Profit Calculation Formula for Accurate Earnings

To understand a company's financial health, knowing the profit calculation formula is key. It's simple: total revenue minus total expenses. This formula shows how much a business makes after paying for everything. It's important for making financial decisions, talking to investors, and planning the business strategy.

The profit equation is a basic but powerful tool. It helps businesses see how they're doing and make better choices. Whether you're in finance, investing, or running a business, grasping this formula is essential. It helps you figure out profit and understand the profit equation.

Introduction to Profit Calculation

Getting profit right is critical for businesses. It shows their financial health clearly. By using the profit formula, companies can see their profit margins. These margins are key for growing and staying competitive.

The profit equation is simple but very useful. It lets companies check their financial health and make smart choices. To find profit margins, use the profit formula. This helps you grasp how to find profit and the profit equation.

Key Takeaways

- Understanding the profit calculation formula is essential for financial decision-making and business strategy.

- The profit equation is total revenue minus total expenses.

- Accurate profit calculations are vital for businesses to evaluate their financial performance and make informed decisions.

- The profit calculation formula is applicable across various industries and business sizes.

- Knowing how to find profit and the profit equation is critical for financial professionals, investors, and business owners.

- The profit margin calculation is a critical component of financial analysis, and it can be calculated using the profit calculation formula.

- The profit equation serves as a foundational tool for assessing business performance and financial health.

Understanding Profit and Its Importance to Businesses

Profit shows if a company is doing well over time. To see how well a business is doing, figuring out its percentage profit is key. This helps in making smart choices about costs, prices, and investments.

Business owners can find profit percentage by subtracting costs from revenue and then dividing by revenue. This number is vital for checking if a business is growing and succeeding. For example, a high profit percentage might mean it's time to grow or invest in new projects. But a low percentage might suggest cutting costs or adjusting prices.

What is Profit?

Profit is what's left after a company pays its costs. It's very important for businesses. It helps them grow, pay out dividends, and stay strong during tough times. To find profit percentage, use this formula: (Profit / Revenue) x 100.

Why Profit Matters for Business Sustainability

Profit is key for a business to keep going. It gives the money needed for growth, innovation, and to invest. Companies with high profit margins attract investors because they promise good returns. By knowing how to find profit percentage, businesses can plan better. This leads to long-term success and growth.

| Profit Metric | Formula | Example |

|---|---|---|

| Gross Profit Margin | (Gross Profit / Revenue) x 100 | (100,000 - 50,000) / 100,000 = 50% |

| Net Profit Margin | (Net Profit / Revenue) x 100 | (100,000 - 60,000) / 100,000 = 40% |

The Basic Profit Calculation Formula

To figure out profit, you need to know the basic formula. This formula is key for businesses to see how profitable they are. For one item, profit is price minus cost. For many items, it's total profit equals unit price times quantity minus unit cost times quantity.

It's also important to look at the profit percentage formula. This shows how profitable something is compared to others. To get profit right, businesses must know the difference between what they earn and what they spend.

Some important things to remember when figuring out profit are:

- Gross profit is the difference between what you earn and the cost of goods sold (COGS).

- Operating profit is what you get after subtracting operating expenses from gross profit.

- Net profit is what you have left after subtracting interest and taxes from operating profit.

Knowing how to calculate profit and using the profit percentage formula helps businesses make better choices. This way, they can work towards being more profitable and reaching their goals.

Types of Profit Calculations

To figure out profit, knowing the different types is key. The total profit formula is vital for a company's financial health. The profit percentage is a key metric, found by dividing profit by revenue and then multiplying by 100.

