Profit and Loss Statement PDF - Download Template

A profit and loss statement pdf is key for businesses to check their financial health. It shows how much money they make and spend over time. This helps owners make smart money choices.

By using a profit and loss statement pdf, companies can see how they're doing. They can spot where to get better and plan to make more money.

The template for this statement has important parts like revenue, expenses, and net income. Revenue is the money from selling things. Expenses are the costs of selling, like what things cost and where they are sold.

When you subtract expenses from revenue, you get net income. This tells if a business is making money or losing it.

Key Takeaways

- Profit and loss statements can be created to analyze business performance over a month, quarter, or year.

- Revenue includes money received for the sale of goods or services.

- Expenses include costs related to sales, such as cost of goods and property rental.

- Net income is calculated by subtracting expenses from revenue.

- A profit and loss statement pdf template can be customized to match business branding and needs.

- Companies can update their profit and loss statements weekly, monthly, quarterly, or yearly to understand their financial performance.

- A profit and loss statement pdf is a valuable tool for businesses to track their financial progress and make informed decisions.

What is a Profit and Loss Statement?

A profit and loss statement, also known as an income statement or P&L, is a financial document. It shows a company's revenues and expenses over a certain time. It helps businesses understand their financial health and make smart choices.

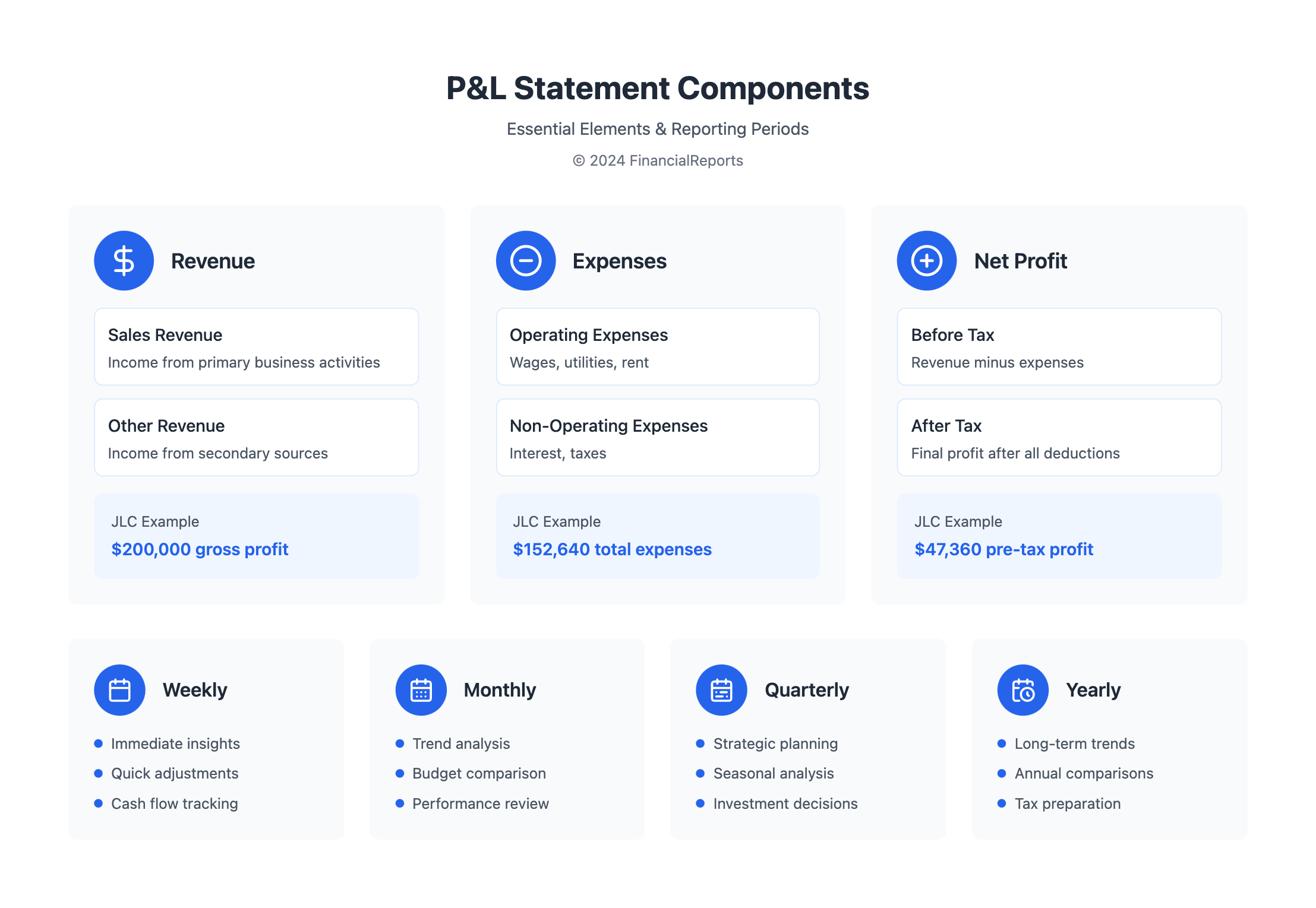

Jayne's Locksmith Company (JLC) made $200,000 in gross profit from sales. They had total pre-tax expenses of $152,640. This left them with a net profit before taxes of $47,360.

Definition and Purpose

A profit and loss statement measures a company's financial health over a set time, like a quarter or year. It helps track income and costs. It also shows where to improve and guides decisions on investments and resources.

Key Components

The main parts of a profit and loss statement are:

- Revenue: The total income from sales, services, or other sources.

- Expenses: The total costs, including operating expenses, taxes, and interest.

- Net profit or loss: The difference between income and costs, showing earnings or loss.

Importance for Businesses

