Optimized Forex Investment Plans for Institutional Investors

Institutional investors need a solid plan to tackle the forex market. A detailed guide helps create plans that fit their specific needs. These plans must understand the market's peak times and sessions.

For institutional investors, a good forex plan is key. It helps reduce risks and increase gains. This includes setting stops and limits and knowing the rollover rate. With the right strategies and tools, they can outperform others and see solid returns.

Introduction to Forex Investment Plans

Forex trading runs 24/5, with major pairs having tight spreads due to high volumes. Institutional investors must factor these into their plans. Regulatory bodies also shape leverage and margin rules, affecting trading options.

Key Takeaways

- Institutional investors require a well-structured approach to forex investment plans

- Understanding peak trading times and market conditions is key for optimized plans

- Setting stops and limits for every trade can reduce risk in forex plans

- Institutional investors must consider regulatory bodies and leverage rules in their plans

- A detailed guide is vital for creating tailored forex plans for institutional investors

- Forex plans need a deep market understanding and its complexities

- Institutional investors can achieve solid returns with the right strategies and tools

Understanding Forex Investment Plans

Forex investment plans are key for investors to succeed in the forex market. A good plan outlines your goals, how much risk you can take, and what you want to achieve. With over $6 trillion traded daily, having a solid strategy is vital.

There are many types of forex investments. These include major, minor, and exotic currency pairs. Knowing these is important for a good investment plan. Plans can be made for both big firms and individual traders.

Important things to think about in a plan include:

- Risk management strategies

- Market analysis techniques

- Diversification approaches

By focusing on these, investors can make a strong plan. This helps them deal with the forex market's challenges.

Forex investments can be grouped in several ways, including:

| Category | Description |

|---|---|

| Major Currency Pairs | Includes pairs such as EURUSD, USDJPY, and GBPUSD |

| Minor Currency Pairs | Includes pairs such as AUDUSD, NZDUSD, and USDCHF |

| Exotic Currency Pairs | Includes pairs such as USDTRY, USDRUB, and USDZAR |

Knowing these categories helps investors make better choices for their plans.

Key Components of a Successful Forex Strategy

A winning forex strategy has several important parts. These include risk management strategies and market analysis techniques. Together, they help investors cut down on losses and boost gains. A well-planned strategy can greatly improve success in the forex market.

Some key elements of a successful forex strategy include:

Some key elements of a successful forex strategy include:

- Understanding the market and its trends well

- Using risk management strategies to lessen losses

- Applying market analysis techniques to spot trading chances

- Diversifying investments to lower risk and raise returns

By mixing these elements, investors can craft a detailed forex strategy. This strategy helps them reach their investment targets. It's vital to keep an eye on and tweak the strategy as market conditions shift. This ensures the strategy stays effective and profitable.

Institutional vs. Retail Forex Investors

Institutional and retail forex investors have different goals and ways of investing. Institutional investors, like hedge funds and banks, handle big money and follow strict rules. On the other hand, retail investors are individual traders who invest smaller amounts and face less regulation.

Some key differences between institutional and retail forex investors include:

- Institutional traders often trade in large volumes, which can impact the share price of a security, while retail traders typically invest in smaller amounts.

- Institutional traders have access to more resources, including research and advisory services, while retail traders often rely on their own research and analysis.

- Retail traders have the advantage of being able to trade in highly liquid markets, where they can enter and exit positions quickly, while institutional traders may be limited to specific markets or products.

Institutional and retail forex investors have different goals and risk levels. Institutional investors aim for long-term growth and stability. Retail investors might focus on quick profits. Knowing these differences helps in creating effective forex investment strategies, whether you're an institutional or retail investor.

Analyzing Forex Market Trends

Understanding the Forex market is key to smart investing. There are two main ways to analyze it: fundamental analysis and technical analysis. Fundamental analysis looks at economic signs like GDP and inflation. Technical analysis, by contrast, studies charts and patterns to forecast prices.