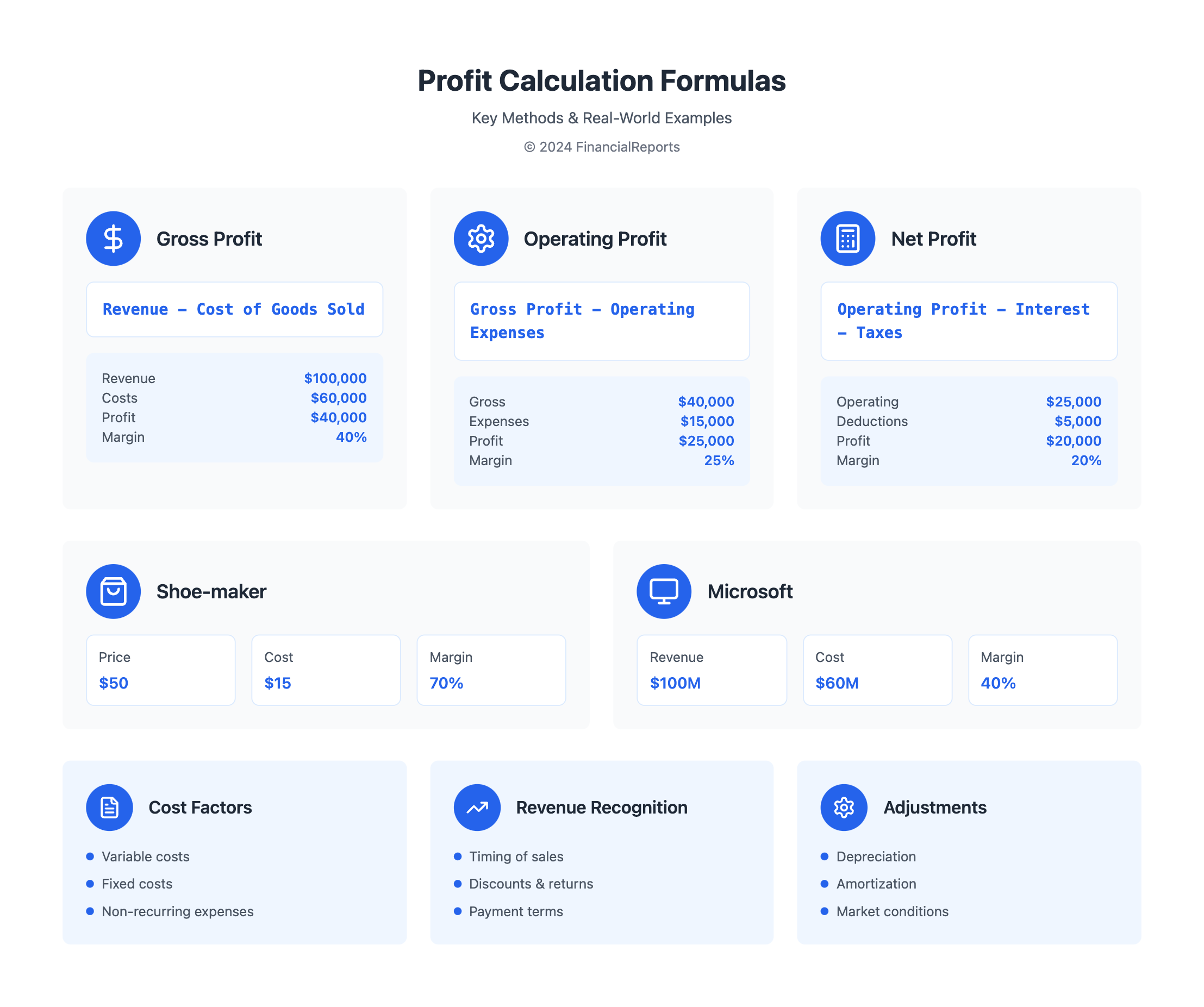

There are three main profit types: gross profit, operating profit, and net profit. Each type has its own formula, giving insights into a company's finances. For instance, gross profit is found by subtracting COGS from revenue. Operating profit is found by subtracting operating expenses from gross profit.

The formulas for each type of profit are:

- Gross Profit: Revenue – Cost of Goods Sold (COGS)

- Operating Profit: Gross Profit – Operating Expenses

- Net Profit: Operating Profit – Interest – Taxes

These formulas help calculate profit percentage and understand a company's financial health. By using them, businesses can find their profit margins. This helps them make better financial decisions.

How to Calculate Gross Profit

To find gross profit, you need to use a simple formula. It's Gross Profit Margin = (Revenue – Cost of Goods Sold) / Revenue x 100. This formula helps you find the total profit. For instance, if a company makes $100,000 and spends $60,000 on goods, its profit margin is 40%.

Let's say a shoe-maker sells shoes for $50 and makes them for $15. This means they have a 70% margin. This example shows how the formula works to find profit and margin.

When calculating total profit, remember to look at both the cost of goods sold and revenue. The gross profit margin is key for checking pricing and production. By using the formula, companies can figure out their profit and make better decisions.

| Company | Revenue | Cost of Goods Sold | Gross Profit Margin |

|---|---|---|---|

| Apple | $100 million | $60 million | 40% |

| Shoe-maker | $50 | $15 | 70% |

In conclusion, knowing how to calculate gross profit is vital for businesses. By using the formula and looking at costs and revenue, companies can figure out their profit. This helps them make smart decisions about their operations.