A profit and loss statement is vital for businesses. It clearly shows their financial health. It helps spot areas for improvement and guides smart decisions. It also meets regulatory needs and aids in tax calculations.

| Category | Amount |

|---|---|

| Gross profit from sales | $200,000 |

| Total pre-tax expenses | $152,640 |

| Net profit before taxes | $47,360 |

How to Read a Profit and Loss Statement

To understand a company's financial health, knowing how to read a profit and loss statement is key. This document shows a company's income, costs, and expenses over a set time, like a month or year. You can download a profit and loss statement pdf to make it easier.

The income part shows what the company makes, like sales and rent. The expense part lists what it spends, like wages and utilities. To find the net profit, just subtract the total expenses from the total income.

Income Section Explained

The income section has a few parts:

- Sales Revenue: The money made from selling things.

- Other Revenue: Money from sources other than sales, like rent.

- Gross Revenue: The total income before any deductions.

Expense Section Breakdown

The expense section has different parts too:

- Wages and Benefits: What the company pays its employees.

- Utilities: The cost of things like electricity and water.

- Rent / Mortgage: What the company pays to use its space.

Net Profit Calculation

To find the net profit, subtract the total expenses from the total income. This shows how well the company is doing financially. A profit and loss statement pdf can help you make a template for your business. This makes tracking your money easier.

| Category | Revenue | Expenses | Net Profit |

|---|---|---|---|

| Sales Revenue | $100,000 | $30,000 (COGS) | $70,000 |

| Other Revenue | $10,000 | $5,000 (Utilities) | $5,000 |

| Total | $110,000 | $35,000 | $75,000 |

Benefits of Using a Profit and Loss Statement

Creating and reviewing profit and loss statements regularly helps businesses a lot. It gives a detailed look at how well a company is doing financially. This helps in making smart choices and planning for the future.

With a profit loss form, you can see all the money coming in and going out. It shows sales, expenses, and profit before taxes. This lets businesses see how they're doing and make choices based on facts.

Financial Analysis and Planning

A good profit and loss statement helps in deep financial analysis. It shows trends, chances, and problems. This info helps in making plans, using resources wisely, and avoiding risks.

