Proven Strategies to Earn Income with Options Trading

Options trading can be very profitable, but you need to know the strategies and risks. To succeed, you must learn about option trading tips and techniques. With the right knowledge, options trading can be a big source of income. It's key to understand the market and the different strategies you can use.

Many investors use covered calls, collars, and married puts, which are good when you own shares. These strategies can help you earn money and manage risks. For example, long straddles and strangles can profit from market changes. Bull call spreads and bear put spreads are good for those who think the market will go up or down.

Introduction to Options Trading

Knowing how to make money with options is vital for success. Tips like using spreads and protective collars can help you deal with options trading's complexities. With 80% of new traders using long calls, it's clear this method can be effective for earning income.

Key Takeaways

- Options trading can be a lucrative way to earn income with the right strategies and risk management.

- Covered calls, collars, and married puts are popular strategies for investors with existing positions in underlying shares.

- Long straddles and strangles can be used to profit from market movements, while bull call spreads and bear put spreads can be beneficial for investors with bullish or bearish sentiments.

- Understanding option trading tips, such as using spreads and protective collars, is essential for success in the market.

- 80% of beginner options trading strategies include the use of long calls, making it a popular approach for earning income.

- Effective risk management, such as using married put strategies, can help investors protect against downside risk and earn income.

Understanding Options Trading Basics

Options trading can seem complex and scary for beginners. But, with the right knowledge, it can help you make smart investment choices. First, you need to know the basics, like what options are, the different types, and important terms.

If you want to learn how to make money with options, start with the basics. Options for beginners should focus on understanding the concepts and strategies of options trading.

What are Options?

Options are contracts that let you buy or sell an asset at a set price before a certain date. They help you speculate on asset prices or protect against losses.

Types of Options: Calls and Puts

There are two main options: calls and puts. A call option lets you buy an asset, while a put option lets you sell it. Knowing the difference is key for smart investing.

Key Terminology in Options Trading

Important terms include strike price, expiration date, and premium. The strike price is the asset's buying or selling price. The expiration date is when the option can no longer be used. The premium is the option's price.

Understanding these basics helps you start a strategy for how to make money with options. Whether you're new or experienced, staying current with market trends is vital for success in options trading.

Benefits of Trading Options

Trading options has many benefits, like using investments wisely and protecting against market risks. By learning how to make money with stock options, investors can find new ways to grow and profit. First, it's key to know how to start trading options. This means learning about the different types of options and what they're based on.

Leveraging Investments with Options

Options let investors use their money more efficiently, entering the market at lower costs than buying stocks directly. This can lead to bigger profits, as options can make gains bigger. For instance, a stock buyer might see a 25% profit, but an options trader could see a 400% return.

Flexibility and Adaptability in Trading

Options trading is flexible and adaptable. Investors can use call and put options to make money from price changes. This lets traders change their plans based on the market and their goals. Some main benefits of options trading are:

- Cost-efficient leveraging power

- Hedging against market risks

- Flexibility and adaptability in trading

- Potential for high returns over a short period

Understanding the benefits of trading options and how to start can help investors make smart choices. Whether you want to grow your investments or protect them, options trading has many chances for success.

How to Choose the Right Options Strategy

Choosing the right options strategy is key to success in trading. Traders need to think about market conditions, their risk tolerance, and the asset's price movement. Option trading tips stress the need to know these factors to make more money and lose less.

Options can be used for hedging, making income, or speculating on asset prices. With many strategies out there, starting with a few simple ones is best. How to make money trading options means understanding how market liquidity, volatility, and direction affect your strategy.

Factors to Consider Before Trading

Before you trade, think about these things:

- Market conditions: Is it trending or ranging?

- Volatility: Will it go up or down?

- Risk tolerance: What loss can you handle?

- Timeframe: When does the option expire?

Personal Risk Tolerance

Knowing your risk tolerance is critical in options trading. Strategies like single-leg long options and multi-leg options help manage risks. But selling naked options, with unlimited risk, needs more capital and margin.

| Strategy | Risk Level | Potential Profit |

|---|---|---|

| Single-leg long options | Defined | Limited to the cost |

| Multi-leg options | Defined | Defined by the trade |

| Selling naked options | Unlimited | Potentially high |

By considering these factors and knowing the different strategies, traders can make better choices. This increases their chances of success in the market.

