Should You Add Options Trading to Your Investment Mix?

Investors often wonder if they should add options trading to their strategy. Is it worth it? The answer depends on understanding the pros and cons of options trading. It can make your portfolio more efficient, reduce risks, and increase returns.

Options trading includes strategies like covered calls and collars. These can help manage risks and boost returns. For example, a bull call spread lets you use less money while aiming for gains. It's great for those who want to save upfront costs but want to benefit from market moves.

Before jumping into options trading, ask yourself: is it worth it? You need to think about your investment goals and how much risk you can handle. This will help you decide if options trading fits into your overall strategy and helps you reach your financial goals.

Key Takeaways

- Options trading can provide increased cost-efficiency, reduced risk, and higher possible returns.

- Strategies like covered calls and collars can help manage risks and increase returns.

- Understanding the options market and evaluating your investment goals and risk tolerance are key before adding options trading to your mix.

- Options trading can be a valuable addition to a portfolio, but it's important to consider if it's right for you.

- Whether options trading is worth it depends on your financial goals, risk tolerance, and market understanding.

- By carefully weighing the benefits and risks, you can make an informed choice about options trading.

Understanding Options Trading

Options trading lets you buy or sell an asset at a set price. It's a financial tool that gives you the right, but not the duty, to act. This trading involves options contracts, agreements to buy or sell at a set price.

The value of these contracts has two parts: intrinsic and extrinsic. Intrinsic value is the amount above the strike price. Extrinsic value is the extra worth beyond that.

There are different types of options, like calls and puts. Calls let you buy, while puts let you sell. Trading options often comes with fees, like a flat fee per trade and a smaller fee per contract.

For example, a stock option contract is for 100 shares. To buy a call, you multiply the contract premium by 100.

When you start options trading, keep these points in mind:

- Check your financial health and pick the right broker.

- Get approval to trade options and make a detailed trading plan.

- Know the tax rules for options trading.

