Optimize Your Portfolio with Option Selling: A Comprehensive Guide

Options trading can be a powerful tool for optimizing a portfolio. It provides a hedge against losses. To learn how to sell options, understanding the concepts and strategies is key. This guide will cover the benefits and risks of options trading.

It will also explain the different types of options, like covered calls and collars. You'll learn how to use them to achieve your investment goals. This knowledge helps investors make informed decisions and optimize their returns.

For example, strategies like long straddles and strangles can profit from market movements. They are useful for investors wanting to learn how to sell options. By understanding these strategies, investors can optimize their portfolios and increase their returns.

Introduction to Options Trading

Options trading involves buying and selling call and put options. These options give the holder the right to buy or sell an underlying asset at a set price. To learn how to sell options, investors need to know the different types and how to use them.

Key Takeaways

- Options trading can be used to optimize a portfolio by providing a hedge against losses.

- Understanding the concepts and strategies involved in options trading is key for making informed investment decisions.

- Different types of options, such as covered calls and collars, can help achieve investment goals through options trading.

- Strategies like long straddles and strangles can profit from market movements, making them useful for investors.

- Options trading involves buying and selling call and put options, giving the holder the right to buy or sell an underlying asset at a set price.

- Investors can use options trading to set a floor on their portfolio's value and limit losses during market declines.

Understanding Options: Key Concepts

Options trading is complex and involves many types of options. It's key to understand the basics to move through this field. Options trading lets you buy and sell contracts that allow you to buy or sell an asset at a set price before a certain date.

There are mainly two types of options: call and put. Call options let you buy an asset, while put options let you sell it. Knowing about strike price, expiration date, and the asset itself is vital for making smart trading choices.

What Are Options?

Options are contracts based on assets like stocks or commodities. They help in making money, speculating, or managing risks. The value of an option changes based on its intrinsic value, time value, and how volatile the asset is.

Types of Options Available

There are several options, but mainly call and put options. Call options allow you to buy an asset, and put options let you sell it. Here are the most common types:

- Call options

- Put options

Common Terminology in Options Trading

Knowing the terms in options trading is essential. Key terms include strike price, expiration date, and the underlying asset. The strike price is the set price for buying or selling, and the expiration date is when the option can no longer be used. The underlying asset is the security the option is based on.

| Term | Definition |

|---|---|

| Strike Price | The predetermined price at which the underlying asset can be bought or sold |

| Expiration Date | The last day on which the option can be exercised |

| Underlying Asset | The security that the option is based on |

The Basics of Selling Options

Selling options means giving someone the right to buy or sell something at a set price by a certain date. If the buyer uses this right, the seller must sell the asset at the agreed price. Knowing how selling options works is key to smart investing.

Buying and selling options are different. Buyers get the right to act, but sellers must follow through. Selling options can be risky but can also earn money and help manage risk.

What Does It Mean to Sell Options?