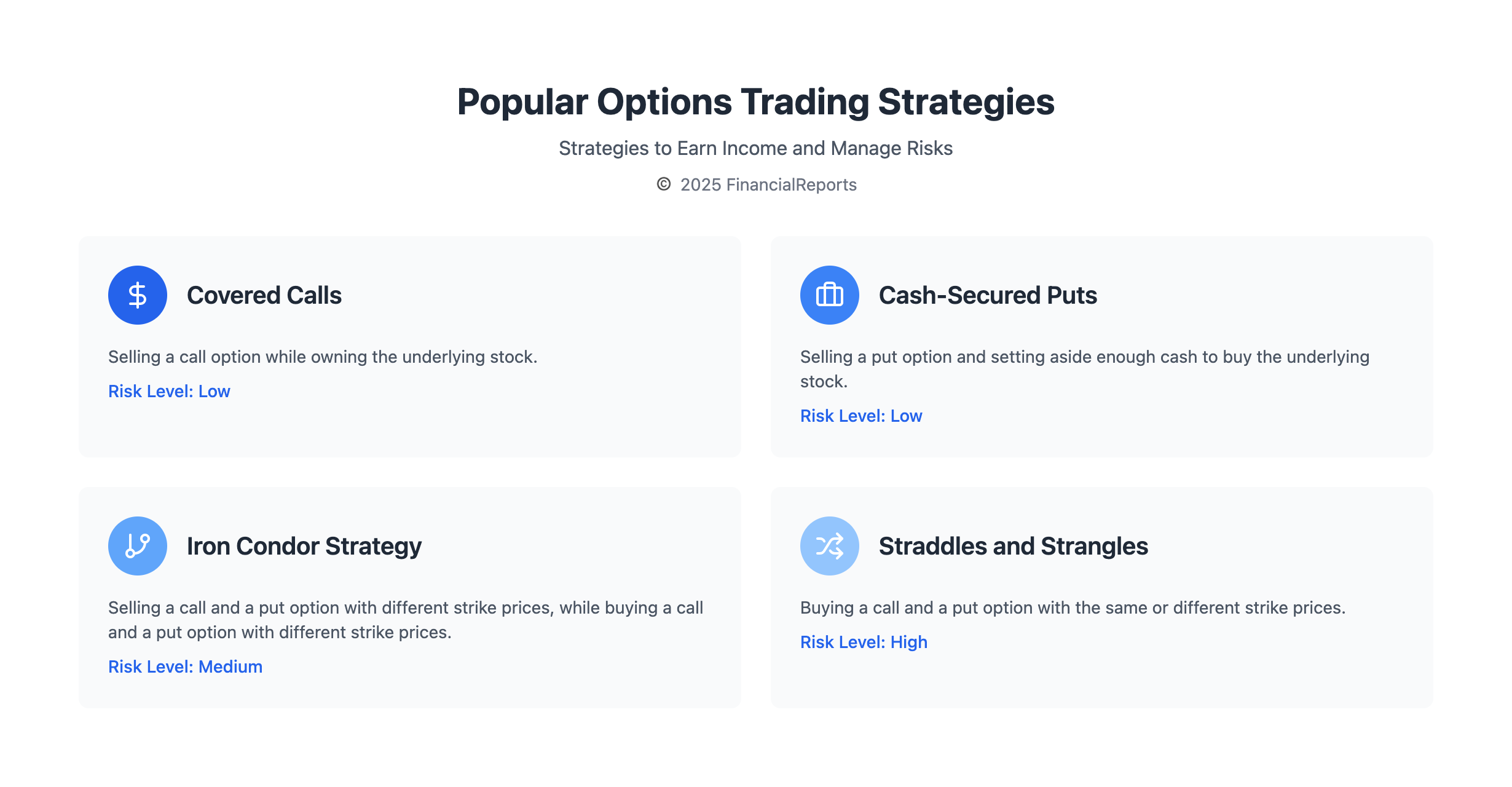

Popular Options Trading Strategies

Options trading offers many strategies to make money. A common question is do i need a bunch of cash to trade options. The answer is no, thanks to leverage. This means you can manage big positions with a small amount of money. To learn how to earn money in options trading, knowing the various strategies is key.

Some popular options trading strategies include:

- Covered calls: This involves selling a call option while owning the underlying stock.

- Cash-secured puts: This involves selling a put option and setting aside enough cash to buy the underlying stock if the option is exercised.

- Iron condor strategy: This involves selling a call option and a put option with different strike prices, while buying a call option and a put option with different strike prices.