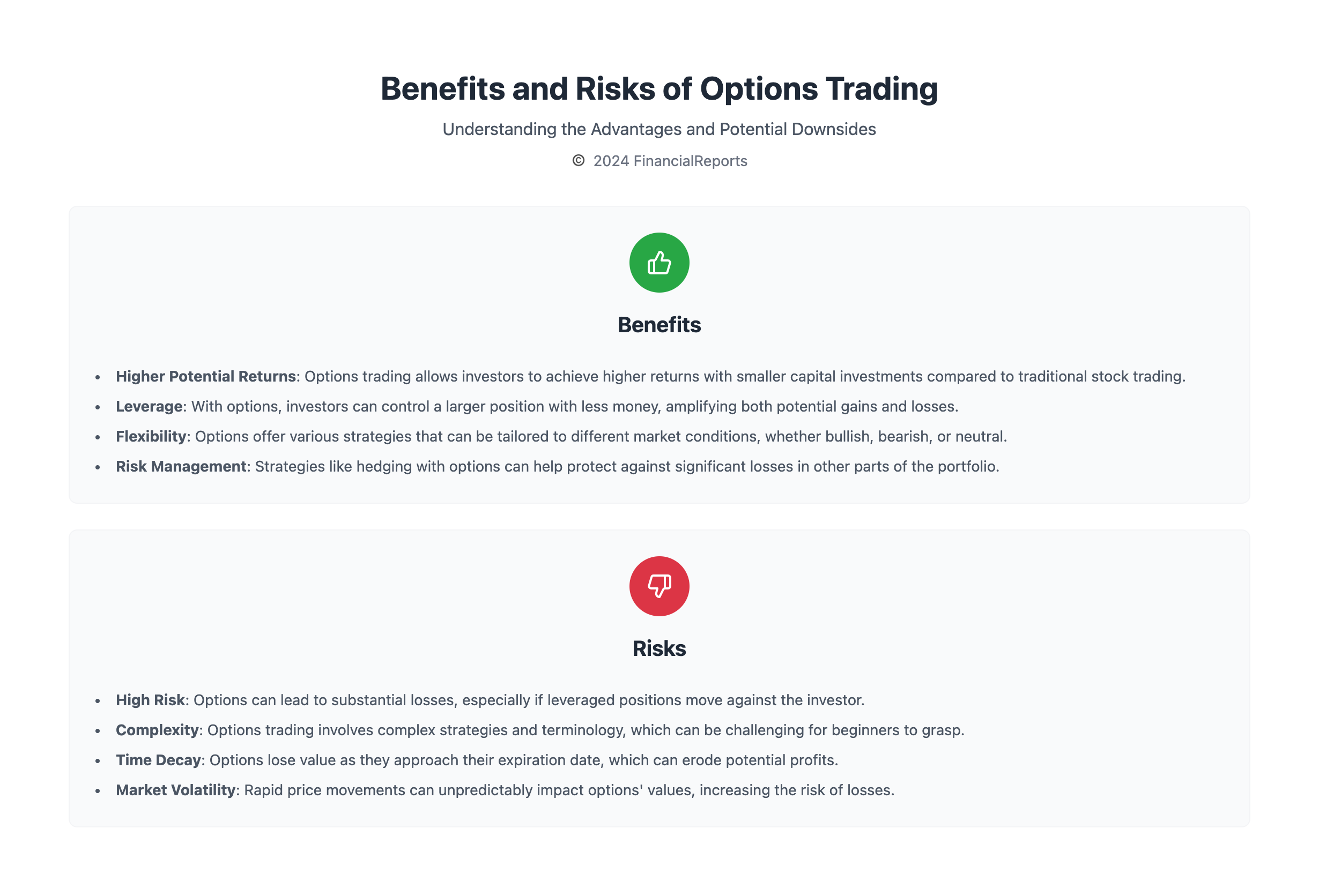

Benefits of Options Trading

Options trading has many benefits. It lets you use a small amount of money to control a big position. This can lead to higher returns. In 2023, about 10.2 billion options were traded, up from 4.2 billion in 2013.

One major advantage is the leverage it offers. This means you can manage a big part of an asset with just a little money. Options can mirror up to 85% of a stock's performance but cost only a quarter of the stock price.

Some key benefits of options trading are:

- Higher possible returns than stocks

- Leverage, letting you control more with less money

- Flexibility, for different strategies like bullish, bearish, or neutral

- Risk management, to limit losses or gain from premium value changes

Overall, options trading is appealing for those wanting to increase their returns while managing risk. It offers the chance for higher gains and leverages small capital. This makes options trading a strategy worth exploring.

| Year | Number of Options Traded |

|---|---|

| 1993 | 250 million |

| 2013 | 4.2 billion |

| 2018 | 5.2 billion |

| 2023 | 10.2 billion |

Risks Involved in Options Trading

Options trading comes with risks like volatility and market risks. These can change the value of the underlying asset. It's key to know these risks before starting to trade options.

The main risks in options trading are:

- Volatility and market risks: These can make the value of the underlying asset go up and down. This can lead to losses for the trader.

- Time decay: Options have a limited time to be used. Their value goes down over time, which can cause losses.

- Complexity of options: Options trading has complex strategies and terms. This can be hard for new traders to grasp.

To lessen these risks, traders can use strategies like hedging and diversification. It's also important to do thorough research and analysis before trading options.

| Risk | Description |

|---|---|

| Volatility and market risks | Fluctuations in the value of the underlying asset |

| Time decay | Decrease in the value of the options contract over time |

| Complexity of options | Challenging strategies and terminology |

By knowing the risks of options trading and using smart strategies, traders can reduce losses and increase gains.

Comparing Options to Other Investment Strategies

Comparing Options to Other Investment Strategies

When looking at investment options, it's key to compare them to other strategies. Comparing options to other investments helps investors make smart choices. A common comparison is stocks vs. options. Both have their own unique features.

Stocks are a traditional choice, giving you a piece of a company. Options, by contrast, are contracts that let you buy or sell something at a set price. This difference changes how much risk and reward each offers.

Key Differences

- Ownership: Stocks give you a share in a company, while options are contracts based on an asset.

- Risk: Options are riskier because they can lead to big losses if not managed well.

- Liquidity: Stocks are usually easier to sell, but options can be less liquid.

The choice between stocks and options depends on your goals, how much risk you can take, and your strategy. By knowing the differences and comparing options to other investments, you can pick what fits your financial goals best.

| Investment Type | Risk Level | Potential Return |

|---|---|---|

| Stocks | Medium | High |

| Options | High | Very High |

Who Should Consider Options Trading?

Options trading can add value to your investment portfolio. But, it's not for everyone. Experienced investors who know the markets well might find it useful. They can use it to manage risks and earn returns.

