Stocks for Dummies: A Beginner's Guide to Investing

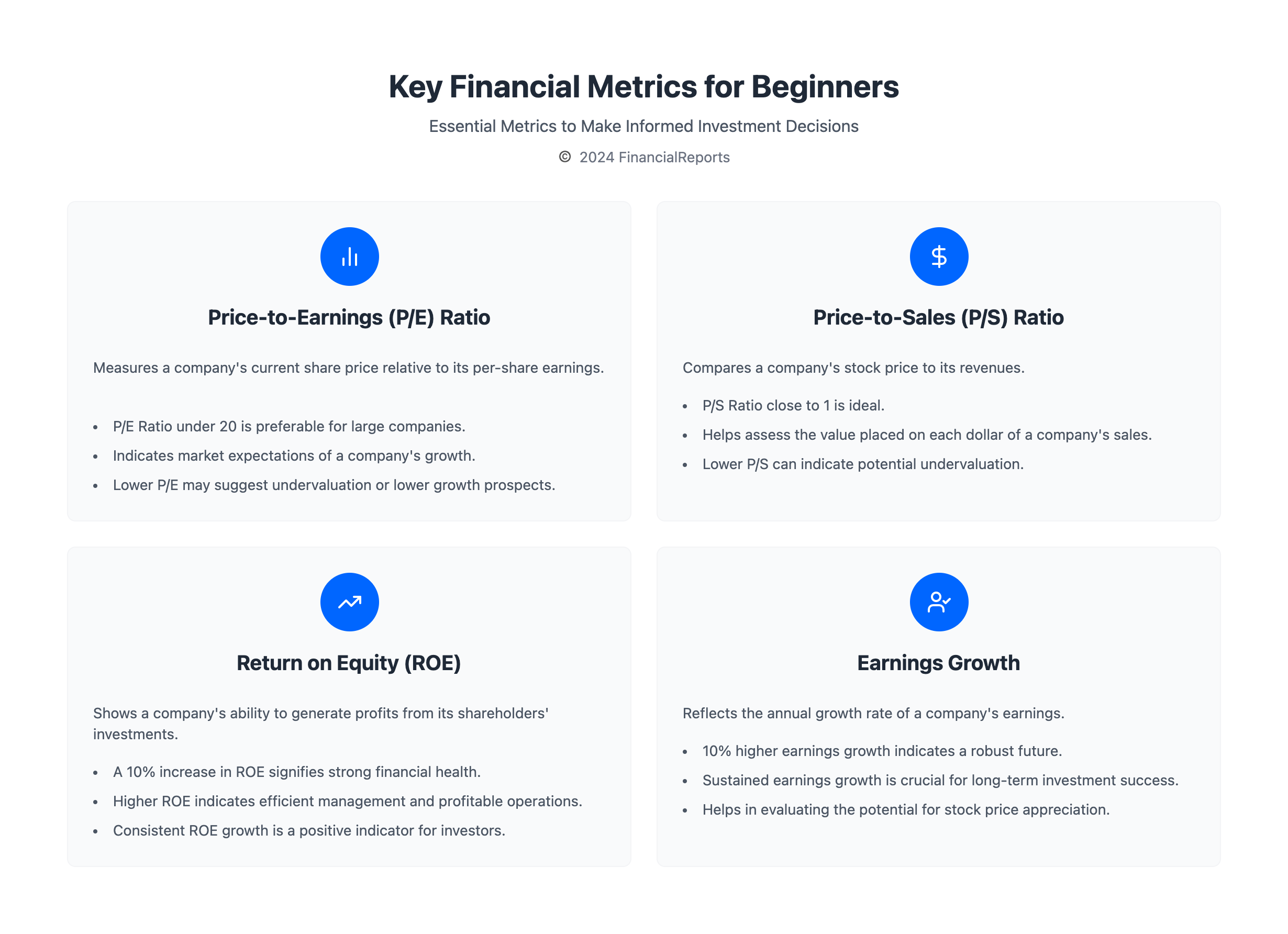

Investing in stocks can help you grow your money over time. It's key to start with the basics. For beginners, knowing about the price-to-earnings (P/E) ratio is important. It should be under 20 for big companies.

Also, the price-to-sales (P/S) ratio should be close to 1. Learning these basics helps you make smart investment choices. This way, you can enjoy the benefits of investing in stocks.