Calculating Operating Profit

Operating profit is key to understanding a company's efficiency. It shows the income from its main business activities. The formula to find operating profit is: Operating Profit = Gross Profit – Operating Expenses. This can also be shown as a percentage using the percentage profit equation.

The percent profit formula helps calculate the operating profit margin. This margin shows how well a company turns its gross revenue into profit. It's important for comparing a company's performance with others in the same field.

Several factors affect operating profit. These include operational expenses, overhead costs, and depreciation. For instance, high operating expenses can lower a company's profit margin. The operating profit margin is found by dividing operating profit by total revenue and showing it as a percentage.

This metric is vital for comparing a company's performance with its peers and industry averages.

Some important points to remember when calculating operating profit include:

- Operating profit doesn't include interest, taxes, or profits from other investments.

- The operating profit margin shows how well a company controls its expenses to increase profitability.

- Differences in operating profit margins among companies can be due to various factors like outsourcing or depreciation methods.

Understanding Net Profit Calculation

Net profit, also known as net income or net earnings, is what's left after all costs are subtracted from a business's total income. To find the equation to calculate profit, you subtract all expenses from total income. The profit percentage definition is about calculating profit on sales. This is done by dividing net profit by total income and showing it as a percentage.

For example, a company with $500,000 in income, $200,000 in costs of goods sold, $150,000 in operating expenses, and $50,000 in taxes and nonoperating expenses would have a net profit of $100,000. The net profit margin is found using the formula: Net Profit Margin = (Net Profit / Total Revenue) * 100. This ratio shows a company's financial health and performance. For more on net profit margin, check out the net profit margin page.

Ways to boost net profit include:

- Pricing strategy optimization

- Technology implementation

- Revenue stream diversification

- Customer retention initiatives

By grasping the equation to calculate profit and how to calculate profit on sales, businesses can make smart choices. This helps them increase their net profit and stay ahead in the market.

| Company | Revenue | Net Profit | Net Profit Margin |

|---|---|---|---|

| ABC | $1,000,000 | $150,000 | 15% |

| XYZ | $500,000 | $75,000 | 15% |

Adjusting Profit Calculations for Accuracy

To get accurate profit numbers, it's key to think about non-recurring costs. You need to adjust the profit formula for these. This helps in figuring out profit percentage correctly, considering all important factors.

Depreciation and amortization are big players in this game. They can really change a company's financial picture. Using the right profit formula helps businesses make smart choices and avoid mistakes in their financial reports.

Some important things to think about when adjusting profit numbers include:

- Revenue recognition and cost allocation

- Market conditions and regulatory compliance

- Depreciation and amortization

By considering these and using the right profit formula, companies can have accurate financial reports. This leads to better decision-making and higher profits.

For instance, a company can use the profit formula to find its net profit margin. This is a key way to check how well it's doing financially. Knowing how to calculate profit percentage helps businesses make informed decisions and grow.