Those who might benefit from options trading have a few key traits. They include:

- A strong understanding of the underlying assets and markets

- Experience with trading and investing

- A willingness to take calculated risks

- A long-term investment horizon

For experienced investors, options trading offers several benefits. It helps hedge against losses, generate income, and profit from market changes. But, it's important to be cautious and weigh the risks and rewards before investing.

| Investor Type | Characteristics | Suitability for Options Trading |

|---|---|---|

| Experienced Investors | High risk tolerance, long-term investment horizon, strong understanding of markets | Well-suited |

| Risk-Tolerant Individuals | Willingness to take calculated risks, ability to withstand possible losses | Potentially suitable |

| Those Seeking Diversification | Desire to manage risk, generate returns, and diversify portfolio | Potentially suitable |

How to Start with Options Trading

To start with options trading, you need to know the basics and pick the right tools. Choosing a brokerage is key because it gives you the tools to trade. Look at fees, trading platforms, and educational resources when picking a brokerage.

Popular brokerages for options trading include E*TRADE, tastytrade, and Interactive Brokers. These sites offer tools like options research, technical analysis, and strategy optimization. For example, E*TRADE's Power E*TRADE platform has a Snapshot Analysis tool and Paper Trading for testing strategies.

After picking a brokerage, fund your account and make a trading plan. Your plan should outline your investment goals, risk tolerance, and how to manage risk. Learning about options trading concepts like intrinsic value, time decay, and volatility is also important. By following these steps and choosing a brokerage that fits your needs, you can start options trading successfully and reach your investment goals.

Some key things to consider when starting options trading include:

- Understanding call and put options

- Learning about trading strategies like covered calls and spreads

- Creating a risk management plan to reduce losses

Popular Options Trading Strategies

Options trading offers many strategies for investors to reach their financial goals. One well-known strategy is the covered call. This involves selling a call option on a stock you already own. It can bring in steady income and lower the cost of owning the stock.

Options trading offers many strategies for investors to reach their financial goals. One well-known strategy is the covered call. This involves selling a call option on a stock you already own. It can bring in steady income and lower the cost of owning the stock.

Other strategies include naked puts, spreads, and straddles. These strategies help investors manage risk and potentially earn high returns.

According to options trading strategies, covered calls are favored for their low-risk income generation. Selling a call option on a stock can earn a premium. This premium can offset the cost of owning the stock. Yet, it's vital to grasp the risks of covered calls and other strategies to make smart investment choices.

Popular options trading strategies offer several benefits:

- Flexibility: Options trading strategies can be customized to fit individual needs and goals.

- Risk management: These strategies can reduce risk and protect against losses.

- Potential for high returns: Options trading can lead to high returns, when combined with other strategies.

Other than covered calls, there are other notable strategies:

| Strategy | Description |

|---|---|

| Covered Call | Selling a call option on a stock that the investor already owns. |

| Naked Put | Selling a put option on a stock without owning the underlying stock. |

| Spread | Buying and selling options with different strike prices or expiration dates. |

Understanding various options trading strategies helps investors make informed decisions. They can craft a trading plan that aligns with their goals and needs.

Tax Implications of Options Trading

It's key for investors to know about the tax side of options trading. This knowledge helps in keeping taxes low. The taxes depend on the type of option and how long you hold it.

When trading options, think about the taxes, including capital gains and losses. For instance, 60% of gains or losses from non-equity options are taxed at long-term rates. The other 40% is taxed at short-term rates. This can really affect your taxes.

Key Tax Considerations

- Gains from options trading are taxed, with long-term gains being lower.

- Losses can offset gains, but there's a rule to avoid claiming losses too soon.

- Trading in an IRA can offer tax benefits, as gains are taxed only when you take them out.

It's wise to talk to a tax expert to grasp the tax aspects of options trading. They can help you find ways to lower your taxes. By understanding the tax implications, you can make better choices and increase your returns.

| Type of Option | Tax Treatment |

|---|---|

| Non-Equity Options | 60% long-term capital gains, 40% short-term capital gains |

| Equity Options | Short-term capital gains |

Tools and Resources for Options Traders

Options trading has grown in popularity, and the right tools are key to success. It's important to look at fees and commissions, as they affect your returns. Also, tools like advanced charts and screeners are vital.

Popular platforms include Thinkorswim by TD Ameritrade, E*TRADE OptionsHouse, and Interactive Brokers. These offer tools like real-time data, alerts, and order systems. For example, Thinkorswim helps with profit and loss analysis, while E*TRADE has a trading simulator.