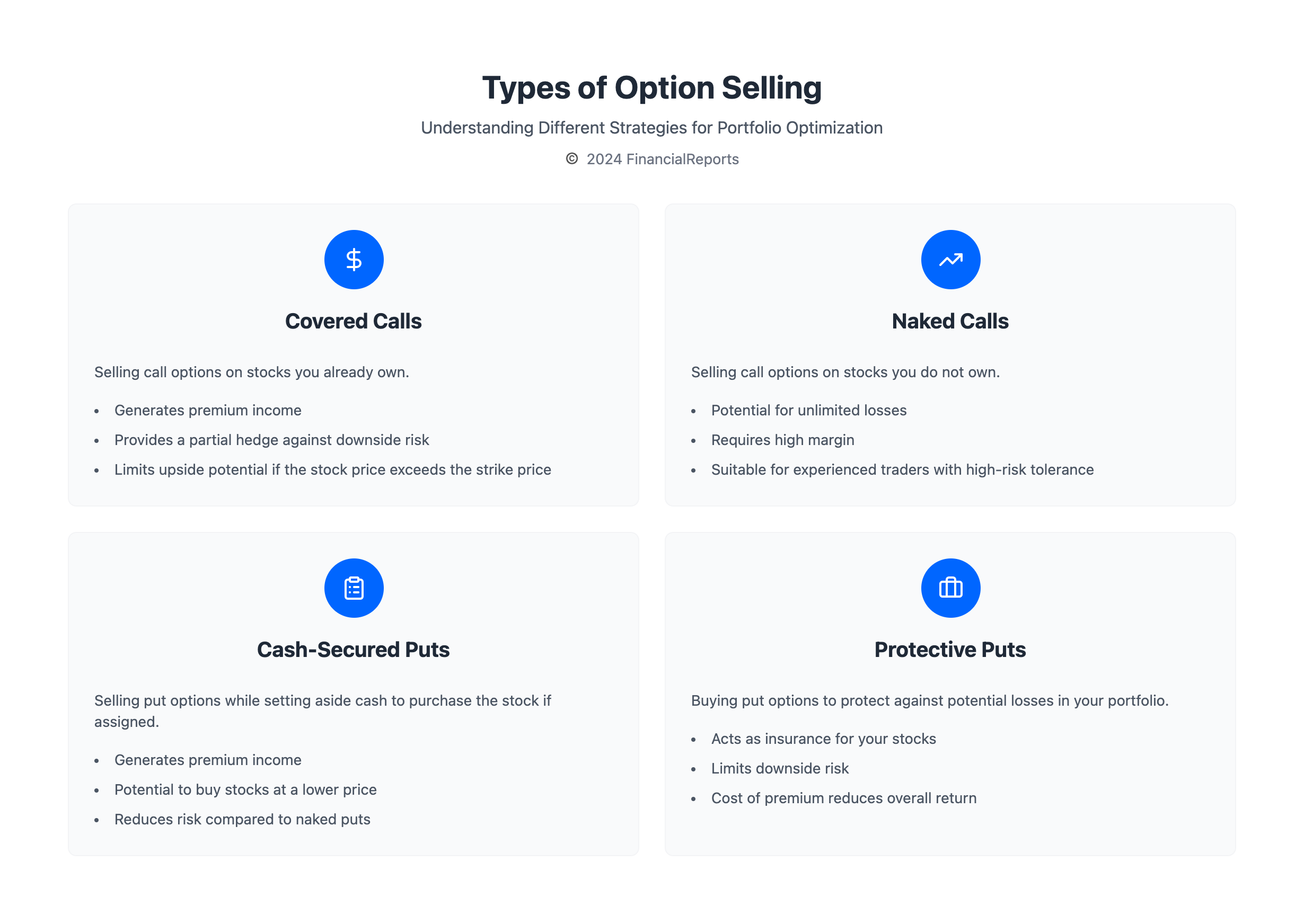

When you sell options, you give someone the right to buy or sell something at a set price. You can use different strategies, like covered calls or naked options. Covered calls are when you sell options on stocks you own. Naked options are when you sell options on stocks you don't own.

Difference Between Buying and Selling Options

Buying and selling options differ in risk and obligation. Buyers have the right but no obligation. Sellers have to sell if the buyer exercises the option. This makes selling options risky, as you might lose money if the market changes.

Here are some key points to consider when selling options:

- Selling options involves giving the buyer the right to buy or sell an underlying asset at a predetermined price.

- Sellers are obligated to sell the underlying asset if the buyer exercises the option.

- Selling options can be a complex and risky strategy, but it can also provide a chance to earn premiums and manage risk.

| Strategy | Description |

|---|---|

| Covered Calls | Selling call options on stocks that the seller already owns. |

| Naked Options | Selling call options on stocks that the seller does not own. |

How to Sell Options Effectively

To sell options well, you need to know the options market and the assets it's based on. Selling options involves several steps. You must pick the right asset, choose the option type, set the strike price and expiration, and decide how many contracts to sell.

There are many options trading strategies to explore. You can use long calls, long puts, covered calls, or protective puts. Each strategy has its own risks and benefits. For instance, buying calls can help you profit from rising prices with some risk. Buying puts can help you make money when prices fall with some risk too.

Here are some key things to think about when selling options:

- Choose the right underlying asset, considering factors such as volatility, liquidity, and market trends.

- Select the type of option to sell, such as a call or put option.

- Set the strike price and expiration date based on your investment strategy and risk tolerance.

- Determine the number of contracts to sell, taking into account your investment goals and risk management needs.

By following these steps and thinking about these factors, you can create a good how to sell options plan. It's also important to keep up with market trends and adjust your plan as needed. With the right strategy and knowledge, selling options can be a profitable move.

| Options Trading Strategy | Description |

|---|---|

| Long Call | Buying a call option to profit from rising prices |

| Long Put | Buying a put option to profit from falling prices |

| Covered Call | Selling a call option on an existing long position to collect premium income |

Risk Management in Options Selling

Managing risk is key in options trading. The risks are high because of the complexity and leverage involved. To lower these risks, traders use strategies like position sizing, diversification, and hedging. Starting with a 1-2% risk per trade can help avoid big losses.

