Operating vs Gross Profit: Key Financial Insights

Gross profit and operating profit are key in financial analysis. They show a company's health and how well it runs. Knowing the difference between operating and gross profit helps understand a company's success. These figures are on the income statement, showing profits at different stages.

Calculating gross profit, operating profit, and net income is important. It helps see a company's strengths and weaknesses. Gross profit looks at direct costs, while operating profit includes more expenses. Net income covers all costs. Watching these numbers helps find ways to get better and make smart choices.

Introduction to Profit Metrics

Understanding the difference between operating and gross profit is key. It guides pricing, production, and planning. Investors look at these to see if a company can grow and make money. By checking these, businesses can work better, make more money, and make smart choices.

Key Takeaways

- Gross profit and operating profit are essential metrics in financial analysis.

- The comparison of operating vs gross profit provides insights into a company's financial health and operational efficiency.

- Gross margin vs operating margin are key indicators of financial performance.

- Regular monitoring of gross profit, operating profit, and net income helps identify financial strengths and weaknesses.

- These metrics are vital for startups and established businesses in budgeting, investment decisions, and improving operational efficiency.

- Gross profit margin and operating profit margin are important for evaluating a company's profitability and growth.

Understanding Profit Metrics in Business

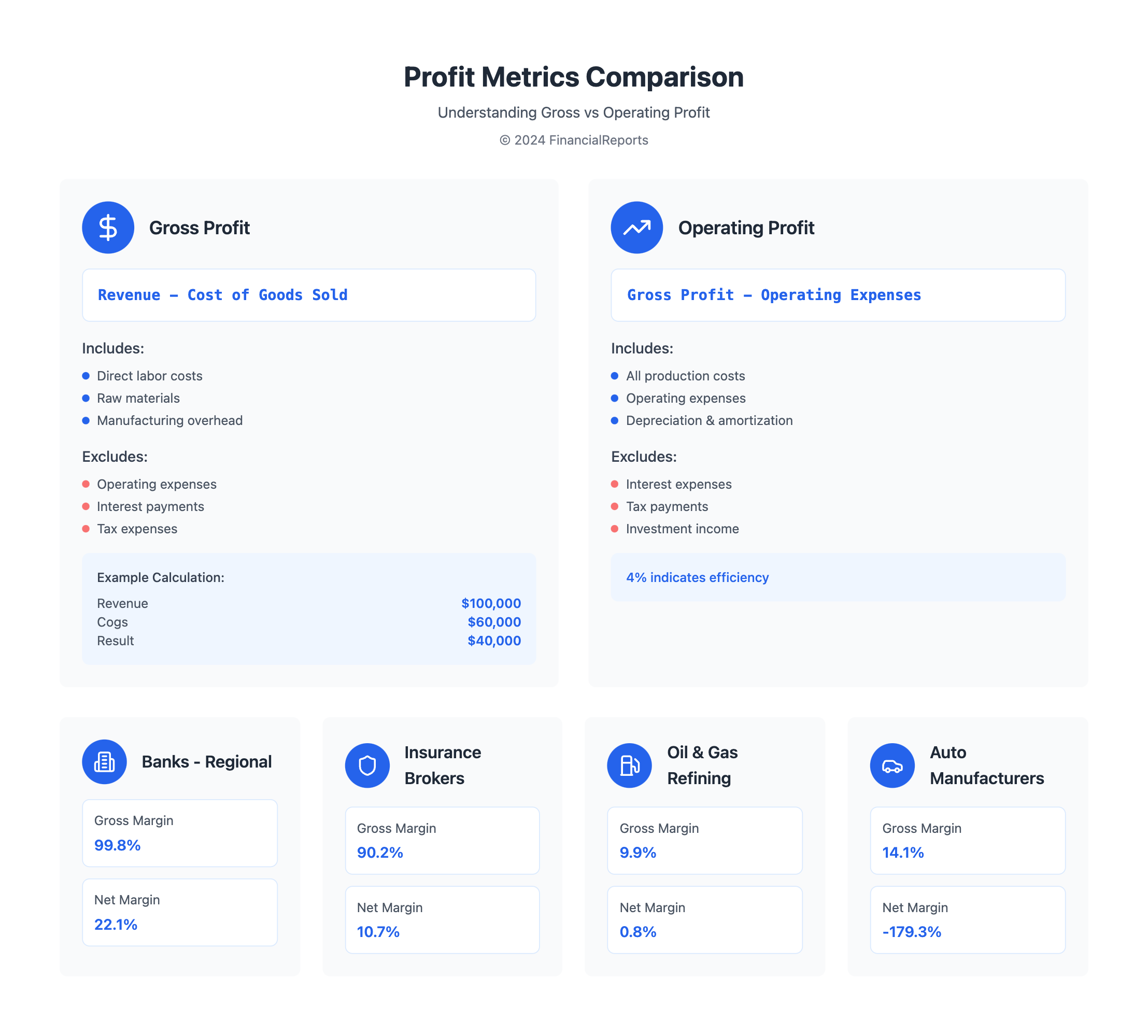

When looking at a company's financial health, it's key to know the different profit metrics. Gross profit is the profit from making goods and services. It's found by subtracting the cost of goods sold from revenue. Operating profit, on the other hand, is what's left after subtracting operating expenses from gross profit.

The operating profit margin and gross profit margin are also important. They show how well a company is doing and how efficient it is. These metrics help investors and financial experts see if a company is running smoothly.

To calculate these metrics, it's simple. Gross profit is found by subtracting the cost of goods sold from revenue. Operating profit is found by subtracting operating expenses from gross profit. The operating profit margin is found by dividing operating income by net sales and then multiplying by 100. Knowing these differences can show if a company is doing well or if there are areas to improve.

Some important things to remember when looking at profit metrics include:

- Gross profit and operating profit both show how well a company is doing financially.

- The operating profit margin and gross profit margin give insight into a company's efficiency and profitability.

- Investors use these metrics to check a company's financial health and compare it to others.

By looking at trends in costs, expenses, and revenue, companies can see how they might do in the future. The operating profit margin vs gross profit margin is very important. It helps companies find areas to get better and improve their financial performance.

| Profit Metric | Calculation | Importance |

|---|---|---|

| Gross Profit | Revenue - Cost of Goods Sold | Indicates profit from production of goods and services |

