Quantitative Risk Analysis - Essential Guide

Quantitative risk analysis is key in managing risks for organizations. It helps them understand and reduce possible risks. Financial experts use it to look at the chances and effects of dangerous events, showing results in numbers.

This method is vital for handling cyber risks, following rules, and using resources well. It measures risks in money terms, chances, or other numbers. This helps in making smart choices.

Quantitative risk analysis is used in many areas like cybersecurity, following rules, and making financial choices. It helps find threats, sort them by risk and impact, and find ways to lessen them. With it, companies can stay safe, protect their assets, and follow the law. This guide will explain how to use quantitative risk analysis well.

Introduction to Quantitative Risk Analysis

Quantitative risk analysis is a way to look at the chances and effects of bad events. It uses math to figure out risks based on how big they are and how likely they are. This helps companies understand the chances of a project's success with the risk info they have.

By getting good at quantitative risk analysis, companies can handle cyber risks well, use resources wisely, and find ways to fix problems.

Key Takeaways

- Quantitative risk analysis is a structured method for evaluating likelihood and consequences of hazardous events.

- It enables organizations to manage cyber risks effectively and ensure compliance with standards.

- Quantitative risk analysis measures risks in terms of monetary values, probabilities, or other quantitative metrics.

- It involves identifying threats, prioritizing them based on likelihood and potentially impact, and implementing effective mitigation strategies.

- Quantitative risk management is critical for organizations to allocate resources efficiently and ensure operational resilience.

- Quantitative risk analysis allows understanding the probability of success of a project given the current risk information.

- It is a process within the Risk Management Knowledge Area, typically performed alongside qualitative risk analysis.

Introduction to Quantitative Risk Analysis

Quantitative risk analysis uses data to evaluate risks. It helps businesses understand the chances of risks happening and their possible effects. This method is key for making smart choices and creating strong risk management plans.

With quantitative risk analysis, companies can check if they will meet their goals. They can also figure out the possible results of business problems. This is very helpful for big risks where knowing the chances is critical for fixing them.

Definition and Importance

Quantitative risk analysis calculates risk based on data to find the cost impact on a business. It's a strong tool for management. It helps companies make fair judgments and plan specific ways to reduce risks.

Key Concepts in Risk Analysis

Important ideas in risk analysis include Single Loss Expectancy (SLE), Annual Rate of Occurrence (ARO), and Annual Loss Expectancy (ALE). These help figure out the value of risks and the cost of fixing them. By mixing qualitative and quantitative methods, efficiency can improve. This leads to better security and accurate risk value assessments.

Quantitative risk analysis has many benefits:

- It's objective in assessment

- It's a powerful management tool

- It clearly shows cost and benefit

- It can be tailored to fit different industries or situations

| Concept | Description |

|---|---|

| Single Loss Expectancy (SLE) | The expected loss from a single occurrence of a risk event |

| Annual Rate of Occurrence (ARO) | The expected frequency of a risk event per year |

| Annual Loss Expectancy (ALE) | The expected loss from a risk event per year |

The Role of Quantitative Risk Analysis in Business

Quantitative risk analysis is key in making business decisions and strategies. It uses stats to understand financial risks. This helps companies make smart choices and use resources well.

It involves using numbers and complex data to figure out the chance of certain events. These events can affect the company in big ways.

This method gives clear, numeric data. It helps make decisions without confusion. It also helps sort out risks, so companies can tackle the biggest ones first.

It's also good for planning finances. It shows how risks could affect money and how much money should be set aside for them.

Some big pluses of quantitative risk analysis are:

- It makes talking about risks clearer with numbers

- It keeps an eye on risks and checks if plans are working

- It leads to better risk management with data

Finance, healthcare, and construction use it to assess risks well. This helps prevent big losses. By managing risks, companies can do better and reach their goals.

| Industry | Application of Quantitative Risk Analysis |

|---|---|

| Finance | Portfolio management and market risk assessment |

| Healthcare | Quantifying the likelihood of success for new drugs or treatments |

| Construction | Assessing and quantifying risks related to supplier reliability and production delays |