- Straddles and strangles: These involve buying a call option and a put option with the same strike price, or buying a call option and a put option with different strike prices.

These strategies help earn income, protect against losses, or speculate on price changes. By learning about these strategies and how to earn money in options trading, traders can make better choices. This can lead to higher profits.

| Strategy | Description | Risk Level |

|---|---|---|

| Covered Calls | Selling a call option while owning the underlying stock | Low |

| Cash-Secured Puts | Selling a put option and setting aside enough cash to buy the underlying stock | Low |

| Iron Condor Strategy | Selling a call option and a put option with different strike prices, while buying a call option and a put option with different strike prices | Medium |

| Straddles and Strangles | Buying a call option and a put option with the same strike price, or buying a call option and a put option with different strike prices | High |

Analyzing Market Trends for Options Trading

To succeed in options trading, understanding market trends is key. It helps traders make smart investment choices. Knowing how to make money using options and using good option trading tips is vital.

There are many ways to analyze market trends. Tools like charts and indicators help spot patterns. Also, understanding market sentiment is important. It helps traders predict the market's mood and make better choices.

Technical Analysis Tools for Options

Tools like moving averages and the relative strength index (RSI) are useful. They help traders see trends and predict price changes. This knowledge helps in making informed investment decisions.

Utilizing Fundamental Analysis

Fundamental analysis looks at what affects an asset's price, like earnings and economic data. Mixing technical and fundamental analysis gives a deeper market understanding. This leads to better trading decisions.

When analyzing market trends for options trading, consider these factors:

- Market volatility

- Economic indicators, such as inflation and GDP growth

- Company earnings reports and financial statements

- Industry trends and competitor analysis

By understanding market trends and using effective option trading tips, traders can boost their success. They can learn how to make money using options.

| Technical Analysis Tool | Description |

|---|---|

| Moving Averages | Used to identify trends and predict future price movements |

| Relative Strength Index (RSI) | Used to measure the magnitude of recent price changes and identify overbought or oversold conditions |

