ROI Stands For: Definition and Meaning in Business Terms

Return on Investment, or ROI, is key in business finance. It shows a company's financial growth and smarts in making decisions. It measures how well investments do by comparing profit to the amount spent. Its formula, ROI = (Net Profit / Cost of Investment) x 100, turns into a percentage. This way, it's easy to see how investments are doing.

ROI is crucial for evaluating financial ventures' success. It lets us compare different investment options. This is important in fields where starting costs are high. It helps attract potential investors through careful ROI analysis.

ROI isn't just about the money. It also covers the social and environmental impact with Social Return on Investment (SROI). For investments aiming for social good, SROI shows the wider effects. Moreover, for specific sectors, ROI has adapted. There's Marketing Statistics ROI and Learning ROI to fit different needs.

Today, ROI is indispensable for making data-driven business decisions. It helps businesses review their past, plan their future, and aim for better results. Yet, it's crucial to know that different fields have their own ROI benchmarks. These depend on factors like market changes and regulations.

Key Takeaways

- ROI is a universal measure of profitability and investment efficiency in business.

- Expressed through a formula, ROI yields a percentage that reflects financial gain in relation to investment costs.

- While traditionally financial, ROI has evolved to measure socio-environmental impact (SROI) and industry-specific outcomes.

- ROI calculations can assist in informed decision-making and have become integral in high capital industries.

- Average ROI figures, such as the S&P 500's historical 10% return, provide benchmarks for performance comparison.

- The pursuit of higher ROI can be enhanced through analytical tools and strategic audience engagement.

- Complex investment landscapes pose challenges to ROI attribution, influencing the fidelity of performance assessments.

What Does ROI Stand For in Business?

In the business world, ROI means Return on Investment. It's key for judging how well an investment does. Or for comparing multiple investments. It uses a simple formula—net gains versus costs—to help businesses decide based on facts. To dive deeper, ROI measures investment returns as a percentage. This makes it easier to see if an investment is profitable or how it stacks up against others.

Understanding the Concept of ROI

ROI is found by taking an investment's net income, subtracting the investment cost, and dividing by the investment cost. Then, multiplying by 100 gives a percentage. For example, a marketing campaign that costs $1000 and brings in $3000 has an ROI like this:

- Net Income: $3000 - $1000 = $2000

- ROI: ($2000 / $1000) x 100 = 200%

This tells us the investment's value doubled, showing a strong return on investment.

Common Misconceptions About ROI

Many misunderstand ROI and its use in business. One key mistake is thinking a higher ROI always means a better investment. This ignores other factors like the time value of money, risk levels, and how long it takes to see returns. Also, ROI doesn't usually consider intangibles like brand reputation, worker happiness, or environmental effects. Yet, these can be crucial for a company's future plans.

Furthermore, ROI can vary by industry or company department, highlighting the need for clear understanding. Specific formulas and contexts for each ROI calculation are essential for accurate comparisons.

In tech investments, ROI might look at efficiency gains and cost savings, not just direct revenue. Meanwhile, social ROI, important in corporate social responsibility, measures community and environmental project impacts in financial terms.

To deal with these complexities, financial experts often use ROI along with other measures like Net Present Value (NPV) and Internal Rate of Return (IRR). This approach gives a fuller picture of investment outcomes.

The Importance of ROI in Business Strategy

Return on Investment (ROI) is crucial in forming business strategies. It shows the profit made from investments. This helps in deciding how to use resources well and make more money. ROI shows if a company is doing well financially and helps plan for the future.

How ROI Influences Decision-Making

ROI greatly affects how companies make decisions. It helps figure out if investing in certain areas pays off. For example, it measures how good marketing efforts or employee training are. This means companies can put money and effort where it works best.

- ROI helps businesses assess the efficacy of marketing campaigns by comparing the financial gains against the amounts invested.

- It aids in quantifying the impact of employee training programs by measuring potential increases in productivity and subsequent profitability.

- Decision-makers use ROI to determine the financial viability of new projects and choose between competing investments.

Having a system to measure and analyze investment returns helps companies grow and last longer. It makes sure they perform well financially.

