Profit and Loss Management Strategies for SMEs

Companies House says small businesses will soon have to file their profit and loss (P&L) accounts. This change shows how vital profit and loss management is for Small and Medium Enterprises (SMEs). It's not just about paperwork. It's key for setting and tweaking business plans.

By using strong profit and loss management, SMEs can get healthier financially. They can make better decisions and compete better in the market. This is all thanks to good profit and loss management.

Businesses should watch their P&L accounts over time to spot trends. This helps them make smart choices based on the data. It's about comparing what they expected with what really happened.

They should look at areas like costs and profit margins. This is a big part of managing profit and loss. It's also good to check P&L accounts often. Some companies even have monthly meetings to review budgets and adjust plans.

Key Takeaways

- Small businesses will be required to file their profit and loss (P&L) accounts, making it a universal practice for businesses.

- Effective profit and loss management is vital for setting and adjusting business strategy.

- Using strong profit and loss management can boost financial health and make a business more competitive.

- Tracking P&L accounts over time helps spot trends and guide strategic decisions.

- Comparing P&L forecasts with actual results shows where to improve, like costs or profit margins.

- Checking P&L accounts regularly is key for reviewing budgets and tracking revenue, both critical for profit and loss management.

- Profit and loss management helps businesses make informed financial decisions and adjust their plans as needed.

Understanding Profit and Loss Management

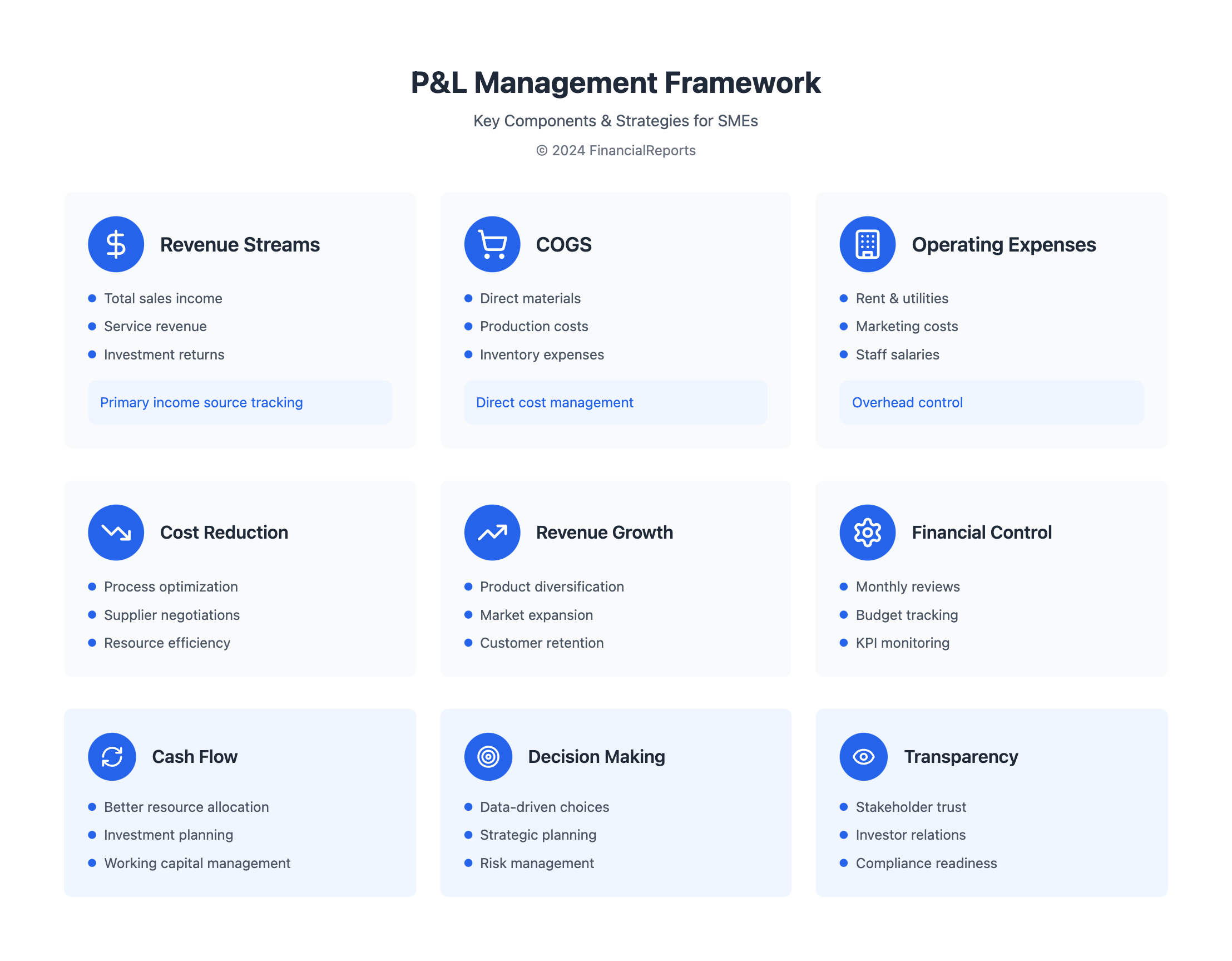

Profit and loss management is key for small and medium enterprises (SMEs). It means tracking, analyzing, and improving a company's finances. A profit and loss account shows a company's income, expenses, and profits over time.