Tracking Business Performance

The profit and loss statement shows a company's financial health clearly. It lets businesses watch their progress over time. By looking at revenue, expenses, and profit, they can find ways to get better.

| Component | Description |

|---|---|

| Sales or Gross Receipts | Total amount of money the business makes from the sale of merchandise |

| Operating Expenses | Categories such as rent, depreciation, repairs & maintenance, salaries & wages, and more |

| Net Profit Before Taxes | Calculated by subtracting total operating expenses from gross profit |

Using a profit and loss statement gives businesses important insights. It helps in making smart decisions and growing. The value of a profit loss form is huge in today's business world.

Common Mistakes to Avoid

When making a profit and loss statement pdf, it's key to avoid common errors. One big mistake is forgetting to include all income sources. This can make your revenue look lower than it really is. Also, misclassifying expenses can mess up how you see your business's financial health.

It's important to keep your profit and loss statement pdf up to date. If you don't, your financial info might not reflect your current situation. To avoid these issues, make sure to include all income, categorize expenses right, and keep your records current.

Key Mistakes to Avoid

- Overstating or understating expenses, which can raise questions about the business's financial performance

- Failure to properly complete the financial statement, resulting in inequitable, incorrect, and unfair settlements

- Overstating or underestimating CPP and EI deductions, leading to discrepancies in the financial statement

By steering clear of these common errors, businesses can make sure their profit and loss statement pdf shows their true financial health. This helps them make better decisions and grow.

| Mistake | Consequence |

|---|---|

| Overlooking income sources | Understated revenue and incorrect profit calculations |

| Misclassifying expenses | Incorrect expense categorization and affected financial performance |

| Neglecting regular updates | Outdated financial information and challenging decision-making |

Creating a Profit and Loss Statement

To make a profit and loss statement, you need to follow a few steps. First, gather all your financial data. Then, organize it in the right way. Lastly, use tools and software to make it easier.

Start by collecting all your financial data. This includes your income, expenses, and net profit. You can find this data in invoices, receipts, and bank statements. After you have it all, organize it into sections for income, expenses, and net profit.

There are many tools and software to help you with this. Accounting software and spreadsheet programs are great options. They can make the process faster, reduce mistakes, and give you a clear view of your finances.

Some important parts of a profit and loss statement are:

- Revenue: This is all the money your business makes, like from sales and services.

- Expenses: These are all the costs your business has, like salaries and rent.

- Net profit: This is what's left after subtracting expenses from revenue. It shows how much profit your business made.

By following these steps and using the right tools, you can make a profit and loss statement. It will show you how well your business is doing financially.

| Category | Quarter 1 | Quarter 2 |

|---|---|---|

| Revenue | $50,000 | $55,000 |

| Expenses | $40,000 | $47,000 |

| Net profit | $10,000 | $8,000 |

Downloadable Profit and Loss Statement PDF Templates

For businesses looking to simplify their financial reports, downloadable profit and loss statement PDF templates are a great option. These templates help organize financial data, making it easier to see revenue and expenses. Using a profit and loss statement pdf ensures accurate and consistent financial reports.

One big advantage of these templates is how customizable they are. Businesses can adjust the templates to fit their needs, adding categories and formulas as needed. This makes it possible to create a profit and loss statement pdf that matches the company's financial situation.

Free Templates Available

Many websites, like Jotform, offer free profit and loss statement templates. These can be downloaded and customized for any business. This way, companies can make a detailed profit and loss statement pdf without spending a lot of money.

Compatibility with Software

Many profit and loss statement templates work well with popular accounting software. This makes it easy to add financial data, making reports more efficient and accurate. Using a template that fits with your accounting software helps manage finances better.

| Template Feature | Description |

|---|---|

| Customizable categories | Enable businesses to tailor the template to their specific needs |

| Compatibility with accounting software | Streamlines the reporting process and reduces errors |

| Free templates available | Provides businesses with a cost-effective solution for financial reporting |

Using a downloadable profit and loss statement pdf template helps businesses make detailed and accurate financial reports. This information is key for making smart decisions and growing the business.

Tips for Maintaining Accurate Records

Keeping accurate records is key for businesses to make smart choices and grow. A detailed profit loss form helps spot areas for improvement. It also shows how well the company is doing financially. By entering data regularly, using accounting software, and checking records often, businesses can keep their financial records up to date and trustworthy.