Poster Child for Performance Measurement

ROI is key in measuring how well investments are doing. It gives a clear picture of the money earned from spending. This is super helpful in fields like tech and marketing. In these areas, knowing the ROI helps judge success.

Here's how firms typically implement and benefit from ROI analysis:

| Activity | Investment | Return | ROI |

|---|---|---|---|

| Email Marketing | $10,000 | $50,000 | 400% |

| Employee Training | $15,000 | Increased productivity worth $60,000 | 300% |

| Product Development | $20,000 | Market value of $80,000 | 300% |

This table not just shows the money made from different activities. It also points out how ROI helps in making smart decisions. Understanding these financial scores is key for staying ahead in business. It helps in finding areas to improve before making moves.

Calculating ROI: A Step-by-Step Guide

Learning how to calculate Return on Investment (ROI) accurately is essential. It helps in evaluating business endeavors financially. ROI is a key measure, comparing net profits to the investment's original costs.

The Basic ROI Formula Explained

The simple formula for ROI is: ROI = (Gross Return – Cost of Investment) ÷ Cost of Investment. This formula shows the investment's profitability as a percentage. It reveals if the monetary input has led to a financial gain. For example, investing in new technology might boost production by 25%. This success is seen in the ROI, indicating better investment efficiency.

Factors to Consider in ROI Calculation

There are key factors to consider for an accurate ROI:

- Net Profit and Cost Inclusion: Include all gains and costs in the ROI calculation. This helps get a precise measure of investment efficiency.

- Annualized ROI: For long-term investments, the annualized ROI formula is vital. It adjusts insights based on investment length, allowing fair comparisons. The formula is [(Ending Value ÷ Beginning Value) ^ (1 ÷ Number of Years)] – 1.

- Risk Adjustment and Period Consideration: ROI does not automatically factor in risk or the time value of money. When calculating ROI, consider market volatility and other external factors that may impact expected profits.

By keeping these elements in mind, your ROI calculations will be more accurate and reliable. This is crucial for wise strategic choices in portfolio management and capital allocation.

Different Types of ROI Used in Business

In the world of finance, knowing the different ROI types is key. This knowledge helps companies make smart moves. They can figure out where to use their money and focus on what helps them grow.

Marketing ROI: Evaluating Advertising Success

Marketing ROI is a crucial measure for checking how well ads do. It looks at whether marketing actions lead to more sales and get the company noticed. By focusing on real outcomes, businesses can tweak their plans to get the best results.

Figuring out marketing ROI means looking closely at how money spent matches up with benefits. Businesses use the Gross ROI and Net ROI methods to see the full financial picture.

Social ROI: Measuring Social Impact and Engagement

Social ROI goes past just money to include social, environmental, and economic gains. It helps businesses see the bigger effect of what they do. This view is key for company sustainability and ethical actions.

It plays a big part in showing a company's role in social responsibility and ESG areas. Social ROI highlights the good that comes out of investments, not just in cash terms but in community improvements.

Other ROI types like ROA and ROE show how well a company uses its assets and keeps shareholders happy. These indicators are vital for a deep dive into a company's financial and operational health. They help everyone understand how wisely a company uses its resources.

Knowing about these ROI varieties helps businesses stay ahead of the game. It also makes sure firms are open and responsible with their investments. This careful approach ensures every dollar spent is well thought out and backed by solid financial analysis.

ROI vs. Other Performance Metrics

In the world of business finance, using financial metrics wisely is key. ROI, or Return on Investment, is crucial for checking investment success and profitability. But when you compare ROI to other metrics like profit margin, you get more insights for smart financial decisions.

Comparing ROI with Profit Margin

Let's explore the differences between ROI and profit margin. Profit margin looks at how profitable sales are after expenses, without considering initial costs. On the other hand, ROI includes initial expenses to show how well an investment did. For example, if a project makes \$100,000 and costs \$70,000, the ROI would be 42.86%. This shows the gain from the initial costs.

| Metric | Formula | Example Calculation | Interpretation |

|---|---|---|---|

| ROI | (Revenue – Costs) / Costs x 100 | (\$100,000 - \$70,000) / \$70,000 x 100 | 42.86% - Good Return |

| Profit Margin | (Net Income / Revenue) x 100 | (\$30,000 / \$100,000) x 100 | 30% - Healthy Margin |

How ROI Differs from Total Return on Investment

ROI shows the percentage gain from the original money put into a project. Total Return on Investment, or TRI, covers more ground. It includes things like dividends and capital gains. TRI is great for looking at long-term investments and their extra earnings.