| Operating Profit | Gross Profit - Operating Expenses | Indicates profit from operations, excluding non-operating items |

| Operating Profit Margin | (Operating Profit / Net Sales) x 100 | Indicates operational efficiency and profitability |

How Gross Profit is Calculated

Gross profit is key to understanding a company's financial health, focusing on operating vs gross margin. It's found by subtracting the cost of goods sold (COGS) from total revenue. COGS includes direct labor, materials, and a part of manufacturing overhead related to production. This shows how well a company makes profit from its main activities, which is vital for checking its gross operating profit.

To grasp how it's calculated, let's look at the main parts. The formula is simple: Revenue - Cost of Goods Sold. For example, if a company makes $100,000 and its COGS is $60,000, its gross profit is $40,000. This figure is important for businesses to see if their prices, production costs, and profits are good.

Formula for Gross Profit

The formula for gross profit is: Gross Profit = Revenue - COGS. This is key to figuring out a company's gross operating profit, which shows how well it's doing financially. By looking at gross profit, businesses can spot where to improve, like cutting COGS or boosting revenue, to better their operating vs gross margin.

Key Components of Gross Profit

The main parts of gross profit are:

- Revenue: The total money a company makes from sales.

- COGS: The direct costs of making goods, like labor, materials, and overhead.

These parts are vital for figuring out gross profit. It gives valuable insights into a company's financial health andgross operating profit.

Operating Profit Calculation Methodology

Operating profit is key in financial analysis. It shows how well a company does and how efficient it is. To find it, you subtract all operating costs from gross profit. This includes both fixed and variable costs.

The formula for the operating margin is: Operating Margin (%) = Operating Profit ÷ Revenue. This shows how profitable a company is as a percentage.

Gross profit margin and operating profit margin are different. Gross profit margin looks at direct costs only. But operating profit margin looks at both direct and indirect costs. For example, NVIDIA Corporation had an operating margin of 38.9% in Q1-22. This shows they are very efficient.

Several things can change operating profit. These include:

- How much revenue a company makes

- The cost of goods sold (COGS)

- Operating expenses like rent, insurance, and payroll

- How much assets are worth over time

Knowing these factors helps in understanding a company's operating profit. It's important for making smart business choices. By tracking operating profit, companies can see how they're doing. They can find ways to get better and make more money.

Components Affecting Gross Profit

Gross profit is key in financial analysis. It's influenced by several factors. Knowing these helps businesses boost their production and profits. Gross profit is found by subtracting Cost of Goods Sold (COGS) from Total Revenue. COGS includes direct costs like raw materials and labor, but not indirect costs.

The link between gross profit and operating profit is important. Operating profit adds operating expenses, interest, and taxes to gross profit. By looking at both, businesses can find ways to cut costs and boost profits. For example, a company might have high gross profit margins but lower operating profit margins due to high expenses.

