Net Percentage Calculator - Quick & Easy Results

A net percentage calculator is a tool for fast and simple percentage calculations. It's great for discounts, tips, and value changes. It's a must-have for financial experts, investors, and big clients who deal with complex numbers.

This calculator helps with various tasks, like finding net income or the total price of a product with tax. It's perfect for anyone who works with percentages. It saves time and cuts down on mistakes, making it a key tool for financial work.

Key Takeaways

- The net percentage calculator is a tool used to calculate percentages quickly and easily.

- It is essential for financial professionals, investors, and institutional clients who need to streamline complex percentage calculations.

- The calculator provides efficient and accurate results, making it an invaluable asset in today's data-driven financial landscape.

- It can be used to calculate percentages for different scenarios, such as calculating net income or determining gross price.

- Using a net percentage calculator can save time and reduce errors, making it an indispensable tool for financial calculations.

- The net percentage calculator is a powerful tool that provides quick and easy results, making it an essential asset for anyone who needs to work with percentages.

- It is a must-have tool for anyone who needs to calculate percentages regularly, including financial professionals, investors, and institutional clients.

What is a Net Percentage Calculator?

A net percentage calculator helps figure out a percentage of a number, considering the net value. It's often used in finance and business to find sales, revenue, or profit percentages. This tool is key for businesses to grasp their financial health and make smart choices.

In finance, it's used to find net income. This is the income left after subtracting expenses and taxes. Net income shows if a business is profitable and can pay back loans. A high net income means a business is doing well financially.

This calculator works well with a percentage of sales calculator to see sales revenue percentages. It helps businesses understand their sales and make better decisions on pricing, marketing, and sales strategies.

| Calculator Type | Description |

|---|---|

| Net Percentage Calculator | Calculates the percentage of a number, taking into account the net value |

| Percentage of Sales Calculator | Calculates the percentage of sales revenue |

Using both calculators gives businesses important insights into their finances. This helps them make choices to grow and increase profits.