For instance, if an investment pays dividends or grows in value plus its revenue, ROI looks at the basic profit, while TRI shows the whole growth. TRI offers a broad view, which is helpful for financial experts who want to check the overall health of an investment over time.

Understanding how ROI compares with profit margin and other metrics offers a full picture of financial health. It aids in making smart investment choices, drives growth, and boosts value for stakeholders.

Practical Applications of ROI in Various Industries

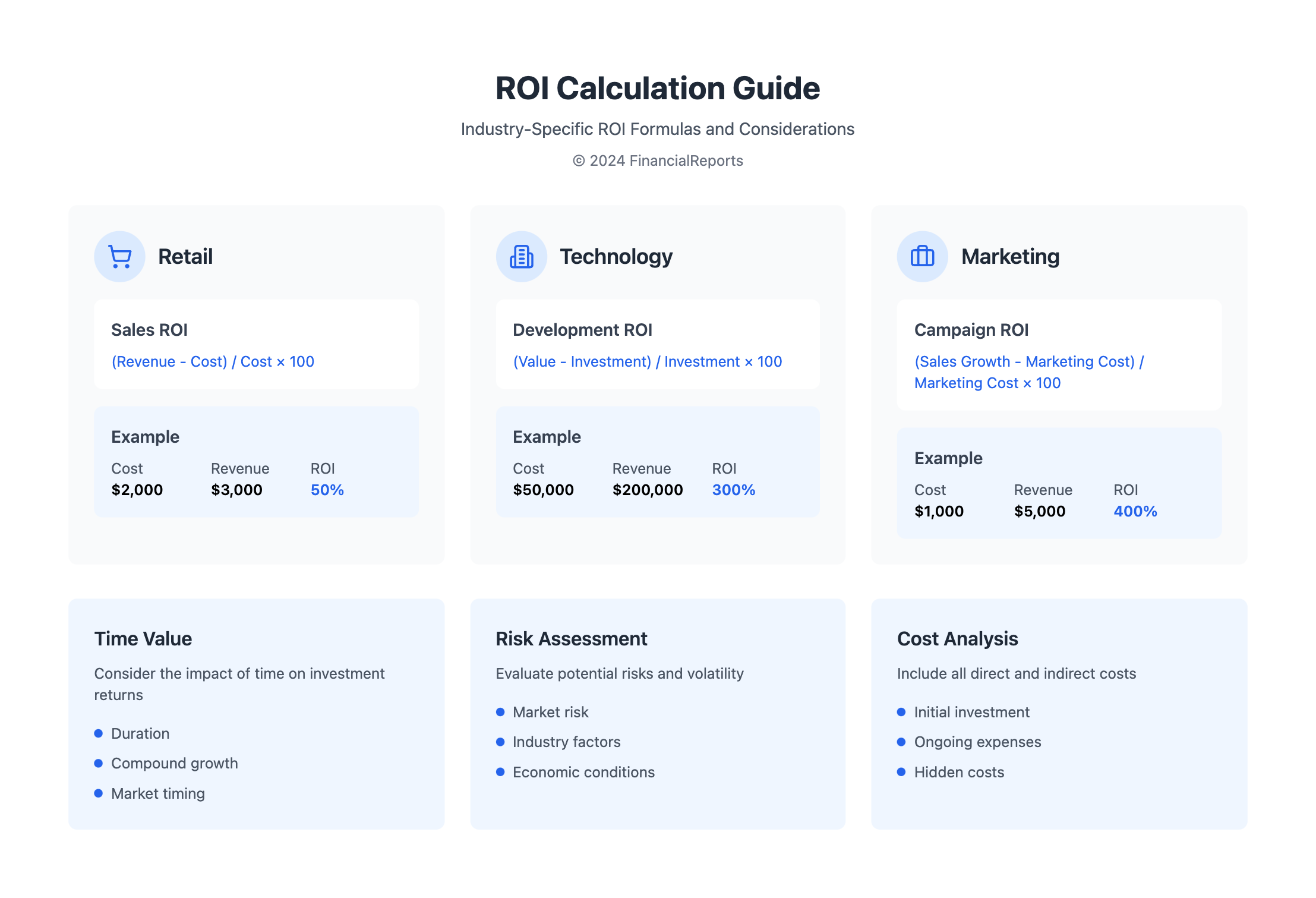

ROI shows its true power in its industry-specific roi uses. It lets businesses in varied sectors create custom investment plans. Knowing how to use ROI improves financial tactics. And it helps investments match the needs of each industry.

ROI in Retail: Measuring Sales Performance

In retail, roi applications focus on checking how well sales and marketing do. Retailers use ROI to see if a product or a whole marketing plan is profitable. This guides them on how to use their money and plan marketing in the future.

They get clear numbers on what they earn from different retail activities. It's a key way to understand financial success.

ROI in Technology: Justifying Investments

The tech industry needs ROI to show why spending money on new tech is worth it. Tech companies count on ROI to predict the financial benefits of their investments. These include putting money into research, making new things, and launching tech innovations.

| Parameter | Technology | Retail |

|---|---|---|

| Investment Focus | Development of new solutions | Marketing campaigns |

| ROI Example | Annualized ROI for Novula Tech's test equipment: 10.69% | Annualized ROI for a retail marketing initiative |

| Strategic Outcome | Guide tech innovation investments | Optimize product and marketing expenditures |

| Industry Impact | Enhances product development cycles | Boosts sales and customer engagement |

These stats show the differences in how retail and technology use ROI. Specific ROI strategies are made to fit the unique needs of each sector. This helps companies do better in the market. By using industry-specific roi data, firms can pick the best investments and do great in their markets.

Common Challenges in Measuring ROI

Accurately measuring ROI is key in finance. Yet, experts encounter many challenges that impact their analyses. One big issue is getting precise investment data. Due to obstacles in data collection and complex ROI calculations, this can be hard.

Data Collection and Accuracy Issues