Revenue Generation and COGS

Revenue and COGS are key to gross profit. Sales volume, raw materials, and labor costs all play a part. To control COGS, businesses can focus on cost reduction and process improvement. This can lead to higher gross profit margins and better financial health.

| Component | Description | Impact on Gross Profit |

|---|---|---|

| Revenue Generation | Total sales revenue | Directly affects gross profit |

| COGS | Direct costs of production | Subtracted from revenue to calculate gross profit |

| Operating Expenses | Indirect costs, such as corporate office costs | Affect operating profit, not gross profit |

Understanding what affects gross profit helps businesses make better decisions. They can improve production, manage costs, and enhance their finances. Knowing the difference between gross and operating profit is vital. It helps businesses spot areas for growth and plan to increase their profits.

Factors Influencing Operating Profit

Operating profit is key for businesses. It shows how well a company does from its main activities. Knowing the difference between operating margin and profit margin is important. It shows how a company's operating income compares to its net income.

Also, comparing gross margin to operating margin is vital. It shows how a company's gross profit relates to its operating profit.

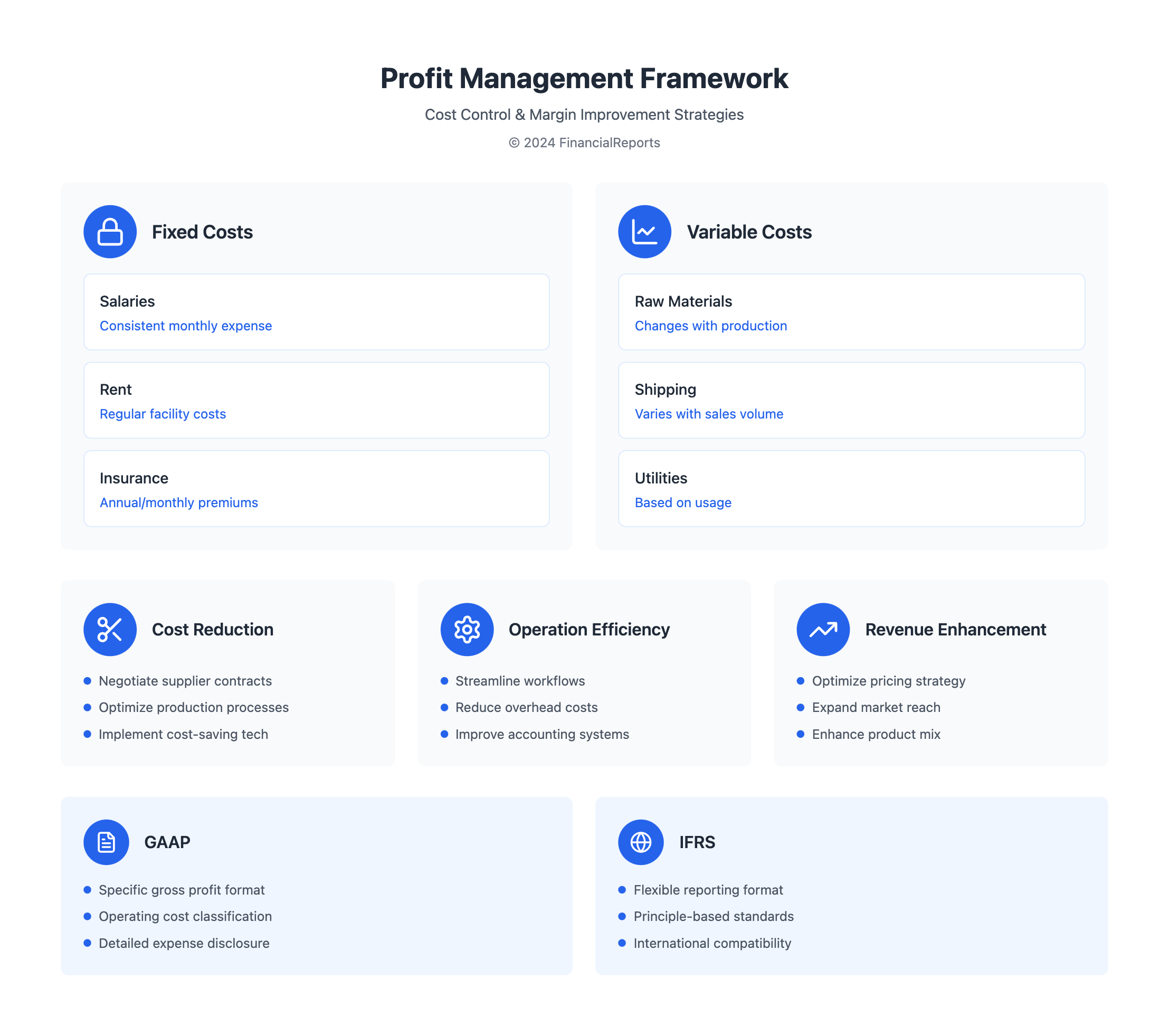

Many things affect operating profit. This includes operating expenses, which have fixed and variable costs. Fixed costs, like rent and insurance, stay the same. Variable costs, like shipping, change with how much is made.