Utilizing Profit Margin Ratios

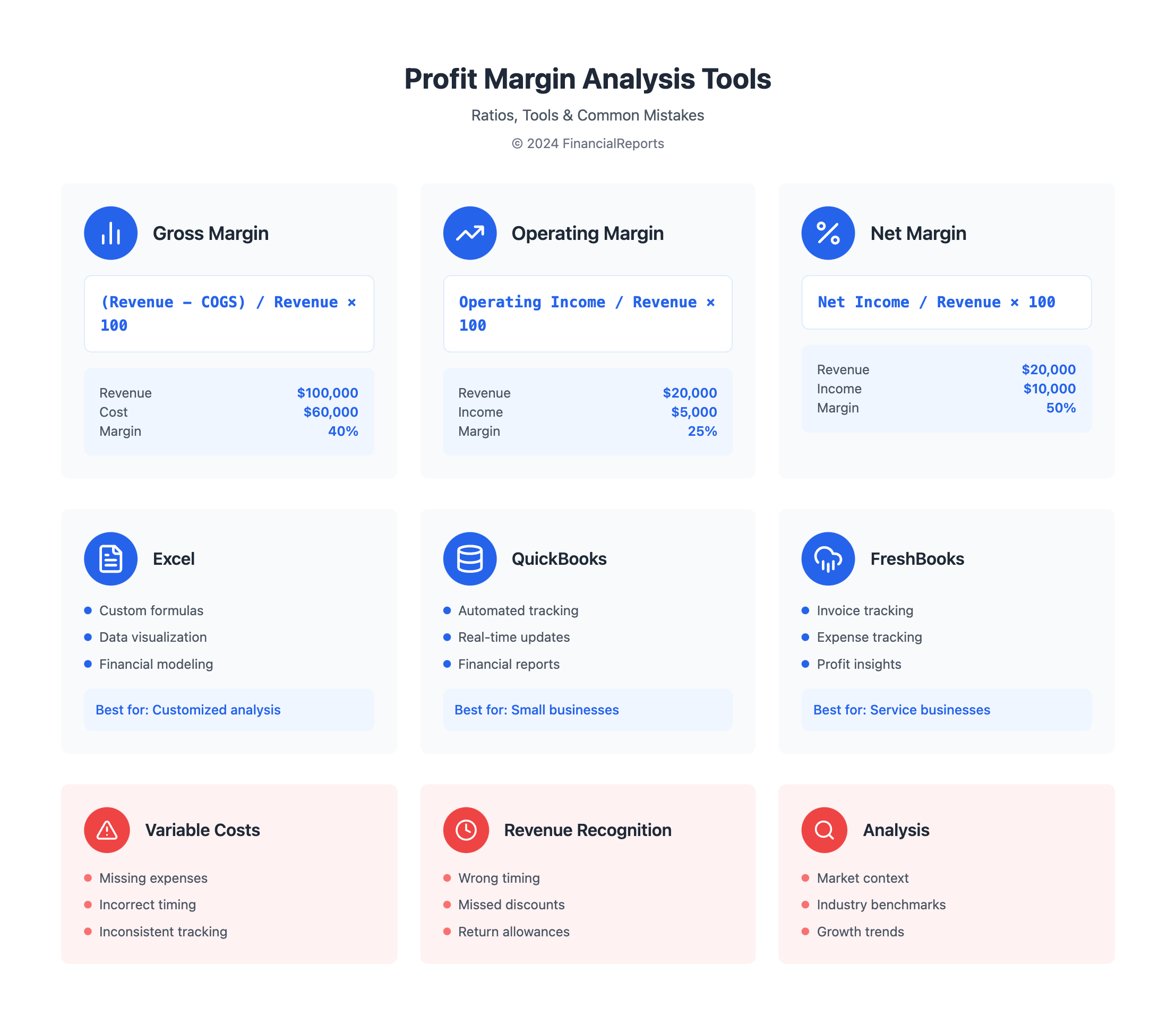

Profit margin ratios are key for businesses to check their financial health and make smart choices. The formula to determine profit calculates the profit margin. This shows how much of sales turn into profit. For example, a 25% profit margin means earning $0.25 in net income for every dollar sold.

To get the profit, businesses must look at their profit cost and revenue. There are different formulas for profit margin ratios like gross, operating, and net profit margins. These ratios give insights into a company's financial health and help spot areas for betterment.

Some important profit margin ratios are:

- Gross Profit Margin: found by dividing gross profit by net revenue

- Operating Profit Margin: found by dividing operating income by net revenue

- Net Profit Margin: found by dividing net income by net revenue

Using these ratios, businesses can see how they stack up against the industry. They can then make strategic moves to cut their profit cost and boost their profit. The formula to determine profit is vital for businesses to reach their financial targets and stay ahead in the market.

| Profit Margin Ratio | Formula | Example |

|---|---|---|

| Gross Profit Margin | Gross Profit / Net Revenue | 70% = ($50 - $15) / $50 |

| Net Profit Margin | Net Income / Net Revenue | 50% = ($20,000 - $10,000) / $20,000 |

Real-World Applications of Profit Calculation

Profit calculation is key in business decision-making. It helps companies check their financial health and make smart choices about pricing, growth, and investments. The revenue profit formula is a vital tool for this, helping businesses figure out their profit margin and adjust as needed.

A company might use the formula to find the best price for a product. They consider the cost of goods sold and other expenses. This helps them set prices that make sense for their business.

Knowing how to calculate company profit is important for all businesses. Small startups and big corporations alike use the revenue profit formula and other financial tools. This helps them understand their profitability and make decisions based on data.

