Revealing the Typical Hedge Fund Manager Compensation

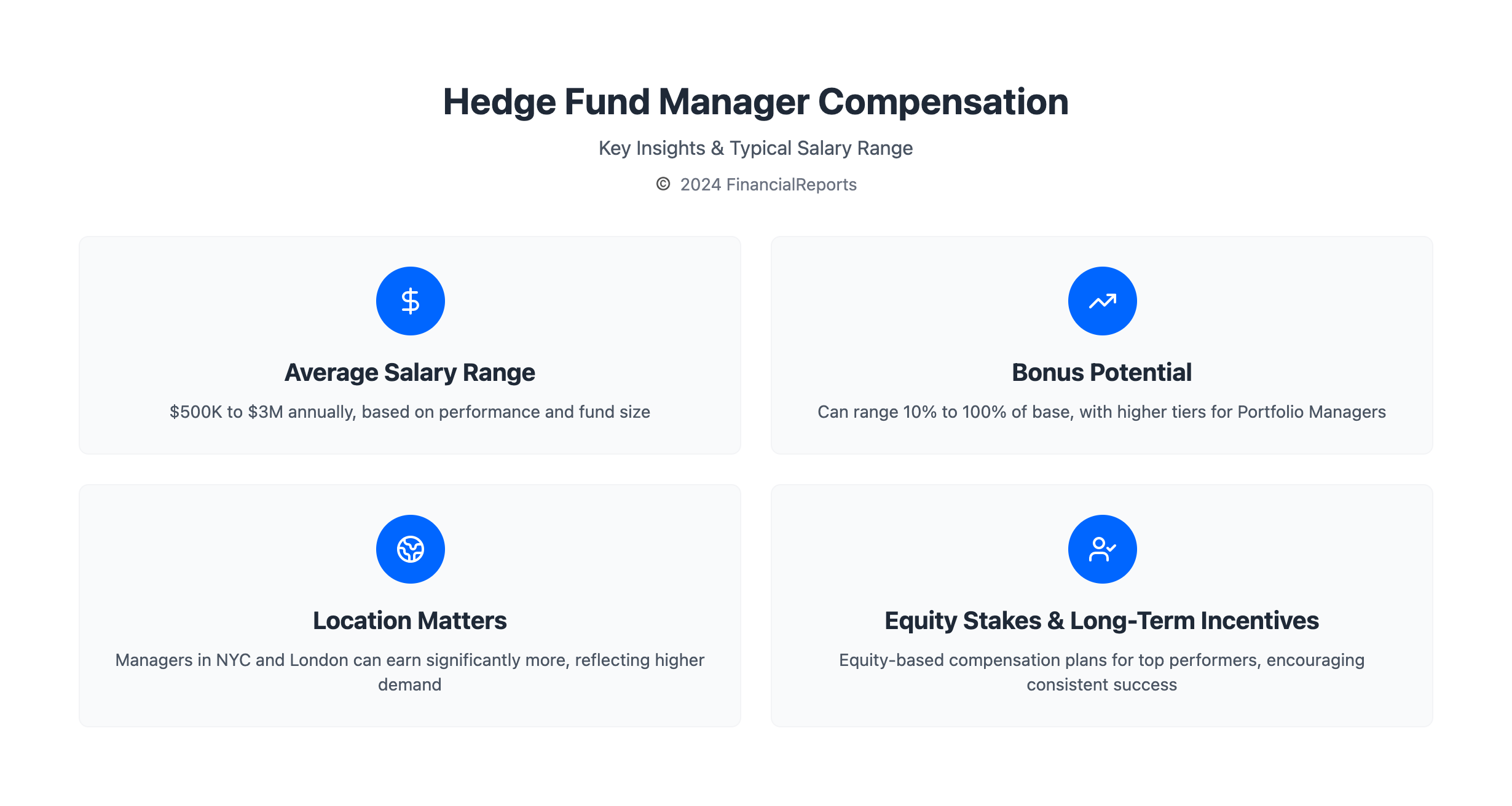

Hedge fund manager salaries are a big deal in finance. People often wonder how much these managers make. Their pay depends on many things, like their skills and the size of their funds. On average, they can earn between $500K and $3 million a year.