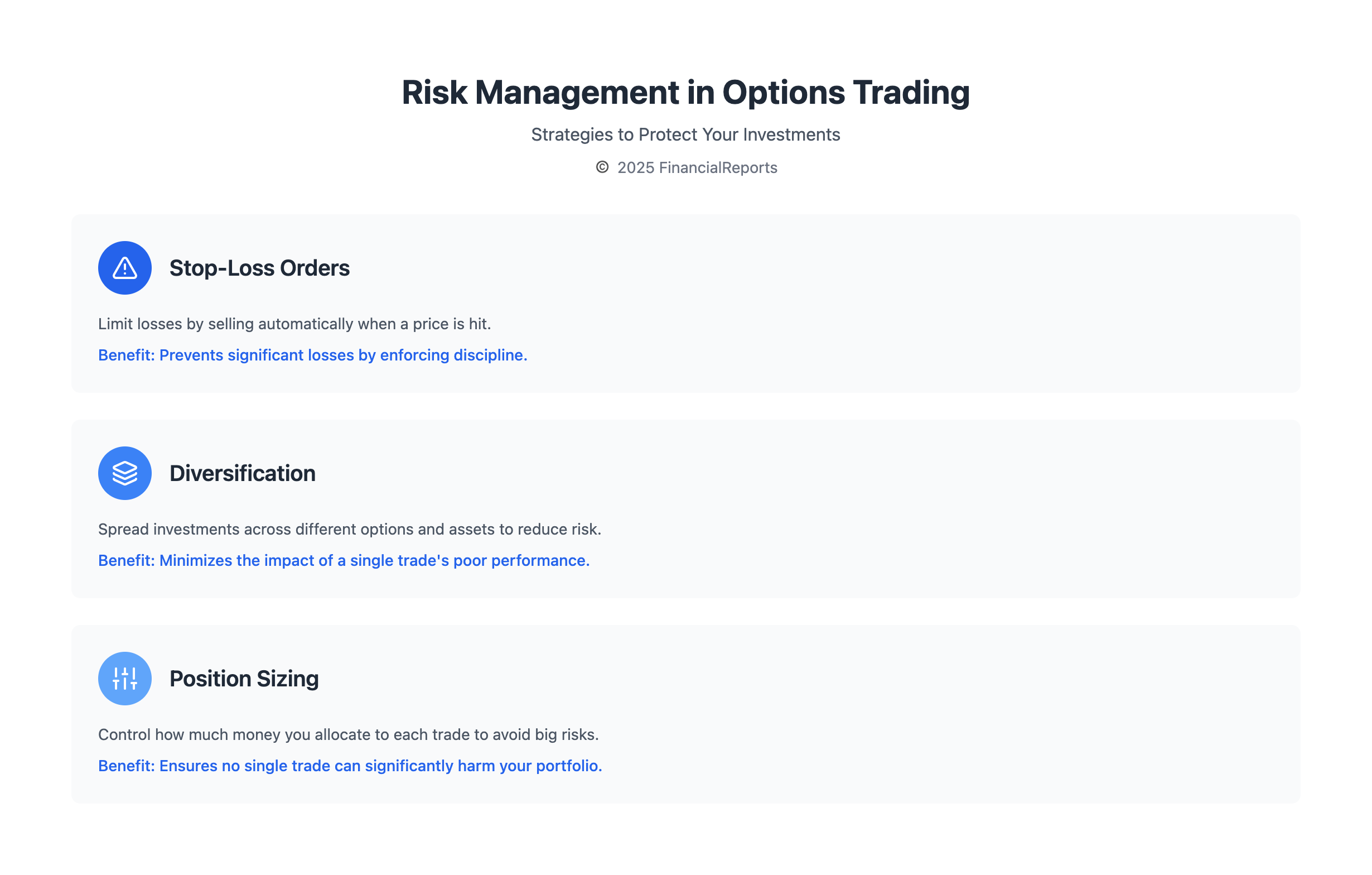

Risk Management in Options Trading

Learning how to make money with options requires good risk management, which is key for beginners. It means setting stop-loss orders, spreading out your investments, and controlling how much you invest. This helps keep losses small.

Understanding the risk of options is important. It's about matching the risk of options to the risk of stocks. This way, you can handle your risks better and avoid big losses. Options let you control more with less money, but this means you could lose more too.

To manage risk, you can use several strategies. Here are a few:

- Set stop-loss levels and profit targets

- Spread your investments across different options and assets

- Control how much you invest in each trade

By using these strategies, you can manage your risks well. This is true whether you're new to options or have experience. Risk management is key to reaching your investment goals.

| Strategy | Description |

|---|---|

| Stop-Loss Orders | Limit losses by selling automatically when a price is hit |

| Diversification | Spread investments across different options and assets to reduce risk |

| Position Sizing | Control how much money you put into each trade to avoid big risks |

Using Options for Income Generation

Investors can make money with stock options in different ways. They can write options for premiums or use dividends with options. To start, it's key to know the basics of options trading. Selling call options on stocks you own is a common strategy.

For instance, if you own 100 shares of ABC stock, you can sell 1 ABC 55 call for $1. This brings in $100 from the premium. This method can offer a steady income. It works well with dividend-paying stocks too.

The table below shows the possible outcomes of this strategy:

| Scenario | Stock Price at Expiration | Profit from Selling Calls | Unrealized Profit/Loss |

|---|---|---|---|

| 1 | $54 | $100 | $400 |

| 2 | $50 | $100 | $0 |

| 3 | $45 | $100 | -$500 |

| 4 | $40 | $100 | -$400 |

| 5 | $60 | $100 | $1,100 |

By learning how to make money with stock options, investors can earn income. They can also reduce risk in their portfolios. This is done through various strategies, like writing options for premiums and using dividends with options.

Tools and Platforms for Options Trading

For successful options trading, having the right tools and platforms is key. Options trading platforms like E*Trade and InteractiveBrokers offer many features. These include easy-to-use interfaces, educational tools, and advanced features.

When searching for option trading tips, check the platform's fees. Some platforms offer free trades, while others charge per contract.

Best Trading Platforms for Beginners

Beginners can start with platforms like Merrill Edge. It has a user-friendly interface and tools like the Options Strategy Assistant. For those new to trading options, platforms like tastytrade are great. They offer good prices and lots of educational resources.

Software and Tools for Options Analysis

Advanced traders can use software like Option Alpha's 0DTE Oracle tool. It's for trading SPX with cash settlement and favorable tax treatment. This tool gives pre-calculated trading ideas and lets you place orders instantly. It's a great tip for improving your returns.

| Platform | Fees | Features |

|---|---|---|

| tastytrade | $0.50 per contract | Competitive pricing, educational resources |

| Interactive Brokers | $0.65 per contract | Lowest margin rates, access to global markets |

| E*TRADE | $0.65 per contract | Beginner-friendly platform, user-friendly tools |

Choosing the right platform and tools can help traders succeed. They can learn valuable tips on making money trading options.