Investors can manage risk in several ways:

- Set stop-loss levels and profit targets to control losses and gains

- Use hedging strategies like protective puts and covered calls to balance risks

- Keep an eye on market volatility, time decay, and changing fundamentals

By using these strategies, investors can protect their capital from big losses. This way, they can reach their investment goals. Risk management is vital for success in options trading.

| Risk Management Strategy | Description |

|---|---|

| Position Sizing | Allocate a fixed percentage of total capital to each trade |

| Diversification | Spread investments across different types of options, underlying assets, and expiration dates |

| Hedging | Use strategies like protective puts, covered calls, and spreads to limit downside risk |

Strategies for Successful Options Selling

Successful options selling needs a good grasp of different trading strategies. Two key ones are naked and covered call selling. Naked call selling means selling a call option without owning the asset. Covered call selling means selling a call option while owning the asset.

Cash-secured put selling is another tactic. It involves selling a put option and setting aside cash for buying the asset if needed. These methods can earn income from premiums but come with risks that must be managed.

Naked vs. Covered Call Selling

Options trading strategies include naked and covered call selling. Naked call selling is risky, selling a call option without the asset. Covered call selling is safer, selling a call option while owning the asset.

Cash-Secured Put Selling

Cash-secured put selling is a strategy that sells a put option and sets aside cash for buying the asset if needed. It can earn income but requires careful risk management to avoid big losses.

When using these strategies, consider market conditions, risk tolerance, financial goals, and experience level. Understanding these factors and choosing the right strategies can boost success in options selling.

| Strategy | Description | Risk Level |

|---|---|---|

| Naked Call Selling | Selling a call option without owning the underlying asset | High |

| Covered Call Selling | Selling a call option and owning the underlying asset | Lower |

| Cash-Secured Put Selling | Selling a put option and setting aside cash to buy the underlying asset | Medium |

By employing these strategies and managing risk well, investors can boost their chances of successful options selling. This can help them reach their financial goals.

Analyzing Market Conditions for Options Selling

When trading options, it's key to do a deep market analysis. This means knowing the current trends, spotting important signs, and seeing both risks and chances. By understanding this, traders can craft good plans for selling options, aiming to win more and lose less.

Understanding market trends is a big part of this. It's about knowing if the market is going up or down. Traders also look at tools like moving averages and the relative strength index (RSI) to get a better feel for the market.

Some key things to think about when looking at market conditions for selling options include:

- Volatility: High volatility means higher option prices, while low volatility means lower prices.

- Economic indicators: Things like GDP, inflation, and job rates can change market trends and how options trade.

- Company performance: How well a company does can affect the price of its stock, which impacts options trading.

By doing a detailed market analysis and thinking about these points, traders can make smart plans for selling options. This helps them make the most of the market and its risks and chances. It's all about making informed choices and aiming for the best results in options trading.

| Market Condition | Impact on Options Trading |

|---|---|

| High Volatility | Higher Option Premiums |

| Low Volatility | Lower Option Premiums |

| Bullish Trend | Increased Demand for Call Options |

| Bearish Trend | Increased Demand for Put Options |

Tools and Platforms for Options Trading

Options trading can be easier with the right tools and platforms. There are many options trading platforms out there. TD Ameritrade, Fidelity, and E*TRADE are some of the most popular, each with its own features and fees.

Key trading tools include options pricing models, volatility charts, and market news feeds. These tools help traders make smart choices and keep up with market trends. Many platforms also offer advanced features like automation, backtesting, and education resources to enhance trading skills.

Some notable platforms and their features include:

- tastytrade: offers low options commissions and a user-friendly interface

- Charles Schwab: provides a wide range of trading tools and resources

- Interactive Brokers: caters to professional traders with advanced tools and pricing structure

When picking an options trading platform, think about fees, features, and customer support. The right platform and tools can help traders manage their portfolios better and succeed in options trading.

| Platform | Account Minimum | Fees |

|---|---|---|

| tastytrade | $0.00 | $1.00 for options on stocks and ETFs |

| Charles Schwab | No account minimum | $0.65 per option contract |

| Interactive Brokers | $0.00 | $0.65 per contract for options |

Tax Implications of Selling Options

When you trade options, it's key to think about the taxes you might owe. The taxes can be tricky and depend on the type of option and how long you hold it. Knowing about these taxes helps you make smart choices and save on taxes.

For most investors, about 65% face long-term capital gains taxes from selling options. These taxes are 15% more than what you'd pay selling stocks. Many investors use tax-loss harvesting to reduce their tax bills, with about 45% doing so.

Here are some important things to remember about taxes on selling options:

- 60% of the gain or loss from non-equity options contracts is taxed at the long-term capital tax rates, while 40% is taxed at short-term capital tax rates.