Portfolio managers usually make more than analysts. This is because they handle big decisions and manage risks. Their salaries can vary a lot, based on their performance and the size of their funds.

Understanding how hedge fund managers get paid is key. It helps financial pros, investors, and clients. Hedge fund managers can earn more than those in investment banking. This is because their pay is based on how well they do.

Introduction to Hedge Fund Manager Compensation

Hedge fund workers in New York get the highest pay. Those in Chicago and Los Angeles also do well, but a bit less than in New York. Bonuses can be 10% to 100% of their base salary. Portfolio Managers often get the biggest bonuses.

Equity stakes and long-term plans are common too. Hedge Fund Analysts can earn between $200K and $600K. Their pay depends on the fund's size and how well it does.

Key Takeaways

- Hedge fund manager salary ranges from $500K to $3 million USD annually, depending on fund size and performance.

- Base salaries for hedge fund portfolio managers are often capped at less than $200K.

- Total team compensation typically ranges between 10% and 20% of their Profit & Loss (P&L).

- Hedge fund professionals in developed markets like London, New York, and Zurich receive higher salaries compared to those in emerging markets.

- Hedge fund salaries offer higher earnings compared to other financial sectors like investment banking due to their performance-based compensation structures.

- Bonuses in hedge funds can range from 10% to 100% of the base salary, with higher percentages for Portfolio Managers.

Understanding Hedge Funds and Their Structure

Hedge funds collect money from rich people and big investors. They use this money to buy different things, aiming for big profits with less risk. Hedge fund managers can earn between $315,096 and over $4 million, based on the fund's size and success.

These funds use various strategies like long/short equity and global macro to make money. The manager's pay can be 10% to 20% of the profits. Analysts can earn between $75,000 and over $120,000, depending on their skills and how well they do.

What is a Hedge Fund?

A hedge fund is a private investment option for a few investors, needing a big minimum investment. It's popular with big investors like pension funds to add variety and earn more.

Types of Hedge Funds

There are many types of hedge funds, like equity and fixed income funds. Each has its own way of investing and risk level. This means different salaries and pay for their workers.

The Role of Hedge Fund Managers

Hedge fund managers are key to a fund's success. They decide where to invest and manage the portfolio. Their pay and bonuses are based on the fund's performance, encouraging them to do well.

The Factors Influencing Hedge Fund Manager Salaries

Hedge fund manager salaries depend on several key factors. The size and performance of the fund are the main factors. Larger funds with more assets under management (AUM) can offer higher pay. For example, a fund of hedge funds salary can change a lot based on the fund's size and how well it does.

Where the fund is located also matters a lot. Hedge fund pros in big financial centers like New York or London often make more. This is because there's a big demand for skilled people in these places. The hedge fund financial analyst salary is usually higher there.

Manager Experience and Track Record

A manager's experience and past success are key to their pay. The question of how much does a hedge fund manager earn depends on their performance history and the fund's size. Managers with a good track record and managing big funds can earn more.

It's important for those interested in hedge fund management to understand these factors. By looking at fund size, location, and manager experience, they can guess their earnings better. This helps them plan their career paths.

