Securities Exchange: Definition, Purpose & Key Characteristics

A securities exchange is a place where companies, governments, and others can raise money by selling securities. It's a marketplace for trading securities, commodities, derivatives, and other financial items. The main job of an exchange is to make sure trading is fair and prices are known, which is vital for the exchange's purpose.

In this article, we'll look at what a securities exchange is, why it exists, and its main features. This guide is for financial experts, investors, and big clients who need detailed financial data solutions.

The idea of a securities exchange is simple: it's a place where buyers and sellers meet to set prices and make deals. Knowing what a securities exchange is helps you understand the complex world of finance. Exchanges are key in helping companies raise money, making it easy for investors to buy and sell, and ensuring prices are fair.

As we explore securities exchanges, we'll cover their main traits, goals, and definitions. These are important for anyone working in finance, investing, or managing big funds.

Key Takeaways

- A securities exchange is a marketplace where securities, commodities, derivatives, and other financial instruments are traded, providing a clear securities exchange definition.

- The core function of an exchange is to ensure fair and orderly trading and the efficient dissemination of price information, which is a key aspect of the securities exchange meaning.

- Securities exchanges play a critical role in facilitating capital formation, providing liquidity for investors, and ensuring price discovery.

- Understanding the definition, purpose, and key characteristics of securities exchanges is important for financial professionals, investors, and big clients.

- The Securities and Exchange Commission (SEC) oversees the securities exchange industry, ensuring compliance with rules and protecting investors' interests.

- Exchanges must follow strict rules, like those for system capacity and security, as set by Regulation SCI.