Depreciation and amortization also play a big role. These non-cash expenses can affect a company's operating profit.

Operating Expenses Breakdown

Looking closely at operating expenses is important. It helps understand what affects operating profit. By analyzing costs, companies can find ways to cut expenses. This can help improve their operating margin and make more money.

Fixed vs. Variable Costs

It's important to know the difference between fixed and variable costs. Fixed costs, like salaries and rent, stay the same. Variable costs, like raw materials and shipping, change with how much is made.

By managing these costs well, companies can keep a good operating margin. This helps improve their financial health.

| Cost Type | Description | Example |

|---|---|---|

| Fixed Costs | Remain constant, regardless of production levels | Salaries, rent, insurance |

| Variable Costs | Change with production levels | Raw materials, shipping, freight |

By looking at what affects operating profit, companies can make better choices. They can work on their cost structure to improve financially. This can lead to more profit and a stronger market position.

Comparing Gross and Operating Profit

Understanding the difference between gross profit and operating profit is key to analyzing a company's health. Gross profit vs operating profit shows how efficient and profitable a company is. It also highlights the expenses included in each profit type.

Gross profit doesn't include debt expenses, taxes, or other running costs. Operating profit, on the other hand, doesn't include interest payments, taxes, or investment income. The operating profit margin shows how well a company operates. For example, a 4% margin means it's efficient and creates value beyond just sales profit.

Here are the main differences between gross and operating profit:

- Gross profit focuses solely on direct production costs

- Operating profit reflects profit after accounting for both direct and overhead expenses

- Gross margin is calculated as (Total Revenue - COGS) / Total Revenue

- Operating margin is calculated as (Operating Income - Operating Expenses) / Total Revenue

Improving both gross and operating margins is vital for a company's financial health and efficiency. By tracking and comparing these margins, companies can set goals, measure success, and increase earnings.

| Metric | Calculation | Description |

|---|---|---|

| Gross Margin | (Total Revenue - COGS) / Total Revenue | Represents a company's total revenue minus its cost of goods sold (COGS) |

| Operating Margin | (Operating Income - Operating Expenses) / Total Revenue | Measures how much operating profit a company makes as a percentage of its total revenue |

Analyzing Profitability Ratios

When looking at a company's financial health, it's key to check profitability ratios. We focus on the operating profit margin and the gross profit margin. The gross profit margin shows how well a company manages its costs. The operating margin looks at revenue and the costs to make that revenue.

The operating vs gross margin ratios help us see a company's financial shape. The gross margin ratio shows how well a company can cover costs and make a profit. The operating margin ratio shows how well a company manages its costs to make earnings.

Gross Margin Ratio

The gross margin ratio is found by dividing gross profit by sales revenue. It shows how well a company can cover its costs and make a profit. A higher ratio means a company can charge more for its products or services.

Operating Margin Ratio

The operating margin ratio is found by dividing operating profit by sales revenue. It shows how well a company manages its costs. A higher ratio means a company is good at managing its operations and making earnings.

For investors, looking at these ratios is important. It helps them see how well a company operates and makes money. By comparing the operating profit margin to the gross profit margin, investors can understand a company's earnings better. This helps them make smart investment choices.

| Ratio | Formula | Interpretation |

|---|---|---|

| Gross Margin Ratio | Gross Profit / Sales Revenue | Efficiency in covering operating expenses and providing net earnings |

| Operating Margin Ratio | Operating Profit / Sales Revenue | Management efficacy in cost control and operational efficiency |

Managing Costs to Improve Profit Margins

To boost profit margins, companies need to manage their costs well. This means cutting the Cost of Goods Sold (COGS) and keeping operating expenses in check. Doing this helps businesses increase their gross operating profit and do better financially.

There are ways to lower COGS, such as:

- Negotiating better deals with suppliers

- Optimizing production processes

- Implementing cost-saving technologies

Also, companies can manage operating expenses by:

- Streamlining operations

- Reducing overhead costs

- Implementing efficient accounting systems

By looking at operating vs profit margin, companies can spot areas to get better. They can make smart choices based on data to improve their operations. This can lead to more profit and help them compete better in the market.