Typical Hedge Fund Manager Salary Ranges

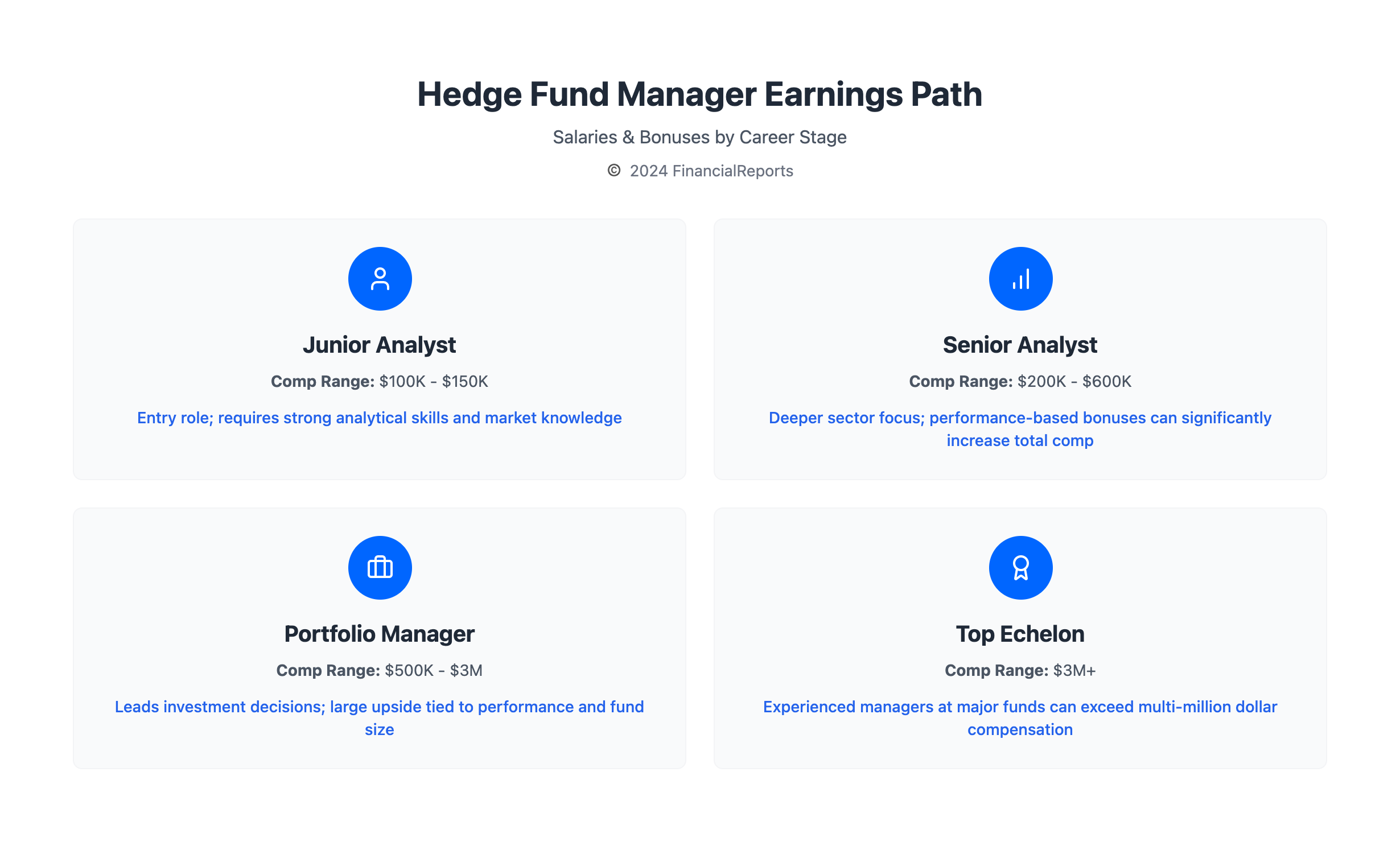

Hedge fund managers are among the highest-paid in finance. To grasp their earnings, we must look at salary ranges by career stage. Hedge fund analyst compensation and investment analyst salary vary with experience and performance.

At the start, junior analysts or research associates earn $100,000 to $150,000. As they grow, they move to analyst, senior analyst, or sector head roles. Salaries for these positions range from $200,000 to over $1 million. Portfolio managers, who decide on investments, can earn much more, sometimes hundreds of millions or billions annually.

| Role | Typical Age Range | Base Salary + Bonus (USD) |

|---|---|---|

| Junior Analyst or Research Associate | 22-25 | $100K - $150K |

| Analyst | 24-30 | $200K - $600K |

| Senior Analyst or Sector Head | 28-33 | $500K - $1 million |

| Portfolio Manager | 32+ | $500K - $3 million |

In summary, hedge fund manager salaries vary greatly. They depend on experience, role, and performance. Knowing these salary ranges is key for those considering a hedge fund career. It shows the high earning potentials for hedge fund analysts or investment analysts.

Incentives and Bonuses in Hedge Fund Compensation

Hedge fund managers earn a lot, with salaries ranging from $200,000 to over $1 million. Bonuses play a big role in their pay, sometimes even exceeding their base salary. The amount they make depends on the fund's size, performance, and location.