For new investors, understanding financial metrics is essential. Return on equity (ROE) and earnings growth are important. A 10 percent increase in ROE and 10 percent higher earnings growth show a company's strong future.

By focusing on these numbers, you can invest with confidence. This helps you reach your financial goals.

Introduction to Stock Investing

Knowing the basics helps you move forward in stock investing. It's important to see the value of stocks for long-term growth. This sets you up for success in the financial market.

Key Takeaways

- Understanding the basics of stock investing is key for success

- Investing in stocks needs a solid financial knowledge base, including metrics like P/E ratio and ROE

- A well-informed approach to investing in stocks can lead to long-term financial growth

- Knowing the importance of data-driven aspects, such as earnings growth and debt-to-asset ratio, helps in making investment decisions

- By focusing on these fundamental concepts, individuals can develop a confident approach to investing in stocks

- Investing in stocks can offer benefits like dividend income and long-term growth, making it a good option for beginners

What Are Stocks and Why Invest in Them?

Investing in stocks can help grow your wealth over time. With the right knowledge, anyone can start. For beginners, understanding the basics is key. A stock lets you own a piece of a company, giving you a share of its profits.

Investing in stocks has many benefits. The stock market has offered about 10% return per year for decades. Plus, many brokerages let you open an account with $0. Online trade fees can be as low as $0 per trade.

When investing in stocks, consider a few things:

- Set clear investment goals

- Determine your risk tolerance

- Choose the right investment account

- Learn about different types of stocks

By learning about the stock market and investing, you can make smart choices. This can lead to long-term financial success. Whether you're new or experienced, staying current with market trends and news is key.

| Investment Type | Average Return | Fees |

|---|---|---|

| Stocks | 10% per year | $0 per trade |

| Robo-Advisors | Varies | 0.25% of account balance |

Different Types of Stocks

Investing in the stock market means knowing the different types of stocks. For beginners, stocks for dummies is a helpful guide. Stocks are sorted by their market value, which is the number of shares times the share price.

There are common stocks, preferred stocks, growth stocks, and value stocks. Common stocks let you vote and get dividends. Preferred stocks offer a fixed dividend and are first in line for company assets. Growth stocks are expected to grow fast, while value stocks are cheaper and might grow slower.

Stocks are also grouped by their market size. This includes:

- Large-cap stocks: $10 billion or more in market capitalization

- Mid-cap stocks: $2 billion to $10 billion in market capitalization

- Small-cap stocks: less than $2 billion in market capitalization

Knowing these stock types helps investors make better choices in the market.

How the Stock Market Works

Investing in stocks can seem scary, but knowing how the stock market works is key. The stock market lets companies raise money by selling shares to investors. Investors get voting rights and a share of the company's profits. This is how you make money in the stock market for dummies.

The stock market is run by big exchanges like the New York Stock Exchange (NYSE) and NASDAQ. These exchanges connect buyers and sellers, making transactions smooth. Stock prices are set by how much people want to buy and sell. Market indices like the S&P 500 and Dow Jones give insights into how the market is doing. Investing in stocks can be rewarding, but you need to understand the market well.

Some interesting facts about the stock market include:

- There are 60 major stock markets worldwide, with the NYSE being the biggest.

- The NYSE is so large that it's bigger than the 50 smallest major stock exchanges combined.

- The S&P 500 has never had a negative return over twenty years.

Napkin Finance says, "Ninety percent of adulthood is getting excited about canceling plans and pretending to understand the stock market." But with the right knowledge, anyone can be a smart investor. By learning about the stock market and keeping up with trends, you can improve your investments. This helps you reach your financial goals in the stock market for dummies.

| Stock Exchange | Market Capitalization |

|---|---|

| NYSE | $28.32 trillion |

| NASDAQ | $26.62 trillion |

| Tokyo Stock Exchange | $6.93 trillion |

Getting Started with Investing

Investing in the stock market can seem scary, but it's not. With the right help, anyone can start investing and reach their financial goals. First, figure out what you want to achieve and how much risk you can take. This will guide you to the right investments.

Understanding the stock market is key. There are many investments like stocks, bonds, ETFs, and mutual funds. Each has its own benefits and risks. For instance, stocks can grow over time but can be unpredictable. Bonds offer steady income but might not beat inflation.