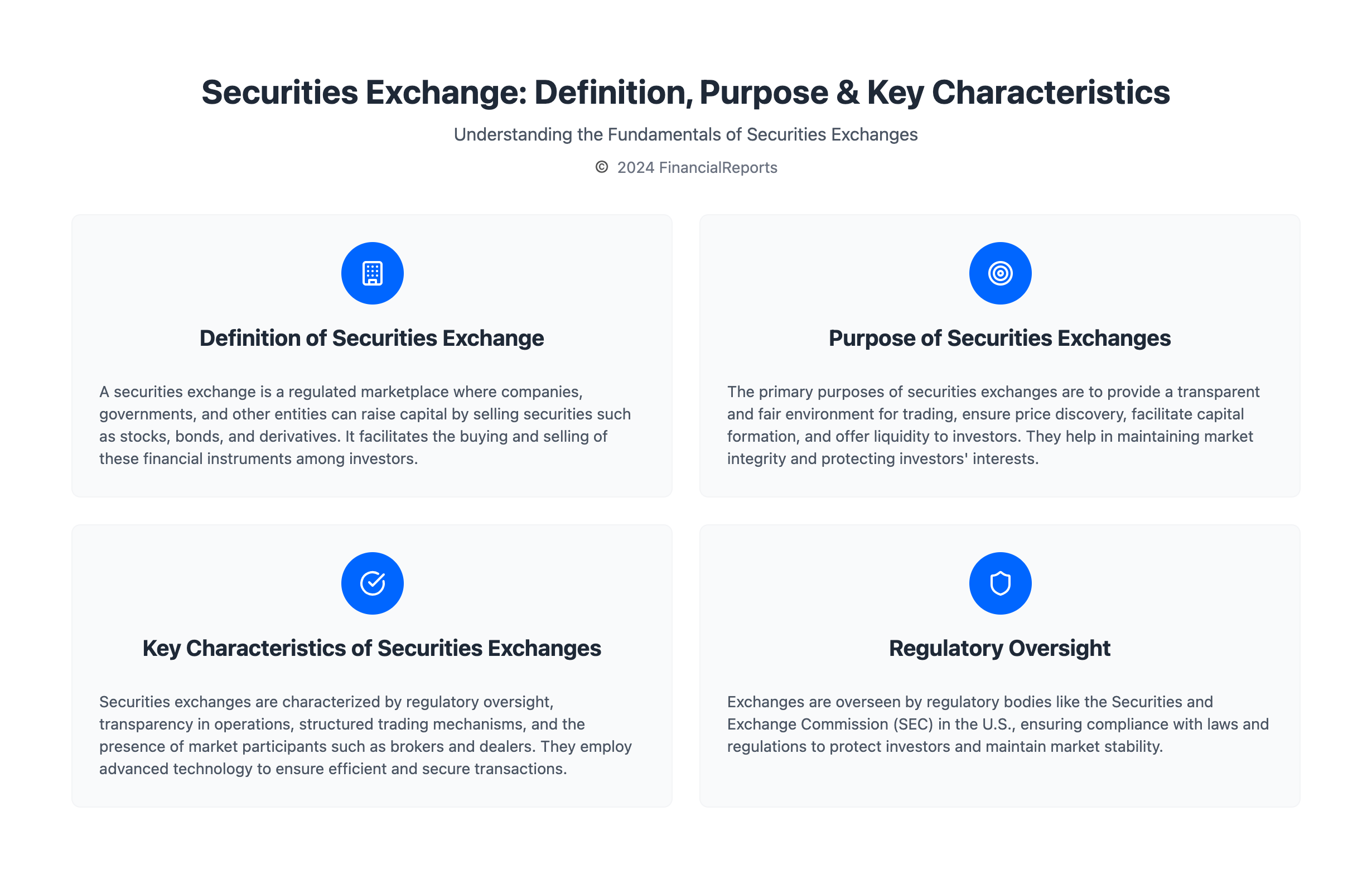

Understanding the Definition of a Securities Exchange

A securities exchange is a place where financial items like stocks and bonds are traded. It includes stock exchanges, commodity exchanges, and more. In the U.S., places like the New York Stock Exchange (NYSE) are key for buying and selling these items.

The U.S. Securities and Exchange Commission (SEC) watches over the markets. It was started in 1934 to help after the 1929 crash. Knowing what a securities exchange is helps those in finance and investing.

The U.S. Securities and Exchange Commission (SEC) watches over the markets. It was started in 1934 to help after the 1929 crash. Knowing what a securities exchange is helps those in finance and investing.

Some important things about U.S. stock exchanges include:

- Most trading happens online, with over 80% on the NYSE.

- Trading hours are from 9:30 a.m. to 4 p.m., Monday to Friday.

- Companies need to meet certain standards, like $4 million in equity for the NYSE.

Understanding securities exchanges helps investors and financial experts make better choices. It's key for navigating the complex world of trading.

| Exchange | Location | Founded |

|---|---|---|

| New York Stock Exchange (NYSE) | New York, USA | 1792 |

| Nasdaq | New York, USA | 1971 |

| London Stock Exchange | London, UK | 1698 |

Purpose of Securities Exchanges

Securities exchanges, like those in the US, are key for raising capital and making markets liquid. They help investors by ensuring prices are fair. The Securities Act of 1933 and the Securities Exchange Act of 1934 guide how securities are sold across states.

In the US, exchanges like the New York Stock Exchange (NYSE) and Nasdaq are closely watched by the government. Companies must get the SEC's okay to trade their stocks. The SEC makes rules to keep the market honest and safe for everyone.

The main goals of securities exchanges are:

- Helping companies raise money by selling shares to the public

- Making it easy for investors to trade quickly and efficiently

- Setting fair prices for securities

Securities exchanges, including those in the US, are vital for the financial markets. They help in raising capital, making trading smooth, and setting fair prices.

| Securities Exchange | Purpose |

|---|---|

| American Stock Exchanges | Facilitating capital formation, providing liquidity, and ensuring price discovery |

| Stock Exchanges in the US | Providing a platform for companies to raise capital and for investors to buy and sell securities |

Key Characteristics of Securities Exchanges

Securities exchanges, like stock exchanges in the USA, have unique features. They are overseen by regulators to ensure fairness. They also provide clear information for investors to make smart choices.

Big stock exchanges in the USA, like the New York Stock Exchange (NYSE) and NASDAQ, have their own rules. For example, the NYSE wants companies to have made at least $10 million in profit over three years. They also need a market value of $100 million in shares. NASDAQ is a bit stricter, asking for $11 million in profit and a market value of $45 million.

Here are some main traits of securities exchanges:

- Regulatory oversight and compliance

- Transparency in operations

- Market participants and their roles

These traits are vital for keeping exchanges fair and efficient. They help keep investors confident in the markets.

| Exchange | Market Capitalization (2018) | Listing Requirements |

|---|---|---|

| NYSE | $23.12 trillion | Pre-tax income: $10,000,000, Market capitalization: $100,000,000 |

| NASDAQ | $10.93 trillion | Pre-tax income: $11,000,000, Market capitalization: $45,000,000 |

Historical Evolution of Securities Exchanges

The history of securities exchanges is long and complex, starting in the 18th century. The first stock exchange in the United States was in Philadelphia in 1790. It was called the Philadelphia Stock Exchange. This was the start of American stock exchanges, which would become huge and very influential.

More stock exchanges came to the United States, like the New York Stock Exchange (NYSE) in 1792. The NYSE is now one of the biggest and most famous stock exchanges in the United States. It has a market value of over $25 trillion as of 2024. The growth of these exchanges was influenced by big events, like the stock market crash of 1929 and the SEC's founding in 1934.