Bonuses for hedge fund pros can vary a lot. Those making over $1 million get an average bonus of $350,000. On the other hand, those earning between $100,000 and $300,000 get an average bonus of $23,700 to $104,300. About 20% of professionals now get a guaranteed bonus.

The table below shows the average bonus ranges for hedge fund professionals based on their salary:

| Salary Range | Average Bonus |

|---|---|

| $100,000 - $300,000 | $23,700 - $104,300 |

| $500,000 - $1 million | $193,200 |

| Over $1 million | $350,000 |

To figure out how much a hedge fund manager makes, you need to look at the bonuses and incentives. Knowing these can help aspiring managers understand the industry better. It also helps them make smart choices about their careers.

Comparisons to Other Financial Careers

Hedge fund manager salaries are often compared to other high-paying jobs in finance. This includes investment banking and private equity. The hedge fund analyst pay and hedge fund portfolio manager salary are often higher. This is because they are based on how well the fund performs.

Let's look at salary ranges in different financial careers:

- Investment Banker: $140,000 - $190,000

- Private Equity Manager: $73,948 - $90,300

- Portfolio Manager: $101,726 - $179,861

- Hedge Fund Manager: $54,299 - $76,872 (trader), $122,084 - $155,384 (finance manager)

Thehedge fund research analyst salarycan vary a lot. It depends on experience and how well they do their job.

Here's a table that shows salary ranges for different financial careers:

| Career | Salary Range |

|---|---|

| Investment Banker | $140,000 - $190,000 |

| Private Equity Manager | $73,948 - $90,300 |

| Portfolio Manager | $101,726 - $179,861 |

| Hedge Fund Manager | $54,299 - $76,872 (trader), $122,084 - $155,384 (finance manager) |

Hedge fund manager salaries are competitive with other finance jobs. They can earn a lot through bonuses based on performance.

The Role of Assets Under Management (AUM)

Assets Under Management (AUM) are key in figuring out how much hedge fund managers get paid. Top earners like Ken Griffin have huge AUM, which boosts their salaries and bonuses. For example, in 2021, Chase Coleman of Tiger Global made $1.5 billion, and Ken Griffin of Citadel made over $1.4 billion.

The link between AUM and pay is clear. Hedge fund managers with big AUM can make a lot, sometimes over $100 million in a year. Several things help them earn high salaries:

- Large AUM

- Strong investment returns

- Reputation

- Specialization in niche asset classes

- Strong investor connections

In the US, the median fund manager makes $462k, and the mean is $1.1m. But, the top 5% make an average of $1.3m in salary and $3.3m in bonuses, totaling $4.6m. This shows how AUM greatly affects a manager's pay, with the biggest earners making more due to their large AUM and success.

| AUM Threshold | Salary Range |

|---|---|

| $1 billion - $5 billion | $500k - $2 million |

| $5 billion - $10 billion | $2 million - $5 million |

| Above $10 billion | $5 million - $20 million |

Geographic Variations in Compensation

Compensation for hedge fund managers changes a lot depending on where they work. The top-paying funds are usually in big financial centers like New York and London. In London, for example, portfolio managers can make between £150,000 to £350,000 a year. With bonuses, their total pay can go over £1 million, based on how well the fund does.

The highest salaries for hedge fund managers are often in places where their skills are most in demand. For instance, hedge fund managers in the United States usually earn more than those in Europe or Asia. But, the highest earners are usually in cities like New York or London, where the competition is fierce.

Several factors affect how much money hedge fund managers make in different places. These include:

- Cost of living: Places like New York or London, where living is expensive, pay more to help with costs.

- Market demand: Areas that really need hedge fund managers, like big financial centers, pay more to get the best people.

- Local market conditions: Things like how easy it is to get funding or the local rules can also change how much they earn.

| Region | Average Salary | Average Bonus | Total Compensation |

|---|---|---|---|

| New York | $200,000 | $500,000 | $700,000 |

| London | £150,000 | £300,000 | £450,000 |

| Asia | $150,000 | $200,000 | $350,000 |

In summary, where you work greatly affects how much you can earn in the hedge fund world. The highest paying jobs and the best paid managers are often in major financial centers.