How to Use a Net Percentage Calculator

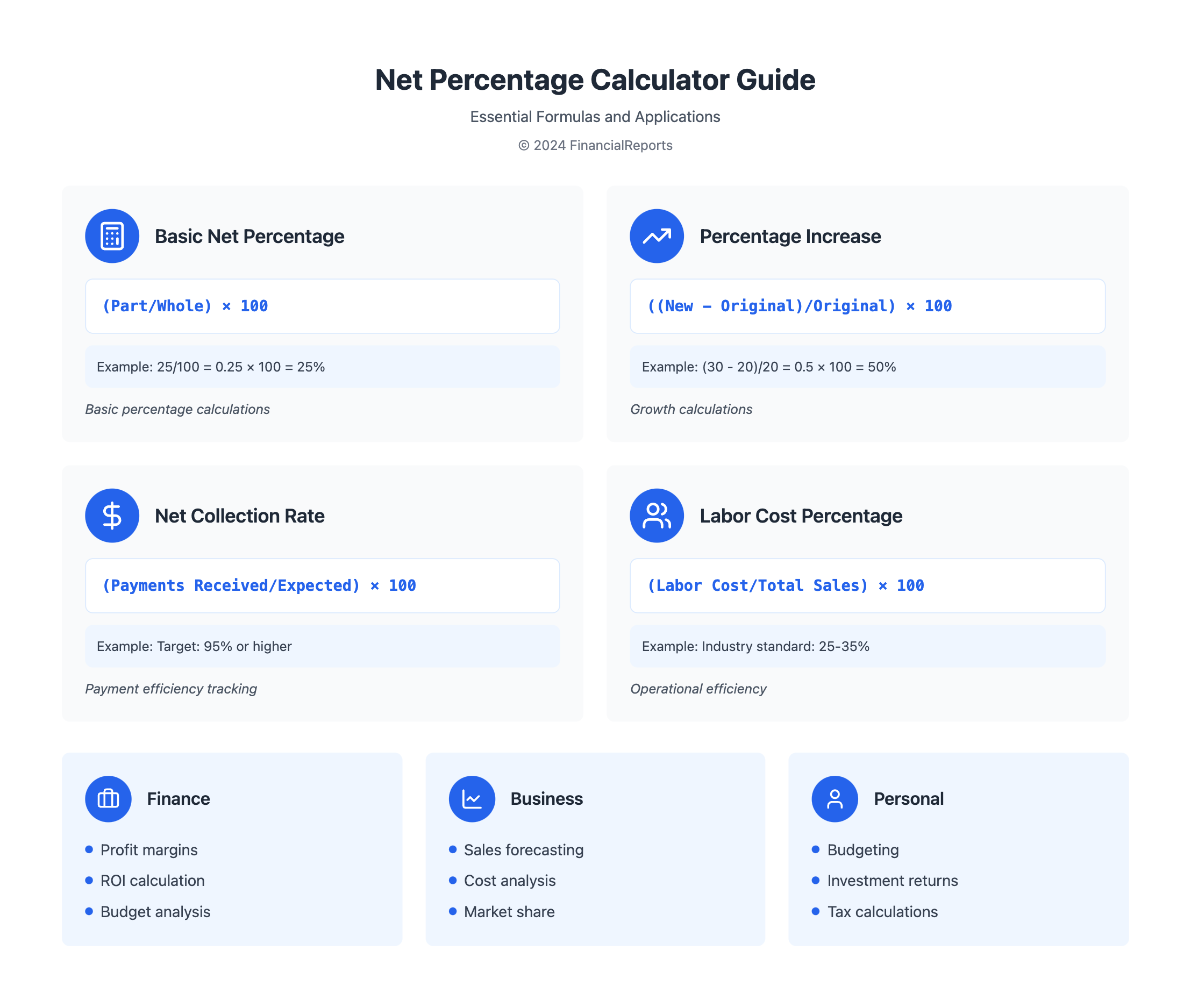

To use a net percentage calculator, you need to know how to calculate percentages. The formula is simple: divide the part by the whole and then multiply by 100. This basic idea is key in many financial tasks, like finding the net percentage of a certain amount.

A net percentage calculator is a big help for those in finance. It makes it easy to figure out percentages. For example, it can show you the real bonus amount after taxes.

Step-by-Step Guide

Here's how to use a net percentage calculator:

- Enter the starting value and the percentage you want to find.

- Pick the type of calculation you need, like finding a percentage of a number or figuring out an increase or decrease.

- Put in any extra details, like tax rates or deductions.

- Look at the results to see the net percentage you've calculated.

Tips for Accurate Calculations

To get accurate results, watch out for rounding errors and complex situations. A net percentage calculator can give you exact figures. Also, knowing the formulas and principles behind percentages helps you make better choices and avoid mistakes.

| Calculation Type | Formula | Example |

|---|---|---|

| Percentage of a Number | (Part/Whole) * 100 | 25/100 = 0.25 * 100 = 25% |

| Percentage Increase | ((New Value - Original Value) / Original Value) * 100 | (30 - 20) / 20 = 0.5 * 100 = 50% |

Applications of a Net Percentage Calculator

The net percentage calculator is used in many areas like personal finance, business, and school. In personal finance, it helps with budgeting, planning investments, and figuring out taxes. For example, it can show how much you can save or invest based on your income.

In business, it's key for predicting sales, checking profit margins, and managing costs. The net product percentage formula, NPP = PR / TR * 100, is used to find out how much of the total revenue comes from a product. This helps businesses see how much their products contribute to their overall revenue.

Some main uses of the net percentage calculator are:

- Budgeting and investment planning in personal finance

- Sales forecasting and profit margin analysis in business

- Statistical analysis and research methodologies in academics

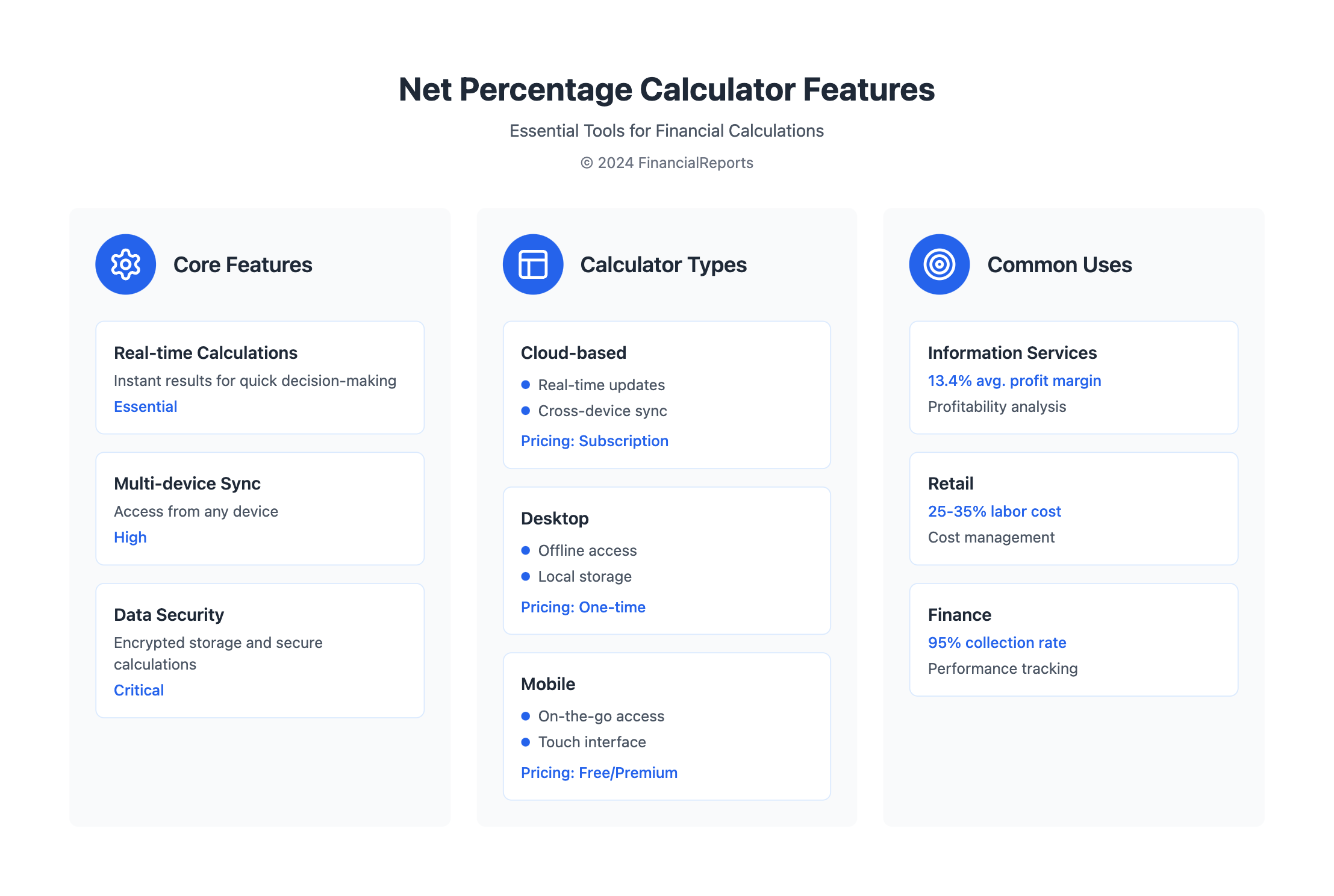

Using a net percentage calculator helps people and businesses make smart financial choices. For instance, knowing the average net profit margin ratio for an industry can guide businesses and investors. For example, the 13.4% average for information services in the U.S. helps set goals and make decisions.

| Industry | Average Net Profit Margin Ratio |

|---|---|

| Information Services | 13.4% |

| Shipbuilding | -1.8% |

The net percentage calculator is a valuable tool for anyone who wants to understand and analyze financial data. It's a must-have for financial experts, investors, and clients.

Benefits of Using a Net Percentage Calculator

Financial experts and investors find a net percentage calculator very useful. It saves time by doing quick and accurate net percentage calculations. This lets them spend more time on analysis and making decisions.

Another big plus is its accuracy and reliability. It reduces the chance of mistakes by automating the process. This means professionals can trust the results for making smart choices. The calculator can also handle tough calculations well, giving consistent and exact results.

Some of the main benefits of using a net percentage calculator include:

- Time savings: automate calculations and focus on analysis and decision-making

- Accuracy: minimize the risk of human error and rely on precise results

- Reliability: handle complex calculations with ease and consistency

By using a net percentage calculator, financial experts and investors can make their work easier. They can improve their accuracy and make better decisions. This can lead to better financial results and higher profits.

| Calculator Feature | Benefit |

|---|---|

| Time Efficiency | Automate calculations and focus on analysis |

| Accuracy | Minimize human error and rely on precise results |

| Reliability | Handle complex calculations with ease and consistency |

Common Mistakes When Calculating Percentages

Calculating percentages can be tricky. Even small mistakes can cause big errors in money plans. A cost percentage calculator helps by giving exact numbers. One big mistake is not knowing the right formula, which is key for things like increases or decreases.

Another mistake is making errors when rounding numbers. For example, a study showed many American college students get a question about total percentage change wrong. They often guess a 4% decrease instead of the right answer. This shows why using a reliable cost percentage calculator is so important.