Traders blend both methods to decide when to buy or sell. Fundamental analysis examines interest rates, inflation, and job numbers. Technical analysis focuses on price trends and uses indicators to guess future prices. This approach helps traders make better choices.

Important things to keep in mind when analyzing Forex trends include:

- Charting indexes over time frames to determine relationships between markets

- Looking for a consensus in other markets to provide insight for entering a trade

- Timing trades based on turning points from longer time frames to increase the chance of successful trades

By mixing fundamental analysis and technical analysis, traders can better understand the Forex market. This leads to more informed investment choices.

Developing a Forex Investment Plan

Creating a successful forex investment plan is all about careful planning. First, setting clear goals is key. This helps investors stay on track and motivated. Goals might include a certain return or profit target.

Choosing the right forex broker is also vital. A good broker ensures your investments are safe and secure. Look for one that is well-regulated, offers a reliable trading platform, and has great customer support.

When planning your investments, think about how long you can hold onto them and how much risk you can take. A longer time frame might allow for more flexible strategies. But, a shorter time frame might mean playing it safer.

It's also important to consider how much risk you're comfortable with. This will guide the types of trades you make. A good plan includes strategies to limit losses, like stop-loss orders and careful position sizing.

Some key things to look for in a forex broker include:

- Regulatory compliance: Make sure the broker is regulated by a trusted body, like the FCA or SEC.

- Trading platform: The platform should be easy to use and reliable, with tools like real-time quotes and charts.

- Customer support: Good support is essential, with options like phone, email, and live chat.

A solid forex investment plan can help you reach your goals and reduce losses. By setting clear goals, choosing a reputable broker, and considering your time frame and risk tolerance, you can create a plan that works for you. This will help you succeed in the forex market.