Important things to watch in p and l management are income, costs, expenses, and profit margins. Keeping an eye on these helps manage finances well. Knowing about p and l management helps SMEs stay stable, grow, and attract investors.

Key Components to Monitor

- Revenue streams

- Cost of goods sold (COGS)

- Operating expenses

- Net profit margins

Good p and l management means looking at these parts to find ways to get better. This way, SMEs can make smart choices, cut costs, and boost profits.

| Component | Description |

|---|---|

| Revenue streams | Total income from selling products or services |

| Cost of goods sold (COGS) | Direct costs for making goods or services |

| Operating expenses | Indirect costs like rent, utilities, marketing, and salaries |

| Net profit margins | Profit left after all costs and expenses are subtracted from income |

Benefits of Effective Profit and Loss Management

Effective profit and loss management is key for businesses to stay stable and grow. It helps companies understand their income and expenses well. This knowledge guides them in making smart choices about investments and cost savings.

Neil Hutchings, a finance director, says P&L accounts show trends in margins, demand, and revenue. This info is critical for businesses to adapt to market changes and stay ahead. Good profit and loss management improves cash flow, decision-making, and financial clarity.

Improved Cash Flow

Good cash flow is a big win from effective profit and loss management. By tracking income and expenses well, businesses spot cost-cutting areas. This leads to smarter investment and expansion choices, boosting revenue and growth.

Enhanced Decision-Making Capabilities

Effective profit and loss management also boosts decision-making. Analyzing P&L data helps businesses spot trends and patterns. This knowledge guides them to seize new opportunities and avoid risks.

Increased Financial Transparency

Financial transparency is another plus. P&L statements give a clear view of a company's finances. This transparency builds trust with investors, lenders, and partners. It can open doors to more capital, better loan terms, and stronger partnerships.

| Benefits of Effective Profit and Loss Management | Description |

|---|---|

| Improved Cash Flow | Accurate tracking of income and expenses to optimize financial resources |

| Enhanced Decision-Making Capabilities | Analysis of P&L data to inform strategic decisions |

| Increased Financial Transparency | Clear and accurate picture of a company's financial performance to boost credibility with stakeholders |

Essential Metrics for Profit and Loss Evaluation

Understanding key metrics is vital for p and l management. A company's financial health can be checked by looking at its profit and loss statement. This includes revenue, cost of goods sold, and operating expenses.

Revenue streams are key in p and l management. They show where a business gets its money. Revenue streams can be sales, services, or investments. By watching these, businesses can spot trends and make smart financial choices.

Key Components of Profit and Loss Evaluation

- Cost of Goods Sold (COGS): direct costs related to producing goods or services

- Operating Expenses: indirect costs associated with daily operations, marketing, and administrative functions

- Gross Profit Margin: calculated by dividing gross profit by total revenue, indicating better profitability after accounting for production costs

Tracking these metrics helps businesses understand their finances. It's important for growth and making smart choices. Good p and l management shows how well a business is doing and helps with decision-making.

Tools for Monitoring Profit and Loss

Managing profit and loss well needs the right tools and tech. Ben Austin, CEO of Absolute Digital Media, says using P&L accounts to compare costs is very helpful. These tools help businesses understand their finances better and make smart choices for growth.

Important tools for tracking profit and loss include accounting software, spreadsheets, and financial models. They help businesses keep an eye on their income and expenses. They also spot where costs can be cut and guide decisions on how to use resources. Financial dashboards give quick views of key profit and loss numbers, helping businesses spot trends and chances to get better.

Accounting Software Solutions

Software like QuickBooks Online and FreshBooks has many features for managing profit and loss. It makes financial tasks easier, cuts down on mistakes, and boosts accuracy. It automates tasks like invoicing and tracking expenses, letting businesses focus on growing and making big decisions.

Spreadsheets and Financial Models

Spreadsheets and financial models are also great for managing profit and loss. They let businesses create detailed financial plans, track important numbers, and find ways to get better. Using them, businesses can really understand their finances and make better choices about how to use resources and plan strategically.

Financial Dashboards

Financial dashboards show key profit and loss numbers in a clear way. They help businesses see trends and chances to improve fast. These dashboards can be tailored to fit a business's needs, showing things like revenue, expenses, and profit margins. With financial dashboards, businesses can keep up with their finances and make smart moves to grow and be more profitable.