Setting Your Financial Goals

To start investing, set clear financial goals. This could be for retirement, a house down payment, or a big buy. Knowing your goal helps you figure out how much to invest and what's best for you. Stocks are a good choice for long-term goals because they often offer higher returns.

Choosing the Right Brokerage Account

Choosing the right brokerage account is important for investing. Look at fees, commissions, and the investments they offer. For beginners, Wealthfront and M1 Finance are good options. They have low fees and easy-to-use platforms, making it simple to start investing.

Fundamental Analysis Basics

Investing in stocks requires a good grasp of fundamental analysis. It's about checking a company's finances, management, and how it stands against competitors. For beginners, this might seem hard, but it's key for smart investing.

Important financial numbers to look at include revenue, costs, and profits. The income statement, balance sheet, and cash flow statement are vital tools. They help investors see how profitable a company is and its financial health.

Earnings reports are also critical. They show a company's financial performance over a set time, like a quarter or year. By studying these reports, investors can spot trends and understand a company's financial state. This knowledge helps in making better investment choices, whether you're experienced or new to stocks.

When checking a company's health, consider these points:

- Revenue and profit growth

- Operating and gross margins

- Cash flow and net income

- Debt and equity ratios

By looking at these and doing deep analysis, investors can make better choices. This boosts their chances of success in the long run.

Technical Analysis for Beginners

Investing in stocks means you need to know about technical analysis. It helps you make smart choices by looking at price trends and market data. It's great for beginners because it shows how to spot good trading chances.

Technical analysis uses indicators to find when to buy or sell. Using two indicators makes your decisions better. Looking at different time frames also boosts your confidence in trading signals. Always have a plan and know how to manage risks to stay safe.

Here are some key tips for technical analysis:

- Trade with the trend to make more money

- Accept some losses to keep your money safe

- Use stop-loss orders to control losses

- Don't overtrade and get advice from reliable sources

By following these tips and keeping up with market trends, you can do well in the stock market. Technical analysis is helpful for both new and experienced investors. It can help you reach your financial goals.

| Technical Analysis Tip | Description |

|---|---|

| Use multiple indicators | Increases accuracy of trading decisions |

| Implement stop-loss orders | Manages and controls losses |

| Avoid overtrading | Preserves capital and reduces risk |

Diversification: Spreading Your Risk

Investing in stocks can be tricky, but diversification is key. It means spreading your money across different types of investments. This way, you can lower your risk. The stock market has many types of stocks, like big and small companies, and even foreign ones.

Diversifying means putting your money in different places. For example, bonds often go up when stocks go down. Commodities, like gold, don't move with stocks. This helps balance your investments.

To diversify, you can invest in:

- Large-cap stocks

- Small-cap stocks

- Bond index funds

- Foreign stocks

- Foreign bonds

- Real estate

By investing in these areas, you can lower your risk. Remember, understanding diversification is important when you start investing in stocks.

Mutual Funds and ETFs: What’s the Difference?

For beginners, stocks for dummies suggest starting with mutual funds or ETFs. Mutual funds allow you to buy small parts of many stocks at once. This makes it easy for investing in stocks. But, ETFs are becoming more popular because they are flexible and clear.

ETFs trade like stocks, so you can buy and sell them all day. Mutual funds, on the other hand, can only be traded once a day. This makes ETFs better for those who want to make quick trades.

Pros and Cons of Mutual Funds

Mutual funds give you a mix of stocks and expert management. But, they often have higher fees and less clear information. ETFs, on the other hand, have lower fees and are more open. Yet, they need more knowledge and effort from the investor.

Advantages of ETFs

ETFs have many benefits, like lower costs, clear information, and flexibility. They also come in many types, from index funds to actively managed ones. With over 1,500 actively managed ETFs and 45 semi-transparent ones, there are lots of choices for investing in stocks.

| Investment Option | Fees | Transparency |

|---|---|---|

| Mutual Funds | Higher | Less |

| ETFs | Lower | More |

Common Mistakes to Avoid

Investing in stocks can be tricky. Emotional investing is a big mistake. It happens when people make quick decisions based on feelings, not facts. This can cause big losses.

For example, a study showed private investors got a 3.1% return from 2005 to 2015. But the market grew at 8.7% each year.