Key Techniques in Quantitative Risk Analysis

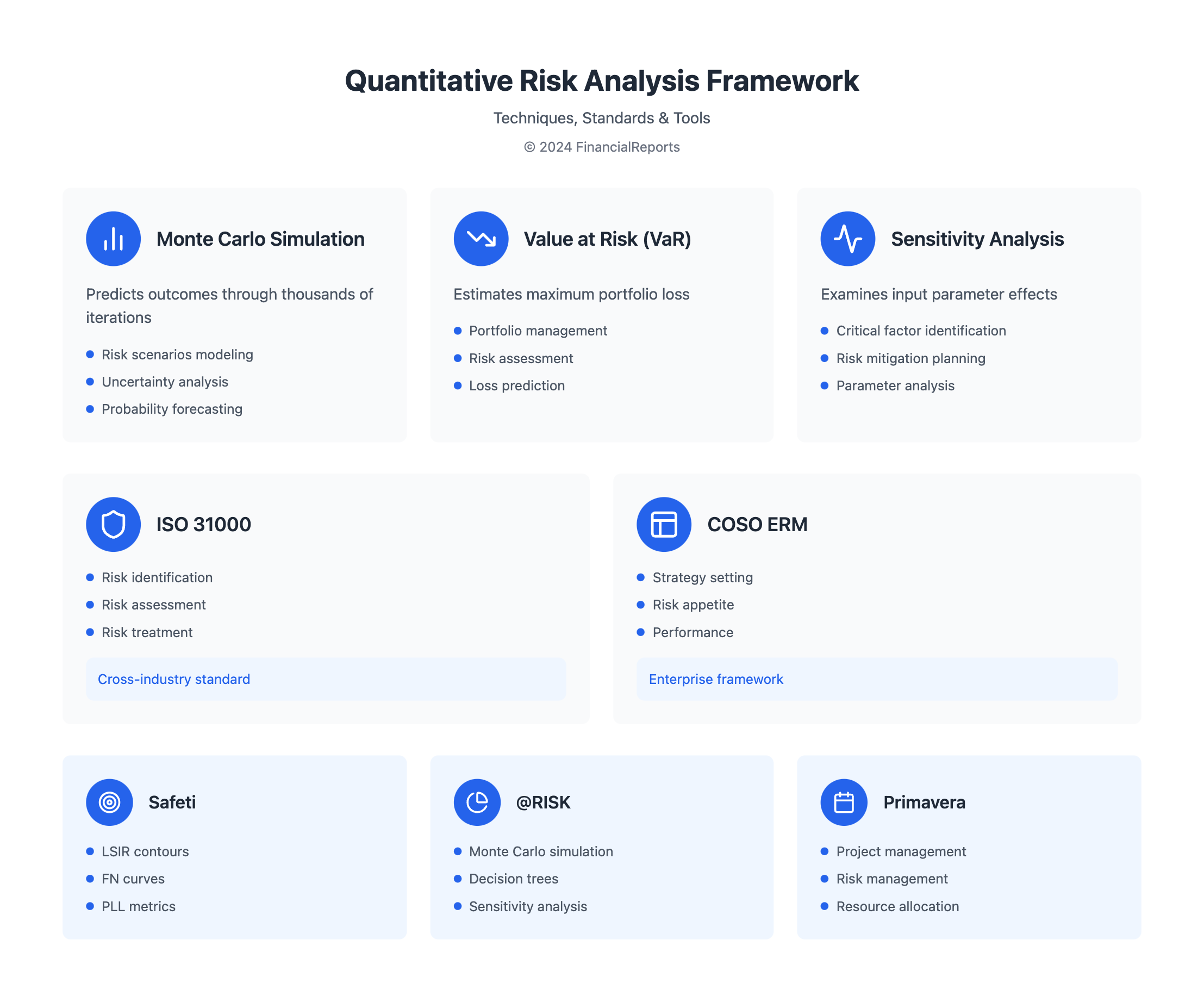

Quantitative risk analysis uses advanced methods to understand and manage risks. Techniques like Monte Carlo simulation, Value at Risk (VaR), and sensitivity analysis are key. These help organizations manage risks more precisely, reducing their impact on operations.

Monte Carlo Simulation

Monte Carlo simulation is a popular method in risk assessment. It uses many iterations to predict possible outcomes. This technique helps organizations understand and manage their risks better.

Value at Risk (VaR) and Sensitivity Analysis

Value at Risk (VaR) estimates the maximum loss of a portfolio. Sensitivity analysis looks at how changes in inputs affect outcomes. These methods help businesses understand and manage their risks more effectively.