In digital marketing, tracking data across many channels is tough. The lack of a shared ROI definition makes it harder. Also, the complex paths customers take, like using social media or visiting websites, add to the challenge.

Digital strategies, such as ads on social media, take time to show results. Analyzing them too soon may give misleading ROI figures. Tools and models are needed to figure out which activities really boost sales.

The Impact of Time on ROI Measurement

Time affects how we see ROI. Comparing long-term investments to short ones fairly means adjusting for time. Not doing this can distort how we view an investment's success.

A survey shows 91% value ROI in making decisions. Yet, 67% say they're just starting or are somewhat skilled at measuring ROI. This skill gap calls for better training and tools.

So, facing data and ROI measurement challenges requires careful and skilled analysis. Setting clear aims, using solid analytics, and knowing more about ROI is key.

Tools and Software for Calculating ROI

In today's business world, managing financial metrics well is crucial. Tools and software for ROI are now a must-have for companies wanting better financial results. They make calculations faster and more correct, helping with strategic decisions.

Popular ROI Calculation Tools

There are many tools for calculating ROI, from simple spreadsheets to advanced software. Cloud cost optimization tools can cut cloud costs by 30%. Development ROI software boosts productivity by 20%, leading to a 300% ROI.

For marketers, analysis tools shed light on important figures like Cost Per Lead and Customer Lifetime Value. These figures help understand how effective campaigns are.

Benefits of Using Software for ROI Analysis

ROI software saves time and resources in business. For instance, companies using Enumerate Central in property management save in areas like accounting. These tools automate tasks, so companies can focus on growth.

| Software | Investment | ROI | Time Saved |

|---|---|---|---|

| Cloud Cost Optimization | Varies | 30% cost reduction | Immediate upon implementation |

| Employee Development ROI Software | $50,000 | 300% | 20% productivity increase |

| Marketing ROI Software | Varies | Dynamic (CPL, ROAS, LTV) | Real-time analytics |

| IT Asset Management | Varies | High, specific to company size and assets | Significant in resource optimization |

| Enumerate Central | Varies based on company size | Impact calculated via ROI formula | Comprehensive across several departments |

Using ROI software smartly lets businesses track and predict financial outcomes. This forecasting helps companies stay flexible in ever-changing markets. So, investment tools and ROI software are key to a modern financial strategy.