- Short puts and short calls are always treated as short-term gains or losses, regardless of the holding period.

- Losses on straddles are generally deferred, with any realized losses not being deductible until the offsetting position is closed out.

Also, the average tax rate for selling options is about 25%. Around 75% of option sellers get help from tax pros to handle their taxes. This shows how important it is to get expert advice in the complex world of options trading and taxes.

| Tax Implication | Description |

|---|---|

| Long-term Capital Gains Tax | Applies to 60% of gains from non-equity options contracts |

| Short-term Capital Gains Tax | Applies to 40% of gains from non-equity options contracts and all short puts and short calls |

Building an Options Selling Strategy

Creating a winning options trading strategy means making a plan that fits your goals, risk level, and market insights. A good plan should outline the options to sell, the assets to use, and how to manage risks.

To craft a strong options trading strategy, focus on these important points:

- Define your investment goals and risk tolerance

- Choose the right underlying assets

- Select the appropriate options trading strategy, such as covered calls or cash-secured puts

- Implement risk management techniques, such as stop-loss orders or position sizing

A tailored plan can help you reach your investment targets and cut down on losses. By adding a solid options trading strategy to your investment plan, you can boost your chances of success in the markets.

| Options Trading Strategy | Description |

|---|---|

| Covered Calls | Selling call options on owned stocks to generate income |

| Cash-Secured Puts | Selling put options on stocks to buy at a discounted price |

By following these tips and making a customized plan, investors can build a successful options trading strategy that suits their unique needs and goals.

Resources for Continued Learning

As an options trader, it's key to keep up with market trends and strategies. Luckily, many options trading resources help with continued learning. You can find books, guides, online courses, and webinars. They offer deep insights into options trading.

Books like "Options Trading for Dummies" and "The Options Course" are great for beginners. They cover the basics, trading strategies, and managing risks. Online courses and webinars also offer interactive learning. They let traders ask questions and get feedback from experts.

Books and Guides on Options Trading

- "Options Trading for Dummies"

- "The Options Course"

- "Know Your Options" book, which teaches how to trade options and use technical analysis

Online Courses and Webinars

Online courses and webinars are top choices for continued learning in options trading. They cover everything from basic concepts to advanced strategies. Using these options trading resources, traders can boost their knowledge and skills. This leads to better trading results.

Common Mistakes to Avoid in Options Selling

When you start trading options, it's key to watch out for common mistakes. Two big ones to avoid are misreading market trends and not following risk management advice.

Misjudging Market Movements

One big risk in options selling is guessing the market wrong. Selling options at the wrong time or not adjusting your plan when the market changes can lead to big losses. It's important to keep up with market news, analyze trends, and watch how your assets perform.

Ignoring Risk Management Tips

Good risk management is key to trading options well. Not protecting yourself from losses or not managing your risk can lead to big financial problems. Using strategies like diversifying your portfolio, setting stop-loss orders, and keeping an eye on your positions can help you trade with more confidence.

FAQ

What are options?

Options are contracts that give the buyer the right to buy or sell an asset at a set price before a certain date. They don't require the buyer to do so.

What are the main types of options?

There are two main types: call and put options. Call options let the buyer buy the asset. Put options let the buyer sell the asset.

What is the difference between buying and selling options?

Buying options means the buyer has the right to act. Selling options means the seller must act if the buyer does.

What are the steps to begin selling options?

To sell options, choose the right asset. Pick the option type. Set the strike price and expiration date. Decide how many contracts to sell.

What are the key risks involved in options trading?

Options trading has market, liquidity, and credit risks. To manage these, use hedging, diversification, and position sizing.

What are some common options selling strategies?

Common strategies include naked call selling, covered call selling, and cash-secured put selling.

How can market trends and indicators be used for options trading?

Trends and indicators like moving averages and RSI help traders decide when to buy or sell options.

What are some recommended trading platforms and tools for options traders?

TD Ameritrade, Fidelity, and E*TRADE are good platforms. Tools like options pricing models and volatility charts are essential.

What are the tax implications of selling options?

Selling options can be complex. It depends on the option type, holding time, and tax status. Capital gains tax applies to profits.

How can investors build a successful options selling strategy?

A successful strategy involves a customized plan. It should consider goals, risk tolerance, and market analysis. Include the type of options, underlying assets, and risk management.

What are some resources for continued learning about options trading?

Books, online courses, and webinars are great for learning. They offer the chance to ask questions and get feedback.

What are some common mistakes to avoid in options selling?

Avoid misjudging market movements and ignoring risk management tips. These mistakes can lead to big losses if not managed.