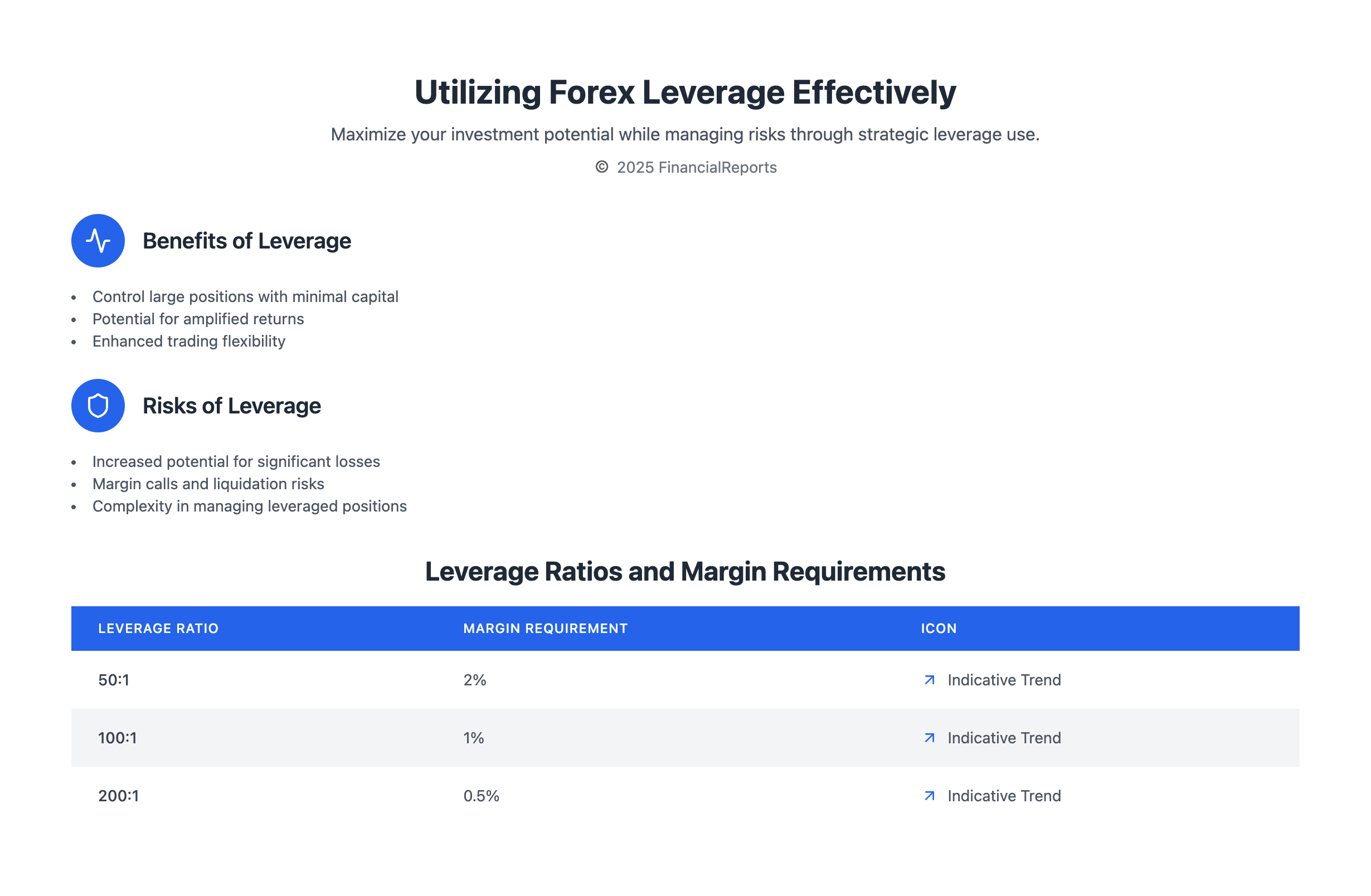

Utilizing Forex Leverage Effectively

Forex leverage lets investors control big positions with small capital. But, it also ups the risk of big losses. The forex market sees over $5 trillion in currency exchanges every day. Leverage ratios can be 50:1, 100:1, or 200:1.

It's key to know the good and bad sides of forex leverage. The main plus is it lets traders handle more capital than they have. This could lead to bigger profits. But, the big minus is small price drops can cause big losses.

Figuring out leverage ratios is vital for picking the right leverage for your strategy. Ratios can go from 50:1 to 400:1. Traders need to make sure losses don't go over 3% of their capital to keep risk in check. Here's a table showing different leverage levels and their margin needs:

| Leverage Ratio | Margin Requirement |

|---|---|

| 50:1 | 2% |

| 100:1 | 1% |

| 200:1 | 0.5% |

Traders must think hard about the pros and cons of forex leverage to avoid big losses. Knowing the different leverage levels and their margin needs helps traders make smart choices. This way, they can manage their risk well.

Automated Forex Trading Solutions

Automated forex trading solutions, like forex robots, bring many benefits. They make trading more efficient and less emotional. These systems differ in speed, performance, and how easy they are to use. It's important to pick the right trading software based on fees, guarantees, and customer reviews.

Some key benefits of automated forex trading include:

- They remove emotional and psychological influences, making trading more logical

- They are faster and more efficient, with trades executed in 0.071 seconds

- They are more accurate, with some firms claiming over 95% winning trades

When choosing an automated forex trading software, consider these factors:

- Look for regulatory compliance from bodies like ASIC, BaFin, and FCA

- Check the trading costs, which vary for major pairs like EUR/USD

- See the variety of assets available, including forex, CFDs, cryptocurrencies, and ETFs

| Feature | Description |

|---|---|

| Execution Time | 0.071 seconds |

| Price Improvement | 0.30 pips |

| Raw Spreads | Starting from 0.0 pips |

Performance Measurement in Forex Investments

Effective performance measurement is key to knowing if forex investments are doing well. By looking at key performance indicators like return on investment and risk-adjusted return, investors can understand how their investments are doing. To learn more about checking how well your forex trading is doing, visit forex performance assessment guides.