Trends in Hedge Fund Manager Salaries

The global hedge fund market is worth about $5 trillion in 2023. It's expected to grow by more than 3.5% from 2024 to 2032. This growth will likely affect the salaries of top paid hedge fund managers. They are key to the success of best paying hedge funds. The highest paid hedge fund managers can earn over $1 million in bonuses, depending on their performance.

Hedge fund manager salaries have gone up over time. Top paid hedge fund managers now earn more in salaries and bonuses. The demand for skilled managers is high, which drives up their pay. Looking ahead, salaries and bonuses are expected to keep rising, making best paying hedge funds even more attractive.

Some important facts about hedge fund manager salaries are:

- Entry-level portfolio managers earn between $150,000 to $250,000 annually.

- Mid-career portfolio managers typically make between $250,000 to $500,000 per year.

- Senior portfolio managers earn $500,000 or more annually, with experienced managers at large firms potentially exceeding $1 million.

| Level of Experience | Annual Salary Range |

|---|---|

| Entry-level | $150,000 - $250,000 |

| Mid-career | $250,000 - $500,000 |

| Senior | $500,000+ |

Case Studies of High-Earning Hedge Fund Managers

The hedge fund industry is known for its high pay, with top managers earning millions each year. To understand their high earnings, we need to look at their careers. The hedge fund ceo salary varies widely, from hundreds of thousands to millions, based on the fund's size and success.

Success Stories from the Industry

Managers like Ken Griffin, Stanley Druckenmiller, and Bruce Kovner have seen great success. Their paths and pay offer insights into what leads to their high earnings. For example, Ken Griffin's hedge fund ceo salary is among the highest, with a net worth of $5.9 billion as of July 2023.

- Ken Griffin, Citadel Investment Group: $16 billion in returns in 2022

- Stanley Druckenmiller, Duquesne Family Office: $6.4 billion net worth as of 2023

- Bruce Kovner, Caxton Associates: $6.6 billion net worth as of 2023

Lessons Learned from Top Performers

Looking at the careers of highest earning hedge fund managers shows their success comes from many factors. These include their investment strategies, risk management, and ability to adjust to market changes. By studying these top performers, aspiring managers can learn the skills and strategies needed for success.

Conclusion: What to Expect in Hedge Fund Manager Salaries

The hedge fund industry offers big paychecks, but it's not easy. Hedge fund manager salaries vary a lot. They depend on fund size, performance, experience, and market demand.

Starting jobs might pay $70,000 to $150,000. But top managers at big funds can make multi-million dollar salaries.

To earn more, you need to keep learning and get better at your job. Focus on building your investment skills and managing risks well. Also, it's important to build strong relationships with clients and other industry professionals.

By staying on top of market trends and beating the competition, you can find the best jobs. This way, you can make the most money in this fast-paced field.

FAQ

What is the typical hedge fund manager salary?

Hedge fund manager salaries vary a lot. Top managers can earn millions. Their pay depends on the fund's size, how well it does, where they work, and their experience.

How do hedge fund manager salaries compare to other financial careers?

Hedge fund managers often earn more than those in investment banking, private equity, and regular portfolio management. They can get big bonuses and share in profits, which boosts their pay.

What role does assets under management (AUM) play in hedge fund manager salaries?

AUM is key in setting manager pay. Managers of big funds get paid more because they handle more money. Reaching certain AUM levels can really increase what they earn.

How do hedge fund manager salaries vary across different geographic regions?

Pay for hedge fund managers changes with location. Big financial centers like New York and London pay the most. This is because of the high cost of living and demand for talent. Even smaller cities are trying to attract top managers with good salaries.

What are the key trends in hedge fund manager compensation?

Manager pay has changed over time due to market shifts and rules. Today, the best performers get high pay. Experts predict salaries will keep growing based on the industry's outlook.

Can you provide examples of exceptionally high-earning hedge fund managers?

Yes, the article shares stories of top hedge fund managers who made a lot of money. These examples show how their success was tied to their fund's performance, AUM, and their skills.