Developing a Profit and Loss Management Plan

For small and medium-sized enterprises (SMEs), making a detailed p and l management plan is key. It helps keep finances healthy and sustainable. A good plan sets financial goals, tracks key performance indicators (KPIs), and checks financial statements to improve strategy.

Absolute Digital Media, for example, has monthly finance meetings. They review P&L accounts and adjust spending on marketing, recruitment, or software. This keeps them financially aware and makes decisions based on data.

Setting Clear Financial Goals

To make a strong p and l management plan, SMEs need to set clear financial goals. These goals should match the business strategy. They look at past financial data, market trends, and areas to improve.

Identifying Key Performance Indicators (KPIs)

Important KPIs like average selling price and gross profit percent give insights into a company's finances. By watching these KPIs, SMEs can see how they're doing. They can spot where to get better and make smart choices for growth.

Regularly Reviewing Financial Statements

Checking financial statements, like the profit and loss statement, is key. It helps see if a company is making money and if the p and l plan needs tweaks. By looking at income, expenses, and profit over time, businesses can see if they're growing, staying the same, or losing ground.

| KPI | Definition | Importance |

|---|---|---|

| Average Selling Price | The average price at which a product or service is sold | Helps to evaluate pricing strategy and revenue growth |

| Average Margin per Unit | The average profit made on each unit sold | Indicates the profitability of a product or service |

| Gross Profit Percent | The percentage of revenue that is gross profit | Shows the efficiency of a company's operations and pricing strategy |

By following these steps and keeping an eye on their finances, SMEs can craft a p and l management plan. This plan helps grow the business, improves finances, and ensures it stays strong.

Common Challenges in Profit and Loss Management

Many startups and SMEs face challenges in managing their finances. They often rely on sales volume and bank balances in the early days. This can lead to inaccurate financial reports, which is a big problem.

Another issue is not accounting for all expenses. Companies might overlook costs like the cost of goods sold. This includes materials and inventory costs. Not counting these can make financial reports wrong, leading to bad decisions.

Economic changes also pose a big challenge. These changes can affect a company's income and expenses. It's important to have financial models that can adjust to these changes. By tracking key metrics, companies can make better decisions and grow their business.

| Challenge | Description |

|---|---|

| Inaccurate Data Reporting | Reliance on incomplete or inaccurate data, leading to poor decision-making |

| Underestimating Expenses | Failure to account for all costs associated with operations, resulting in inaccurate profit and loss statements |

| Impact of Economic Changes | Economic fluctuations affecting revenue and expenses, requiring flexible financial models to adapt to market changes |

Understanding these challenges helps companies manage their finances better. They can take steps to improve their financial health. Good profit and loss management involves solving key problems and setting goals to measure success.

Strategies for Reducing Costs

Effective p and l management definition means finding ways to cut costs and boost revenue. One important strategy is to make operations more efficient. This includes getting rid of unnecessary steps and using resources wisely. By looking at both revenue and costs, businesses can spot where they can do better.

Using technology is also key to saving money. For example, cloud computing can make operations smoother and cheaper. Also, tools like business intelligence and financial planning help manage profits better.

Streamlining Operations

- Process optimization to eliminate redundancies

- Resource allocation to maximize efficiency

- Regular review of financial statements to identify areas for improvement

Negotiating with Suppliers

Talking to suppliers is vital for cutting costs. Getting quotes from different suppliers helps find the best prices. It's also important to compare costs with industry standards and act if they're too high.

By using these methods, businesses can lower costs and do better financially. It's important to keep an eye on fixed costs and variable expenses. This helps plan for the future and stay cost-effective.

Increasing Revenue Streams

Effective profit and loss management means finding new ways to make money. This can be done by selling different products, reaching out to new markets, and building strong customer ties. By looking at what makes money and finding new chances, businesses can grow their income and profits.

Some key strategies for increasing revenue streams include:

- Diversifying product offerings to appeal to a wider range of customers

- Exploring new markets and expanding into new geographic regions

- Strengthening customer relationships through effective marketing and sales efforts

By using these strategies, businesses can make more money and manage their profits better. This can help them stay profitable for a long time. Increasing revenue streams is a key part of a good profit and loss management plan. It helps businesses grow and reach their financial goals.

| Strategy | Description |

|---|---|

| Diversifying product offerings | Expanding product lines to appeal to a wider range of customers |

| Exploring new markets | Entering new geographic regions or industries to expand customer base |

| Strengthening customer relationships | Building strong relationships with customers through effective marketing and sales efforts |

The Role of Forecasting in Profit and Loss

Financial forecasting is key in business management. It helps with budgeting, setting goals, and managing risks. A big part of p and l management definition is predicting income and expenses. This uses past data and models to guess future finances.