Choosing a platform means looking at customer service too. Good support helps traders understand options and make smart choices. Here's a comparison of fees and commissions:

| Platform | Fees and Commissions |

|---|---|

| Tastytrade | $0.50 per contract |

| Charles Schwab | $0.65 per contract |

| Interactive Brokers | $0.65 per contract |

| E*TRADE | $0.65 per contract (decreases to $0.50 per contract after 30 trades in a quarter) |

In summary, the right tools and resources are essential for options trading success. By considering fees, tools, and customer service, traders can make better choices and reach their goals.

Common Mistakes in Options Trading

Options trading can be very profitable if done right. But, it's all about careful planning and execution. One big risk is making common mistakes that can lead to big losses. Over-leveraging positions is a big one, where investors use too much margin, making losses worse.

Other mistakes include ignoring market conditions, not doing enough research, and not diversifying. Data shows 7 common mistakes to avoid when trading options. It's clear that having a strategy and staying disciplined are key to success.

Key Mistakes to Avoid

- Over-leveraging positions

- Ignoring market conditions

- Lack of research and analysis

- Failing to diversify

- Using margin to buy options without proper risk management

To steer clear of these mistakes, it's vital to have a solid trading plan. Do your homework and stay disciplined. Knowing the risks and managing them can help you succeed in options trading and avoid big losses.

The Future of Options Trading

The future of options trading is influenced by new technologies and rules. As the market changes, it's key to keep up with these updates. This helps us adapt to the shifting landscape.

Several trends will shape the future of options trading. These include:

- More use of tech like AI and machine learning to better trading and risk handling.

- More interest in options trading in new markets, thanks to more investors and easier access.

- Tighter rules to protect investors and keep the market fair.

To succeed in the future of options trading, we need to know the latest market news. We must also be ready to change our strategies. By using new tech and understanding market trends, we can make smart choices. This helps us reach our investment goals.

| Trend | Impact on Options Trading |

|---|---|

| Technological Advancements | Improved trading decisions and risk management |

| Emerging Markets | Increased demand for options trading and investor awareness |

| Regulatory Changes | Stricter requirements for investor protection and market integrity |

Conclusion: Is Options Trading Right for You?

Options trading has its own set of benefits and risks. Whether it's right for you depends on your financial goals and how much risk you can handle. Before diving into options, think about your investment goals, risk level, and get advice from experts.

Assessing Your Financial Goals

Check if options trading fits into your financial plan. Think about your investment time frame, need for diversification, and return expectations. Options can offer leverage and income, but they also come with big risks.

Evaluating Your Risk Tolerance

Options trading is volatile and can lead to big losses. Look at your ability to handle market ups and downs. Options might be for those who are experienced and can handle risks.

Making an Informed Decision

Learn about the options market, study trading strategies, and practice with a paper account. Use educational resources and talk to a financial advisor. This will help you decide if options trading is right for you.

FAQ

What are options and how do they work?

Options are financial contracts that let you buy or sell something at a set price later. They come in two types: calls and puts. Calls let you buy, while puts let you sell.

What are the benefits of options trading?

Options trading lets you control big positions with small money. It can lead to high returns and help manage risks. It also offers ways to make money.

What are the risks involved in options trading?

Options trading has risks like market volatility and time decay. It's also complex. Knowing and managing these risks is key.

How do options compare to other investment strategies?

Options offer unique benefits compared to stocks, ETFs, and bonds. Each has its own pros and cons. It's important to consider these when choosing.

Who should consider options trading?

Options trading is for experienced investors and those who can handle risks. It's for those looking to diversify, but you need to understand it well.

How do I start with options trading?

To start, choose a brokerage, fund your account, and make a trading plan. Your plan should match your goals and how much risk you can take.

What are some popular options trading strategies?

Popular strategies include covered calls, naked puts, and spreads. Each has its own advantages and disadvantages.

What are the tax implications of options trading?

Options trading can affect your taxes, including gains and losses. You need to know about tax reporting and how it impacts your long-term plans.

What tools and resources are available for options traders?

Traders have many tools and resources. These include trading platforms, educational materials, and market analysis tools. They're vital for success.

What are some common mistakes in options trading?

Mistakes include over-leveraging, ignoring market conditions, and not doing enough research. Avoiding these can help reduce risks.

What is the future of options trading?

The future of options trading will be shaped by market trends, technology, and regulations. Staying updated on these can help traders succeed.