The following table shows how these techniques are used in risk analysis:

| Technique | Description | Application |

|---|---|---|

| Monte Carlo Simulation | Generates probabilistic results by running thousands of iterations | Predicting risk scenarios and capturing uncertainty |

| Value at Risk (VaR) | Estimates the maximum possible loss of a portfolio | Quantitative risk assessment and portfolio management |

| Sensitivity Analysis | Examines how variations in input parameters affect outcomes | Identifying critical risk factors and developing mitigation strategies |

Using these techniques, organizations can make better decisions. They can manage technical quantitative risk more effectively, helping them achieve their goals.

Data Collection for Quantitative Risk Analysis

Quantitative risk analysis uses numbers to measure risks. This makes outcomes clear and objective. To get this right, you need good data. This data comes from past incidents, threat intelligence, and lists of assets.

After collecting data, it's checked for accuracy. Any mistakes can mess up risk assessments. To avoid this, quality control steps are taken. These steps include checks and models to make sure data is reliable.

Quantitative risk analysis gives detailed insights into risks. This helps in making good plans to reduce risks. On the other hand, qualitative risk analysis depends more on what experts think.

Some important tools for quantitative risk analysis are:

- Expected Monetary Value (EMV) calculations

- Monte Carlo simulations

- Decision trees

- Time series analysis

These tools help understand risks and make better decisions. By using these methods, businesses can predict better and make smarter choices. This improves how we use global financial data.

| Technique | Description |

|---|---|

| Expected Monetary Value (EMV) | A method used to calculate the expected value of a decision |

| Monte Carlo simulations | A method used to model and analyze complex systems |

| Decision trees | A visual representation of a decision-making process |

| Time series analysis | A method used to analyze and forecast data over time |

Risk Assessment Frameworks

Organizations have two main choices for risk assessment: qualitative and quantitative. Qualitative risk analysis uses scenarios and is more subjective. On the other hand, quantitative risk analysis gives a number to each risk. Both methods have their uses in risk assessment frameworks.

A good risk assessment process finds, measures, and reduces risks. Frameworks like ISO 31000 and COSO ERM help with this. They guide risk management and make sure it fits with the company's goals.

Key Frameworks

- ISO 31000: A widely recognized standard for risk management, applicable across industries.

- COSO ERM: A framework providing detailed methodologies for enterprise risk management.

Using these frameworks with quantitative risk analysis helps companies make better decisions and follow rules. The choice between qualitative and quantitative risk analysis depends on what the company needs. But using both can give a full picture of risks and help find ways to reduce them.

Tools and Software for Quantitative Risk Analysis

Quantitative risk analysis and management are key for smart decisions in organizations. Many tools and software help with these tasks. For example, Safeti is a software that combines consequence analysis and risk management. It offers metrics like LSIR contours, FN curves, and PLL.

Look for tools with easy-to-use interfaces and real-time data. They should also work well with systems like ERP and CRM. Here are some top risk analysis software:

- Safeti

- Palisade's @RISK

- Oracle's Primavera

Choose a tool that fits your organization's needs. It should handle complex data well. The right tools help make better decisions with big data.

| Software | Features | Industry |

|---|---|---|

| Safeti | Consequence analysis, risk management, LSIR contours, FN curves, PLL | Gas transmission pipelines, occupied buildings risk assessment |

| Palisade's @RISK | Monte Carlo simulation, decision tree analysis, sensitivity analysis | Finance, insurance, energy |

| Oracle's Primavera | Project management, risk management, resource allocation | Construction, engineering, IT |

Implementing Quantitative Risk Analysis in Organizations

To successfully use quantitative risk analysis, a clear plan is needed. First, set goals and gather the right data. Then, pick the best tools and methods. This helps businesses spot, measure, and sort risks, guiding big decisions.

Getting everyone on board is also key. It's about sharing information clearly to build trust in making decisions based on risk. When goals and risk strategies match, companies can use resources wisely and cut down on losses.

Here are some top tips for starting quantitative risk analysis:

- Use statistical models like regression and Monte Carlo simulations to figure out risk chances and effects

- Do scenario and stress tests to see how things might play out

- Use numbers for managing risk in portfolios and for reports

By taking these steps and following these tips, companies can really get into quantitative risk analysis. This boosts their ability to handle and lessen risks.

| Quantitative Risk Analysis Benefits | Description |

|---|---|

| Risk Identification | Using statistical models to understand risk chances and effects |

| Resource Optimization | Using risk numbers to decide where to put resources |

| Compliance and Reporting | Using numbers to meet rules and report |

Challenges in Quantitative Risk Analysis

Starting quantitative risk analysis can be tough. Companies often struggle to get it right. They face issues like not having enough good data, which can cause inaccurate results.