For example, a study showed private investors got a 3.1% return from 2005 to 2015. But the market grew at 8.7% each year.

Trying to time the market is another mistake. It's hard to guess what the market will do. Instead, focus on investing in stocks for the long haul. Spread your money across different companies and avoid making decisions based on emotions.

Here are some tips to avoid these mistakes:

- Diversify your portfolio by investing in various industries

- Avoid making emotional decisions and instead, focus on long-term goals

- Don't try to time the market, but instead, invest regularly and consistently

By following these tips, you can make smart choices. This will help you succeed in the stock market, even if you're new to it.

| Mistake | Consequence | Solution |

|---|---|---|

| Emotional Investing | Impulsive decisions, significant losses | Focus on long-term goals, avoid emotional decisions |

| Timing the Market | Risky, difficult to predict market movements | Invest for the long term, diversify portfolio |

Monitoring Your Investments

When investing in stocks for dummies, it's key to keep an eye on your investments. You should watch how your stocks are doing and tweak your portfolio when it's needed. The stock market can change fast, so knowing what's happening is important for smart choices.

When to Review Your Portfolio

Checking your portfolio often can show you where you might need to do better. It also makes sure your investments match your money goals. Think about checking your portfolio:

- Every quarter to see how you're doing and make changes if needed

- Every year to look over your investment plan and update your portfolio

Tools for Tracking Stocks

There are many tools to help you keep track of your stocks and stay current with market trends. These include:

- Financial news websites and apps

- Stock tracking software and platforms

- Tools and resources from your brokerage account

By watching your investments and using the right tools, you can make smart choices. This helps you reach your financial goals in the stock market. Always stay informed, and don't be afraid to ask for expert advice when investing in stocks for dummies.

Resources for Continued Learning

Starting your journey in stocks for dummies and investing in stocks is exciting. But, it's important to keep learning. The stock market changes a lot, and knowing what's happening helps you make smart choices. Luckily, there are many ways to learn more and get better at investing.

Books and Online Courses

"Investing in Stocks For Dummies" by Forbes Finance Council is a great place to start. It teaches you the basics and how to build a good portfolio. Online courses, like those on Investopedia, offer lessons and games to improve your skills.

Financial News and Analysis Sites

Keeping up with financial news and trends is key for smart investing. Sites like NerdWallet, The Intelligent Investor, and Unshakable give you insights and analysis. Also, check out podcasts, like Ric Edelman's, for a fun way to learn.

Investing in the stock market is a long-term journey. By always learning and joining a community of investors, you'll reach your financial goals. Investing wisely in the stock market is within your reach.

FAQ

What are stocks and why should I invest in them?

Stocks are like owning a piece of a company. They can grow in value over time and offer income. This makes them a good choice for a well-rounded investment portfolio.

What are the different types of stocks?

Stocks come in many forms. You have common stocks, preferred stocks, and types based on size like large-cap and small-cap. There are also growth and value stocks.

How does the stock market work?

The stock market is where people buy and sell stocks. It happens on big exchanges like the New York Stock Exchange. Prices change based on how much people want to buy or sell.

How do I get started with investing in stocks?

First, set your financial goals and know how much risk you can take. Then, pick a brokerage account that fits your needs. Remember, spreading your investments helps reduce risk.

What is fundamental analysis, and how can it help me evaluate stocks?

Fundamental analysis looks at a company's financial health. It checks things like earnings and revenue. This helps you make smart investment choices.

What is technical analysis, and how can it inform my investment decisions?

Technical analysis studies market trends and chart patterns. It helps find good times to buy or sell. It's useful for managing risk and timing your investments.

Why is diversification important when investing in stocks?

Diversification spreads your investments across different areas. This reduces risk. It protects your portfolio from big losses in any one investment.

What is the difference between mutual funds and ETFs?

Mutual funds and ETFs are both investment pools. But they differ in structure, fees, and how they trade. Knowing the differences helps you pick the best for your portfolio.

What are some common mistakes to avoid when investing in stocks?

Avoid emotional investing and trying to time the market. Also, don't forget to diversify. Staying disciplined and focused on the long term helps avoid these mistakes.

How should I monitor my investments?

Regularly review your portfolio and use tools to track your investments. Think about tax efficiency too. This helps you keep your portfolio in check and make needed changes.