to capital gains and dividend income. It also gives you voting rights, letting you shape the company's future.

How are stock prices determined?

Stock prices are influenced by demand, earnings, and economic indicators. The supply and demand law plays a big role.

What is the role of stock exchanges?

Stock exchanges like the NYSE and NASDAQ let buyers and sellers trade. They increase visibility, liquidity, and credibility for companies.

What are some common investment strategies for stocks?

Strategies include long-term investing, diversifying, and dollar-cost averaging. These can reduce risk and boost returns.

What are the risks involved in stock investment?

Risks include market volatility, company risks, and economic downturns. These can greatly affect stock prices and returns.

How can I choose the right stock to invest in?

Research a company's fundamentals and industry trends. Use stock ratings and recommendations from trusted sources to make informed choices.

How do tax implications affect stock ownership?

Selling stocks incurs capital gains tax, and dividends are taxed too. Tax strategies like tax-loss harvesting can help reduce your tax burden.

What are the future trends in stock ownership?

The future will see tech's impact on trading, ESG investing, and more market volatility. New industries will also emerge.