The idea of making a $3 profit on each sale is a simple way to understand profit calculation. It shows how companies aim to make a profit on each sale.

Several factors influence profit calculation:

- Product pricing and revenue

- Cost of goods sold and expenses

- Market trends and competition

By looking at these factors and using the revenue profit formula, companies can create strategies to boost their profit margin. This helps drive business growth.

| Company | Revenue | Cost of Goods Sold | Profit |

|---|---|---|---|

| Microsoft | $100 million | $60 million | $40 million |

The table shows how Microsoft's revenue and cost of goods sold help calculate its profit. By using the revenue profit formula and other financial tools, companies like Microsoft can understand their profitability. This helps them make smart decisions about their business strategy.

Common Mistakes in Profit Calculations

When learning how to calculate profit on sales, it's key to know common mistakes. One big error is forgetting variable costs, which can really affect profits. Businesses should make sure to include all expenses, like marketing and overhead, when figuring out profit percentage.

Another mistake is getting revenue wrong. This can happen if you don't recognize revenue at the right time or forget about discounts and returns. To get the profit percentage right, companies need to have accurate revenue numbers. Knowing these mistakes helps businesses avoid them and get more accurate profit figures.

Some common mistakes in profit calculations include:

- Inconsistent accounting practices

- Failure to consider opportunity costs

- Neglecting to adjust for inflation in long-term profit analysis

By knowing these pitfalls, businesses can better calculate profit. They can use tools and resources likethis link to guide them.

By following best practices and avoiding common mistakes, companies can get accurate profit figures. This is vital for making smart business decisions and growing. Whether you're trying to figure out how to calculate profit on sales or how to compute profit percentage, knowing the pitfalls is key to success.

| Mistake | Impact on Profit Calculation |

|---|---|

| Overlooking variable costs | Can lead to inaccurate profit margins |

| Miscalculating revenue | Can result in incorrect profit percentages |

Tools for Profit Calculation

Knowing your profit is key to smart business choices. Luckily, many tools and software make this easier. Microsoft Excel is a top choice for creating formulas to work out profit.

Software Solutions for Accurate Calculations

There are also accounting and financial software like QuickBooks, Xero, and FreshBooks. They help with invoicing, tracking expenses, and financial reports. These tools offer easy-to-use interfaces and dashboards to quickly find profit and spot areas for betterment.

Utilizing Excel for Profit Calculations

For a tailored approach, Microsoft Excel is a strong tool for 3 dollar profit calculations. You can set up a spreadsheet with your income and costs to find profit margins. Excel also helps you see your financial health with charts and graphs, making trends clear.

Choosing the right tool is vital for your business. It should meet your needs and give accurate financial data. With technology, you can make profit calculations easier and make better decisions for your company's growth.

FAQ

What is the profit calculation formula?

The basic profit formula is: Profit = Revenue - Expenses.

Why is profit important for businesses?

Profit is key for a business to grow and stay strong. It shows how well a company is doing financially. It also helps attract investors and stay competitive.

What is the difference between revenue and expenses?

Revenue is the money a business makes. Expenses are the costs to make that money.

What are the main types of profit calculations?

There are three main types: gross profit, operating profit, and net profit. Each shows different parts of a business's performance.

How do I calculate gross profit?

To find gross profit, use this formula: Gross Profit = Revenue - Cost of Goods Sold. It shows how profitable a company's main activities are.

How do I calculate operating profit?

Use this formula for operating profit: Operating Profit = Gross Profit - Operating Expenses. It shows how well a company runs its operations.

How do I calculate net profit?

For net profit, use this formula: Net Profit = Revenue - All Expenses (including taxes and interest). It shows a company's overall financial health.

How do I adjust profit calculations for accuracy?

To get accurate profits, remember to include non-recurring expenses, depreciation, and amortization. Keeping accounting practices consistent is also important.

What are profit margin ratios, and why are they important?

Profit margin ratios show how profitable a company is compared to others. They help in financial analysis and setting goals.

How can I use profit calculations to guide business decisions?

Profit calculations help in making big decisions, like pricing and expansion. They give insights for improving business strategy and performance.

What is the "3 dollar profit" concept?

The "3 dollar profit" is a simple example. It shows how profit is made, aiming for a $3 profit on each sale.

What tools are available for accurate profit calculations?

Tools like accounting software and Microsoft Excel help with profit calculations. They provide insights for making better business decisions.