Good cost management is key for businesses to keep a healthy gross operating profit and better operating vs profit margin. By using these strategies, companies can reach their financial goals and stay competitive.

Industry Variations in Profit Metrics

When looking at profit metrics, it's key to think about how different industries compare. The gross profit margin and operating profit margin can vary a lot. For example, Banks - Regional have an average gross profit margin of about 99.8%. On the other hand, Oil & Gas Refining & Marketing has an average of around 9.9%.

Comparing ebit vs gross margin and operating vs gross profit can give us important insights. Here's a table showing the average gross and net profit margins for different industries:

| Industry | Average Gross Profit Margin | Average Net Profit Margin |

|---|---|---|

| Banks - Regional | 99.8% | 22.1% |

| Insurance Brokers | 90.2% | 10.7% |

| Oil & Gas Refining & Marketing | 9.9% | 0.8% |

| Auto Manufacturers | 14.1% | -179.3% |

By looking at these differences, companies can get a clearer picture of their financial health. This helps them make better choices to boost their operating vs gross profit margins.

Financial Reporting Standards

Companies must follow specific standards for financial reporting to ensure transparency and accuracy. In the United States, Generally Accepted Accounting Principles (GAAP) guide public companies. The International Financial Reporting Standards (IFRS) standardizes reporting worldwide.

GAAP and IFRS have different rules for gross profit and operating profit reporting. For example, GAAP shows gross profit as revenue minus cost of goods sold. IFRS offers more flexibility in operating profit reporting. Knowing these differences is key for analyzing financial statements and comparing operating margin vs profit margin across countries.

Important aspects of financial reporting standards include:

- Revenue recognition

- Expense classification

- Inventory valuation

By following these standards, companies can make sure their financial reports are accurate. This gives stakeholders a clear view of their gross profit and operating profit.

Conclusion: Making Sense of Profit Metrics

We've looked closely at the big difference between operating and gross profit. They are key for businesses to understand. Gross profit shows how well a company manages its costs and production. On the other hand, operating profit gives a full picture of a company's success, including all expenses.

Recap of Key Takeaways

Gross profit margin and operating profit margin are important for financial insights. The gross profit margin shows how well a company manages its direct costs and revenue. The operating profit margin, though, looks at all expenses to show the company's true profitability. Both are key for making smart decisions and checking how well a company is doing.

Strategic Implications for Management

Knowing the difference between operating and gross profit is key for leaders. Gross profit helps with making things more efficient and setting prices. Operating profit, though, is about planning for the future, like cash flow and growth. Using both helps understand a company's health and how well it works.

Importance for Stakeholders and Investors

For those who invest or have a stake in a company, looking at gross and operating profit margins is essential. These numbers tell a lot about a company's costs, pricing, and success. They are key to figuring out if a company is a good investment and if it will grow.

FAQ

What is the difference between operating profit and gross profit?

Gross profit looks at the direct costs of making a product. Operating profit includes all costs of running a business. This gives a clearer picture of a company's success.

Why are gross profit and operating profit important in financial analysis?

These metrics help understand a company's health and how well it operates. They show how profitable a company is and how it performs.

How is gross profit calculated?

To find gross profit, subtract the cost of goods sold from total sales. This shows how much profit comes from making products.

What is the formula for operating profit?

Operating profit is found by subtracting all business costs from gross profit. This gives a full view of a company's profit.

What factors affect gross profit?

Several things can change gross profit. These include how much a company makes, its production costs, and sales discounts or returns.

What are the main components that influence operating profit?

Operating profit is shaped by business costs, both fixed and variable. Depreciation and amortization also play a role.

How do gross profit and operating profit differ, and when should each metric be emphasized?

Gross profit focuses on making products, while operating profit looks at all business costs. The right one to use depends on the business and what you want to know.

How are profitability ratios, such as gross margin and operating margin, calculated and what do they reveal?

These ratios are found by dividing profit by sales. They show how efficient a company is and its profit level.

What strategies can businesses employ to improve their gross and operating profit margins?

Companies can cut production costs and control expenses to boost profit margins. This makes them more profitable overall.

How do profit metrics vary across different industries?

Profit metrics change by industry due to different business needs and market conditions. EBIT helps compare profitability across sectors.

How do financial reporting standards, such as GAAP and IFRS, impact the reporting of gross and operating profit?

The choice of financial standards affects how profit is reported. This is key when comparing companies in different places.