There are many ways to forecast, like using expert opinions or data analysis. Qualitative methods, like the Delphi technique, rely on what experts say. Quantitative methods, like time series analysis, use past data and math to predict. These methods help businesses make smart financial choices.

Forecasting has many benefits for profit and loss management. It improves budgeting, goal-setting, and risk management. By using forecasting, businesses can make better decisions and grow.

Integration of Profit and Loss with Overall Business Strategy

Effective profit and loss management is key for any business's success. It helps companies make smart decisions and grow. By linking profit and loss management with the business strategy, companies can make sure their financial goals match their broader plans.

Keeping a close eye on revenue lets companies check how they're doing against their goals. This is very important in fields like Life Sciences. Here, managing R&D costs, clinical trial expenses, and manufacturing costs is vital for profit and loss management.

Aligning Financial Goals with Business Objectives

To manage profit and loss well, companies need to align their financial goals with their business objectives. They should set clear financial targets, like growing revenue and cutting expenses. They also need to have key performance indicators (KPIs) to track their progress.

Communicating across Departments

Good communication across departments is key for successful profit and loss management. Companies should share financial information and insights with all teams, like sales, marketing, and operations. This ensures everyone is working towards the same goals.

Continuous Improvement Practices

Continuous improvement is essential for long-term success in profit and loss management. Companies should regularly review their financial statements, find areas to improve, and make changes to boost financial performance. By always looking to get better, companies can stay competitive and reach their financial goals.

Some key industries that need effective profit and loss management include:

- Investment management, where analyzing investment returns, management fees, and operational costs is critical

- CPG/eCommerce, where optimizing supply chain efficiency, marketing spending, and product pricing is essential

- Manufacturing, where monitoring production costs, raw material expenses, and distribution logistics is vital

By linking profit and loss management with their overall business strategy, companies can grow, improve their finances, and achieve long-term success.

| Industry | Key Profit and Loss Management Considerations |

|---|---|

| Life Sciences | Managing R&D expenses, clinical trial costs, and manufacturing expenditures |

| Investment Management | Analyzing investment returns, management fees, and operational costs |

| CPG/eCommerce | Optimizing supply chain efficiency, marketing spending, and product pricing |

| Manufacturing | Monitoring production costs, raw material expenses, and distribution logistics |

Case Studies of Successful Profit and Loss Management

We look at real-life examples of small and medium businesses that got profit and loss management right. Absolute Digital Media, a digital marketing agency, used their P&L to make smart choices. They invested in new services, landing big contracts and boosting their revenue.

Swiftdogz, a pet supply store, faced financial hurdles but learned from them. They watched their spending and found ways to save money. This helped them stay strong during tough times and prepare for the future.

These stories teach us key lessons for managing profits and losses well. Using financial dashboards, doing scenario analyses, and working together across departments are key. These steps help businesses grow and stay profitable.

FAQ

What is the definition of profit and loss management?

Profit and loss management is about keeping track of a company's money. It looks at how much money comes in and goes out. This includes looking at sales, costs, and profits.

Why is profit and loss management important for small and medium enterprises (SMEs)?

For SMEs, managing profit and loss is key. It keeps the business stable and growing. It also helps attract investors by showing clear financial details.

What are the key benefits of effective profit and loss management for SMEs?

Good P&L management helps with cash flow and making smart choices. It also makes the business more transparent. This builds trust with investors and partners.

What are the essential metrics that SMEs should track for profit and loss evaluation?

SMEs need to watch their sales, costs, and expenses. Tracking these over time helps spot trends. This information guides better decisions.

What tools and technologies are available for SMEs to monitor their profit and loss?

SMEs can use accounting software, spreadsheets, and dashboards. These tools help keep an eye on finances and make informed choices.

How can SMEs develop a complete profit and loss management plan?

SMEs should set clear financial goals that match their business plan. They should pick important KPIs and check their financial reports often. This helps improve their P&L strategy.

What are the common challenges that SMEs face in profit and loss management?

SMEs often struggle with wrong data, not knowing their costs, and economic changes. They can beat these by managing finances well and keeping data accurate.

What strategies can SMEs use to reduce costs as part of their profit and loss management efforts?

SMEs can make their operations more efficient, talk better deals with suppliers, and use technology. These steps save money without hurting quality or productivity.

How can SMEs increase their revenue streams as part of profit and loss management?

SMEs can offer more products, enter new markets, and improve customer service. Using data helps find the most profitable customers.

What is the role of forecasting in profit and loss management for SMEs?

Good forecasting helps make smart business choices and sets achievable goals. SMEs can use different methods to predict their finances. This guides their strategies.

How can SMEs integrate profit and loss management with their overall business strategy?

SMEs should link their financial goals with their business aims. They need to talk well across teams and always look to improve their P&L management. This supports their long-term goals.