Some important moments in American stock exchanges history are:

- The establishment of the NYSE in 1792

- The creation of the SEC in 1934

- The launch of the National Association of Securities Dealers Automated Quotations (NASDAQ) in 1971

These events helped stock exchanges in the United States grow. They are now key players in the global financial system.

Types of Securities Traded on Exchanges

Securities exchanges handle many financial items, like stocks, bonds, and derivatives. Knowing what a securities exchange definition is key to understanding trading. A define securities exchange is a place where securities are bought and sold, helping buyers and sellers meet.

Securities can be grouped into several types, including:

- Stocks and equities, which show ownership in companies

- Bonds and fixed-income securities, which are debt obligations

- Derivatives and commodities, which are contracts based on other assets

These securities are traded on big exchanges like the NYSE and Nasdaq. These exchanges have rules for listing, like income and market size. Companies must meet these to be listed.

| Exchange | Listing Requirements |

|---|---|

| NYSE | Aggregate income over $10 million over the past three fiscal years |

| Nasdaq | Specific income, market capitalization, and revenue criteria |

Knowing about the different securities and exchange rules is vital. It helps financial pros, investors, and big clients in the complex world of trading. By understanding the securities exchange definition and the types of securities, investors can make better choices and reach their goals.

Major Securities Exchanges in the World

The global securities market is led by major stock exchanges, including those in the US. The New York Stock Exchange (NYSE) and the Nasdaq are among the largest American stock exchanges. They have a combined market capitalization of over $30 trillion. These exchanges host some of the world's biggest and most influential companies.

The stock exchanges in the US follow strict rules. This ensures the market's integrity and stability. The NYSE and Nasdaq are respected and established exchanges. They have a long history of helping companies raise capital and investors buy and sell securities.

Some key features of major securities exchanges include:

- High market capitalization: The NYSE and Nasdaq have a combined market capitalization of over $30 trillion.

- Strict listing requirements: Companies must meet strict listing requirements to be listed on these exchanges.

- High liquidity: These exchanges are highly liquid, with millions of shares traded every day.

- Transparency: The exchanges are highly transparent, with real-time pricing and trading information available to all market participants.

Besides the NYSE and Nasdaq, there are other major stock exchanges in the US. The American Stock Exchange (AMEX) and the Chicago Stock Exchange (CHX) are examples. These exchanges offer a platform for companies to raise capital and for investors to buy and sell securities. They are a key part of the US financial system.

| Exchange | Market Capitalization | Number of Listed Companies |

|---|---|---|

| NYSE | $25.56 trillion | 3,000 |

| Nasdaq | $10 trillion | 3,300 |

| London Stock Exchange | $3.42 trillion | 3,000 |

The Role of Technology in Securities Exchanges

Technology has changed the securities exchange world a lot. It brought in electronic trading systems and blockchain technology. These tools make trading fast and secure, and they keep records clear and open. In the world of securities exchanges, tech has been key in making markets work better.

Electronic trading systems have become more common, with many stock exchanges in USA using them. Blockchain tech also looks promising, as it could lower the costs of checking financial data. Some main advantages of blockchain include:

- Transparent tracking of asset holdings

- Secure and efficient execution, clearing, and settlement of trades

- Reduced need for centralized database management

As the securities exchange world keeps growing, tech will likely play an even bigger part. With more interest in blockchain and other new tech, securities exchanges and stock exchanges in USA need to keep up. This will help them stay ahead in the market.

| Technology | Benefits |

|---|---|

| Electronic Trading Systems | Fast and efficient trading, improved market operations |

| Blockchain Technology | Secure and transparent recording of transactions, reduced reconciliation costs |

The Importance of Market Regulation

Market regulation is key to keeping securities exchanges stable and fair. A securities exchange definition is a place where securities trade. It's vital to have rules to keep markets running smoothly.

The Securities and Exchange Commission (SEC) is a big player in the U.S. securities market. It works to protect investors and keep markets fair. Other groups like the Financial Industry Regulatory Authority (FINRA) and the Commodity Futures Trading Commission (CFTC) also help regulate.

Some important parts of market regulation include:

- Regulatory oversight and compliance

- Transparency in operations

- Protection of investors

- Maintenance of fair and efficient markets

Knowing about market regulation is important for anyone in finance. It helps prevent fraud and keeps markets stable. This builds trust among investors.

| Regulatory Body | Role |

|---|---|

| SEC | Oversees the securities market in the U.S. |

| FINRA | Regulates the securities industry |

| CFTC | Regulates the commodities and futures markets |

Global Trends in Securities Exchanges

The securities exchange industry is changing fast. This is thanks to the growth of emerging markets and new trading systems. In the US, big stock exchanges like the New York Stock Exchange (NYSE) and the Nasdaq are leading the way. The NYSE's market value was over $28.5 trillion by mid-2024, while the Nasdaq's was over $25.5 trillion.