Real-World Examples of ROI

Looking into ROI case studies offers insights into good financial planning. For example, consider when a $2,000 ad brings in $3,000. This case shows a 50% ROI, proving the ad was profitable. It's crucial to know that high ROI means good profits. At the same time, low or negative ROI suggests it's time to change strategies.

Successful Case Studies Utilizing ROI

Success in areas like finance or Medicare isn't just about quick profits. It involves looking ahead, understanding long-term gains. It's vital to know how much acquiring a customer costs and how valuable they are over time. This is especially important in businesses focused on keeping clients.

Tools like Google Analytics help by providing important data. Platforms like LeadingResponse's Hub make this easier by showing metrics that matter for ROI. Using these tools right can lead to better strategies based on solid facts.

Learning from Failed ROI Calculations

It's important to learn from ROI mistakes to improve in the future. Setting realistic ROI goals helps, guided by industry standards. Discussing what went wrong after a project can help set better goals next time. Acting as a performance consultant can change client relationships for the better.

Understanding how ROI differs from IRR is key. It helps align investments with how you want your money to grow over time. For instance, comparing IRR results of 12% and 29% helps investors choose what fits their financial goals.

FAQ

What Does ROI Stand For in Business?

ROI means Return on Investment in business. It's a way to see how profitable an investment is. It compares the money you make to the money you spent.

How Does Understanding the Concept of ROI Impact Business Decisions?

Knowing about ROI helps leaders and investors choose where to put their money. It shows how likely an investment is to make money. This helps with making smart business plans.

What Are Some Common Misconceptions About ROI?

People often think a high ROI always means a good investment. But they forget about other important things. Like risk, how long it takes to get returns, and how long the returns last.

What Is the Basic Formula for Calculating ROI?

You calculate ROI by taking the investment's current value, subtract the cost, and then divide by the cost. This gives a percentage showing the investment's efficiency.

What Factors Should Be Considered When Calculating ROI?

When calculating ROI, consider more than just the initial cost. Include ongoing costs, gains or losses, and how long you'll invest. Also think about how the value of money changes over time and other investments you could make.

How Does Marketing ROI Differ From Traditional ROI?

Marketing ROI is specific to marketing campaigns. It compares the cost of these efforts to the sales they bring in. It's a special way to see how profitable your marketing is.

What Is Social ROI and Why Is It Important?

Social ROI looks at ROI including its social and environmental effects. It connects to ESG metrics. It's key because it shows the wider effects of investments, like on society and the planet.

How Does ROI Compare to Profit Margin as a Performance Metric?

ROI and profit margin are different. ROI looks at investment efficiency versus its cost. Profit margin is about how much money a company makes from selling. They measure different aspects of financial health.

What Is the Difference Between ROI and Total Return on Investment (TRI)?

ROI is about profits based on the initial cost. TRI includes more, like dividends and capital gains. TRI gives a fuller picture of how an investment does over time.

What Are Some Practical Applications of ROI in Retail and Technology Industries?

In retail, ROI measures product or campaign profits. In tech, it helps justify spending on new solutions. It estimates financial gains versus development costs.

What Are the Challenges Associated With Measuring ROI?

Calculating ROI can be tough. It's hard to get the right data and keep investments separate. You also have to be accurate and consider how long it takes to see returns. Comparing short versus long-term investments is hard.

How Can Tools and Software Improve the Accuracy and Efficiency of Calculating ROI?

Tools and software make calculating ROI better. They can manage complex data and consider different factors and timings. This helps give faster, more accurate analysis for decisions.

Can You Give Examples of How Real-World ROI Case Studies Are Beneficial?

ROI case studies show what works and what doesn't by looking at past investments. They teach good strategies and warn against common mistakes. Understanding trends, consumer behavior, and risks is crucial.