Misunderstanding the Formula

It's vital to know the formula for percentages and use it right. A cost percentage calculator makes this easier by giving clear and correct results. Some common mistakes include:

- Not understanding how percentage change works with the original number

- Using the formula wrong, which messes up financial plans

- Not thinking about how rounding affects the accuracy of numbers

Rounding Errors

Rounding errors can really mess up calculations, even with big numbers. A cost percentage calculator helps by giving exact results. For instance, a $30 million increase to $38 million shows almost a 27% rise. But small rounding mistakes can make a big difference in money plans.

| Original Value | Percentage Change | Calculated Value |

|---|---|---|

| $30 million | 27% | $38.1 million |

| $30 million | 26% | $37.8 million |

Using a cost percentage calculator helps avoid these mistakes. It ensures accurate numbers, leading to better financial choices.

Comparing Different Net Percentage Calculators

Choosing the right net percentage calculator is key. Look for one that offers accurate and quick calculations. It should also be easy to use.

Important features include how fast it calculates, its range of functions, and if it works with other financial tools. Also, check its security features. The calculator's design, how well it works on mobile devices, and if you can customize it are part of the user experience.

Features to Look For

- Calculation speed and accuracy

- Range of functions, including percentage increase and decrease calculations

- Integration capabilities with other financial tools, such as spreadsheets and accounting software

- Data security features, including encryption and secure data storage

User Experience

A great net percentage calculator is easy to use. It should be simple, even for those not tech-savvy. Being able to use it on mobile devices is also important.

| Calculator | Calculation Speed | Range of Functions | Integration Capabilities | Data Security Features |

|---|---|---|---|---|

| Calculator 1 | Fast | Basic | Limited | Basic encryption |

| Calculator 2 | Very Fast | Advanced | Extensive | Advanced encryption and secure data storage |

By looking at these points, you can pick the best net percentage calculator. It should meet your needs and give you accurate, fast results.

Real-life Scenarios to Use a Net Percentage Calculator

Financial experts and investors often use a percentage of sales calculator. They analyze budgetary expenses to make smart choices. For example, a company can see how much net income it has compared to revenue. If it's over 10%, it's considered good.

A net percentage calculator is useful in many financial areas. It helps with budgeting, tracking investments, and analyzing performance. When making a budget, it helps allocate resources well. It also shows how expenses compare to income.

In investment tracking, it helps calculate returns and compare portfolios. This way, you can see how different investments perform.

Practical Applications

- Budgeting: Find out how much of your income goes to expenses like housing and food.

- Investment Tracking: See how much you're making on your investments and compare it to others.

- Performance Analysis: Check sales targets and market share to find ways to improve.

Using a percentage of sales calculator helps make informed decisions. It can help your business grow. For more tips on percentages, check out this resource. It shows how to calculate percentages and improve your financial planning.

Enhancing Your Calculation Skills

To make smart choices in finance, business, and more, knowing percentages is key. A net percentage calculator is a great tool. It helps you grasp percentage concepts better, leading to more precise decisions.

Understanding percentages is vital in many areas, such as:

- Financial planning and budgeting

- Calculating discounts and interest rates

- Assessing return on investment

- Setting and tracking health and fitness goals

A net percentage calculator can check your math and boost your math skills. By solving real-life problems, you'll get better at using percentages in your choices.

| Concept | Formula | Example |

|---|---|---|

| Percentage Increase | (New Number - Original Number) / Original Number * 100 | 30% increase in working hours |

| Percentage Decrease | (Original Number - New Number) / Original Number * 100 | 23% decrease in working hours |

By learning to calculate percentages and using a net percentage calculator, you'll understand financial data better. This knowledge will help you make smarter choices in your life and work.

Frequently Asked Questions (FAQs)

Understanding the difference between gross and net percentages is key when using a cost percentage calculator. The gross amount includes tax, while the net amount does not. This is important for many financial tasks, like figuring out the cost of goods sold or the net profit margin.

It's also important to know if you're working with gross or net amounts. This helps you accurately calculate percentages. A cost percentage calculator makes these tasks easier.

Common FAQs

- What is the difference between gross and net percentages?

- Can I use a cost percentage calculator for monthly expenses?

- How do I handle negative percentages when using a cost percentage calculator?