The Importance of Continuous Learning

Continuous learning is key for success in options trading. It helps traders keep up with market changes and new trends. To earn money in options trading, you need to spend time learning and getting better at it. It's more important to understand the market than to have a lot of money.

A Pew Research Center survey found that 87% of workers value learning new skills. This is true for options trading, where the market is always changing. By staying informed, traders can make better choices and boost their success.

Staying Updated on Market Changes

Keeping up with market changes is vital for options traders. It lets them find new chances and tweak their plans. Here are ways to do it:

- Following financial news and market analysis

- Attending webinars and workshops

- Participating in online forums and discussion groups

Networking with Other Traders

Networking with other traders is also key. It lets you share and learn from others. You can join online groups, social media, or go to events to connect.

Common Mistakes to Avoid in Options Trading

Options trading can be tricky, even for seasoned traders. To boost profits and cut losses, knowing how to use options wisely is key. It's vital to steer clear of mistakes that can upset your trading plan.

About 60% of traders lack a clear strategy, leading to rash decisions and big losses. Those who act on emotions can lose up to $5,000. But, traders who stick to a risk plan see an 80% success rate.

Key Mistakes to Avoid

- Lack of diversification: Not spreading out your investments can cause big losses if one trade fails.

- Insufficient understanding of the Greeks: Not knowing about delta, gamma, vega, and theta makes options trading tough.

- Inadequate risk management: Not using stop-loss orders and managing trade sizes can lead to big losses.

To sidestep these errors, create a solid trading plan, stay focused, and keep learning about options trading. This way, you'll make better choices and boost your chances of success.

| Mistake | Percentage of Traders | Average Loss/Return |

|---|---|---|

| No defined strategy | 60% | $5,000 loss |

| Lack of diversification | 75% | N/A |

| Insufficient understanding of the Greeks | 50% | N/A |

Knowing these common pitfalls and how to avoid them can improve your trading strategy. Always follow tested tips and keep up with market trends to increase your earnings in options trading.

Conclusion: Mastering Options Trading for Profit

Mastering options trading takes time, dedication, and a commitment to learning. The strategies and insights shared here are a good start. But success comes from adapting, refining, and applying these principles consistently.

Long-Term Strategies for Success

Successful options traders know it's not a quick way to make money. It's a disciplined way to make consistent income over time. By building a strong trading routine, managing risk well, and always learning, you can grow in the options market.

Building a Trading Routine

Having a consistent trading routine is key for options traders. It means setting aside time for market research and analyzing strategies. A structured approach helps you avoid emotional decisions and stay disciplined in the fast-changing options market.

Final Thoughts on Options Trading

Options trading is full of opportunities for those who are patient and willing to work. Whether you're new or looking to improve, remember options can help you earn income and manage risk. Stay committed to your goals and let these lessons guide you to success in options trading.

FAQ

What are options and how do they work?

Options are financial contracts that let you buy or sell something at a set price later. They offer flexibility and leverage in the markets.

What are the main types of options?

There are two main types: call options and put options. Call options let you buy something, while put options let you sell.

What are the possible benefits of trading options?

Options trading can offer leverage, flexibility, and risk management. They can help you earn income, speculate, and protect your portfolio.

How do I choose the right options trading strategy?

Choose a strategy based on your risk tolerance, market conditions, and goals. Understand the risks and rewards of each strategy.

What are some popular options trading strategies?

Popular strategies include covered calls, cash-secured puts, iron condors, and straddles/strangles. Each has its own risk and reward, fitting different goals and markets.

How can I analyze market trends to inform my options trading decisions?

Use technical analysis tools, monitor sentiment, and do fundamental analysis. This helps identify opportunities and make informed decisions.

How can I manage risk in options trading?

Manage risk with stop-loss orders, diversify, and control position sizes. This minimizes losses and protects your capital.

Can I generate income using options trading?

Yes, you can earn income through writing options, monthly strategies, and leveraging dividends. These methods can provide a steady income stream.

What tools and platforms are available for options trading?

Many platforms, software, and resources are available for traders. Choose tools that fit your style and needs.

Why is continuous learning important in options trading?

Continuous learning is key as the market changes. Stay updated, network, and read books to improve your skills and stay ahead.

What are some common mistakes to avoid in options trading?

Avoid over-leveraging, ignoring signals, and not having a trading plan. Proper risk management and discipline can help you avoid these mistakes.