Starting with good record-keeping means documenting every deal between a customer and the business. Tools like bar codes and scanners help track prices, manage stock, and keep tabs on customers. These tools make record-keeping easier and cut down on mistakes.

Some important ways to keep records accurate include:

- Regular data entry to record all transactions correctly and on time

- Using accounting software to automate and improve financial record-keeping

- Setting up review processes to check the accuracy and reliability of financial records

By using these methods, businesses can keep their financial records accurate and reliable. This is vital for making good decisions and increasing profits.

Analyzing Profit and Loss for Decision Making

A profit and loss statement pdf is key for businesses to make smart financial choices. It helps spot areas to improve and guides decisions to boost growth and profits. By comparing different periods, businesses can see how they're doing against past times.

Looking closely at a profit and loss statement pdf is vital. It lets businesses track important numbers like revenue, expenses, and net income. This way, they can see how they've changed over time.

To really benefit from a profit and loss statement pdf, tracking certain ratios is important. For example, looking at overhead or staff payroll ratios. Also, separating income and costs helps check how well a business is doing. Here are some steps to follow:

- Grouping related expense categories, such as staff labor, occupancy, and marketing

- Tracking staff and provider labor expenses separately to evaluate efficiency and productivity

- Using a profit and loss statement pdf to identify trends and make informed financial decisions

By following these steps and using a profit and loss statement pdf, businesses can make better choices. This tool is powerful for spotting where to improve and making decisions based on data. By looking at trends and tracking key numbers, companies can stay competitive and reach their financial targets.

FAQs about Profit and Loss Statements

Let's answer some common questions about profit and loss (P&L) statements. A P&L statement usually covers a year, split into quarters or months. This helps track performance over time.

For businesses, making a P&L statement at least once a year is a good idea. Larger companies often do it monthly or quarterly. This helps them keep a close eye on their finances.

Even small businesses can get a lot from P&L statements. They show important details like income, expenses, and profit. With the right tools, making and understanding a P&L is easy for any company.

FAQ

What is a profit and loss statement?

A profit and loss statement, also known as an income statement or P&L, shows a company's financial health. It outlines revenue, expenses, and net profit or loss over a set period.

What are the key components of a profit and loss statement?

A profit and loss statement has three main parts: revenue, expenses, and net income or loss. Revenue is the money earned from operations. Expenses are the costs to earn that revenue. Net income or loss is the difference between revenue and expenses.

Why are profit and loss statements important for businesses?

These statements are vital for businesses. They help track financial performance, make decisions, and meet legal needs. They're key for analysis, planning, and attracting investors.

How do I read and interpret a profit and loss statement?

To understand a profit and loss statement, look at the income and expense sections. The income section includes gross revenue and sales returns. The expense section lists various costs like wages and utilities. Net profit is found by subtracting total expenses from total revenue.

What are some common mistakes to avoid when preparing a profit and loss statement?

Avoid overlooking income, misclassifying expenses, and not updating the statement. Ensure all revenue is captured, costs are correctly categorized, and records are up-to-date for accurate statements.

How can I create a profit and loss statement?

To make a profit and loss statement, gather all financial data and organize it correctly. Use specialized tools and software to streamline this process and manage data effectively.

What are the benefits of using a downloadable profit and loss statement PDF template?

Our downloadable templates offer free and customizable options. They work well with popular accounting software, making data access easy and efficient.

How can I maintain accurate financial records for my profit and loss statement?

For accurate records, practice regular data entry and use accounting software. Implement strong review processes to ensure reliable financial reporting.

How can I use a profit and loss statement for strategic decision-making?

Analyze your statement to spot trends and understand key performance indicators. This helps make informed decisions, driving growth and attracting investors.

What is the appropriate time period for a profit and loss statement, and how often should it be prepared?

Statements are prepared for periods like monthly, quarterly, or annually. The right time and frequency depend on your business size and needs. Regular analysis helps make informed decisions and track performance.