Some important metrics for performance measurement include:

- Absolute drawdown

- Relative drawdown

- Profit factor

- Standard deviation

- Sharpe ratio

These metrics help investors check how their strategies are working. By watching key performance indicators and tweaking their strategies, investors can make their forex investments better. This helps them reach their financial goals.

| Metric | Description |

|---|---|

| Absolute Drawdown | Measures the difference between the minimal point below the deposit level and the initial deposit |

| Relative Drawdown | Calculates the highest Max-Drawdown in percentage in the test period |

Common Mistakes in Forex Investing

Forex investing is full of common mistakes that can hurt your success. One big mistake is emotional trading. This means making choices based on feelings, not facts. It can lead to quick, big losses.

Another mistake is overleveraging. This happens when you use too much leverage, leading to big losses. To avoid these, know the risks and take steps to lessen them. This includes setting clear goals, using risk management, and making choices based on facts, not feelings.

Here are some ways to avoid common mistakes in forex investing:

- Set a plan for when to exit to limit losses

- Don't risk more than 1% of your capital on one trade

- Stay calm and make choices based on facts, not emotions

By knowing these mistakes and how to avoid them, you can do better in the forex market. It's key to approach it with a plan and keep your emotions out of it to reach your long-term goals.

| Mistake | Impact | Strategy to Avoid |

|---|---|---|

| Emotional Trading | Impulsive decisions, significant losses | Set clear objectives, use risk management strategies |

| Overleveraging | Significant losses | Do not risk more than 1% of capital on any single transaction |

Future Trends in Forex Investing

The forex market is on the verge of big changes. New technologies are changing how we invest.

Artificial intelligence (AI) and machine learning are making a big impact. They give traders better insights and help manage risks. Algorithmic trading systems are also becoming more common. They make trading more efficient and based on data.

Decentralized finance (DeFi) is opening up new opportunities. It lets traders use more assets and options. Blockchain technology is making transactions safer and more transparent. This reduces risks and costs.

Mobile trading apps are making investing easier. Traders can now trade on the go. Regulatory changes and ESG criteria are also important. They ensure the market is fair and sustainable.

The forex market is growing, and technology is advancing. The future looks bright for forex investing. By keeping up with trends and using new tools, investors can succeed in this fast-changing market.

FAQ

What is a forex investment plan?

A forex investment plan outlines your goals and how much risk you can take. It's key to success in the forex market.

What are the different types of forex investments?

Forex investments include major, minor, and exotic currency pairs. Knowing these types is vital for a good plan.

What are the key components of a successful forex strategy?

A winning strategy includes managing risk, analyzing the market, and diversifying investments.

How do institutional forex investors differ from retail forex investors?

Institutional investors, like banks, have bigger portfolios and follow stricter rules. Retail investors have smaller funds and more freedom.

What are the two primary methods of forex market analysis?

There are two main ways to analyze the market. Fundamental analysis looks at economic data. Technical analysis studies charts to predict prices.

What are the key considerations when developing a forex investment plan?

A good plan sets clear goals and considers your time frame. Choosing the right broker is also important.

How can investors utilize forex leverage effectively?

Leverage lets you control big positions with small capital. But, it also raises the risk of big losses. It's important to calculate leverage carefully.

What are the advantages of automated forex trading solutions?

Automated trading, like using forex robots, boosts efficiency and accuracy. It helps reduce emotional bias. Picking the right software is key.

How can investors measure the performance of their forex investments?

Measuring performance is vital. Use indicators like return on investment and risk-adjusted return. Comparing to market indices helps evaluate success.

What are some common mistakes in forex investing?

Mistakes include emotional trading and overleveraging. Emotional trading is making decisions based on feelings. Overleveraging can lead to big losses.

How are emerging technologies shaping the future of forex investing?

New technologies like AI, machine learning, and blockchain are changing investing. They will likely have a big impact on the forex market.