Using old methods and not understanding results well can also make things harder. These problems can stop quantitative risk analysis from working well.

Common Pitfalls and Errors

- Limited access to accurate data

- Reliance on outdated methodologies

- Misinterpretation of results

To beat these challenges, companies can try technical quantitative risk methods. For example, the Expected Monetary Value technique helps by using numbers to figure out risks. This way, companies can make better choices and feel less unsure.

Quantitative methods are different from qualitative risk assessment because they are more based on facts. They give a clearer view of risks than methods that rely more on opinions.

Addressing Uncertainty and Assumptions

It's key to deal with uncertainty and assumptions in quantitative risk analysis. Companies can use data and models to improve their guesses and check them against real results. This helps them make better choices.

The main goal is to know how likely success is. Data helps create models or simulations to see if goals will be met.

Case Studies in Quantitative Risk Analysis

Quantitative risk analysis has been a game-changer in many industries. It helps financial institutions understand portfolio risks and cybersecurity firms predict data breaches. This shows how it can be a powerful tool.

One of the key benefits of quantitative risk analysis is its flexibility. It can be tailored to fit different scenarios. Real-world examples show how this flexibility leads to better results, depending on the organization's needs.

Industry-Specific Applications

In mining, quantitative risk analysis helps assess mega project risks. These include access roads, creek protection, and power elements. The risks from these elements were found to be much higher than the tailings dam's risk, leading to a project halt.

Another example is in power-generation refurbishment projects. Here, quantitative risk analysis found a 35% contingency. This was based on the probability and cost impact of each item, following Project Management Institute standards.

Lessons Learned from Real-World Scenarios

These examples show the value of quantitative risk analysis in mining and industrial projects. It's key for making informed decisions on insurance and buffer stock sizing. It helps prioritize and compare risks effectively.

By studying these cases, businesses can learn from successes and challenges. This knowledge is vital for shaping their own risk management strategies. It also emphasizes the need to choose the right risk analysis approach for each situation.

Conclusion: The Future of Quantitative Risk Analysis

Business operations are getting more complex, and quantitative risk analysis is playing a bigger role. New tech like AI and machine learning will change how we handle risks. With predictive analytics, companies can spot threats early and improve their risk plans.

The future of quantitative risk analysis depends on businesses being ready to adapt. As rules and trends change, keeping up is key to staying ahead. Tools like Centraleyes make it easier to assess risks and make smart choices fast.

Using technical quantitative risk analysis will help companies face the challenges of today's business world. By being proactive, leaders can set their companies up for success. This ensures their businesses can grow and thrive over time.

FAQ

What is Quantitative Risk Analysis (QRA)?

Quantitative Risk Analysis uses data to measure risks. It looks at how likely risks are and what might happen. This method uses math and statistics, unlike the guesswork of other methods.

Why is Quantitative Risk Analysis important for businesses?

It helps businesses make smart choices and plan their finances well. By using numbers, companies can see how much risks might cost and how likely they are. This helps leaders plan better and grow stronger.

What are the key techniques used in Quantitative Risk Analysis?

Important techniques include Monte Carlo Simulation, Value at Risk (VaR), and Sensitivity Analysis. These tools help companies understand and manage risks better.

What are the essential data sources for Quantitative Risk Analysis?

Good data is key for QRA. Companies need to find and use reliable sources like past records and threat reports. Making sure the data is right is very important.

How can organizations effectively implement Quantitative Risk Analysis?

To do QRA well, follow a clear plan. First, set goals, then gather data, and pick the right tools. Getting everyone on board and sharing information is also critical.

What are the common challenges in Quantitative Risk Analysis implementation?

Challenges include not having the right data and using old methods. To avoid these, keep improving your approach and check it against real results.

How is Quantitative Risk Analysis applied in different industries?

Looking at how QRA works in different fields can teach a lot. For example, banks use it to check their investments, and tech companies use it to protect against cyber threats. Each story shows how QRA can be adapted to fit specific needs.