Knowing the answers to these questions helps you use a cost percentage calculator well. It's great for tracking spending, sticking to a budget, or planning finances. Having a cost percentage calculator is very useful.

| Calculator Type | Functionality |

|---|---|

| Cost Percentage Calculator | Calculates the percentage of a given cost |

| Gross Percentage Calculator | Calculates the percentage of a given gross amount |

| Net Percentage Calculator | Calculates the percentage of a given net amount |

Choosing the Right Net Percentage Calculator

Financial experts have many net percentage calculators to pick from. It's key to look at what each tool offers. These calculators help figure out percentages, profit margins, and make smart decisions.

Today, we have online and offline tools. Online ones give updates in real-time and work on any device. Offline tools keep your data safe and work without the internet. Think about what your business needs when picking a calculator.

Key Features to Consider

- Accuracy and reliability

- Ease of use and user interface

- Integration capabilities with other financial tools

- Data security and privacy

- Customer support and resources

Popular choices include cloud-based, desktop, and mobile apps. These offer features like profit calculations and expense tracking. The right calculator helps professionals work better, make fewer mistakes, and make smarter choices.

| Calculator Type | Key Features | Pricing |

|---|---|---|

| Cloud-based | Real-time updates, cross-device synchronization | Subscription-based |

| Desktop application | Data privacy, operation without internet connectivity | One-time purchase |

| Mobile app | Accessibility on-the-go, user-friendly interface | Free or subscription-based |

By looking at these points and picking the right calculator, financial pros can work better. They'll make fewer mistakes and help their business grow. A net percentage calculator is a must-have for anyone in finance, making it easy to understand financial data.

Industry Standards for Percentage Calculations

In the financial world, following industry standards for percentage calculations is key. A percentage of sales calculator is very helpful. It aids in figuring out important numbers like labor costs and how much money is collected.

Labor costs can be a big part of a business's expenses, sometimes up to 35% or more. This is even more true for industries like construction and retail. The formula to find labor cost percentage is: Labor Cost Percentage = (Total Labor Cost / Total Sales) × 100. Most businesses aim for a range of 25% to 35% for profit, but this can vary.

The net collection rate is another critical metric. It's calculated this way: NCR = PR / PA * 100, where NCR is the net collection rate, PR is the total payments received, and PA is the total payments expected. A good net collection rate is 95% or higher, according to industry standards.

| Metric | Formula | Industry Standard |

|---|---|---|

| Labor Cost Percentage | Labor Cost Percentage = (Total Labor Cost / Total Sales) × 100 | 25-35% |

| Net Collection Rate | NCR = PR / PA * 100 | 95% or above |

By using a percentage of sales calculator and sticking to industry standards, businesses can make sure their financial reports are accurate and follow the rules.

Conclusion: Embracing Precision in Percentages

As we wrap up this guide on the net percentage calculator, it's clear that knowing how to calculate percentages accurately is key. This skill is vital for making smart financial choices. It's important for everyone, from financial experts to individuals looking to manage their money better.

Using a cost percentage calculator can make your financial analysis easier. It helps avoid mistakes and gives you an edge in the market. These tools are essential for tasks like budgeting, tracking investments, and analyzing performance.

The world of finance is always changing. We'll see new tech like AI and blockchain in percentage calculations soon. These advancements will help financial experts make even better decisions with more precision and speed.

To succeed, you need to understand percentages well and use the right tools. Keep learning and using the latest methods. By doing this, you can improve your financial work with net percentage calculators.

FAQ

What is the difference between gross and net percentages?

Gross percentages show the total or initial value. Net percentages consider deductions or adjustments. For instance, in sales, the gross percentage is the total revenue. The net percentage includes costs and discounts to show the profit margin.

Can I use a net percentage calculator for monthly expenses?

Yes, you can. Net percentage calculators are great for tracking monthly expenses. They help you see how much of your income goes to different expenses. This way, you can find ways to save money and improve your budget.

How do I handle negative percentages when using a net percentage calculator?

These calculators work with both positive and negative percentages. For negative percentages, like a drop in sales, the calculator shows the correct change. It gives you the net percentage result accurately.

Can I use a net percentage calculator to calculate year-over-year changes?

Yes, you can. Net percentage calculators are perfect for year-over-year financial changes. By entering data from the current and previous years, the calculator shows the net percentage change. This is key for tracking business growth and revenue changes.

How can I integrate a net percentage calculator with my other financial software?

Many calculators can connect with financial software and tools. This includes accounting systems, spreadsheets, and business intelligence platforms. Integration makes data transfer easy and automates calculations. It simplifies your financial analysis and decision-making.