American stock exchanges are seeing more trading. The S&P 500's daily volume is now 76% higher than in January 2020. It's also 95% higher than in October 2019. This boost comes from more retail traders, with 5 out of 8 high TRF days in June 2024.

Some key trends in global securities exchanges include:

- Growth of emerging markets, such as China and India

- Rise of alternative trading systems, such as dark pools and high-frequency trading

- Increased trading volumes, driven by retail traders and institutional investors

The global equity market hit over $100 trillion in 2024, the World Federation of Exchanges reports. This growth is expected to keep going. It's driven by more demand for securities and new trading platforms. As the industry evolves, it's key for financial pros, investors, and clients to keep up with the latest in stock exchanges in the US and globally.

| Stock Exchange | Market Capitalization (2024) |

|---|---|

| NYS | $28.5 trillion |

| Nasdaq | $25.5 trillion |

| Euronext | $7.3 trillion |

| Tokyo Stock Exchange | $6.7 trillion |

| Shanghai Stock Exchange | $6.55 trillion |

Risks Associated with Trading on Securities Exchanges

Trading on securities exchanges comes with many risks. Market volatility is a big one, causing stock prices to swing wildly. This makes it hard for investors to guess what will happen next. Operational risks also exist, due to mistakes or system failures during trading.

In the USA's stock exchanges, these risks are even bigger. The fast pace of electronic trading can sometimes overwhelm systems. This leads to execution risks. Also, global markets are so connected that news in one market can quickly affect others. This shows how vital it is to understand and manage these risks when trading on securities exchanges.

To lessen these risks, investors and financial pros need to keep up with market and regulatory news. Knowing about rules like Rule 15c3-5 under the Securities Exchange Act of 1934 is key. This rule helps manage financial, regulatory, and other risks tied to market access. By grasping these points and actively managing risks, those in securities exchanges can better navigate the markets.

Future of Securities Exchanges

The future of securities exchanges looks set for big changes. These places must keep up with new market trends and try new trading ways. As the securities exchange definition changes, exchanges will have to stay ahead to stay relevant and competitive.

Exchanges will focus on adapting to market shifts. This is key, with emerging markets growing and alternative trading systems becoming more common. They'll need to draw in global investors and make their operations more efficient and cost-effective.

New trading methods, like blockchain technology and high-frequency trading, will also shape the future. Exchanges that use these innovations and offer advanced trading options will do well in the future.

By understanding the changing world of securities exchanges, everyone can stay ahead. Financial experts, investors, and clients can make smart choices that fit with the new define securities exchange landscape.

FAQ

What is a securities exchange?

A securities exchange is a place where companies and governments can raise money by selling shares to the public. It makes sure trading is fair and prices are known to everyone.

What are the different types of securities exchanges?

There are many types, like stock, commodity, and derivatives exchanges. Each has its own rules and works differently.

What is the primary purpose of a securities exchange?

Its main job is to help companies get money by selling shares. It also makes sure investors can buy and sell easily and find out prices.

What are the key characteristics of securities exchanges?

They are overseen by rules, are open and clear, and involve brokers and dealers. These features set them apart from other markets.

What is the historical evolution of securities exchanges?

They started in the 18th century in the US and Europe. Over time, they've grown into the complex markets we see today.

What types of securities are traded on exchanges?

You can find many financial products, like stocks, bonds, and derivatives, on these exchanges.

What are the major securities exchanges in the world?

Big names include the New York Stock Exchange (NYSE), Nasdaq, and London Stock Exchange. They are among the biggest and most active.

How has technology impacted securities exchanges?

New tech, like electronic systems and blockchain, has made trading faster and safer. It's changed the way exchanges work.

What is the role of market regulation in securities exchanges?

Bodies like the Securities and Exchange Commission (SEC) keep exchanges in check. They make sure rules are followed to protect investors and keep markets fair.

What are the global trends in securities exchanges?

The industry is changing, with more focus on emerging markets and new trading systems. This includes dark pools and high-frequency trading.

What are the risks associated with trading on securities exchanges?

Trading comes with risks like market ups and downs and system failures. It's important for everyone involved to understand these risks.

What is the future of securities exchanges?

The future is uncertain, with many changes and new ideas coming. They will need to adapt to these changes and new technologies.